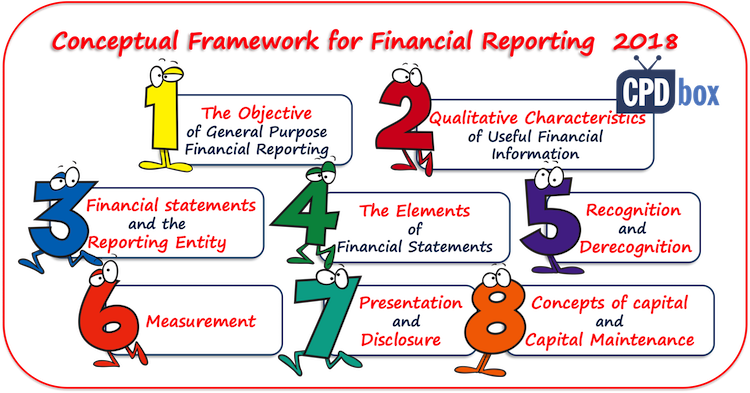

Conceptual Framework for the Financial Reporting 2018

The Conceptual Framework for the Financial Reporting (let’s title it just “Framework”) is a basic document that sets objectives and the concepts for general purpose financial reporting.

Its predecessor, Framework for the preparation and presentation of the financial statements was issued back in 1989.

Then in 2010, IASB published the new document, Conceptual Framework for the Financial Reporting, however it was a bit unfinished as a few concepts and chapters were missing.

The newest and completed Framework published in 2018 comprises 8 chapters and in this article, I would like to sum it up.

Is the Framework equivalent to the Standard?

Let me please make one point clear:

Framework is NOT a Standard itself.

Thus if you wish to decide on the financial reporting of certain transaction, you need to look into the appropriate standard – IFRS or IAS.

Sometimes, it may even happen that the rules in that IFRS or IAS standard will be contrary to what the Framework says.

In this case, you need to apply the standard, not the Framework.

When should you apply the Framework?

In most cases, when there are no specific rules for your transaction and you need to develop your accounting policy, then you would look to the Framework as you cannot depart from its basic principles and definitions.

Chapter 1: The objective of general purpose financial reporting

The main objective of general purpose financial reports is to provide the financial information about the reporting entity that is useful to existing and potential:

- Investors,

- Lenders, and

- Other creditors

to help them make various decisions (e.g. about trading with debt or equity instruments of a reporting entity).

Chapter 1 is NOT about the financial statements itself – these are described in Chapter 3.

Instead, Chapter 1 describes more general purpose reports that should contain the following information about the reporting entity:

- Economic resources and claims (this refers to the financial position);

- The changes in economic resources and claims resulting from entity’s financial performance and from other events.

Chapter 1 puts an emphasis on accrual accounting to reflect the financial performance of an entity. It means that the events should be reflected in the reports in the periods when the effects of transactions occur, regardless the related cash flows.

However, the information about past cash flows is very important to assess management’s ability to generate future cash flows.

Chapter 2: Qualitative characteristics of useful financial information

In this Chapter, the Framework describes 2 types of characteristics for financial information to be useful:

- Fundamental, and

- Enhancing.

Fundamental qualitative characteristics

- Relevance: capable of making a difference in the users’ decisions. The financial information is relevant when it has predictive value, confirmatory value, or both.

Materiality is closely related to relevance. - Faithful representation: The information is faithfully represented when it is complete, neutral and free from error.

Enhancing qualitative characteristics

- Comparability: Information should be comparable between different entities or time periods;

- Verifiability: Independent and knowledgeable observers are able to verify the information;

- Timeliness: Information is available in time to influence the decisions of users;

- Understandability: Information shall be classified, presented clearly and consisely.

Chapter 3: Financial Statements and the Reporting Entity

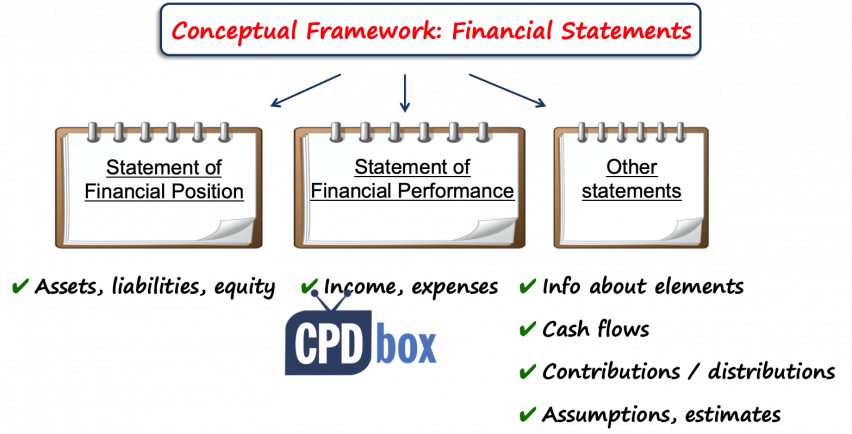

Financial Statements

The financial statements should provide the useful information about the reporting entity:

- In the statement of financial position, by recognizing

- Assets,

- Liabilities,

- Equity

- In the statements of financial performance, by recognizing

- Income, and

- Expenses

- In other statements, by presenting and disclosing information about

- recognized and unrecognized assets, liabilities, equity, income and expenses, their nature and associated risks;

- Cash flows;

- Contributions from and distributions to equity holders, and

- Methods, assumptions, judgements used, and their changes.

.

Financial statements are always prepared for a specified period of time, or the reporting period.

Normally, the financial statements are prepared on the going concern assumption.

It means that an entity will continue to operate for the foreseeable future (usually 12 months after the reporting date).

By the way – what if an entity cannot present as going concern? For example, when the liquidation is assumed within 12 months? Learn what to do here.

Reporting Entity

This is a new concept introduced in 2018.

Although the term “reporting entity” has been used throughout IFRS for some time, the Framework introduced it and “made it official” only in 2018.

Reporting entity is an entity who must or chooses to prepare the financial statements. It can be:

- A single entity – for example, one company;

- A portion of an entity – for example, a division of one company;

- More than one entities – for example, a parent and its subsidiaries reporting as a group.

As a result, we have a few types of financial statements:

- Consolidated: a parent and subsidiaries report as a single reporting entity;

- Unconsolidated: e.g. a parent alone provides reports, or

- Combined: e.g. reporting entity comprises two or more entities not linked by parent-subsidiary relationship.

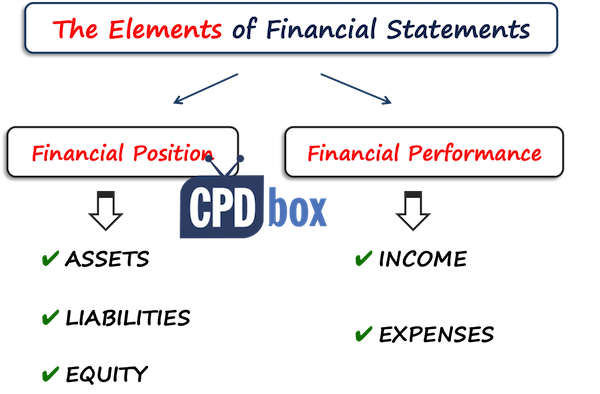

Chapter 4: Elements of the financial statements

This chapter extensively deals with the definitions of individual elements of the financial statements.

There are five basic elements:

- Asset = a present economic resource controlled by the entity as a result of past events;

- Liability = a present obligation of the entity to transfer an economic resource as a result of past events;

- Equity = the residual interest in the assets of the entity after deducting all its liabilities;

- Income = increases in assets or decreases in liabilities resulting in increases in equity, other than contributions from equity holders;

- Expenses = decreases in assets or increases in liabilities resulting in decreases in equity, other than distributions to equity holders;

The Framework then discusses each aspect of these definitions and provides wide guidance on how to decide what element you are dealing with.

Chapter 5: Recognition and derecognition

This chapter discusses the recognition and derecognition process.

Recognition

Simply speaking, recognition means including an element of financial statements in the financial statements.

In other words, if you decide on recognition, you decide on WHETHER to show this item in the financial statements.

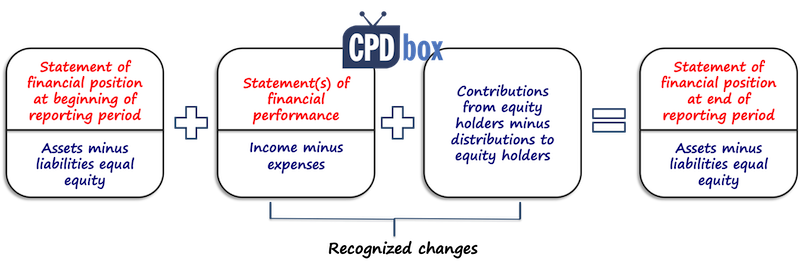

Recognition process links the elements in the financial statements according to the following formula:

Please let me stress here that not all items that meet the definition of one of the elements listed above are recognized in the financial statements.

The Framework requires recognizing the elements only when the recognition provides useful information – relevant with faithful representation.

Then, the Framework discusses the relevance, faithful representation, cost constraints and other aspects in a detail.

Derecognition

Derecognition means removal of an asset or liability from the statement of financial position and normally it happens when the item no longer meets the definition of an asset or a liability.

Again, the Framework discusses the derecognition in a greater detail.

Chapter 6: Measurement

Measurement means IN WHAT AMOUNT to recognize asset, liability, piece of equity, income or expense in your financial statements.

Thus, you need to select the measurement basis, or the method of quantifying monetary amount for elements in the financial statements.

The Framework discusses two basic measurement basis:

- Historical cost – this measurement is based on the transaction price at the time of recognition of the element;

- Current value – it measures the element updated to reflect the conditions at the measurement date. Here, several methods are included:

- Fair value;

- Value in use;

- Current cost.

Each of these measurement base is discussed in a greater detail.

The Framework then gives guidance on how to select the appropriate measurement basis and what factors to consider (especially relevance and faithful representation).

What I personally find really useful is the guidance on measurement of equity.

The issue here is that the equity is defined as “residual after deducting liabilities from assets” and therefore total carrying amount of equity is not measured directly.

Instead, it is measured exactly by the formula:

- Total carrying amount of all assets, less

- Total carrying amount of all liabilities.

The Framework points out that it can be appropriate to measure some components of equity directly (e.g. share capital), but it is not possible to measure total equity directly.

Chapter 7: Presentation and disclosure

The main aim of presentation and disclosures is to provide an effective communication tool in the financial statements.

Effective communication of information in the financial statements requires:

- Focus on objectives and principles of presentation and disclosure, not on the rules;

- Group similar items and separate dissimilar items;

- Aggregate information, but do not provide unnecessary detail or the opposite – excessive aggregation to obscure the information.

The Framework discusses classification of assets, liabilities, equity, income and expenses in a greater detail with describing offsetting, aggregation, distinguishing between profit or loss and other comprehensive income and other related areas.

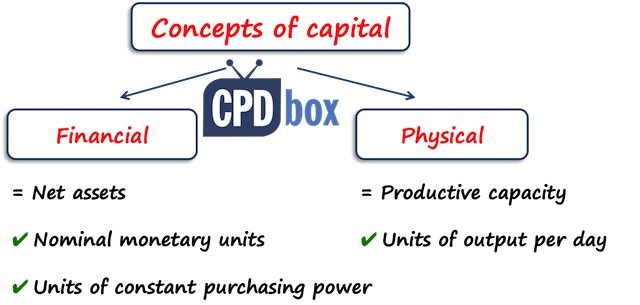

Chapter 8: Concepts of capital and capital maintenance

This chapter is carried forward from previous versions of Framework, so there’s nothing new here.

Let me recap shortly.

The Framework explains two concepts of capital:

- Financial capital – this is synonymous with the net assets or equity of the entity.

Under the financial maintenance concept, the profit is earned only when the amount of net assets at the end of the period is greater than the amount of net assets in the beginning, after excluding contributions from and distributions to equity holders.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

The financial capital maintenance can be measured either in- Nominal monetary units, or

- Units of constant purchasing power.

- Physical capital – this is the productive capacity of the entity based on, for example, units of output per day.

Here the profit is earned if physical productive capacity increases during the period, after excluding the movements with equity holders.

The main difference between these concepts is how the entity treats the effects of changes in prices in assets and liabilities.

You can watch a video with the summary of the Conceptual Framework here:

Any comments or questions? Please leave me a message below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

47 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

thank you and take love

Many thanks for your invaluable support.

Thank you for nice summary on conceptual framework, it simply alot my lecturer notice and make it understandably

thank you Selvia thank you for your contuse given thank you my teacher

hey Silvia – great article. Question from me – Trying to figure out if I should follow the rules for presentation currency or translation of foreign operation. I have a sub division of a much larger group. the group functional currency is Euro. The division is dollar but has a few legal entities with various other currencies. We choose to do a consol at division although not legally required when consolidating FX gains and losses do they get included in P&L or OCI in this situation particularly as a lot of Intercompany transactions are booked that are not eliminated at consol due to different currencies – do they fx differences in particular get booked in P&L or OCI in this min consol. Thanks

DEAR silvia am in Uganda,

i have used your notes to prepare for my FR paper tomorrow 20th DEC 2020

i owe you a lot you have been my teacher i didn’t have to go to a any class

thanks a lot

Oh, I wish you good luck! Please let me know how it went!

What are the Conceptual framework of Accounting in relation of IFRS

hi

what do we mean by the future economic benefits ?

Hello Silvia, I appreciate your work and I’ve gain alot of knowledge, but I will appreciate if you can elaborate more for my learning purpose on this statement and give some examples thanks: (Please let me stress here that not all items that meet the definition of one of the elements listed above are recognized in the financial statements.

The Framework requires recognizing the elements only when the recognition provides useful information – relevant with faithful representation.)

I await your response, thanks in advance

Thank you silvia

Thank you Silvia for making IFRS simpler for everyone to grasp.

Hi Silvia,

Thank you for the video, it was really interesting! I’m doing a project on your video and I wanted to ask what impacts do you think the changes in asset/liability definitions will have on future financial reports and financial ratios? Thank you!

Olá Silvia, parabéns. Estou no Brasil, mas admiro e uso bastante os seus artigos que são extremamente objetivos e práticos. Obrigado!

Hi Sylvia, I write-up the books of account for a residential sectional scheme (body corporate (bc)). During it’s just completed financial year, the bc had to replace its two lifts (elevators) at a cost of approximately R 1,868,000.00. They now wish to capitaise the lifts in the financial statements. The question is, will the lifts be regarded i.t.o. the IAS conceptional Framework as a non-current asset, thus allowing them to indeed capitalise it? The auditors of the bc says that it is not recognised as an asset and as a result, it cannot be capitalised. I on the other hand am of the view that it can be recognised as an assest i.t.o. IAS 16 and can therefore be capitalised. Kindly advise your thoughts on this matter. Would it be possible to respond via e-mail?

Lifts? Well, normally they are non-current assets, but there must be some reason why auditors refuse to capitalize them. If you can find this reason out, then I will be able to say my opinion on that.

This presentation helps me a lot in discussing my topics on the conceptual framework and accounting standards. Thank u for this

Hi Silvia, i got a question about the presentation of liabilities in the financial statements and financial risk management section of financial statements. My question is ” Does the salary payables to employees or payables to taxes and other social security pension funds represents financial liability of the entity”? because as i mentioned BIG 4- entities does not include above items in the financial risk management sections, and ignore them as financial liabilities. Is the “payables to another entity” as defined in the standards the key word of financial liability?

Thanks very much for your assistance some of us we wrong know how the master the financial instruments so i assume that this information will help me to met the further needs in my knowledge’s as well as my further used documents.

Awesome !!!

Much appreciated.

Hi

Is your entire program dealing with IFRS and not IFRS for SME. Do you draw references to the distinction between the two ? For examply is IFRS 15 applicable when you use full IFRS and not to be applied for IFRS for SME and we continue to follow that standard

Hi Anantha,

yes, it is the full IFRS only, but I am working on comparison video to be included.

Dear Silvia,

I would like appreciate your work on IFRS and Framework, you have done a great job which is helping me in ACCA SBR paper. i truely feel more command on IFRS when i refer to your videos.

I have a question about chapter 1 of Framework, it emphasis on accrual accounting to reflect the financial performance of an entity, does it mean now there will be no concept of Cash Basis of accounting?

Thanks. looking forward to your reply.

Hi

Your articles are very helpful. Thanks.

In this article, I think there is a mistake in 2nd paragraph where you mention that first framework was issued in 1998.

It was issued in 1989.

Plz check and confirm.

Thanks again

Vivek Baid

Yes, that was a typo, thank you!

Hi, your note is always helpful. I get summary of everything easily.

Thanks.

Your presentation is very understandable and simplify my lecturer notes

Thank you very much for nice presentation………we learn a lot from you dear!

Hello Silvia…. Must admit that i never thought that the fundamentals of accounting can be explained so nicely.. Awesome work done by you and your team.. Thanks for sharing this and in ACCA it becomes very important to note the definitions of elements and also to depict changes in the framework in comparison with the 2010 one.. Thanks once again..

so educative. Thank you.

Very informative. Thank you.

Hi Silvia. thank you for the insight on the IFRS and the Framework as to which is superior to the other.

Dear Silvia could you kindly please send me the full set of the IFRS Conceptual Framework so that I will have it as a reference? Hassen Nasser from Ethiopia

Regards,

Dear Hassen,

I cannot, I am sorry. This is the material copyrighted to the IFRS Foundation and I would be breaching their rights if I would send out their materials. You need to buy it at http://www.ifrs.org. Thanks for your understanding. S.

Hi/As salam o alaikum

Being accountants, for reporting, financial instruments are very boring. you are requesting to compile understandable and practical qualitative and practical guide about financial instruments and its applicables

Hi Muhammad,

I beg to disagree – for me, the financial instruments are most exciting part 🙂 Anyway, you can find the free materials here and if you need step by step guide, then I strongly recommend the IFRS Kit – you will find more than 7 hours of really entertaining and practical videos on financial instruments, including many case studies solved in excel. All the best! S.

It is always necessary for personal development to get to the fundamentals of accountant such “the framework” to update knowledge of accounting. A good start for the review of all IFRS.

Thanks very much!!!

Glad to help!

Thanks for writing an excellent article on Conceptual Framework. It is very helpful in giving clarity to concepts captured in the framework and improvement required. Much appreciated

Thank you 🙂

Hi Silvia – thanks for the usual excellent summary with pictorials. I find rather eccentric the change from the criteria for recognition: the old framework required the economic benefits associated with elements (assets, liabilities notably) to be (1) probable, and (2) readily measurable; & these are still in the individual IFRS.

The new framework recognition criteria however, are now stated as (a) relevant information and (b) faithful representation, & the discussion sections allow for both low probability, and highly uncertain estimates. These conflict with the individual IFRS criteria, which over-ride the framework if conflict exists. A rather weird scenario, to say the least.

Hi Rich, well, I don’t think that lots of low probabilities and highly uncertain estimates are permitted. For example, chapter 4 clearly defines a liability as an obligation and it further clarifies that an obligation is a duty or responsibility that an entity has no practical ability to avoid (4.29) – I don’t see low probability here. Maybe you should specify a bit more what you are referring to. S.

Great

That was helpful, thanks.

Thank you so much and take love ❤