How to Account for Cryptocurrencies in line with IFRS

When I heard about cryptocurrency Bitcoin for the first time, I could not make up my mind:

Is this just a new hype that will go away soon?

Or, is this something valuable that will remain here for years, some new asset worth to invest in?

I am not going to write my personal opinions about how worthy is to invest in cryptocurrencies or use them – this is indeed out of scope of this website.

More and more people and businesses perceive cryptoassets as a great investing, business or other moneymaking opportunity and thus more and more people and businesses hold and create these assets.

Logically, the question is:

How to account for holding and creating cryptocurrencies?

Before I start digging in this topic, let me tell you that although cryptocurrencies were the first cryptoassets, new types of cryptoassets have been created since Bitcoin was born.

Along with new cryptocurrencies such as Litecoin, Ethereum and similar, so-called tokens were created for specified purposes, for example utility tokens, asset-backed tokens, hybrids and similar.

In this article, I will focus on accounting for cryptocurrencies only, because the accounting for tokens depends on their purpose and terms and it can (and in most cases will be) different from cryptocurrencies.

What is cryptocurrency?

Cryptocurrency is a digital “currency” designed to function as a medium of exchange.

It means that you can perform financial transactions with cryptocurrency (if your counterparty accepts it) and you can make investments in cryptocurrency as well.

When I was performing my research on cryptocurrencies, my mind boggled – there are so many materials and explanations and frankly speaking, it is not always easy to wrap your head around this topic.

If you would like to learn how cryptocurrencies are created and how they work, I recommend spending 26 minutes and watching this video (author: 3Blue1Brown) on YouTube.

You will get non-scientific and non-accounting, very simplistic and comprehensive explanation of how it actually works.

Cryptocurrencies usually have the following common characteristics:

- The are decentralized – i.e. not issued by any central bank or similar body;

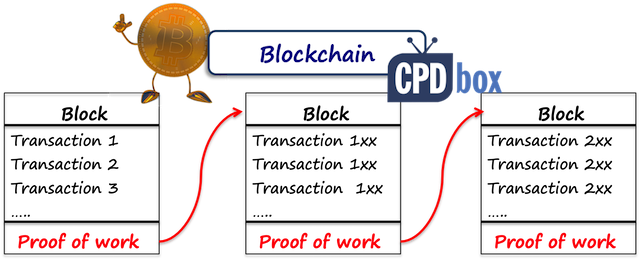

- They are recorded on a distributed ledger – which means that all transactions in that currency are recorded in one big ledger called “blockchain” and every participant has his/her own copy of this ledger;

- The cryptography is used to ensure security and prevent fraud – to verify correctness of the transactions, each valid transaction carries a sort of digital signature – or hash.

What does it all mean?

Cryptocurrency is NOT a financial instrument

Many people are tempted to say that cryptocurrencies are financial instruments, because they contain the term “currency” and thus they must be the same as cash.

Wrong.

The application guidance of IAS 32 (par. AG3) defines currency as a financial asset, because:

- It represents the medium of exchange; and

- It is the basis on which all transactions are measured and recognized in financial statements; and

- The deposits if cash in banks represents the contractual right of the depositor to obtain cash from the institution…etc.

However, the following applies for cryptocurrency:

- It can be used in exchange for particular goods or services, but it is not widely accepted.

- It is not used as the monetary unit in pricing goods or services – the pricing is usually done in “normal” currency and then pricing in cryptocurrency is derived from regular currencies.

- Cryptocurrencies are poor store of value due to their high volatility.

What’s probably the most important fact:

There is NO contract whatsoever.

The basic definition of a financial instrument is that it a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity (see IAS 32).

In other words – if you hold some cryptocurrency, you do not have any contractual right to receive cash or another financial asset, because there is no contract and there is NO counterparty.

So how should we classify and account for cryptocurrencies?

How to account for cryptocurrencies in line with IFRS?

Let’s discuss two types of entities that might be interested in accounting for cryptocurrencies:

- Holders of cryptocurrencies: if you purchased cryptocurrencies to store value or to make an investment return, but you are not involved in any “mining” activity;

- Miners of cryptocurrencies: if you decided to invest in all that hardware (computers, graphic cards and other stuff), electricity and other resources with the purpose of serving the network and creating new cryptocurrency units. We will explain mining a bit later.

Accounting for cryptocurrencies by the holders

Until recently, there was literally nothing official related to accounting for holding of cryptocurrency.

However, IFRS Interpretations Committee (IFRIC) met in June 2019 and discussed that and issued their decision, so at least we have some official guidance for a part of the problem.

In accordance with IFRIC decision, cryptocurrency meets the definition of intangible asset in line with the standard IAS 38 Intangible Assets.

Cryptocurrency is an asset for sure, because asset is a resource controlled by an entity as a result of past event from which future economic benefits are expected to flow to the entity – that is fully met.

Under IAS 38, intangible asset is an identifiable non-monetary asset without physical substance.

Yes, cryptocurrency has no physical substance and is a non-monetary asset as I explained above.

Identifiable means either:

- Separable – i.e. you can separate or divide it from the entity and sell, transfer, rent, etc.; or

- Arising from contractual or other legal rights – not applicable here since there is neither contract nor other legal rights.”

Since the cryptocurrency can be sold, it is separable and thus meets the definition of the intangible asset.

Great, but that’s not all.

The accounting method depends on the purpose of your holding:

1. Cryptocurrency held for trading

If you are holding cryptocurrencies for sale in the ordinary course of business, you might need to apply IAS 2 Inventories.

So, if your business is to act as a broker-trader of cryptocurrencies, then you should apply IAS 2, more specifically IAS 2.3b for commodity brokers and traders.

As you might know well, commodity brokers and traders measure their inventories (cryptocurrencies) at fair value less cost to sell.

2. Cryptocurrency not held for trading

If you acquired cryptocurrency units in order to hold them and store value over extended period of time or for other purposes, then you need to apply the standard IAS 38 Intangible Assets.

Unfortunately, IFRIC did not state any recommendations or decisions on how to apply IAS 38 for cryptocurrencies.

Here, the main consideration is which model permitted by IAS 38 to apply:

- Cost model – here, you would need to hold your cryptocurrency at cost less accumulated amortization less impairment.

This is doable – especially when there will probably not be any amortization because cryptocurrencies have indefinite useful life in general.

However, when there are declines in cryptocurrency’s fair value, you need to account for any impairment.

Then there is another problem: if the fair value of cryptocurrency increases above your cost, you would never recognize this increase under the cost model.

Hmm, that’s not very intuitive when you hold cryptocurrency for capital appreciation purposes.

- Revaluation model – if the active market exists, you can revalue cryptocurrencies to their fair value and account for any increases directly in other comprehensive income, or for decreases in profit or loss.

This is not very symmetric, but if you hold cryptocurrency for capital appreciation, it is probably more appropriate than the cost model.

Don’t forget the appropriate disclosures, mainly about setting the fair value, any judgments used, etc.

Accounting for cryptocurrencies by miners

While holders received some guidance from IFRIC, there is literally no guidance on accounting for cryptocurrencies by their miners.

And, the truth is that while you did not have to understand the full cryptocurrency process if you are a holder, it would be great to understand it for miners.

The reason is that once you understand what in substance you do, then you can decide on how to reflect it in your accounts.

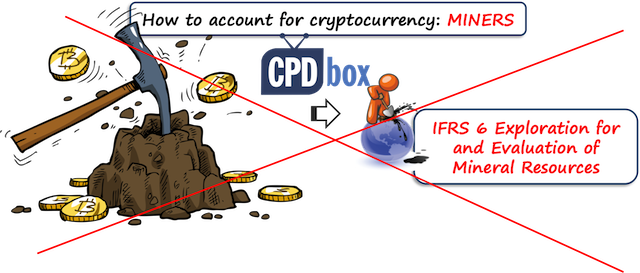

Many people think that cryptocurrency miners are literally mining, and therefore the standard IFRS 6 Exploration for and Evaluation of Mineral Resources applies.

No, no, no and NO!

Here, miners are NOT mining in this sense.

So, what are miners doing?

This question brings me back to the basic characteristics of cryptocurrencies that I described above.

One of them was that cryptography is used to ensure security and prevent fraud.

How?

In short – each transaction must be verified by adding a sort of digital signature and added to the digital distributed ledger.

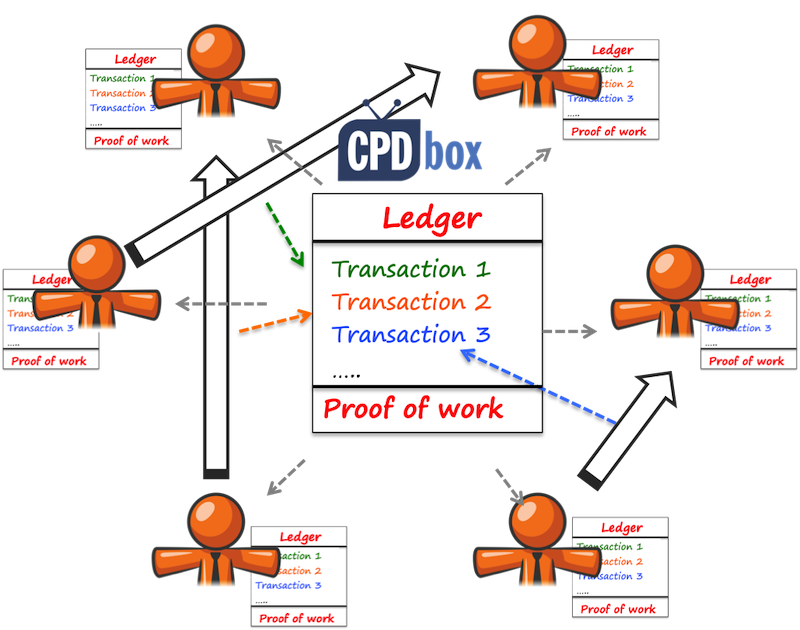

So, when somebody makes a transaction with cryptocurrency (e.g. pays for some service with Bitcoin), then this transaction is broadcasted to the network of participants.

Then, a miner is responsible for:

- Verifying the transaction and creating the new block of transactions.

Very simply speaking – they do so by collecting the transactions broadcasted by the participants, organizing them to the block and then solving mathematical puzzle with cryptographic hash function to add the proof of work of to that block.

It simply means that the miner must literally guess the correct authentification digital code that meets the algorithm criteria.

- Update the distributed ledger to include newly verified transaction (or block of transactions, to be precise).

Thus the miners communicate their “proof of work” to the network of participants and each participant updates their ledger (blockchain; remember, blockchain is decentralized and each participant has its own copy of it).

Just a side note: that huge decentralized ledger is called blockchain, because all transactions are split into blocks. One block is created by a number of individual transactions.

Well, if you want to know more technical details about proof of work, how it prevents fraud, how we can be sure that everybody has the same version of decentralized ledger, etc., please watch the 26-minute video here.

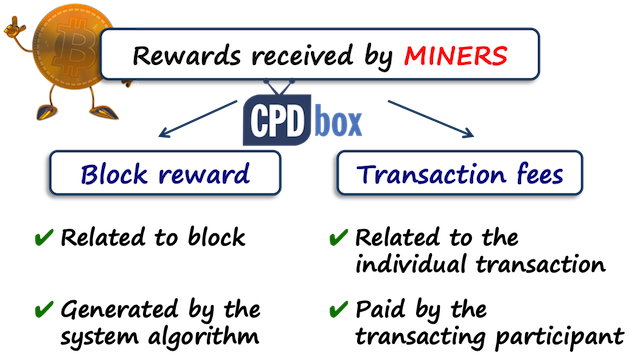

For their work, miners get two types of reward:

- Block reward – earned for creating the block; and

- Transaction fees – earned for validating a specific transaction.

Remember, there are many transactions in one block and when miner solves puzzle, he currently earns both types of fees.

Moreover, when miners “mine”, or do the computational work to verify transactions and update the blockchain, they use huge resources, such as loads of computers, graphic cards, high electricity bills, etc.

Therefore the question is: how to account for all these expenses spent in cryptocurrency mining?

And how to account for the rewards they earn for mining?

Let’s tackle them one by one.

Accounting for block rewards by miners

Every time when the miner guesses the digital code or hash, verifies the transactions and updates the ledger with new block, he earns the small amount of cryptocurrency.

Where does this amount come from and who pays that?

Out of thin air.

No one pays that – the system is set and programmed this way.

This is the first part of miner’s reward and is often referred to as block reward because it relates to creating the new valid block (including more transactions).

However, it will not go infinitely – for example for Bitcoin, the blockchain reward decreases with time as the total number of blocks increases. So after some time, block reward will be zero and miners will earn only the transaction fees as described below.

Currently, it is set to 12.5 BTC (with about 612 000 blocks of transactions). When the number of blocks in the ledger (blockchain) reaches 630 000, the block reward will decrease to 6.25 BTC.

This is all set in the blockchain algorithm programmed by its creators.

I don’t want to go deeper into technical details now, because that’s not really the purpose of this article.

However, how to account for this block reward?

OK, so what are miners doing here?

In fact, they are providing some service to the network. The block reward is a reward for solving the puzzle, creating a new block with certain transactions and updating the ledger.

That implies that we should apply the revenue standard IFRS 15 to accounting for block rewards, however there is one problem:

There is no customer. No contract.

Miner is getting paid by the algorithm.

Some people argue that it is implied that the whole network is a customer, but I think there is a problem with enforceable rights and obligations – there are none.

Thus, we cannot apply IFRS 15.

However, when the miner receives the block reward, it certainly represents the inflow of economic benefits – thus it meets the definition of income as stipulated in Conceptual Framework.

The conclusion: Include it in your profit or loss at the moment of receiving the block reward, measured at fair value.

The journal entry is:

- Debit Intangible assets – cryptocurrencies;

- Credit Other income in profit or loss.

(If the miner happens to be a trader with cryptocurrencies, then Debit is Inventories).

Accounting for the transaction fees by the miners

The transaction fee is earned for validating the transaction and including it in the individual block of transactions.

So, the fees are not earned by the system for the validating the block as a whole (block reward is to compensate that), but they are earned for the individual transaction.

Also, while the block reward is created out of thin air and no one really pays it (because it is created by the block algorithm, or the program underlying the cryptocurrency), the transaction fee is paid by the specific network participant.

For example, Jane pays 5 BTC to Eve and for that transaction, the fee of 0.005 BTC is sent to the miner who includes this transaction to the block, manages to guess the hash and validates block and includes it in the blockchain.

Technically speaking, here we have a customer – it is the originator of the transaction (Jane in the above transaction).

And also, the contract is implied here because it is understood that Jane will have to pay the transaction fee.

Conclusion: We can apply IFRS 15 in this case and recognize the transaction fee as revenue at the point of time when the performance obligation is satisfied – i.e. when the miner validates the transaction and becomes entitled to the fee.

Accounting for expenses incurred by the miners

Well, I heard some arguments that since cryptocurrency is an intangible asset (as described above), then the miners are developing intangible assets.

Therefore, they should capitalize all expenses incurred in mining (like hardware, electricity bills, etc.) and when they earn block reward for the successful solving of the puzzle, then they have completed the development and start the development of the new intangible asset (i.e. new block reward for another transaction).

I am NOT in favor of this view.

The reason is that if you want to capitalize internal development of an intangible asset, you need to meet 6 PIRATE criteria (see here).

One of them is that you can reliably measure the expenditure attributable to the intangible asset during its development.

And in this case, you CANNOT.

Why?

In reality, there are many miners out there, trying to solve the puzzle and win the race.

Indeed, being able to validate the transaction is more like winning the lottery, rather than systematic building of some asset.

Also, it is quite difficult to separate costs incurred for the successful guess from all previous unsuccessful guesses.

Which is more important – what is the nature of miner’s activity?

They are validating transactions and updating the blockchain (ledger) – thus it seems like providing the service to the network rather than building an asset.

Conclusion: Miners should account for the expenses incurred with “mining” in profit or loss as they are incurred.

For those who like matching principle – here, you cannot really attribute the specific expenses to the specific revenues because of a “lottery element” included in mining.

Single miner or pool?

Sometimes, more entities combine their computational power and create mining pool.

In this case, they mine together and have agreements on sharing the rewards and fees.

Let me mention that the accounting principles described for individual miners are the same for pools.

The only difference is that they maybe create some joint arrangement and need to apply IFRS 11 as well.

Final word

Well, I tried to be as clear as possible and as a result I omitted a few topics, like proof of work vs. proof of stake, forked currencies, other cryptoassets, etc.

The number of digital transactions and their variety increases and becomes more complex.

I am grateful to IFRIC that it finally took some stand to accounting for holdings of cryptocurrency.

However, many people would appreciate their guidance on accounting for mining of cryptocurrency, ICOs, tokens and other issues.

Also, please bear in mind, that I tried to think about these issues, make up my own opinion, cross-check it with IFRIC’s decision and other available guidance – but indeed, you may need to develop your own accounting policy if the terms of your cryptoassets are different.

The guidance is absent – so good luck with your auditors!

You can watch a video summing up the accounting for cryptocurrencies under IFRS here:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

42 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on Example: IFRS 10 Disposal of Subsidiary

- Silvia on IFRS 17 Insurance Contracts: Summary

- Shiksha on Example: IFRS 10 Disposal of Subsidiary

- Chrisant on IFRS S2 Climate-related Disclosures: What, How, When

- Raja Sekharan on How to test hedge effectiveness under IFRS 9?

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Dear Silvia, thank you for the explanation. You are really amazing.

I have a question.

Which model should I use when we received cryptocurrency as a payment method (the clients pay our services and properties as houses or condominiums via Cryptocurrency), and then we use them to pay providers and some cases the employees’ salaries as well.

Hi Jasmina,

great question. Well, applying what I have written in the article above, it is a barter transaction, since you are receiving intangible assets (crypto) in exchange for the services and properties. Read more about barters here.

Hi Silvia,

I manage a Fund, which invests in cryptocurrencies, and the way the cost is calculated is AVCO, and are revalued on a weekly basis using the market price available.

My question is where the unrealised gain/(loss) should be reversed on disposal of the assets. Should the realised gain be calculated as follows : – (Disposal price – AvCO price) x disposed quantity?

very nice.

Hi Silvia, i am researching on crypto accounting and came across you YouTube video and article it is really great explanation.

I have a doubt though,

1. An individual hold Crypto for trading (like in share trading i.e. short term or intraday) and not Trading or Broking platform, so will it be accounted as inventory or as Intangible asset?

It is clear that if a Crypto platform which is Trader or Broker will classify it as Inventory and other which hold for capital appreciation as Intangible asset.

2. If classified as Inventory for short term than how will be bifurcate at initial stage the crypto which are for long term ( classified as Intangible Asset) or Short term (as Inventory), what will be the valuation and accounting for them as well.

Your new follower

Thank You,

Hope you clarify this ASAP.

hey dear silvia:

I want to use some part of your research in my article and to referencing i need to write your ISSN/DOI. unfortunately i couldnt find it in your page. can you help me with it please?

Dear Hope, please write me a message through my contact page. Thank you!

Hello dear silvia;

Thank you so much for this efficient article♥

Hi, Silvia, the descriptions on cryptocurrency was out-of-this-world. Thanks a lot for this article and all other useful guides prepared. I have a question in this regard.

It is said that any deal in cryptocurrencies are actually based on smart contracts. Isn’t it that missing contract mentioned about this new type of asset?

Thanks a lot.

Dear Alireza, thanks a lot for your kind words!

Now, let me tackle what “smart contract” actually is. It has nothing to do with the “contract” as defined under IFRS 15 (=agreement between an entity and a customer). The smart contract with respect to cryptocurrencies is simply a program stored in a blockchain and that program starts running when some conditions are met. So it is NOT the agreement; it is merely some preprogrammed piece of code, hence you cannot really say it is the missing contract meeting the conditions under IFRS 15. All the best!

Many thanks for your great explanation..

Hi Silvia,

Great article! Thank you so much. I have some several question for you.

If a crypto company still holds their original tokens (minted from ICO), in which account would you book them? Would it be considered as inventory ?

Lastly, crypto company has multiple amounts in multiple currencies on multiple

exchanges. These amounts come from several sources. There are user money,

company’s money and fees charged to users. What would a

simplified and schematic balance sheet look like? User money (liability) and company’s money and fees charged to users (assets)?

Thanks you!

Hi Silvia,

Assuming I am trading Bitcoin for Ethereum and that both are financial instruments in my book. How should I be accounting for this exchange in my book?

1) Should it be just Dr Ethereum Cr Bitcoin, based on Bitcoin market value at that point in time?

2) Should it be just Dr Ethereum Cr Bitcoin, based on Ethereum market value at that point in time?

3) Others?

Hi TPL,

I do not agree with your treatment of Bitcoin and Ethereum as financial instruments in your books. My position and explanation are stated above. They are deemed as intangible assets, not financial instruments. And, based on this view, you are essentially doing barter transactions (“exchanges of assets”) and these should be accounted as such; that is if the transaction is of a commercial substance, then the cost of acquired asset is measured at its fair value (i.e. market value at the point of time). If that does not equal to the carrying amount of asset given up, then the difference is recognized as a gain or loss in profit or loss. Please see more in IAS 38 par. 45-47. I hope it helps! S.

Thanks Silvia! So excited to see your reply. I am a diehard fan of you regarding IFRS 😀

1) I would think treatment of crypto depends on company biz nature and the purpose of the crypto. For instance, coinbase definitely treat their customer asset and liability as financial assets/liabilities. So assuming their customer swap Bitcoin to Ethereum on their platform, then I would presume the entries would be

Dr Customer fund asset – Ethereum at fair value

Cr Customer fund asset – Bitcoin (to mirror Ethereum fair value at point of entry)

Cr Customer fund liability – Ethereum at fair value

Dr Customer fund liability – Bitcoin (to mirror Ethereum fair value at point of entry)

2) Regardless of intangible or financial instruments or inventory, I would think your approach is correct, based on fair value of acquired asset. But there is really not much explicit guidance in the standards. This then lead me to another hypothetical question, assuming my functional currency is USD, and I convert my JPY bank balance to EURO bank balance. Then how should I account for this in my book?

a) Dr Euro Bank account based on EUR/USD exchange rate? Then Cr JPY Bank account accordingly with no gain/loss?

b) Cr JPY Bank account based on USD/JPY exchange rate? Then Dr Euro Bank account accordingly with no gain/loss?

I would think (a) is the right approach again, and that the reason why there is no gain or loss is because the carrying amount of asset given up (i.e. JPY) is the same as the FV of asset acquired (i.e. EURO).

Hi TPL, my diehard fan (LOL :D),

1) I beg to disagree. Under IFRS, the treatment of crypto does not depend on the company business nature at all – maybe on the purpose of holding crypto, but in any case it is NOT a financial instrument. If you believe so, please give me reference. Instead, there was this IFRIC decision I mention above. Either you treat it as intangibles, or as inventories if you trade with crypto.

2) I don’t like these approaches at all. I would say it is more like Dr. Cash in transit/Cr JPY account with USD/JPY rate and then Dr. EUR account/Cr. Cash in transit with EUR/USD rate. And believe me, there will be a difference/uncleared balance in Cash in transit account that needs to go in profit or loss. The reason is that you are still exposed to foreign currency risk and that is expressed in this profit or loss from the transaction. However, there is no clear guidance on that, I agree, so yes, I have seen other approaches in practice. But let me mention that similar situation happens when you have a parent and a subsidiary, they trade together, but they use different functional currency. In this case, you will incur some foreign exchange gain/loss from elimination of mutual transactions just because they are both exposed to foreign currency risk.

Hi SIlvia,

So what will be the correct way to record cryptocurrency swap for instance exchanging Bitcoin with Ethereum in the balance sheet? and how do you reconcile such transactions? Do I just upload a Coinbase statement and reconcile accordingly? How do I reflect a sale of cryptocurrency portfolio from an individual account to a business that I own.

Thank you so much Silvia for this wonderful and comprehensive explanation.

How about fiat currency or stablecoins which are backed by USD such as BUSD, USDT etc., Can they be considered as financial instruments? Because each supply of these coins are backed by actual USD reserves by the issuer

Hi Benedicto, nice question. I will research it and give my opinion. Because, you should always look at what is going on in substance of any asset/transaction… and then decide on its treatment.

Hi Silvia,

company A has recognized bitcoins as intangible asset. A contract is signed in which company A lends bitcoins to company B (sister company). Company B must pay ‘interest’ in bitcoins as well. How to account for this contract.

Kind regards,

Silva

Hi Silvia

Hope keeping well

Please i want to ask if you can help us explaining the accounting treatment for GHG emission under IFRS .

Thanks

Genius work!

Thank you so much.

You have simplified what appeared very complex and topical issue Silvia. Thank you very much!!!

Thank you Silvia for this article.You are a blessing to the accounting profession.

Silvia I ve been following your articles but this one is very unique, you have opened my eyes to so many issues arising in the cryptocurrencies sphere, thanks for the enlightenment

The best explanation I found so far! Thank you!

Thanks 😉

Many Thanks Silvia for sharing your views on such a complex issue . your write up has helped me understand it a lot better in a short span of time. I have shared it with my colleagues and they also were very impressed with the explanations & logics put forth in a simple manner!

Thank you Silvia for yet another insightful article. This really sheds some light on a very topical issue, and most importantly- you made it so simple to understand.

Thank you so much SIlvia.

It’s always a pleasure reading your articles.

Your contribution on lessons of IFRS benefits for those of us living in the 3rd world.

Dear Silvia,

You are literally amazing. Thank you so much for this wonderful explanation.

It’s always a pleasure reading your articles. The explanation is appropriately supported by logics and diagrams. Though I am from India (into teaching and training of Ind AS) where we apply Ind AS, but it is basically convergence of IFRS.

Thanks Silvia. As always excellent explanations.

Thank you very much dear Silvia,really very explanatory. i was thinking cryptocurrncies have physical existence,because when i read about them they came with coin designated marks. You clearly show us how to think them as intangibles assets (lifting my perception of them as financial instruments) and how to account them as a holder and miner. Also how to show in books of accounts the rewards and fees earned by miners. Thank you. Keep it up dear Silvia,Your contribution on lessons of IFRS benefits for those of us living in the 3rd world.

Thank you, Rahel, I am glad I clarified a few things for you! 🙂

Actually you help me a lot in IFRS. Till definitely I became an Expert ?

Awesome explanation. I really appreciate the simplicity with which you are able to articulate a complex process and drive the fundamental theory and appropriate IFRS treatment in respect of the process. Thanks a lot.

You are welcome 🙂

Hey why don’t I see here sharing option for LinkedIn ? Missing that.

Love your blogs Sylvia. They all are so well structured and so educative. This one particularly got me in shock because this is really a trending topic and we as accounting professionals really just be in tune with what is going on out there. You’re helping us a lot here. ??

Thank you! 🙂 I will check that LinkedIn option with my developers, but you can simply create a new post linking to the article. 🙂

Thank you very much for this article.