How to account for income from loan application fees?

“I work for a banking industry and my bank is charging a fee of 3% for each loan issued to customers on some of loan categories. However such fee is divided into two categories:

- Loan Origination Fee of 1 % is amortized over the loan period. Currently we are using straight-line as an alternative for effective interest method, and

- Loan application fee is 2%. This is fully recognised as income in profit or loss because management states that it is directly linked to freely transacting via Bank’s agent network across the country along with administrative fees limited to cost of stationeries, credit checks, security and business appraisal.

Is this treatment OK under IFRS?”

Answer: It depends.

Nice question.

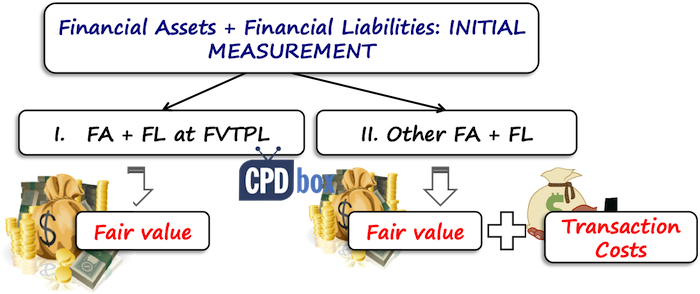

First of all, the treatment of all these transaction costs depends on how you classify the financial instrument.

Here, I’m going to focus on financial assets, because the question relates to the bank providing a loan, thus generating financial assets:

- If you classify the financial asset at fair value through profit or loss, then you must recognize the transaction costs in profit or loss when they arise.

- If you classify the financial asset at fair value through other comprehensive income or at amortized cost, then the transaction costs enter into the initial measurement of the financial asset.

I guess most of the retail loans provided by banks to the customers is indeed measured at amortized cost, because they usually meet the two criteria for amortized cost measurement.

Well, you can learn more about the classification of loans in the podcast episode n. 4.

So, it is clear that if the loans are at amortized cost category, then the transaction costs enter into the initial measurement.

Subsequently, you should amortize these fees or costs over the expected life of the loan.

In most cases, they are included in the effective interest rate calculation, but yes, you can use alternative method of amortization.

Now, we need to distinguish what the transaction fees are received for.

Here, focus on what the customer gets for these costs or what service is delivered to the customer.

Do NOT look at what own expenses the bank wants to recover by charging those fees – like security cost, cost of running the branch, etc. – it is not relevant here.

The standard IFRS 9 gives us some guidance on which fees associated with the loan are transaction fees and which are not the transaction fees.

What is the purpose of these fees? Why did the bank charge them?

The most common types of the transaction fees are:

-

- Origination fees on creation of the loan.

The bank usually charges these fees to cover its costs for evaluating the borrower’s financial condition, for assessment of guarantees or collateral, negotiating the terms of the loan, preparing the loan contract and other similar activities.In other words, origination fees cover the activities that result in creating the loan.

- Origination fees on creation of the loan.

Another type is

- Fees charged for loan servicing.

These fees are charged usually throughout the life of the loan for the administrative aspects for the loan, like fees for sending monthly payment statements, collecting the payments, maintaining the records and other items.

It seems that the bank from today’s question charged loan application fees to partially cover its expenses related to loan generation and loan servicing, too.

The loan servicing fees are NOT the part of the loan’s initial measurement, but these are accounted fr in line with the standard IFRS 15 Revenue from contracts with customers.

What does it mean in this case?

It can happen that the loan servicing fees are charged up front in one sum at the time of generating the loan.

But, you still cannot recognize them straight in profit or loss at the time of charging them.

The reason is that under IFRS 15, you have to recognize them as revenue when you meet the performance obligation – in this case, when you service the loan, over the life of the loan.

Thus, the right accounting treatment would be to recognize the loan servicing fees received up front as a contract liability under IFRS 15 and subsequently, derecognize the contract liability over the life of the loan.

Illustration – loan transaction fees

Let’s say that the bank provides a loan of CU 1 000 for 3 years and charges the fee of CU 100, thereof

- CU 50 for the assessment of borrower’s situation and collaterals, and

- CU 50 for loan servicing over the life of the loan.

The loan is at amortized cost.

The accounting treatment of the loan is as follows:

- Initial recognition of the loan:

- Debit Financial Assets – Loans: CU 1 000

- Credit Cash: CU 1 000

- Transaction cost – loan origination fee:

- Debit Cash: CU 50

- Credit Financial Assets – Loans: CU 50<l/i>

- Transaction cost – loan servicing fee received upfront:

- Debit Cash: CU 50

- Credit Contract liability: CU 50

When loan servicing fees are charged monthly instead of one up-front fee , then they can be recognized straight in profit or loss, because the receipts would be roughly aligned with the pattern of providing the service to the customer – which is OK under IFRS 15.

Any questions or comments? Please let me know below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

46 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello Silvia, thank you for your valuable discussion.

But the company who will receive that loan at their preoperating stage i.e. under construction, (not started the operation) will it be treated as finance cost under preoperating expenses or will be treated as a separate line item i.e. Loan Processing Fees under preoperating expenses?

Hi Silvia,

I am confused, about whether to consider ECL on loan receivables when calculating the asset under management or not.

Grateful if you could please guide me.

Hello, Silvia thank you for another useful topic.

I have question about penalty fees. When costumer is fined on loan overdue. Should I treat penalty fees under IFRS 15? IF it is so, then is it a variable consideration? Entity has a practice that some fees are forgiven and written off. Should i account it still on accrual method?

Hi Sandro,

it depends. If it is a fixed fee, then treat it under IFRS 15 (just straight in P/L if it is the fee related to that period, it depends on the contract); however if it is an increased interest rate on that loan, then treat it under IFRS 9 – but in practice, if you will apply the penalty interest only in the next period, not over all the loan term, then basically you can just recognize it in profit or loss because it does not make a big difference.

Hello,

I have a situation where i am charging loan disbursement fee (one off). This is being recovered in full i.e 1% of the loan value. As stated earlier, the purpose of this fee is to cover its costs for evaluating the borrower’s financial condition, for assessment of guarantees or collateral, negotiating the terms of the loan, preparing the loan contract and other similar activities.

Kindly guide me:

Assuming the loan is a 2 year loan, and the fees is recovered as a one off – Should i amortize these fees over the life of the loan or i can earn these fees straight into my P & L or what guidance does IFRS 9 recommend?

Hi sylvia,

Thank you for this valuable guidance. However I would like to know the reference from IFRS allowing to use alternate amortization method for amortizing transaction cost/processing fee.

Thanks in advance

Hi,

Could you please tell me how to amortize upfront fees in case of a bank loan with variable interest rate

Hi Silvia,

Suppose bank has sanctioned loan of £2m to customer, however, its only partially disbursed. Can you please advise how to account this in books? Further, where to charge the Int and processing fee?

It would be great, if you could advise via journal entries.

Thanks in advance & looking forward to hear from you.

Hi Silvia,

For example. A client took a term loan from the bank and paid some percentage of the total loan value as management fee. Say USD 200 million term loan and .05% management fee in order to activate the facility with the bank. This management fee is non refundable even the client later decided not to with draw. How should the client record the management fee in his books?

As a part of the measurement of the loan – i.e. include it in the amortized cost table as cash out. For example, you got 200 mil. loan and paid the fee of 10 mil., thus your net cash in is 190 mil. and your effective interest rate goes up. S.

Hi everyone,

I work in a bank, and actually the bank is designing a loan for which a fee would be given from to the real estate agency for the intermediary services, while the customer would bear the total commission ( intermediary commission and disbursement commission). How would the bank defer this commission, on net basis, meaning disbursement commission of the customer – intermediary commission? Or should this commission be deferred individually, defer as expense the intermediary and defer as income the disbursement commission.

I would like to have some opinions on the matter.

Hello Silvia,

I currently work for an investment bank. It’s financial assets are classified as amortised cost & FVOCI. In purchasing these financial assets, the company incurs brokerage charges which are paid upfront and are added to the asset value and recognised at the initial stage.

I believe per the rules of IFRS 9, this transaction cost (i.e. the brokerage charge) are supposed to be amortised throughout the life of the asset.

If I am right, what is supposed to be the correct amortisation treatment of the transaction costs? Should it be a daily thing, monthly or yearly? This is because I strongly believe the accounting system being used is not doing the correct treatment.

Company is in the business of Lease, the company also charges 1% of the finance amount as the processing fees,This fees is non-refundable and is collected in lieu of the processing the application

There are directly attributed functions related to the fees in terms of application processing, review, credit analysis etc. How we treat this processing fee?

Hello Sliva,

Thanks, i do have a question what if my company made an early settlement for Part of the loan, what should we do with the loan Upfront fees?!

1.should it be amortized over the remaining loan period or,

2.should it be treated as prorate of the remaining balance of lone.

Much appreciated

Hussein

if the loan portfolio is assumed to be at amortised cost

Hi Silvia, how does one account for loan portfolios in terms of journals?

Hi Silva,

How would committment fee be treated by borrower after IFRS 9 amortised cost? (Fees paid before the lender has paid loan) Accrue until loan is paid, and then amortized over loan, or expensed directly to P&L?

Hi Silvia, many thanks for the quick response. I have requested for the information from their team and currently awaiting their response. In the mean time, one of my colleague has sent a mail to your team asking for details of the cost of your yearly IFRS learning videos. The mail came from jadedeji@axxelagroup.com Kindly ask your team to check and revert to us. We plan to always subscribe for this on a yearly basis. I can tell your team is doing a great job on this.

Hi Ayoola, thank you! We haven’t received any e-mail from that e-mail address so far, but if you write us via contact form, we will get back soon.

Hi Silva, what is the correct classification of transaction cost on Financial liability (Bank loan with Variable Interest Rate) carried at amortized cost. My Auditors have argued that given that the loan has Variable Interest rate , the related transaction cost be treated as a financial asset and splitted into Current & Non-current.

Please ask them for a reference in IFRS 9 for this treatment, I am eager to know. Thank you!

Hi Silvia, I would like to be clear with this. If a bank as part of their negotiation agrees to take up the legal costs of moving a mortgage from one bank to their bank would that be considered an origination fee and therefore be eligible for amortization over the life of the loan?

Hi Siliva,

How commitment fee is treated in accordance with IFRS 9? commitment fee is charged on loans authorized by the lender but not taken by the borrower. The Company measures the financial liability initially at fair value through profit or loss and subsequently at amortized cost. Could you please indicate the specific paragraph of the standard?

I have doubt, when I’m

Disclosing the loan amount in the balance sheet do I need to show the net amount after deducting the arrangement fee or show the loan and the arrangement fee separately

Hassa, since the application fee is a part of the effective interest method, it is not shown separately.

Hie Silvia. I am confused on the best way a company should treat embargoed Funds/ Blocked funds as a result of sanctions imposed on the company by US.

My company had many payment receipts blocked by US years ago. The current practice is accounting them as current assets. Is this correct? Another thing also is that the company is no longer on the sanctions list effective early last year but funds are being released slowly. The following is a list of outstanding amounts to be released.

Date Client Amount

Blocked

7/29/2008 XY 10,702.40

8/6/2008 NZ 2,150.00

8/6/2008 PP XY 10,775.00

8/18/2008 Hond 2,509.17

8/19/2008 Place TC 765.00

9/2/2008 London 14,442.45

3/8/2010 TMZ 76,931.00

Should we account these as current assets?

Hi Silvia, thank you for this interesting article, I have one short question, You have stated that the contract liability shall be derecognized during the life of the loan (in this example 3 years, which assuming straight line would mean CU 16,667 every year of the loan). What would happen with the remaining balance of the contract liability, if for example after two years the loan is impaired and the bank has 100% recognized expected loss (i.e. believe that it is not possible to collect the loan)?

Hi – If the fees was changed during the loan tenure will the amortization calculation be retrospective from the loan effective date or prospective from the date when the fees was changed?

Thank you for this! I hope you could answer my question in relation to the third entry. How do you recognize the service fee if it was deducted from the amount of the loan?

Hi Silvia,

Thank you again for the explanation. we have such fees in my Bank. my question would be,

1. For the loan origination fees, as we are charging this for cost recovery purpose can we deduct some related costs from the fee before crediting to the FA-loan? e.g. out of the 50 say 30 is direct cost the bank incurred. what would be the accounting treatment?

2. Regarding EIR, is this some thing different from contractual rate agreed with the borrower? and in the absence of any fees (loan origination fees), can we say contractual rate equals EIR?

regards

Gadissa M

Thanks for bearing my questions.

But in example you have mentioned that “Let’s say that the bank provides a loan of CU 1 000 for 3 years and charges the fee of CU 100, thereof

CU 50 for the assessment of borrower’s situation and collaterals, and

CU 50 for loan servicing over the life of the loan.”

Initially you have stated loan amount as 1000 and origination fees as 50 then may I know why are we netting off loan and origination fee in journal entry?

May I please refer you to the chapters in the IFRS Kit that are related to the initial measurement of financial assets? I think you are my subscriber and everything is very clearly explained there. S.

I understand what you are trying to say Gayatri. I am also confused. If you borrowed 1000, and were charged a sum of 100 for borrowing the money. why should the charge be adjusted with the borrowing amount because that is not an installment. An installment and a transaction cost are two different transactions. An installment reduces a loan amount but why should a transaction cost. To me it feels like an incorrect netting off transaction. That the carrying amount of a liability is reduced by the fees.

Hi Silvia,

Thanks for your article.

I have one question on the journal entry for loan origination fees. In entry you have credited “financial assets loan’. Would this entry not reduce “financial assets loan”? whereas loan origination fees is part of p&l.

Hi Gayatri,

well, I don’t get it. Loan origination fees reduce the financial asset – loan, they don’t enter profit or loss – please see explanation above. S.

Initial loan is recorded for 1000 by debiting “loan financial assets” and in second journal entry above you have credited “loan financial assets” for receipt of loan origination fees of 50. Would it not make loan to 950?

Oh yes and that’s correct.

But my question is why loan origination fees would reduce the amount of loan from 1000 to 950? can you please explain.

Because the bank gave cash of 1 000, but immediately received 50 back in form of origination fees, so the net loan provided was 950.

Hi thanks so much for explaning about fees. would you send me the tools to caculate effective interest rate

Thank you for this summary. But what if as a result of assessment of borrower’s situation, the bank refuses to issue a loan for him/her? As you know, the bank first charges the customer to carry out this assessment (application fee) in advance. It is not supposed to return the fee due to the unfavorable results of the assessment, right?

Hi Baybala,

thanks a lot for the comment!

Well, it depends on the agreement between the lender and the borrower, but in any case – if this fee is not refundable, it is specifically charged for the assessment of the borrower’s situation, then it is recognized in profit or loss when the assessment is performed. The reason is that when the assessment fails, then there’s no financial asset created and there’s noting to amortize. Best, S.

Hello.

Thank you for the insight. My question is this: What would be the accounting treatment in the borrower’s books for that example?

I would have thought it would be a straight one-off expense for any failed loan applications. Cr Cash, Dr Expense, since an amount has been spent and there is no further loan or asset from the potential borrower’s perspective.

will this be a finance cost or bank charge?

Hi, I’m confused as to the definition of the assessment fee.

Is the assessment fee considered an ‘activity in evaluating the borrowers financial condition’ and therefore included as transaction cost with only the failed assessment fees being taken to P&L (given there’s no asset created) – or are you saying that only if the assessment fee is non-refundable do they all go to P&L? thanks