3 Biggest Myths in Accounting for PPE

I often talk with many professionals about a practical application of IFRS and the topic of long-term tangible asset is very frequent.

To my surprise I found out that a lot of them believed that with regard to accounting for property, plant and equipment (especially real estate of various kinds), there is just 1 standard – IAS 16, and just 2 models are prescribed:

- Cost model, and

- Fair value model under which you revalue your PPE to fair value and you recognize fair value changes in other comprehensive income.

Let me tell you – this is wrong.

Here, I’d like to correct this misunderstanding and set the record straight.

Myth #1: You have to account for all long-term tangible assets under IAS 16

This is wrong.

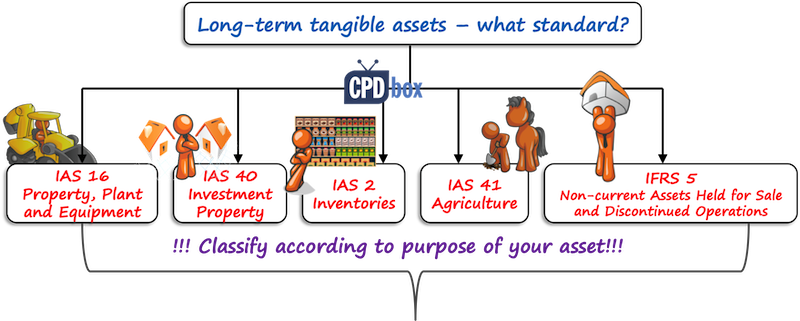

There are few IFRS standards to pick from and the selection basically depends on the purpose or reason why you hold an asset.

Be extremely careful here, because sometimes, the classification is NOT that easy and obvious and you need to make judgment in order to pick the right standard.

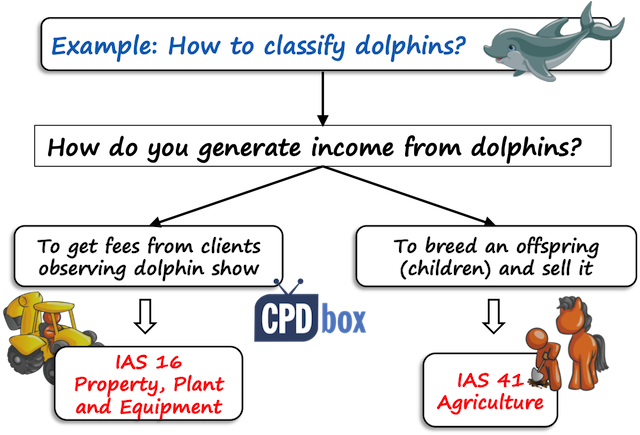

Short example: which standard to apply?

As an example – last year we visited dolphin show with my kids. While they were observing dolphins dancing in the water, I was thinking about how to account for them (yes, I suffer from “job-related impacts”).

The fact it’s a living animal might suggest that it’s automatically biological asset under IAS 41, but is it really?

Well, no. Here, the dolphins were used primarily for being shown to people and they generated income from fees paid by these people – this is NOT an agricultural activity and as a result, IAS 41 does NOT apply. Yes, you guessed that – here, IAS 16 applies.

But, if the company would have bred the dolphins in order to get their offspring (children) and sell young dolphins, then yes, this would have been an agricultural activity and IAS 41 applies here.

This short example should give you a hint to be a little bit careful and think before you classify your assets.

Which standards can we choose from?

- IAS 16 Property, Plant and Equipment

IAS 16 is probably the first standard catching your attention when you need to decide how to account for your newly acquired piece of long-term tangible asset.

Indeed, if you hold your assets with the purpose of using them in the production of goods or providing services, for rentals to others or administrative purposes, then yes, this one can be the right choice.

- IAS 40 Investment Property

IAS 40 is often an omitted standard, but it gives you a great choice for your buildings or lands held to earn rentals.

Moreover, if you hold your buildings or land for capital appreciation purposes (i.e. making profit from their fair value changes), then you need to apply IAS 40 rather than IAS 16.

- IAS 2 Inventories

This should be no surprise for a seasoned CFO: when you hold some long-term assets in order to sell them in an ordinary course of your business, then they are inventories rather than property, plant and equipment.

For example, car dealers report new cars for resale under “inventories”, and cars for their own use usually under “property, plant and equipment”.

- IAS 41 Agriculture

- IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

IFRS 5 is here for a very special occasion: as soon as specified conditions are met (i.e. management is committed to a sale, an asset is immediately available for sale, etc.), then you can forget about IAS 16 and other standards.

Instead, you need to focus on IFRS 5.

I’m mentioning this one just to give you the full picture, but here again, think of IAS 41 for all your biological assets used in an agricultural activity (with the new exception of bearer plants).

As you can see, the first question you need to ask when classifying your long-term asset is:

What is the purpose or the reason why we hold this asset?

Myth #2: You can choose only between cost model and fair value model.

This is wrong again.

As I wrote above, there are many standards fitting individual situations and each standard contains at least one model available.

But for a while, let’s forget about assets held for sale, inventories and biological assets. Anyway, most questions I receive related to production assets, especially buildings and lands.

What models are available for the production assets, including buildings and lands?

There are 3 models:

- Cost model under IAS 16;

- Revaluation model under IAS 16; and

- Fair value model under IAS 40.

The most common model is probably the cost model, under which you hold your assets at their cost less accumulated depreciation (less accumulated impairment losses if there are some).

Sometimes, this model does not fit the situation well – for example, when you invested into a building with the purpose of selling it later.

Also, many companies do not apply the cost model properly, as they often forget to revise useful lives of their assets and as a result, they still use fully depreciated assets in the business.

Let me tell you, that with the reference to 2 remaining models, there’s one very common misconception:

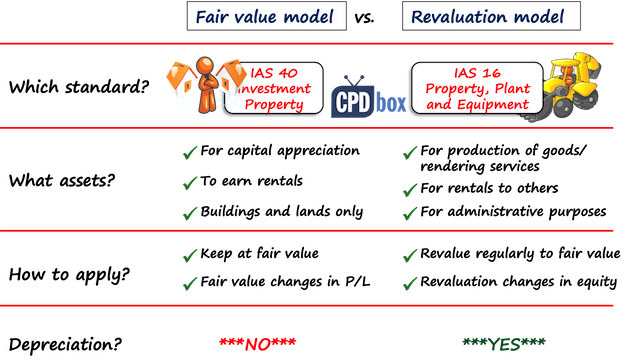

Myth #3: The fair value model is the same as the revaluation model.

Wrong!

These models are totally different, although they have one common feature: fair value.

Yet I often hear the wrong statement: “under fair value model, you revalue your assets regularly to their fair value with the changes recognized in other comprehensive income”.

This was a mixture of fair value model and revaluation model.

So what’s the difference?

Revaluation model

Revaluation model is prescribed as an option under IAS 16 Property, Plant and Equipment.

It means that you can apply it for any assets used for more than 1 year in the production process, for rental to others or for administrative purposes, including your buildings or machinery.

Under this model, you should revalue your assets regularly to their fair value and depreciate revalued amount over remaining useful life. When you revalue your assets, the change is recognized in other comprehensive income (with some exceptions).

Here, the important thing is that you can use revaluation model also for machinery (unlike fair value model) and also, you charge depreciation (not under fair value model).

Fair value model

Fair value model is prescribed as an option under IAS 40 Investment Property.

You can apply it only for buildings and lands held either to earn rentals or for capital appreciation (or both).

Under this model, you should value your assets at their fair value after initial recognition, with the fair value changes recognized in profit or loss.

Here, you cannot apply fair value model to your machinery (unlike revaluation model), and also, you do NOT charge any depreciation.

To illustrate the differences between fair value model and revaluation model, let’s solve a small example.

Example: Building and 2 models

On 1 January 20X1, ABC company acquired a building with the total cost of CU 300 000. As of 31 December 20X1, the following information is available:

- Building’s useful life is 30 years.

- Building’s fair value at 31 December 20X1 is CU 310 000.

What accounting entries shall ABC make with respect to this building in 20X1 under:

- Fair value model

- Revaluation model

Building and fair value model

Here, the things are quite simple and easy. ABC simply revalues building to its fair value of CU 310 000 and does not care about the depreciation as there’s none.

The journal entry is:

- Debit Assets – Investment property with CU 10 000 (310 000-300 000); and

- Credit Profit or loss – Fair value gain on investment property with CU 10 000.

Here please note that the building is shown under the heading “Investment property” and not “Property, plant and equipment” and of course, it’s purpose is either to earn rentals or for capital appreciation (otherwise, you cannot apply IAS 40 and fair value model).

Building and revaluation model

Similarly as before, ABC revalues its building to the fair value of CU 310 000.

However, as we are under revaluation model now, some depreciation for 1-year usage in 20X1 should be recognized. The building’s useful life is 30 years, therefore, ABC makes the following journal entries:

Depreciation in 20X1:

- Debit Profit or loss – depreciation with CU 10 000 (300 000 divided by 30 years); and

- Credit Assets – PPE (accumulated depreciation) with CU 10 000.

Revaluation as of 31 December 20X1:

- Debit Assets – PPE with CU 20 000 (Fair value of CU 310 000 less carrying amount of CU 290 000); and

- Credit Equity – revaluation surplus with CU 20 000.

In 20X2, ABC will charge depreciation amounting to CU 10 690 per year, which is calculated as revalued amount of CU 310 000 divided by the remaining useful life of 29 years.

The little trick here is to make a transfer between retained earnings and revaluation surplus in equity amounting to difference in depreciation charges from revalued amount and original cost:

- Debit Equity – Revaluation surplus with CU 690; and

- Credit Retained earnings – depreciation charge with CU 690.

The reason for this transfer is to bring revaluation surplus related to building to zero together with its depreciation over its remaining useful life.

I hope that this article cleared the confusion related to fair value model and revaluation model, plus a couple of other myths related to measurement of long-term tangible assets.

Please, if you have anything to say, leave a comment below and share this article with your friends – thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

how is revaluation reserve shown in cash flow statement?

As it is a non-cash item, it must be adjusted in movements of PPE.

Hi Sylvia, but I am not in this case. By impairing first the client is able to get a higher revaluation and a lesser revaluation if they impair after. Is there any further guidance on this?

Hi Sylvia,

Thank you for the informative lecture.Please clarify forme the below:

So according to the revaluation model,which comes first revaluation or impairment then revaluation of the asset?

I would say it does not matter, because you will get the same result in the end.

Hi Sylvia

Thank you very much for such a comprehensive summary

A quick question. Can a lessor revalue the vehicles used in operational leases? In substance these are commercial assets held for up to 4 years generating lease income and gain/loss on disposal at the end of the lease term.

Hi Angela,

thank you. I see no reason why not. Those vehicles are its PPE, under IAS 16 you can apply revaluation model. S.

Thank you so much.

but I have a doubt about why revaluation gain is recognized under other compressive income and fair value gain is recognized in the profit and loss account. those two types of assets are used for long-term purposes. ? what is the rational for that??

The rationale of that is that we are talking about two types of assets based on their different purpose.

Thank you Silvia, this article has really demystified these PPE, IFRS matters.

thank you selvia

from the Date of this article ( one of the more strong article that you wright as i see ) too much useful ( i like it ) you make a lot of changes in our accounting

Thank you! 🙂

Bravo, Silva. I have struggled with this concept of the applications of Fair Value vs Revaluation. I am currently writing papers in our Regional Chartered Accountants Body, however, it has been a completely difficult process of understanding these concepts. Nevertheless, your presentation has demystified the longstanding confusion..

Thank you!

Hi Siliva,

Will my regular depreciation & Accumulated Depreciation will hit if I am charging the depreciation on the revaluation amount.

Depreciation charge will change, of course, because your depreciable amount changes as a result of the revaluation. However, you should transfer a part of depreciation charge that relates to the revaluation surplus in OCI/equity/revaluation surplus.

Thank you for your response,

If this case at the end the “Revaluation Model” applies the same principle under the “Fair Value Model” because at the end of each reporting period we revalue the PPE in reference to their real value” Fair value” and does not matter where we will include the amount of gain or loss of revalued Asset (profit or loss or other comprehensive income) because we must calculate the Total Comprehensive Income… the only exception that we can not include Depreciation at “Fair Value model”.

Sorry for long answer

Regards

Not quite like that. Under revaluation model, you revalue once in a while, not necessarily each year and then you actually charge depreciation. Under fair value model, you do revalue each year and do not charge depreciation. I believe I explained it quite understandably above in point #3.

Thank you for the clarification

Thank you Silvia for your article,

I was wondering about the reason of not including the Depreciation charge under the “Fair Value Model”, instead we should calculated under the “Cost Model” ?

Thanks in advance,

Regards,

Mohammad

Because under the fair value model you do not need depreciation since you keep your investment property at fair value and any changes are recognized in profit or loss.

This is an eye opener

Thank you Silvia,

Was hoping to see IFRS 13 coming into play here since its effective date is 1 January 2013.

thank you

Dear Silvia,

we have done a revaluation on land through OCI. For doing this I used also your above article as guidance – thanks for that. This land is owned by a subsidiary which reports in a foreign currency. On consolidation level I have the following issue: The revaluation gain is shown in OCI in the subclass “no recycling to P&L”. But where do I show the FX loss on the translation of this unrealised revaluation gain? My feeling would be: together with the revaluation item! Thus, in the subclass “no recycling to P&L”. But IAS 21 says translation of foreign operation is to be shown in the subclass “recycling to P&L”. Am I right or not?

Thank you for your answer.

I need more guidance on accounting for construction contracts , value work , work in progress , contract asset. I will appreciate

The article is quite compelling to read and very insightful too. It throws a good spanner into our routine PPE accounting. Thanks for the knowledge shared.

Very interesting topic,

Thank you

Hi Sylvia, i want to thank you for simplifying these standards. Among many you have simplified is this difference between Fair value and Revaluation model and how to account for the increase in each of the method. This is much much appreciated, you are making my life so easy as i was struggling interpreting some of these standards in my auditing field. Thank you once more

Oh, glad to read that, thank you!

it was quite helpful, and we further expect contents such as this from you.

Thanks for making things clear!

Thank you Silvia.

Hi silvia, thanks for this concept clarity, can you pls put more light in context of gain r loss raising from fair value method, it is mentioned it should be taken to profit n loss account, but I am thinking it is unrelised gain or loss , so why this gain n loss arising from fair value model not taken to oci, pls reply

Hi Sylvia

Thanks for the insightful article! I have a question, say if we have adopted revaluation model for our PPE, and we wish to back to cost model. Is this allowed? How are we going to assess the impact and what is the entry involve?

Excellent and many thanks for this.

hello Sylvia

when a company realised foreign currency from foreign currency denominated debtors, shall we calculate gain loss ?? In fact another Foreign currency monetary assets comes instead of Foreign currency debtors.

Dear Sylvia,

If the Classification from IAS 16 to IAS 40 is done at beginning of the year, than we change in IAS 40 cost model to fair value model at the end of the year than the difference between FV and cost should go to Retained earning or Revaluation reserve. Please guide.

Thanks Suman

Hello Suman,

As the said Asset is already classified as Investment Property with the subsequent measurement being done under the fair value model, any difference between the carrying amount and Fair value at the measurement date will go to the Statement of Profit or Loss.

Thank Silvia,

Really it is a great help.

One small clarification required, in case of IAS 40 we are carrying the value of investment properties in books as per cost model i.e Cost less accumulated Impairment Loss for Land.

However, after couple of years, we decided to switch to Fair value model. so my question is that since this is change in accounting policy so in this year should i transferred all difference to retained earnings. i.e FV Less: (Cost Less Impairment loss), or we need to adjust first the impairment loss through PL and rest adjusted through retained earnings.

Looking forward for your reply.

Thanks Suman

Thanks Ms. Silvia for the post.. I have question on revaluation model. Building is fully depreciated and net book value is zero. Managemants wants to revalue the building and take in to the books. How will i do the depreciation in this case? Do we need to reassess the life time of building?

Thank you Silvia

I am still confused as to when will an asset fall under IAS 16 due to the requirement of “rental to other”. I can see when is it IAS 41 due to held to earn rentals. What would be an example of assets under IAS 16 due to “rental to others”?

For example a vehicle or a machine. Something that is neither land nor building and you use it to earn rentals.

Thanks for the Silvia – always very informative!

I have a question with regards to Residual Values on buildings.

The accounting policy adopted is the Cost Model and the the buildings are shown at historical cost (with no residual value). An independent valuation is performed annually on the buildings to determine the current fair value.

1) Is it a IAS 16 requirement that all assets should have a residual value (if it is, can you provide me with the reference?)

2) Can the valuation that was performed not be seen as the residual value? The valuation that was performed indicates the current fair value of the building in the event of selling it.

Dear Silvia,

Very appreciated for your excellent explanation for the differences between the two models.

Query:

on the transition date, what if the transfers from PP&E under Cost model to investment property under the fair value model? Shall i recognize the difference in OCI Or RE?

Thank you very much

Thank you Silvia well-expelaned article

I am living in Ethipa as a nation we are trying to implement IFRS your site also important for more understanding.

Thank you

thank you very much

HI Silvia,

Thank you very much for post.

They have always tremendously helpful to me.

However, I have one small question hope you will help me clarìy it:

In the comparison between Fair Value (FV) model and revaluation model:

FV model: to earn rentals

Revaluation model: for rentals to others.

May I know the underlying difference between these 2 expression?

Thank you very much and best regards!

FV model relates to investment property only (land and buildings), revaluation model to PPE (that is, other than land and building as the land and building would most often fall under IAS 40 if they are used for the purposes defined in IAS 40).

Hi ,

Is it possible to use the revaluation model on motor vehicles ??

Well, yes, it is not prohibited.

Silvia , i have a question

am making audit on a fund , and The fund aims to achieve capital gains on the short and medium term through Purchase of developed land in all regions of Saudi Arabia and divide them as residential and commercial land then market and sell them to achieve returns to investors and distribute the units and profits to investors and end the fund.

the fund classify those lands as investment properties and i think it must be inventories as the example in IAS 40 The following are examples of investment property:

(a) land held for long-term capital appreciation rather than for short-term sale in the ordinary course of business.

and The following are examples of items that are not investment property and are therefore outside the scope of this Standard:

(a) property intended for sale in the ordinary course of business or in the process of construction or development for such sale (see IAS 2 Inventories), for example, property acquired exclusively with a view to subsequent disposal in the near future or for development and resale.

If many assets (Office equipments) were unintentionally booked as revenue expenses instead capital expenses over the years. Now, After physical inventory we gather 60 items which was booked under revenue exp. instead CAPEX. What do I now? IAS 8 Accounting error ? Or Can I revalue or assess fair value? Can I put zero acquisition cost? Please elaborate help

What about the smile of an reception due to which people are attracted to organization and generates benifits for organization why is smile then not an intangible assets can you please explain??

OMG, but really are you asking me this???? Please read this article and try to assess whether the smile meets identifiability criteria – just as a hint.

Thanks alot silvia for sharing this wonderful article. I have learned a lot from your articles and this is another eye opener article.

Ms.Silvia, Many thanks for your mail and clear explanations.

You are really appreciated.

Hi Silvia

i want your kind support for the below question.

Is the difference( increase) between deemed cost( IFRS 1)

and previous book vale upon first time adoption of IFRS credited to retained earnings or revaluation reserve?

I know someone who do not revise useful lives of the tangible assets and still using assets WDV Zero, is it right or violation ?

That’s violation of IAS 16.