How to account for intercompany loans under IFRS

During my audit days in Arthur Andersen I had a privilege to lead audit engagements in a few subsidiaries of international holdings and groups.

For me, it was very interesting and educative.

First of all I learned that the local management of these subsidiaries is often just a formal function and the real decisions are taken somewhere else.

This was exactly the case with the local subsidiary of a multinational group selling and servicing some equipment.

The local company was quite small and as we auditors like to say – its size represented a rounding error within the group (meaning it was so small that any error or misstatement in its account would be immaterial for the group).

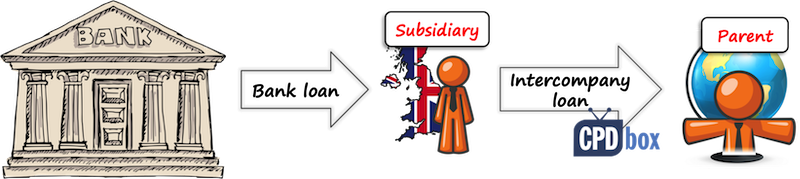

That’s why I was very surprised to see the huge loan they took from the local bank.

Why? Where did the cash go?

Oh, I spotted it instantly – there was a big receivable towards the parent company.

In other words, the parent company took the loan from our local bank via its subsidiary.

I asked for the documentation related to the loan provided to the parent.

No success.

There was literally nothing.

So I asked – but what is this receivable all about? What is the repayment date and schedule? Does it carry any interest?

All these questions are very important for two reasons:

- How to recognize this loan at fair value;

- How to present this loan in the financial statements (current or non-current?).

No answers.

I believe that the similar situation arises in many companies and in a great selection of various scenarios, for example:

- The parent sends cash to subsidiary in order to cover the operating losses or to finance the operations or whatever.

- The subsidiary sends cash to the parent just because the local lending is cheaper that the lending in parent’s domestic country.

- The companies within the same group are sending cash to each other in order to improve cash management…

…and many others.

Intercompany loans within the group are very frequent these days.

But, they bring a lot of troubles and issues, especially if there’s no documentation (contract), no fixed repayment date or schedule and no interest.

In today’s article, I would like to tackle a few questions related to intercompany loans.

Issue n. 1: We have no loan documentation.

This happens very often, especially between the parent and a subsidiary.

The parent just sends the cash without a single word (OK, in reality, the parent’s people tell you what it is for, but it’s nothing formal).

Here, we have one big problem:

Did the subsidiary receive a loan?

It can happen that the cash send from the parent to the subsidiary is not a loan at all.

Let me explain.

If the parent explained that it would demand the repayment of that cash in the future, then it’s a liability in subsidiary’s accounts.

However, I had a different experience with one of my clients.

The client’s local branch was always loss-making and the parent always sent big cash to cover the loss with no further explanation after the year-end.

We knew why this happened.

The subsidiary was loss making because of bad transfer pricing practices and the parent wanted to rectify the situation with cash transfers.

In this case, the substance of this cash transfer might be a capital contribution and NOT a loan.

Of course, this must be cross-checked with the local legislation, but in most cases, when the loan is NOT repayable at all, or repayable upon subsidiary’s decision, then it is NOT a loan, but capital.

So, the parent would record the loan as an investment in subsidiary and a subsidiary as equity.

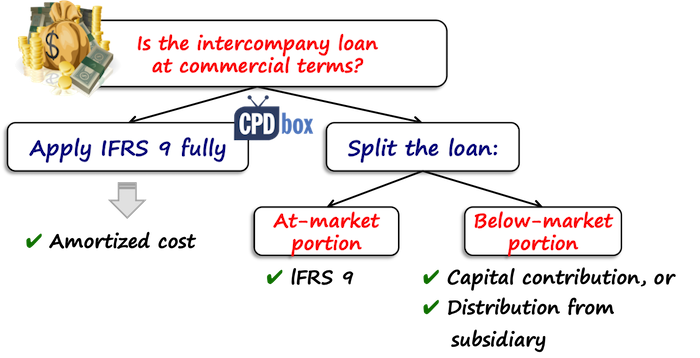

Issue n. 2: The loan has no interest (or interest at below-market rate).

Let’s say that you solved the issue n. 1 and said – no, it’s not equity, but it’s a loan.

But, the loan is at very low (or zero) interest.

Yes, that often happens within the group.

The loan might not be provided on normal commercial terms.

However, the standard IFRS 9 says that you should recognize a financial instrument initially at fair value.

The fair value of this loan is simply future cash flows from that loan discounted to the present value with market interest rate.

Now, that’s nice, but how would you treat the difference?

Let me show you.

Illustration: Interest-free loan

Let’s say that the parent provided an interest-free loan of CU 100 000 to its subsidiary, the loan is repayable in 3 years and market interest rate is 5%.

The fair value of this loan is CU 86 384 (it is CU 100 000 in 3 years discounted to present value with the market rate of 5%).

There is a difference between the cash received of CU 100 000 and the fair value of the loan of CU 86 384 amounting to CU 13 616.

How should the subsidiary and the parent recognize this difference?

Normally, when the companies are not within the same group, this difference is recognized in profit or loss (exceptions exist).

However, this time, we are dealing with the capital contribution from a parent to the subsidiary, because interest-free loan would never happen without the related party relationship.

So, the parent recognizes the loan initially as:

- Debit Loans receivable: CU 86 384

- Debit Investment in subsidiary: CU 13 616

- Credit Cash: CU 100 000

The subsidiary’s entry is very similar:

- Debit Cash: CU 100 000

- Credit Loans payable: CU 86 384

- Credit Equity – capital contributions: CU 13 616

If the loan is provided in the opposite direction (by subsidiary to parent), then analogically, the “below-market” component is recognized as a distribution from subsidiary.

Issue n. 3: How shall we classify the intercompany loan and measure it subsequently?

I received the same question a few times.

How should you classify the intercompany loan if it bears no interest?

The answer is – at amortized cost.

The reason is that the interest-free intercompany loan still meets both conditions for amortized cost classification:

- It is held within the business model whose aim is to collect contractual cash flows (I guess that no intercompany loan is there for other purpose), and

- The contractual cash flows arise solely from payments of principal and interest (here, interest payments can be zero and this condition is still met).

If we look at the loan from the above example, then subsequently, you need to remeasure the loan at its amortized cost by charging an interest (assuming there’s no repayment in the first year).

The journal entry in parent’s books is:

- Debit Loans receivable: CU 4 319 (86 384*5%)

- Credit Profit or loss – interest income: CU 4 319

The trouble with all financial assets at amortized cost is that the parent needs to recognize an impairment loss.

Under the newest IFRS 9 requirements, we need to apply general 3-stage model to all loans (no exception).

It makes it quite complicated, because the parent now needs to calculate 12-month expected credit loss on the loan to subsidiary if it is in stage 1 (no deteriorated credit risk).

And, it needs to estimate the probability of subsidiary’s default within the next 12 months.

Issue n.4 : There is no fixed repayment date.

This also happens very often.

Either the loan is somehow documented in the contract, but the repayment date is missing, or there’s no documentation at all and you have no idea what the repayment date is.

In this case, I would kindly advice to go through any available communication or documentation, like minutes from the board of directors.

If it does not help, then the management of a subsidiary should express their best estimates and assessment of the loan repayment, in order to set the loan’s fair value and present it correctly.

The best thing would be seeking guidance from the parent, of course.

The management should mainly assess if the loan could be repayable on demand.

Believe me, this is a very probable scenario and I’ve seen this in practice a lot – if the parent does not explicitly says about the repayment and it is NOT a capital contribution, then you have no choice but to see the loan as repayable on demand.

It means that you would classify the loan as a current liability.

The advantage of this approach is that you don’t have to discount anything (as the “loan” is short-term).

On the other hand, the big disadvantage is that the financial rations like liquidity immediately worsen, because the current liabilities would rock to the sky.

If the loan is not repayable on demand, then:

- If the loan is not repayable at all, then please take a look back to issue #1

- If the loan is repayable in a longer time with uncertain timing, then you should make the best estimate based on past practices within the group and set the loan’s fair value based on that based estimate.

Finally…

I have described the mechanics of accounting for below-market interest rates in this article, so please check that out if interested.

Unfortunately, there is no specific IFRS guidance on how to treat intercompany loans, so we need to use what we have.

I have tried to help a bit in this article, but I know very well that every single loan is different, provided at different circumstances and indeed, you should carefully assess every single aspect of it.

Also, I would like to stress that as intercompany loans ARE an intragroup transaction with related parties, you will have to include the number of disclosures in line with IAS 24 to your financial statements.

Good luck!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

What happens if the intercompany receivable become a loan forgiveness in a particular year. But the following year the two companies continue to transact. What is the subsequent treatment for it.

Dear Silvia,

Thanks for your detailed clarifications on this subject.

Thank you Silvia for sharing a such important and challenging topic.

Excellent articles and nice videos on Accounting & Finance. Many thanks for the good job you’re doing.

If a parent (US/USD) has a loan with a subsidiary (AUS/AUD) where the loan is denominated in the subsidiaries currency how does the elimination process work in consolidation? As a separate question if the loan is supporting a loss making research focused subsidiary doesn’t that mean that it potentially needs to be treated as capital? Loved your overview and so appreciate any help with this.

Hi Silvia, is the capital contribution/distribution situation described in issue 1 above applicable to loans/advances to/from associates/joint ventures?

Entity A provided a loan to its subsidiary at the following terms:

• Repayable within one year;

• Convertible (both outstanding principal and markup) into ordinary shares of the subsidiary with an equal number of shares at the rate of 10 per share value at the option of the parent; and

• Interest is charged at the market rate of interest.

Question:

Does this loan form part of capital contribution and is considered as an investment in a subsidiary? In this case, impairment requirements of IAS 36 would be applied instead of IFRS 9?

so what is the best practice?as a loan or capital contribution?

Hi Silvia,

Thank you for the easy-to-understand article.

I would like to ask in the case of interest free loan from an individual shareholder that we account the difference between actual cash received and the present value as the equity contribution. Whether that equity contribution can be converted to capital, to retained earning or as dividend payout?

Thank you.

Dear Silvia

Just a follow up on the illustration of interest-free loan, above an account receivable of 86,384 and a Investment in subsidiary by 13,616 were created. On subsequent measurement the account receivable of 86,384 will unfold interest for three years until the receivable hits 100,000. When subsidiary pays the amount due or 100,000 the receivable will be cancelled, however, what happens with the investment in subidiary by 13,616 created on onset???

Grateful thanks to Silvia for the significant accounting facts explained so clearly. It is prevalent to find that inter-company transactions are taken lightly. Still, in light of what has been explained in this article, one cannot escape attention to certain important facts, e.g. transfer pricing regulations and the relevant disclosures.

If A is a holding company and B is a subsidiary company, B taken a loan from bank and A is the guarantor, B default to pay the loan and now A will pay the remaining loan to bank, what should be the book entries for Company A??

Simple company A paid a loan to company B via bank, entry will be loan to B Dr and Cash to Cr.

If the loan repayment is doubtful as subsidiary is not trading , so its a case of impairment. How does it gets recognised in consolidated accounts?

You are making me to grasp my group accounting treatments. Thank you so much. I will continue to follow til I get your text manual

Thank you for your kind words!

if the holding company get a loan from associate , what is the accounting treatment if it free interest ?

Thanks for sharing Silvia. This is explicit. Most intercompany loans end up as equity especially where there is transfer pricing issues.

Hi Silivia,

Thanks for the useful article.

Do you have any articles regarding what currency to recognise intercompany loans in where the functional currency of the parent (lender) is different to the functional currency of the subsidiary (borrower)?

Thanks

Hi

What is the accounting treatment if the loan is repaid by the subsidiary before maturity? Do we reverse the capital contribution in the subsidiary’s books?

Thanks

Many thanks Silvia for your helpful article.