Expected Credit Loss for Accountants

Apply ECL Model in Practice

With Focus on Trade Receivables

ECL for Accountants is an online course

that helps YOU:

Get orientation in ECL model

Help to proceed with ECL calculation

Work with trade receivables to derive historical PD

Learn about external sources of information

Get certificate of completion

HERE'S WHAT IS INSIDE:

#1 15 Video Lectures

Let me explain you the rules first.

I make all the things clear, straight, practical and funny at the same time, so that you can grab these rules and apply them in your job.

You get 1-year access to all the lectures and you can re-watch each lecture as many times as you wish.

#1 15 Video Lectures

Let me explain you the rules first.

I make all the things clear, straight, practical and funny at the same time, so that you can grab these rules and apply them in your job.

You get 1-year access to all the lectures and you can re-watch each lecture as many times as you wish.

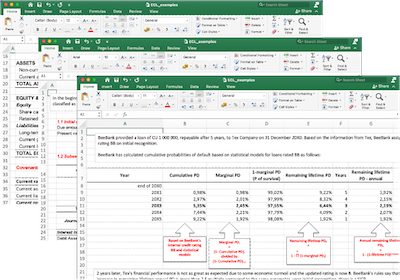

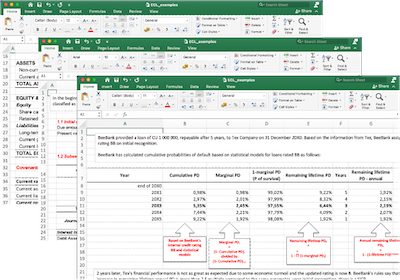

#2 4 Examples in Excel

After you learn the rules with me, we’ll dive in the examples.

You can track my mouse cursor to show you WHAT I do, HOW I do it and I tell you WHY I do it.

You can download the Excel file with these examples, explore the formulas and replicate the same process when working with your own trade receivables.

#2 4 Examples in Excel

After you learn the rules with me, we’ll dive in the examples.

You can track my mouse cursor to show you WHAT I do, HOW I do it and I tell you WHY I do it.

You can download the Excel file with these examples, explore the formulas and replicate the same process when working with your own trade receivables.

#3 60+ Pages of Handouts

Some of us like to take notes when learning...

... or refresh their memories a bit later.

Therefore, you can download all handouts from all the lectures, print them and use as you like.

#3 60+ Pages of Handouts

Some of us like to take notes when learning...

... or refresh their memories a bit later.

Therefore, you can download all handouts from all the lectures, print them and use as you like.

#4 Quiz

Test your new knowledge with our quiz!

Quiz contains questions with correct answers and their explanations when needed, so that you can support your active learning and gain even greater confidence in your new skills.

#4 Quiz

Test your new knowledge with our quiz!

Quiz contains questions with correct answers and their explanations when needed, so that you can support your active learning and gain even greater confidence in your new skills.

#5 Certificate of completion

Print out the certificates of completion

After you complete the lessons and successfully pass the quiz, you can print out the certificate and use it as a proof of your learning activities.

#5 Certificate of completion

Print out the certificates of completion.

After you complete the lessons and successfully pass the quiz, you can print out the certificate and use it as a proof of your learning activities.

CREATED BY TOP INDUSTRY EXPERTS

Silvia Mahutova, founder of CPDbox.com

Silvia founded IFRSbox.com back in 2010 and later it rebranded to CPDbox.com. She has more than 20 years of experiences with auditing, consulting and teaching and in 2009, she became a fellow member of ACCA.

Since 2010, she has written many IFRS articles, produced many videos, helped many students pass their exams and many accountants solve their difficult accounting issues.

Laurence Milner, co-founder and director of i9 Partners

Laurence is CEO of CEEi, a South African leader in Credit Intelligence and Co-founder and Director of i9 Partners. He is a Chartered Accountant with 25 years experience in audit, credit and outsourced services, with among others Moody’s in Europe and South Africa and the FirstRand group.

He has extensive experience with credit analysis and modelling. He runs a credit outsourcing company and consults to banks, asset managers and corporations globally.

ANSWERS TO FREQUENTLY ASKED QUESTIONS

Silvia does. Laurence contributed his knowledge, but the videos are made and presented by Silvia in her usual style.

Not a problem, I’m here to help. Just use our contact form to write me an e-mail and I’ll get back to you. But please be aware that your question needs to relate to the material covered by this course and you need to make a reference to the specific video or example you are struggling with.

Yes, absolutely. Once you click “Get Access” button, you will be transferred to PayPal, which is well-known reliable payment gate. We don’t see any of your payment details except for your name and e-mail address.

We do strongly recommend at least some level of IFRS knowledge prior subscribing to this course.

Unlike the IFRS Kit, Expected Credit Loss for Accountants is a course for advanced accountants who already know IFRS at least to some extent.

If you are new to IFRS, I recommend checking out our IFRS Kit to get you started.

After you make a payment, please allow up to 12 hours for the login details to arrive to your email address. We are still working on the learning management system details.

Then you just visit https://www.cpdbox.com/account and you log in with your username and password. You can watch all the videos online.

If you don’t receive any e-mail from us within 12 hours of your purchase, please contact us.

Currently no, because the offered price is discounted already and in the future when we launch regular offering of this course, the price will be likely EUR 97.

However, it will be possible to get the combination of courses at a discount in the future (no estimated timing).

This is something we are still working on, so please be a bit patient with us.

Let’s say you signed up for the IFRS Kit on 1 September 2021, and you signed up for ECL for Accountants on 20 November 2021. Your account will show all the courses, but it will show that your subscription will expire on 1 September 2022 on both courses.

No worries, we keep good records on all subscriptions and in reality your subscription to ECL for Accountants will expire on 20 November 2022.

This technicality is a reason why we offer this course only to our subscribers for a reduced price and it has not been released to the wider public. Thank you for your understanding.

Payments with PayPal:

If you are NOT from the European Union, then the price is final and there are no additional charges.

If you are from the European Union, then we have to add value added tax (VAT) to the price. The rate of that tax depends on the country in which your credit card was issued.

However, if you are making a purchase on behalf of your employer or a company and you have a valid VAT number, please send it to us. We will verify it via EU VIES system and if it is valid, we will refund the VAT to you.

Payments with direct wire transfer:

Please let us know if you need to pay us with wire transfer and we will let you know about the additional taxes (if any, but the rules are the same as described above). However please be aware that when paying with wire transfer, it is you who is responsible to cover transfer charges (depending on your bank).

You can send us a payment via direct wire (bank) transfer. Please send us a message via our contact page and we will send you details.

SUMMARY OF WHAT YOU WILL GET

15 Videos

4 Examples Solved in Excel

Quiz to test your knowledge

Certificate of completion