How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

The new lease standard IFRS 16 has been here for a while and yes, it imposed a challenges on all companies who leased their assets under operating leases.

The reason is that IFRS 16 requires presenting ALL the leases in the same way, regardless whether they were classified as finance or operating.

Just for the lessees though and with some exceptions (small leases, short-term leases).

So, now, if you have any sort of a lease as a lessee, you have to present right-of-use asset and the lease liability. You can read more about it here and there are also detailed explanations with solved excel examples inside the IFRS Kit.

On top of challenges this new treatment brings, many of you asked me to show how to present these new leases in the statement of cash flows.

Hence let me show you on the solved example.

Example: IFRS 16 Leases in the statement of cash flows (IAS 7)

On 1 January 20X4, ABC entered into the lease contract. The details are as follows:

- Initial right-of-use asset equals to CU 20 000, thereof:

- the present value of the lease liability is CU 17 000; and

- initial direct costs paid in cash are CU 3 000.

- During 20X4, ABC paid the lease payments in total amount of CU 3 700, thereof:

- the repayment of the lease liability was CU 3 209; and

- the payment of the related interest was CU 491.

- In 20X4, amortization of ROU asset was CU 4 000.

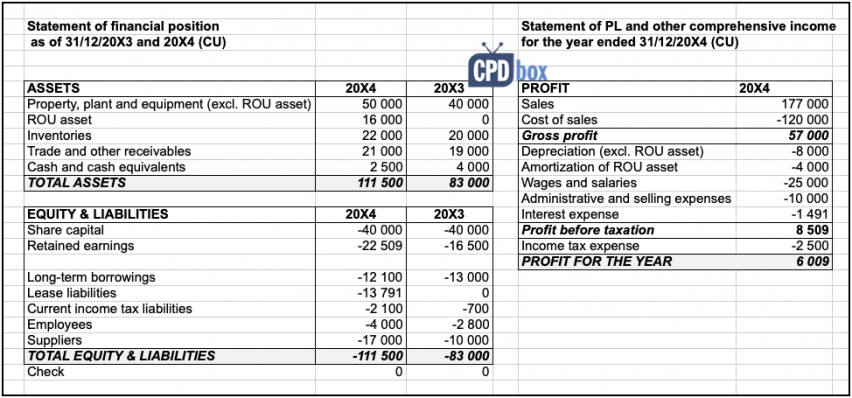

This transaction has been incorporated to financial statements as shown below.

Your task is to prepare the statement of cash flows for the year ended 31 December 20X4.

To prevent any misunderstanding, “CU” simply means currency unit (instead of mentioning EUR, USD, JPY, what have you).

Please note the following points in the presented financial statements:

- The right-of-use (ROU) asset as of 31 December 20X4 amounts to CU 16 000 in the statement of financial position, which is the initial ROU asset of CU 20 000 less amortization of ROU asset in 20X4 of CU 4 000. You can see the amortization of ROU asset of CU 4 000 in the statement of PL and OCI, too.

- The lease liability as of 31 December 20X4 amounts to CU 13 791 in the statement of financial position, which is the initial lease liability of CU 17 000 less its repayment in 20X4 amounting to CU 3 209.

- Interest expense for the year 20X4 of CU 1 491 includes the amount of interest paid on the lease liabilities of CU 491.

Solution: Preparing the statement of cash flows

Before I start with actual steps of making this particular statement of cash flows, let me point you to one of my other articles in which I described all the steps with lots of details.

I always use this method of preparing statement of cash flows as it is simple, logical, easy to follow and always gives good results.

If you are unsure how to do that, I sincerely recommend reading that article first and watching the 14-minute video at the end of it with basic explanations of making statement of cash flows.

From now on, I am going to follow the exact same steps, so I will describe them just in short.

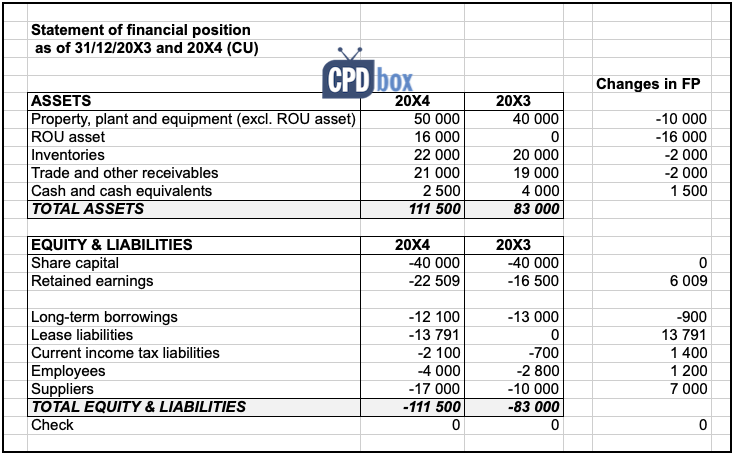

Step #1: Calculate changes in the statement of FP

Here, you will simply calculate the difference between opening balance and the closing balance of each individual item in the statement of financial position (FP).

A few tips:

- Please do not mess with signs: I always use “+” for assets and “-“ for equity and liabilities.

- And, please always do opening balance less closing balance, not vice versa.

- Do NOT include subtotals.

This should look something like the following picture:

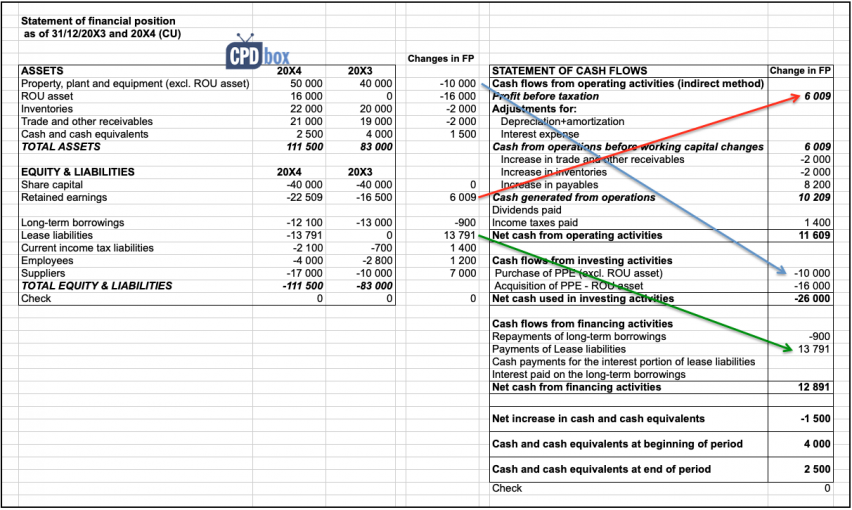

Step #2: Classify each change in FP to the statement of cash flows

Each change in the statement of FP affects the statement of cash flows somehow.

The point of this step is to assign each change in FP to the correct place within the statement of cash flows. Therefore:

- Take the blank statement of cash flows with no numbers;

- Go and classify each change in the correct place within the statement of cash flows, one by one, EXCEPT for cash and cash equivalents;

- Put the opening balance (20X3) of cash and cash equivalents to the line “Cash and cash equivalents at the beginning of the period”;

- Put the closing balance (20X4) of cash and cash equivalents to the line “Cash and cash equivalents at the end of the period”;

- Make the following check: sum of all changes without subtotals should give you the difference between the last 2 lines of your CF statement.

The following picture shows this step. I even pointed to 3 changes to illustrate what I meant by the classification of each change:

Do not worry if the numbers make no sense – that’s OK at this stage, they will make sense as we go further.

In relation to presenting your new leases in the statement of cash flows, please note:

- Change in ROU asset of CU – 16 000 was classified into the Cash flow from investing activities and since this is a minus, that points to cash paid (not received) and I labeled it as ”Acquisition of ROU asset”.

Before you start making a point that ABC did not pay CU 16 000 for the acquisition of ROU asset, hang on a minute – we have not finished yet. - Change in the lease liabilities of CU 13 791 was classified into the Cash flow from financing activities and since it is a plus, it means that the cash was received (not paid). Again, if it makes no sense at this stage, that’s OK – it will at the end.

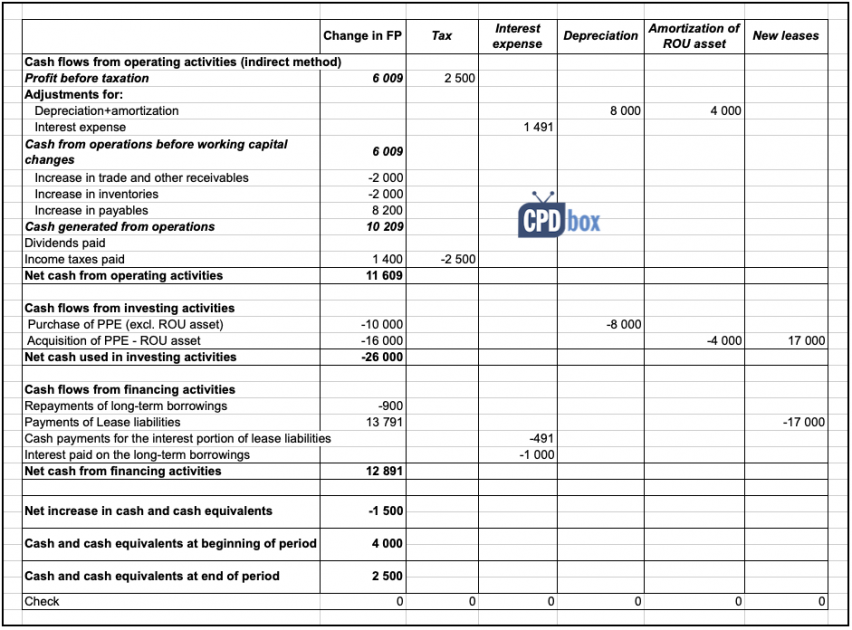

Step #3: Deal with non-cash items

This is the crucial part to understand and get it right, especially in the case of leases under IFRS 16, because taking a lease is a non-cash item at the initial recognition.

Before we start actually working on adjustments for non-cash items, here are a few tips:

- Make each adjustment in a separate column.

- Making adjustment means adding a number to certain line item and deducting it from the other one, so that it’s total is always zero.

OK, for this example, let’s do just a few adjustments, namely the one for tax expense (which is universal crucial adjustment for ALL statements of cash flows), interest expense, depreciation and then all adjustments related to leases only (we will pretend there are no other adjustments.

Adjustment #3.1: Tax expense

You can see that currently, your CF statement starts with profit before tax, but in fact, there is a balance of CU 6 009 which is profit after tax in fact (just look at the statement of PL and OCI).

Therefore, we add back the tax expense of 2 500 to the first line and deduct it from the line “income taxes paid”.

If there were some unsettled income tax liabilities or deferred tax assets/liabilities, then you should adjust them as well, but let’s keep it simple here. You can always take a look at the IFRS Kit where you will learn all the details.

Adjustment #3.2: Interest expense

Interest expense always adjusts non-cash items in the operating part, therefore we add its amount of CU 1 491 accordingly to the line “Adjustments for: interest expense”.

The standard IAS 7equires presenting interest paid either in the operating part or in the financing part (well if you work for a bank or other financial institution, then you do not have this dilemma because it is clearly the operating part in most cases).

Let me also bring your attention to the requirement of paragraph 50 of the standard IFRS 16. It requires that you shall classify the cash payments for the interest portion of the lease liability separately in the statement of cash flows.

Therefore, I split the total interest paid into two parts:

- Cash payments for the interest portion of the lease liabilities: CU – 491; and

- Interest paid on the long-term borrowings (not related to leases): CU – 1 000.

As you can see below, I decided to classify the interest paid in the financing part rather than operating one, although you have a choice.

Adjustment #3.3: Depreciation

This is clearly non-cash item included in your profit, so you need to add it back in the line “Adjustments for: depreciation and amortization” in the operating part.

You should deduct it then from the same line item in which you reported the change in FP related to property, plant and equipment in the investing part.

Adjustment #3.4: Amortization of ROU asset

Again, this adjustment is of a very similar character as depreciation (#3.3).

You need to add the amount of CU 4 000 back in the “Adjustments for: depreciation and amortization” in the operating part.

Then, you deduct it in the same line in which you classified the change in ROU asset: Acquisition of PPE – ROU asset.

Adjustment #3.5: New leases

As I have mentioned above, acquisition of assets under the leases are non-cash item initially, therefore we need to adjust it.

So, initial change of ROU asset amounted to CU 20 000 (prior amortization), but ABC paid only CU 3 000 for the initial cost. The rest of it was new lease liabilities, that are also non-cash item.

Therefore, you need to cancel these 2 non-cash items, so you need to:

- Add back the non-cash amount of acquiring new ROU asset of CU 17 000;

- Deduct the non-cash amount of acquiring new lease liabilities of CU – 17 000.

That’s it, we are done with non-cash items for leases.

It looks as follows:

Step #4: Add up

At this stage, you are almost done.

Just add up all the columns, line by line, to get the actual statement of cash flows.

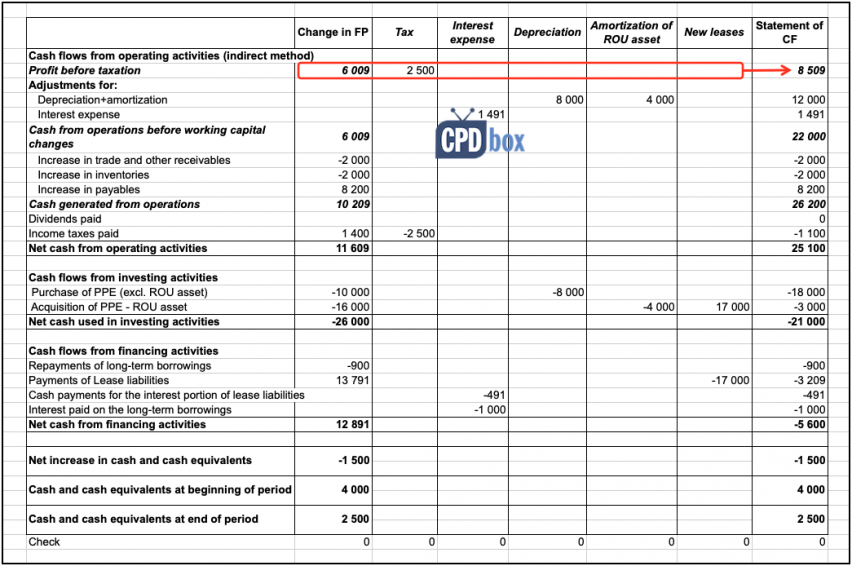

For example, take a look at the line “Profit before taxation”. You need to add up all the numbers from all the columns in that line, in this case CU 6 009 plus CU 2 500, which is CU 8 509 – exactly as Profit before tax from your statement of PL and OCI.

On top of that, it would be nice to add subtotals to show totals for individual parts of statement of cash flows clearly.

I have done that for you, here you go:

Step #5: Perform final checks

Let’s take a look at some final numbers related to leases in the statement of cash flows to see if they make sense:

- Acquisition of PPE – ROU asset: The final statement of cash flows shows the amount of CU 3 000. This is OK, because ABC paid CU 3 000 for initial direct costs related to the lease. The remaining part of ROU asset was financed by the lease itself (not cash).

- Payments of lease liabilities: The statement shows the amount of CU 3 209. This is OK since ABC repaid CU 3 700 within the lease payments, thereof CU 3 209 for the reduction of the lease liability (please take a look at the question above).

- Cash payments for the interest portion of lease liabilities: : The statement shows the amount of CU 491, presented separately from other types of interest paid and this amount corresponds with the numbers in the question above.

When you are preparing complex statement of cash flows, I also recommend verifying the movement of certain balance sheet items. I am not going to do that here in this article as the movements are clear enough from the statement, but if interested, check out this article again (step 6) or take a look inside the IFRS Kit.

The following video shows this process, so please check that out:

The excel file from this video is included in the IFRS Kit.

Any ideas or questions? Feel free to comment below. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

29 Comments

Leave a Reply Cancel reply

Recent Comments

- ASHAGRE TILAHUN TAYE on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Silvia on Example: IFRS 10 Disposal of Subsidiary

- Silvia on IFRS 17 Insurance Contracts: Summary

- Shiksha on Example: IFRS 10 Disposal of Subsidiary

- Chrisant on IFRS S2 Climate-related Disclosures: What, How, When

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hi Silvia,

I have questions regarding treatment of lease under RoU and Finance Lease for project cash flow/Discounted Cash Flow. From my understanding, the amount reported for RoU as ‘Acquisition of RoU’ in the audited Statement of Cash Flow does not necessarily mean there is actual cash outflow occured at that point of time. The RoU represents the PV of lease payments. The real cash outflow happened via the annual payments of lease liability and is presented in the CF under the Financing Activities. Please advise.

If that is the case, in preparing my project CF using the DCF method, do I have to:

1. exclude acquisition of RoU from the investing activities?

2. include the payment of lease liability (for RoU and Hire purchase) in the investing activities or financing activities?

Please advise.

Thank you so much!

Dear Mahima,

I think that this article gives quite a good response in that. Please revise step #3, adjustment 3.4 (and prior adjustments, too). Thank you!

Hi Silvia, I do agree in posting the “Cash payments for the interest portion of lease liabilities” in the “Cash Flows from financing activities” but, in financial literature, I often read that the interest portion should go in the Cash Flow from Operating Activities. What is your opinion? Which of the two possibilities is the best one and why? Many thanks!

Dear Vittorio,

thank you for this comment. In fact, IAS 7 gives you the choice, when it comes to presenting the interest paid: either in financing or in operating activities, according to what is more relevant to your situation. So there is no black or white answer to that. Thank you!

Hi Silvia,

Appreciate your write up.

I’m wondering how will early termination of lease be presented in Cash Flow?

Thanks

Hi Elaine,

it depends. I would need to see the specific balances in the books prior termination and go from there. S.

Hi Silvia, this is wonderful work. It was really helpful. Thank you

Hi Silvia,

Thank you for this. Surely now our operating cash flow is incomparable to prior periods as we are effectively paying our rent out of financing activities. Adding back Depreciation and Interest to net income to reach OCF would be inflating the cash flow generate. The company would not be able to generate operating cash flow without its premises so I am slightly confused.

thanks,

No, adding back depreciation and interest to the net income to reach OCF foes NOT inflate the cash flows. The opposite is true – that enables you to see the real cash flows from operating activities.

And yes, I understand your point about categorizing rent as financing activity – but as soon as you take the asset under the lease and create ROU, then you are financing your business, because effectively you took a loan (lease).

Thank you very much, Silvia

Thanks for your efforts, Silvia, you are explaining it in a simple way,

Hello, thank you for the detailed example. However, I don’t understand why the cash payments for the interest portion of lease liabilities is presented separately from interest on long-term borrowings. IAS 7 paragraph 32 requires the total interest paid to be disclosed in the statement of cash flows, which implies that the two amounts should be summed and presented in a single line. IFRS 16 paragraph 50 just requires that the requirements of IAS 7 for interest paid be applied to the cash payments for the interest portion of lease liabilities – it doesn’t seem to suggest it needs to presented separately from other interest paid. Paragraph 53 has other specific disclosures such as to disclose the interest expense and the total cash outflow, but those are usually covered within the notes. Some of the Big 4 model/illustrative financial statements do not appear to separate the interest paid on lease liabilities from other interest paid in the statement of cash flows.

The above is in connection with the following part of the article:

“paragraph 50 of the standard IFRS 16. It requires that you shall classify the cash payments for the interest portion of the lease liability separately in the statement of cash flows. Therefore, I split the total interest paid into two parts:”

.

Thanks for the comment. Actually I discussed the same issue with my colleagues because indeed it seems that there are different interpretations of both IAS 7.32 (which in my opinion does not prevent you from splitting the amount of interest paid as soon as you include the total amount) and IFRS 16.50 and I would agree that if the interest paid on lease liabilities is not material, it is perhaps OK not to split the amount of total interest. Anyway it is not the major issue though.

Hello please is it safe to conclude that the interest expense on lease liability will be similar to the amount recognized as cash payments for the interest portion of the lease liability (IFRS 16.50) in the statement of cash flows.

Hello Silva, nice article as always!!

Please is it safe to conclude that in all cases, the interest expense on Lease liability will be same as the cash payments for the interest portion of the lease liability(required by IFRS 16 paragraph 50)?

Not always. I assume cash payments are in line with the lease contract (sometimes it will state the schedule with listing the cash payments), but accounting can differ due to the items not taken into account in the contract. So I would be careful in making similar assumption.

Hi, I am paid customer for the IFRS box but I could not locate the excel file you mentioned in the article as a part of the ifrs kit. Can you help me locate the file ?

Thank you Silva for this Great write-up. Do you agree with the position that lease payments made on or before commencement date and capitalized directly to the Right of Use assets should be recognized as Cash outflow under “Investing Activities”. I’m relying on the definition of Investing activities in IAS 7 which requires that they cover activities relating to acquisition/disposal of long term assets.

Hi Olayinka, frankly speaking I did not give it a thought, but your arguments are valid.

Another real life situation: VAT. Invoices from lessors for the lease of RoU asset include it, so how do you handle that? Ignore it and keep posting the vendor liabitiliy to the AP accounts or complacate?

You made it easy . Thanks a lot

I do appreciate the way you conduct lectures on IFRSs. Keep it up

Hello,

Hi, There I am Very Grateful That You Provide me Short and Brief Explanation About IFRS.. So Please Keep It Up The Good Work.

Thank you 🙂

Thanks you very much Sylvia. Your work is excellent because it brings these sometimes obscure accounting issues to life. Cash flow statement construction so that it ties out with the year on year change in cash is always challenging.

Hello all…at the end of the day, analysts need to know what the cash rental expense is so that it can flow to the DCF model. Assuming no short term leases not capitalized in the above example, we have to use depreciation and interest as a proxy for the actual rental payment. This comes to 4000 + 491 = 4491. The cash payment, based on the CFS above is 3700…so which one is correct? The balance sheet numbers are dependent on assumptions for interest rates and lease life, which also impact the notional interest and amortization, and if these change from year to year it will change the balance sheet numbers making the year on year change look like a cash event when it is not…or maybe it is. Also, the liabilities almost never equal the asset values and the balance goes to equity. The extent of this balancing amount depends on the age of the lease portfolio. Welcome to IFRS 16…we have lots of information, all of it non-cash, which is of little use to analysts and to cap it all…companies no longer report the actual rental expense, the very number which is needed.

Hi Greg, all good points. However, do not deem this example as real-life, under commercial fair value terms. I made it up out of thin air just to illustrate the concept and to put some numbers into it. Maybe under the commercial terms, “4491” would come closer to “3700”.

Thank you so much, Silvia! Allways your articles so clear and useful!

🙂