IAS 18 Revenue

The world today is packed with different kinds of products, services, transactions and many other activities that people and business do. Logically, it is sometimes very tough issue for accountants to determine WHEN and even WHETHER to recognize revenue in the financial statements.

That’s exactly the main aim of the standard IAS 18—to give guidance on the revenue recognition and help in the application of the revenue recognition criteria.

UPDATE 2018: Please note that for the periods starting on or after 1 January 2018, you have to apply IFRS 15 Revenue from Contracts with Customers and IAS 18 becomes superseded. I leave this article here for your information.

What is Revenue?

Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inflows result in increases in equity, other than increases relating to contributions from equity participants.

Agency relationship = revenue?

Here I would like to stress that the revenue includes only the economic benefits received or receivable on the entity’s own account. However, entities often collect the amounts on behalf of the third parties, such as taxes payable to the state budget—these amounts are NOT revenue and CANNOT be recognized as such.

Also, agency transactions are very common in today’s business and sometimes it’s not easy to determine the agency relationship. In agency relationship, the agent just collects the amounts on behalf of the principal and thus cannot recognize the revenue.

For example, mobile operators often sell some additional content with their monthly prepaid calling plans, such as music or application. The relationship between 3 parties is illustrated in the following scheme:

However, it is difficult to determine the existence of agency relationship and therefore IAS 18 sets in its Appendix 4 criteria that, individually or in combination, indicate that an entity is acting as principal:

- The entity has the primary responsibility for providing the goods or services to customer or for fulfilling the order.

- The entity has the inventory risk before or after the customer order, during shipping or on return.

- The entity has latitude in establishing prices, either directly or indirectly.

- The entity bears the customer’s credit risk on the receivable due from the customer of the service.

So each transaction must be carefully assessed and if only 1 criterion is met then the entity probably acts as a principal and recognizes revenue from the transaction.

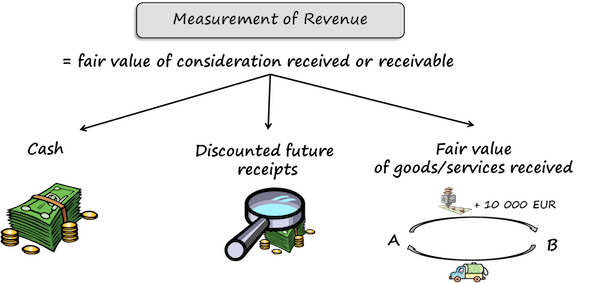

Measurement of Revenue

The revenue shall be measured at fair value of consideration received or receivable. IAS 18 specifies the following:

- Any trade discounts or rebates shall be deducted and revenue is measured net of these items.

- When the cash inflow is deferred or postponed to future, then the fair value of consideration received might be less than its nominal amount. In this case, the fair value of consideration received is determined by discounting future cash flows to their present value using the imputed rate of interest.

- With regard to exchanges of goods or services (barter transactions):

- When goods or services are of a similar nature, then the exchange is not regarded as a transaction revenue generating and the revenue cannot be recognized.

- When goods or services are of a dissimilar nature, then the exchange is regarded as a transaction revenue generating and the revenue is recognized in amount of fair value of goods/services received (adjusted by the amount of any cash transferred).

Recognition of Revenue

IAS 18 specifies revenue recognition criteria for 3 basic revenue generating scenarios:

- Sale of goods

- Rendering of services

- Interest, Royalties and Dividends

Sale of Goods

Revenue from sale of goods is recognized when all of the following conditions are satisfied:

- the entity has transferred to the buyer the significant risks and rewards of ownership of the goods

- the entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold

- the amount of revenue can be measured reliably

- it is probable that the economic benefits associated with the transaction will flow to the entity

- the costs incurred or to be incurred in respect of the transaction can be measured reliably.

IAS 18 sets in its Appendix the practical guidance on recognition of revenue from various situations when selling goods. I have summarized it in the following table:

| Transaction | Revenue Recognition |

| Bill and Hold Sales | When the buyer takes title. |

| Goods Shipped Subject to Conditions | |

| – installation & inspection | When the buyer accepts delivery and installation & inspection is completed. |

| – on approval | When the buyer formally accepts the shipment |

| – with limited right of return | When the goods were delivered and time for return lapsed. |

| – consignment sales | After the buyer sells goods to the final customer. |

| – cash on delivery sales | When delivery is made and cash is received by the seller. |

| Lay Away Sales | When the delivery is made. |

| Sale and Repurchase Agreements | Look out for financing arrangement – not revenue. |

| Subscriptions to Publications | In line with the period over which the items are dispatched. |

Rendering of Services

Here, can the outcome of the transaction be estimated reliably?

- If yes, then the revenue can be recognized by the reference to the stage of completion of the transaction at the end of the reporting period.

- If not, then the revenue can be recognized only to the extent of the expenses recognized that are recoverable.

When can the outcome of the transaction be estimated reliably? It is when all the following conditions are satisfied:

- the amount of revenue can be measured reliably

- it is probable that the economic benefits associated with the transaction will flow to the entity

- the stage of completion of the transaction at the end of the reporting period can be measured reliably and

- the costs incurred for the transaction and the costs to complete the transaction can be measured reliably

IAS 18 sets in its Appendix the practical guidance on recognition of revenue from various situations when rendering services. I have summarized it in the following table:

| Transaction | Revenue Recognition |

| Installation Fees | With reference to the stage of completion. |

| Servicing Fees | If subsequent services are included, then defer the revenue for the subsequent services. |

| Advertising Commissions | |

| – Media Commissions | When the related advertisement appears before the public. |

| – Production Commissions | With reference to the stage of completion. |

| Insurance Agency Commissions | |

| – Agent Renders Further Services | Defer over the period during which the policy is in force. |

| – Agent Does Not Render Further Services | At the date of policy commencement or renewal. |

| Financial Services | |

| – Integral Part of Effective Interest Rate | Based on the classification of the related financial instrument |

| – Earned As Services Are Provided | When related service is provided. |

| – Earned On Execution of Significant Act | When related significant act has been completed. |

| Admission Fees | When the event takes place or allocate proportionally to individual events. |

| Tuition Fees | Over the period of instruction. |

| Initiation, Entrance, Membership Fees | |

| – No additional services provided | Immediately when membership starts. |

| – Additional services provided | Defer over the membership period on some reasonable basis. |

| Franchise Fees | On the basis reflecting the purpose for which the fees are charged. |

| Fees from Development of Customized Software | With reference to the stage of completion, including the post-delivery service support stage. |

Interest, Royalties and Dividends

Revenue arising from the use by others of entity assets yielding interest, royalties and dividends shall be recognized when:

- it is probable that the economic benefits associated with the transaction will flow to the entity and

- the amount of the revenue can be measured reliably.

Revenue shall be recognized on the following bases:

- interest shall be recognized using the effective interest method as set out in IAS 39

- royalties shall be recognized on an accrual basis in accordance with the substance of the relevant agreement

- dividends shall be recognized when the shareholder’s right to receive payment is established.

Current development

In May 2014, the new standard IFRS 15 Revenue from Contracts with Customers was issued and will replace IAS 18 for the periods starting on or after 1 January 2018 mandatorily.

Please watch the following video summarizing IAS 18:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

72 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi,

i have a case where it was agreed with one specific customer via email, that by the end of each year the customer receives a credit note around 5% (regardless of the items sold). should we provision for it, and book it as an expense or instead by the end of the year, book it as a revenue reduction.

If this is agreed up front, you should reduce revenues straight away.

Hi Silvia,

How do we account for sale and repurchase agreement?

Hi silvia

i would like to know the answers of these questions which are mentioned below .

1 )According to IAS 18 when is revenue recognized? Cite examples of revenue?

2)How does borrowing cost IAS 23 affect asset valuation?

3)How does it affect depreciation and recognition of gain/loss on sale of asset?

Hi Arshad,

these questions seems like homework and if you work a bit, you will find extensive answers throughout this website – good luck!

Hie Silvia

How do we recognise revenue for Non profit organisations under IFRS 15. The organisations receive funding or grants from Funders or Partners

Hi Norman,

well, grants or funding from partners is NOT a revenue under IFRS 15 for one very simple reason – your funders or partners are NOT your customers and you are NOT delivering any goods or services to them, isn’t it? So you should better apply different standard, such as IAS 20 or maybe Conceptual Framework if they are shareholders. S.

Hi Silivia, I would like to know the impact on revenue recognition as to when revenue should be recognized in case of goods given on loan basis. i.e. Raw Materials taken from vendor on loan basis due to temporary shortages, which are used in manufacturing process, and the same returned to the vendor when they are available with the manufacturing company. Thanks.

Hi Silvia

We have not yet converted to IFRS 15 for our current financial year and I have the following issue:

We entered into an agreement with a customer whereby we borrowed them crude oil stock, which they had to return within a couple of months. This was done in order to assist them with their operations, for which in return, we would receive a portion of the profits they make.

They failed to return the crude oil stock.

How do we account for this?

Hi Silvia

I am a company selling pharma products to a hospital. The hospitals gives me premises for selling and storing the goods. I pay the hospital commission of turnover as percentage. My customer would be the hospital and not the external customers. Can this license be considered as payable to customer under IFRS 15 and if so do i need show my revenue net of this commission on turnover?

Dear Sylvia,

how to account for amounts received against early contract termination (revenue upon agreement termination or recognize it over the remaining term od the original contract)?

Thanks!

Hi Silvia,

Thank you for creating such a good platform to exchange professional views! Let me explain my query as follows,

Our company is a manufacturing business. customers have credit days. All are non-contractual customers,

the incoterms are BOL, CIF CFR and DDP.

the transporter/freight forwarder cover the insurance for the goods for certain limit.

Advise me how and when the revenue should be recognized? what are the process and accounting treatments?

Hi Sylvia,

I produce our product at our factory and ship it to the customer. Sometimes we ship CIF and sometime FOB. When FOB, the customer is responsible for the shipping costs but often still wants us to arrange the shipping and bill them for this. We add this to our invoices. Would this be revenue. I beleive this would depend on if we view ourselves as principal or agent…likely agent.

I would appreciate your views.

Thanks

David

Hi David,

if you are the provider of the shipping and you are responsible for the provision and quality of the shipping, then yes, it’s your revenue. S.

The Company has received insurance claim against the losses incurred by them in past year which they have accounted for in those respective year. In the current year, the Company has received claim from insurance company. Should the Company net off the insurance claim income in expenses head or should it account the same as insurance claim received income in statement of profit or loss.

It depends on materiality, but in general, you should not offset these items – IAS 1 prohibits offsetting with some exceptions. S.

Hi,

If the parent company is recharging their subsidiaries for the corporate services provided (accounting, HR, IT, Legal ets,), with a mark-up, should these recharges be recognised as income or net off against the expenses in the charging entities books ? The charging company is a manufacturer of industrial products and providing corporate services is not their main operation.

Thanks.

Hi Silvia,

Hope you are perfectly alright.

I have a query. Situation is as follow:

Company A: Specialized in vocational trainings

Company B: Related party of Company A, who have won a contract with Company C for vocational training of certain number of persons

Company C: Contracted with Company B to offer vocational training against certain remuneration

Company B does not have skills to perform the contract and subcontracted the same to Company B on such terms that the only the actual cost incurred by Company A can be recovered from Company B.

My Question is that for Company A Does the arrangement between Company A and Company B be accounted as:

1- revenue and expenses; or

2- netting off of expenses incurred by Company A through receipts from Company B.

Thanks in advance.

Dear sir,

What will be the accounting treatment of amount received in advance against services of 3 to 4 years. Whether we will discount it or not to recognize time value of money?

Plz iNFORM ME IF THE DEbetor is considered goods but un secured is need to be created provision against these debtor

Dear Azhar,

you should evaluate the probability that this debtor will not repay its debts. If you are pretty sure that you will receive all your payments on time (with no delay), then no provision is necessary. The best evidence would be having a history of trades and payments with that debtor. S.

Hello Silvia

Whether the Cash discount will be reduced from sales or will be considered as expense???

Thanks & Regards

Hi Bharat, I wrote an article about discounts here 🙂 S.

Hello Silvia.

Please if you can briefly explain whether sales discount on early settlement of credit from customer can be recorded after gross profit as an expense? or it is must to record this discount in reaching Net Sales.(i.e. as contra revenue account)

Ref. to IFRS would help.

Thanks

Regard,

Thank you for this helpful overview. I have two questions:

1) What if the agreement between buyer and seller does not address when title passes. Is there a default definition for when title passes?

2) The helpful summary chart of sale of goods uses the word “delivery.” Does ISA 18 contain a definition of “delivery?”

Hi Roy, in IFRS, passing of a title is important as an indicator of transferring risks and rewards of ownership, but it is not a decisive factor for the accounting. Therefore, I would rather searched for the evidence of transferring risk and rewards, rather than a legal title. And no, IAS 18 does not contain any definition of “delivery”. S.

Uncollectible revenue:

If it is probable that an interest income is uncollectible due to previous default in payment, where provision has been provided to all the previous interest income, should we stop recognising the interest income?

Dear Silvia,

We have an agent to whom we ship goods to be sold.

The goods are supposed purchased from USA and sent to Saudi Arabia to the customer.

Purchase terms CIF

Sales terms with the customer are that we send the goods to the agent. he sells in the market, deducts his overheads and then whatever remains, profit or loss is shared in a certain ratio with us.

When do we book revenue in this case ?

What needs to be done with regards to cut off procedures at quarter and year ends.

Please advise.

Thank you and regards,

Aliasgar

Hi Silvia, thank you so much for your work. It’s really helpful.

I have a question I hope you can help with: Entity A and B had an open-book contract, which ended. For the time on the contract there were employed people, for which provisions for employee benefits where created. After the contract was interrupted and all the bills issued by the entity A – paid, the entity B is asking for a credit note in order to return the amount of provisions for employee benefits which were not used. How should entity A account for this credit note?

Many thanks in advance!

Cheers, Ana

Hi Tshechu

If you could also share with us as to what is the final understanding if you are clarified.

Thanking you

Sonam Choeden

Bhutan

Dear Silvia M

Will this para

“Revenue is recognised only when it is probable that the economic benefits associated with the transaction will flow to the entity. However, when an uncertainty arises about the collectibility of an amount already included in revenue, the uncollectible amount, or the amount in respect of which recovery has ceased to be probable, is recognised as an expense, rather than as an adjustment of the amount of revenue originally recognised.” (IAS 18, para 22)

not apply in case of Sonam Choden’s specific case of offsetting.

Tshechu

Dear Tshechu,

I think this paragraph just wants to say that if you have recognized a revenue (and some related receivable), then when you are not sure the client will pay you, you do not decrease the revenue, but you book the provision or adjustment for doubtful debts. So no, this paragraph does not apply for Sonam’s question. S.

Dear Silvia,

Thanks for the clarification. But I would like put forward how I understood about the Sonam’s case. This kind of case normally happens when one company agrees to take up construction work for its client on agreed amount and deadline. The construction company would have billed to the client simultaneously recognizing the receivables in the books of accounts on the completion of the work. Due to non completion of work within the agreed deadline, the client might deduct the penalty amount from the bills and pay the net amount. In such cases, the company will receive lesser amount than the agreed amount of contract (contract amount less penalty) or the billed amount. “So can we net off income and expense(agreed amount less penalty) or show income before deduction of penalty as income and show penalty as expense?”

And if we apply para 22 of IAS 18, I feel the full revenue must be presented on the SoCI and penalty (i.e. amount in respect of which recovery has ceased to be probable) must be presented separately as expenses. Please help me clarify on this.

Thanks

Tshechu

Dear Tshechu,

thank you for clarifying this. I had the impression that the penalty is charged separately. However, it seems that if a supplier does not meet the deadline, his revenue is reduced – in this case, this is not a “separate event”. IAS 18 is not that clear about it, but IFRS 15 is. It says that the revenue making company should estimate the transaction price as the probable amount to be received. So, if the delay is clear, then the transaction price is net of any penalties or reductions.

However, I still insist that paragraph 22 of IAS 18 does not apply here. It really says about bad debts, in fact. The reason is that the revenue is reduced due to non-meeting the deadline and not due to uncollectability.

S.

Dear Silvia

Thanks for the clarification.

Hi Silvia

This is query on offsetting . There is a scenario where the company is providing a service , and income is earned from that service however, due to delay in service , the company providing the service was charged liquidity damages/penalty by the company received the services. So can we net off income and expense or show income before deduction of penalty as income and show penalty as expense.

I would appreciate receiving your comment on the above query.

Thanking you

Sonam Choeden

Bhutan

Dear Sonam,

IAS 1 is quite strict when it comes to offsetting. You should not offset (only at some cases). However, if penalties are not material, then I would offset.

Also, the question is whether the penalty is charged separately, or the contract says that there would be reduction in revenue. Because if there’s a reduction in revenue, then it’s not a separate penalty. IFRS 15 is more precise on that – the company receiving revenue should really estimate the transaction price and incorporate the assessment of meeting/not meeting the deadlines and resulting financial impacts in it.

S.

When a same company act as an principal and agent for their normal cause of business, how we present the revenue in the financial statements?

Principal – Gross basis

Agent – Net basis

If Principal and Agent – What basis?

Divassini,

all transactions in which the company acts as a principal, are recognized on the gross basis, and all transaction in which the company acts as an agent are recognized on the net basis. S.

Thank you Silvia, But when we report the revenue in the statement of Comprehensive Income, there will be a two captions in Revenue.

Revenue from Principal

Revenue XXXXX

Cost of sales (XXXX)

Gross profit XXXXX

Revenue from Agent

Net Revenue xxxx

Can we present like this in the financial statements?

I have confused in drafting the statement of comprehensive income.

Can you please tell how will be the revenue caption presented in accounts by giving me an numerical example?

Kindly awaiting for your response !!!

Hi Silvia,

We are a group of companies. We have several expenses incurred by the top company on behalf of all companies in the Group. We then recharge these expenses to the companies each month (as a fixed recharged). Should this recharge be shown as revenue or netted off expenses? The top company bears the credit risk. There is no percentage or commission earned on this.

Thanks for your help.

Hi Silvia,

in terms of the recognition of revenue for a cost-plus construction contract under IFRS, is the percentage of completion method ever used for a cost-plus contract? Or is the revenue of a cost-plus contract Always equal to the actual costs incurred + Either a % of the actual costs incurred or a fixed fee?

Thank you for your help!

Daniel

Hi Silvia,

I’m thinking that the revenue of a cost-plus contract Always equal to the actual costs incurred + Either a % of the actual costs incurred or a fixed fee. However, I’m not 100% sure, so hopefully you can let me know what you think. Thank you!

Daniel

Yes, Daniel, percentage of completion is also used in cost plus contract. The reason is that the billing can be different from actual cost incurred (thus actual revenue recognized). S.

A Company is an online retail cloth shop. The company website displays the following statement.

“100% refund is guaranteed”

Past Experience of the company is about 1% sales leads refund and returning.

How the company should treat the impact of future returns and refunding in their financial statements.

Hiras,

if you treat your revenue under IAS 18, then you should recognize a provision of 1% of sales at the time of making the sale (this is cancelled after refund period lapses). S.

Hi Silvia

We have Export sales where we are charging Freight & Insurance cost with in the invoice to Customer.

My Question is Under IFRS what would be right treatment for these charges recovered from customer along with the sale of goods.

Shall we show it under gross revenue or Freight & Insurance charges should be adjusted with the actual payment by us to the shipping company.

Appreciate a reply on priority.

Regards

Sumit

Hi Sumit,

that’s more question about the presentation of your income and expenses, rather than recognition of revenue. As you described it, I would present it as revenue, not as adjustment to your cost, because you do not purely re-invoice it, do you? Who is responsible for providing these services? Anyway, also think about materiality. S.

Hi, I will like to seek some advise on whether should we classify our Company as an agent or a Principal. Currently we are buying from our Holding Company and selling to third parties all over the world.

We have been issuing invoices and all the sales related documents to buyer via banks. From there, we will recognize the sales to buyer and purchase from holding company. We don’t have a marketing arms in Singapore, all sales are coordinate in our Holding Company but on behalf for us. Once sales are established, we will purchase from our Holding Company and will shipped directly to third parties. we call this back to back sales.

We still recognize Trade receivable and Trade payables in our book. Under the four criteria that was listed under IAS18, we fulfilled two criteria, which is the inventory and credit risk. Under inventory risk, we will need to take responsibilities when there is any problem with the goods by either giving a discount or refund. And we will then claim from Holding Company which is the supplier if the problem lies on them. Another risk will be credit risk, we are responsible from collecting the outstanding from the buyers before we make payment to Holding Company. We do have a certain percentage fixed before making payment to the Holding Company.

Now I am confused since we do fulfilled a certain part as a principal but yet we also have some similarities as an agent.

So will appreciate if you could help me on the above. Thanks in advance.

Dear Silvia,

Thank you for the sharing.

For a shipping company where there is exchange of container slots onboard of a vessel, may I seek your expertise on below:

1)exchange slots with another shipping company with no cash payment between both party.

Revenue should not recognized at all?

2) exchange slots with another shipping company B with net receivable from B.

The net receivable should be recognized as revenue?

3) if there is no wording of exchange in contract but one party Z sell slots to another party G in jan for transport from point a to b and later in feb, G sell slot to Z for point c to point d. Is this still consider an exchange for similar goods?

Thank you in advance!

Dear CY,

OK let me quickly:

1) If it’s 1 for 1 (at least when fair value is concerned) and the slots are identical, then you are right, this is an exchange of almost identical services and no revenue is recognized.

2) This is a mixed transaction. Here, no revenue for services 1:1 and the revenue only for slots provided for cash.

3) Well, it depends here. Is there some cash settlement? Or is it again just exchange of slot for slot, just in a different time?

S.

Thank you Silvia.

For q3, there are cash settlements hence if to apply the rule, so long there is cash settlements, we will recognize the revenue amount per the cash settlements, right?

Dear Silvia,

Thanks for the helpful summary here and on your YouTube channel.

I need your kind advice and your professional opinion on the below case.

RAM is a manufacturer and seller of TV units. The purchase price of the TV unit includes installation of the TV unit, two years warranty and annual service for three years from the date of purchase. The warranty covers repairs and breakdown whereas the service is for preventative maintenance. The TV unit cannot be purchased outright on its own.

History indicates that one repair will be required to be performed on each unit sold over the two year warranty period.

The company provides maintenance services to customers with RAM TV that do not take this option up-front or whose units are more than three years old. It does not install TV units for non-RAM TV units. RAM can determine the costs of providing each service offered in its sales package.

There are no refunds on the TV units unless they are faulty within three months of installation.

RAM’s competitors sell TV without any installation, service or extended warranties attached to the product. The standard warranty period on sales of all such TV units is one year.

Should this arrangement be accounted for under IAS 18 Revenue, paragraph 13 or 19?

Hi Dear Silvia..

I would like to take this opportunity to express my heartfelt thanks to you for such a productive work.. These lesson are very helpful for me..

Really interesting forum! Tks

Was trying to better understand the linked transactions concept and its consequences from an accountint pow. One simple ex. I have a contract with a supplier that will generate revenues only if i will put in place certain commercial actions, incurring in additional costs that otherwise i will not be subject to.

My approach was to consider this as one single accounting event, netting revenues and income and representing the result in one line of revenues in my financial statement.

Am i going too far in my interpretation?

Dear Giorgio,

I understand your concerns, and indeed, it’s an interesting thought to net it off.

However, for me, it does not appear as true and fair presentation in this particular case (although I have no details). Linked transactions simply mean that you need to assess and account for these transactions as for one, but it does not mean that you really need to net off the revenues and expenses necessary to get these revenues.

You should better look to IAS 1 for guidance. It explicitly says “no netting off” with some exceptions, but your situation simply does not fit to any of these exceptions. I understand that your incremental costs aren’t any discount or rebate and moreover, they are not incurred with the same entity (as revenue), are they? So from what you wrote, I would not be very willing to present net. S.

Hi Silvia

Need your advise urgently. My company is involved in generation of electricity, and we are required to provide certain units of energy free of cost to our government as royalty energy , so in this connection how do i account do we we account royalty energy and if we do at what rate do we account. Non royalty energy are then sold at the rate defined by our regulatory body.

Your advise on this would be highly appreciated.

Thanking you

Sonam Choeden

Bhutan

Hi Sonam,

it depends on the contract with government. I have no idea what other arrangements with your government you have and you need to assess this transaction as a whole, in context of other transactions with them.

If it is a sole transaction, in other words – some kind of tax, then you don’t account for revenue, but if you incur some costs for this royalty energy, you need to disclose it separately. S.

Dear silvia

And yes we do incur expense for production of energy. And yes this is some kind of tax for using public/government resources. For which lets say we are to generate 100 units of energy we are required to provide 15 units as royalty and bill for remaining units of 85 at the rate of 1.45. So for 85 units we recognise as income at 1.45 but how do we account for that 15 units provided free of cost as royalty and if we do account at what rate should we acocunt.

Thanking you

Sonam Choeden

Bhutan

Silvia, I’d appreciate your view on Rev Rec in the following scenario:

A Membership organisation charges a one-off $100 admission fee plus a $50 annual service fee (can be renewed after 12 mths for an additional $50).

The $50 service fee earns the member the right to receive services over a 1 yr period, so Rev Rec will be spread evenly over the 12 months. No problems.

The $100 admission fee is collected from the member and passed over to an external financial institution, which holds it in escrow for 12 months. The external financial institution has a separate agreement with the member to provide credit facilities. In the event of default by the member, the external institution retains the $100 funds. If there is no default by the member during the first 12 months, then the funds are passed back to the membership organisation.

How should the membership organisation rev rec the $100 admission fee? (for simplicity, assume the rate of default after the 12 month period is zero).

Thanks

Thank you for your lesson it’s helpful

Thank you lesson is very useful for me, but I need Questions and answers( Q & A) for IAS 18 to increase understanding

Hi Silvia

As mentioned in my first comment , we would be selling energy during the peak season when we have extra generation and buying the energy during the lean season, so basically there is exchange of electricity for electricity. For eg. Lets say we sold 100 units of electricity during peak season at $ 1 per unit , and we bought electricity of 20 units during lean season at $1 , so payment would only be received for 80 units of electricity.So in this scenario, do we recognize revenue for $100 and expense purchase of energy for $20 or just show net revenue of $80($100-$20).

Hi Sonam,

OK, now I understood. Before, I missed that part in which you stated that you actually buy some electricity back – I thought that you simply sell less in a lean season (not buy back).

Well, in this case, it’s really commodity for commodity, so under IAS 18, you should recognize just net revenue, as one for one does not give rise to any revenue. I know it’s easier to do it on the gross basis, but that’s not what IAS 18 requires. S.

Dear Silvia,

As per your comments, if they will net off the energy sold and energy bought, its mean entity have to defer the energy sale revenue until it become clear in lean season how much actually bought, then later net it off (sale-buy energy) it is the time difference,

I think best solution will be if they recognize revenue grossly 100 unit energy in peak season and make a provision of estimated buying in lean season. at the end of reporting period what ever actual (+-)buying is happening it should be adjusted in Cost of Sale section of (P+L).

please comments, is such treatment is acceptable……?

Yes Muhammad, you made a valid point. I just pointed the basic rule – swap is simply recognized as swap, but the standards do not solve details or technicalities.

I also think that if there’s a bigger time shift between sale and purchase in the lean season, I could defend the gross treatment (that’s what you also proposed in the end) instead of the net treatment, as the prices might shift and the fair value of the same good came be different in different seasons.

You see, there’s a lot more to assess and really, it would require closer look to the agreement and the substance of the transaction.

Thank you,your lessons are extremely helpful for us!

Hi there

We are looking into energy banking where by energy sold when there is excess energy during peak season will be adjusted against energy bought during the lean season , how do we account when there is actually no inflow of cash.

Thanks

Hi Sonam, I think this is more about settlement than revenue recognition. You should recognize revenue when you deliver the electricity. When there’s no cash, then simply put it to unbilled revenues (Dr. Unbilled revenues / Cr. Revenue). You would clear your “unbilled” account during low season when less electricity is delivered, but part of cash is received for the previous higher deliveries. Hope it helps! S.

Hi Silvia

Thanks for the comment , and yes like you said we do recognize revenue on gross basis, but my confusion was mainly because to quote the abstract from IAS 18 ” When goods or services are exchanged or swapped for goods or

services which are of a similar nature and value, the exchange is not regarded as a transaction which generates revenue ” so based on this abstract i am still not sure whether to account revenue at gross or net.

Hi Sonam,

hmm, maybe I did not understand you correctly – but what is the exchange? You change electricity for what? IAS 18 is referring to situations when commodities or goods are swapped, e.g. you exchange sugar for oil, etc. But in your case, I think, you’re just delivering electricity and the buyer buys whatever amount you produce, isn’t it? S.

Hi Silvia M. will you give me a recommendation and applicability for this topic. Thank you 🙂