Expected Credit Loss on Intercompany Loans

Should you ever recognize impairment, or a provision on your intercompany loan (if you are a lender, of course)?

Why would you do that when all intercompany balances are eliminated on consolidation and there’s nothing left in the consolidated financial statements – no loan, no provision?

Short answer – YES, you should, in most cases.

Why? What’s the point?

Let me illustrate.

Imagine you hold 60% in a company A and you exercise control of that company.

You got a loan from the subsidiary of CU 100 000.

One year later, the subsidiary assessed that the impairment on that loan amounting to its expected credit loss (ECL) is CU 10 000.

Why should you book it – won’t it will be eliminated on consolidation?

OK, do you pay yourself a dividend from that subsidiary? How much?

This is the point.

The impairment of a loan in subsidiary’s accounts decreases the amount of profit available for distribution to shareholders.

In subsidiary’s individual financial statements, this intercompany ECL provision directly affects the subsidiary’s results and you simply have lower amount available for dividend.

This issue becomes even more important when other shareholders are involved, too – in this small example, non-controlling interest is 40% and these shareholders are also interested in subsidiary’s results.

Also, in many jurisdictions, ECL provision can affect the amount of income tax paid to the state authorities.

I think these reasons are enough to care, aren’t they?

How to account for impairment of loans

The new standard IFRS 9 Financial Instruments has been in place for some time, so most accountants have already familiarized themselves with new rules.

Just let me shortly recap.

IFRS 9 requires recognizing impairment of all financial assets held at amortized cost and at fair value through other comprehensive income, in the amount of expected credit losses (further “ECL”).

There are two approaches how to do it:

- General approach – you need to recognize an impairment based on the stage in which the financial asset currently is; in the amount of either 12-month ECL or life-time ECL; and

- Simplified approach – the impairment is recognized in the amount of life-time ECL and it is not necessary to determine the stage of a financial asset.

You can read more about general ECL model rules here.

Let me remind you that you have NO choice here.

IFRS 9 specifies types of assets for which you can apply general approach and simplified approach.

Having that said – simplified approach is NOT available for loans, thus you have to go with general approach.

However, before you start calculating the amount of ECL, you need to answer one very important question:

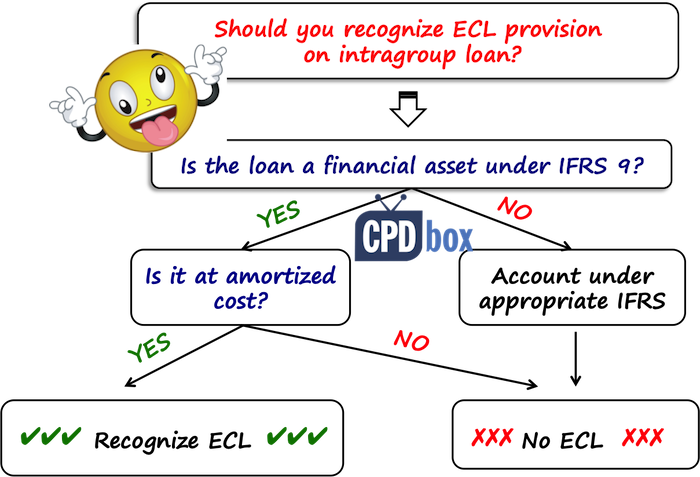

Do you have to apply ECL model on your intercompany loan?

As I have already mentioned, ECL model applies to all financial assets held at amortized cost or FVOCI (debt only).

Therefore, two questions arise:

1. Is your intercompany loan a financial asset?

Companies within the same group can provide financing to each other in many different ways.

Sometimes, they sign a formal contract arranging a loan.

Sometimes, there is no formal contract and the financing provided from a parent to a subsidiary can represent a capital contribution in fact.

Please read about different forms of intercompany financing and the classification challenges here.

Therefore, your first task is to determine whether the intercompany loan is a financial asset under IFRS 9 or some sort of a capital contribution accounted for in line with different standard (i.e. IAS 27).

If your loan is NOT a financial asset under IFRS 9, then forget about impairment and ECL model.

If your loan IS a financial asset under IFRS 9, then proceed to the second question:

2. Is the loan held at amortized cost or FVOCI?

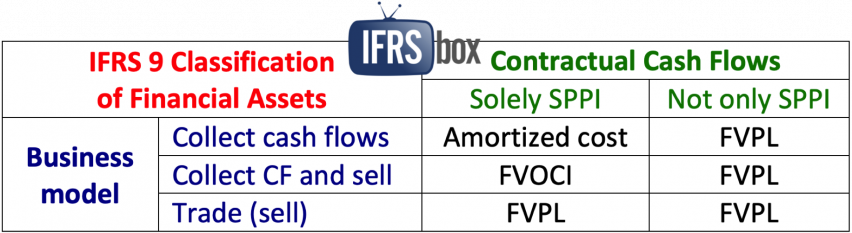

Under IFRS 9, you need to classify the loan as either at amortized cost, fair value through profit or loss (FVPL) or fair value through other comprehensive income (FVOCI).

If, and only if, you classified your loan as held at amortized cost or FVOCI, then you need to calculate and recognize ECL.

If your loan is at FVPL, you do NOT calculate any ECL.

Now, while most loans are classified as held at amortized cost, it is NOT an automatic choice.

The reason is that the loan must meet two criteria for amortized cost category:

- Business model:: the loan is held with the purpose of collecting contractual cash flows (not selling); and

- Contractual cash flows:: the cash flows from the loan represent solely payments of principal and interest on principal outstanding, nothing else.

The following table sums up the classification rules:

While the first criterion in met by most intercompany loans, there could be some special features of intercompany financing that prevent loan being classified at amortized cost.

For example, imagine the parent provides a loan to its subsidiary to finance a construction of an apartment house.

The loan is repayable in 5 years, carries an annual interest of LIBOR+0.2% plus 2% of revenues collected from clients who buy the apartment in that house.

In this case, the loan cannot be classified as held at amortized cost, because “2% of revenues” cash flow represents NEITHER payment of principal, NOR interest.

As a result, this intercompany loan is classified most likely at FVPL and thus ECL model of impairment does NOT apply here.

Thus, if you spot “suspicious” terms such as prepayment options, non-recourse loans, performance-based compensations and similar in the loan contract, be aware of this implication.

How to apply ECL model to intragroup loans

Let’s say your intercompany loan is a financial asset held at amortized cost, thus you need to calculate ECL.

As I have already mentioned, you cannot go for simplified approach.

Instead, you need to follow general approach which can be a bit challenging.

There are two steps to follow:

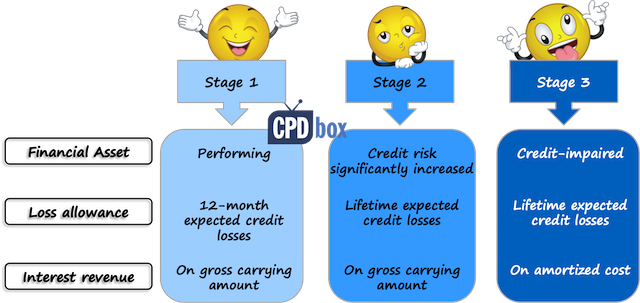

Step #1. Determine the stage in which the loan sits

If you apply general model, then you need to assess the credit risk of your intercompany loan at the end of each reporting period.

Your loan can be either in:

- Stage 1: Performing loan, low credit risk

- Stage 2: Loan with significant increase in credit risk since initial recognition

- Stage 3: Credit-impaired loan

In order to determine the stage, you need to monitor the credit risk.

How?

Well, that’s the topic for another long article, but in short, you need to watch out for the things like:

- Financial troubles of the borrower;

- Adverse market changes affecting the revenues of the borrower;

- Borrower is late in repayment of his other liabilities – this is especially important if the intercompany loan is repayable in one amount at the maturity date;

… and in most cases, you need to consider more factors and overall situation.

To ease your life, there are a few practical tips (based on IFRS 9):

- Low credit risk: If your loan has low credit risk, then you don’t have to assess whether there was a significant increase in credit risk since initial recognition (tons of work saved!!!);

- ”Rebuttable presumption”: If a loan is 30 days past due, there is a significant increase in credit risk. And; if a loan is 90 days past due, the loan is credit impaired.

Unfortunately, this presumption is not applicable to many intercompany loans, because in many cases, no repayment is required until the maturity day, or the loan is repayable on demand (however that does not mean that there is no impairment). - Not possible to identify significant increase in credit risk (SICR): if you cannot determine SICR without undue cost and effort, then you don’t have to, but in this case you need to recognize life-time ECL (which is higher than 12-month ECL in most cases, thus it’s better to determine SICR).

Very important note: Collaterals or similar credit enhancements do NOT affect the assessment of significant credit risk, only in some circumstances.

In most cases, collaterals affect the amount of ECL, but not SICR.

Step #2: Measure ECL

Once you know the stage of your loan, you need to measure:

- 12-month expected credit loss for loans in stage 1; and

- Life-time expected credit loss for loans in stage 2 and 3.

The measurement of both types of ECL is similar – the only difference is probability of default applied at your calculation.

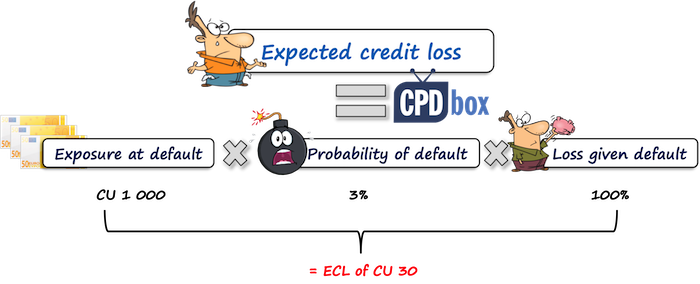

In most cases, ECL is calculated using the following formula:

- Probability of default (PD) = likelihood of a default event that would send your loan to stage 3 (credit impaired). You need either to calculate the probability that default happens within 12 months for stage 1 loans or within the full loan’s life for stage 2 and stage 3 loans.

How?

Again, that’s a material for a separate story, but in short – you can use either:

- Internal information:: internal credit ratings, history of borrowers debt repayment, cash flow forecasts and other. If these are not available, then you may use

- External information: credit ratings of the borrower prepared directly by some lending bank (if applicable); or even paid information about PD from external credit rating agencies – however, use this only as a benchmark and starting point, because these percentages usually reflect just the past (not forward-looking information as required) and the average industry situation (not the specifics of a borrower). However – better than nothing.

- Loss given default (LGD) = the percentage of amount lost in the case of default. This percentage can be affected by many factors, such as :

- Credit enhancements (letter of support, financial guarantee issued by the parent, collateral, etc.);

- Assets of the borrower at the reporting date (is the borrower able to sell these assets and use the cash to repay the loan?)

and other.

- Exposure at default (EAD) = the balance of the loan outstanding at the reporting date. This is the easiest parameter to find out.

Important note:This is just ONE method of calculating ECL and it does NOT mean you absolutely HAVE to stick with it.

Instead, you can select different method.

Short example of ECL provision on intercompany loan

Imagine a parent granted a loan to a subsidiary some years ago and is performing the assessment of this loan at the reporting date.

Let’s assume that the parent cannot determine whether there was a significant increase in credit risk since initial recognition (in other words, we are not sure if a loan is in stage 1 or stage 2), and therefore, life-time ECL will be recognized.

The information related to the loan is as follows:

- The balance of loan at the reporting date: CU 100 000;

- Probability of subsidiary’s default: 3% (based on information purchased from credit rating agency and adjusted upwards for specific risks);

- Percentage of loss at default: 70% (because, there is a bank guarantee for 30% of a loan).

Also let’s say that if there is no default, the subsidiary will repay its debts on time (hence no expected credit loss in “no default” situation).

What is ECL?

Please remember that ECL is a weighted average of possible outcomes and as a minimum you should consider 2 outcomes: default and no default.

However, we assume that in “no default” situation the subsidiary repays everything on time, thus the ECL in this situation is zero.

Therefore, we can simplify the ECL calculation as follows:

ECL = PD of 3% x LGD of 70% x EAD of CU 100 000 = CU 2 100.

This is just the mechanics of a calculation, without taking a complex assessment.

Specific questions related to ECL on intercompany loans

I have received loads of questions related to intercompany loans, so let me answer a few of them:

Q1: Loan to fully controlled subsidiary and ECL?

Question 1: We are a parent and we took a loan from our fully controlled subsidiary. Does the existence of control of lender have the impact on ECL recognized by the borrower (subsidiary)?

Answer 1: No, existence of control does NOT prevent the recognition of ECL by the lender.

The rules of IFRS 9 apply to all financial assets held at amortized cost and as soon as you classified the loan that way, then you MUST stick with IFRS 9 rules on ECL.

Q2: Letter of comfort to the borrower – any impact?

Question 2: We provided a loan to our underperforming sister company (under the common control of a parent). The parent issued a letter of comfort to our borrower to express its support of the going concern of the borrower (meaning that the parent will provide sufficient funds to the subsidiary to keep it going in the foreseeable future – at least 12 months). Should we still calculate ECL on that loan?

Answer 2: Yes. A letter of comfort, or letter of support, are the credit enhancements that can affect the LGD (loss given default) parameter downwards and thus decrease the amount of ECL.

However, a letter of support does NOT have the same contractually binding character as a financial guarantee offered by the bank or by some other entity.

Also, a letter of support usually promises support the going concern – which by definition covers the period of 12 months. If the loan is in stage 2 or 3, with the maturity date beyond 12 months, this is not enough.

Nevertheless, you need to assess the ability of a parent to keep its promise (is a parent financially OK?).

Therefore, yes, a letter of comfort can slightly decrease the amount of LGD, but not to zero and as a result, there still will be some ECL.

Q3: Low probability of default = no ECL?

Question 3: Based on historical and other internal and external information we assessed that probability of default of our borrower is very low and as a result, ECL is not material. Can we forget about ECL?

Answer 3: Not so fast. ECL can arise also due to the fact that you will receive the repayment of the loan later than assumed in the loan terms – which is a “no default” situation.

Thus, there can be some ECL even in “no default” situation, simply because of a discounting effect.

Finally…

I wanted to come up with solved examples as well, however I realized that just the explanation of these basic things is a long story.

Therefore in my next article, I will solve a few numerical examples related to typical intercompany loans, like undocumented loans, interest-free loans, etc.

Meanwhile, please leave me a comment below about your issues, questions or suggestions related to intercompany loans. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

19 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Silvia,

I am writing to request your guidance on calculating Expected Credit Losses (ECL) for a loan granted by a company in its first year of operation to its related parties.

The loan qualifies as an Amortized Cost financial asset due to the SPPI test. Given that repayments commence after five years, there is no historical default rate. Furthermore, the loan is unsecured, lacking any collateral.

If we adopt the EADPDLGD approach, the PD would primarily be influenced by macroeconomic factors. However, since the loan is not yet due, there is no flow rate, and we lack recovery rate data to calculate LGD.

I would appreciate your insights on the most appropriate ECL calculation method for this scenario and any specific considerations for loans to related parties.

Thank you for your time and expertise.

Background:

Delta Co. has been transferring Funds to Alpha Solutions since 2019 onward to meet the operational working capital requirements. Delta and Alpha shareholders have the mutual understanding to convert the amount paid to Alpha to increase Share capital of Alpha, admitting Delta as new shareholder. Accordingly, it has been disclosed Delta Financial as advance against the investment. However, one of the shareholders, the investee company (Alpha) has some restrictions from Government Authorities for transferring / changing the shareholdings in companies. Both companies believe that this is temporary and could be resolved soon.

Issue:

The Investee Company (Alpha) accumulated losses exceeds 50% of its shareholding and material uncertainty is disclosed in the financial statements of the company as per the Company’s Act and ISA 570. Considering the accumulated losses situation of the company, the amount of SR 12 million receivable may be subject to impairment. Further, the balance was classified as advance for investment purposes since January 01, 2021.

DELTA point of view for not recording impairment in its books:

Below are the reasons as to why no impairment was made;

a. The majority (75% two of three) shareholders of the Alpha company have given written support letter to undertake the Company financial obligations when fall due.

b. The Company remained committed to complete share capital increase process and

c. The Alpha was established in 2013 and established the waste management plant, however, operational license got delayed till 2018. Hence, it Commenced the commercial operation late 2018 onwards, in first two years Alpha ended up with losses due to less customers and fixed overhead, however, Alpha started earning profit since last year and attracting more customers.

Question:

1. What is the right classification of the amount paid to alpha. As in the Books of Delta amount is classified Due from a related party (under non-current assets?

2. Whether impairment should be done as per IFRS 9 and if so whether it can be under simplified or general approach.

Hi Silva

Do we need to calculate deferred tax on ECL provision?

It depends on the local tax laws. E.g. in our country, 100% ECL provision is tax deductible only after receivable is 3 years overdue, therefore if you make ECL provision earlier than that – yes, deferred tax arises.

Thanks Silva for your prompt response. I am referring to United Kingdom.

So please ask tax advisors in the UK. I am sorry, I am definitely not the expert on UK tax.

If the Company obtain a guarantee from the Government, should we still count the ECL?

Yes, sure – however, the amount of the ECL would be different.

hi silvia ,

Im in a country where exemption is granted for ECL application but for the sake of our management we still want to use ECL model. i v problem in understanding its application to my entity’s debtors. as my debtors have outstanding amount against multiple segments each having its different credit period i.e. 0,7,15,30,45 days etc. so how would i be able to apply this model.

Hi Aali, this article would help. S.

Hi Silvia,

I dont understand this:

“The impairment of a loan in subsidiary’s accounts decreases the amount of profit available for distribution to shareholders.In subsidiary’s individual financial statements, this intercompany ECL provision directly affects the subsidiary’s results and you simply have lower amount available for dividend.”

When parent company grants a loan to its subsidiary. I dont see how a provision would have been booked into susbsidiary’s individual financial statements? I would have thought a provision would need to be booked to parent”s company individual statements…

Hi Silvia great article I have just a question imagine that a parent company grant a loan to its subsidiary and this subsidiary invest in real estate to the repatriation of cash is done by the subsidiary from earning the rents to the parents as payment of interest if The real estate suffer impairment that would affect the subsidiary and hence an ECL should be booked at the level of the parent is there not in this case a double booking at the level of consolidated accounts ?

Hi Sami, first of all – does the amount of interest depend on the rent collected by the subsidiary? If yes, I suspect this loan cannot be classified at amortized cost because it fails SPPI test. You can still classify this at FVOCI. The second point – yes, you are right, the parent books a provision (ECL) in its own accounts and eliminates it upon consolidation. Why bother? Please read the introduction of this article.

Thank you very much for your greate articles.

Hi Silvia, it will be great if you can come out with some articles that related to simplified approach, which is the observable credit loss based on the past experience is zero or closed to zero (for example, all the debtors are always settled their outstanding invoices not more than 90 days based on the 30 days credit term). In this case, does the Provision Matrix is still relevant to calculate the ECL or can we just do a sense check by multiplying a percentage let said 1% (source from the credit agency website by using the BBB rate – still consider good rate) on the trade receivables amount to determine if the ECL amount would be material and no further work done is required or do we still need to use the provision matrix by setting the default condition & amount (for example, all amount above 90 days are presumed default & 100% amounts are not collectible) in order to calculate the ECL based on the above scenario?

Please advise and many thanks!

Hi Liew, I wrote an article about ECL and trade receivables here. However, let me comment on this – if you assess, based on historical information WITH regard to forward looking information as well (like, some event happened that will change the pattern of collection of your receivables), that your maximum ECL is immaterial, then you don’t have to recognize it. But, there can be some ECL purely because of your debtors paying you late (effect of discounting) – if you also assess this as immaterial, then why bother.

Hi Sylvia,

Where a parent provides a bullet, non-tenored loan repayable on demand, will there be need for ECL; if so, what approach will be taken?

Thanks for the great work you are doing.

Hi Blesxzoh,

I will cover this in my next article with examples. S.

Thanks very much for thus article. but if i may suggest, it would have been more appropriate if the article was or is prepared in a PDF such that it’s downloadable.