IAS 10 Events After the Reporting Period

The standard IAS 10 has been here for a long time. In fact, it is one of the oldest standards in place.

It is sweet and short and often it is seen as a minor thing compared to other complex standards.

However, the ongoing pandemic of coronavirus brought this standard to light.

Clearly, the biggest effects of pandemic on businesses happened in 2020, after the end of 2019 reporting year.

So, what does IAS 10 says about similar events? Should you adjust or not?

Let’s sum it up.

Why IAS 10?

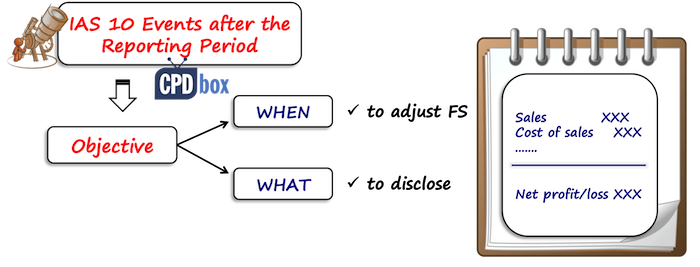

The objective of the standard IAS 10 Events After the Reporting Period is to answer to two main questions:

- WHEN you should adjust your financial statements for the events after the reporting period; and

- WHAT you should disclose about those events.

Let’s answer those one by one.

When should you consider events after the reporting period?

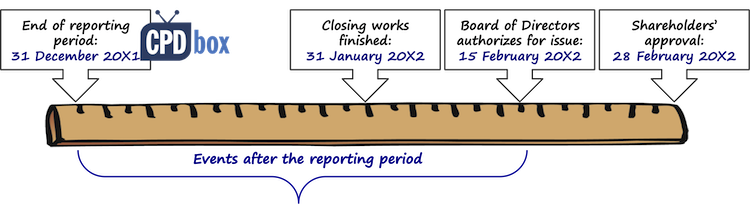

By definition (IAS 10. 3), events after the reporting period are those events, both favorable and unfavorable, that occur between:

- The end of the reporting period, and

- The date when the financial statements are authorized for issue

.

So imagine that the end of your reporting period is 31 December 20X1, your accountants finish the closing works on 31 January 20X2, the board of directors authorizes them for issue on 15 February 20X2 and the shareholders approve them on 28 February 20X2.

By definition, you need to consider everything that happens between 31 December 20X1 and 15 February 20X2 as an event after the reporting period.

OK, but what if earthquake happens on 16 February 20X2 and destroys your building?

Well, that is the event after the reporting period for sure, but not under the definition of IAS 10, because it falls outside those two important dates.

Of course, the date of authorization of the financial statements for issue by the management might defer based on the specific country legislation.

The standard IAS 10 specifically says that if the financial statements need to be approved by the supervisory board made up solely of non-executives, still the management’s approval date is more important and decisive (i.e. you don’t care about the date of approval by the supervisory board).

Let’s move to the second question:

What should you report on events after the reporting period?

OK, so your event after the reporting period falls within the two important dates and thus you must do something about it .

What?

It depends on the type of the event you’re dealing with.

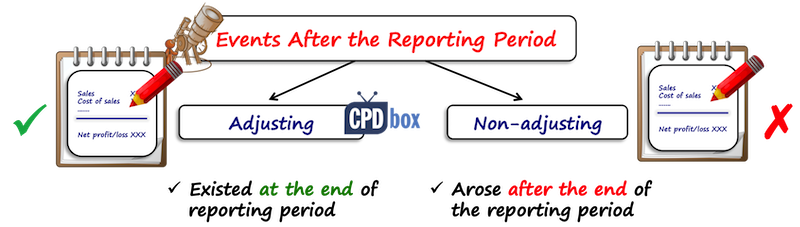

There are two types:

1. Adjusting events

These are events that provide evidence of conditions that existed at the end of the reporting period.

Examples:

- The court case is settled after the end of the reporting period and it confirms that an entity had a present obligation and should have created a provision in line with IAS 37.

- Bankruptcy of a customer after the end of the reporting period confirming that a client was credit-impaired and ECL should have been recognized in line with IFRS 9.

- Sale of inventories after the end of the reporting period at below-cost price suggesting that the inventories’ NRV was lower that their cost.

- Profit-sharing or bonus payments determined after the end of the reporting period suggesting that there was a present obligation at the year-end.

- Discovery of errors or fraud showing that the financial statements are incorrect.

What to do with those events?

In line with IAS 10.8, you should adjust the amounts recognized in your financial statements to reflect adjusting events after the reporting period.

Short illustration:

DEF faces the court case for selling contaminated food to its customers. DEF denied all claims and no provision was made in its financial statements at 31 December 20X1.

On 2 February 20X2, the court awards CU 1 mil. damages against DEF. The financial statements have not yet been authorized for issue at that time.

Therefore, this adjusting event must be reflected in the financial statements at 31 December 20X1.

DEF needs to create a provision for the damages because the present obligation existed at 31 December 20X1 (they sold contaminated food prior that date):

- Debit Legal costs in profit or loss: CU 1 mil.;

- Credit Provision against legal costs: CU 1 mil.

2. Non-adjusting events

These are events that are indicative of conditions that arose after the reporting period.

Examples:

- Decline in fair value of investments after the reporting period,

- Natural disasters, wars, pandemics, etc. happening after the reporting period

What to do with those events?

In line with IAS 10.10, you shall NOT adjust the amounts recognized in your financial statements to reflect non-adjusting events after the reporting period.

Instead, in line with IAS 10.21, you should disclose, for each material category of non-adjusting events after the reporting period, both:

- The nature of the event, and

- An estimate of its financial effect (or say it cannot be made if that’s true).

Short illustration:

DEF owns a plant. On 15 January 20X2, huge earthquake in the area destroyed the plant.

The financial statements for the year ended 31 December 20X1 have not been yet authorized for issue by the management at the time of earthquakes.

DEF should NOT adjust the numbers in the financial statements, because the earthquake is non-adjusting event.

Instead, DEF discloses this event and its financial effect in the notes to the financial statements.

Dividends after the reporting period

The standard IAS 10 specifically says in par. 12, that the dividends declared after the reporting period are NOT reported as a liability at the end of the reporting period.

In other words, you need to treat them like they are non-adjusting event

Let’s say that in January 20X2 DEF declared dividend in total amount of CU 10 000 from profit of 20X1.

The dividend liability is recognized when the shareholder’s right to receive them has been established – that is supposedly in January 20X2, but NOT in 20X1.

IAS 10 and going concern

IAS 10.14 says that you should NOT prepare your financial statements on a going concern basis if the management determines after the reporting period either that:

- it intends to liquidate the entity, or

- it intends to cease trading, or

- it has no realistic alternative but to do one of the above two.

.

What does it practically mean?

Well if any of events after the reporting period trigger liquidation of business or cessation of trading, then going concern no longer applies and the entity will not operate for at least 12 months after the reporting period.

Let me give you two illustrations:

#1 Management decides to liquidate

Let’s say that on 15 January 20X2, DEF’s managers decide to liquidate the business and sell all the assets and settle all the liabilities of DEF.

Here, going concern no longer applies and the financial statements for the year ended 31 December 20X1 shall not be prepared on a going concern basis.

How shall they be prepared then? I wrote a Q&A episode on this topic here.

#2 Earthquake devastates the business

Take a look at the earthquake illustration described above, but now imagine that earthquake was so bad that destroyed most of DEF’s assets and as a result, DEF will not be able to continue the business.

I have written above that the earthquake was a non-adjusting event and therefore DEF should just disclose it with its financial effects.

However, that was valid under the assumption that DEF would survive the earthquake and continue the business in the foreseeable future.

Now, DEF is in a completely different situation.

Here, going concern does NOT apply as DEF is forced to stop the business.

As a result, regardless of earthquake being non-adjusting event, the financial statements for the year ended 31 December 20X1 are NOT prepared under going concern assumption.

Finally…. how about coronavirus pandemic?

I have described my position on the recent coronavirus pandemic, including the application of IAS 10, here in this article.

However, let me make this point clear:

If the impact of the measures on your business resulting is so severe that your business will not survive, then the going concern no longer applies and you should NOT prepare the financial statements under the going concern assumption.

Here’s the video with the summary of IAS 10 Events After the Reporting Period:

Please, share your thoughts and experiences below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

21 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Discontinued Operations of subsidiary after reporting period is Adjusting events or not

I Think It’s not Adjusted entries because They not provide evidence of conditions that existed at the end, Just You can Disclose about Them in Your FS.

Hi Silvia. Thanks for this article. How will aviation industry prepare their financial statement for the year 2020. Besides, some of them have signed their financial statement for 2019 before the pandemic.

Great explanation !

Great Job Silva. Many thanks.

Thank you for sharing this.

This has been on my mind on how the standard will cater for this Pandemic issue

Thank you Silvia for this timely article

Quite helpful as usual.

Thank you very much Silvia.

Dear Silvia,

Here is a minor mistake in the article:

“So imagine that the end of your reporting period is 31 December 20X2, your accountants finish the closing works on 31 January 20X2,”. Year end should be “31 December 20X1” (“1” instead of “2”) 🙂

Thank you, good catch!

Thank you Silvia for this wonderful knowledge. stay safe

That’s for this Silvia . My year end was April so not an IFRS10 issue and our auditors have already insisted we adjust our ECL under IFRS 9 for COVID provision . So we are reviewing entire bad debt provision in relation to this .

Yes, I think this situation will shake with valuation of everything – ECL in the first place; then also inventories, properties, etc. What I also think is that we will not see the full effects at once. It will emerge gradually, for some assets immediately, for some with delay – this is another challenge for valuations.

Thanks a lot Silva for highlight of a very useful and practical issue during this lockdown.

Great work Silvia. Thanks a lot

I think the pandemic can be an adjusting event for entities with year ends after December, say a company with a March year end could have adjusting events caused by the pandemic. Just my thoughts.

Of course, you are completely right!

Thank you for this wonderful knowledge. I appreciate ma

Silvia, This is the discussion on everyone’s mind after the ‘effect of COVID-19 on economy and life in general: How to report COVID-19 pandemic in Financial Statements. As a mater of fact, COVID-19 was declared ‘pandemic’ by WHO on 11th March 2020, way ahead into Y2020. You are absolutely right in taking a stand that this is ‘Non-adjusting’ event and only financial quantification and disclosure are necessitated by current IFRS standards. Ofcourse, one need to look at ‘Going Concern’ basis for FS 2019 finalisation.

Point is, even if one does not need to do any adjustments on the face of Financial Statements, Disclosure and financial implications quantification will force one to revisit each and every one of IFRSs on Inventory valuation, PPE Valuations based on usage of assets, ECL provisioning models, IFRS 16 & lease payments cessation, Revenue Recognition under IFRS 15, Onerous Contracts accounting among others.

Hi Hemant, thanks for your comment. Yes, I agree with your point – but this revision will happen in 2020, not back in 2019. All the best!

Thanks so much Silvia for your insightful write up. In your response to Hemant, are you saying that it won’t be necessary to do the revisit and disclose findings in 2019 financial statements? Kindly clarify please… thanks in advance