Can we capitalize a customer list under IFRS?

“A bank purchased information about subscribers from a telecom company in order to reach its targeted customers via phone, SMS or other advertising medium.

Can the bank recognize the expense incurred to buy this subscriber data as the intangible asset?

The bank expects to generate the future economic benefits from the data since it will get new customers using the data, but the bank does not have the sufficient control over the expected economic benefits.

The reason is that the bank can’t guarantee sales from the customers as they can decide not to buy the bank’s products.

Therefore, shouldn’t the bank just expense the data as a part of our advertising activities? Normally, the advertising activities cannot be capitalized”

Answer: Surprisingly, in some jurisdictions, yes.

The short answer is – YES, in the circumstances described in the question, you actually CAN capitalize the subscriber information – in other words – the customer list. Let’s just assume that this is happening in jurisdiction in which such a purchase is NOT illegal.

Why?

Let’s split this issue into 2 separate questions:

- Is the purchased customer list an intangible asset at all?

- Can we capitalize that intangible asset?

So, let’s answer one by one.

1. Is a purchased customer list an intangible asset?

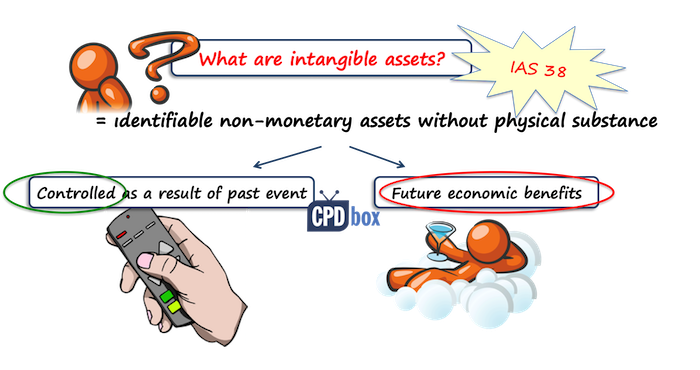

IAS 38 says that the intangible asset is an identifiable, non-monetary asset without physical substance.

Clearly, customer list has no physical substance and is non-monetary, but is it identifiable?

Again, under IAS 38, an asset is identifiable if it is separable – so you can separate it or detach it from the entity and you can actually sell it, transfer it, license it, rent it or do whatever you like.

Also, assets arising from contractual rights can be separable, too.

If you purchase the customer list, is this separable?

Oh yes, it is –the seller was a telecom company, and it was clearly able to put this list up, separate it and sell it to the bank.

So yes, this customer list is identifiable.

Here let me warn you that the customer list must contain identification details of the subscribers in order to target them directly.

It’s not a mere description of the specific groups, it is the list of specific names, numbers, contact details etc.

OK, so we have the answer to the first question – a customer list is definitely an intangible asset, because it is identifiable non-monetary asset without physical substance.

One more note: the question asked if the customer list is just like advertising activities, some campaign or promotion.

No, it is not.

The difference is exactly the separability – you can separate the customer list and sell it to someone else, but you cannot do the same with your advertising campaign – so, an advertising campaign is NOT an asset, but the customer list is.

Finally, we should be aware that an entity should have control of the asset, in this case I assume that nothing prevents the buyer to control the use of purchased customer list.

Now, let’s tackle the second question:

Can we capitalize the customer list?

IAS 38 says that you can capitalize the intangible asset only if:

- The future economic benefits are expected to flow to the entity from the use of that asset, and

- The cost can be reliably measured.

Does the buyer of a customer list expect the future economic benefits?

Yes, of course, otherwise she would not have bought that list. The question said that the bank expected to get new customers.

Please remember that the standard does NOT ask you to quantify these benefits or measure the future economic benefits. It’s almost impossible.

Also, you should not expect to control these future economic benefits – that’s also rarely possible.

So, the bank expects future economic benefits from the use of the purchased customer list and thus this criterion is met.

Can the cost of purchased customer list be measured reliably?

Yes, of course – the buyer knows how much she paid for the customer list.

Just be careful because you cannot capitalize the customer list that you generated internally – or the list of customers that you acquired yourself by collecting the data about them.

The reason is that the cost cannot be measured reliably in this case.

You just cannot distinguish the cost of such a customer list from the cost of running your business, can you?

This is also truth about the subsequent expenditures related to purchased customer list – you cannot capitalize them.

If you want to ask your own question, send it via Contact form on my website.

Thank you very much for reading, please this podcast with your friends and colleagues and stay tuned!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

52 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia ,

We have had a system disaster where we have lost all our 3years company data from system. Now, IT team has developed a new system and tried to recover the system. Thus, Our company has declared a special incentives to those who worked under this project. Can we capitalize this cost ?

Hi Sharmeen,

I would say no, because these costs are not incremental – in other words, they are not necessarily incurred in creation of the new asset, rather they are reward for the work of your employees. S.

Hi Silvia! If we order an advertising capmpaign from an agency. So it is derived from a contract with agency and is separable in this case, isn’t it? Is it an identifiable intangible asset in this case and we can capitalise it?

No, it is not separable based on the contract with the agency, because no contractual right arises from that contract except the right to receive advertising services. Campaigns are not assets and you can only defer their expenses if the campaign duration takes more than one reporting period (or a part of it takes in the other reporting period).

but what if i am not sure from the future economic benefits could i make test for impairment loss – i think it’s not allowed under IFRS – How we can account about this case

Good article, thank you.

When a customer list is acquired as part of an overall acquisition of a business, how would the value of the customer list portion be determined (as distinct from developed software assets, goodwill etc), as the price is for the whole business?

I realise customer relationships may be valued using Multi Period Earnings Excess Method and an attrition / churn rate, but lists are different.

Hi NZ, well, maybe you could turn to expert valuator to ask that question, because IFRS do not prescribe any specific valuation method.

Hi Silvia, in a transaction in which several payments had been determined, but due to the terms of the contract there is a payment that is not finally made on a list of customers. How does this impact the subsequent measurement of the intangible asset?

I don’t understand the question. Maybe you should give me numerical example.

do you amortise intangible assets

Yes, but not all of them.

Hello Silva,

We are implementing a new IT system into our company and we require some of our staff to work on this project full time. Just wondering can we capitalise all their wages or does the staff that substitutes their role come into play?

Hi Simon, if you have a good method of attributing the wages to the project, then yes, because their work is necessary to bring the asset (IT system) to the intended location and use. Don’t forget related expenses like social security payments etc.

Hello Silvia

can you consider youtube contents as intangible asset?

thank you

Hey silvia,

I read all your articles and a big fan for u. U make the concepts so simple. I have a doubt in my CA final syllabus in indas 38 , the paragraph is like this

“An entity may have a portfolio of customers or a market share and expect that, because of its efforts in building customer relationships and loyalty, the customers will continue to trade with the entity. However, in the absence of legal rights to protect, or other ways to control, the relationships with customers or the loyalty of the customers to the entity, the entity usually has insufficient control over the expected economic benefits from customer relationships and loyalty for such items (e.g. portfolio of customers, market shares, customer relationships and customer loyalty) to meet the definition of intangible assets. In the absence of legal rights to protect customer relationships, exchange transactions for the same or similar non-contractual customer relationships (other than as part of a business combination) provide evidence that the entity is nonetheless able to control the expected future economic benefits flowing from the customer relationships. Because such exchange transactions also provide evidence that the customer relationships are separable, those customer relationships meet the definition of an intangible asset.

So here he says there is no control, but seperability criteria met. How is that possible? N can u simplify above paragraph pls, i asked many people but failed. Here cutomer relationships and customer lists are same?

Hi Silvia

For the purchase of a customer list (insurance policy holders) from one agent to the other agent.

Can this be accounted for as an intangible asset and capitalized?

As soon as it is not against the laws of your country, yes.

Hi Silvia,

thank you so much for the amazing information.

Just a question, I saw some example financial statements in which the “subscriber acquisition cost” or “cost of contract acquisition” is capitalized as assets and it seems that they are marketing costs to acquire users. But you told that “it can’t be recognized as it is directly prohibited by IAS 38”.

I just wanted to know if they are not marketing costs or is there any other standard or way to capitalize these costs as assets?

https://ir.brinkshome.com/sec-filings/all-sec-filings/content/0001265107-20-000007/0001265107-20-000007.pdf

http://203.153.122.40/sites/default/files/financial_statement_december_2007.pdf

https://ir.crowdstrike.com/static-files/9e86565f-65ed-49c4-8eae-33ca3a0592f7

https://www.sec.gov/Archives/edgar/data/1584423/000158442317000006/a2017q1document.htm

Looking forward to your answer,

Thanks

Hi Mojtaba,

in general, marketing costs cannot be capitalized, especially if they represent some sort of advertising – because, it is hard to justify the asset nature of such costs. Also, above I referred to internally generated customer list – which indeed cannot be capitalized. However – if you can attach the cost to the specific contract with specific customer (subscriber), then you can capitalize it under IFRS 15 – but this is a different situation from generating customer list. Also, I just saw your first link and it seems that this company does not use IFRS.

Hi. Thanks very useful.

So as an acquired intangible customer list is not a revenue generating asset. It will have to assessed for impairment as part of a CGU.

What about useful lives? Can they be reassessed? How should a company go about annually reviewing the useful lives? What things should they consider?

can customer list be impaired by the fair value less cost to sell and the value in use.

Hell0 Silvia

how the company should account for the cost of the customer list. if the cost is capitalized, how the life over the assets will be expensed. with regard to relevant accounting standard, how intangible assets are expensed

Hi Sangay, if it is capitalized, then apply IAS 38. As for amortization – in many cases, a customer list has indefinite useful life, in many cases it has finite useful life – that depends on the assessment of the specific company and situation.

Hello Silvia,

What does it mean when we say that the cost of internally generating a customer list cannot be distinguished from the cost of developing/running the business as a whole? May you please provide a brief example if possible? Thank you

Hello Silvia,

I have a question coming from the sellers side. My company had 50% interests in an associate, accounted for at the equity method. Then is was decided to sell the interest to the other party (which owned the other 50%) and the selling price includes a payment for the shares value and as well a non-competition payment, which we receive, and is mostly in relation to the customer list and us not engaging in any competitive business.

Usually when we sale companies we would recognize it in Profit and Loss, in Other income.

But how do I account now for the the sales from the non-competition clause? Is it all together or does it has to be separated? I could not find any IFRS documenting the seller’s perspective, if there is one, please let me know.

Thank you so much!

Hi Ruxandra, well no, IFRS do not cover specifically this case, however – if it is a compensation for not doing something, then IFRS 15 does not apply in general and you need to recognize the income in profit or loss.

Hi dear Silvia,

Is “purchased Goodwill” recognized in parent company’s individual account as INTANGIBLE ASSET?

Why if yes?

Why If no ?

Thanks for your time ?

e.g.

Parent company buys X company for $5 million (including brand name for $700,000 and goodwill for $300,000) what’re the double-entries in Parent’s individual account?

1st version:

Dr investment 5mln

Cr cash 5mln

2nd version:

Dr investment 4mln

Dr brand name 700K

Dr Goodwill 300K

What’s the correct answer?

Hi Silvia

What about if there is a transfer of customers from a company that is ceasing to trade to a new company at no cost except for cost of migrating the new customers. Would this still be an intangible asset as there is no price on the customer list and therefore the cost may be more difficult to measure.

Hello Silvia

Can I use your slides in my course on the standards quoting your name? Actually, I am gonna translate them into my language. However, the way you design your slides is very impressive.

Thanks

Hi Hulya, what slides do you mean? Those freely available? Yes, you can use those with quoting the full reference (website).

Hi Silvia,

Thanks again for the amazing IFRS work you are doing.

Quick question, what are some of the ways a firm can carry out impairment test on its acquired customer list (intangible)?

Hi Scott, I believe it would be difficult to test it for the impairment as a single asset because it probably does not generate cash inflows and outflows independent from other assets; you may need to test it within some cash generating unit. S.

Hi Silvia,

If IAS 38 directly prohibits recognition of the Internally generated customer list then how could the telecom company classify the customer list as a asset in its financials. I mean how is the customer list even generated if it is directly prohibited IAS 38.

Also there are some companies that engage solely in just collecting Information for the purposes of data analytics, say one of the companies collect information regarding the average use time of internet in a particular region, this will obviously generate them economic benefits maybe in the long term, In that case i presume it should be classified as a FA.

One last question, Why will the company not be able to calculate the cost of generating the customer list , won’t the actual expenses incurred in gathering the customer data be the actual cost of the asset?

Telecom company cannot capitalize the customer list as it was internally generated. But the bank can, as from the bank’s perspective it is not internally generated (well, if it is not illegal in that particular country). Also, to the collecting information – I would not say that this database of collected information is the same as a customer list. Customer list is really a list of actual customers of that company – not some list of collected data. S.

hi Silvia,

If we are upgrading a fully depreciated system (software) and its life will now be extended by the upgrade, can we capitalize the upgrade costs under IAS 38?

Hi Silva, really good explanation regarding IAS 38.

How about a situation whereby, an internally generated customer list is valued by an independent expert at $x, would this be able to be capitilised on the statement of financial position if using the revaluation method under IAS 38?

Yes, I am sorry, it can’t be recognized as it is directly prohibited by IAS 38.

Thank you 🙂

Hello Silvia, thank you for the informative article. Is it legal for telecom company to sell customer info to the bank? Thank you.

In some countries yes. This was a real question 🙂

Hello Silvia,

I am a student and I am working on my thesis. I would like to quote from your article and I have to use your name and surname. If is it possible can you share with me your surname .

Thank you in advance.

Hey Naz, sure, you can use my article with quoting my full name AND the website. My surname is Mahutova.

Thank you very much Silvia

Hi Silvia

What happen if the Company have outsourced their sales force and then this other company sell a customer list that constructed in a relationship with the Company (they sell a customer list with “Overlapping customers”.

Thanks!

Dear Karla,

first, they should solve any legal issues 🙂 Also, the sales agent who created a customer list and sold it later still cannot capitalize it, because it was generated internally and thus its cost cannot be measured reliably. As for the customer who bought the list from the sales agent – the rules described above apply. S.

Thanks Silvia for this explicit explanation provided. What is your advice for companies that have high cost yearly on advertisement? They could say that future economic benefits will flow to the entity as a result of advertisement cost incurred in previous year.

Hi Lovely,

yes, there are future economic benefits from the advertising campaign. The problem is that the campaign is not an asset because you cannot separate it from the entity – you can’t sell it, rent it, lease it… so it’s not the same as a customer list. I am sorry, advertising expenses are – expenses in profit or loss. S.

Hello Mam your articles helped me lot in learning IFRS in easy way but there is confusion in my mind regarding identifiablity of intangible assets.Kindly explain it with few examples.

I don’t wan to believe the company has ‘control’ over the customer list because any of the customer on that list can take there business else where and the company would have no power to stop them.

Popoola, while you cannot control a customer, you actually control a customer list – that’s the difference. Actually, you can decide how to deal with that list… whether you sell it, use it, whatever.

Thank you,clear answer.