Example: How to Adopt IFRS 16 Leases

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases.

I am grateful for many responses and comments I got from you. Almost all e-mails I received from you asked me to publish solved numerical example to see how to implement IFRS 16 in practice.

Therefore, unlike in my other usual articles, this time I’ll solve one example with one specific lease contract for you.

You might well know that the IFRS 16 affects mostly lessees who are involved in operating leases, because under the new rules they need to bring the assets from off-balance sheet to the daily light.

In other words, they will no longer be permitted to book all rental expenses from operating leases in profit or loss, but they will need to recognize the lease liability and the right of use asset.

Therefore, in this article, I illustrate the application of the full retrospective approach and modified retrospective approach to IFRS 16 adoption.

Ready for the example? Here you go!

Example: Operating lease in the lessee’s accounts under IFRS 16

ABC, the manufacturing company, needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019.

During the preparatory works, ABC discovered that the operating lease contract related to a machine might require some adjustments.

ABC entered into the contract on 1 January 2017 for 5 years, annual rental payments are CU 100 000 in arrears (that is, 31 December each year) and at the end of the lease term, the machine will be returned back to the lessor. The economic life of a machine is 10 years.

How can ABC restate the contract under IFRS 16 using both full retrospective and modified retrospective approach?

Use the discount rate of 3%.

Little note about the discount rate

If you are a lessee, then be careful about the selection of the appropriate discount rate, because its definition in IAS 17 no longer applies.

Here, the new definition in IFRS 16 says that you should derive the interest rate implicit in the lease from:

- The lease payments,

- The unguaranteed residual value,

- The fair value of the underlying asset and

- The initial direct costs of the lessor.

This is very hard and sometimes unrealistic, because most lessors won’t share the unguaranteed residual values and their initial direct costs.

Therefore, most lessees will need to use the incremental borrowing rate – that is, the rate at which they would be able to get the new borrowings for acquisition of the same asset with similar terms.

This is quite judgmental, but at least it’s more realistic than asking your lessor for additional information in most cases.

In this numerical example, let’s assume that given 3% is the ABC’s incremental borrowing rate.

Presenting the contract under IAS 17 and IFRS 16

Before you start drafting your journal entries to adopt IFRS 16 and cease reporting the contract under IAS 17, you need to see clearly how you reported that contract under both sets of rules.

Operating lease contract under IAS 17

Here, it’s very simple and straightforward: ABC accounted for all the lease payments from the operating lease directly in profit or loss.

Operating lease contract under IFRS 16

Under IFRS 16, ABC needs to recognize the right of use asset and the lease liability.

The lease liability is calculated as all the lease payments not paid at the commencement date discounted by the interest rate implicit in the lease or incremental borrowing rate.

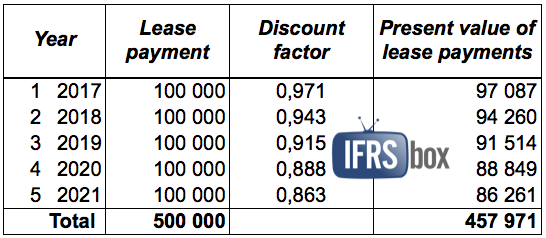

I have done that for you in the following table:

Note: Discount factor in the first year is calculated as 1/((1+3%) to the power of year 1), etc.

Fine, we have the lease liability.

The right of use asset equals to the lease liability at the commencement date, plus lessee’s initial direct costs, plus some other things – but in this case, we have nothing like that, so let’s just say it’s the same as the lease liability.

Under IFRS 16, the initial journal entry would be:

-

Debit ROU (right of use) asset: CU 457 971

-

Credit Lease liability: CU 457 971

Subsequently, ABC needs to take care about 2 things:

- Depreciation of the ROU asset: Let’s say it’s straight line over the lease term of 5 years, thus it’s CU 91 594 per year (CU 457 971/5).

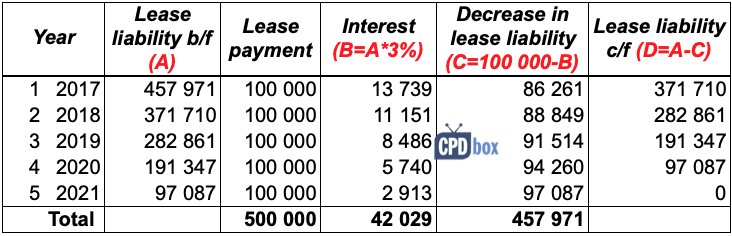

- Lease payments: Each lease payment of CU 100 000 is split between the repayment of the lease liability and interest.

I’ve done that in the following table:

Compare the accounting under IAS 17 and IFRS 16

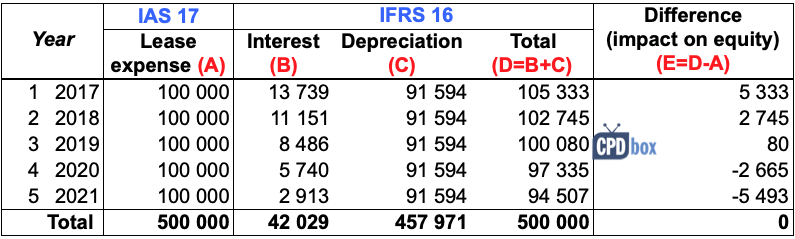

To calculate the adjustment in equity related to this contract, let’s summarize the profit or loss impact of the lease in individual years under both IAS 17 and IFRS 16:

As you can see, total profit or loss impact of both IAS 17 and IFRS 16 application is the same CU 500 000, however, the timing is a bit different.

So, now we have set everything and let’s see how to make adjustment in equity and how to present the restatement under both full and modified retrospective approaches.

I described both approaches in this article, so I won’t repeat it here and let me focus on numbers.

Full retrospective approach

ABC adopts IFRS 16 in its financial statements for the year ending 31 December 2019, and that means that the transition date is 1 January 2018.

We need to restate all numbers for the comparative period, too.

Most of the work has been done above (see tables 1-3), so I’ll draft the journal entries here:

- Restatement of opening balances of the earliest period presented (that is: BEFORE 1 January 2018):

- a) Recognizing ROU asset and lease liability:

-

Debit ROU (right of use) asset: CU 457 971

-

Credit Lease liability: CU 457 971

-

- b) Reversal of the lease payments before 1 January 2018 under IAS 17 (there was just one):

-

Debit Cash: CU 100 000

-

Credit Retained earnings (equity): CU 100 000

I know, I know! No cash moved! Wait until we are done with this exercise. This is just to illustrate that in fact, you are reversing the “old entries” and then making the “new entries”.

And why retained earnings and not profit or loss?

Because you are making this entry on 1 January 2018 and at this date, all profit or loss accounts from 2017 were transferred to the retained earnings.

-

- c) Accounting for the lease payments before 1 January 2018 under IFRS 16 (there was just one):

-

Debit Lease liability: CU 86 261

-

Debit Retained earnings (equity): CU 13 739 – this is for the interest

-

Credit Cash: CU 100 000

Note: The numbers come from table 2 for the year 1 (2017).

-

- d) Accounting for the depreciation of the ROU asset before 1 January 2018 under IFRS 16 (there was just one year):

-

Debit Retained earnings (equity): CU 91 594

-

Credit ROU asset: CU 91 594

-

In fact, you can do all 4 entries in one adjustment and it would look something like:

-

Debit ROU asset: CU 366 377 (CU 457 971 less depreciation of CU 91 594)

-

Debit Retained earnings in equity: CU 5 333 (-100 000+13 739+91 594, or see table 3 for the year 1)

-

Credit Lease liability: CU 371 710 (CU 457 971 less the lease liability repayment of CU 86 261, or see table 2 for the year 1)

In reality, you would adjust in in 1 single entry, but I wanted to show the rationale behind, its breakdown and logic.

- a) Recognizing ROU asset and lease liability:

- Restatement of the comparative period (year 2018):

Here, you are only restating the 2nd lease payment made. As I’ve illustrated the breakdown of all entries above, let me show you just one summarizing entry here:

-

Debit Lease liability: CU 88 849

-

Debit Interest (profit or loss of 2018): CU 11 151

-

Debit Depreciation (profit or loss of 2018): CU 91 594

-

Credit ROU asset: CU 91 594

-

Credit Operating lease expenses (profit or loss of 2018): 100 000

The numbers come from table 2 for the year 2 (2018).

-

- Restatement of the current period (year 2019):

Normally, you would have already applied IFRS 16 in 2019, but if not and you are doing everything during the closing works, here’s the entry:

-

Debit Lease liability: CU 91 514

-

Debit Interest (profit or loss of 2019): CU 8 486

-

Debit Depreciation (profit or loss of 2019): CU 91 594

-

Credit ROU asset: CU 91 594

-

Credit Operating lease expenses (profit or loss of 2019): 100 000

-

OK, that’s for the entries and adjustments.

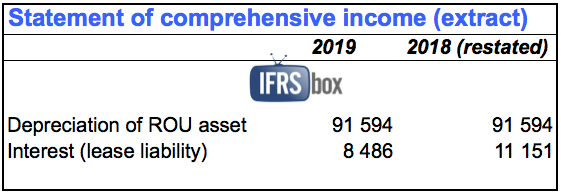

If you apply the full retrospective approach, the problem is that you have to report the comparative period – year 2018 in this case – under both IAS 17 and IFRS 16:

- In the financial statements for the year ended 31 December 2018, you are still applying IAS 17, so your current numbers for 2018 are under IAS 17, but

- In the financial statements for the year ended 31 December 2019, you apply the new IFRS 16 and also your comparatives need to be stated under the same rules – thus you need to book the above entries n. 1 and n.2 carefully.

How would your financial statements look like?

Here you go:

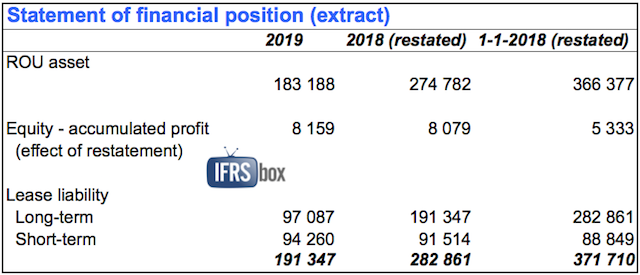

The statement of financial position (extract) is here:

All the numbers related to the lease liability come from table 2 above.

The extract from profit or loss statement:

Now, let’s show the modified approach.

Modified retrospective approach

Under the modified approach, ABC needs to make an equity adjustment on 1 January 2019 – that is at the beginning of the current reporting period.

Comparative numbers remain the same as presented before – so no restatement.

This is a way easier method to apply than the full retrospective approach, because you do not restate the previous years’ numbers.

However, the price for this relief is lower comparability.

It is quite difficult to compare current year under IFRS 16 with the previous year under IAS 17 and it does not say much about how your leases developed.

Just see it for yourself in the below extracts from the financial statements.

Before you jump into the journal entries, please note that I assumed the same discount rate at the date of application as original discount rate – just for the sake of this example, because thus I don’t need to recalculate the amounts from full approach.

In reality, you need to measure the lease liability under modified retrospective approach as present value of the remaining lease payments discounted by the rate at the initial application. You can revise the same example taking different discount rates into account here.

In this example, lease liability is effectively measured as present value of the remaining lease payments discounted by the original discount rate (as taken from above).

Let’s draft the journal entries:

- Restatement of opening balances at 1 January 2019:

- a) Recognizing ROU asset and lease liability:

-

Debit ROU (right of use) asset: CU 457 971

-

Credit Lease liability: CU 457 971

-

- b) Reversal of the lease payments before 1 January 2019 under IAS 17 (there were two):

-

Debit Cash: CU 200 000

-

Credit Retained earnings (equity): CU 200 000

-

- c) Accounting for the lease payments before 1 January 2019 under IFRS 16 (there were two):

-

Debit Lease liability: CU 175 110

-

Debit Retained earnings (equity): CU 24 890 (= interest)

-

Credit Cash: CU 200 000

Note: The numbers come from table 2 for the years 1 and 2 – you need to make a total for these 2 years (2017 and 2018).

-

- d)Accounting for the depreciation of the ROU asset before 1 January 2019 under IFRS 16 (there were 2 years):

-

Debit Retained earnings (equity): CU 183 188

-

Credit ROU asset: CU 183 188

-

-

Debit ROU asset: CU 274 782 (CU 457 971 less depreciation of CU 91 594*2)

-

Debit Retained earnings in equity: CU 8 079 (-200 000+24 890+183 188, or see table 3 for the years 1 and 2)

-

Credit Lease liability: CU 282 861 (CU 457 971 less the lease liability repayments of CU 86 261 and CU 88 849, or see table 2 for the years 1 and 2)

Similarly as with the full approach, you can make just one aggregate entry instead of these four:

- a) Recognizing ROU asset and lease liability:

- Restatement of the current period (year 2019):

It’s the same as under the full retrospective approach and if you have accounted for your operating leases under IAS 17 during the whole 2019, then you need to do this adjustment:

-

Debit Lease liability: CU 91 514

-

Debit Interest (profit or loss of 2019): CU 8 486

-

Debit Depreciation (profit or loss of 2019): CU 91 594

-

Credit ROU asset: CU 91 594

-

Credit Operating lease expenses (profit or loss of 2019): 100 000

-

Note: Here, I measured the ROU asset as if IFRS 16 has always been applied – in this case, it was easier for me as I have already calculated all the numbers above.

However, you can measure your ROU asset in the amount of the lease liability. This would be even easier, because you would not have to recalculate ROU asset in the past. You would simply calculate the lease liability (=present value of the remaining lease payments) and that’s it.

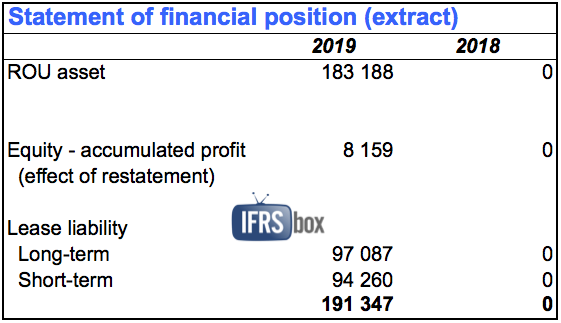

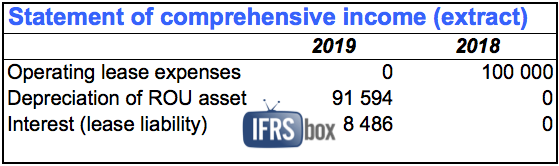

What about the ABC’s financial statements?

Here you go:

The extract from the statement of financial position:

Please note that there are zeros for the comparative year 2018 – the reason is obvious. We are presenting the previous year under IAS 17 and there was no lease liability and right of use asset under IAS 17.

The extract from profit or loss:

This was just a basic example with a very simple and straightforward contract. If you’d like to learn more about IFRS 16, its application, adoption and see many practical examples solved in Excel, then I recommend checking out my IFRS Kit – IFRS 16 is extensively covered!

Also, here’s the same example illustrating different transition options and practical expedients, so check it out.

Any questions or comments?

Let me know below – thanks!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

Thank you so much for this information. I am comparing Full retro/Modified retro and Simplified as we are taking on the asset management for a client that has already established their calculations and it very tricky to materially align opening balances. I am not sure I chose the correct adoption method, however they adopted back in 2020 so was not sure if this mattered given we are doing 2022?

I found commentary that said “Modified retro has a lower depreciation expense than Simplified (which has the highest ongoing expense profile) but is higher than Full retro”. I am trying to understand this. The example above show same depreciation and interest amounts for the relevant years. I guess the adjustment to equity is different under the different approaches meaning the resulting amounts that will be expensed will also be different, even if the expense for a current and futures years will be the same? Any insight would be really appreciated.

Thanks for the article. In lease liability, what is Short term lease liability? How is it calculated?

Hi Silvia,

Thanks you for this web and the material in it.

IFRS 16 state that for purpose of determinating the incremental interest rate we have to consider the rate to a loan with an amount similar or equal to value of right-to-use asset (and not the value of underlying asset)… Especifically, how we can determine the value of right-to-use asset in this sense? please

Thanks.

Hi Francisco, yes, there is a difference. You just need to realize what that difference is. Imagine you are renting an office for 3 years. Thus, the ROU asset is the value of the right to stay in the property for 3 years, rather than the value of that office itself, because you are not acquiring the office itself. So in this case, I would perhaps try to see what you would pay for the rental contract for 3 years if you want to pay all the amount upfront. For example, ask the lessor how much he would charge for one upfront payment for 3 years in advance. Or other lessors offering similar offices. You get the point. That one-off upfront payment would come very close to the value you are looking for.

Thank you very much Sylvia. 🙂

Silvia

your material are very helpful.

can you please explain what should be the Incremental borrowing rate in below case-

our company in india has cc limit with 9% interest p.a while our country reserve bank rate is 6% however the company has also ECB loan from Europe/france @2% p.a as interest.

Can we take the IBR/Discounting rate @2% being on ECB as the lowest for calculating ROU

Hi Madam,

Thank you for the lecture on IFRS 16.

How about situations where the lease payment was prepaid.

For example ABC Limited entered into a lease agreement for 5 years at annual rent of 100,000. The 500,000 was paid on the first day of commencement of the lease. Hos will this be treated? Your response will be highly appreciated.

Dear Cyril

Could you please share the response you received on this, if any. Thanks

Hi Ade,

everybody received the answer, it is here: https://www.cpdbox.com/question/ifrs-leases-prepaid-for-years-in-advance/

Hi

Please make it clear when we depreciate the right of use asset, why we deduct the gross guaranteed residual value from the right of use instead of present value of guaranteed residual value undaer IFRS 16.

Dear Silvia

Thank you for your clarifications.

Please advice what will be the disclosure for a land lease contract from previous period is amended in the current period for immaterial amounts.

Thank You

Dear Silvia

Thank You for your clarifications.

Could you please assist with this query?

A land lease contract from previous year is adjusted with immaterial amounts in the current period due to change in the contract terms. What will be the disclosure in the financials?

Thank you

Dear Silvia,

just a question of understanding about commencement date: Our lease contract requests the first payment to be paid before the commencement date of the lease contract. So, payment date of first payment 30 September, commencement date 01 October. Thus, we treated the first payment as not being part of the lease liability. Was this correct?

Thank you very much for a short answer.

Thank you Silvia For your illustration,

I want to ask you about lease payments, if the lease payments that should be paid is $10,000 is the first year and the total amount for interest and installments are 9,000 + 1,000(interest), why when you calculate the liability at the end of reporting you do not deduct the full amount(installment and interest = 10,000) whereas you deduct what is called decrease in lease liability?

Dear Silvia,

Thank you for your clarifications.

Please help me in this query.

In our company a land lease contract signed on December 2016 was revised after four months on April 2017 by changing all the terms of the previous contract. But erroneously during conversion to IFRS the required IFRS 16 transactions were passed using the first contract which we shouldn’t had to use.

The error is noticed on December 2020. And our conversion period was June 30, 2016.

Please advice how to correct the error.

Thanks,

Hi Hanna, recalculate the impact of error on your financial statements. If it is material, then you have to go back and correct it retrospectively via equity in line with IAS 8. If it is not material, you can make correction in 2020 in profit or loss.

thanks

Thanks,its very usefull.

Thanks silvia for such a wonder explantion which makes easy to understand the accounting difference under both IAS-17 and IFRS-16.

Hi there Silvia,

Could you kindly assist with the following?

How do we treat an invoice received from the lessor? Do we capture it or keep it as supporting documents? My colleagues have been capturing the monthly lease liability invoices from the lessor, These have been expensed directly to the P&L, and to the Accounts Payables. Over and above that the depreciation expense is also posted to the P&L. No postings were being made to lease liability account.

Dear Silvia,

Good Day,

please help me out on this doubt which i have on the fit our period rent.

shall i add my rental amount paid for fit out period in the right of use of asset or not

let say for example my lease commencement date is 01-03-2020 and rent free period is till september-2020, again the lessor is charging let say for example USD40,000 for another 4 months from oct-2020 to jan-2021, shall I include this cost in calculation of right of use of asset or i will expense it out in the P&L, i am not getting an clear about this.

Dear Silvia,

Definitely its very nice presentation. I want to know about the prevailing House Rent Agreement, how can it be presented as per IFRS 16.

Hello, thank you for the information.

By the way, i have an issue and seek for your assistance, scenario as below:-

Original lease 1/1/19 to 31/12/20 (2 years), no option to purchase and option to extend in original lease contract, the leases are recognised as ROU assets and lease liability. Subsequently, management enter a new lease (same item) from 1/1/21 to 31/1/21 (12 mth).

May i know is that any different in accounting treatment if the lease agreement signed on 31/10/20 or 1/1/21? Can it treated as short-term lease if the agreement signed on 1/1/21?

wonderful explanation THANK YOUUUUUUUU

Hello, You tutorials are always very easy to understand. Thanks for That. Please respond to my following issues;

1) Please let me know about to the treatment of refundable advance paid to lesser and will be reimbursement to lessee after the completion of lease terms?

2) My Co. financial year closed on June 30 every Year. . Our Co. take building on rent for 5 years in 2018. I want to apply IFRS 16 prospectively. Can i do the same . please respond with relevant reference to IFRS 16.

Hi Silvia,

Thanks for your wonderful explanation!

I have come across a complicated scenario, much appreciated if you could share your technical expertise on this.

There are four companies A, B, C and D with different contracts as summarized below.

• Contract 1 – Company “B” (Lessee) rents a space (marked as SW”15N) from company “A”(Lessor) for a period of five years with an annual rental of USD 100K (Head lease),

• Contract 2 – Company B leases the same space (SW”15N) to company “C” in a sublease with the same lease term and consideration of USD 100k as the head lease.

• Contract 3 – Company “C” offers the same space (SW”15N) to company “D” with a markup of 20% i.e. USD 120K p.a. in a separate contract.

• Contract 4 – Company “C” shares the revenue earned from this arrangement with Company “B” in a separate 50-50 revenue sharing contract (e.g. USD 10K revenue share each)

It is noteworthy that company “C” (Sub lessee) cannot enter into a direct contract with company “A” (head lessor). Also company “B” (Intermediate lessor) cannot directly enter into a contract with company “D” due to political reasons.

My question is as follows:

Is it allowed for Company B to treat the sublease and revenue sharing contracts as a single contract under IFRS 16 such that lease payments under the sublease arrangement will include share of revenue over the lease term?

Or,

Should the first two contracts be separately treated under IFRS 16 (Sublease arrangement) and the 3rd and 4th treated under IFRS 15?