Can we classify loans with variable interest at amortized cost?

The loans generated by the banks come with various features, such as variable interest linked to inflation, interest payments depending on the market value of collateral, minimum or maximum amount of the interest to be paid, you name it.

The question is how to classify and subsequently account for similar loans.

Anna from Russia asked similar question:

“We provided a loan with a variable interest rate and there is a limitation for max/min interest rates to be paid.

Will this feature prevent this loan from passing SPPI test (solely payment of principal and interest)?

Or it is still possible to classify this loan as amortized cost category?

Are there any limitations of SPPI test passing on the basis of collateral type?

Implementation guidance in IFRS 9 specifies that “In some cases a financial asset may have contractual cash flows that are described as principal and interest but those cash flows do not represent the payment of principal and interest on the principal amount outstanding . For example, this could be the case when a creditor’s claim is limited to specified assets of the debtor or the cash flows from specified assets.

Could you please tell us some examples in order to clearly understand what does the Standard mean in this case? Because it is a usual practice that loans are collateralized by particular assets, for example mortgage or other collateral type.”

Answer: It depends on what the interest is paid for

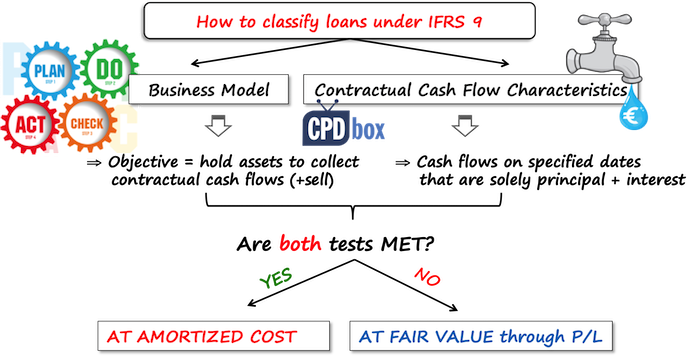

Under IFRS 9, you can classify the loan at amortized cost only if it passes 2 tests:

- Business model test: The objective of the entity’s business model is to hold the financial asset to collect the contractual cash flows (rather than to sell the instrument prior to its contractual maturity to realize its fair value changes).If you are a bank that normally creates loans and you normally collect the repayments of these loans – and you are not selling or otherwise trading with these loans, well, then this criterion is met. But in this answer, we will not deal with it.We will more focus on the second criterion that is

- Cash flow characteristics test: The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. Nothing else.That’s the abbreviation SPPI – solely the payments of principal and interest.

If the loan meets both criteria, then you can classify it at amortized cost and set up a nice effective interest method table and recognize interest and repayment of principal over the life of the loan in line with that table.

But what if the loan fails to meet one of these criteria? In such a case, no amortized cost, but you have to classify the loan at fair value through profit or loss.

That is additional burden and completely different accounting, because you have to set the fair value of such a loan at each reporting date – which is not automatic and can be difficult and challenging.

Let’s get back to the question.

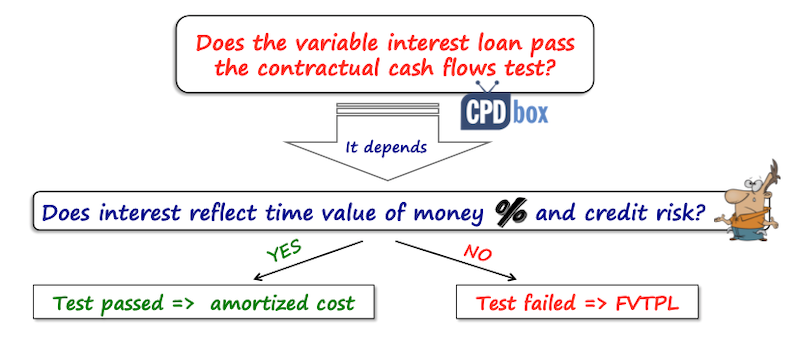

Does the variable interest loan pass contractual cash flows test?

The answer is – it depends.

The interest must reflect only the consideration for the time value of money and credit risk – nothing else.

If there’s something else included, then it would not be OK and the test would fail.

Examples: The loan meets the test

- Interest rate linked to market ratesIf the variable interest loan provided by the European bank is let’s say LIBOR 6m+0.5% – in other words, tied to some interbank market rate and nothing else – yes, that’s fine, because the cash flows from that loan are solely the payments of principal and interest – it does not matter whether it’s variable or fixed interest.

- Maximum or minimum interest to be paidIf there’s some limit on the amount of interest to be paid – some cap with maximum interest or floor with minimum interest – it reduces the variability of cash flows from the interest paid.If this is the only reason for cap or floor, then it’s OK and the test is passed.

- Interest linked to inflationThen we can have a loan that carries interest linked to inflation. What to do in this case?If the terms say that the loan carries an interest depending on the inflation index each year, then it’s fine because linking payments of interest and principal to inflation index kind of updates the time value of money to the current level. The test is passed.

- Full recourse loans with collateralsIf the loan is full recourse, or fully backed by the collateral of the borrower, then yes, we can say that this collateral does not affect the loans classification and the loan can still meet contractual cash flows test.

All these types of the loans meet the contractual cash flows characteristics test and if the business model test is met, too, you can classify them at amortized cost.

Examples: The loan does NOT meet the test

- Non-recourse loan with collateralWhen you have a non-recourse loan secured by some collateral, it might not pass the test. Why?Non-recourse loan means that if the debtor defaults, the bank can take the collateral (like sell the property and take the cash to collect the loan), but the bank but has no right any further compensation, even if the collateral does not cover the full value of the defaulted amount.

So in this case, logically, contractual cash flows can be limited to the value of collateral and that is not meeting the contractual cash flows test.

Just don’t panic if you are a retail bank providing mortgages to individual clients, these are full recourse in most countries and in most cases.

- Interest depends on cash flows from collateralsAnother example of not meeting the test is loans with interest depending on some cash flows from collateralized assets.Let’s say the bank provides a loan for the construction of apartment house, the collateral is the land under the house and the payments of cash flows can be increased or decreased depending on the sales proceeds got from the sales of apartments.

This does not meet the test, because the cash flows include also other component – share on profit – not only payment of interest/principal.

Another example – if the future repayment of loan depends on the movement in market price of collateral – that’s the problem, too.

- Loans convertible to fixed amount of ordinary sharesAnother example of loan not passing the test is convertible loan to fixed amount of ordinary shares.If the bank provides a loan to some big company with option to convert this loan into ordinary shares instead of taking repayment, that’s the problem, because the cash flows are NOT only for repayment of principal and interest, but they are adjusted for the conversion feature.

Again, this requires careful analysis, because if the loan is convertible to variable number of shares and the unpaid amount of loan equals to the fair value of total shares converted, then that’s OK. It’s not all black or white.

- Loans with leveraged interest ratesWhat about leveraged interest rates? Or link to leveraged inflation index?

For example, what if the loan carries an interest of 2 times 3-month LIBOR – that’s leveraged, because it’s multiple.That’s the problem, too, because the variability of cash flows steeply increases and these cash flows do not have the economic characteristics of interest – reflecting just the time value of money or credit risk.

In general, this is for a long debate, I just gave you a few examples of the most common cases, but remember – you always need to assess whether the cash flows are only a principal repaid and interest, and whether that interest reflects just the time value of money and credit risk.

Here’s the video summing up this issue:

Any comments? Please let me know below, thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

22 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, can you share the accounting treatment for variable interest loans borrowed

hey Jeyam, did you find the answer to this? I also want to know how to calculate EIR? Do we need to updater each year and recalculate it again and again. But in this case your loan value change even for old period. SO not sure how to deal with it?

Hi silvia, thanks for such wonderful concept clarity, pls I request how to calculate fair value at the end of each reporting date when loan carries variable interest rate, at the time of conception rate was different, every year rate is year till maturity. My next question how to pick the effective interest rate belonging to which period ( starting, end of ist year, later one

Hi Silvia, i have a question on sub-participation. can i email you the question?

Hi, Silvia! How to deal with the situation if we issue a loan to an external party with a nominal amount of 50m on a condition that 2m (cash reserve) from this will be kept by us to apply to the loan interest payment? Basically we transferred 28m only. I would assume amortized cost at EIR is still at place, but how would overall entry look like in Y0 and Y1. Thank you! Love your podcasts!

If you transferred just 28 and not 30 (or 50?), then you really look at your cash flows. In other words, you provided just 28, not 30 and your EIR will be calculated based on 28.

Hello Silvia,

Thank you for sharing the concepts & ides. I have one queries which is as: Company ‘A’ gets loan from Government at lower than market rate for wholesale lending to other entities . As a result further loan provided by company ‘A’ is lower rate due to government restriction on limit of interest rate. Should i require to amortized both lending & invested loan at market rate ?? please guide me….

Hi Chakra,

these loans still meet the conditions to be at amortized cost. But, you need to recognize them at fair value – please see how here. The article is about employee loans, but it is the same principle with any below-market loan.

Hello Silvia,

I have a concern, in my company, we have carried a loan at amortized cost as on December 2017, where the market interest and coupon rate is the same (i.e. 8%). Now, the coupon rate is changed to 12%, should we revise the amortized cost as on December 2018 by discounting future cash flows based on 12% at initial EIR i.e. 8%

Hi Silvia

What happens when a loan’s interest is linked to a CDS pricing index of the borrower itself? I would associate this as relating to the credit-rating of the borrower/parent company- although the cash flow payments can vary. Does it still pass the SPPI test or should I assume it’s an automatic fail?

Hi, Silvia

Love your explanations. Great work:) Can I know how to check the test for continuous loans given by promoters without a specific repayment date?

Hi Nikhila,

is this your liability – meaning, is this the loan from promoter? Then this test does not apply. If you are a promoter and you have the loan asset, then answer to 2 questions – business model? cash flows? If it’s normal for you to provide loans within your business and you plan to collect only interest + principal, then just look to the way how the interest is quoted. S.

Hi Silvia

Thanks for sharing your insights on this topic. I have two questions on the SPPI test:

(1) do you have a list of (if not all then most of) the features will fail SPPI criterion (for e.g. equity linked, convertible etc etc).

(2) would you kindly share any process flow on how to do SPPI test?

Many thanks once again for your help.

Hi Alex,

no, I don’t have similar list because I’m not aware if it exists and if someone has done it 🙂 Hmmm, and how to do SPPI test… I’m not sure there is any process to follow except for what I’ve already written above. You just screen the asset and answer whether it meets both criteria, that’s all. S.

any article or schedule to help me how to calculate financing lease .

Hi Silvia, how about interest-fee loan that normally happened on intercompany? Should we classify the loan under FVTPL due to the SPPI doesn’t meet? Thanks!

Hi Chin Sien, I don’t think that in the case of intercompany loans SPPI is not met. If the loan is interest-free and no other conditions are attached, then the cash flows from the loan are indeed solely for the repayment of principal and interest (although it is zero). So yes, you can actually classify the interco loan at zero interest at amortized cost. However, you need to recognize it at fair value which is not its nominal amount if interest is zero (hint: you should discount the future cash flows with market rate). S.

Hi Silvia, thank you for taking time to answer my question and I understand the principal better now!

Silvia,

Your analysis of amortized cost is to the point and easy to understand.

Thanks for sharing.

Thank you 🙂

Thank you for sharing another great work…This is more than just a question & answer session….

Thanks, Umar, hopefully it will help 🙂