IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Updated: May 2025

Capitalizing borrowing costs under IAS 23 can be surprisingly tricky — especially with general borrowings, foreign currency loans, or intercompany financing.

In this guide, we will dive in to learn the key rules, give you worked examples, and help you avoid common traps.

? Bonus: Download the free IAS 23 Practical Checklist and watch a free video lecture.

Jump to section:

1. Free VIDEO lecture: Overview of IAS 23 in 7 minutes

2. Core Principle: What does IAS 23 Borrowing Costs say?

3. What are qualifying assets?

4. What are the borrowing costs?

5. How to capitalize borrowing costs?

6. Three burning questions related to IAS 23

- 6.1 Question #1: Can you capitalize interest cost in the cost of inventories?

- 6.2 Question #2: Can you capitalize foreign exchange loss on specifically borrowed money in a foreign currency?

- 6.3 Question #3: Can you capitalize interest cost on intercompany loan for qualifying assets?

7. DOWNLOAD IAS 23 Practical Capitalization Checklist (including disclosures)

8. Further reading & learning

1. Overview of IAS 23 in 7 minutes (free VIDEO lecture)

2. Core Principle: What does IAS 23 Borrowing Costs say?

The core principle of IAS 23 Borrowing Costs is that you should capitalize borrowing costs if they are directly attributable to the acquisition, construction or production of a qualifying asset.

Other borrowing costs are expensed in profit or loss.

Let’s break this down.

Return to top

3. What are qualifying assets?

Qualifying assets are assets that take a substantial period of time to get ready for their intended use or sale.

Note here that IAS 23 does not say it must necessarily be an item of a property, plant and equipment under IAS 16. It can also include some inventories or intangibles, too!

But what is a “substantial period of time”?

Well, that’s not defined in IAS 23, so here you need to apply some judgment. Normally, if an asset takes more than 1 year to be ready, then it would be qualifying.

Return to top

4. What are the borrowing costs?

IAS 23 specifically mentions 3 types of borrowing costs that can be capitalized:

- Interest expenses (refer to the effective interest method under IFRS 9/IAS 39);

- Finance charges on leases under IFRS 16 Leases; and

- Exchange differences on borrowings in foreign currencies, but only those representing the adjustment to interest costs.

However, IAS 23 is pretty silent on some types of expenses and there are doubts whether they are borrowing costs or not, for example:

- Interest cost on derivatives used to manage interest rate risk on borrowings;

- Dividends payable on preference shares (or other types of shares classified as liabilities);

- Gains or losses arising from early repayment of borrowings, etc.

Here again, we need to apply our knowledge from other IFRS standards and sometimes, make a judgment, too.

Return to top

5. How to capitalize borrowing costs?

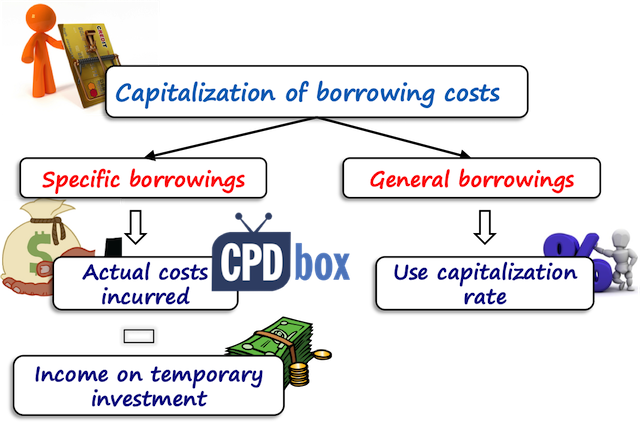

IAS 23 differentiates between capitalizing borrowing costs on general borrowings and specific borrowings.

5.1 Specific borrowings + example

If you borrowed some funds specifically for the acquisition of a qualifying asset, then the capitalization is easy:

You simply capitalize the actual costs incurred less any income earned on the temporary investment of such borrowings.

Let me give you a short example:

Question:

On 1st May 20X1, DEF took a loan of CU 1 000 000 from a bank at the annual interest rate of 5%. The purpose of this loan was to finance a construction of a production hall.

The construction started on 1 June 20X1. DEF temporarily invested CU 800 000 borrowed money during the months of June and July 20X1 at the rate of 2% p.a.

What borrowing cost can be capitalized in 20X1? (Assume all interest was paid).

Answer:

Although the funds were withdrawn on 1st May, the capitalization can start only on 1st June 20X1 when all criteria were met (the construction had not started until 1st June).

Calculation:

- Interest expense: CU 1 000 000 x 5% x 7/12 = CU 29 167

Note: this is very simplified calculation and if the loan is repayable in installments, then you need to take the real interest incurred (by the effective interest method). - Less investment income: CU 800 000 x 2% x 2/12 = CU 2 667

- Total borrowing cost to capitalize in 20X1: CU 26 500

Just don’t forget that the borrowing cost in May 20X1 is expensed in profit or loss, as the capitalization criteria were not met in that period.

Return to top

5.2 General borrowings + example

Now, there’s more trouble with capitalizing general borrowings, as you need to prepare a bit more calculations.

General borrowings are those funds that are obtained for various purposes and they are used (apart from these other purposes) also for the acquisition of a qualifying asset.

In this case, you need to apply so-called capitalization rate to the borrowing funds on that asset, calculated as the weighted average of the borrowing costs applicable to general pool.

To illustrate it, let me give you an example about capitalizing borrowing costs on general borrowings.

Question:

KLM had the following loans in place at the beginning and end of 20X1:

| Description | 1 January 20X1 | 31 December 20X1 |

| Bank loan, 6% p.a. | 0 | 200 000 |

| Bank loan, 8% p.a. | 130 000 | 130 000 |

| Debenture stock, 5.5% p.a. | 50 000 | 50 000 |

The bank loan at 6% p.a. was taken in July 20X1 to finance the construction of a new production hall (construction began on 1 March 20X1).

The bank loan at 8% p.a. and debenture stock were taken for no specific purpose and KLM used them to finance general spending and the construction of a new machinery.

KLM used CU 60 000 for the construction of the machinery on 1 February 20X1 and CU 25 000 on 1 September 20X1.

What borrowing cost should be capitalized for the new machinery?

Answer:

You ignore bank loan at 6% p.a., because it is a specific borrowing for another asset.

Only general borrowings relate to the financing of the new machinery and therefore, we need to calculate the capitalization rate:

- Weighted average rate = (8% x 130 000 /(130 000+50 000)) + (5.5% x 50 000/(130 000+50 000)) = 5.78%+ 1.53% = 7.31%

- Borrowing costs for the new machinery in 20X1 = CU 60 000 x 7.31% x 11/12 + CU 25 000 x 7.31% x 4/12 = CU 4 021 + CU 609 = CU 4 630.

6. Three burning questions in capitalizing borrowing cost

After we know the basics, let me give you my opinion on 3 the most common and often questions I get in relation to capitalizing borrowing cost.

I receive these questions quite often, so let me shed some light there.

6.1 Question #1: Can you capitalize interest cost in the cost of inventories?

It depends.

In most cases, inventories do not take a substantial period to get ready and in this case no, you cannot capitalize.

But here, there are some examples of inventories that can take a substantial period to complete:

- Wine, cheese or whiskey that matures in bottle or cask for a long period of time;

- Large items of equipment, such as aircraft, ships etc.

In this case, you can capitalize borrowing cost, but it’s up to you if you will or won’t.

While you have no choice for PPE (you have to capitalize), you have a choice for inventories: either you capitalize, or expense in profit or loss.

Return to top

6.2 Question #2: Can you capitalize foreign exchange loss on specifically borrowed money in a foreign currency?

No, you cannot do it fully.

Yes, IAS 23 says that exchange differences on foreign currency borrowings are a borrowing cost to the extent that they are regarded as an adjustment of interest cost.

Simply speaking – you can capitalize the difference between the interest on the foreign currency loan and the hypothetical interest expense in your own (functional currency), because that’s regarded as borrowing cost.

The rest must be expensed in profit or loss.

Return to top

6.3 Question #3: Can you capitalize interest cost on intercompany loan for qualifying assets?

Yes, in the separate financial statements of the borrowing company.

However, be a bit careful about the consolidated financial statements, because based on the intercompany relationship (subsidiary or associate?), the intercompany loan might be eliminated.

Also, let me point out one more issue in relation to intercompany loans: often, they are provided interest-free.

Under IFRS 9, you should recognize almost all financial instruments at their fair value (sometimes plus transaction cost) and if a subsidiary gets an interest-free loan from a parent, it’s nominal amount is not at fair value.

Therefore, a subsidiary needs to set the fair value of the loan received using the market interest rates and book the difference between the loan’s fair value and the cash received in profit or loss (based on the substance of a transaction).

Then, interest expense calculated by the effective interest method is capitalized.

I know, this might sound odd: the loan is interest-free, but you still need to capitalize some borrowing cost on it. Careful!

Return to top

7. IAS 23 Practical Capitalization Checklist – free DOWNLOAD

8. Further reading & learning

Explore more on IAS 23: Visit this page to access the full library of all IAS 23-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

I have a question. Do we capitalized interest accrued that will be part of the principal when borrowing payments are in arrears? let say company made a loan to fund a construction of asset with specific arrangement that payment of interest will only from completion of construction (assets ready for use) i.e after 3 years of construction period. There is an unexpected delay in completion causing the extension of construction period to another 2 years. Company will have to start paying interest in year 4 but due to no revenue generated, the payments are in arrears for the subsequent 2 years. Company entered into an arrangement with the bank to accrue the interests payments in arrears into outstanding principal amount for 2 years until completion of construction. If according to IAS 123, the recognition of capitalized interest will stop once assets are ready for use. Therefore, based on the scenario, the interest that will be capitalised in the 2 years construction is still in progress will be calculated based on: [(principal + accrued interest) x interest rate] amount, right? Please advise. The reason I am asking is there is specific compensation clause that covers capitalised financing costs and I am trying to assess the financial impact of this clause by understanding the interest capitalisation approach when there is accrued interest.

Thanks in advance!

Hi Silvia,

What about the situation where the interest rate on the intercompany loan is higher than the market rate? Should we apply the same logic, but in the reverse manner?

Hi Silvia

I’ve found your IFRS resources extremely helpful. I noticed there isn’t a lecture video on IAS 23 (Borrowing Costs) available on your YouTube channel or website. Could you please consider creating and sharing a video lecture on IAS 23? It would be valuable for many learners.

Thank you for your excellent work.

It is currently in progress, will be up in 2 weeks 🙂

Hi Silvia,

Thank you for uploading the IAS 23 lecture video in such a short time. I truly appreciate your quick response and dedication to helping the IFRS community. Your clear explanations and practical resources make a real difference. Is there anything more detailed or specific about IAS 23 that I should focus on for the ACCA F7 (Financial Reporting) exam? Any tips or common mistakes would be appreciated.

Best regards,

Lakshan

Thank you 🙂

What is $ 100 paid for capex and then got reimbursement loan from bank for $ 100 after 6 months and repayable after 3 year construction will continue for 2 year. How much borrowing costs to be capitalized here

Dr please how will you capitalize for interest on borrow cost of a specific borrow where there is 30% payable annually in areas.

you borrowed $15m

made payment to contactors as ff

1st October 2022 $10m

1st December 2022 $10m

Explain two factors to consider in determination and measurement of eligible borrowing cost to be capitalized

Hello Silvia. Reference is made to question 3 in the article above, that is, capitalisation of interest on intercompany loan for qualifying assets.

Question 1:

Considering that the intercompany relationship is a parent-subsidiary relationship, how do you account for the capitalised borrowing cost on consolidation? Do you eliminate the capitalised borrowing cost from the asset and the interest received from p/l?

Question 2:

Considering the fact that the parent company acts as the finance arm of the group and it has borrowed money to pass over to the subsidiary for developing a project. The amount borrowed by the parent is at a rate of interest of 2% and amount loaned out from the parent to the subsidiary to undertake the project is at 2.5%. On consolidation how is this accounted for please?

main questions are whether capitalization of the interest during constrution would actually increase the book value of the assets or if that would be a separate line item also is the interest during construction that are actually paid in the construction period and not just accrue can be capitalized or should be expensed

Dear sir,

I have a doubt that if company incurs expenditure more than the borrowed general funds and there are no specific funds for the same.

for eg

Funds borrowed at 10% on 1.4.20×1 Rs. 1000000 general borrowing

Funds borrowed at 10% on 1.10.20×1 Rs. 500000 general borrowings.

Expenditure incurred on qualifying asset on 1.4.20×1 1200000

Expenditure incurred on qualifying asset on 1.10.20×1 600000

What would be borrowing cost which should be Capitalized and how will you calculate weighted average Capitalization rate since you can not be sure which funds are used first own funds and borrowed funds ?

Hi,

My doubt is regarding KLM example. As per the third condition of Commencement of Capitalization, capitalization begins when activities are in progress to prepare the asset for intended use, which is 1st March (as mentioned in example). Loan of 60,000 used for construction on 1st Feb.

So capitalization of borrowing cost shall be for 10 month (counting from 1st March) as per my understanding. Why you have taken 11 months ? Please explain. Your reply would help me in clearing my exam.

Hi Silvia,

I am little a bit confused in regarding to this question how to solve, Can you help me ?

On September 1, 2014, Spin Industries Limited (SIL) started construction of its new office building

and completed it on May 31, 2015. The payments made to the contractor were as follows:

Date of Payment $

September 1, 2014- 10,000,000

December 1, 2014- 15,000,000

February 1, 2015 -12,000,000

June 1, 2015- 9,000,000

In addition to the above payments, SIL paid a fee of $8 million on September 1, 2014 for obtaining

a permit allowing the construction of the building.

The project was financed through the following sources:

(i) On August 1, 2014 a medium term loan of $25 million was obtained specifically for the

construction of the building. The loan carried mark up of 12% per annum payable semiannually. A commitment fee @ 0.5% of the amount of loan was charged by the bank.

Surplus funds were invested in savings account @ 8% per annum. On February 1, 2015

SIL paid the six monthly interest plus $5 million towards the principal.

(ii) Existing running finance facilities of SIL

Running finance facility of $28 million from Bank A carrying mark up of 13% payable

annually. The average outstanding balance during the period of construction was

$25 million.

Running finance facility of $25 million from Bank B. The mark up accrued during the

period of construction was $3 million and the average running finance balance during

that period was $20 million.

Required

Calculate the amount of borrowing costs to be capitalised on June 30, 2015 in accordance with the

requirements of International Accounting Standards.

(Borrowing cost calculations should be based on number of months).

Hello Silvia, What is the best way of treating Interest which was deflated. Accrue to Interest Accrual or capitalize to loan balance?

Could you please explain what you mean by “deflated interest”?

Sorry Silvia i meant defaulted interest.

I see. Well, you should really be looking at the difference between a liability/an accrual; or a receivable/a deferred income on the other hand. If you have a contractual right to receive that interest, then it is Debit Loan receivable (maybe some sub-account for better records) / Credit Interest revenue.

Hello Silvia, When a loan is specifically obtained for a qualifying asset, then why do we stop capitalizing interest cost when the asset is ready and not when the loan is repaid?

Thank you.

Thank you very much

Hello Silvia. I would like to ask about borrowing treatment which was received for acquiring CGU. Can i capitalize borrowing costs on CGU? Or is it scope of IFRS 9?

Hi Sandro,that’s outside of scope of IFRS 9, it is within the scope of IAS 23. As soon as your assets qualify under IAS 23, you can do so. However, IAS 23 says nothing about CGU though – that’s the term used in connection with impairment testing.

Hi Silvia, I would like to ask on how to treat the on investment income in which the company has invested for RM2 M from the amount borrowed with interest rate 3% per annum during suspension phase.

Hello, how would you treat a RCF loan which is general borrowing and interest rate changes each month?

e.g.

Project cost incurred 1st January of £200,000 and further costs incurred 2nd February. Project completion 31st December.

RCF loan already drawn on 1st January of £1,000,000 @1%

RCF loan rolled on 1st February @ £900,000 and new interest rate is 0.9%

RCF loan fluctuates up or down each month and each month a new interest rate is applied.

How would general borrowing costs in this scenario be applied?

Hello everyone here, I have a question about capitalization of borrowing costs!

The company made two contracts to have loan from a bank, one of them is for financing the construction of the manufacturing factory, one of them is for financing ten different import contracts to buy machines of 20.

1. Situation is clear about capitalizing the interest of 1st contract

2 Is not clear there are 20 different types of Machines which we can’t use until the construction is not finished yet,

Can anyone help me with the situation, please.

Dear Umarjon,

According to the best industry practice first of all we should define what the qualifying assets are. Qualifying assets should satisfy two main critera:

1. It should be manufactured or constructed. If it is just bought for the resale purpose, it is not a qualifying asset.

2. The substantial amount of period should be more than six months.

Considering the critera above the acquisition of 20 machines are not a qualifying asset, so no need for a capitalisation of interest expenses