IFRS Reporting in Hyperinflationary Economy (IAS 29)

It seems that these days everything changes and goes south as a consequence of a pandemic.

And yes, it seems yet another country is undergoing economic collapse, albeit perhaps not as a direct result of the pandemic.

This time, it is Lebanon – it is imploding fast.

Not only economic experts warn that the financial collapse is just around the corner, but some of my friends living there described their daily reality these days (I am writing this in late July 2021).

The economic data confirm the sad situation: Lebanese pound loses its value, Lebanese GDP has gone down by 40% and inflation went crazy hitting its high of 120% a year ago.

This has a painful effect on Lebanese people. The prices of food and gas went up and according to one survey I read, 3 out of 4 Lebanese families struggle to afford food (if they can even find it at stores).

Also, infrastructure seems to suffer, too – sometimes, power outages can last hours and hours. If you happen to be in Lebanon (or other hyperinflationary country), by the way, please leave us a comment below this article and let us know your view on the current situation.

Yet, what does the Lebanese government do?

They print more money, of course. But the Lebanon is not the only one trying to solve this economic misery by printing money. In fact, almost every single government does that and it starts to resemble a runaway freight train.

Therefore I suspect that the economic set up of this world will change in the near future and one of the possible outcomes is massive hyperinflation in some countries.

Sure, I am not a macroeconomic expert; I am just using my common sense and basic university knowledge.

However, one thing that we, the accountants, CFOs, auditors and other people around financial reporting should do, is to get ready and updated.

The thing is that hyperinflationary reporting is often omitted and we are quite oblivious about it because we perceive it as some distant, remote thing not affecting us.

But, as the world economy sinks further, I do believe it is time to get ready and refresh our memories.

That’s why today I pulled the standard IAS 29 Financial Reporting in Hyperinflationary Economies to the light.

Objective of IAS 29

The standard IAS 29 is quite an old standard, issued in 1989 for the first time with a few subsequent amendments.

The main objective of IAS 29 is to provide guidance on the financial reporting of the entity whose functional currency is the currency of hyperinflationary economy.

The reason is to show how much purchasing power the company lost on monetary items and gained on non-monetary items, simply speaking.

Albeit, I would NOT say that you “gain” purchasing power on non-monetary items in hyperinflation; rather you preserve it.

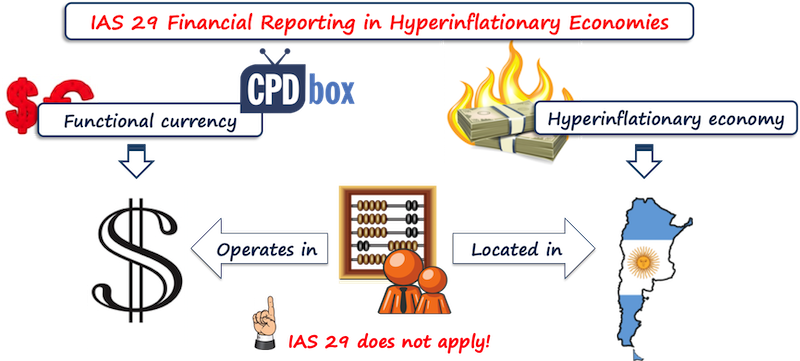

Functional currency, not location!

It is crucial to realize that the functional currency matters, not the country suffering from the hyperinflation.

What’s the difference?

Let me shortly illustrate:

There could be a company located in Argentina due to pleasant labor cost and yes, Argentina currently is a hyperinflationary economy.

But, the same company operates in USD that is its functional currency.

In this case, IAS 29 does not apply because it is tied to the functional currency, not the location, all right?

That company would simply prepare its financial statements without all the restatements to reflect hyperinflation, all in USD.

Now, I am not saying that USD will not be a hyperinflationary currency, who knows, but for now it is not.

What is hyperinflationary economy?

The standard IAS 29 does NOT define what the hyperinflationary economy is.

Also, IAS 29 does not provide the list of hyperinflationary countries, but IAS 29 contains certain characteristics of hyperinflationary economies as guidance.

The most exact indicator is that the cumulative inflation rate over 3 years of this country approaches to or exceeds 100%.

Currently, International Monetary Fund publishes the information about the inflation and its forecasts. According to the information updated at the end of 2020, there are 8 hyperinflationary countries including Argentina, Iran, Lebanon, South Sudan, Sudan, Syria, Venezuela and Zimbabwe.

How to report in hyperinflationary economy

The results reported in hyperinflationary currency are no longer useful for the readers of the financial statements, because current prices are changing crazy.

Just imagine you bought an asset for 1 000 CU (=currency unit) last year, the inflation rate reached 100% and as a result the same asset costs 2 000 CU at the end of this year.

Perhaps it is more relevant to state that asset in the amount of 2 000 CU rather that in its original cost of 1 000 CU, because it better reflects the company assets in terms of its purchasing power.

Therefore, the results should be reported in terms of measuring unit current at the end of the reporting period.

It means you actually need to restate the numbers in your financial statements to reflect hyperinflation.

The three basic steps are:

- Determine the general price index (GPI);

- Restate the financial statements at the end of the current reporting period using that GPI; and

- Restate the comparative information at the end of the previous reporting period.

Let’s break this down.

Step #1: Determine the general price index (GPI)

General price index (GPI) is a certain measure of the inflation.

In other words, it is a factor by which you would restate the historical information to reflect the change in the purchasing power.

In most cases, consumer price index (CPI) represents generally accepted measure of inflation, however it is crucial that selected CPI is representative of the hyperinflationary currency.

It practically means that different kinds of goods and services representative of that economy are included in its calculation. Usually, you can get it from the local institutions like national or central banks, statistical offices, or even IMF (International Monetary Fund) provides useful information about CPI in many different countries.

However, it can happen that a reliable CPI or GPI is simply not available.

In this case, you can impute the index by comparing the movement in the exchange rate between some solid currency (e.g. EUR…) and the hyperinflationary currency.

Step #2: Restate the financial statements at the end of the current reporting period

I will split this step into smaller portions to make it more digestible as it can go quite messy.

Step #2.1: Decide on monetary vs. non-monetary items

The first thing you do, after selecting your GPI, is to determine which assets and liabilities are monetary and which are non-monetary.

Leave out equity items for now; we will deal with these later.

Many items are straightforward:

- Monetary items are: cash, cash equivalents, loans, receivables, debt securities, payables, borrowings, taxes payable.

- Non-monetary items are: property, plant and equipment, intangible assets, biological assets, investment property, equity investments (e.g. ordinary shares), inventories, deferred income, some provisions, etc.

Some items are not that straightforward and we need to help ourselves with the definition of monetary items directly from IAS 29.12: “money held and items to be received or paid in money”.

You can find further guidance in IAS 21 and I recommend reading this article stating more details.

There will still be troubles. For example, deferred tax assets and liabilities are quite difficult to assess because there are arguments for stating they are either one, so just be aware it requires careful assessment and restatement here, especially when they are related to temporary differences of different nature.

Step #2.2: Restate assets and liabilities

The rules for restatement of assets and liabilities are:

- Monetary assets and liabilities: Do NOT restate at all, because they already reflect the purchasing power at the end of the reporting period.

The exception here are inflation-linked items like inflation linked-bonds that you need to adjust in line with terms of that instrument. - Non-monetary items carried at current cost: Do NOT restate them at all. The current cost simply means the value reflecting the current purchasing power of these items at the end of the period. For example, items revalued at the year-end to the fair value are at their current cost.

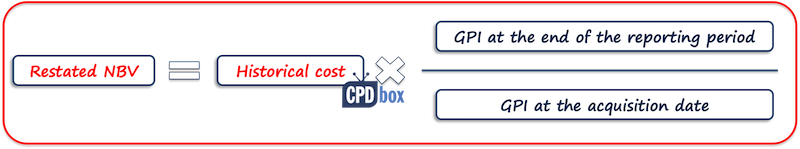

- Non-monetary items carried at historical cost: Restate them using the formula below.

Please be careful with the distinction of non-monetary items at current cost vs. at historical cost.

To illustrate: let’s say you apply revaluation model for your property, plant and equipment and you revalued your assets few months ago to the fair value.

At the end of the reporting period, they are no longer expressed at fair value, because some time has passed since recent revaluation and yes, inflation might have eaten some portion of the purchasing power, thus you need to restate them as if they were at historical cost.

If you revalued your PPE at the year-end, that’s fine.

Let me add one small note to the application of that GPI formula above.

It is quite challenging to apply because you need to get a good track on acquisition dates and then applicable GPIs.

Also, there might be certain specific calculations and adjustments to the borrowing cost, impairment and other items.

So, the restatement is not simply a mathematical recalculation in the current period. I will try to publish numerical example in the near future.

Step #2.3: Restate equity items

Here it goes a bit tricky again, because you actually need to determine WHEN you are making a restatement:

- Equity components at the beginning of the first period when IAS 29 is applied:

- Revaluation surplus: eliminate that completely;

- Retained earnings: derive from all the other amounts in the restated statement of financial position. In other words, this will be your balancing figure;

- Other equity components: restate by the application of GPI from the dates of contribution or other acquisition whatever way that component of equity was created.

- Equity components at the end of the first period when IAS is applied AND subsequently: restate by the application of GPI from the beginning of the period or from the date of contribution if the component arose during the year.

Step #2.4: Restate profit or loss and other comprehensive income

The rule is very simple here: restate all the amounts by applying the general price index from the transaction date.

The formula to use:

A few notes:

- Use of GPI fraction:

Let me draw your attention to the GPI – it is expressed as a fraction because you would have GPI for certain period that might not be the same as the period passed between the transaction date and the year-end.

This fraction expresses just that and some literature and practice call it the conversion factor.

It might be quite a challenge to gather GPI’s for every single day, but you can use approximation, for example some average weekly GPI if it is appropriate.

However, if inflation soars out of the roof and the prices change like crazy, that would NOT be appropriate to use, so you need to use your judgment.

- Different restatement of some items:

Also, some items are calculated in a different way.

For example, deferred tax is derived from the changes in the temporary differences.

- Gain or loss on the net monetary position:

You will have that as a separate line item in your profit or loss.

This is the number that expresses how much purchasing power you lost to inflation during the period on your monetary assets (if they are greater than non-monetary assets) or how much you gained if the situation is the opposite.

It is calculated as a change in GPI applied to the weighted average of a difference between your monetary assets and monetary liabilities.

It is extremely impractical to calculate that way and therefore in practice, it is assumed that gain or loss on the net monetary position is simply the opposite of the gain or loss on non-monetary items – which is the sum of your restatement adjustments, very simply said.

Well, that takes practical exercise to verify though and it is playing with numbers and calculations a lot.

Step #2.5: Restate cash flows

The standard IAS 29 does not say much about the restatement of cash flows, but it does require that all items should be expressed in the measuring unit that is current at the end of the reporting period.

It practically means that you need to restate all the amounts, similarly as with profit or loss and other comprehensive income.

Many practical issues and dilemmas may arise here and it requires lots of judgment, too.

Step #3: Restate the financial statements at the end of the previous reporting period (comparatives)

Again, the same principle applies: all items should be expressed in the measuring unit that is current at the end of the reporting period.

In this case, you would simply apply GPI to all comparative numbers.

This time it will be much easier than with statement of cash flows and profit or loss, because you just take GPI and apply it to all the numbers by simple mathematical calculation.

The reason is that all items were there at the beginning of the period and none of them arose during the year, so no fraction is necessary to use.

You can watch the video summing this all up here:

Please if you wish to share any of your experiences with hyperinflation and its reporting, feel free to add comment below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

39 Comments

Leave a Reply Cancel reply

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hello,

there is a company with hyperinflationary currency, applying IAS 29, with cash half in local currency and half in €. Can I consider the half in € a NON MONETARY asset?

Hello, Silvia.

Could you kindly give your thoughts on the following scenario?

Company A is only a paper entity whose functional currency is the TRY. It does not have any operations, but it does have a subsidiary (company B), whose functional currency is USD, based in Turkey, where IAS 29 is used. Company A only has one transaction: paying the state for the property on which its subsidiary works. This sum is insignificant in comparison to the subsidiary’s transactional quantities. My question is if you believe the parent business (A) should apply IAS29 in this instance, even if it is just a legal entity and the whole activity is carried out by the subsidiary. Applying IAS 29 makes little sense to me considering that the operation is being carried out in USD.

I’d appreciate it if you could weigh in on this.

Thank you very much.

Hi Silvia,

There is a company located in Lebanon, with functional currency of USD, but reporting currency is Lebanese Lira , does IAS 29 apply ?

No, because IAS 29 clearly says it applies only to entities with functional currency of a hyperinflationary economy.

I would agree with Silvia. It only applies to entities whose functional currency is the currency of the hyperinflationary economy.

Please i need an example about ias29

For 2 years

Hi Silva,

I am writing from Lebanon; the situation is catastrophic. in 2017, 1$ = 1500 Lebanese Pound, now it 40,000 it means Lebanese pound dropped by more than 26 times. so, I need to clarify about one matter in your article when you said that restate income statement from transaction date; I am confused since evaery day we’ve handreds of transactions; so, of course I don’t have to readjust every transaction; what is the best way to deal with?

Hello Mohammad,

I believe CPI are released on monthly basis. The standard enjoins practitioners to apply practical sound judgement in applying this standard. So one of the practical approach is the use of monthly CPI’s in deriving the conversion factors to be used to multiply the historical figures. So the transactions that might have a occurred within a month would be assigned only one CPI.

For example, All revenue generated in January with CU 2000, and with CPI for January 150, December CPI 200. ( Assume the year end in December)

Solution; Revenue for January would be 2000*(200/150)=2,666.67

Hi. Thank you for the article. I would like to find out from people that are or have applied the standard for the first time, what system (except using excel) was used to do the calculations?

Hi Silvia

I would like to ask something regarding the first adoption of IAS29. In the video it is said that at first adoption, the beginning balance of Retained earnings derived from all other components, those all other components from my perspective should only include non-monetary ítem right?

Thank you for your good effort. I have a question that I hope you will help me answer, which is the feasibility of continuing to apply this standard in light of the approval of the application of fair value, as well as in light of IFRS 9

Having followed the procedures in paragraphs 42 and 43 of IAS 21 the Group now needs to eliminate the intragroup transactions within its consolidation to comply with IFRS 10 B86. However there is a problem because the hyperinflation entity has applied IAS 29 and IAS 21, as required above, and now the amounts of revenue for this subsidiary in the consolidation do not match and set-off against the costs included in the consolidation of the other subsidiaries. Therefore what do you do with this difference?

Hi Silvia,

I would like to know your oppinion about an issue that we are having. We have an opperation in a hyperinflationary economy and have been applying IAS 29 for a couple of years now. However, we have a profit sharing agreement with a company bases in a non inflationary country/currency and, when we compare a restated P&L, finish goods and raw materials inventories vs nominal terms we find a significant impact in profit. I’d like to understand if “it is fair to inflate costs and share less profit with our partner or not?”

Hi Silvia,

I have a doubt about how to consolidate a subsidiary that is operating under a hyperinflation economy.

I am preparing the consolidated financial statement (CFS) of the Holding Company (US Based) and one of the subsidiaries is in Argentina with functional currency ARS. While preparing CFS, shall I take standalone TB of Argentina entity post impact of GPI to reflect current value for non-monetary and income statement items and then translate amounts in reporting currency i.e. USD OR shall I take amounts as it is (without the impact of GPI) and translate amounts of non-monetary items using the historical rate and fixed the amount of CTA for that entity at the date of the determination of hyperinflation economy with any additional CTA charged as operating expenses in the income statement.

Please suggest the right accounting treatment.

Hi Vishal, you need to apply IAS 29 first; that is in the individual financial statements and then translate to presentation currency.

Thanks, Silvia.

I have noticed there is a difference in accounting treatment under USGAAP vs IFRS.

Can you throw some light on the USGAAP concept?

Thank you Silvia for such an insightful article. It is been quite difficult to consistently apply the standard especially here in Zimbabwe.

Thank you for your reply Sylvia.

I understood from IAS 21 that we need to restate our figures in functional currency (i.e. Lebanese Lira) before translating the financial statements into any other presentation currency like USD. Is this correct?

“Special rules apply for translating the results and financial position of an entity whose functional currency is the currency of a hyperinflationary economy into a different presentation currency. [IAS 21.42-43]

Where the foreign entity reports in the currency of a hyperinflationary economy, the financial statements of the foreign entity should be restated as required by IAS 29 Financial Reporting in Hyperinflationary Economies, before translation into the reporting currency. [IAS 21.36]”

Hi Sylvia, thank you for the support you provide to us while publishing such informative articles.

As mentioned above, application of IAS 29 is really hard and costly specially when it comes to first time adoption.

Is it possible to prepare the financial statements using a stable currency like USD (reporting / presentation currency) without restating the figures of an entity whose functional currency is the currency of a hyperinflationary economy?

Hi Maria, yes, that is fully possible – in this case, if your functional currency is hyperinflationary and the presentation currency is not, then you basically apply IAS 21 paragraphs 42 and 43.

I think you cannot use Presentation Currency as USD unless you apply IAS 29 first.

You can use any presentation currency as you like. Please refer to IAS 21. However – for your legal tax purposes, that’s a different story.

Hi Slyvia

Am writing from Zimbabwe,we have been preparing the inflation adjusted FS since 2019.There is something that puzzles me when i preparing the cash flow statement.It seems if you totally ignore the monetary gains or loss in the cash flow it just balances without any problems.What is the effect of this on the cash flow preparation.

Regards

Valuable insights, Thanknyou Slyvia!

How would one treat unrealised exchange gains/(lossses)

I have a situation where IAS 29 is applicable. But subsidiary reports in a non hyper inflationary economy. Teporting currency is USD.

When those numbers are converted to USD, the answer is showing an even bigger loss in USD.

How do you report and interpret the exchange loss in the USD set?

Hello, I will try to cover all these practical implications in the separate article.

Apart from IAS 29 guideline, what is the business context for fully eliminating revaluation surplus?

Hi Silvia,

As an analyst, I came across the use of IAS 29 in a company’s annual report. I was startled by the result of such application, but I did not have the time to read through the standard and understand how it is to be applied. Thank you for this article, because now I have a glimpse of its application.

Thank you so much silvia, this is insightful

Hi Silvia, Thank you very much for sharing your thoughts on the topic in the era when too much money is chasing few commodities but accounting emphasizes on monetary value rather than real value of an asset even when an entity is found itself poorer in the real sense, Thank you once again

This is a very helpful article, much appreciated. We will be applying IAS 29 on our subsidiaries in Lebanon. My only query is as follows: We have a lot of non-monetary assets, now applying IAS 29 the value of non-monetary assets will increase which makes me think it will lead to a gain on P&L (DR Non-Monetary Assets CR P&L).

In this case, I am struggling to understand the intuitive logic of net-monetary gain/loss? Where is the loss from loss of purchasing power?

Hi Asad, you hit the point. As I was writing this article, this also struck me – what is presented as a gain on non-monetary assets, in fact that’s not a gain in real life. In fact that’s just how much it takes to preserve the same purchasing power in a hyperinflated currency. As for monetary assets, you do not present anything (as you do not restate them), but exactly they lost their purchasing power, isn’t it?

The same analogy can be found when looking to the price of gold over time. Yes, it fluctuates, but generally goes up over the years. Many years ago it was 35 USD per troy ounce; now it is about 1800 USD per troy ounce – does it mean that gold gained purchasing power? Not at all, because for one troy ounce, you could buy a nice wool suit years ago and these days, too. Instead, it is US dollar that lost its purchasing power in terms of gold. That’s how you need to see the financial statements restated for hyperinflation – it’s not your non-monetary assets that gained; it is the hyperinflationary currency that lost.

And yes, you can have a loss, too, because you need to revalue also non-monetary liabilities.

I am a Lebanese young women who got her dip in ifr feb 2020, i am among the few lucky ones that was able to get to Canada as a permanent resident june 2021. my pension which used to be worth over 30K usd for the last years i have worked is worth more like 1500$ today and by the time i collect it won’t be worth anything. I used to earn over 3500$ In 2019, and on april 2021 i was barely getting paid 300$ worth in Lebanese Pounds. This catastrophic loss of money value was not hidden but postponed through financial modeling used by bank du Liban throughout 20 years, as the government was still supporting the local currency by new debts. With the absence of debts the currency uncovered some of its true value, add to it beirut explosion, corona and corruption , the loss is unbearable. I have just began to read the article and once i am through with it , i will be providing another comment.

Hi Maya,

I am grateful that you shared your experience. It is painful to read… that must simply be horrible. Well, I don’t want to provide any economic advice here, but it is obvious that savers in local currency are the worst off. Wishing you all the best!

Having experienced IAS 29 for the second time in Zimbabwe, what I can say is a lot of people see the application of the standard as a box ticking exercise. A lot of people dont really understand the logic behind the standard and the standard itself. The standard is merely applied for IFRS compliance sake. The standard is a lot of work for both preparers and auditors thus costly (Increased training costs, audit fees, time etc). Its really hectic especially when its first time adoption. I think the main reason is that there is no much guidance in the standard which leaves room for a lot of judgement, thus sometimes disagreements. However I find the SFP and SCI to take more time than the cashflow statement. I personally have been using the method you shared in one of your cashflow statement articles for historic numbers. The most it took me to complete and balance an IAS29 cashflow statement is 30mins using that approach. Thank you for that. I really to read more of your articles.

Hi Michael,

thank you – that’s what I thought – that the application is very difficult because there is quite little guidance around. Well, I am quite sure we will see similar situations in other countries too (let’s hope not!).

Unfortunatelly, in Argentina accountants lead with the fact that macroeconomic conditions for the Argentine peso indicate that this standard must be applyed since 2018 (to prepare FS of entities whose functional currency is the Argentine peso, of course). In my view, the outcome from applying the USGAAP approach for Highly Inflationaries Economies (ASC 830) is more intuitive for users. Restated ammounts are not easy to understand -and sometimes these could suggest strange conclutions. However, IAS 29 is a fact, and while this is the solution for hyperinflation accounting in IFRS, it will be the running treatment. A little remark: IAS 29 was written when the majority of current IFRS standards still did not exist. That’s why applying IAS 29 is a big challenge for the financial community in anywhere it shall be implemented.

Hi Hernan,

thanks a lot for sharing this. I wonder if you got any support (or provided any support if you are in that position) from the side of your regulators. Did they publish GPI’s that are easy to use? And yes, you are completely right – IAS 29 is very old standard and to me it seems a little outdated with regard to all the new standards in place – at least, thorough guidance is missing.

Thanks for the summary. We have applied this standard in Zimbabwe for 2 consecutive periods now. While some areas have been ironed out it comes with a lot of challenges and a lot of judgement is involved. As for the cashflow statement we restate using the inflated figures from the balance sheet and income statement. Balancing it is also a mammoth task. Hopefully we will cease hyperinflationary reporting soon

Thank you, Future, and yes, I wish you getting out of the hyperinflation!