Expected Credit Loss on Intercompany Loans

Should you ever recognize impairment, or a provision on your intercompany loan (if you are a lender, of course)? Why would you do that when all intercompany balances are eliminated on consolidation and there’s nothing left in the consolidated financial statements – no loan, no…

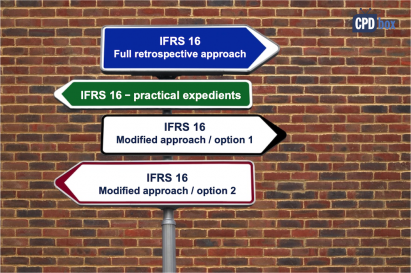

Adopting IFRS 16 – What Is The Best Option For You?

Let’s compare different transition options that you have when adopting IFRS 16 in your company. Let’s see what they are, which one is easier and which one has the smallest impact on your equity.

IFRS 2 – How to Calculate Fair Value for Share Based Payments

Note: This article is a guest post and its author asked me not to reveal his name, so he stays anonymous. IFRS 2 Share-based Payment (the “Standard”) is the financial reporting standard dealing with share based payments. It was first introduced in 2005, and is…

Example: Cash flow projections and value in use under IAS 36

In my last article, I tried to outline the main things to consider and to avoid when preparing the cash flow projections for the impairment tests under IAS 36. Here let’s illustrate the theory and show the numerical example of making cash flow projections for…

How to Make Cash Flow Projections for Impairment Testing under IAS 36

Impairment tests are one of the most judgmental areas in IFRS. It is all about estimating, judging, evaluating and forecasting. Sometimes it is almost like fortune telling, isn’t it? When I audited a few companies, I really disliked going through their impairment tests because all…

IFRS 9: An Auditor’s Perspective

The end of 2018 spelled out relief for most accounting and financial modelling experts responsible for the implementation of IFRS 9: all necessary changes to accounting policies, models and methodologies were designed and enforced, all in time for a lovely Christmas break at the end…

Conceptual Framework for the Financial Reporting 2018

The summary of the Conceptual Framework for Financial Reporting 2018 – with VIDEO!!!

Is your auditor being unreasonable?

“They waste time asking the same questions every year.” “They do not know my business and they are wasting my time.” “They are expensive and offer zero value to us – in fact they are The necessary evil!” These are some of an infinite list…

How to account for free assets received under IFRS

The best things in life are free… … at least that’s what Janet Jackson sang in one of her top hits. However, when your company receives some free assets, then the question is: Are they really received at no cost and no strings attached? Is…

How to make a change in functional currency

Some time ago I was a part of an audit team auditing the financial statements of a medium-sized manufacturing company. When we received the trial balance of that client, we spotted something strange: There were loads of transactions in a foreign currency and resulting impact…

Recent Comments

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)