THE 3 BIGGEST MYTHS ABOUT IFRS

… and what you can do about them…

There are 3 biggest myths about IFRS that people believe…

…and they hold them back and sometimes, they cause them to fail.

Do you believe them, too?

And if you are, don’t worry. It’s EASY to fix once you know what they are.

Myth #1: IFRS is very dull, boring and difficult

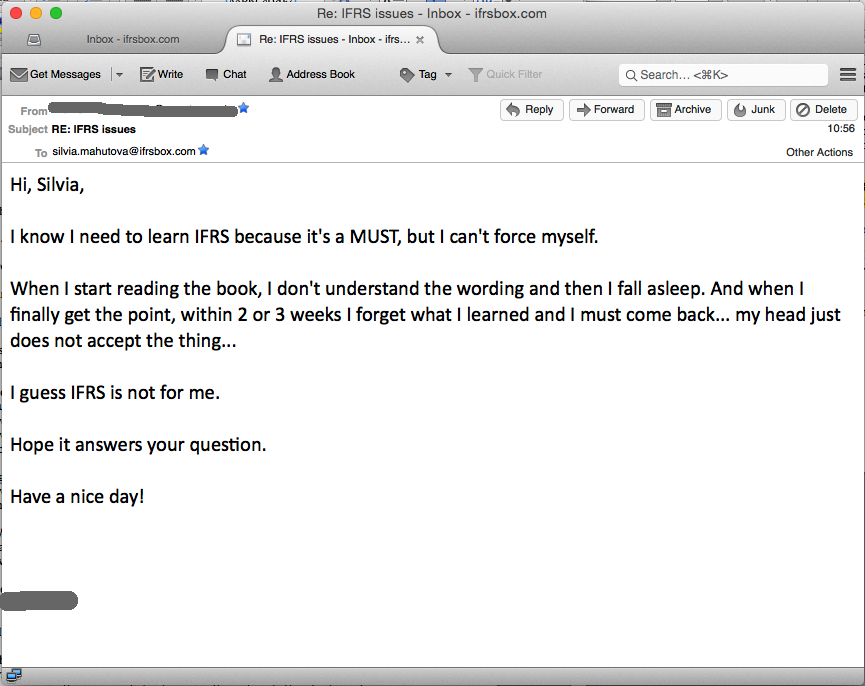

I still hear this all the time! Many of my readers and subscribers wrote me about their frustration from IFRS, because they find it boring, dull and difficult.

Here’s just one quote:

I get it – I went through the same. When I prepared myself for some exam, I worried hours before actually sitting with the book about how dull and terrible this is going to be.

What’s worse, I did not know where to start. IFRS rules are not easy and I did not have any structure or procedure to follow – as a result, I was simply overwhelmed and lost in the bunch of different and conflicting theories.

However, after some time, I realized that IFRS is NOT a problem – it’s the WAY of tackling it… and that brings me to myth #2:

Myth #2: “I just have to try harder”

This one is very unfortunate, yet very frequent.

When I started to learn IFRS, I tried almost everything: I attended some classes, then I read some books, then classes again, then some articles, browsing the web and other.

I achieved some results, that’s true. But when I came across some particular IFRS challenge, whether it was a new client or a new question from the client, I was lost! Simply not knowing where to start.

And then I thought – OK, maybe I need to try harder. So I did – reading books in my free time, signing up for the new courses, etc.

I dedicated maybe 2-3 hours per day on top of my working day to improving my own knowledge – and you can imagine the cost of it. I was simply broke, exhausted and depressed, something like this:

Once I realized that “working harder” wasn’t working (and would NEVER work), I broke through and found a solution that didn’t get just short-term results… More on that soon…

Myth #3: “Books, pen and paper will do”

What about all those classes and courses that encourage you to revise the notes, take pen and paper and solve the lecture questions?

When I got ready for my ACCA exams, I did exactly the same thing. Revised the notes, re-did the examples with my pen and paper. It worked relatively OK for the exams – I was able to pass.

But when it came to applying the new knowledge practically, again – I was lost. I understood that most courses or lectures do not prepare people to be the best out there. They prepare people enough to pass the test (sometimes not even that).

Years after I found my own way and became an IFRS expert, I saw many unhappy accountants or CFO’s who were very intelligent and educated, yet they had to pay me or other consultants to solve some IFRS issues.

Most people believe they have to read lots of IFRS books, memorize all the rules, attend expensive courses and spend tons of time to master IFRS and get their desired better job.

Do these mistakes seem familiar to you? Are you making them yourself?

Well, I made them too!

Instead, from my own experience, I’ve discovered what works the best:

- Learn IFRS in small chunks,

- Translate IFRS to a very simple language (you can use visual aids for that, like examples, clear and funny pictures or movies),

- Instantly apply the IFRS rules on real-life examples using real-life working tools (Excel, not pen and paper),

…and ONLY THEN make another step towards more demanding concepts.

This approach is far more effective if you want to master IFRS and achieve faster career promotion.

Within the next few days, I’ll show you exactly how to learn IFRS fast, in a simple language so that you can remember it for a long time. We’ll start with one of the most challenging, yet essential accounting techniques – making cash flow statements by the systematic easy-to-follow method.

Stay tuned and watch out for my next e-mail!