How to Write Notes to Financial Statements under IFRS

Warren Buffett once said: “Other guys read Playboy. I read annual reports.”

This is a profound statement indicating that Warren Buffett actually takes his time to go through a complete annual report, including the financial statements and notes.

Thus, Mr. Buffett does NOT consider the numerical information about the company as sufficient for him to decide about investing in that company.

In fact, he reads a lot of text, too.

If you ever want to invest in some shares, I would recommend you doing the same thing.

Yes, notes are usually pain to read, because they are too long and too extensive (and yes, boring).

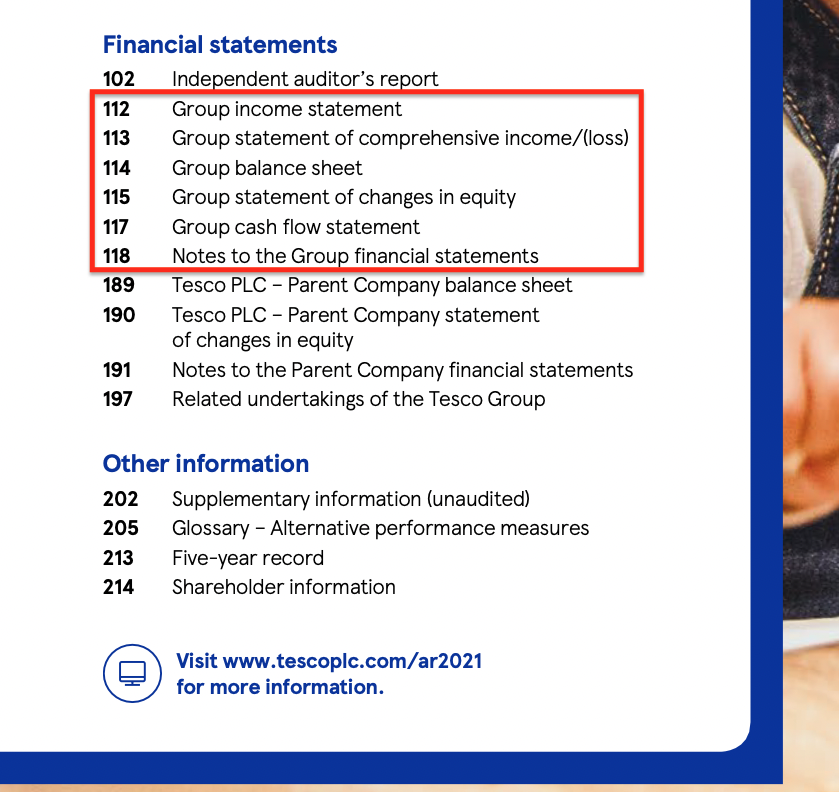

As an example, take a look to the annual report of Tesco Plc containing the financial statements under IFRS.

What can you see?

The numerical, tabular statements take about 6 pages to show (pages 112-117), but notes themselves take 71 pages (118-188)!

I would say that exactly the extent and length of the notes is the reason why regular investors just don’t read them.

Yes, the investors take a look at numbers, but skip the notes and that’s why sometimes they make dumb investment decisions. It goes like:

“Oh I did not know that this company faced a lawsuit with huge potential settlement!!! I did not see the provision in the balance sheet and the related expense in profit or loss!!!”

Yes, that’s possible, because that company could had assessed the probability of losing the lawsuit at below 50% and only disclosed the contingent liability in the notes, instead of making a provision in the balance sheet.

So did you look at the notes and read about the contingency?

Hmmmm, I thought so.

On the other hand, if you find yourself at the other side preparing the financial statements and specifically notes, how to write them so that you say everything what you should AND not make it clutter and mess?

In this article, I want to give you a few tips and advices related to the notes so that they meet their purpose just right.

What are the notes to the financial statements?

Notes are the integral part of a complete set of financial statements in line with IAS 1.

Therefore, you just cannot stay that the financial statements are just the numerical tabular statements, like:

- the statement of financial position (or balance sheet),

- the statement of profit or loss and OCI and other numerical statements,

- the statement of changes in equity; and

- the statement of cash flows,

because that’s incomplete.

Notes are in fact very significant because they explain the numbers and expand the information about them.

How do notes look like?

No. Prescribed. Format.

Once again: neither IAS 1, nor any other standard within IFRS gives you some uniform format of the notes.

Thus, it is up to you to design the optimal layout and structure of your notes.

IAS 1 gives you the minimum requirements related to the content of the notes (see below) and requires you to present notes in a systematic manner so that the users of the financial statements can actually better understand the numbers in there.

Here, I will give you a guidance on preparing the notes, but please bear in mind that it is just one option and not the strict requirement.

This is simply the method I learned from auditing and consulting to many different companies, stemming from best practices. If you look at some financial statements online, you will often see similar structure as presented here.

Having that said, you can come up with your own structure if it complies with IFRS and is more relevant.

Content of notes – what to include?

The notes are usually prepared in the form of a document structured into certain parts.

I present these parts in the order in which I would present them in the real notes, together with the IFRS paragraph asking for that presentation:

1. Identification information

Just as any other component of the financial statements, also the notes shall at minimum contain full identification information in line with IAS 1.51:

- Name of the reporting entity;

- Info about the level of financial statements: consolidated? Individual?

- Period covered by the notes, e.g. year ended 31 December 20X1;

- Presentation currency;

- Level of rounding: thousands? Millions?

You can very effectively state this information in the header of that document to show on each page of your notes, for example by writing:

(in thousands EUR)

That would do the job quite well.

2. General information about the reporting entity

I would start the notes with stating the information about the entity as required by IAS 1.138. You should include:

- Domicile, legal form, country of incorporation

- Entity’s operations and principal activities

- Name of the parent and ultimate parent of the group

- Length of company’s life if limited.

As an example:

General information

JBC Plc. (“the Company”) was established on 12 January 2002 in Dublin, Ireland as a joint stock company.

Domicile of the Company: Ireland.

Address of registered office: Mysterious Street 10000, 10000 Dublin, Ireland.

Name of the parent and ultimate parent: JBC USA…

The Company is major wholesaler and retailer of home and kitchen appliances within UK and European Union. It operates within 5 regional branches within UK and 6 subsidiaries within European Union.

3. Statement of compliance with IFRS

Right after the general information, please write a sentence in which you clearly say that these financial statements are under IFRS. That’s the requirement of IAS 1.16, often forgotten.

Example:

4. Summary of significant accounting policies

This section can be quite boring and long to read, but again, extremely important.

Let me tell you a story from my practice.

Story time!

I was discussing the financial statements of one big company with a very clever investor who was seeking a company with good potential to invest in.

He was skimming through the balance sheet, looking at different numbers there and said something like:

“Look, company’s PPE (property, plant and equipment) looks very nice, it seems they heavily invested into it last year.”

I was puzzled because I knew this company did not “heavily” invest into its PPE; it merely did some minor replacements.

And, indeed! The increase in carrying amount of PPE was impressive.

Hmmm. Something did not feel right. Thus I suggested: “You know, let’s take a look at the notes, we are missing something here.”

So we did. As an experienced accountant, I went straight for the summary of significant accounting policies.

One small note said that the Company was applying revaluation model to its PPE and as there are no market values available, the company determined fair value by using “3rd level of inputs” into the fair value model.

In other, much simpler words: That Company constructed some sort of discounted cash flow model, with significant portion of estimates and judgments, determined the fair value based on that model and, bam, you have your fair value with huge upward revaluation through the equity.

Yes, all the estimates and judgments were described in the notes, too (but if not searching for it, we would have skipped reading that).

However if the Company would not have applied revaluation model, but the cost model, its PPE and equity would have not looked that great. Not even mentioning that the auditor did not say a word in its report.

There you go.

You absolutely should read the accounting policies, too, no matter how boring they are. You can find some “hidden gems and pearls” in there.

How to describe the accounting policies

I suggest the following components to describe in your accounting policies:

- 4.1 Basis of preparation

You should disclose whether the company’s financial statements were prepared on going concern basis or not.

This disclosure is not normally listed within accounting policies, but I think it’s the most appropriate place to make this statement, because the accounting policies will depend on going concern, too.

- 4.2 The measurement basis

You can disclose the measurement basis either as a separate note, or disclose the measurement basis of individual line items together with disclosure of specific accounting policies for that item.

For example, you can state that the company measures all items at historical cost with the exception of PPE which is measured at revalued amount.

- 4.3 Critical accounting judgements and key sources of estimation uncertainty

I like to disclose this before describing specific accounting policies for individual line items, but of course the order is up to you – whatever works for you.

Here, you should describe judgements and uncertainties separately.

Judgments are considerations made by the management in applying the accounting policies. For example, when deciding how to account for the specific lease contract as a lessor, management applies judgment to assess whether the lease is operating or finance.

Uncertainties relate to the future information or events that may affect the financial statements, for example when describing how the management determined the present value of obligation from the pension plans, it must state how the estimates of future benefits and other components were made.

I suggest you insert the Covid-19 related estimates, assumptions and judgments here, too.

Judgments and uncertainties would make a topic for a separate article, so we are not getting into further details here.

- 4.4 Application of accounting policies in the financial statements

This is the part where you go line by line and describe the accounting policy applied for that line.

For example, you say: “The company applies cost model for accounting for its property, plant and equipment….”.

You should include only significant and material accounting policies to avoid clutter and obscuring of significant information by loads of unnecessary details.

I also suggest to add the short information about the initial application of certain IFRS standards and the standards that have been issued but not yet adopted.

5. Risk management and other disclosures on capital management

Here, all the disclosures based on IFRS 7 and on IAS 1.134 (and following) can be stated, if applicable.

It is more logical to describe principles before providing further numerical and specific information about the individual line items.

What to describe here:

- 5.1 Principles of risk management

Describe what risks the Company is facing and how it manages them, especially foreign exchange risk, interest rate risk, credit risk and liquidity risk.

These disclosure stem from IFRS 7 Financial Instruments: Disclosures.

- 5.2 Disclosures on capital management

Describe how the company manages capital, what are the objectives and methods of managing capital and bring in qualitative and quantitative disclosures, too.

Again, this type of disclosures is a huge topic so here I focused on describing short basics.

6. Disclosures on individual line items of financial statements

Here, you need to go line by line and describe each line item in the financial statements.

The requirements for content of these individual disclosures are in the individual standards arranging that item.

For example, disclosures required for property, plant and equipment are listed in the standard IAS 16 paragraphs 73-79, so please read that standard and provide details in line with these requirements.

7. Integral part

The notes are the integral part of the complete set of financial statements under IFRS and I suggest that you highlight this fact in the notes.

I prefer to do so in the footer at each page of the notes just to stress the importance of the notes for the reader (although not directly required by the standards).

You can add the following simple sentence in the footer:

Final tips and tricks for the notes

The notes are the most extensive and elaborate part of the financial statements and yes, the readers of the financial statements often skip reading it just because it is soooo loooong, boooring to read.

How to make it easier for users?

Let me give you a few tips:

- Balance out!

Please, do not include every single information about the company or its numbers.

Nobody is interested in how you account for petty cash expenses (unless they are huge; or material).

You need to find the right amount of balance between “detailed” and “easy to read while sufficient”.

Include only material, significant items. Also bear in mind that an item might not be material when considered individually, but it can be material when considered as an aggregate with other items.

Let me mention here that despite this golden rule, the notes still tend to be lengthy and cluttered.

That’s why IASB undertakes the improvement project in this field and we can expect some new amendment related to the amount of disclosures.

Let’s watch.

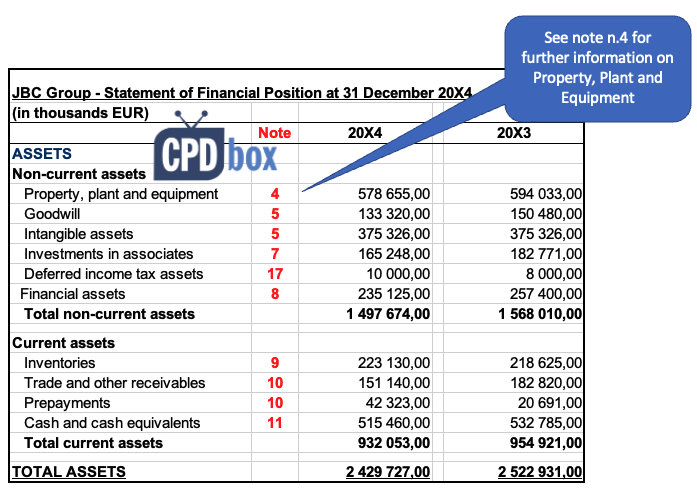

- Cross-reference!!!

Cross-referencing is a great tool and a big help. By cross-references, the readers can find the detailed information about the related item very quickly.

For example, number the individual disclosures in the notes and state the relevant number directly in the balance sheet next to the relevant item, as shown in this picture:

- Be systematic!!!

Go through this list and then through your balance sheet and other statements and make your notes systematic by ordering the individual disclosures as they go.

There are number of templates or sample financial statements available on the internet, so you can get a lot of inspiration from there.

Any comments or questions?

Please let me know below!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

9 Comments

Leave a Reply Cancel reply

Recent Comments

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (74) 74

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (56) 56

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (27) 27

- Uncategorized (1) 1

Thanks for sharing Silvia, love you

Thanks for information on the note to financial statements, I want to know whether the note will be prepared separately for each statement for that period. For example, income statement note should be prepared separately, balance sheet note, separately.

There is one set of notes, split into several captions. One caption should relate to certain item, for example, PPE, inventories, etc.

Thanks, Silvia. The article was helpful. When I review financials I see a lot of historical information related to past years. Can you please confirm whether the information contained within the financials should only be reflective of the current reporting period and the prior period reported on a comparison basis? This is something that always has me thinking.

Hi Jenny, thank you. Yes, I would say that only the info that is relevant to the periods reported. However, I’d like to point out that sometimes you have past historical information dated years back, but they still affect the current/previous reporting period and thus they are relevant.

Silvia, I’m impressed by your mastery of IFRSs. I discovered this website about a week ago and it has totally changed my perspective about accounting. I have come to believe its not difficult. I’m recommending the site to many of my friends. Silvis, I came across one of your computations regarding under IFRS 5 Dunes Property but lost the link. Kindly redirect me to the link. Regards

Hi Mike, thank you, that’s exactly the goal of this website – to make people realize that it is not that difficult. As for IFRS 5 – not sure if that link was mine, but all I have about IFRS 5 is here.

I would love to master IFRS and excel in my career as an accounts person.

Would be possible to commence at the very beginning of this course

Dear Ms Gilda, this is exactly why I designed this website and the courses and I did my best to prepare my materials for people like you, explaining the rules clearly and putting everything into context so that you actually understand what you are doing and why. I hope it is also practical enough. If you need my further advice, it is better to contact me via my contact form.