Monetary or Non-Monetary?

Updated: 2023 – please scroll below to download the infographics for your future reference, it is free.

When you need to translate your items denominated in foreign currency to your own functional currency, then there’s one little problem:

Is that item monetary or non-monetary?

If you determine the nature of your item incorrectly, it can lead to totally wrong presentation in the financial statements.

It’s not so important when you consolidate and you need to translate some foreign subsidiary to your own presentation currency, right?

Why?

Because, the rules in IAS 21 The Effects of Changes in Foreign Exchange Rates say that in such a case, you translate all your assets and liabilities by the closing rate. That’s clear.

But when it comes to translating individual items and transactions in your own financial statements to the functional currency, then the rules are more complex.

Let’s take a look.

What do the rules say?

For translation of the amounts in foreign currency to your functional currency, the standard IAS 21 states that you should re-calculate all items after initial recognition using exchange rate based on characteristics of the specific item.

More specifically:

- For all monetary items in foreign currency – use closing exchange rate at the reporting date;

- For all non-monetary items in foreign currency carried at historical cost – use the historical exchange rate (at the date of transaction – thus, you keep non-monetary asset at historical rate with no recalculation);

- For all non-monetary items in foreign currency carried at fair value – use the exchange rate at the date when fair value was determined.

The principal question here is:

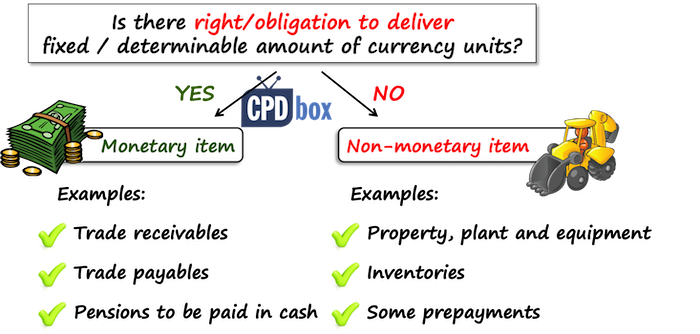

What is monetary and what is non-monetary?

There’s one essential characteristic that makes a difference:

A right to receive or obligation to deliver a fixed or determinable number of units of currency.

All monetary items DO have this feature. All non-monetary items DO NOT have this feature.

Once you apply this rule of thumb, it should be easy to determine what’s monetary and what’s not.

In the following table, I have summarized various kinds of items with their characteristics for you:

| Item | Monetary/Non-monetary |

| Assets | |

| Property, plant and equipment | Non-monetary |

| Intangible assets (including goodwill) | Non-monetary |

| Investments in associates | Non-monetary |

| Equity investments (e.g. shares) | Non-monetary – see below |

| Investments in debt securities | Monetary |

| Net investment in the lease | Monetary |

| Biological assets | Non-monetary |

| Deferred tax asset | Monetary – see below |

| Inventories (including allowances) | Non-monetary |

| Contract assets (IFRS 15) | Monetary – see below |

| Trade receivables (including allowances) | Monetary |

| Other receivables to be settled in cash | Monetary |

| Advances and prepayments | It depends – see below |

| Deposits and bank accounts | Monetary |

| Cash | Monetary |

| Equity and liabilities | |

| Share capital | Non-monetary – see below |

| Other components of equity | Non-monetary |

| Provisions for employee benefits | Monetary |

| Lease liability | Monetary |

| Deferred tax liability | Monetary – see below |

| Bank and other loans | Monetary |

| Accruals | Monetary |

| Contract liabilities (IFRS 15) | Non-monetary – see below |

| Deferred income | Non-monetary |

| Trade payables | Monetary |

| Advances received | It depends – see below |

| Current tax liability | Monetary |

As you can see from this table, some items are crystal clear, but some of them are not and further questions arise.

Advances paid or received

You need to assess the character and substance of every advance paid or received carefully, because some advances can be monetary and some of them can be non-monetary.

However, I have explained particularly this issue in my article on Accounting for prepayments in foreign currency under IFRS together with the numerical example, so please read there if interested.

Deferred taxation

Currently, this is a little bit unclear in the standards.

The standard IAS 12 Income Taxes indirectly indicates that the deferred tax assets and liabilities are monetary items, because it notes that the exchange rate differences on deferred foreign tax liabilities or assets are recognized in the statement of comprehensive income (par. 78).

Investments in preference shares

Investments in preference shares are another item that requires our careful judgment.

More specifically, you should assess the rights attaching to the shares.

In fact, both IAS 39 and IFRS 9 say that investments in equity instruments are non-monetary items.

It means that if terms of the preference shares lead to the shares classified as equity instrument, then they are non-monetary.

For example, the share that does NOT specify any mandatory redemption by the issuer at some future date would represent an equity instrument (or at least an equity component of a compound financial instrument).

On the other hand, if terms of the preference shares lead to the shares being classified as a financial liability, then it should be treated as a monetary item.

For example, the share that DOES specify mandatory redemption by the issuer at some future date would represent a liability.

Share capital in a foreign currency

Some companies issue their share capital in a foreign currency.

However, neither IAS 21, nor IFRS 9/IAS 39 specify whether the share capital in a foreign currency is monetary or non-monetary item and how to treat the difference.

In practice, the ordinary share capital is viewed as non-monetary item and maintained at the historical rates. The reason is that its retranslation to closing rate does not affect the cash flows of the company.

However, I have experienced the opposite in the past. A few companies treated their foreign currency share capital as a monetary item, but they took foreign exchange differences directly to equity, and not to profit or loss. In this case, total equity is the same as the share capital would have been kept at the historical cost.

Contract assets and contract liabilities

In short, contract assets are monetary and contract liabilities are non-monetary, however exceptions may exist. Please read this article for full explanation with examples.

Download the infographics here

Please click here and download the infographics that you can save and use for the future reference when in doubt. It is free.

Is there any item you would like me to explain further? Please leave me comment right below article. Do not forget to share this article with your friends. Thank you!

Please, let me know in a comment below the article and if you know someone who can use this information, please share – thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello and thanks

Excellent and helpful as always

Is it correct to assess a S.A.F.E note as any other equity instrument and classify it as non-monetary item?

very precise and clear explanation with examples, has certainly helped.

Thank you. your explanations are very clear. All the best for your future

Hi, if we have redistribute our retained loss, e.g. we have £400m retained loss and we distribute the loss to the Shareholders by decreasing the Share Capital, is the distribution at spot? . I.e SC £401m (€390 at historic) and we distribute £401 m (€360 at spot)? or would the distrubtion be at historic rate?

Hi Silvia, Contributed surplus + Capital to fund is in USD. Functional Currency is CAD. Please confirm if it is correct to record the Contribute Surplus and Capital at the rate at date of funding and then us this as the historical rate going forward, neither retranslating Contributed Surplus or Capital

Hi Silivia,

When we receive advance from customer, in some cases we recognize it as advance from customers and in some cases, we recognize it as deferred revenue as both are liabilities in nature. My question is that on what grounds we recognize these transactiona as advance from customer and deferred income?

Thanks

Hi Silvia.

can we consider the unbilled revenue for (constriction company ) as Monetary item and apply the Current Rate while the revenue will be kept under historical rate?

Thank you

Hi Silvia, I would like to check regarding retained earnings. I have a consolidation and the parent’s currency is $. It has various subsidiaries with different currencies. For each subsidiary’s retained earnings, is this to be exchanged using the historical exchange rates? If it is impossible to use the historical exchange rates, given that this has never be done in the past and that the subsidiaries have been in existence for several years, what would you recommend to check closing retained earnings?

Thank you Selvia ….. you make it Clear