Difference Between Fair Value Hedge and Cash Flow Hedge

The first thing you need to do before you even start to play with hedge accounting is to determine the TYPE of hedge relationship that you’re dealing with.

Why?

Because: the type of hedge determines your accounting entries. Make no mistake here. If you incorrectly identify the type of the hedge, then your hedge accounting will go totally wrong.

But here’s the thing:

Although all types of hedges are neatly defined in IFRS 9, we all struggle with understanding the differences and distinguishing one type from the other one.

A few weeks ago I was giving a lecture about hedge accounting to the group of auditors. Most of them were audit managers and seniors – so not really freshmen, but experienced and highly qualified people.

Yet after about 5 or 10 minutes of speaking about different types of hedges, one audit manager interrupted me with the question:

“Silvia, I get the definitions. I just don’t get the difference. I mean the real substance of a difference between fair value hedge and cash flow hedge. It looks the same in many cases. Can you shed some light there?”

Of course.

What types of hedges do we have?

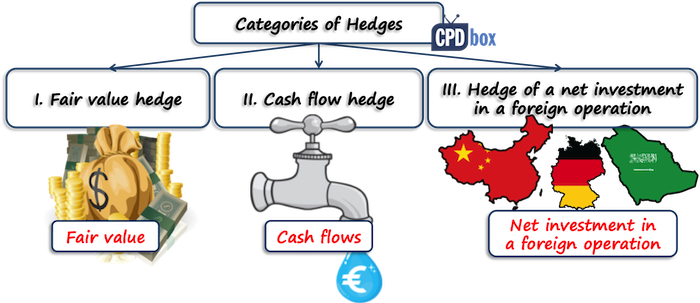

Although I clearly explain a hedge accounting in details in my IFRS Kit, let me shortly explain what type of hedges we have:

- Fair Value Hedge;

- Cash Flow Hedge, and

- Hedge of a Net Investment in a Foreign Operation – but we will not deal with this one here, as it’s almost the same mechanics as a cash flow hedge.

First, let’s explain the basics.

What is a Fair Value Hedge?

Fair value hedge is a hedge of the exposure to changes in fair value of a recognized asset or liability or unrecognized firm commitment, or a component of any such item, that is attributable to a particular risk and could affect profit or loss.

That’s the definition in IFRS 9 and IAS 39.

So here, you have some “fixed item” and you’re worried that its value will fluctuate with the market. I’ll come back to this later.

How to Account for a Fair Value Hedge?

OK, let’s not go into details and let’s just assume that your fair value hedge meets all criteria for hedge accounting.

In such a case, you need to make the following steps:

- Step 1:

Determine the fair value of both your hedged item and hedging instrument at the reporting date; - Step 2:

Recognize any change in fair value (gain or loss) on the hedging instrument in profit or loss (in most cases).

You need to do the same in most cases even if you don’t apply the hedge accounting, because you need to measure all derivatives (your hedging instruments) at fair value anyway. - Step 3:

Recognize the hedging gain or loss on the hedged item in its carrying amount.

To sum up the accounting entries for a fair value hedge:

| Description | Debit | Credit |

| Hedging instrument: | ||

| Loss on the hedging instrument | P/L – FV loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument | FP – Financial assets from hedging instruments | P/L – FV gain on hedging instrument |

| Hedged item: | ||

| Gain on the hedged item | FP – Hedged item (e.g. inventories) | P/L – Gain on the hedged item |

| OR | ||

| Loss on the hedged item | P/L – Loss on the hedged item | FP – Hedged item (e.g. inventories) |

Note: P/L = profit or loss, FP = statement of financial position.

What is a Cash Flow Hedge?

Cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all or a component of a recognized asset or liability or a highly probable forecast transaction, and could affect profit or loss.

Again, that’s the definition in IAS 39 and IFRS 9.

Here, you have some ”variable item” and you’re worried that you might get less money or have to pay more money in the future than now.

Equally, you can have a highly probable forecast transaction that hasn’t been recognized in your accounts yet.

How to Account for a Cash Flow Hedge?

Assuming your cash flow hedge meets all hedge accounting criteria, you’ll need to make the following steps:

- Step 1:

Determine the gain or loss on your hedging instrument and hedge item at the reporting date; - Step 2:

Calculate the effective and ineffective portions of the gain or loss on the hedging instrument; - Step 3:

Recognize the effective portion of the gain or loss on the hedging instrument in other comprehensive income (OCI). This item in OCI will be called “Cash flow hedge reserve” in OCI. - Step 4:

Recognize the ineffective portion of the gain or loss on the hedging instrument in profit or loss. - Step 5:

Deal with a cash flow hedge reserve when necessary. You would do this step basically when the hedged expected future cash flows affect profit or loss, or when a hedged forecast transaction occurs – but let’s not go in details here, as it’s all covered in the IFRS Kit.

To sum up the accounting entries for a cash flow hedge:

| Description | Debit | Credit |

| Loss on the hedging instrument – effective portion | OCI – Cash flow hedge reserve | FP – Financial liabilities from hedging instruments |

| Loss on the hedging instrument – ineffective portion | P/L – Ineffective portion of loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument – effective portion | FP – Financial assets from hedging instruments | OCI – Cash flow hedge reserve |

| Gain on the hedging instrument – ineffective portion | FP – Financial assets from hedging instruments | P/L – Ineffective portion of gain on hedging instrument |

Note: P/L = profit or loss, FP = statement of financial position, OCI = other comprehensive income.

As you can see, you don’t even touch the hedged item here and you only deal with the hedging instrument. So that’s completely different from fair value hedge accounting.

How to Distinguish Fair Value Hedge and Cash Flow Hedge?

What I’m going to explain right now is my own logic of looking at this issue. It’s not covered in any book.

It’s how I look at most hedging transactions and this is a very simplified view. But maybe it opens up your mind to logical thinking about hedges.

Please, ask first:

What kind of item are we hedging?

Basically, you can hedge a fixed item or a variable item.

Hedging a Fixed Item

A fixed item means that the item has a fixed value in your accounts and it may provide or require fixed amount of cash in the future.

The same applies for unrecognized firm commitments that have not been sitting in your accounts yet, but they will be in the future.

And when it comes to hedging fixed items, then you’re practically dealing with the fair value hedge.

Why is that?

Well, here, you are worried, that in the future, you would be paying or receiving a different amount than the market or fair value will be. So you don’t want to FIX the amount, you want to GET or PAY exactly in line with the market.

I’m referring to “GET” or “PAY” only for the sake of simplicity. In fact, you don’t even need to get or pay anything in the future – you’re just worried that the item will have a different carrying amount in your books that its’ fair value.

Fair Value Hedge Example

You issued some bonds with coupon 2% p.a.

It’s nice that you always know how much you’ll pay in the future.

BUT you are worried that in the future, market interest rate will be much lower than 2% and you will be overpaying (in other words, you could get the loan at much lower interest in the future than you will be paying at the fixed rate of 2%).

Therefore, you enter into interest rate swap to receive 2% fixed / pay LIBOR12M + 0.5%. This is a fair value hedge – you tied the fair value of your interest payments to market rates.

Hedging a Variable Item

A variable item means that the expected future cash flows from this item change as a result of certain risk exposure, for example, variable interest rates or foreign currencies.

When it comes to hedging variable items, you’re practically speaking of a cash flow hedge.

Why is that?

Here, you are worried that you will get or pay a different amount of moneyin certain currency in the future that you would get now.

In fact, in a cash flow hedge, you want to FIX the amount of money you’ll get or pay – so that this amount would be the same NOW and IN THE FUTURE.

Cash Flow Hedge Example

You issued some bonds with coupon LIBOR 12M+0.5%.

It means that in the future, you will pay interest in line with the market, because LIBOR reflects the market conditions.

BUT – you don’t want to pay in line with market. You want to know how much you will pay in the future, as you need to make some budget, etc.

Therefore you enter into interest rate swap to receive LIBOR 12 M + 0.5% / pay 2% fixed. This is cash flow hedge – you fixed your cash flows and you will always pay 2%.

To Sum This All Up

Now you can see that the same derivative – interest rate swap – can be a hedging instrument in a cash flow hedge as well as in a fair value hedge.

The key to differentiate is WHAT RISK you hedge. Always ask yourself, why you undertake the hedging instrument.

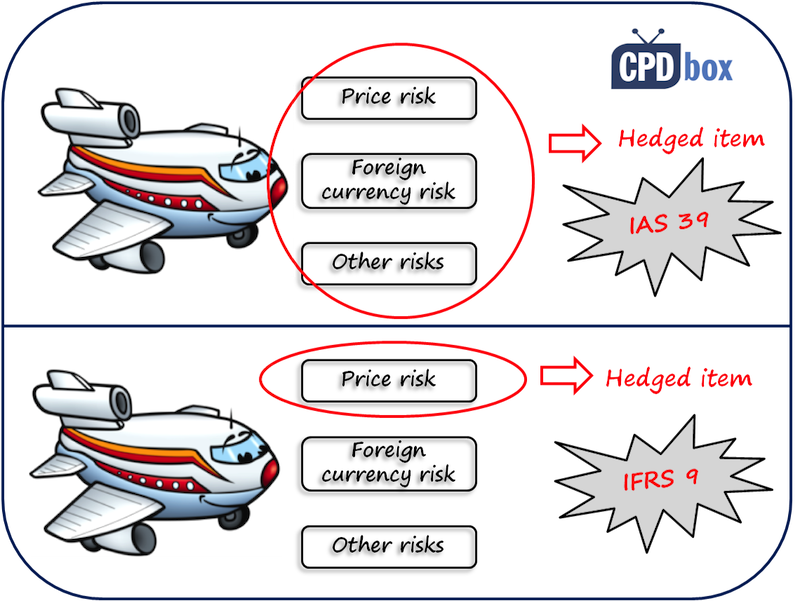

But it’s not that simple as it seems because there are some exceptions in IAS 39 and IFRS 9.

For example, even when you have a fixed item, you can still hedge it under cash flow hedge and protect it against foreign currency risk.

Equally, you can hedge a variable rate debt against fair value changes – and that’s the fair value hedge.

Therefore, please refer to the following table summarizing the types of hedges according to risks and items hedged:

| Item hedged | Risk hedged | Type of hedge |

| Fixed-rate assets and liabilities | Interest rates, Fair value, Termination Options | Fair value hedge |

| Fixed-rate assets and liabilities | Foreign currency, credit risk | Fair value hedge or cash flow hedge |

| Unrecognized firm commitments | Interest rates, Fair value, Credit risk | Fair value hedge |

| Unrecognized firm commitments | Foreign currency | Fair value hedge or cash flow hedge |

| Variable-rate assets and liabilities | Fair value, termination options | Fair value hedge |

| Variable-rate assets and liabilities | Interest rates, foreign currencies, credit risk | Cash flow hedge (most cases) |

| Highly probable forecast transactions | Fair value, interest rates, credit risk, foreign currency | Cash flow hedge |

Now, I’d like to hear from you. Please leave me a comment and let me know whether you have dealt with some hedge accounting in practice, what issues you faced and how you solved them. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hello Silvia, thank you for your clearly explanation. Could you help to explain for case below that why it is treated as fair value hedge?

Inventory bought at $100M, and enter the future contract to sell at $95M,

My understand from your guide that it is FIXED amount you get , it should be cash flow hedge.

Many thanks.

Dear Silvia,

Could please advice what are the criteria of cross currency interest rate swap agreement ?

Hi Silvia

Thank you for great insights on this comlicated subject . I have a question if you may .

i have entered into an irs where i recieve floating rate ( euribor 3m flat ) and pay fix ( + spread ) .

this spread on the fix side is composed of credit exposure + funding cost & ext .

obviously , the irs is not nill at inception ( because the spread added to the fix side )

my question to you is how do i treat that irs from accounting point of view ( my main problem from now on is to check effectiness’ and how do i enter this not nill irs into the books ) . my primary objective in entering this irs in 1st place was to hedge afloating loan i took , so it was cash flow hedge .

many thanks , looking forward for your insights on that subject

Adiv

Hi Silvia,

Thank you for your explanations, very helpful indeed. One question related to presentation & disclosure in the F/S: Let’s assume I want to hedge a future sales transaction which will happen in a foreign currency – and I want to secure it against FX rate changes (not applying hedge accounting). In what PNL line item would I record the hedge revaluation effects in my financials until the underlying sales transaction will happen somewhere in the future?

Thx a lot in advance.

Hi Daniel, if you do not apply hedge accounting, then all change in FV of your derivative goes in profit or loss. Now, the standard does not tell you the exact classification and it will depend on your policy choice, but I would recommend grouping it somewhere after sales/cost of sales since it relates to this main business, but of course there are many factors affecting the policy choices.

Hi Silvia

I have a question regarding the fair value hedge.

Normally, inventories (e.g. Oil..) are measured at lower of cost and NRV. Do we measure inventories at fair value in case of fair value hedge accounting?

Thanks in advance!

Hi Movsar, if they are hedged item, yes.

Is it appropriate to recognise the fair value of a hedge contract before the effective date of the contract due to a prepayment of the hedging premium?

if you cash flow hedge account for a future cash flow from a signed sales contract, once that sale contract is invoiced to the customer it appears in the GL as an account recieable which is revalued monthly as part of the ERP’s reval process but we are still hedge account for this transacton, do we need to discontinue the reval process as the AR is included in our hedge account amounts.

Hi Silvia, I would like to ask what the impacts on the balance sheet for both hedging methods? Will they lead to no balance sheet volatility if it is a 100% effect hedge?

Also, if I have a FVOCI asset that is hedged using a put option, will I need to do amortisation?

Hi Silvia, Could you please answer my question. If Swap is sold (terminated) but Bond (hedge item) is still live what will be the treatment of MTM realization from Swap, as of now there is no MTM taken to P&L apart from Ineffectiveness portion.

Hi Akanksha, you need to take everything to P/L, including accumulated cash flow hedge reserve in other comprehensive income. So even if you do not realize any profit or loss at the date of swap termination, you will still need to derecognize this reserve (accumulated in OCI) and recognize it in P/L.

Dear Silvia,

My company is applying the layer approach while hedging future probable sales forecast.

I tried to find out if IFRS 9 can offer a guidance related to de designation. If the hedge is outside the range defined in the company(over hedged) am I forced to de designated full last layer or I can use partially de designation? Thank you a lot for your guidance.

Ana Maria

HI Silvia – in the above it says that the you account (In most cases) for fair value changes in a fair value hedge through P&L _ yet we go to the importance of hedge accounting in the guest article – and the first example – a fair value hedge of the AFS – it would seem only the ineffective portion is going to the P&L. Can you please clarify?

Well, the second treatment (ineffective portion in P/L) relates to the cash flow hedge; you first sentence relates to fair value hedge.

Hi Silvia, what happens when swap is early terminated but hedge item still live. How to deal with MTM. Thanks

Hi Silvia,

The steps for accounting a Net Investment hedge will be the same as per the Cash Flow Hedge right?

Thanks, amazing support you have provide!

Hi Michael, yes, almost the same. Anyway, I am working on an article with the example on net investment hedge, so I’ll keep you posted (if you are subscribed to my newsletter). S.

hi Silva,

thanks for your nice and simple explanations for the treatment of derivative transactions.

i have one query:

we have commodity swap contracts entered with some broker and we follow cash flow hedge accounting and the settlements payments/receipts are accounted in inventory but out of these some contracts are terminated by mutual agreement and for that we need to pay say usd 3/MT for 10000 MT.

we we should take this termination cost directly taken to P&L or can i inventorise it. pl clarify

Hi,

A clarification. If a forward contract is booked for cashflows (basically for receipt of dividend, receivables etc) by a manufacturing company. year end falls on 31st March and the company follows cash flow hedging. When will the reclassification happen if the company is booked the forward as a single contract based on approximate value for dividend and receivables ?

What reclassification do you mean? In general, it depends on how you designate the hedging instrument. At the year-end it is necessary to fair-value your hedging instrument and any gain/loss on this derivative is split to effective part (in OCI) and ineffective part (P/L).

Is it possible to take out forward cover on a dividend for which the timing and amount is uncertain and then designate the FEC contract as a cash flow hedge?

Assume the FEC is taken out in March. The dividend is declared in May and will be paid in June. Based on budgets, management can estimate the amount of dividend to be paid March and take out an FEC at this point.

My understanding is that a parent entity cannot designate the foreign currency risk on a highly probable inter-company dividend as a hedged item in its group financial statements in a cash flow hedge. Inter-company dividends are not foreign currency transactions that can be hedged, because they do not affect the consolidated income statement. They are distributions of earnings.

Stay blessed you helped me a lot in understanding difference between fair value and cash flow hedge.

Hi Silvia,

You have a really amazing article right here!

I was just wondering if I wish to hedge an investment in a local subsidiary where I’ve purchased shares in, would I be able to apply hedge accounting for such an investment if the investment is a) recognised at cost and b) equity accounted for (an associate company)

I am not quite sure whether I am correct or not, but I fill that you must have mentioned about spot rate and forward rate in relation to cash flow hedging. Am I right?

Well, I was just describing the differences between the different types of hedge relationships and you don’t really have to mention spot and forward rates, since I was not calculating fair values. S.

Thank you for the wonderful article.

When I enter into an interest rate swap for 4 quarters (receive fixed 5%, pay variable LIBOR+2%) offsetting my variable income elsewhere, at end of each quarter, two things happen

a) my fair value of this swap on FS changes (let’s say it increases from 0 to 40 in end of q1)

b) i receive fixed cash flows ( I receive 5%, pay 4% thereby making 1% offsetting my variable pay of 4% elsewhere) fully effective because my net inflow = 4 (revenue) +5-4 (cash flow based on hedging) = 5

So, as per your definition

“OCI should recognize ineffective portion in P&L” because hedge the swap is a hedge right?

why not that means 39 in P&L and 1 in oci?

Hi, Silvia,

This is a very good article.

I would have a different type of question under IFRS – knowing that in a bank there could be many dormant accounts with long dormancy periods and assuming there is no eschatement law and the statutes of limitation never start (so the bank is forever liable to pay back these accounts to its customers) could use as hedged item a pool of dormant deposits due to customers (in a bank, liabilities, not valued at fair value but at nominal value) and hedge against the risk that these deposits are claimed (knowing that there is a chance that maybe 20 out of 100 are claimed in the future, based on history and actuarial models)? The hedging item would be a swap (derivative) with an external party. Would this arrangement qualify for hedge accounting? Thank you so much.

HI Silvia,

I have trouble identifying the correct hedge accounting method for the following:

– A lends B an amount of USD 5,000, B pays 4% fixed interest to A

– A measures its loan to B at amortised cost

– A enters into a pay-fixed/receive variable swap contract with Z

– SWAP: A pays 4% fixed and Z pays variable market interest

Do I need to use CF or FV hedge?

Many thanks in advance!

Regards,

Jay

Well, A exchanges fixed to variable, hence it is a fair value hedge as A effectively ties the cash flows from this hedge to market, and gives up certainty of fixed cash flows.

Hi Silvia,

Does OCI is a part of Cash flow? If yes then which items of OCI should be considered while preparing Cash flow statement?

Hi, do you mean cash flow hedge reserve in OCI? Yes, you have to take it into account, but careful – the change in cash flow hedge reserve should be treated as a non-cash item in the operating part. Please see more here. S.

Hi Silvia

I work for an Australian Listed entity and we have entered into a number of Fixed Rate USD bonds, we have entered into CCIRS that take that debt from Fixed USD to Fixed AUD as we want to protect against FX Risk and Interest Rate Risk, by understanding is this is a cashflow hedge as we are protecting against movements in the USD/AUD exchange rate and also the AUD interest rate by locking in a fixed interest rate. Is my assessment correct?

We also issued AUD debt fixed rate debt, do I need to fair value this debt at each reporting period and record the movement through PL? I don’t believe I have to if I have classified this as a Loan under AASB139

Sylvia, hope you are well! My question resides on the presentation of the hedging instrument’s gain or loss when it is ultimately reflected in the P&L. If I have a cash flow hedge to protect exchange variations on the income tax payable account, it appears that the hedge instrument’s gain or loss would impact the income tax expense account. However, this creates some confusion in my mind because what is generally a pre-tax item (the outcome from the hedging item) would be impacting tax expense.

Thanks in advance for your thoughts, and thank you for all the teachings!

Hi Juan,

frankly speaking, I’ve never come across similar situation when you are hedging the income tax. Anyway – if it is a cash flow hedge, you need to know the exact amount that you are hedging and if your real income tax expense is different, then the remaining part would be just unhedged. Also, you are right, the outcome of hedging instrument is presented together with the outcome of the hedged item and yes, if it affects the income tax, then of course, there will not be perfect match. S.

Hello Silvia,

Thank you in advance for your all supports.

I am still having difficulty for distingushing the difference of cash flow and fair value hedge.

I live in Turkey and as you know our currency is TL. My company, that I work in, services in operational fleet car leasing industry. We take borrowing to purchase the car by EUR currency because it is cheaper then TL funding. Due to this we make the rental contract by EUR with our customers which are not recognized in asset.

When the currency rate increase we book foreign exchange loss which is calculated through our borrowings. Avoid of the fx loss in our statements we started to use fair value hedging. In our case, we use our borrowing as a hedging instrument and we hedged our firm commitments which is hedge item.

After starting fair value hedge, although we book fx loss for our borrowings if the currency rate increase, at the same time we book fx gain for our firm commitment which is calculated according to the difference between reporting dates currency rate and contracts starting dates currency rate.

As a result, we do hedging avoid of fx loss coming from our borrowings, because most of time fx rate increases in Turkey.

Everything that I explained above was confirmed by our audit company which is one of big four.

I kindly ask you that if our hedging methodology, which is fair value, correct or not or can we use either cash flow or fair value?

Thank you in advance.

Hi Gurcan,

that’s OK. As you can see from the table in the article, you can hedge foreign currency risk in both cash flow and fair value hedge. S.

Hi Silvia,

I saw you double entries for hedge item only for fair value hedge. For effective cashflow hedge, means there is not necessary to retranslate hedge item at closing rate and difference posted to P&L?

Hi Silvia,

Thank you for this useful link on hedge accounting.

I have a question I would like to ask you.

Do you think it is possible to achieve hedge accounting if we forward hedge against forecast debt, i.e. the underlying debt is not yet drawn, but anticipated to be drawn, so there is a risk of being overhedged, could we still achieve hedge accounting?

Hey Silvia,

So here is my question, Suppose i have taken forward cover against my foreign currency receivable, so is it a cash flow hedge or fair value hedge?

Also if i have taken forward cover for an amount which is more than/less than my foreign currency receivable, then what will be the treatment of excess/short position taken?

Hi Silvia,

I’m interested on the CVA/DVA impact on the cash flow hedge portion especially on recognizing the accounting entries that should goes to OCI. Would you be able to provide some insight and sample affecting this matter.

Thank you.

Rgds/Zed