IFRS 15 vs. IAS 18: Huge Change Is Here!

When to recognize revenue? This simple question is one of the most controversial issues in today’s accounting.

Why?

Well, it’s simple and easy when you sell goods, but how about long-term contracts or some sort of services?

You need to have some rules on WHEN to recognize the revenue from all these things, because all your profits and losses, your reputation in front of the outside world and your taxes depend on this.

Revenue recognition rules have just changed and later in this article, you’ll find an example showing you the impact of this change.

Revenue Recognition: IFRS vs. US GAAP

Until now, revenue recognition was exactly one of the biggest gaps between IFRS and US GAAP.

As you know, IAS 18 Revenue contains principles for revenue recognition, but they are quite broad and as a result, many companies use their judgment to apply them in their specific situation. Some companies even developed their own IFRS policies based on the US GAAP rules.

Opposed to IFRS, US GAAP guidance about revenues is very detailed – US GAAP contains about 100 separate documents and protocols about revenue recognition in specific areas (often conflicting, by the way).

Finally, these 2 standards came closer and tried to solve all these differences on 28 May 2014.

IFRS 15 Revenue from Contracts with Customers

New revenue recognition standard was issued: IFRS 15 Revenue from Contracts with Customers and it should fill the gap between IFRS and US GAAP.

FASB (the US GAAP standard setting body) issued the new revenue recognition standard, too: Topic 606, which is almost a mirror of IFRS 15 (full text of Topic 606 is here).

Although I’ll cover this standard in one of my videos in the following months, here are the basic points for your information:

-

- You’ll need to apply IFRS 15 for reporting periods beginning on or after 1 January 2018 (early application permitted);

- IFRS 15 will replace the following standards and interpretations:

- IAS 18 Revenue,

- IAS 11 Construction Contracts

- SIC 31 Revenue – Barter Transaction Involving Advertising Services

- IFRIC 13 Customer Loyalty Programs

- IFRIC 15 Agreements for the Construction of Real Estate and

- IFRIC 18 Transfer of Assets from Customers

- The core principle of IFRS 15 is that an entity will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration (payment) to which the entity expects to be entitled in exchange for those goods or services.

To apply this principle, you need to follow a five-step model framework described below.

- IFRS 15 contains guidance for transactions not previously addressed (service revenue, contract modifications);

- IFRS 15 improves guidance for multiple-element arrangements;

- IFRS 15 requires enhanced disclosures about revenue.

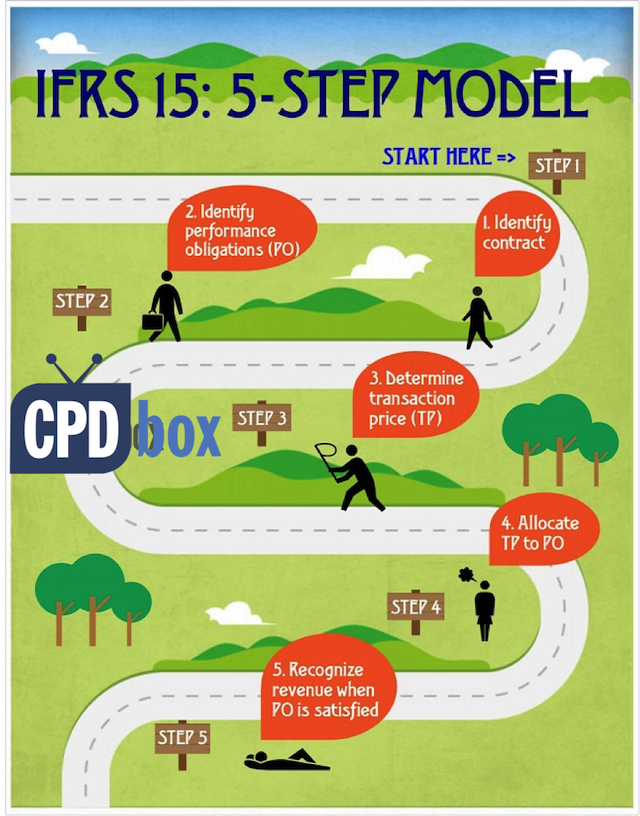

Five-Step Model Framework

Every company must follow the five-step model in order to comply with IFRS 15. We’ll not go into details, just let me brief you a bit:

- Step 1: Identify the contract(s) with a customer.

IFRS 15 defines a contract as an agreement between two or more parties that creates enforceable rights and obligations and sets out the criteria for every contract that must be met.

- Step 2: Identify the performance obligations in the contract.

A performance obligation is a promise in a contract with a customer to transfer a good or service to the customer.

- Step 3: Determine the transaction price.

The transaction price is the amount of consideration (for example, payment) to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties.

- Step 4: Allocate the transaction price to the performance obligations in the contract. For a contract that has more than one performance obligation, an entity should allocate the transaction price to each performance obligation in an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for satisfying each performance obligation.

- Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

Who Will Feel the Biggest Impact of IFRS 15?

The experts say that the most impacted industries are telecom, software development, real estate and other industries with long-term contracts.

If you work in an industry where bundled contracts of “product + service” are quite common, then you should pay attention.

I’m referring mainly to software development or telecommunications, where customers usually buy a prepayment plans with a handset or software development comes with implementation and post-delivery service in 1 package, or any similar arrangements.

Under the new model, companies in telecom and software will probably recognize revenue earlier than under older rules.

Why is that?

Well, because under new IFRS 15, the transaction price must be allocated to the individual performance obligations in the contract and recognized when these obligations are delivered or fulfilled.

It means that under new IFRS 15, telecom operator must allocate a part of the revenue from prepayment plan with free handset to the sale of handset, too.

Under IAS 18, the revenue is defined as a gross inflow of economic benefits arising from ordinary operating activities of an entity.

It means that if the operator gives a handset for free with the prepayment plan, then the revenue from handset is 0.

OK, if that sounds a bit confusing, we’ll better look at numbers.

Example: IAS 18 vs. IFRS 15

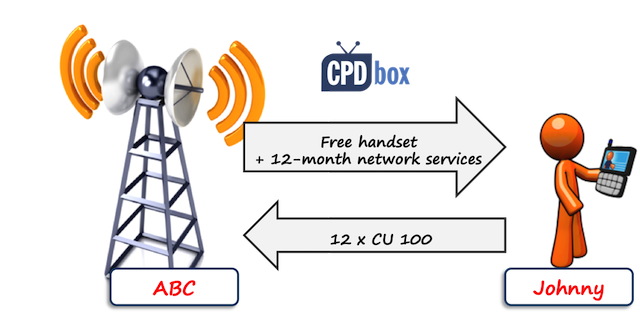

Johnny enters into a 12-month telecom plan with the local mobile operator ABC. The terms of plan are as follows:

- Johnny’s monthly fixed fee is CU 100.

- Johnny receives a free handset at the inception of the plan.

ABC sells the same handsets for CU 300 and the same monthly prepayment plans without handset for CU 80/month.

How should ABC recognize the revenues from this plan in line with IAS 18 and IFRS 15?

OK, let’s ignore a couple of things here, like a price of a SIM kit, or the situations when Johnny hangs on the phone for hours and spends some minutes in excess of his plan. Let’s focus just on these 2 things.

Revenue under IAS 18

Current rules of IAS 18 say that ABC should apply the recognition criteria to the separately identifiable components of a single transaction (here: handset + monthly plan).

However, IAS 18 does not give any guidance on how to identify these components and how to allocate selling price and as a result, there were different practices applied.

For example, telecom companies recognized revenue from the sale of monthly plans in full as the service was provided, and no revenue for handset – they treated the cost of handset as the cost of acquiring the customer.

Some companies identified these components, but then limited the revenue allocated to the sale of handset to the amount received from customer (zero in this case). This is a certain form of a residual method (based on US GAAP’s cash cap method).

For the simplicity, let’s assume that ABC recognizes no revenue from the sale of handset, because ABC gives it away for free. The cost of handset is recognized to profit or loss and effectively, ABC treats that as a cost of acquiring new customer.

Revenue from monthly plan is recognized on a monthly basis. The journal entry is to debit receivables or cash and credit revenues with CU 100.

Revenue under IFRS 15

Under new rules in IFRS 15, ABC needs to identify the contract first (step 1), which is obvious here as there’s a clear 12-month plan with Johnny.

Then, ABC needs to identify all performance obligations from the contract with Johnny (step 2 in a 5-step model):

-

-

- Obligation to deliver a handset

- Obligation to deliver network services over 1 year

-

The transaction price (step 3) is CU 1 200, calculated as monthly fee of CU 100 times 12 months.

Now, ABC needs to allocate that transaction price of CU 1 200 to individual performance obligations under the contract based on their relative stand-alone selling prices (or their estimates) – this is step 4.

I made it really simple for you here, so let’s do it in the following table:

| Performance obligation | Stand-alone selling price |

% on total | Revenue (=relative selling price = 1 200*%) |

| Handset | 300.00 | 23.8% | 285.60 |

| Network services | 960.00 (=80*12) | 76.2% | 914.40 |

| Total | 1 260.00 | 100.0% | 1 200.00 |

The step 5 is to recognize the revenue when ABC satisfies the performance obligations. Therefore:

-

-

- When ABC gives a handset to Johnny, it needs to recognize the revenue of CU 285.60;

- When ABC provides network services to Johnny, it needs to recognize the total revenue of CU 914.40. It’s practical to do it once per month as the billing happens.

-

The journal entries are summarized in the following table:

| Description | Amount | Debit | Credit | When |

| 285.60 | FP – Unbilled revenue | P/L – Revenue from sale of goods | When handset is given to Johnny | |

| Network services | 100.00 (= monthly billing to Johnny) | FP – Receivable to Johnny | When network services are provided; on a monthly basis according to contract with Johnny | |

| 76.20 (=914.40/12) | P/L – Revenue from network services | |||

| 23.80 (=285.60/12) | FP – Unbilled revenue | |||

So as you can see, Johnny effectively pays not only for network services, but also for his handset.

What’s the Impact of the IFRS 15?

The biggest impact of the new standard is that the companies will report profits in a different way and profit reporting patterns will change.

In our telecom example, ABC reported loss in the beginning of the contract and then steady profits under IAS 18, because they recognized the revenue in line with the invoicing to customers.

Under IFRS 15, ABC’s reported profits are the same in total, but their pattern over time is different.

Why does it matter?

Well, because some contracts surpass one accounting period. They are long-term and reporting revenues in incorrect accounting periods might cause wrong taxation, different reporting to stock exchange and other things, too.

Don’t believe me?

Just look at ABC. Let’s say that contract started on 1 July 20X1 and ABC’s financial year-end is 31 December 20X1. Just look how much profits ABC reports from the same contract with Johnny under IAS 18 and IFRS 15 in the year 20X1:

| Performance obligation | Under IAS 18 | Under IFRS 15 |

| Handset | 0.00 | 285.60 |

| Network services | 600.00 (=100*6) | 457.20 (=76.2*6) |

| Total | 600.00 | 742.80 |

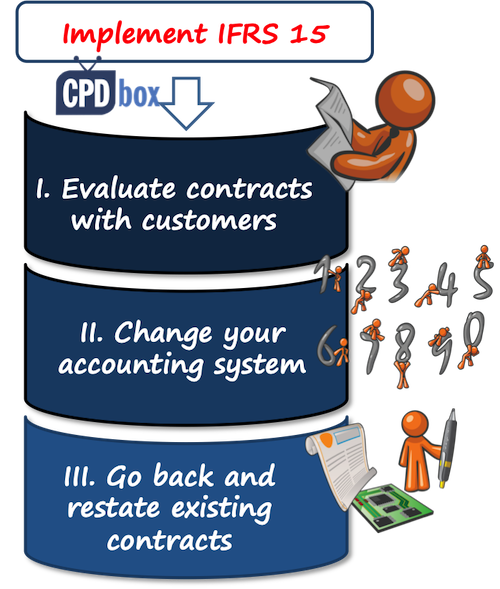

How to Prepare for IFRS 15

I really do think that IFRS 15 is a huge change and it requires a massive amount of work not only from accountants, but also from IT departments, tax people and maybe other departments in your company, too.

A few ideas for your future steps:

- Go through your contracts and evaluate

Your profit reporting will depend on the specific contract terms. If your company has a number of different types of contracts, you need to assess each type separately and decide how to deal with that type in line with IFRS 15.

- Change your accounting system

OK, how many customers does the “average” telecom company have?How many contracts are there?

Thousands. Millions. Tens of millions.

And once you decide how to recognize revenue for each type of contract that you have, then you need to implement this accounting process into your accounting software or system.

Whether you realize it or not, the implementation of IFRS 15 will cost affected companies significant amount of money for system upgrades, consultants, training the employees and other related activities.

That’s why IFRS 15 must be implemented starting 1 January 2018 – some time is left for making these changes.

- Go back and restate existing contracts

I did not want to scare you in my previous point, but this is going to be a bit scary:All companies need to look back and recalculate profits and revenue reporting from all contracts.

When you apply IFRS 15, you need to apply it as the new rules have always been in place, that is retrospectively.

Let’s say that Johnny and ABC enter into 2-year plan on 1 July 2015 and IFRS 15 has not applied yet; thus ABC recognized zero revenue for handset and monthly revenues from network services in line with the billing.

On 1 January 2017, ABC will apply IFRS 15 and contract with Johnny is still open (it expires on 30 June 2017). ABC needs to perform all the calculations as shown above and adjust opening balances related to the contract.

What does it mean?

Companies will need to gather lots of numbers, fair values, estimates, stand-alone selling prices and other things and then perform lots of recalculations and adjustments.

Just imagine you work in a construction of real estate and you’re affected by IFRS 15. Some contracts run for 10 or 15 years … OK, I finish here and leave it to your imagination.

UPDATE 2018: I have written few articles about IFRS 15 and you can check them out here:

- IFRS 15 Examples: How IFRS 15 affects your company

- Accounting for discounts under IFRS

- How to account for customer incentives under IFRS

- Principal or agent – revenue or liability?

- Short summary of IFRS 15 Revenue from Contracts with Customers (with video)

Now, I’d really love to hear your view. Do you think IFRS 15 will hit you hard? Are you making your plans to adopt or implement it? Please leave a comment below and if you liked reading this article, share it with your friends here.

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

I have a query about how book revenue for software development company whereby a contract or agreement is signed say around third quarter (e.g. say Oct 2023) for the contract obligation to be covered in 6 months and lets say the project faces some delays of three months so how do i go about booking the revenue at end of 2023. Would i book split revenues and how do i reflect the element of delay?

Hi Mo,

don’t just split revenues by the time apportioning method. First, you need to assess if the performance obligation (software for the client) is delivered at the point of time or over time. If it is over time, then at the end of the year, you need to measure the progress towards completion. If, for example, you assess that the project is 10% complete at 31 December, then you can recognize 10% of total contract revenue.

Hello! I see that this standard only covers exchange transactions. What about non-exchange transactions where there is revenue generated but no performance obligations?

costs to paint the building:

o Debit Contract costs (asset in balance sheet);

o Credit Employees (or suppliers or whatever is relevant)

• Use of paints:

o Debit Contract costs (asset in balance sheet)

o Credit Inventories

If you pls Selvia as i think by this Method you add the Contract Costs 2 times one when you BUY and the Other when you USE

I hope you replay to me if there is miss understanding from me

Yes, you are right, these entries do not fit, I would do it as follows:

– Buying paints: Debit Inventories of paints / Credit Suppliers

– Using paints: Debit Contract costs (assets) / Credit Inventories of paints

I hope it helps. S.

Thank you so much salvia!!!

Hi Silvia, If the company receives deposits for work done, how should that be handled in terms of revenue recognition? Should this be credited to another account until all the work is done? Additionally, should VAT be charged the deposit up front, or to the total contract price?

Thanks for your response in advance!

Hi Anika,

as for VAT – it depends on your VAT legislation, so I cannot really say. In our country, we need to charge VAT also on the deposits received. If you cannot retrieve VAT from the state, then you can include it in the cost of PPE/other asset.

As for received deposits, typically you need to recognize them as Debit Cash/Credit Contract liability and as soon as you meet the conditions to recognize revenue, you will book Dr. Contract liability/Cr. Revenue. Here there is the solved example. I hope it helps! S.

Hi Silivia,

Very informative site..

In case of telecom sector, Entity providing internet service, cable tv service and landline phone service these services are bundled I-e $ 3000 and also sold separately with $ 2000, $ 500 and $ 1000 respectively basis. Revenue in respect of these should be recognised over the time as customers are invoiced on monthly basis. Is it necessary to allocate contract price to separate performance obligation as revenue in total remained the same I-e $ 3000 or allocation is necessary for disclosure purpose. Pleas comment..

Very simplified points and example – this is amazing.

Thanks!

Hi Silvia,

Thanks for writing a very helpful article on IFRS 15.

I am in the retail industry where the company is offering $200 voucher having a validity of one year on the purchase of $1000.

How do I recognize revenue & voucher?

How would the accounting treatment work if the cellphone contract were over 2 years.

IFRS 15 offers the practical expedient of ignoring time value of money if the contract is for 12 months or less. So in the instance where the contract expands over 2 years, would we be discounting the stand-alone selling price of the monthly installments too? Or do we argue that the data bundle is provided on a monthly basis, and payment is on a monthly basis, in which case the time frame is less than one year so there is no discounting for that. Is there any instance where we would discount the stand-alone selling price?

Hi Thomas,

great question. Well, IFRS 15 says that there is a significant financing component if timing of payment of promised goods/services provides either customer or the entity with the significant benefit of financing. However, in the case of similar monthly prepaid plan this is not the case, because the service is provided over time, a performance obligation is partially met over time and the payment relates to that part satisfied within the last month, thus there is no significant financing component and no need to discount anything.

Example of a significant financing component would be purchase of a machine with immediate delivery, but the customer pays 1/2 now and 1/2 after 18 months – the time difference between the satisfaction of a performance obligation (delivery of a machine) and 1/2 payment is 18 months, thus you have significant financing component and you need to discount the second half.

Silvia Thanks for your contribution to accounting knowledge especially the focus on ever changing scenarios

Dear Silvia

I hope you are well.

Your articles have simplified the standard. Can you please assist me as well, I am working for university in the accounting department, i just want to bounce my ideas with you.

University major sources of income are tuition and other fees, residence fees, government grants.

Government grants are excluded on IFRS 15.

I have a question though on tuition and other fees and residence fees.

Do we have a contract with the students?

My view is we have a contract.

The second question is what is University performance obligations?

My view again is to provide education services and accommodation.

Determination for transaction price is not a problem since we charge separately for each component. and allocation of transaction price is also not an issue.

The last question is when the university should recognise revenue?

The standard requires the revenue to be recognized when performance obligation is satisfied.

My view is we recognise the revenue at the end of the semester or year depends on the duration of the coarse. At the end of the financial year which is linked to the academic period, we can recognise the revenue for yearly cause and recognise revenue for semester coarse after 6 months.

In case of accommodation, when the university has provided the accommodation to the students, which will also be end of the semester.

Please help

Hi Rose,

I generally agree with what you wrote – yes, you have a contract related to tuition and other fees and yes, your main performance obligation is to provide tuition (education). I see it as satisfied over time, and thus you should recognize the tuition fees over time based on the progress towards completion. For example, let’s say the student pays the annual fee of 10 000 for the period from September Y1 to June Y2; and for the sake of simplicity let’s say that the tuition is evenly distributed and you can use straight-line basis to calculate progress towards completion. Student pays you in September Y1 the full amount, thus you need to book Debit Cash Credit Contract Liability 10 000. In December Y1 (let’s assume this is the end of your financial year), you recognize revenue of 4 000 (4 months/10 months) and the entry would be Debit Contract Liability Credit Revenue 4 000. Sure, you can use other methods of calculating progress towards completion – but that’s roughly how I see it. I hope it helps!

Silvia thankyou for this information that very help full,

i want to ask how about construction contract ? do you have an example?

please let me know,

Thankyou verymuch

Yes, I think this will help. S.

thankyou very much Silvia, wish you the best.

Hie Silvia

How do we recognise revenue for Non profit organisations under IFRS 15. The organisations receive funding or grants from Funders or Partners

Hello Silvia,

Thanks for your invaluable article on this topic.

If a Company has carried out all the performance obligation but could not certainly tell how much Revenue it will receive from its customer at the end, must such a Company wait till when payment is received from customer before recognizing it? Or what is the correct treatment?

(The Customer pays based on the services rendered by the Company and because of the volume of the services, there is always disagreement between the two parties on the number of services rendered in a month in most cases and as such the income the Company receives may be different from what is expected from the Customer)

Hi Silvia,

If retrospective application is dependent on a significant amount of data, which is not readily available, can one apply the “impracticable” provision in IAS 8?

What onus of proof is necessary to prove that it is “impracticable” to apply it retrospectively?

Well, you need to have some justification that the cost of getting that retrospective information would exceed the benefits – in other words, the items are not so material and the cost of getting the info is too high.

Hi Silvia,

How does IFRS 15 account for work in progress?

I think this can help.

Hi Silvia

How does this affect the Banking industry

Hi Silvia,

thanks for your useful information. could you please advise if the companies needs to apply IFRS 15 and 9 for interim periods of 2018 under ias 34? say 6m 2018? it confuses me, because the standards are applicable for the annual periods usually.

Dear Silvia,

I would like to request an example for the changes from construction contracts(AIS11) using input method vs. revenue recognition (IFRS15) using output method.

Thank you so much in advance. Very much appreciated your way of sharing your knowledge.

Hi Arn, I will publish such an article soon, no worries!

Dear Silvia

Thank you for providing such deep insights regarding “How to account for customer incentives under IFRS 15”. I am still not clear about certain aspects of customer incentive such as

i) Wholesale company provides free insurance coverage to their dealers if they purchase a specified amount of products during the financial year. How should this transaction be treated as a reduction of revenue or marketing expense? In addition, it may be mentioned here that insurance plan is purchased by the company from insurance company so that they can provide it to dealers.

II) Retail company provides free foreign tour to their customers if they purchase a specified amount of products during the financial year. How should this transaction be treated as a reduction of revenue or marketing expense? In addition, it may be mentioned here that foreign travel tour plan is purchased by the company from travel agency so that they can provide it to customers.

Thanks in advance. Appreciate your effort and time to make IFRS easy for everyone..

Warm regards

Mymoon

Dear Silvia,

Thank you for your valuable articles and videos in IFRS. I am a huge fan of your work.

I have question:

When companies capitalizes costs “cost to acquire a contract and cost to fulfill contact” it will be presented in the statement of financial position.

What about the cash flow statement?! where are such costs presented? CFO or CFI? and why? please

Hi Silvia. what does FP in your above illustration stand for? Also could you kindly clarify what the double entries for the 285,60 for the handset should be? Many thanks

Hi Sunat, FP stands for financial position (balance sheet). And, I strongly believe that all double entries for the 285,60 are there!

Very useful.

Hi Silvia,

I hope everything would be fine on your side.

Really it is great that you are sharing knowledge.

My question is that i want to know that how we gonna treat construction contract in IFRS-15.

Like we incur the cost but the revenue should be recognize at the time when customer satisfy, but what about the cost we gonna incur in manufacturing the asset for customer.

kindly let me know with proper double entry and relate the scenario with example, it will be very helpful for me.

Your corporation will be appreciated.

Thank you in advance.

Hi Adnan,

thanks a lot for this question! I plan to publish a full article within a few months, so stay tuned!

Hi Silvia,

Can you please explain with an example of IT company view point? That would be great!!

Regards

Pankaj Singla

how about interest example term loan interest at property development have effect under IFRS 15

Thanks it very helpful

Hi,

is it IFRS15 or not if my company offer is 12 months plan(mobile data) with 50% discount. Only the service.

Thanking You in advance,

Marina

Hi, i still dont really understand the the degree of collectibility of the receivables,

lest say below example

I have a service contract with customer with $ 100,000 on monthly base, and i Delivered the service to him but i am not sure he can pay , what should i record in my books DR and CR in this case

Hi silva,

i’m working in company sale of goods with free service and free parts credit voucher.

1.1.1 With free service

eg: 3000 hours free service on labour,

mileage ,travelling time and filter only

-Issue WII and charge services/part costs to respective department as free service

1.1.2 With parts credit

– Finance-AR issued parts & service voucher after customer fully paid for machinery

Current practice

free svc

DR Aft Sls Service

CR Service sales

Parts credit

DR Trade debtors credit

CR Parts credit recorded

How to recognised revenue under MFRS15 changes?

I think it might be fare value of handset in the market.

Hi Saliva,

This is excellent! I actually have an assignment on this and I find this extremely useful; it has, by far, enhanced my knowledge and understanding of both IFRS 15 and IAS 18 and my coursework is now a lot easier. God bless you!

Regards,

Glodz

Thank you, glad to help 🙂

Hi Silvia,

I think there is an alternative treatment for first time adopters, which is called the simplified transition, under which the effect is recorded as a lumpsum adjustment to retained earnings on 1-1-2018 without affecting the comparative information, please advise.

Hi Ahmed, yes, there is. It is called modified retrospective approach. I wrote similar article about implementing IFRS 16 Leases with example illustrating both full and modified approach here. With IFRS 15, it’s the same methodology. S.

Nevermind, I see my mistake. We recoginze the revenue when we fullfill the obligation and give Johnny the headset. sorry, my mistake!

Please see my example below: I think you should be recognizing revenue of 600.00 in both years from the same contract.

Month Headset Rev Network Rev Total

july 23,80 76,20 100,00

august 23,80 76,20 100,00

sept 23,80 76,20 100,00

october 23,80 76,20 100,00

novembe 23,80 76,20 100,00

december23,80 76,20 100,00

jan 23,80 76,20 100,00

feb 23,80 76,20 100,00

march 23,80 76,20 100,00

april 23,80 76,20 100,00

may 23,80 76,20 100,00

jun 23,80 76,20 100,00

Hi Silvia,

Why did you recognize all of the revenue from the headset in the first 6 months (and not over 12 months) in your example when the revenue extends into another accounting period (i.e. July 1) above?

This obviously will lead to an overstatement in revenues; in the journal entry example you gave, you´re taking the 100.00 from the monthly service received and you´re allocating 76.20 to revenue from network services and 23.80 to revenue from unbilled revenue which makes sense because it is over 12 months. But then right below it you´re taking 285.60 of revenue being allocated to the headset and you´re recognizing it all in the first 6 months of the contract.

There is a mismatch and I don´t understand it – I think it should still be over 12 months regardless of whether or not the contract was entered into in July.

Please let me know what I am missing. Thank you for your help!

John

hi, I want ask whether we have to recognise the revenue from an incomplete job, for example if a company was given a contract to manufacture a specialize equipment for the customer’s operation and the equipment 80% complete by the end of the accounting period. do we have to recognize the revenue such deposit? I appreciate if you could reply to this thank you

Under IFRS 15, you need to assess whether the control passes to customer at the point of time or over time. There are 3 criteria for control pass over time – if one of them is met, then yes, you recognize revenue based on the progress, if none of them is met, then you recognize revenue when the asset is handed over to your customer. From what you wrote, I can’t really assess it because I don’t enough information. S.

Silvia Hi

What if the equipment (special production line tailored to customer) is sold with the assembly service that has to be performed by the producer of equipment (bundle). In the middle the equipment is transported to the customers facility for the assembly (invoice issued) and the customer obtains physical control over the unassembled equipment that can not use until assembled and tested. We presumed that in this case we have just one performance obligation. Would you have any concern with this? The contract doesn’t define that the producer has the enforceable right to retain payment (this means that very probably the producer would have to return the advance payments and go into a lawsuit for damages. This would indicate that the revenue recognition is at point in time. How would you suggest to recognise revenue?

Hi Slyvia, I wondered what would happen to the following revenue methods in line with the implementation of IFRS 15, as follows: (1) Installment Methods for installment sales , (2) Percentage of Completion for long-term construction contract , and (3) cost-recovery method. Are these mentioned revenue methods still applicable?

In the old standard, the free handset will be recognised as an expense. In contrast, the for the new standard we have to allocate the cost of free gift and recognise as revenue.

Does it mean that the company will understate its expenses for the new standard since it does not do not recognise the free handset as an expense? The free handset is a cost to the company and why isn’t it recorded as an expense?

Hi Sharon,

no, the expenses will not be understated. Under the new standard, you still have to recognize the expense for the free handset as cost of sales (not marketing cost) and recognize corresponding revenue (0 under IAS 18). S.