IFRS 17 Insurance Contracts: Summary

IFRS 17 was issued in 2017 and is mandatorily applicable for the period starting on or after 1 January 2023.

It replaced “temporary” standard IFRS 4 Insurance Contracts, which is no longer applicable.

This summary splits the topics covered in IFRS 17 to the following subtopics:

- Introduction: Objective, scope, definitions, separating and aggregation;

- Recognition;

- Measurement: Overview of measurement models, general model, premium allocation approach, other measurement models;

- Modifications and derecognition;

- Presentation and disclosures;

- Full practical course and video with summary.

1. Introduction to IFRS 17 Insurance Contracts

1.1 Objective of IFRS 17

IFRS 17 establishes the principles for recognition, measurement, presentation and disclosure of the contracts within the scope of IFRS 17 (see below).

The objective is to make sure that entities provide relevant information faithfully representing insurance contracts. (see IFRS 17.1)

1.2 Scope of IFRS 17: to which items does it apply?

It is the common misconception that IFRS 17 applies to all insurance companies.

Actually, that’s just partially true.

Instead, IFRS 17 applies to the following types of contracts, regardless who issued them:

- Insurance contracts, including reinsurance contracts issued;

- Reinsurance contracts held; and

- Investment contracts with discretionary participation features, if the entity issues also insurance contracts.

As a result, if any entity issues the insurance contract, IFRS 17 applies.

And, it may not necessarily be titled “insurance contract” – if it meets the definition in IFRS 17, it must be applied.

Also, let me point out that IFRS 17 does not apply to insurance contracts held.

If you purchased an insurance policy to cover your own risk, then do NOT apply IFRS 17.

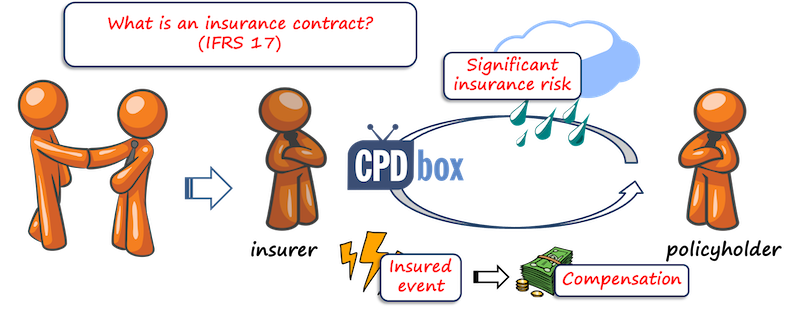

1.3 Definition: What is an insurance contract?

Insurance contract is a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policy holder if a specified uncertain future event (insured event) adversely affects the policyholder. (IFRS 17, Appendix A).

The key elements of the insurance contract are:

- Significant insurance risk; and

- Insured event

1.4 Separating components from an insurance contract

An insurance contract can contain some components besides the insurance.

These components can be:

- Embedded derivative – in this case, we need to separate it and account for the embedded derivative under IFRS 9 if criteria are met;

- Investment component – here; if it is:

- Distinct: separate it and apply IFRS 9;

- Not distinct: account for the whole contract under IFRS 17, but exclude results from the investment component from the insurance results.

- Distinct goods or services – separate them and account for them under IFRS 15 Revenue from Contracts with Customers

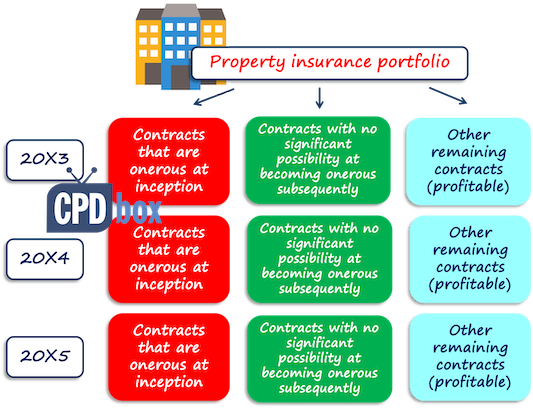

1.5 Level of aggregation of insurance contracts

IFRS 17 requires insurers to measure the insurance contracts and their profitability by portfolios, or groups of contracts.

NOT individually, contract by contract (unless there is some significant material insurance contract that is managed separately from others).

Therefore, insurer needs to define the level of aggregation (grouping) of the insurance contracts.

How to do that:

- Step 1: Assign an insurance contract to specific portfolio on the initial recognition.

Here, portfolio is some larger grouping of contracts with similar risks that are managed together. For example, this can be different product lines, like portfolio of vehicle insurance contracts or life insurance contracts. - Step 2: Divide that portfolio into at least three groups according to the minimum requirements in IFRS:

- Contracts that are onerous at the inception;

- Contracts with no significant possibility at becoming onerous subsequently, after initial recognition;

- Other remaining contracts (that are profitable).

- Step 3: Create separate groups of the same portfolio at least annually, since IFRS 17 prohibits including the contracts issued more than one year apart to the same group.

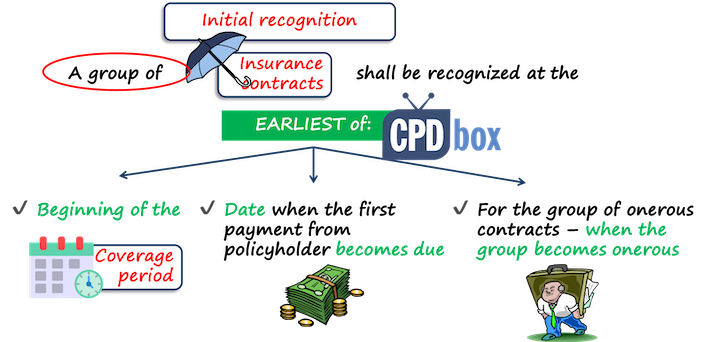

2. Recognition: When to recognize insurance contracts?

A group of insurance contracts shall be recognized at the earliest of the following three dates (IFRS 17.25):

- The beginning of the coverage period;

- The date when the payment from policyholder becomes due (if the contract does not set that date, then when the first payment is received);

- For the groups of onerous contracts, the date when the group becomes onerous – or loss making.

3. Measurement of insurance contracts

3.1 Overview of measurement models required by IFRS 17

IFRS 17 introduces a few measurement models to apply to different types of insurance contracts:

- General model;

- Simplified model, called premium allocation approach;

- Variable fee approach;

- General model with modifications applicable to certain types of contracts.

.

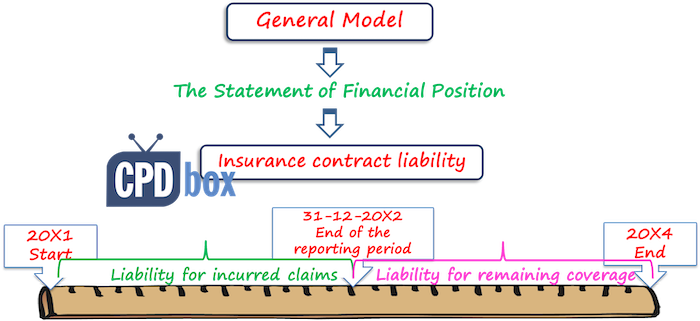

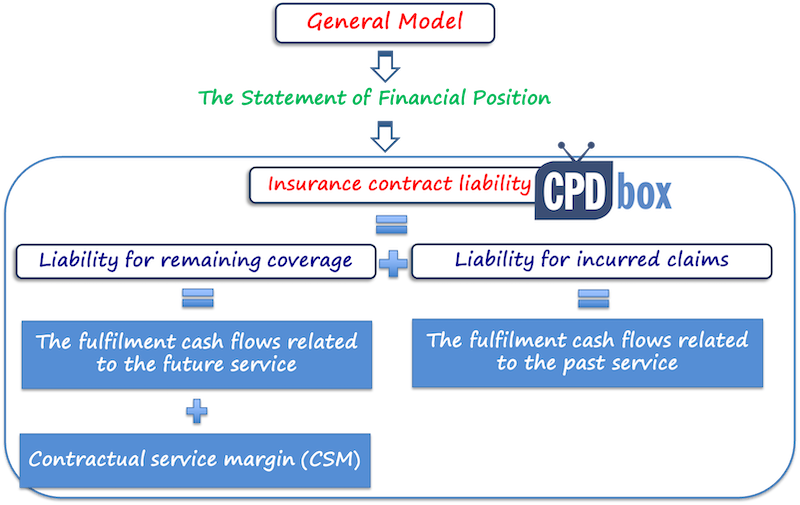

3.2 General model: applicable to all insurance contracts (with exceptions)

The main principle of the general model is to:

- Recognize the loss on onerous contracts immediately in profit or loss; and

- Recognize the profit on other contracts over the coverage period, not immediately at initial recognition.

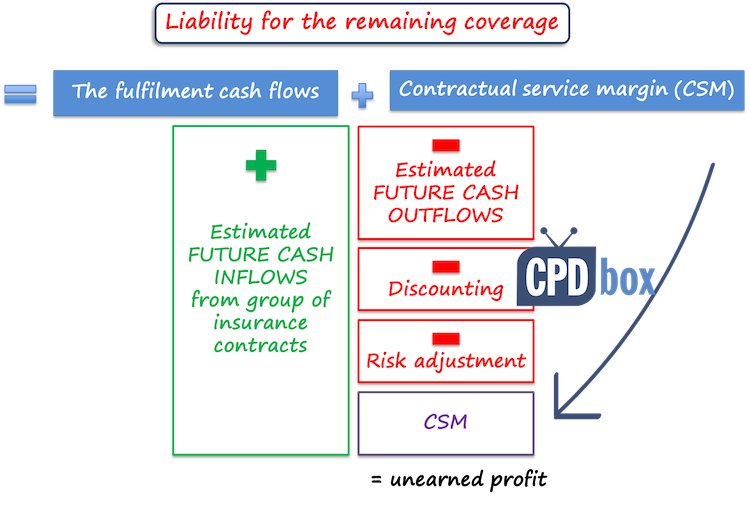

Under the general model, a group of insurance contracts is measured as the total of:

- Liability for the remaining coverage: in fact, this is the liability for the coverage starting at the reporting date to the end of the coverage period. This is the future service;

- Liability for the incurred claims: this is the liability for the past service, for the claims incurred in the period from the initial recognition until the reporting date.

Initial measurement under the general model:

At initial recognition, there is no past, therefore the liability for incurred claims is zero.

The liability for the remaining coverage is calculated as the sum of:

- Fulfilment cash flows – those comprise:

- Estimates of future cash inflows and outflows, for example insurance premiums, claims payments, claim servicing costs, etc.;

- Adjustment to reflect time value of money and financial risks related to future cash flows – discounting to present value;

- Risk adjustment for non-financial risk

- The contractual service margin, which is at initial recognition:

- The negative value of fulfilment cash flows for contracts other than onerous);

- Zero for onerous contracts.

As a result, at initial recognition, the insurance contracts are measured at:

- Zero, if the contracts are NOT onerous;

- Insurance contracts liability equal to the net cash outflows, if the contracts are onerous.

Please refer to the solved example related to initial measurement of insurance contracts under IFRS 17 here.

Subsequent measurement under the general model:

Subsequently, the insurance contracts are measured at the sum of:

- Liability for the remaining coverage: which is the sum of:

- Fulfilment cash flows related to the future service, and

- Remaining balance of contractual service margin (that will be released in profit or loss in the future periods.

- Liability for the incurred claims: it is equal to the fulfilment cash flows related to the past service.

3.3 Premium allocation approach

Premium allocation approach (PAA) is a simplified model for measurement of insurance contracts.

It is optional, not mandatory.

PAA can be applied only if the following conditions are met (see IFRS 17.53):

- Either the liability for remaining coverage under this approach does not materially differ from the liability for remaining coverage under the general model – so here, you would need to test it and compare; or

- If the coverage period of all contracts within the group is one year or less.

Initial measurement under PAA:

The liability for the remaining coverage is the sum of:

- Premiums received at initial recognition; minus

- Any insurance acquisition cash flows at that date.

The liability for incurred claims at initial recognition is zero.

Subsequent measurement under PAA:

The liability for the remaining coverage at the end of the reporting period is the sum of:

- Liability for the remaining coverage brought forward (at the beginning of the reporting period); plus

- The premiums received during the reporting period; minus

- Insurance acquisition cash flows during the period; plus

- Amortization of insurance acquisition cash flows in that period; plus

- Adjustment to a financing component (for contracts over 1 year); minus

- The amount recognized as an insurance revenue for services provided in that period; minus

- Any part of investment component that was paid or transferred to the liability for incurred claims.

The liability for the incurred claims is calculated in the same way as under the general model.

3.4 Other measurement models

The standard IFRS 17 requires application of other measurement models, as follows:

- Variable fee approach: for contracts with direct participation features;

- General model with modifications: for reinsurance contracts held.

4. Modifications and derecognition

4.1 Modifications of insurance contracts

If the parties modify the insurance contract, then if the modification is substantive, an entity shall:

- Derecognize the original contract; and

- Recognize the modified contract as new.

IFRS 17 contains the guidance on what is substantive modification, too.

4.2 Derecognition of insurance contracts

An insurance contract shall be derecognized when:

- It is extinguished; or

- The conditions for substantive modifications are met (see above in 4.1).

5. Presentation and disclosures

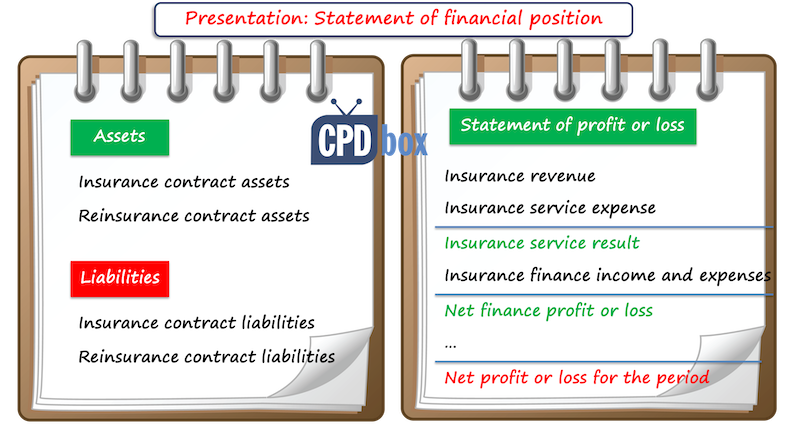

5.1 Presentation of insurance contracts

The presentation describes how to show the numbers related to the insurance contracts in the financial statements.

In the statement of financial position, it is necessary to present (see IFRS 17.78):

- Insurance contract assets;

- Reinsurance contract assets;

- Insurance contract liabilities;

- Reinsurance contract liabilities.

In the statement of profit or loss and other comprehensive income, an entity presents (IFRS 17.80):

- Insurance service result, comprising:

- Insurance service revenue, and

- Insurance service expenses;

- Insurance finance income or expenses.

5.2 Disclosures related to insurance contracts

IFRS 17 requires extensive amount of disclosures related to insurance contracts, that can be grouped into a few categories (see IFRS 17.93 and following):

- The amounts recognized in the financial statements related to insurance contracts: here, it is necessary to disclose the qualitative and quantitative information about the amounts. the main method how to do it is to provide the reconciliation that shows how the net carrying amounts of the contracts within the scope of IFRS 17 changed during the period.

- Significant judgements in applying IFRS 17: methods and processes to measure the insurance contracts and to determine the inputs to measurement;

- The nature and extent of risks arising from the contracts within the scope of IFRS 17.

6. Final word

The standard IFRS 17 is quite complex, because it deals with complex and uncertain transactions. It involves many estimates and calculations, often done by actuaries.

The premium course the IFRS Kit now contains the full video lectures with many practical examples solved in Excel that will guide you, step by step, through the insurance contracts and their accounting.

Here’s the video with this summary, if you prefer watching it:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

5 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Silva,

Thank you for providing details about IFRS 17 implementation. I work for a General Insurance Company as Finance Manager. I presented Management accounts for half year and was asked the implication of IFRS 17 on the perfromance so far, since the Management accounts are implementing IFRS 4 standards? Kindly advise what factors i should consider , if I may have to forecast to year end?

Hi Silvia

Hope this finds you

Kindly share with me the total amount that is required to become a member and be enable to access the lectures on IFRS 17, Specifically PAA

Hello Mayanja, thank you for your interest in our lectures. The full information is here: https://www.cpdbox.com/ifrs-kit/

PAA approach is covered.

Hi Silvia, thanks for all you do.

I would love to subscribe to the full package, however, it’s challenging making foreign currency payments right here from Nigeria. It would be greatly appreciated if you could advise another seamless payment method.

I look forward to your usual prompt response.

Kind regards,

Kehinde Lateef

Hi Kehinde,

thank you for your interest in our courses, I sincerely appreciate. Yes, there are ways to transfer the fees from Nigeria, just please contact us via Contact form. Thank you!