IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

Updated: April 2025

IFRS 15 sets out the 5-step model for recognizing revenue from contracts with customers. This guide simplifies each step with practical examples — including a telecom contract case — plus it includes a free video lecture and downloadable IFRS 15 Journal Entry Template (PDF).

Jump to section:

1. Free VIDEO lecture: 5-step model under IFRS 15 (with solved example)

2. What is 5-step model and should we really apply it to ALL contracts with customers?

3. Short simple example: Simple shop purchase

4. More complex example: Telecom contracts

- 4.1 Step #1: Identify the contract with the customer

- 4.2 Step #2: Identify the performance obligations in that contract

- 4.3 Step #3: Determine the transaction price

- 4.4 Step #4: Allocate the transaction price to the individual performance obligations

- 4.5 Step #5: Recognize revenue when or as the entity satisfies a performance obligations

- 4.6 Journal entries

5. Conclusion – the main point of IFRS 15

6. FREE DOWNLOAD – IFRS 15 Journal Entries Template

7. Further reading and learning

1. Free VIDEO lecture: 5-step model under IFRS 15 (with solved example)

Return to top

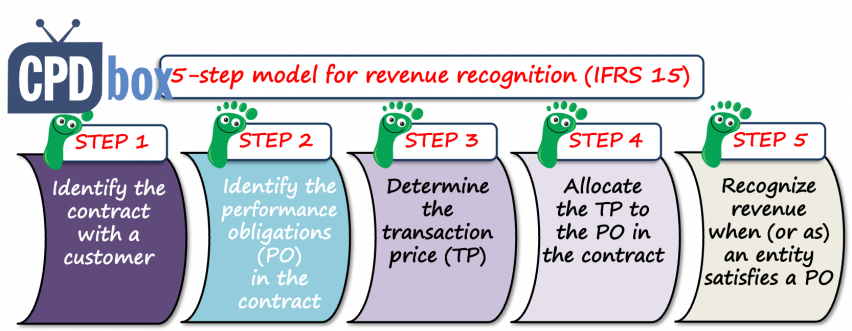

2. What is 5-step model and should we really apply it to ALL contracts with customers?

Even the simple shop sales of groceries?

The short answer is YES, you should, because 5-step model represents five steps that you should apply to ALL contracts with customers.

However, if the transaction is very simple, then the 5-step model is easy to apply, without thinking too much about it.

Return to top

3. Short simple example: Simple shop purchase

The customer just walks into the shop, buys newspapers for 3 CU and chocolate bar for 1 CU, pays you and walks out.

Strictly applying this model:

- The contract: It is the customer’s acceptance of shop’s terms in line with the applicable laws;

- The performance obligations: The newspapers and chocolate bar.

- The transaction price: 4 CU (3+1)

- The allocation of transaction price to the individual performance obligations: CU 3 to newspapers and CU 1 to chocolate bar.

- Recognition of revenue AT the point of time: At the time of purchase, because the customers takes newspapers and chocolate bar.

That’s it.

Easy, right?

Well, of course, the complications arise when there are some rules or terms attached to the contract.

In such a case, my recommendation is to go through each step carefully.

Let me illustrate on an example.

Return to top

4. More complex example: Telecom contracts

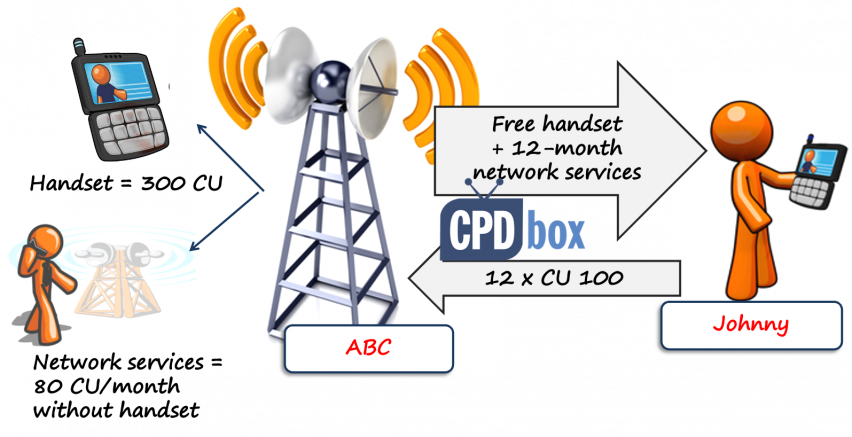

ABC, a telecom company, entered into a contract with Johnny:

- Johnny subscribes for ABC’s monthly plan for 12 months, and

- as a bonus he receives free handset from ABC Corp. immediately after contract signature,

- Johnny will pay a monthly fee of CU 100.

ABC sells the same handsets for CU 300 and the same monthly plans for CU 80/month without handset.

How should this telecom company account for that contract?

Warning before we start applying the 5-step model:

You just cannot treat the mobile phone as a marketing cost. That’s wrong and that’s what changed by IFRS 15.

Now, let’s start with 5-step model.

Return to top

4.1 Step #1: Identify the contract with the customer

Here, it is very straightforward, because ABC has a written contract with Johnny.

4.2 Step #2: Identify the performance obligations in that contract

Performance obligations are simply the promises that the telecom company gave to Johnny in that contract. Here, we have two in fact:

- Network services or connection for 12 months

- Phone that the company gives to Johnny right away after signing the contract.

4.3 Step #3: Determine the transaction price

It means to determine how much in total will Johnny pay to ABC.

He should pay 100 CU per month over 12 months, so that’s 1 200 CU in total.

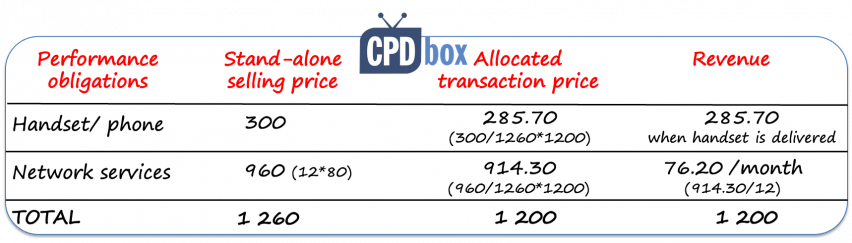

4.4 Step #4: Allocate the transaction price to the individual performance obligations

This is where it becomes interesting.

We know that total transaction price is 1 200 CU (see step #3) and we need to allocate it based on the relative stand-alone selling prices.

The stand-alone selling price is simply the price at which ABC would sell the handset and network services separately.

From the information in the example, we know that:

- ABC sells similar phones at CU 300, and

- ABC offers similar monthly plans for CU 80 per month if purchased without handset.

Therefore, the total of stand-alone selling prices is CU 1 260 (being CU 300 + CU 80*12).

Now, we can do the allocation in the table:

So, you can see, that we allocated CU 285.70 to “free” mobile phone and CU 914,30 to the network services (CU 76.20 per month).

Return to top

4.5 Step #5: Recognize revenue when or as the entity satisfies a performance obligations

There are two basic ways of satisfying the performance obligations:

- Over time: this would apply to the network services; and

- At the point of time: this applies to the mobile phone delivered at the time of contract start.

This step is important to determine WHEN to recognize revenue in your journal entries.

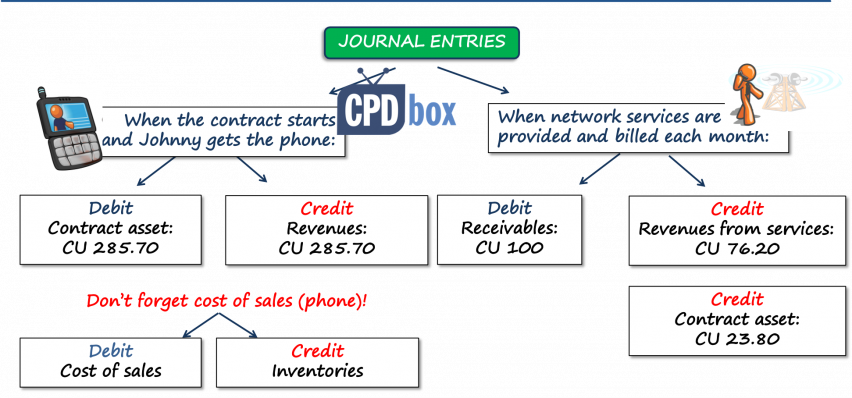

4.6 Journal entries

Let’s wrap it up and draft the journal entries which ABC passes in connection with the Johnny’s contract.

At the start of the contract when the phone is delivered:

- Debit Contract asset: CU 285.70;

- Credit Revenues from sale of a phone: CU 285.70;

As you might notice, the amount of CU 285.70 comes from our table in the Step #4. It is the amount allocated to the phone.

Also, why contract asset and not receivable?

Well, in short, because ABC does not have any right to issue invoice to Johnny in the amount of CU 285.70, as the phone is given for “free”.

If you would like to more about the difference between contract asset and receivable, please see here (with video).

At the end of each month when ABC issues monthly invoice for the network services:

- Debit Receivables: CU 100;

- Credit Revenues from network services: CU 76.20;

- Credit Contract asset: CU 23.80;

The amount of CU 76.20 for the revenue from network services comes from the allocation table in step #4. Again.

And, the amount of CU 23.80 is just the balancing amount between the receivable of CU 100 (invoicing to Johnny) and revenues recognized (CU 76.20).

Over 12 months of services, the contract asset gradually decreases to zero.

CU 23.80 * 12 = CU 285.60

OK, OK. The initial contract asset was CU 285.70, so sorry for my rounding here.

5. Conclusion – the main point of IFRS 15

The main point of IFRS 15 is to ensure that revenue is recognized in a way that reflects the transfer of goods or services to customers at an amount that reflects the consideration the entity expects to receive.

In other words – IFRS 15 requires us to look at the contract and ALL of its promises, while none of these promises are free to the customer, but the customer pays a part of the total price for those “free” promises, too.

Instead of recognizing zero revenues for phone and CU 100 per network services, you should recognize some revenue for mobile, too, based on relative stand-alone selling prices.

The mobile phone is NOT a marketing cost.

Return to top

6. IFRS 15 Journal Entries Template – FREE DOWNLOAD

Here’s the list of the most common IFRS 15 journal entries related not only to these examples covered here, but also other cases and transactions in line with IFRS 15:

- Contract with a customer is signed: no entry

- Advance payment is received from a customer:

- Debit: Bank account;

- Credit: Contract liability.

- Performance obligation is satisfied AND advance payment was received from a customer:

- Debit: Contract liability;

- Credit: Profit or loss – revenue.

- Performance obligation is satisfied AND advance payment was NOT received from a customer:

- Debit: Contract asset;

- Credit: Profit or loss – revenue.

- Performance obligation is satisfied AND invoice to a customer is issued at the same time:

- Debit: Trade receivables;

- Credit: Profit or loss – revenue.

- Revenue is recognized based on progress towards completion:

- Debit: Contract assets;

- Credit: Profit or loss – revenue.

- Invoice issued for the work done (if < than revenue recognized over time):

- Debit: Trade receivables;

- Credit: Contract asset.

- Payment received from a customer for the goods, but with a right of return:

- Debit: Bank account;

- Credit: Refund liability.***

- ***Assess the probability of return.

- Goods delivered to the customer, but with right of return within XY days:

- Debit: Asset – right to recover goods;

- Credit: Inventories***.

- ***Assess the probability of return.

- Revenue recognized when right of return expires (see entry n. 8):

- Debit: Refund liability;

- Credit: Profit or loss – revenue.

- Cost of sales recognized when right of return expires (see entry n. 9):

- Debit: Profit or loss – cost of sales;

- Credit: Asset – right to recover goods.

- Customer decided to return goods (see entry n. 8) – refund payment:

- Debit: Refund liability;

- Credit: Bank account.

- Customer decided to return goods (see entry n. 9) – receipt of goods:

- Debit: Inventories;

- Credit: Asset – right to recover goods.

- Costs to fulfil a contract with a customer that meet criteria of IFRS 15:

- Debit: Asset – contract costs;

- Credit: Payables / bank account / cash***.

- ***Depending on payment method.

- Amortization of costs to fulfil a contract (see entry n. 14):

- Debit: Profit or loss – amortization of contract costs;

- Credit: Asset – contract costs.

- Revenue recognition when there is a significant financing component in the contract:

- Debit: Trade receivables***;

- Credit: Profit or loss – revenue***.

- ***At present value, using appropriate discount rate (IRR).

- Interest revenue on receivables – significant financing component (see entry n. 16):

- Debit: Trade receivables;

- Credit: Profit or loss – interest income***.

- ***Using appropriate discount rate (IRR).

- Expected credit loss allowance on contract assets and assets related to costs to fulfil a contract:

- Debit: Profit or loss – ECL allowance;

- Credit: Contract asset or asset – contract costs.

7. Further reading

Explore more on IFRS 15: Visit this page to access the full library of all IFRS 15-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

If you have any question, please leave a comment below – I read every single one. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

8 Comments

Leave a Reply Cancel reply

Recent Comments

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Really helpful and easy to follow, But a simple question, is it nesseary to make a cost of sale entry directhy affter the recognizing the revenue from the sale of handset or we can wait til the end of period to identify the cost of sales for all handsets within the period.

Really helpful and easy to follow! The examples make everything much clearer.

Wish to be able to make such wonderful content myself. Thanks for sharing this Silvia

It was really helpful

Thanks

Hi Silvia,

Thank you for sharing your knowledge on IFRS 15, your content is amazing, and easy to understand. Can you please also provide your knowledge on how to account warranty as per IFRS 15

Explained very well through the telecom company example……..now deferring the revenue recognition is not possible.

Hi Silvia,

Super efforts by you !

Hi Silvia,

Thanks for sharing . Both your blogs and videos have amazing and useful content which are easy to understand and comprehend.