How to present restricted cash under IFRS?

Recently, I got a question from Lotte who works in a construction company. Because this is a very common practice, let me answer and comment on that.

The question goes:

“We are a constructing company and we received an advance payment from our customer for the construction of the specialized production hall amounting to 5% of the total sales price. This is very significant for our financial statements.

The issue is that we have to keep this money on a separate bank account and we cannot use it until the hall is handed over to our customer. In fact, we cannot put our hands on that deposit without the third party agreeing. We assume the delivery of the hall 2 years after the construction started.

Can we still present this amount on our bank account as cash and cash equivalents?

If not, how shall we present it in our balance sheet and the statement of cash flows?”

This is a very good question – by the way, you, my readers and followers, ask me great questions anyway.

Answer: It depends.

The simple answer to this particular case is NO, this is NOT the cash and cash equivalents.

Let’s explain it.

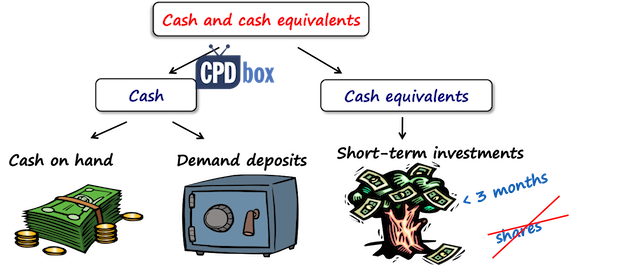

Cash and cash equivalents under IAS 7

The standard IAS 7 Statement of cash flows defines cash as cash on hand and demand deposits.

When you have some money on the bank account that you can’t touch for 2 years, it is neither cash on hand (because you can’t use it) nor demand deposits.

Cash equivalents are short-term, highly liquid investments that are readily convertible to cash without the significant risk of changes in value.

IAS 7 specifies that in order to meet this definition, these investments must be convertible within 3 months or less.

So, the deposit on your account is NOT the cash equivalent, because it’s not convertible within 3 months, you just can’t touch it.

This is so-called restricted cash.

Word of warning: The answer relates to this particular case only and you need to assess your specific circumstance. For example, you might be required to keep that cash on a separate account, but nothing prevents you from demanding that cash and getting it – then it is a demand deposit. Please read the discussion from IFRIC meeting held in March 2022 here.

Anyway, this is not the focus of this article. We are examining how to present restricted cash once you identify you have one.

Examples of restricted cash

Let me tell you some other examples of restricted cash:

- Amounts pledged as collaterals to insurance companies – sometimes, when insurance companies cover just a portion of some risk, they require some cash to be pledged as collateral and often, this cash needs to be held at separate escrow account.

- Mandatory deposits held in central banks – this is very common in many countries that every bank needs to deposit certain amount of cash to the central bank and this amount is simply not available to use.

- Contributions to cover pensions on a separate account – some companies create funds to cover some employee benefits, like pensions, to be paid after many years.

- Cash held under exchange controls – you can have a subsidiary that operates in some country with some restrictions or exchange controls that could prevent the use of cash.

So you get the point.

How to present restricted cash

In all above examples there was restricted cash and you need to assess whether you can still present it as a cash equivalent or not.

The main factor to assess is the character of the restriction.

Let’s say that some conditions specify that you need to maintain specified amount of cash as a minimum balance, but you do not have to keep it at the separate bank account.

In this case, it is still restricted cash, but you could present it as cash and cash equivalents.

Now, how is restricted cash presented in the financial statements?

- The statement of financial position of the balance sheetIf you have restricted cash, then you should present it within other financial assets in most cases.Then also, you should be very careful with current and non-current distinction.If your restricted cash will stay there for more than 12 months after the end of the reporting period, then it’s non-current asset.

- Statement of cash flowsNormally, you present the change in cash and cash equivalent in the final reconciliation, because that’s the purpose of the statement of cash flows – to explain how and why the balance of cash moved.When you have the restricted cash not presented as cash in the balance sheet, you cannot present it as such in the statement of cash flows.Instead, this would be presented either in the investing activities, operating activities or in the financing activities, depending on what it is.

For example, changes in restricted cash related to the repayments of borrowings are financing activities.Changes in these deposits taken from clients to build an asset for them are related to the main revenue generating activity, and therefore they are operating activity.

You can learn more about it in my IFRS Kit – I will teach you to prepare the statement of cash flows in an easy and fail-proof method.

Here’s the video summing up the issue:

Do you have your own experience or question related to the restricted cash?

Please share it below in the comments. Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

27 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Silvia on IFRS 3 Business Combinations

- Silvia on How to Account for Government Grants (IAS 20)

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Has this page been updated to reflect changes in IAS 7 effective 2023?

What changes in IAS 7 specifically do you mean?

Hi. It is probably IFRIC decision regarding Demand Deposits with Restrictions on Use arising from a Contract with a Third Party (from April 2022).

Will this IFRIC decision affect presentation of restricted cash mentioned in article?

Hello, restricted cash is for guarantee for work done. It is on banks account, but organization could not do anything before contract comes to an end. Should organization make discount and recognize financial expense?

My client has some cash with the Employee Benefit Trust. They can get this money whenever they want but need to follow the protocols i.e.. getting trustee approvals etc. Still they believe it is unrestricted cash. Is this the correct view?

Checking in the help line, what does the $227 cover? Is this to access the tutors?

Please see here. If you have further questions, please contact us via our contact form.

Hi Sylvia

I work for a company, which has several legal cases, and these demands made that the Bank freeze an important amount of money, in a separe account.

Is it cash restricted? We do not know for sure, when theses cases can be solved.

Unless you can freely manipulate with that cash, then I guess it meets the definition of being “restricted”.

Dear Silvia,

“Let’s say that some conditions specify that you need to maintain specified amount of cash as a minimum balance, but you do not have to keep it at the separate bank account.

In this case, it is still restricted cash, but you could present it as cash and cash equivalents.”

Why does it make sense to maintain your money in separate account and define it as other financial assets. What is the difference between maintaining it in separate account and the same account? Because you can’t use both of them, it seems to me that they both are restricted and should be treated the same.

Dear Silvia, Thanks for your interesting and educative article. My question is related to the following question asked by Yeldar. Why is it not restricted and defined as current asset. You said in the article: “The statement of financial position of the balance sheetIf you have restricted cash, then you should present it within other financial assets in most cases.Then also, you should be very careful with current and non-current distinction.If your restricted cash will stay there for more than 12 months after the end of the reporting period, then it’s non-current asset.”

“Thanks for your article. What about the restricted cash which was restricted for the entire year but shall become available in February following year (i.e. less than 3 months after reporting date). Will it still be restricted as at reporting date? Many thanks.”

Can the restricted funds move to expense accounts in the budgeting process without recognising as revenue?

Hi Silvia,

Your article is quite interesting and educative. Can you please clarify if balances due from a stock brokerage firm to another brokerage firm which arose primarily from one acting as the broker to the other can be considered as part of cash classification? The balance due was not settled or demanded as at the year end.

The argument is that stock brokerage firm is a classify as other financial institution and hence the balance due must form part of cash and not receivable.

Dear Silvia,

Thanks for your article. What about the restricted cash which was restricted for the entire year but shall become available in February following year (i.e. less than 3 months after reporting date). Will it still be restricted as at reporting date? Many thanks.

No.

Hi Silvia,

we had lease contract under which there were obligation to put funds into bank as deposit.

Two years ago contract had been expired and there were need to get confirmation from tenant in order to get funds back.

It is already two years passed, so my question is how to treat such deposit if we still do not know whether we receive money back or not? Shall we reclassify them as AR and create BDA for 100% or write it off directly to P&L and once money is returned to reverse it?

Thank you

Dear Silvia,

Usually the last line of the statement of cash flows show “closing cash and cash equivalent”.

Now my question is does this closing balance includes restricted cash amount. I understand restricted cash is not a part of “cash and cash equivalent.

For example: Balance sheet shows under current assets-

Cash and cash equivalent USD 100

Restricted Cash USD 20

Total cash, cash equivalent and restricted cash USD 120

Now my question is; the closing cash and cash equivalent of cash flow statement will show USD 100 or USD 120 as per IFRS. I understand as per FASB the answer would be USD 120. But i am little bit confused what IFRS says regarding this matter. Better if you could mention any reference of IAS 7.

Hi Silivia

I have concerns about the restricted cash or current cash investment

If we have a bank deposit in foreign currency, should we record the difference of exchange rate effect, on monthly basis “we make a monthly FS” or leave it till the end of restriction.

Hi Silvia

If we have restricted cash and cash equivalents or financial asset due to legal order or mandatory regulation, do we have to book an impairment due to restriction of use? (I know that provision against legal cases are accounted under IAS 37 but assuming that the outflow of cash is remote).

Hi Silvia,

your problem solving is very amazing and very logic.

What if the restriction was for land, for example, a real estate company is 50% ownership for government and the other 50% is for the private sector. the government partner has provided the land to the company to build a commercial mall and to be rented to a private sector, this land is restricted from selling, currently it is presented in the financial statements within the PP&E.

My question is shall I re-classify these land as an investment property according to IAS 40 of division no. 16 of SMEs? and should these land to be subject to revaluation?

Thank you very much

Hi Silvia,

Thanks a lot for your help!

Sorry for my english, but i have a case and i’d like to know if it’s restricted cash also.

An entity which cash out (in an outside group account) an amount to secure a guarranty given to sellers for an earn out based on specifics’ conditions (< 2 years).

Can we consider this as restricted cash?

Many thanks

Hi Silvia,

Thank you for the good write-up. What about a Debt Service Reserve Account (DSRA) which is quite common in Project Financing? The DSRA typically is held as a security in a separate account and can only be used to pay debt in the situation where such debt cannot be paid from operating cash.

Yes, it seems that is meets the definition of the restricted cash, too.

Hi Silvia,

During a year end audit, i noticed from one of the bank statements obtained pertaining to a bank balance in the TB, the name of the company was different( Not the name of the entity under audit).

When we enquired the client about this, they said it was the old co name. Since the account is dormant they did not transfer the money under new company name.

when we checked the old documents we verified and confirmed this.

1) Can the proof we got about the change in company name considered as a valid legal ownership supporting to record the balance in the entity’s balance sheet.Is it permitted under IAS7?

2) if yes, Is to be recorded as a restricted cash since currently company can not use the money until they transfer the funds to the valid accounts.

Hi Priya,

1) well, that’s more question to your legal department, not to me being IFRS girl. IFRS do not say nothing about it.

2) No, I would not say so. The reason is that you can’t control the restricted cash, but you can control this one – it is within their control to transfer the funds and start using them. S.

Many thanks Silva.

I volunteered to prepare financial statement for a non-profit making organization. Members of the organisation make pledges to support projects on a need to do basis. This pledge is paid into a bank account tagged ‘pledge for projects’. How should the balance in the bank account classified in the statement of financial position and the income from pledge in statement of activities. Awaiting your comments.

Hi ayobami,

the question is how the non-profit making organization can use this cash. If they can’t touch it and the cash must stay on the bank account, then it is restricted cash and all above applies. Thank you!