Global Minimum Tax – Who? How? Any IFRS Impact?

when it comes to taxes, the world can sometimes feel like a vast and intricate puzzle. Different countries, different rules and different rates. Hmmm, that sounds like a good scope for tax planning departments of huge corporations, isn’t it? Why not designing some nice and…

IFRS 3: A Business or an Asset?

Last update: August 2023 Did you note that with the globalizing world, the number of large entities decreases and their size increases? Just as an example – 20 years ago, there were about 50 large media companies in the USA, controlling US entertainment industry. I…

Monetary or Non-Monetary?

Updated: 2023 – please scroll below to download the infographics for your future reference, it is free. When you need to translate your items denominated in foreign currency to your own functional currency, then there’s one little problem: Is that item monetary or non-monetary? If…

IAS 8 Accounting Policies, Changes in Accounting Estimates, Errors

Updated in March 2023 I bet every single company needed to change something in its accounting records and financial statements. Often, the change is very small, so you just don’t worry about it and make correction on the go. But sometimes, the change can impact…

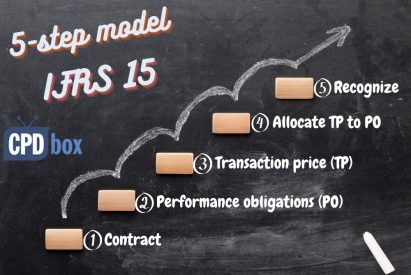

5-Step Model for Revenue Recognition under IFRS 15 + Journal Entries

The standard IFRS 15 has been with us for a while now, yet I still receive the same question: What precisely is 5-step model and should we really apply it to even the simple shop sales to the customer? The short answer is YES, you…

How to determine the fair value of a machine?

Market prices of most non-financial assets are usually not available, because these assets might be outdated or highly customized or simply not traded on the market. How do you set the fair value of these assets in this case? Learn here!

Can you capitalize rental expenses of land?

Can you capitalize rental expenses of land under IFRS? And what about the rental of the temporary offices? Find out here!

How to allocate cost of conversion to inventories at abnormal levels of production?

How to allocate fixed overheads to the cost of inventories? What if your production is abnormally high or abnormally low? Find out here with examples included!

Should we create a provision for major overhauling?

How to deal with anticipated major repairs, maintenance, overhauling, regular replacement of small parts and similar items under IFRS? Find out here!

Distinct or not distinct under IFRS 15?

How to determine whether the performance obligations in the contract are distinct or not distinct under IFRS 15? Find out here, with example included!

Recent Comments

- Jelilat on How to Measure Fair Value in Agriculture – IAS 41 and IFRS 13

- ROHAIL on Expected Credit Loss on Intercompany Loans

- Muhammad Anwar on Top 4 Changes in Profit or Loss Statement under IFRS 18 (with video)

- DEBET on How to Account for Compound Financial Instruments (IAS 32)

- Peter on How to account for intercompany loans under IFRS

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (51)

- Foreign Currency (9)

- IFRS Videos (69)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

- Uncategorized (1)