IFRS 16 Leases Explained: Full Guide + Free Video & Checklist

Updated: May 2025

IFRS 16 changed lease accounting forever. Lessees now bring almost all leases onto the balance sheet — no more hiding operating lease liabilities in the footnotes.

In this guide, you’ll learn how IFRS 16 works in practice, including main rules, two free video lectures and practical checklist to download and use as your reference.

Jump to section:

1. Free VIDEO lecture: Overview of IFRS 16 Leases

2. Objective of IFRS 16

3. What is a lease under IFRS 16?

4. Accounting for leases by lessees

5. Free VIDEO lecture: Example of lease accounting step by step

6. Accounting for leases by lessors

- 6.1 Classification of leases

- 6.2 Finance lease: Initial measurement

- 6.3 Finance lease: Subsequent measurement

- 6.4 Operating lease

7. Sale & leaseback transactions

8. Presentation and disclosures in line with IFRS 16

9. DOWNLOAD IFRS 16 Practical Checklist

10. Further reading&learning

1. Overview of IFRS 16 Leases (free VIDEO lecture)

2. Objective of IFRS 16

The objective of the standard IFRS 16 Leases is to specify the rules for recognition, measurement, presentation and disclosure of leases.

But, why is there a new lease standard when we had an older IAS 17 Leases?

The main reason is that under IAS 17, lessees were still able to hide certain liabilities resulting from leases and simply not present them on the face of the financial statements.

I’m talking about operating leases, especially those with non-cancellable terms.

Under the new standard, lessees will need to show all the leases right in their statement of financial position instead of hiding them in the notes to the financial statements.

Note: IFRS 16 applies for the periods starting on or after 1 January 2019 (careful about the comparatives).

Return to top

3. What is a lease under IFRS 16?

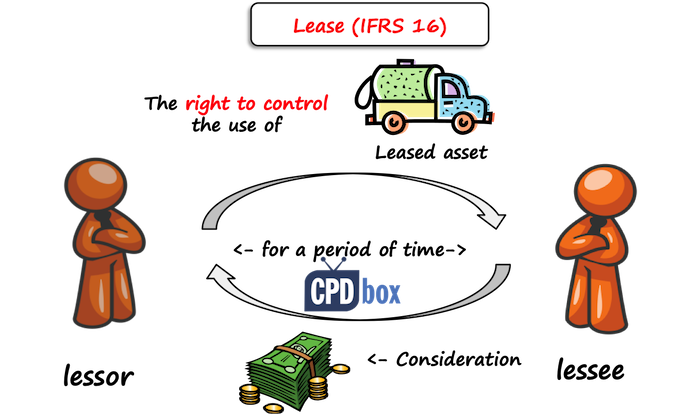

A contract is or contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration (IFRS16, par.9).

This definition of lease is much broader than under the old IAS 17 and you must assess all your contracts for potential lease elements.

You should carefully look at:

- Can the asset be identified? E.g. is it physically distinct?

- Can the customer decide about the asset’s use?

- Can the customer get the economic benefit from the use of that asset?

- Can the supplier substitute the asset during the period of use?

If the answer to these questions is YES, then it’s probable that your contract contains a lease.

As I wrote in my article about comparison of IFRS 16 and IAS 17, the impact of this new broader definition can be quite big, because some service contracts (with payments recognized directly in profit or loss) can now be considered as lease contracts (with necessity to recognize right-of-use asset and lease liability).

Under IFRS 16, you need to separate lease and non-lease components in the contract.

For example, if you rent a warehouse and rental payments include the fees for cleaning services, then you should separate these payments between the lease payments and service payments and account for these elements separately.

However, lessee can optionally choose not to separate these elements, but account for the whole contract as a lease (this applies for the whole class of assets).

Return to top

4. Accounting for leases by lessees

Warning: Lessees do NOT classify the leases as finance or operating anymore!

No classification!

Instead, lessees account for all the leases in the same way.

4.1 Initial measurement

At lease commencement, a lessee accounts for two elements:

- Right-of-use asset Initially, a right-of-use asset is measured in the amount of the lease liability and initial direct costs.Then it is adjusted by the lease payments made before or on commencement date, lease incentives received, and any estimate of dismantling and restoration costs (remember IAS 37).

- Lease liability The lease liability is in fact all payments not paid at the commencement date discounted to present value using the interest rate implicit in the lease (or incremental borrowing rate if the previous one cannot be set).These payments may include fixed payments, variable payments, payments under residual value guarantees, purchase price if purchase option will be exercised, etc.

Let me outline the journal entries for you:

- Lessee takes an asset under the lease:

-

Debit Right-of-use asset

-

Credit Lease liability (in the amount of the lease liability)

-

- Lessee pays the legal fees for negotiating the contract:

-

Debit Right-of-use asset

-

Credit Suppliers (Bank account, Cash, whatever is applicable)

-

- The estimated cost of removal, discounted to present value (lessee will need to remove an asset and restore the site after the end of the lease term):

-

Debit Right-of-use asset

-

Credit Provision for asset removal (under IAS 37)

-

4.2 Subsequent measurement

After commencement date, lessee needs to take care about both elements recognized initially:

- Right-of-use asset

Normally, a lessee needs to measure the right-of-use asset using a cost model under IAS 16 Property, Plant and Equipment.It basically means to depreciate the asset over the lease term:-

Debit Profit or loss – Depreciation charge

-

Credit Accumulated depreciation of right-of-use asset

However, the lessee can apply also IAS 40 Investment Property (if the right-of –use asset is an investment property and fair value model is applied), or using revaluation model under IAS 16 (if right-of-use asset relates to the class of PPE accounted for by revaluation model).

-

- Lease liability

A lessee needs to recognize an interest on the lease liability:-

Debit Profit or loss – Interest expense

-

Credit Lease liability

Also, the lease payments are recognized as a reduction of the lease liability:

-

Debit Lease liability

-

Credit Bank account (cash)

If there is a change in the lease term, lease payments, discount rate or anything else, then the lease liability must be re-measured to reflect all the changes.

-

4.3 Is this too complicated? Exemptions exist!

If you got this far in reading this article, maybe you find it overcomplicated, especially for “small” operating leases.

Here’s the good news:

You do NOT need to account for all leases like described above.

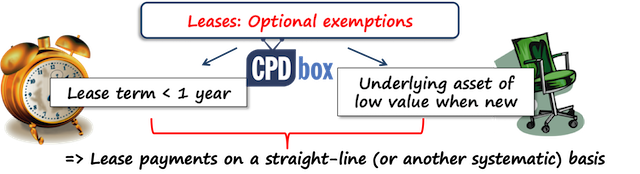

IFRS 16 permits two exemptions (IFRS 16, par. 5 and following):

- Leases with the lease term of 12 months or less with no purchase option (applied to the whole class of assets)

- Leases where underlying asset has a low value when new (applied on one-by-one basis)

So, if you enter into the contract for the lease of PC, or you rent a car for 4 months, then you don’t need to bother with accounting for the right-of-use asset and the lease liability.

You can simply account for all payments made directly in profit or loss on a straight-line (or other systematic) basis.

Return to top

5. Example: Lease Accounting by the Lessee (free video lecture)

6. Accounting for leases by lessors

Nothing much changed in accounting for leases by lessors, so I guess you already are familiar with what follows.

6.1 Classification of leases

Unlike lessees, lessors need to classify the lease first, before they start accounting.

There are 2 types of leases defined in IFRS 16:

- A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an underlying asset.

- An operating lease is a lease other than a finance lease.

IFRS 16 (IFRS 16, par. 63) outlines examples of situations that would normally lead to a lease being classified as a finance lease (and they are almost carbon copy from older IAS 17):

- The lease transfers ownership of the asset to the lessee by the end of the lease term.

- The lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date of the option exercisability. It is reasonably certain, at the inception of the lease, that the option will be exercised.

- The lease term is for the major part of the economic life of the asset even if the title is not transferred.

- At the inception of the lease the present value of the lease payments amounts to at least substantially all of the fair value of the leased asset.

- The leased assets are of such a specialized nature that only the lessee can use them without major modifications.

6.2 Finance lease: Initial measurement

At the commencement of the lease term, lessor should recognize lease receivable in his statement of financial position. The amount of the receivable should be equal to the net investment in the lease.

Net investment in the lease equals to the payments not paid at the commencement date discounted to present value (exactly the same as described in lessee’s accounting) plus the initial direct costs.

The journal entry is as follows:

-

Debit Lease receivable

-

Credit PPE (underlying asset)

6.3 Finance lease: Subsequent measurement

The lessor should recognize:

- A finance income on the lease receivable:

-

Debit Lease receivable

-

Credit Profit or loss – Finance income

-

- A reduction of the lease receivable by the cash received:

-

Debit Bank account (Cash)

-

Credit Lease receivable

-

Finance income shall be recognized based on a pattern reflecting constant periodic rate of return on the lessor’s net investment in the lease.

IFRS 16 then also specifies accounting for manufacturer or dealer lessors.

Return to top

6.4 Operating lease

Lessor keeps recognizing the leased asset in his statement of financial position.

Lease income from operating leases shall be recognized as an income on a straight-line basis over the lease term, unless another systematic basis is more appropriate.

Here you can see that the accounting for operating leases is asymmetrical: both lessees and lessors recognize an asset in their financial statements (it’s a bit controversial and there were huge debates around).

7. Sale and Leaseback transactions

A sale and leaseback transaction involves the sale of an asset and the leasing the same asset back.

In this situation, a seller becomes a lessee and a buyer becomes a lessor. This is illustrated in the following scheme:

Accounting treatment of sale and leaseback transactions depends on the whether the transfer of an asset is a sale under IFRS 15 Revenue from contracts with customers.

- If a transfer is a sale:

- The seller (lessee) accounts for the right-of-use asset at the proportion of the previous carrying amount related to the right-of-use retained. Gain or loss is recognized only to the extend related to the rights transferred. (IFRS 16, par.100)

- The buyer (lessor) accounts for a purchase of an asset under applicable standards and for the lease under IFRS 16.

- If a transfer is NOT a sale:

- The seller (lessee) keeps recognizing transferred asset and accounts for the cash received as for a financial liability under IFRS 9 Financial Instruments.

- The buyer recognizes a financial asset under IFRS 9 amounting to the cash paid.

8. Presentation and disclosures in line with IFRS 16

Lessees must:

- Present right-of-use assets either separately or within the same line item as similar assets.

- Show lease liabilities separately or as part of other financial liabilities.

- Disclose:

- Maturity analysis of lease liabilities

- Expense from short-term and low-value leases

- Cash outflows for leases

- Additions and carrying amounts of right-of-use assets

- Significant judgments (e.g., lease term, discount rate)

Lessors must disclose:

- Risk exposure from residual value guarantees

- Selling profit or loss for manufacturer/dealer lessors

- Income from variable lease payments

9. DOWNLOAD IFRS 15 Practical Checklist

10. Further reading and learning

Explore more on IFRS 16: Visit this page to access the full library of all IFRS 16-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

Any questions? Please let me know below, thank you!

Return to top

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Slivia,

Thanks for the wonderful explanation. I have a scenario. An automotive dealership sold a vehicle with the repurchase agreement. The car sold at US$ 20,000 (full payment at the upfront) and agreed to repurchase after 2 years at US$ 5,000. The market value after 2 years assumes to be equal to the agreed repurchase price. The ownership (legal title) will be transferred to the purchaser. How do we treat this? As per my understanding this should be treated as operating lease under dealership account. Kindly suggest me the possible JVs for this arrangement.

Hi Hafeel,

well, under IFRS 15 paragraph B65, it seems that if the vehicle will be repurchased by the dealership at then-market value, then it is a lease under IFRS 16 (since I assume that then-market value will be lower than the original selling price), so you should really think of lease accounting.

Hi Silvia,

The tenancy agreement has been terminated. How to record the transaction?

Thanks.

Very general question. Are you asking about premature termination? Are there any penalties involved? Are you asking as a lessor or as a lessee?

Hey Silvia,

May you add one or more illustrations about service contract that will satisfy and considered as a lease?

e.g. acquisition of power service, accessing international network gateway (connections and data)?

Thanks

Hi, Thank you for making accounting standards much easier for us! Appreciate it. It would be great if you help me with the below question.

A company has leased lands from the government which expires in 2067.

The company had already invested and built residential apartments on the lands and they generate rental income for the company.

In 2019, the company adopted IFRS 16, and they accounted for the Right-of-Use (ROU) and lease liability based on future rental payments to the government.

Since the property satisfies the requirements for an investment property, the ROU and Building cost is accounted for under IAS 40, the investment property fair value model, which is permissible in IFRS 16.

The company revalues all of its investment properties every three years. Hence, in 2021, they revalued the lease land and building using an external valuer (valuation for land is done assuming that the lease will be continuously renewed upon expiry).

The difference between;

1. the ROU NBV (after deducting the amortization charge for 2019-2021) and land fair value, and

2. Building cost (not depreciated since IAS 40 fair value model) and fair value of the building,

is taken to P/L as revaluation gains in the year 2021.

Now I have the below questions,

1. In the yearend of 2022, how should the company amortize its right of use for its lands, which is a revalued value? Or, shouldn’t the company amortize the land as it is classified under the FV model of IAS 40?

2. Starting from November 2022, the government has revised the rental payment for the lease. Now, I need to remeasure my liability for the new rental payments. Hence, how should I account for the difference between the lease liability as of Nov 2022 and the new remeasured lease liability?

Thanks in advance

1. Amortization of Right-of-Use (ROU) for Revalued Land:

# Since the land is classified as an investment property under the fair value model of IAS 40, the revalued amount of the land should not be amortized. In the fair value model, changes in the fair value of investment properties (including land) are recognized directly in profit or loss.

# Therefore, there is no need to amortize the revalued amount of the land. Instead, any changes in fair value will be recognized as revaluation gains or losses in the profit or loss statement.

2. Remeasurement of Lease Liability for Revised Rental Payments:

When the government revises the rental payment for the lease starting from November 2022, you need to remeasure the lease liability to reflect the new terms. This adjustment is accounted for prospectively.

# The difference between the lease liability as of November 2022 and the new remeasured lease liability should be accounted for as an adjustment to the carrying amount of the right-of-use asset (ROU). This adjustment is recognized in profit or loss over the remaining lease term using the effective interest rate method.

# The accounting entries would involve updating the lease liability and the carrying amount of the ROU asset on the balance sheet. The interest expense on the new liability is recognized in profit or loss, and the principal portion of the payment reduces the lease liability while adjusting the carrying amount of the ROU asset.

In summary, for the revalued land, there is no amortization, and any changes in fair value are directly recognized in profit or loss. For the revised lease payments, the difference in the lease liability is adjusted to the carrying amount of the ROU asset and recognized in profit or loss over the remaining lease term. Always ensure compliance with the specific requirements of IFRS 16 and IAS 40, and consider consulting with a professional accountant or financial advisor for detailed guidance tailored to your company’s circumstances.

Hi Silvia

I have a very unique case when it comes to lease modification.

The case is about a long term lease for 40 years has been modified by reducing the yearly payment to a very low amount lets say it was 50 then it went down to 20 this resulted in a very big reduction in the lease liability which was even higher than the right of use asset amount so if we go by the standard the asset amount will be negative so any thought about this peculiar situation because we are treating this change as a modification and not as new lease therefore we have to adjust the asset and the liability by the liability differential amount

Hi Silvia,

Thanks for the article

Question: We rent a building for 6 years with a total cost of CU 60 000, of which we paid 60,000.00 fully at the beginning of the lease contract, how can we measure it?

I recommend reading this answer to one of the reader’s questions.

in short, you have only ROU to depreciate on straight line basis for the period of the lease agreement 60 000 / 72 months =833,33

Dr – Dep Exp

Cr – Acc Dep Rou Asset

Hi Silvia,

Thank you for your videos i find them very helpful, I do have a question in relation to finance lease.

At the end of the finance lease we are working with Lease Asset Disposal Company to transfer ownership from our company to the lessee . In relation to the nominal fee charged to do this ( based on the market value of the asset at the end of the lease) how should this income be recognized ? Does this need to be recognized at the start of the deal and discounted to NPV, can this be treated as Admin Fee ( which i dont think it is as its not set fee) or how is this income recognized if considered as purchase consideration when IFRS 15 doesn’t apply to leases?

Dear Cathy,

thanks a lot for your question, however I need clarification because I don’t fully understand the mechanics. You are the lessor, and then you pay the admin fee to the Lease Asset Disposal Company to transfer ownership? Or?

Hi Silvia,

Thank you for your swift reply.

Yes we are the lessor

The LADCO process requires a sales invoice for the asset to be issued from us to LADCO. Separately we issues a rebate of rentals to the lessor.

The payment of the amount also results in the legal transfer of the asset to LADCO and then LADCO to the customer.

Also the amount that needs to be paid varies depending on the difference between the market value of the asset and the lease rentals paid, .

The payment of the consideration results in the legal transfer of the asset.

I have included an excert from the Revenue guidance on LADCO below This outlines the various stages of the transaction which might also be useful.

· The leasing company invoices LADCO for the sale of the asset i.e. the leasing company sells the asset to LADCO. The sale must be at market value

· Where the lessee wishes to acquire the asset, LADCO invoices the lessee for the asset i.e. LADCO sells the asset to the lessee

· The lessor issues a rebate of rentals credit note to the lessee. The rebate usually equates with the bulk of the sale consideration. Tax and Duty Manual Part 04-06-04 8 To reverse the disposal e.g. where a mistake has been made or at the request of the lessee, the following transactions take place:

· The lessor issues LADCO with a credit note for the asset

· LADCO issues a credit to the lessee for the asset

· The lessor issues a cancelling reversal of rebate invoice to the lessee. Standard invoicing documentation is used to give effect to these transactions

I am just wondering as this is an option at the end of the lease how should this income ( the LADCo fee be recongnised)

thank you

Cathy

Yes we are the lessor

the fee relates to the purchase of the asset and is paid to us at the end of the deal

Hi silvia

Hope this message finds you well.

I have a question related to IFRS 16 as below.

Our company is giving a building to AB company and that company is reconsturcting that buildig for 23 billion UZS from its own capital for us and pays 7.5 million UZS for the rent everymonth, In the contract lease term is 5 years and after the 5 years time our company pays in 60 days time the outstanding amount that the AB company paid for the reconstruction of the building, How can we apply IFRS 16 here ? pleas help me.

Hi Silvia,

Thanks for the article.

I have a question about the situation when the purchase option is realized, should we transfer the Right-of-use asset to Fixed assets?

Hi Silvia

Thanks alot for article that you have shared.

Would like to check with you, what if the lease payment is variable. For example, the rental payment of the building, is based on % sales made by the Restaurant?

Shall we consider this included into IFRS16, calculation of ROU?

Hi Budi,

I guess that this short article will give you the answer. Best, S.

Hi Silvia

Thanks a lot, it is very clear answer.

Hi Sylvia,

Thank you very much for the education.

I am currently facing a peculiar problem where the nature and business model of the entity qualifies their operations as a finance lease however the regulations of the country requires a certification or license before the entity can operate a finance lease.

At the end of the review period, the entity is refusing to pass adjustments to the effect of the finance lease since they are skeptical about the regulatory implications.

What must be done

Hi Kweku, if you report under IFRS, then the substance over form principle applies. However, I recommend formally asking your regulator (some government agency responsible to pass accounting rules in your country for a guidance, because legal and IFRS principles actually clash here.

Hi Silvia,

Thank you for sharing your knowledge and especially for IFRS Kit course. It’s really beneficial. But unfortunately, I can’t find anywhere an answer to one question. I hope you have time to look at my message.

We sublease an office building.

At the end of the lease term the unguaranteed residual value remains in our books (Lease receivables). The same in your example in IFRS 16 course (tab 11-LessorFL in excel file – USD 50 000). We are not going to lease the building anymore, and therefore not going to have any sublease.

How should we derecognize the unguaranteed residual value (Lease receivables)?

In short what sublessor should do with the unguaranteed residual value (Lease receivables) at the end of sublease, if it is not going to continue any lease/sublease operations?

Thank you very much!

Hi Silvia

Thanks alot for your previous sharing’s, comments and articles

Would like to ask you a simple questions.

If says, a lessee enter into the financing lease scheme,

and required to pay the purchase option let say 5% from the total amount agreed.

This purchase option paid in arrear / advances, what accounting treatment should be correct?

It is accounted as part of ROU? or advances paid for Leasing?

if accounted as part of ROU, shall be depreciated along the non-cancelable period ? or the economic usefull life of that leased assets?

Hi Budi, any payments paid prior the lease commencement enter into ROU.

Dear Silvia,

Quick question regarding the 1st entry that a lessor is required to show for finance leases

Debit Lease receivable

Credit Underlying Asset

Since the lease receivable is the value of the net investment and may differ from the Carrying value of the underlying asset, where do we put the difference between those values to? Would it be expensed to P/L as maybe Admin expenses?

In profit or loss.

Hey Silvia, Wonderful Explanation ! Thank you so much.

I have a doubt related to Initial Direct Cost in case of Lessor.

In case of Operating Lease, should it be considered as an asset and expensed over lease term?

In case of Finance lease, should it be reduced from net investment in lease or ?

Hi Silvia

Do we have to do a test of impairment at year end for ROU assets as well? If Yes, do we have to carry out the same as in IAS 16?

Yes, if there is an indication of impairment, you have to test ROU asset in line with IAS 36.

Hi SIlvia,

Can I record a vehicle purchased via hire purchase as Right of Use? or should i use the current terminology to record it as Fixed Asset?

I am quite confused actually since ROU is a very broad term.

Thank you Silvia.

Regards,

Budi

Dear Silvia,

Great as usual, thanks.

I have one question. Assume Company XYZ rents a building for its office. The contract agreement is for 6 months. XYZ has been using this building for the past 3 years and was renewing the contract every 6 months. Is this lease exempted from IFRS 16 for < 12 months criteria? I'm thinking "Substance over form".

If it is exempted, don't you think IFRS 16 is prone to manipulation of "off-balance-sheet financing"?

Thanks

Hi Silvia,

Right of use asset (ROU) means The Company (Lessee) has a right to sublet it to other party, too?

Hi Budi, not necessarily – it just means that the lessee has the right to use that asset. As for subletting, it depends on the specific lease contract.

Thank u so much silvia

Hi silvia

Hope this message finds you well.

I have a question related to IFRS 16 as below.

My Company has a leasehold land for 30 years lease acquired somewhere in 2012. We have been doing construction over that land and it is in the final stages and we will shift to the new location within a year most probably.

Currently, we are charging all the rentals under CWIP for the leasehold land whereas all the construction related cost are being capitalized under CWIP under Buildings which will be capitalized as fixed assets when it becomes available for use.

I want to know how we should treat rentals of leasehold land as it is meeting criteria of leases under IFRS 16. Even if we apply IFRS 16, asset should be recognized at the fair value but I am clueless how to recognize the liability as we have already paid rentals for the last 8 years. I mean where the remaining difference between the fair value of assets and PV of lease payments will go.

Appreciate if you could response please.

Dear Junaid,

you are right, you should recognize ROU asset here related to the lease of the land, that was originated in 2012. And yes, I know that you paid rentals – all these rentals and asset adjustment shall be recognized as an adjustment into the equity. I wrote an article about it here, so maybe it will help. S.

Dear Silvia,

Hope you are doing well.

I have two questions:

1- If the contract is less than a year, and the value of the assets let’s say is below $1,000, however, there is a purchase option or the lessee must buy the asset by the end of this contract. How the lessee would record this asset? is it a financial lease? or let’s say is it a lease contract?

2- The second question is about the supplier’s right to change the asset. Does it still be considered as a contract even if the supplier has the right to change the asset?

Thank you very much.

Hashem Yasin

Hi Silvia,

I have one question :

I have the case where a company A bought a building for 30Mio GBP on 1st of August 2020 and lease back the said building during 3 years for 2 Mio GBP per year directly to the seller (the Company B) with a rent free period of one year (until 01 August 2021). This rent free is deducted from the purchase price of 30 Mio GBP at the moment of the payment.

What would be the price of the building in the accounting of A as at 31.12.2020 ?

And how I could record these entries ?

Do I need to record a deferred income and /or an income in 2020 ?

Many thanks for your help,

Florent

Hi Silvia your articles and website is so helpful it has helped me through many questions I have come across on IFRS 16. Huge thank you for making things so easy to understand.

I have a question I wonder if you could please Advise on… in relation to the asset restoration costs that need to be added to ROU asset, presumably this is the NBV of the asset restoration costs at 1st jan 19 that is added to ROU asset and depreciated on Straight line basis? Presumably there would be no impact to the depreciation hitting the p&l on the asset restoration piece as it is not discounted the same way with present value of future lease payments ?

Do you just disclose it as reclassification under IFRS 16 on PPE note ?

Thanks

V

Hi Silvia,

Can we capitalise depreciation charges on right to use asset (land) during the construction period of a permanent building on the same land?

Can i calculate the impact to B/S and P/L and comment immaterial to apply FRS116 even thought we did not fulfilled the exemption requirement?

What it means by lease by lease basis?

Hello Mam, today i am buying one asset on my customer request, customer is going to reimburse me full cost of asset + 15%. after period of 36 months customer has right to buy this asset at $1 (negligible amount) what should be accounting treatment in my books ?

Hi Silvia,

If the tenancy agreement doesn’t state the lease term, and either of of the party can terminate by giving 1 month notice. is IFRS 16 still enforceable?