Global Minimum Tax – Who? How? Any IFRS Impact?

when it comes to taxes, the world can sometimes feel like a vast and intricate puzzle.

Different countries, different rules and different rates.

Hmmm, that sounds like a good scope for tax planning departments of huge corporations, isn’t it?

Why not designing some nice and complex schemes to shift tax liabilities to the tax jurisdictions with low-income tax rates?

Indeed, some of the giant names like Pfizer and Amazon faced a lot of criticism for using legal loopholes and offshore entities to minimize their global tax burden (yes, Pfizer’s effective tax rate used to be about 5%).

Why is this a problem?

Well, it is certainly not a problem for the corporations, they are saving taxes after all.

However, it is a problem for countries losing their tax revenue – that can lead to even greater inequality in the world than there already is.

Therefore, in October 2021, about 135 countries (with more than 90% of global GDP) agreed to major international tax reform.

What you will learn in this article:

- How the Global Minimum Tax Will Work

- How to calculate top-up tax (6 steps in detail)

- Example: Top-up tax (numerical calculation step by step)

- Who needs to pay the Global Minimum Tax?

- When will the liable companies required to pay?

- What are the effects on the IFRS reports?

How the Global Minimum Tax Will Work

The Global Minimum Tax is a two-pillar approach:

It is exactly Pilar Two that will have significant effects on taxes and reporting.

Pilar Two creates a global anti-base erosion rule – “GloBE rule”.

GloBE rule will require multinational companies to pay a minimum level of tax on their global income, regardless of where the income was earned.

There are four different mechanisms that individual countries can adopt to their own tax legislation to implement. Many of these changes will come in effect in 2024.

How to calculate top-up tax?

There are six steps to follow when calculating top-up tax:

1. Calculate covered taxes

Covered taxes include all entity’s current income tax expense in the particular jurisdiction.

A few remarks:

- If the same group operates two different companies in the same jurisdiction, then covered taxes are sum of current income tax expenses of both companies.

- Non-income-based taxes are excluded. For example, property tax, payroll tax, value added tax, etc.

- Current income tax expense is then adjusted for tax credits and deferred tax adjustments. For example, entity A might have deduct tax credit from its current tax expense, but it needs to add it back for the purpose of covered taxes calculation.

2. Calculate GloBE income or loss

The GloBE income/loss is entity’s profit or loss included in the consolidated financial statements of the ultimate parent (either in line with IFRS, or US GAAP or other applicable reporting standards).

Again, a few remarks:

- Include all companies belonging to the same group in the same jurisdiction (same as above).

- For the purpose of GloBE, entity needs to add back intragroup items (not eliminate them).

- Eliminate some common differences between accounting and tax rules, for example policy disallowed expenses, accrued pensions, dividends, etc.

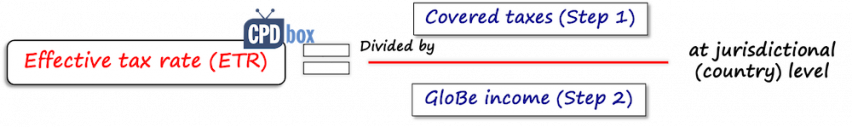

3. Calculate effective tax rate (ETR)

Simply divide covered taxes (from Step 1) by the GloBE income (from Step 2) at jurisdictional level.

4. Calculate top-tax rate

If your ETR (from Step 3) falls below 15%, then the top-tax rate is 15% less ETR.

5. Calculate excess profit

Excess profit is exactly the base for the top tax.

So, the top tax is NOT calculated from GloBE income from the Step 2, but the different base is used, which is excess profit.

Excess profit is calculated as:

- GloBE income, less

- The substance base income exclusion, which excludes a fixed return for substantive activities within a jurisdiction, and it is calculated as follows:

- The payroll carve-out of 10% of entity’s eligible payroll costs (reducing to 5% over the years), plus

- The tangible asset carve-out of 8% of entity’s carrying amount of tangible assets located in that jurisdiction (reducing to 5% over the years).

6. Calculate top-up tax

Top tax equals the excess profit multiplied with top-up rate.

And then, if there are more than one entity operating in the same jurisdiction, top-up tax is allocated to the individual entities based on their relative GloBE income.

Example: Top-up tax

Imagine a multinational group having two of its subsidiaries in jurisdiction when foreign income is taxed with the tax rate of 3% and domestic income with the tax rate of 20%.

We assume that we are calculating top-up tax in the first year, that is the full 10%/8% carve-outs are taken into account in the calculation of excess profit.

The financial information about the two subsidiaries are as follows:

| Currency Units (CU) | Subsidiary A | Subsidiary B | Total |

| Profit for the year | 10 000 | 1 000 000 | 1 010 000 |

| Current income tax expense | 2 000 | 38 500 | 40 500 |

| Carrying amount of eligible tangible assets | 800 000 | 150 000 | 950 000 |

| Eligible payroll expenses | 500 000 | 5 000 | 505 000 |

Here, we will not take any adjustments into account for the sake of simplicity. This is an illustration.

So, let’s go step by step:

- Covered taxes: CU 40 500

- GloBE income: CU 1 010 000

- Effective tax rate: 40 500/1 010 000 = 4.00%

- Top-tax rate: 15%-4% = 11%

- Excess profit:

- GloBE income: CU 1 010 000;

- less the payroll carve-out – 10% of CU 505 000: – CU 50 500;

- less the tangible assets carve-out – 8% of CU 950 000: – CU 76 000;

- Excess profit = CU 883 500;

- Top-up tax: CU 883 500 * 11% = CU 97 185

So now, thanks to the new OECD rules, the current income tax expense in that particular country increased from CU 40 500 to CU 137 685 (original 40 500 plus top-up 97 187).

The specific mechanics will be solved country by country, just please note that top-up tax is calculated on aggregate level in each jurisdiction, not company by company.

It is quite logical. If you look to our illustration, the effective tax rate of Subsidiary A is 20% (2 000/10 000), so it would not be liable to pay top-up tax on its own.

This opens a room for certain manipulation between the entities within the same jurisdiction.

However, please consult the tax specifics with the tax specialists, because I deal with the reporting aspect of that tax, not the calculations themselves.

Who needs to pay the Global Minimum Tax?

Not every single corporation is liable.

According to the OECD, the new rules apply to multinational groups whose consolidated revenues exceed EUR 750 million in at least two of the last four years.

Also, once the group meets the criteria for the Global Minimum Tax, then it needs to calculate top-up tax in every single jurisdiction it operates, except for the countries in which the group’s revenues do not exceed EUR 10 million and profit does not exceed EUR 1 million.

When will the liable companies required to pay?

Not so fast.

OECD rules are one thing, but they do not impose the top-up tax liability yet.

First, the local jurisdictions need to choose the most appropriate mechanisms of application and bring it to their own local tax legislation.

But, it is assumed that the changes will happen in many countries by the end of 2024.

What are the effects on the IFRS reports?

Well, this is the interesting part.

Every single group recognizes the deferred taxes.

However, the top-tax regime significantly differs from the traditional tax regime.

Sure, because while traditional tax regime always triggers some taxes on taxable profit, the top-tax regime only if the effective tax rate is below 15%.

And so, many questions arise, for example:

- Will additional temporary differences arise as a result of top-up tax?

- How to determine the rate to measure deferred taxes? (it requires lots of “crystal-ball” forecasting)

Hmmm.

Difficult to say.

And, exactly this is the reason why in May 2023, the standard IAS 12 Income Taxes was amended.

It introduced a temporary exception from accounting for deferred taxes related to top-up tax.

Therefore, if the specific jurisdiction adopts the tax laws implementing top-up tax, then an entity will neither recognize nor disclose any information about deferred tax related to the top-up tax.

This is a temporary exception, so it will cease to apply at some point in the future when the situation becomes clearer and IASB comes up with the more precise rules.

But it does not mean that corporation do nothing in its financial statements.

Remember – OECD rules are NOT the tax laws themselves. Individual countries still need to enact the local tax laws bringing top-up tax in effect.

So, before the top-up tax applies in the jurisdiction, but after the tax laws have been enacted, the corporations do not need to pay the top-up tax (no laws, no liability).

However, they still need to provide the information about its exposure to Pillar Two income taxes at the reporting date, as indication.

The type of information to be provided:

- Qualitative: how the company is affected by top-up tax, in which jurisdiction, etc.

- Quantitative: the proportion of profits that might be affected by top-up tax, average effective tax rate on those profits, and how the effective tax rate would have changed after top-up tax.

After local tax laws come in effect, then well, top-up tax will become a part of current income tax expense and full IAS 12 Income Taxes applies.

Final Word

Will the global minimum tax put an end to tax havens?

Hmmm.

Yes, it certainly will make the things more difficult, and potentially bring more tax revenues to the state budgets.

But… we will see. What do you think? (let me know in the comments below)

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)