Irregular lease payments under IFRS 16 Leases

Question

We took the lease contract to rent a building for 6 years with total cost of CU 60 000, of which:

- CU 30 000 is paid up front before we moved in; and

- CU 30 000 is paid at the beginning of the 4th year.

How should we account for the above?

Answer

Initial recognition and measurement

Under IFRS 16, you shall recognize the right-of-use (ROU) asset and the lease liability.

Lease liability:

The lease liability is calculated as the present value of the lease payments not paid at the commencement date discounted with the interest rate implicit in the lease (IRR), or the incremental borrowing rate if IRR cannot be determined.

So, in this case, there is only one payment not paid: CU 30 000 to be paid at the beginning of the 4th year.

And, in most cases, it will be difficult and impractical to determine the IRR, so we take the incremental borrowing rate. More on that topic here. For the purpose of this example, let’s say we take the similar borrowing rate of 3%.

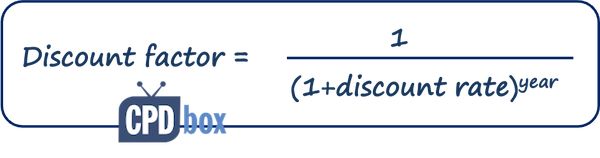

You can discount CU 30 000 with 3% with one simple formula. Just multiply CU 30 000 with the discount factor for 3% and 3 years. You can calculate the discount factor with the following formula:

Just please bear in mind that you are discounting for 3 years, not 4 – the payment was to be done at the beginning, not at the end of the year 4, so in fact it is in 3 years time.

The present value is then CU 27 454 which is equal to the lease liability in this particular case.

ROU asset:

Here, the ROU asset is calculated as the sum of:

- The lease payments made at of before the lease commencement date. Here, this is equal the first payment of CU 30 000 made up front before you moved in.

- The amount of the initial measurement of the lease liability – see above, calculated at CU 27 454.

The ROU asset is then CU 57 454, and your initial journal entry is:

-

Debit ROU asset: CU 57 454

-

Credit Lease liability: CU 27 454

-

Credit Bank account (cash paid): CU 30 000

Subsequent measurement

Lease liability:

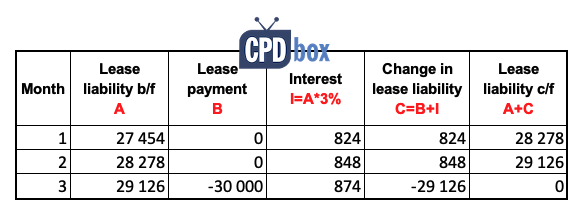

You would need to accrue interest each year, even if no lease payment is made, until you have some lease liability left.

To do that, the easiest way is to set up a table:

As you can see, the lease liability after the second payment becomes zero, which is OK because there are no payments left to make from the year 4 onwards.

Thus in the years 4, 5 and 6, you will still show ROU asset as the lease term is ongoing, but no lease liability since there will be none.

Journal entries:

At the end of year 1, year 2, and year 3 you just accrue the interest:

-

Debit Interest expense in P/L: CU 824 (year 1) or CU 848 (year 2) or CU 874 (year 3)

-

Credit Lease liability: CU 824 (year 1) or CU 848 (year 2) or CU 874 (year 3)

At the beginning of the year 4, the lease liability becomes CU 27 454 (initial amount) plus CU 824 (interest in year 1) plus CU 848 (interest in year 2) plus CU 874 (interest in year 3), which is – not surprisingly – CU 30 000.

You pay the second payment, then:

-

Debit Lease liability: CU 30 000

-

Credit Cash: CU 30 000

Of course, do NOT forget to depreciate the ROU asset, maybe on a straight-line basis over the lease term of 6 years. Thus at the end of each year, the entry will be:

-

Debit Depreciation in P/L: CU 9 576 (which is ROU asset of CU 57 454 divided by 6)

-

Credit ROU asset: CU 9 576

So, if you have any questions, feel free to ask below in the comments.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

6 Comments

Leave a Reply Cancel reply

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hi silvia

I have a question regarding the calculation of lease interest for finance leases,

For new leases ,our accounting system currently calculates the lease interest for the entire month, regardless of the actual start date of the contract. For example, if a lease liability begins on January 15, 2023, the system calculates interest for the full 31 days in January, instead of the 16 days actually applicable.

Could you please clarify if this method of calculating lease interest for the full month aligns with the requirements of IFRS 16?

If you have a lease term of 10 years with for example 10,000 each year. If with the signature of the lease agreement, the lessee is obliged to pay the lessor the sum of 10,000 and this sum is set-off with the last payment, how should this be treated?

Hi Silvia,

Thank you for this clear explanation. With this example, kindly also show what final figures will sit on the statement of cash flows. Thanks in advance.

ROU is part of investment activity

Lease liability is consider as part of financing activity

Please explain the short terms

1. CU in the lease interest

2. C= B + I in the table

Please make videos on IFRS -15 Revenue

Hi Jafir,

1. CU = currency unit (as I prefer to write in general, not mentioning any specific currency like EUR, GBP, whatever)

2. C is change in lease liability, equals to B (lease payment column) plus I (interest column)

I hope it helps!