Current or Non-Current?

Most balance sheets present individual items in distinction to current and non-current (except for banks and similar institutions).

This seems so basic and obvious that most of us do not really think about classifying individual assets and liabilities as current and non-current.

We do it automatically.

But not always correctly.

For example, one of the biggest mistakes I have seen in this area is presenting the long-term loans.

Many companies present them automatically as non-current liabilities – while they are not!

Why?

Just go on reading!

What do the rules say?

The standard IAS 1 Presentation of Financial Statements specifies when to present certain asset or liability as current.

Many people believe that “12 months” is the magic formula or the rule of thumb that precisely determines what is current or non-current.

Not always true.

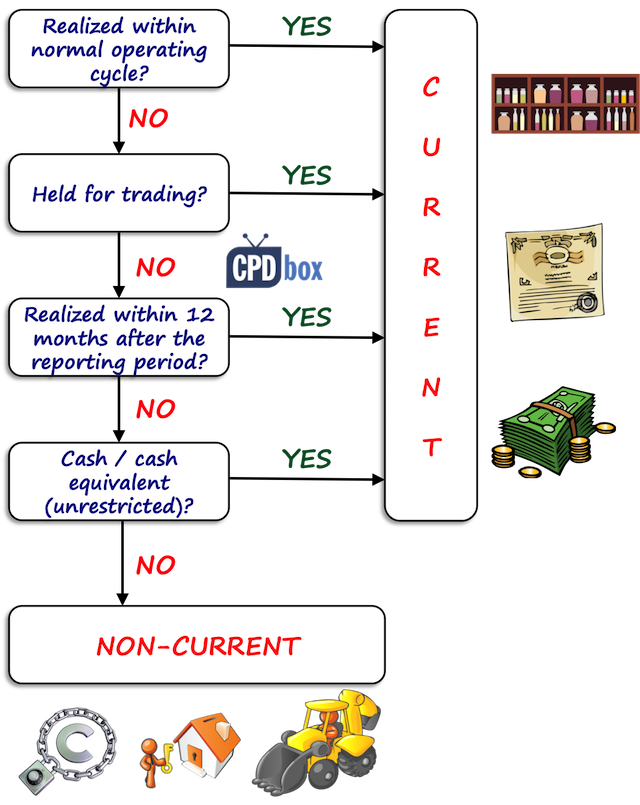

More specifically, an asset is presented as current when:

- It is expected to be realized (sold, consumed) in its normal operating cycle.

Here, the standard does not specify what the normal operating cycle is, as it varies from business to business. Sometimes it’s not so clear – in these cases, it is assumed to be 12 months. - An asset is held for trading.

It does not matter that the company will probably not sell an asset within 12 months; as soon as its purpose is trading, then it’s current. - It is expected to be realized within 12 months after the reporting period, or

- It is a cash or cash equivalent (not restricted in any way).

The same applies for liabilities, too, but the standard IAS 1 adds that when there is no unconditional right to defer settlement of the liability for at least 12 months after the reporting period, then it is current.

Everything else is non-current.

Typical examples of current items are inventories, trade receivables, prepayments, cash, bank accounts, etc.

Typical examples of non-current items are long-term loans or provisions, property, plant and equipment, intangibles, investments in subsidiaries, etc.

These are just examples, but there are a few items that are not that outright and need to be assessed carefully.

Property, plant and equipment

In most cases, property, plant and equipment (PPE) is classified as non-current, because the companies use these assets for a period longer than 12 months, or longer than just one operating cycle.

This also applies for most intangible assets and investment properties.

However, there is a few exceptions or situations, when you should present your PPE as current:

Non-current assets classified as held for sale under IFRS 5

When some non-current assets meets the criteria of IFRS 5 to be classified as held for sale, it shall no longer be presented within non-current assets.

Instead, all assets held for sale or of a disposal group shall be presented separately from other assets in the statement of financial position. The same applies for liabilities, too.

So you would include one separate line item within your current assets, labeled something like “Assets classified as held for sale”.

Non-current assets routinely sold after rental

Some companies hold non-current assets for rentals and then they routinely sell them after some time.

For example, car-rental company routinely rents out its cars to various clients for a short period of time and then these cars are sold after 1 or 2 years. Here, I’m not talking about any finance lease – I mean short-term, or even long-term operating lease.

These assets shall be presented as non-current during their rental period, but when a company stops renting them out and wants to sell them, they shall be transferred to inventories.

Inventories

Inventories are a typical current asset, as inventory production usually determines the length of company’s operating cycle.

It does not matter whether the asset produced has the economic life shorter than 12 months or not – if you produce machinery or cars, from your point of view it’s still a piece of inventory (unless you’d like to use some items for your own business, for example for test drives, advertising purposes or so).

I’d like to point out that also inventories whose production period is longer than 12 months and are expected to be realized (sold) beyond 12 months after the end of the reporting period, are classified as current assets.

For example, cheese, wine or whiskey that need to mature for a few years, are still classified as current assets.

Deferred tax assets and liabilities

No discussion here.

Deferred tax assets and liabilities are always classified as non-current.

Loans with covenants

This is the trickiest one in my opinion. Here, the companies make big mistakes in presenting their loans.

The standard IAS 1 specifically says that when an entity breaches some provisions of a long-term loan arrangement before the period end and the effect is that the loan become repayable on demand, the loan must be presented as current.

The standard is very strict here – it applies also in the case when the lender (bank) agreed not to demand the payment as the consequence of breach after the end of the reporting period, but before the financial statements are authorized for issue.

Let me illustrate it on a short example:

Question:

ABC took a loan from StrictBank repayable in 5 years. The loan agreement requires ABC to maintain debt service cover ratio at minimum level of 1,2 throughout the life of the loan, otherwise the loan may become repayable on demand.

ABC found out that the debt service cover ratio was 1.05 at the end of November 20X1 and reported the breach to StrickBank. How should ABC present the loan in its financial statements for the year ended 31 December 20X1?

Solution:

The answer depends on the reaction of the StrictBank.

If StrictBank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant at or before the period end (31 December 20X1) and this agreement is valid:

- For more than 12 months after the end of the reporting period => the loan is classified as non-current.

- For less than 12 months after the end of the reporting period => the loan is classified as current.

If StrictBank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant after the period end (31 December 20X1), but before the financial statements are authorized for issue, the loan is classified as current, because ABC does not have an unconditional right to defer the loan settlement for at least 12 months after that date.

The impact of presenting the loan as current instead of non-current can be tremendous, as all liquidity rations worsen immediately.

Therefore, if your company took some loans from the banks, I would strongly encourage you to revise and check keeping the covenants well before the end of the reporting period, so that you have enough time to ask your bank for agreement with non-repayment on demand.

Is there any item you would like me to explain further? Please leave me comment right below article. Do not forget to share this article with your friends. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Sylvia, very useful article!

thanks a lot

Dear Ms. Silvia,

On January 5, 2019, a deposit is placed with a bank for 3 years. Since the tenure is more than 12 months, this is classified as non-current up to January 5, 2021 and in every balance sheet after January 6, 2021 it should be classified as current.

However, there is a contention that up to the maturity date, this deposit should be classified as non-current for the simple reason that “INITIALLY” the deposit was placed for more than 12 months.

Please share your view on this, please.

Dear Surya,

strictly in line with the rules of IAS 1, the deposit is non-current if it will be realised more than 12 months after the end of the reporting period. So, in the financial statements for the year ended 31 December 2021, that deposit is current, because the maturity date is 5 January 2022 – which is less than 12 months after the end of the reporting period.

Dear Silvia,

I have a question about the interpretation of IAS 1.69. Is it correct that IAS 1.69(d) is only checked in combination with IAS 1.69(c) and not with IAS 1.69(a) and IAS 1.69(b)? So if it is expected to settle a liability within its operating cycle or it is held for trading it is always classified as current, doesn’t matter if I have the unconditional right to defer settlement for at least twelve months? The exception of (d) is only hitting if a liability would be due in twelve months (c) but if the settlement could be deferred for at least twelve months (d) is overruling (c). Am I reading this correct?

Hi Silvia, I hope you can explain to me if the loan is revolving credit loan and bank agreement indicate the loan is revolving within 12 months. Auditor do not agree to classify the loan to non-current liabilities even the loan is settled more than 12 months. Could you advise to me.

Hi Silvia, can loans and advances be classified into current being the portion of loan realizable within 12 months after the reporting date while the other portion realizable 12 months after reporting date be classified as non-current?

Yes. It should be this way – not another option.

Dear Silvia,

Thank you for these articles, they are very useful. This one especially came on time as I am dealing with an issue similar to what you describe. Can you please explain what I shall do in my situation. we are a daughter company and we have interest free LT loans from mother company. According to the agreement, each loan tranche (we call them capital notes) gets mature in 5 years. Some of these capital notes expired this year. We prepare our financials on monthly basis, and on quarterly basis consolidated FS are issued, so we must reconcile related parties transaction. Before the expiry date everything was easy. I discounted the nominal by market rate and 5 years and recognizes LT liability and capital reserve. Then I accrued interest. Some capital notes reached their nominal value in July 2022, some – in Sep 2022. It’s quaterly closing now. And the accounting policy for these expired notes is as if they were repaid and taken again for 1 year. So, in September I discount them for 1 year, accrue interest for the part of the year from expiry date to Sep 30, 2022, And what do I do else? And what do I do in December 2022? I should discount them again. But how? Technically I am not sure how to calculate this. I hope you can help.

You make even complex issues simple and understandable. Thank you

Thank you Silvia for your illustration,

I have two questions regarding the presentation of the financial statements, Q.1 why when we classify the non-current asset as held for sale we take the lower amount of carrying amount and fair value less cost to sell not vice versa? Q.2 why the discontinued operations does not have measurement rule (only classification in the financial statements?

Thanks in advance,

regards

Hi. For assets. Let’s say that at year end 31.12.2020 a loan receivable was repayable on 30.6.2021 but in 2021 before tha accounts of 2020 issued/signed both parties (lender and borrower) decided to change repayment terms after 5 year. How this will be presented in the FS of lender at 31.12.20 as current or non current? In the FS of borrower i understand that it will be presented as current. Please clarify as the standard specifies/clarifies only for liabilities.

YES Selvia you make it easy like every time

But what about IFRS-16

:you asked to tell you about new subjects we need you to talk about

Dear Silvia, could you please advise what is the classification (current or non current) for a security deposit from a simple contract that does not specify whether refundable and when to refund. Thank you

Dear Sylvia, very enlighten article! My question is: are contract liabilities that expected to be settle after 12 month current items? Should We consider them as part of the normal operating cycle? Which is the definition of normal operating cycle and which items should be part of it? Thank you!!!

Dear Ms. Silvia,

Can you please advise on how t0 classify the closing balance of lease liability into current and non-current. Should the current portion be the sum of the present value of lease payments payable in next 12 months and rest be considered as a non-current portion?

Hi!

I really do like your resources and love the way they breakdown complex standards into much simpler formats. Thanks a lot for that.

My question (also linked to subsequent events, and fair value) comes in when we talk of expected to be received/settled.

Now I do occasionally audit a company a year or 2 after its year end. In this case, I have all the information with regards to what was *actually* received or paid within 1 year from the reporting date.

Despite the fact that at year the client the client would obviously claim that he did realistically expect to receive all the amounts within 12 months.

In this case, do we go for the expectation as at year end, or the actual fact?

If, as I have seen indicated in the article, we go for expectation as at year end, do we record a fair valuation gain/loss based on the fact that the debtors/creditors have not been received after year end? and if we do, is it not inconsistent to recognise a fair valauation gain/loss on a current asset/liability?

Similarly for liabilities, I did not have a specific right to defer payment, but the fact is, I have deferred payment.

Do I rely on the actual fact that I have not paid the amount, or do I present my FS based on my expectation at year end, that I was going to settle my creditor withing 12 months.

Hi Saqlain,

I think the first part of your question does not relate to this topic, but let me express my opinion.

Let’s say that the client’s financial statements for the year ended 31 December 2018 have been authorized for an issue in March 2019 and the client’s debtor still has not paid. The ECL provision (“FV valuation as you named it) should be based on the client’s expectations valid at that time. The fact that the client has not paid 2 years after the due date is the event after the reporting period. However – if that event happens AFTER the financial statements have been authorized for an issue, then technically speaking, this is NOT the event after the reporting period under IAS 10, so you do NOT adjust.

What shall an auditor do? OK, at the time of audit, you have much more information available, but you are still auditing the picture at 31 Dec 2018 and you have to assess what was available then. But, as the date of audit report is very recent, with new info available, you should add “emphasis-of-matter” paragraph to your report stating clearly that the situation changed…

As for deferred right of payment – was there some agreement between the debtor and your client about the deferral? If not, then no question, it is current – regardless the fact that the client did not pay. I hope it helps.

Thanks for the prompt response! Really appreciate it.

I do need some more clarification if you could please assist.

What I mean in the first part of my question is, I am auditing financial statements year ended 31.12.17. They will be authorised for issue (hence signature date) will obviously be once the audit is completed. Since I am beginning the audit, say on 1st Jan 2020, the debt is already 2 years old and has not been paid up.

Now here, I know for a fact that the debt, as at 31.12.17, is non current. Do I classify it as non current based on the fact it was not received subsequently?

To the second part of the question,

I understand your view of classification as current liability. This prompts the question about fair valuation gains.

I.e Having not paid the debt for over a year, there is a fair valuation gain therein. Do I recognise that gain despite continuing to classify the creditor as current?

Thanks 😀

I am confused – are you asking about receivable or payable? Or are they 2 different items?

The fact that something has not been paid does NOT automatically mean reclassification to non-current, unless there is a right to do so. Without seeing the contract I cannot really say.

As for fair valuation – no, I would not say so, if this is the liability of the client – again, unless the due date was contractually postponed.

I’m asking for both. I’ve encountered both scenarios in my audits.

Thanks for the clear cut answers.

May I ask for the basis for the same (so I can use that understanding and apply those underlying basis in future scenarios)

I.e Why would the fact that something has not been paid, not lead to automatic classification to non current.

Doesent the actual receipt/non receipt of the balance count as a subsequent event (with regards to when the debt is to be received?)

Similarly for the liability.

The fact that I haven’t paid my liability for 12 months does to me indicate that the value of the liability is less than what the books show. I.e I am using subsequent events to give me information on the value of the liability.

Why then do we not fair value the liability.

Thirdly, and I would pose this question stating my view on the same based on your article

Company A has a loan from a related party. The loan is repayable on demand.

Company A does not have direct access to funds to pay off the balance in the current year. I.e If they want to pay, the shareholders would need to inject further capital/take out a loan.

Per my understanding of all you’ve taught me today, I believe this would still be classified as a current liability right? With the assumption being that the loan would be demanded and that the shareholders would have to look for funds (and that we ignore the RP relationship)

Is my view fine?

Dear Saqlain.

the basis are simply the rules of the standard IAS 1. If anything not paid leads automatically to classification as “non-current”, then loads of entities would simply not paid their dues, reclassified to non-current and thus improve their liquidity rations, etc. – do you really think it is the objective of IFRS?

I need to end this discussion, as I expressed my clear opinion. As for intragroup loan – yes, of course – unless there is a clear proof (letter from shareholders, anything…), it is automatically seen as on-demand. I know that in some countries the practice is different – however I do not say that I agree with similar practices. If you need more discussion or advice, please sign up for my Helpline service and our consultants will provide professional advice.