How to make a change in functional currency

Some time ago I was a part of an audit team auditing the financial statements of a medium-sized manufacturing company.

When we received the trial balance of that client, we spotted something strange:

There were loads of transactions in a foreign currency and resulting impact of constant conversion to the local currency on profit or loss was huge.

In the past years, the company was simply buying materials from its parent, made semi-finished products locally and then sold these semi-finished products to another company in the group.

Apparently, the group was simply using the local company as a production factory due to lower labor cost.

All was fine – both purchases and sales were made to companies in EUR in the past.

However, the main and only customer of our client changed during the period due to some group structure changes.

As a result of that change, our client was making purchases of raw materials in EUR, but 100% of its sales were made in GBP because the new customer insisted on GBP pricing.

Hmmm, that smells like a change in the functional currency.

And yes, it was.

But, it does not need to be something you should worry about.

In this article I would like to show you how to deal with the change in your functional currency and I will also try to address a few practical questions related to such a change.

Please note that here we are dealing with the currencies of non-hyperinflationary economy.

Functional vs. presentation currency

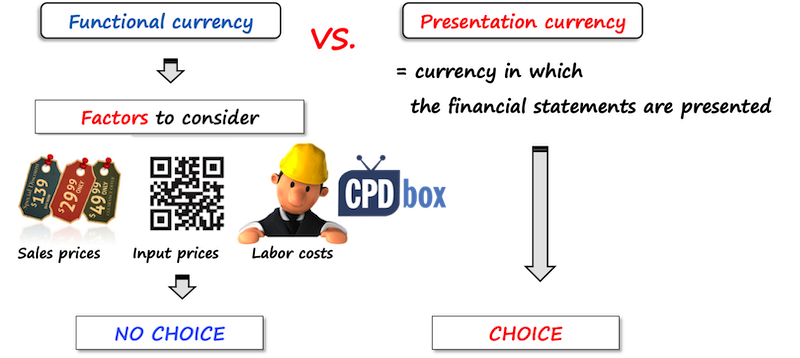

Before we even start with the explanation, I need to remind you that there is a BIG difference between the functional and the presentation currency:

- Functional currency is the currency of the primary economic environment in which you operate.

Your functional currency is NOT a matter of your choice, but the matter of your economic environment.

You should determine it by the careful assessment of factors like the primary currency in which you make sales, cost of sales, etc.

In fact, it is the functional currency in which you keep your accounting records and book the transactions.

- Presentation currency is the currency in which you present your financial statements.

The presentation currency is any currency that you choose.

This summary contains nice illustrative explanation of the practical difference between the two.

When to make a change in functional currency

First of all, you have to assess your primary economic environment to find out your functional currency.

In other words, you need to assess the economic effects of the underlying transactions, events and conditions relevant for you.

In this podcast episode I outline what and how to assess it.

However, sometimes these underlying transactions, events or conditions change and in this case, your functional currency changes, too.

Just as in my story from the beginning of this article: our client, the manufacturing company, changed its sole customer and was forced to sell its products in GBP rather than EUR.

Since the sales were the primary factor determining the functional currency in this case (as purchases and labor cost were all in different currencies and in a lower number of transactions), our client had to account for the change in functional currency.

Now, when to make a change precisely?

It should be on the specific date when the circumstances change.

In our example, the company knew exactly when they stopped selling in EUR and started to sell in GBP – so that was the date.

However, sometimes it happens that the change is not immediate. It could happen gradually over some period of time.

In this case, you need to apply your judgment and determine the appropriate date of change.

One small piece of advice: I would do it on the first day of your reporting period (if you don’t want to be your own enemy).

So, if your reporting period starts on January 1, do it on January 1.

Why?

Well, because it will be easier for you to translate all the balances to your presentation currency at the beginning of the reporting period (you will deal with translation from one functional currency, not two different functional currencies during the same period).

How to change functional currency

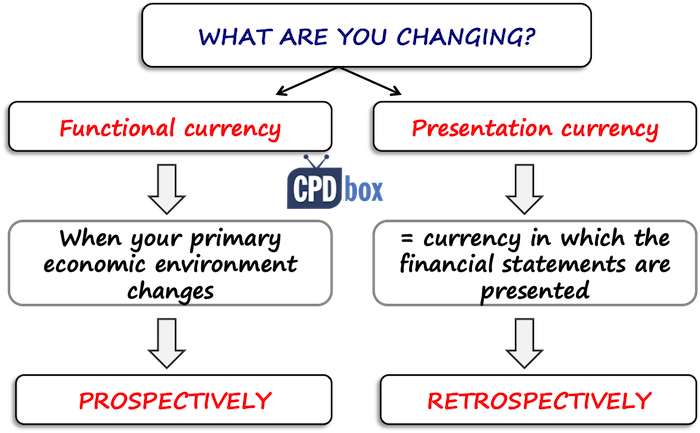

The standard IAS 21 requires applying all the procedures related to the change in functional currency prospectively from the date of change.

No restatement of previous period.

You simply need to translate all items of assets and liabilities into the new functional currency using the exchange rate at the date of change.

For non-monetary items, this amount will be the item’s new historical cost. It means that you are NOT going to update the recalculation at the year-end with the closing rate.

For example, let’s say your functional currency was EUR.

You decided to change your functional currency to USD on 1 January 2019 when the exchange rate was 1,145 USD/EUR.

In your balance sheet, there’s a property, plant and equipment (PPE) with the cost of EUR 10 000 as at 1 January 2019.

After the change in functional currency, the cost will be 11 450 USD and this is the new historical cost of PPE (no further currency revaluation in functional currency).

And, this will be the new historical cost event if you bought the same property in USD.

How to present comparatives when the functional currency changes

So, if you change your functional currency and you always present your financial statements in the same currency as your functional currency, then we are facing two changes in fact:

- The change in functional currency itself – as I explained above, you need to make this change prospectively without any restatement of previous periods.

- The change in presentation currency – the change in presentation currency is treated as a change in accounting policy and is to be applied retrospectively.

Imagine you presented in EUR last year. Your new functional currency is USD and you plan to present your financial statements in USD.

Thus you need to translate your comparative financial statements in EUR to USD using the appropriate exchange rates applicable for the comparative reporting period.

Now, if you decide to present in EUR despite your new functional currency is USD, then you will use IAS 21 rules for translating amounts in your functional currency to presentation currency as described here and here.

I better explain it with an example.

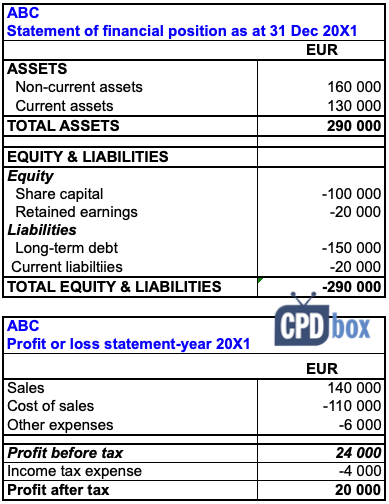

Example: Change in functional and presentation currency

ABC changed its functional currency on 1 January 20X2 from EUR to USD and decided to present its financial statements for the year ended 31 December 20X2 in new functional currency USD.

The financial statements for the year ended 31 December 20X1 were presented in EUR (previous functional currency).

Show how ABC needs to make a change in functional currency and how to present comparative amounts in the financial statements for the year ended 31 December 20X2.

ABC’s financial statements as at 31 December 20X1 in EUR are as follows:

The exchange rates USD/EUR are as follows:

- 31 December 20X0: 1,05

- 31 December 20X1: 1,17 (same as 1 January 20X2)

- Average 20X1: 1,08

- At the issuance of share capital: 1,21

Let’s deal with this situation step by step.

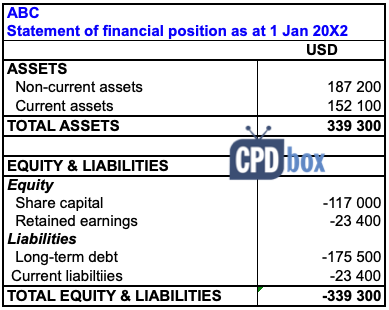

Change in functional currency

As the first thing, ABC should change its functional currency at the date of change – 1 January 20X2.

Therefore, ABC needs to recalculate all assets and liabilities to USD using the rate at the date of change – 1 January 20X2.

How about equity items like share capital and retained earnings?

Article 37 of IAS 21 says it clearly: you should apply the exchange rate at the date of the change to all items (hence including equity) and this amount will become their historical cost.

In fact, the change in functional currency is NOT the change in accounting policy and therefore the retrospective restatement, i.e. measuring share capital in new functional currency before that change (using the rate at its issuance) would NOT faithfully represent share capital at the time of making a change.

Yet still there is a sort of controversy here and I’ve even seen measurement of share capital and other equity items using the transaction date rate instead of the rate at the date of change.

Well, it is simply not under IAS 21.

Here’s the link to the financial statements of a company who changed its functional currency in 2016 from NOK to EUR. You can see this process real life.

The following table shows the recalculation:

| Item | EUR | Which rate? | Rate applied | USD |

| Non-current assets | 160 000 | 1 Jan 20X2 | 1,17 | 187 000 |

| Current assets | 130 000 | 1 Jan 20X2 | 1,17 | 152 000 |

| Share capital | -100 000 | 1 Jan 20X2 | 1,17 | -117 000 |

| Retained earnings | -20 000 | 1 Jan 20X2 | 1,17 | -23 400 |

| Long-term debt | -150 000 | 1 Jan 20X2 | 1,17 | -175 500 |

| Current liabilities | -20 000 | 1 Jan 20X2 | 1,17 | -23 400 |

| Total | 0 | 0 |

Thus here’s the statement of financial position of ABC at 1 January 20X2:

During 20X2, all the transactions will be recorded in the new functional currency – USD and at the end of 20X2, ABC will need to:

- Recalculate all monetary assets and liabilities denominated in currencies other than USD to USD using the closing exchange rate;

- Keep non-monetary items at their historical rate;

- Recalculate all items of income and expenses in currencies other than USD to USD using the exchange rate at the date of transaction.

Change in presentation currency

As I have already mentioned above, the change in presentation currency is a change in accounting policy and it is applied retrospectively.

At the end of 20X2, ABC’s new presentation currency USD is the same as its functional currency, so there is no need to recalculate anything.

However, for comparative financial statements, it is necessary to restate the amounts in EUR using the same exchange rates as if ABC had always presented its financial statements in USD.

More specifically:

- All assets and liabilities will be translated to USD using the closing rate at 31 December 20X1,

- All items of profit or loss will be translated to USD using the rates at the dates of transactions (we will use the average rate for 20X1 as acceptable approximation),

- All equity items will be translated with their historical rates.

Please note that within retained earnings, we only have the amount of EUR 20 000 – the same as profit for the year 20X1.

I made it intentionally simple, because now you need to recalculate full retained earnings with the average rate for 20X1 – the same rate that you would use for recalculating your income and expenses.

In practice, when there are more components of retained earnings, you need to keep track and show each component at its appropriate rate (e.g. profit of 20X0 at the average rate of 20X0, etc.).

Here’s our recalculation:

| Item | EUR | Which rate? | Rate applied | USD |

| Non-current assets | 160 000 | 31 Dec 20X1 | 1,17 | 187 000 |

| Current assets | 130 000 | 31 Dec 20X1 | 1,17 | 152 000 |

| Share capital | -100 000 | Date of issuance | 1,21 | -121 000 |

| Retained earnings | -20 000 | Average of 20X1 | 1,08 | -21 600 |

| Long-term debt | -150 000 | 31 Dec 20X1 | 1,17 | -175 500 |

| Current liabilities | -20 000 | 31 Dec 20X1 | 1,17 | -23 400 |

| Total | 0 | -2 200 |

As you can see, we have a difference in USD balance amounting to USD 2 200.

This is simply a component of equity called “exchange reserve” or “currency translation difference”.

But, here’s one small inconsistency:

The share capital in your comparatives is translated using the historical rate and the same share capital is translated in your current reporting period using the rate at the date of change.

Well, the difference between these two of EUR 4 000 is a part of total cumulative exchange reserve of USD 2 200 and it will be reported in the statement of changes in equity as “the effect of change in functional currency”.

The same applies for the difference in retained earnings of EUR 1 800.

Your statement of changes in equity would look something like:

| Description | Share capital | Retained earnings | Exchange reserve | Total |

| 31 Dec 20X1 | -121 000 | -21 600 | 2 200 | -140 400 |

| Effect of change in functional currency | 4 000 | -1 800 | -2 200 | 0 |

| 1 January 20X2 | -117 000 | -23 400 | 0 | -140 400 |

I am completely persuaded that there will be some questions or doubts related to this example.

No wonder.

There is not much practice since the change in functional currency is not that frequent, but I will try to help if I can.

Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

35 Comments

Leave a Reply Cancel reply

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hi Silvia, I would like your help as I could not find the answer and I am a bit puzzled., I have started a new job, and here they translate the monthly report from GBP to USD and use the Average Rate to translate the P&L, not the monthly Ave Rate, but the one from the beginning of the year (for example, not the October Average Rate, but the Jan-October Average Rate). Is this correct? Should we use the October Ave Rate for the October monthly report? Also, should we translate the whole year in December with the Jan-Dec Average Rate or we can sum the months?

Thank you in advance for your help!

Hi Velika,

well, the prescription by the standard IAS 21 is that you should really use the rate that approximates the rates for that period (par. 40), unless the rates fluctuate a lot (here it would not be appropriate). So the question is – are they translating only October revenues and expenses with the average rate Jan-Oct? Or the aggregate revenues/expenses from Jan-Oct? I would say you can use the average rate Jan-Oct if the report aggregates the amounts for Jan-Oct. When it comes to the year-end: there are no strict rules, just do whatever approximates the real daily rates in the best manner.

Hi Silvia, thank you so much for your answer! Thank you for the content – it is really beneficial and helpful!

We translate only October with the Jan-Oct rates. From November onwards, I will change the current way and translate the Jan-Oct numbers. Thank you once again for your help, Silvia!

What happens if the parent company changes its functional currency to the elimination entries of investments in subs and equity of the subs. Because I now create a new historical value for all balances on the switch date in the parent company books, the new restated investment in subs value does not necessarily eliminate with the equity of the subs. Any idea what to do with this difference you create because of the currency switch?

What rate is used in PY FS in the case of changes in functional currency? You did not explain in your example.

Hello Silva,

So I’m preparing financial statement for a company that changed their functional currency from NGN to USD in the year but retained their Presentation currency as NGN.

All their transactions including the Trial balance for the current year are now in USD. I have the following questions:

1) Should the Share capital be REtranslated in the current year i.e should it change from the prior year NGN amount. If yes am i to use the exchange rate at the date of change or year end rate

2) Is it cool to include the translation reserve in the translation reserves through OCI?

3) Please are you aware of any published financial statements where there were changes to functional currency. Kindly share the name

Hey, thanks for your writeup – It is very good and insightful!

I have one question regarding the change in presentation currency, I understand the change in the equity account, but I was wondering whether such a change can also have an impact on the P&L? I have seen a situation where a company uses this change in currency as an EBITDA adjustment, but the way I understand this is that this will only impact the statement of other comphrensive income and not the P&L directly, or am I mistaken here?

Thanks for your help!

Hi Silvia. Many thanks for this. However I am curious to know what happens when there are retained earnings from prior years e.g The company changes presentation currency from 1 January 2021 and there are retained from before 2020, e.g 2019, 2018 and 2017 within equity. How do you treat these?

Hello Silvia. A great article.

I have just one question. What if the functional currency changes but presentation currency remains the same? For example functional currency changes from USD to Euro but presentation currency is still USD? At the conversion date, translation reserves will get created. Now at year close, will another translation difference get created due to translation from Euro to USD or there will be no difference as presentation currency is the same?

Hi Silvia Thank you for the comment. Yes that is what I was trying to explain to lawyers, but since they see decrease in the share capital value they insist that this cannot happen.

Change was made 01.01.2019 (Rate 1.1397). Incorporation date 09.03.2017 (Rate 1.0551). Shares issued 200,000.

Therefore in 2019 FS we have:

Share Capital 2019 €175,485 (200,000/1.1397)

Share Capital 2018 €189,555 (200,000/1.0551)

Translation reserve from change in presentation currency will be apportioned between share capital and Retained earnings and eliminated on 01.01.2019 as per IAS 21 rules.

As per Cy law there can not be a monetary decrease in the share capital at any case only by court approval. And lawyers cannot understand that the monetary decrease is due to IFRS treatment. What they have said to me is that the Law is above the IFRS……

Well, what to say… it seems that your lawyers are great IFRS experts…

Hi,

Under Cyprus law a Company cannot decrease its share capital unless if has a court order. Doesn’t the change in functional and presentation currency comes into direct violation with the law?

Legal department is convinced that we must show the share capital in the new currency at nominal value (e.g. 1,000 shares at nominal value of €1.00). New currency is €. Old currency was US$. Under IAS 21 we shall use spot rate at the date of the change and historic rate for the comparatives which ultimately in the FS we will show a decrease in share capital. Bottom line. What weights more. IFRS or Cyprus Companies law??

Hi Andreas,

by changing the functional currency, you are NOT decreasing your share capital. Please see the example above as how to present the equity items, including share capital. It is totally clear that the change in share capital was caused by the effect of changing the functional currency and NOT by the decrease in share capital itself.

Hi Silvia – is it also worth mentioning that on a change in functional currency it is possible you now have your taxable profit/loss and hence tax base determined in a currency that is different to your functional currency and hence IAS12 para41 means you would have temporary differences arising on movements in exchange rates?

Dear many thanks …

What if the currency is in a hyperinflationary economy.

Hi Silvia

Thanks for the detailed example. As you say there is a grey area whether to use historical rates to convert non-monetary items or using the rate at date of change.

Where an entity has been purchased and the functional currency is being changed post purchase, it would be difficult to follow the change in share capital and retained earnings since inception of the company when it was under the previous owner, Would you say then the non-monetary items can be revalued using the exchange rate as at date of purchase of the company?

Hello and many thanks for the article, my question if I may is about the treatment of forex loss upon the change of the functional currency, thanks again

Silvia, Thank you for this article, it does increases my understanding. There is still a small question that I need your help clarifying with regards to what happened to the Accum. Currency Translation adjustment at consolidation level when a subsidiary change their functional &/ presentation currency.

Ie. A company has a functional currency NOK, presented them as NOK also and gets its numbers consolidated translated into USD resulting to Currency Translation Adjustment entries accumulated every month to balance the ledger. If this company change its functional &/ presentation to USD then after they did all the revaluation of the non-monetary items and the reval gain/ loss is charged out, should the balance in the Currency Translation Adjustment be written off at the same time?

Hi Silvia

I have a question regarding exchange gain/*loss. if customer paid in advance against sale. The general entry is bank to advance from customer and at that time exchange rate of $ is Rs. 121. But at the time of sale exchange rate of $ is Rs. 130 and sale invoice is $ 1000. How we record exchange gain/loss at the time of sale?

Intially: Dr cash 121000 and cr advance 121000

At the time if sales: Dr. FTL by 9000 Dr. Advance 121000 and Cr. Sales by 130000

URGENT

Hi Silvia, I have an urgent question regarding this. If my share capital was originally purchased in SGD (for example SGD100,000 for 100,000 ordinary shares), but my functional currency is USD (for example USD78,000 – after convert at the date of issuance of share capital due to functional currency is USD at that date). Now the company has found out that their functional currency no longer to be USD but instead SGD. In this case, translate the USD78,000 by using the rate at the date of change of functional currency will not result in exactly SGD100,000 which was shown in the corporate secretary file record/statutory record.

Hence, what the accountant did was to allocate the difference (for example SGD100 difference) between the new translated amount (for example SGD100,100) and the originally SGD100,000 to translation reserve account (a new account)? Is this correct ? Or I should treat SGD100,100 as the new share capital ?

Thank you Silvia for the article. In my country we were recently presented with a monetary policy the major highlight being devaluation of local currency to 2.5 which was previously pegged at 1:1 with the USD. Our financial statements were presented in USD since 2009 which was not a problem until the announcement of the monetary policy on 20 February 2019 which saw the birth of new curreny RTGS$ which is the functional currency for our organisation. In which currency are we going to present our financial statements for the year ending 31 March 2019. Are we suppose to translate our sales which are sold at 60/40 RTGS$ to USD .The rate of 2.5 was the rate on 20 February but since then it has been floating between 2.5 and 2.6 which is likely to continue rising.

What happens if there is a change in functional currency from local currency to USD but the presentation currency remains the same as it has to be in local currency?

Hi Silvia

Do we need to convert retained earning at each year’s average rate if we change our reporting currency. Why can’t we covert retained earning at closing rate for ease in case of change in reporting currency

Hi Subodh,

well, you can do it since there are no rules of how to convert the equity items to your presentation currency. However, the best practice is to do it at historical rates. S.

Thank you Silvia for providing this clear example for dealing with $ # ? currency changes in the dynamic economic environment we often find ourselves. With much appreciation,

Kind regards

Hi Emmanuel, glad to help! 🙂

Thanks so much for Silvia for bringing out clearly the technicality in foreign currency accounting.

Thanks Silvia for the explanations, I have a question here if we have same functional currency & presentation currency then whats the headache? It would be easy to calculate the Financial statement’s elements.

No headache 🙂 This article is about the headache if you actually have to change your functional currency.

Dear Silvia,

Thank you for delivering to us such an insightful article on the Foreign exchange translation.

Dear Silvia,

Thank you for delivering to us such an insightful article on the Foreign exchange translation.

Assuming that there has been a change in the functional currency from Euro to USD in the middle of the financial year, and at that time, the presentation currency has also switched from Japanese Yen to RMB, it follows that for the first half of the year, the foreign currency denominated transactions conducted have already been converted from Euro to Yen, with the resulting exchange difference thus recorded. In such a case, shall I reverse the exchange difference for the first half of the year, and then reconvert those in foreign currencies into the new reporting currency RMB all over again? How shall I record such exchange differences arising?

Hi Edmund, I cannot believe this would be the real case! But yes, there will always be some exchange translation reserve if your functional currency is different from presentation currency.If the similar case happens, then first of all, you should forget about Japanese Yen financial statements (old presentation currency). You are working with translations to RMB as you have always be presenting in RMB. Thus you would work out the comparative amounts and everything as if you would have always done that in RMB.

Hi Silvia,

Very good article. Something which does not seem to be covered is an instance when the change in functional currency is part way through the year. Could you please explain the impact of such change when the change is not at cut-off date i.e. no 1st January but say mid-April?

Hi Silvia, isn’t a change in functional currency accounted for prospectively? Your analysis here depicts retrospectively. Can you shed more light please?