IFRS S2 Climate-related Disclosures: What, How, When

Climate-related disclosures as arranged by IFRS S2 affect literally every single company without exception (I mean those issuing reports under IFRS).

Yes, I know this is a strong statement, but if you keep reading, you will find out why and how.

IFRS S1and IFRS S2 function as one package. They are intertwined, working together and you need to apply both requirements in IFRS S1 and IFRS S2.

I have already briefed you about the general standard IFRS S1 General requirements here.

Now, let’s take a look at its “twin”, the IFRS S2 Climate-related disclosures.

#1 What is IFRS S2 about?

IFRS S2 requires you to disclose material information about climate-related risks, more specifically:

- Physical risks, such as the risks resulting from severity of extreme weather, and

- Transition risks, for example those associated with policy action and changes in technology, that can affect how a company can run its business in a future.

Also, you need to provide information about climate-related opportunities.

Unlike risks, those are potential positive effects of climate change for a company, for example, adoption of low-emission energy sources, development of new products and services, etc.

All this information is important for investor to understand how the company is affected by the climate change.

#2 How and where should you provide the information in line with IFRS S2?

This is arranged by the general standard IFRS S1.

In short, you should provide only relevant and material information that affect YOUR company.

Not all of it.

And, you should definitely provide this information in the general-purpose financial report, together with and at the same time as the financial statements.

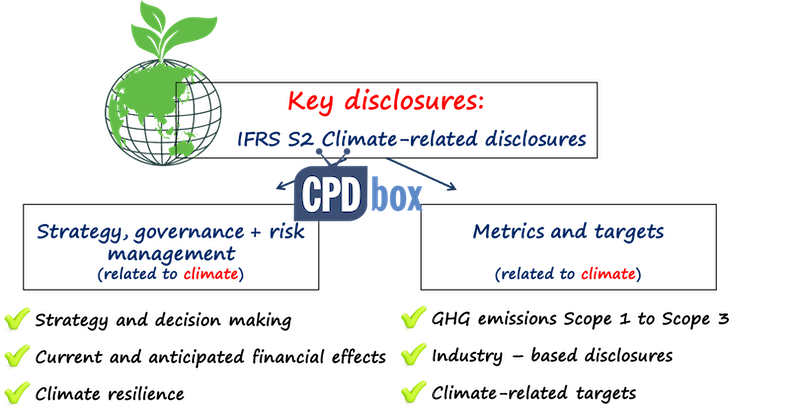

#3 What are the key disclosures of IFRS S2?

The company needs to disclose the information in two main categories:

- Strategy, governance and risk management specifically related to climate:

- Strategy and decision making;

- Current and anticipated financial effects;

- Climate resilience (please see more about it below)

- Metrics and targets related to climate:

- GHG emissions Scope 1 to Scope 3 (see more about it below)

- Industry-based disclosures

- Climate-related targets.

While some of these items might seem familiar, let me focus on the less familiar parts.

#4 What is climate resilience?

This is the resilience of company’s strategy and business model to climate-related changes, developments and uncertainties.

Here, you would need to use climate-related scenario analysis to form your disclosures about climate resilience, but IFRS S2 does not tell you WHICH scenarios you should use.

So, that is up to individual company to select the appropriate type of scenario, but then you need to provide information what you have used, including your assumptions.

Just as an example, you can use the quantitative scenario narrative, or even complex statistical modelling.

IFRS S2 does require using a method for climate-related scenario analysis that is commensurate with company’s circumstances. To select this method, you are required to assess:

- The company’s exposure to climate-related risks and opportunities (the greater is exposure, the more precise or elaborate scenario analysis is required)

- The company’s skills, capabilities and the resources available for that scenario analysis

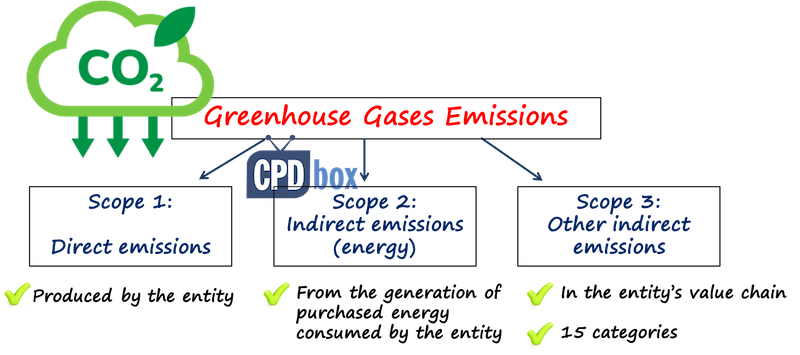

#5 What are GHG Emissions Scope 1 to 3?

GHG emissions are greenhouse gases emissions.

You are required to disclose the information about both direct and indirect emissions; in three scopes:

- Scope 1: Direct emissions

- Scope 2: Indirect emissions from the generation of purchased energy consumed by the company

- Scope 3: All other indirect emissions that occur in the company’s value chain – here, 15 categories of these emissions are listed.

A company should apply GHG Protocol Corporate Standard.

If you are using different method, you can apply it in the first year of reporting under S2, but then you should switch to GHG Protocol Corporate Standard.

#6 Why does IFRS S2 apply to every single company?

I partially answered this question in the previous one, but let me stress that out.

Even if your company is NOT producing direct emissions, you need to report on the indirect emissions, too.

So, are you purchasing electricity? From which sources? If it is not purely green energy, then you need to calculate indirect emissions caused by your purchases.

Of course, IFRS S2 is not just about emissions, but this is just one example of how it might affect your company.

#7 Working in a bank or other financial institution? Then watch out:

One of the categories of Scope 3 emissions are so-called financed emissions – those are emissions that banks and investors finance through their loans and investments.

For example, if you work in a bank which provided a loan to another company generating emissions, this bank needs to include emissions generated by its borrower as Scope 3 GHG emissions in their sustainability report.

As you can see, the bank then needs to gather the information about indirect emissions generated by its borrowers.

#8 What are industry-specific requirements?

IFRS S2 requires reporting on certain industry-based metrics that are associated with common business models and activities within specific industry.

You can find detailed information about the specific industries in a document “Industry-based guidance on implementing IFRS S2 Climate-related disclosures”.

The guidance is indeed extensive – on more than 500 pages, you can find the specifics about financials sector, consumer goods sector, services sector, etc.

#9 When should you apply IFRS S2?

I have mentioned it in my previous emails already, but let me repeat:

Both IFRS S1 and IFRS S2 are mandatorily applicable for annual reporting periods beginning on or after 1 January 2024.

So, I just hope that you have your monitoring processes for gathering data in place.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

3 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Well explained article

Can we get video version of this article

Simplified and well explained article.

Great article. Very clear and educative.