Contract Asset vs. Trade Receivable – What’s the Difference?

When the new IFRS 15 introduced contract assets, it caused a bit of confusion among accountants, although it is not completely a new concept.

When to account for a contract asset and when for a trade receivable?

Analogically, when to account for a contract liability and when for a trade payable?

Here’s the question from my reader:

“What is the difference between contract asset and an account receivable? I know that contract asset is a new term under IFRS 15, but I just don’t understand when we should account for a contract asset and when to account for a trade receivable. Isn’t it the same?”

IFRS Answer: Contract asset vs. trade receivable

The answer is – NO, it is not the same thing.

I will try to explain the definitions of both terms and try to explain in a simple human language with common sense what the difference is.

Then I will illustrate it in the example.

What do the rules say?

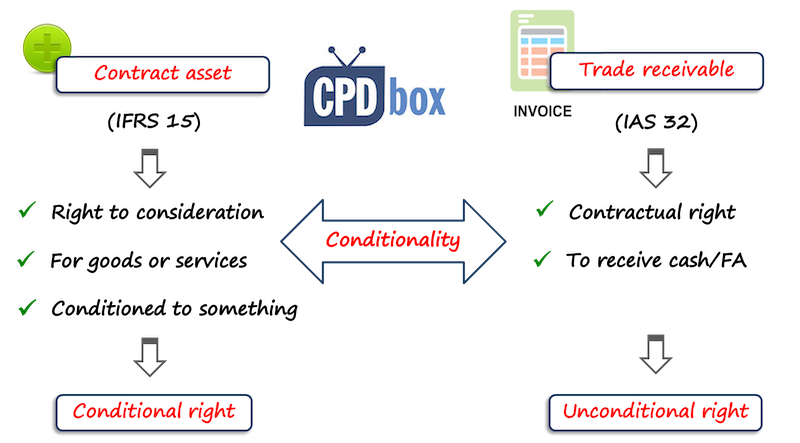

Contract asset is the term defined in IFRS 15 as an entity’s right to consideration in exchange for goods or services that the entity has transferred to a customer, when that right is conditioned on something other than the passage of time, for example the entity’s future performance.

Trade receivable or account receivable is a financial instrument defined by IAS 32 as a contractual right to receive cash or another financial asset from another entity.

As you can see, the main difference between the contract asset and a trade receivable is conditionality.

Contract asset is a conditional right, while a trade receivable is an unconditional right.

OK, you might think, but what does that actually mean?

When should you account for a contract asset and when for a trade receivable?

A contract asset arises when you as a supplier have already performed something – deliver part of the services or goods as agreed – but under the contract, you still have something to do before you can bill the client.

Illustration: contract asset vs. account receivable

Imagine you agreed to build a hotline center for your big client. The project will take 9 months and starts 1 July.

Total contract price is CU 100 000.

In the contract you agreed that the customer would pay you for the whole project when the hotline is complete and handed over to the customer.

OK, a bit unrealistic, but let’s keep it simple to illustrate.

At the year-end, you have been working on the project for 6 months and under IFRS 15, you need to recognize the revenue based on the progress towards completion.

You assess that the project is 70% complete, so you book 70% of the total price – that is CU 70 000.

What’s the journal entry?

The credit side is the revenue, but what’s the debit side?

Well, a contract asset.

Not a trade receivable.

The reason is that at the end of the year, after only 6 months of work, you do NOT have the unconditional right to a payment.

The condition that you must meet before you get paid is to complete the project.

At the end of the year, this condition has not been met yet, so you CANNOT recognize a trade receivable.

Instead you debit contract asset. And the journal entry is:

- Debit Contract asset: CU 70 000

- Credit Revenues: CU 70 000.

Then, you work for another 3 months, you complete the project and hand it over to the customer.

At that moment, you have an unconditional right to a payment and not a contract asset of any kind.

Also, you have to recognize revenue over time for these remaining 3 months.

So what is your journal entry?

- Debit Trade receivables: CU 100 000 – because the unconditional right to a payment was created by handing the project over to the customer,

- Credit Contract asset: CU 70 000 – because your conditional right created last year turned into trade receivable or the unconditional right, and

- Credit Revenues: CU 30 000 – because you need to recognize the revenues for the last 3 months based on the progress towards completion.

I think that by now you should have a good understanding of the difference.

I published a nice solved full example on construction contracts on my website, so don’t forget to check it out.

What about impairment?

Last but not least.

Contract asset is NOT a financial instrument, so IFRS 9 does not apply here, with one exception: impairment.

So, you have to assess the contract asset for any impairment, determine the expected credit loss and recognize a loss allowance – exactly as with any trade receivables you have.

Here’s the video summing up the issue:

Any comments or questions?

Please let me know below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

62 Comments

Leave a Reply Cancel reply

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello Silivia, your articles are my go to for any doubts I may have. In relation to trade receivable, if a company bills a client in advance of work done. The invoice has a 30 days credit terms. What are the double entries if the 30 days credit falls due before year end and after year end. Does the 30 days really matter for accounting purposes or just billing.

What of the difference between Contract liability and Trade payables, are they related?

The difference is : A Contract liability arises in lack of the ability to recognize the revenue yet, because the performance obligation is not satisfied yet ( For example, the entity has promised to deliver the goods/services but has not been able to do so yet) . On the other hand, either a) the consideration/payment has been received or b) the entity has (already) an unconditional right to receive the consideration (which has not been paid yet).

The journal entries would be for both cases as follows

a) Bank Account Debit to Contract Liability

b) Accounts Receivable Debit to Contract Liability

On the other hand, Trade payables are our obligation to pay because we have received/obtained goods/services. Here it is already a liability that is assumed and recorded. Example: An entity buys goods and according to the contract is supposed to pay as soon as the goods are delivered. Upon receipt of the goods, the entity would pass the following journal Entry :

Raw materials/Goods Account Debit to Trade Payable

(PS : Sales Tax payable ignored)

PPS: A contract liability is associated with REVENUE a Trade payable is related to procurment.

GD Silvia,

Thank you so much for the explanation.

I have doubts about the agency scheme. if my company performed work as a agent, may we recognised CA on these?

I cannot really say, because I have no idea what the contract between “agent” – “principal”- “customer” is.

How about the Goods in transit and contract asset difference? Do you have something to say ?

Thanks for your detailed explanation however please explain further:

– Contract consists of goods and service both and length of contract is 3 months for example.

– once you supply the goods then delivery note is being raised and after getting customer acknowledgement we normally raise the invoice for the consideration towards supplied goods.

– so please let me know in case job will be getting over in 3 months then how supplied goods will be treated in the books as “goods delivered but pending for invoicing” and when risk & rewards against the goods will be transferred to customer?

– In case supplier doesn’t have project accounting module.

– Project value is USD 50k of which goods value is USD 30k.

– Please explain how the accounting entries to be posited into monthly closing.

I am looking at a company that provides the following reconciliation

Contract assets O/B

Add : Revenue recognized during the period but not yet billed (A)

Add: Contract asset additions (B)

Add: Contract assets acquired through business combinations

Less: Contract accounts classified to receivables

Contract assets closing balance

Trying to figure out the difference between A and B above? shouldn’t this be the same?

Hi Ahamed,

that was the first question that popped in my mind when I read through the first 3 lines. I advise you to go and ask that company directly what and why they differentiate. S.

Many thanks Silvia. Gives me the confidence to ask.

I’m wondering whether this is due to contracts that the company has started work on but is not recognizing revenue just yet, as these have not completed a minium threshold in percentage of completed.

Will ask, thanks.

If that is the case, where’s the other side of the journal entry?

If your CU is a foreign currency for the contract assets, should you revalue for exchange differences ? My take is yes. I just spent the last one hour trying to convince my Auditors that it must be revalued because at the end of the contract you would have book differences that arose from exchange rate differences.

Hi Silva, thank you for that awesome explanation

I have a question how can i calculate the ECL for the contract assets ??

should i use the same rates applicable for the AR Or i need to apply a new study for only the contract assets ?

Hi Khaled, it depends, but in general – contract assets have their counterparty (=your client), so applying the same ECL rates as for the receivables with the same client is acceptable.

Hi Silvia, for gym membership businesses , if the members had subscribed for memberships in 2019 (12mths), but the membership duration is overlap (6mth in 2019 – fees paid and 6mth in 2020 – fees unpaid) whereby the FY for this gym is 31 Dec 2019, does the 6mth membership fee in 2020 is consider as contract assets as at 31 Dec 2019?

How about assets recognized according to para 91 -95 .

the cost of obtaining the contract or incurred to fulfill the performance obligation and not accounted for as PP&E , Inventory or Intangible assets .

how shall I apply para 103

Hi Mohamed, OK, so I think I must make another article explaining the difference between contract costs (that’s what you are referring to) and contract assets (that’s what I am referring to in this article). These are not the same. S.

Thank you Silvia

HI Sylvia,

I have one query to understand on contract asset, If company sales employee cracks the contract with customer for software services of two year lets say in Aug’2020 and after signing the contract company pays sales commission to the employee. so as per IFRS 15 we would recognize the revenue as per performance obligation is met and the sales commission is capitalized by creating asset debit to credit capitalized cost. so, please understand me if company needs to present Deferred commission asset as contract asset or under trade & other receivables under Balance sheet.

Hi Madhukar, sales commission is NOT a contract asset. It is a cost to fulfil the contract which is a completely different thing and yes, you need to show this in the balance sheet, too.

Thank you Silvia for your prompt response, and I am going through your each article of IFRS and you have explained each standard conceptually in easy to understand.

May I request you to share one reason as why we should not club Sales commission under contract asset?

Because it is NOT a contract asset. Contract asset is by definition something else – simply said when you deliver more than you have right to bill.

HI,

Will this also apply to a long-term contract such as real estate development where the payments will be received only after development?

Hi Silvia, what about other receivables such as negative salaries of employees, housing and car plan loans receivables. Do they need to be assessed for impairment? Thank you.

Hi Silvia, What would be the deferred tax implications of a contract asset? Would it be the same as trade receivables? What would be the tax base be? Perhaps you can use a simple example.

I am a big fan from South Africa and i like your explanation. Can you please come up with example from this concepts: “Refund liability, contract liability and Refund assets” . because i fail to identify them in a scenario though i understand definitions.

Thank you so much Silvia. You simplified it.

Thanks Silvia, for explaining the difference between Trade Receivable (akin to unconditional right) and Contract Asset (akin to conditional right, not dependent on passage of time)

Hi Silvia

thank you for your explanation

I am confused about whether the same concept in distinguishing between contract asset and receivable as conditional and non conditional applies for contract liability and payable ( trade payables ) and deferred revenue if you could explain if the same criteria applies here or not i would be very thankful to you , your student 🙂

Hi Silvia,

Thank you so much for the explanation. And i am confused that since contract cost is separated from contract asset when it could be recognized as a single line item and the contract asset is financial asset, would the contract cost be classified under financial asset as well? Could you help me on this?

Well, a contract asset is not specifically a financial asset (I said that above) – however, some IFRS 9 provisions apply to it (such as impairment). Thus you should not present contract assets in the same line item as financial instruments. Contract cost is a different asset too and IFRS 9 does not apply to it at all.

Many thanks Silvia.

Thanka Silvia – Quick question. I’ve noticed some companies first time adopting of IFRS 15 moving balances that were in Inventory and trade receivables to contract assets. I think i understand why some trade receivables will now be classified contract assets, but am not sure why inventories would now be classified contract assets? Could you help me on this?

Hi Ahamed,

well, my opinion is that the trade receivables do not constitute a contract asset and thus should not be reported there. For reasons, please see the above explanations. As for inventories – it requires careful thinking and assessment, but in general no – they are either inventories if not spent on the project, or contract costs if spent on the project. Please see the following example with full journal entries: https://www.cpdbox.com/example-construction-contracts-ifrs-15/

Many thanks Silvia

Hi Silvia,

Thank you so much for the explanation.

As contract asset is mainly reflecting the transaction with customer, what about supplier?

For example, advance payment made to our supplier, will this consider as contract asset? If not what is the appropriate term for this? Appreciate your prompt reply.

Thank you.

Hi Shane, IFRS 15 relates only to the contracts with customers – not to the contracts related to suppliers. As for advance payments – it depends whether you have already got some delivery or not. If not, then it is a current or non-current asset (sort of receivable).

our client is engaged in manufacture of steel for which he received advance from customer for sale of goods ,and our client still need to perform supply of goods ,whether advance received to be shown as contract liability and similarly when the control over goods has been transferred ,still the payments need to be received no performance obligation lies with the company, whether it should be shown as contract asset or trade receivable

Our Co. is providing maintenance services and we have deputed our technical staff permanently on client premises and incurring costs on monthly basis BUT work is done whenever any maintenance is required by the client and revenue is recorded based on actual quantities executed by our technical team. If there is no maintenance work for any specific month we cannot record revenue.

So in those months when there is no work can we record actual cost incurred as contract asset instead charging to PL account?

That is not a contract asset for sure. These expenses are rather costs to fulfil the contract, but still I am not sure if they meet the conditions for capitalizing as costs to fulfil the contract. It depends on their nature, but if they are just salaries or so – then they should be expensed.

Unbilled receivable why the only thing outstanding is the act of invoicing, is this a contract asset? There’s nothing conditional. However, you seem to imply that it has to be invoiced in the reply above.

“If you invoice together with revenue recognition, then it is trade receivable since you have an unconditional right to a payment.”

Hi Marcey, whether unbilled or not – you always have to ask if there is a condition to receive a payment other than passage of time. I don’t think my above answer implies what you wrote it implied.

Dear Silvia. In your example, the agreement is that the whole project must be complete before payment is made (and thus trade receivable recognized).

What if the agreement states that a payment of 70% is required for performance done when the project is 70% complete (and the remaining 30% at completion of project). Would you recognize a trade receivable or a contract asset at 70% invoicing in this case?

If you invoice together with revenue recognition, then it is trade receivable since you have an unconditional right to a payment.

Hi Silvia,

What is the difference between contract assets and unbilled revenue?

Thank you for this regular enlightenment, please if i may ask, how do we determine effective interest rate when dealing with transactions that requires determination of present value, or Financial instrument.

Dear Silvia, Thank you for this explanation! What if there is a prepayment of services in 95% as per contract alongside with over the time revenue recognition in accounting. After payment receipt it will be “advance received” from this customer, but how to account issued (but unpaid at the reporting date ) invoices? As per contract counterpart is obliged to pay in advance but our service is still in progress.

I am not sure I understand the scenario well, but in general, issued invoices are accounted for as Debit Trade receivable / Credit Contract asset (or revenue). Please see more in this article, it contains the example with full journal entries.

Dear Silvia,

Is the contract asset same as accrued revenue?

I would like to know this as well. Our auditor has stated that all revenue is contractual and, therefore, anything we previous classified as Accrued revenue or Deferred revenue should now be classified as Contract asset or Contract liability respectively. For example, if we receive payment from customers for booking coach journeys for a future period, we would classify this as deferred revenue i.e. debit Bank; credit Deferred revenue. Should this be classified as a Contract liability?

OK OK – if I think about it, I think yes – accrued revenue is pretty much the equivalent of a contract asset. However, the difference is that the contract asset must be tested for the impairment exactly under the same rules of IFRS 9 as trade receivables.

I think it’s Contract Liability, and not Contract Asset, if a customer pays in advance.

But I was not referring to the deferred revenue (when the customer pays in advance). I was referring to accrued revenue, or unbilled revenue, when the company performs before the customer pays. Please refer to original question asked by GOO SOON KEE.

Silivia, it is actually 3 steps:

1) Partial performance: Dr. Contract Asset, Cr. Revenues

2) Full performance before billing: Dr. Accrued Income, Cr. Contract Asset

3) Billing: Dr. Receivable, Cr: Accrued Income

I beg to differ. Even if you fully performed and have no right to bill the customer, you would use contract asset account rather than accrued income. But if that’s how your company does that and if your auditors agree, then go for it. It all depends on the contract.

Dear Silvia,

This practice we are following in AS 7 (Indian Accounting Standard) from past 8 years in Manufacturing sector.

Great explanation Me Silva. Can you explain how the expected loss impairment model under IFRS 9, with practical examples.

Good day Ms Silvia,

Before the impairment part I understood every thing about . but when impairment part comes along I can not account for journal entry . would you please let me fully know about the last part that you mentioned ?

Do you mean how to account for an impairment? In the same way as for the impairment of trade receivables – you book the loss allowance as Debit profit or loss – Credit allowance account to contract assets (if there’s any impairment).

But that has to be made only when any impairment does occurs or is assessed or determined objectively at recognition date. It means that suppose that customer has gone down financially and its capability to pay deteriorates or if there is a dispute by the customer on the quality and acceptance of the project whereby he or she is no more willing to pay you full price…then any amount likely to be not received in future may be accounted for as an impairment loss…..under IAS 36….by debiting impairment loss on trade receivables account & crediting trade receivables account by that amount …Nice seeing these posts Silvia…its a good resource….

Great Explanation Ms Silvia ! Thanks.

Can someone help me post this question. If contract assets represent 70% of the current ratio, it is accurate when computing the current ratio?