How to Make Consolidated Statement of Cash Flows with Foreign Currencies

Did you know that many groups prepare their consolidated cash flow statement completely incorrectly?

And, if you are well-experienced accountant, you can actually spot the faulty numbers instantly when you look to the statement of cash flows.

Sadly, this wrong method is often taught in many accounting courses.

What method is it?

Similarly as with the individual statement of cash flows, you take the consolidated statements of financial position, consolidated statement of total comprehensive income, then you calculate “deltas” or the differences between the closing and opening balances of your assets, liabilities and equity items…

… there you go, I described this method here with details in the video.

It’s very simple method and you’ll get nice consolidated statement of cash flows.

But it’s incorrect.

Don’t get me wrong now – this method is perfectly OK for consolidated cash flows when the parent and the subsidiary use the same functional currency.

Therefore, if you both use EUR (or any other currency) – use it.

Or, if you attend an exam and the question gives you two sets of financial statements, both in the same currency – use it. You’ll be fine.

However, as soon as foreign currencies are involved, then I do NOT recommend using this method.

Why?

Because, it does not comply with IAS 7 Statement of Cash Flows.

The reason is that under IAS 7, you should apply the rates applicable at the dates of transaction, or at least the average rates prevalent during the reporting period.

You need to realize that the consolidated balance sheet was prepared using the closing rates, because you had to translate all assets and liabilities in different functional currency using closing rates.

Therefore, if you make consolidated statement of cash flows based on the consolidated balance sheet, you are automatically using the wrong translation foreign exchange rates.

As a result, the individual line items in your consolidated cash flow statement would contain lots of effects of changes in foreign exchange rates – and maybe you know that this effect should be reported separately at the end.

How can you spot this wrong methodology in any financial statements?

It should NOT be!

So, what’s the right method?

Let’s explain in a few simple steps and illustrate on an example.

Example: Consolidated Statement of Cash Flows with Foreign Currencies

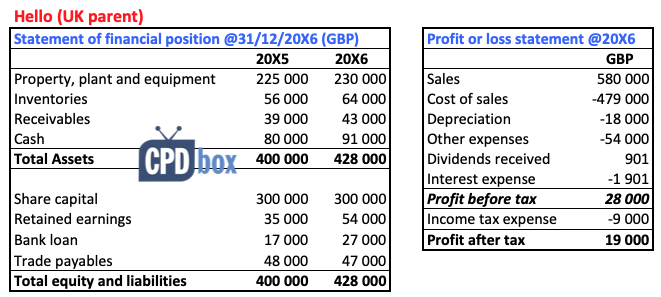

Hello, the UK company has owned 100% in GutenTag, a German subsidiary since January 2015. The following transactions occurred in 2016:

- On 31 October 2016, GutenTag paid dividend on EUR 1 000 to Hello.

- On 30 November 2016, Hello purchased goods from GutenTag for EUR 5 000 (GutenTag’s cost: EUR 4 500). The goods remained unsold at the year-end and the payable was unpaid.

The applicable exchange rates GBP/EUR:

- 31 December 2015: 0,7340

- 31 October 2016: 0,9005

- 30 November 2016: 0,8525

- 31 December 2016: 0,8562

- Average in 2016: 0,8188

The financial statements of Hello and GutenTag as at 31 December 2016:

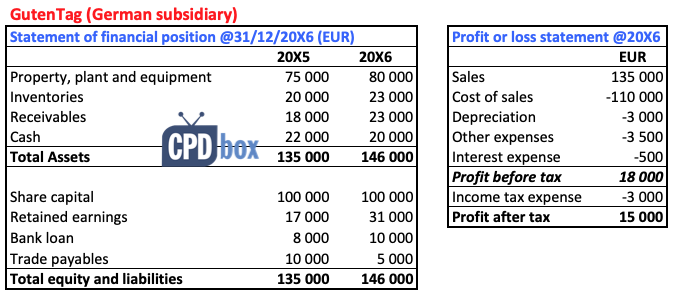

Step 1 – Prepare individual statements of cash flows of both parent and subsidiary

Clear enough.

I am not going to do this step in details here, because I published a complex article on how to prepare statement of cash flows here.

Also, if you need more detailed explanations with analysis of various types of transactions, then I recommend checking out my IFRS Kit where cash flows are extensively covered.

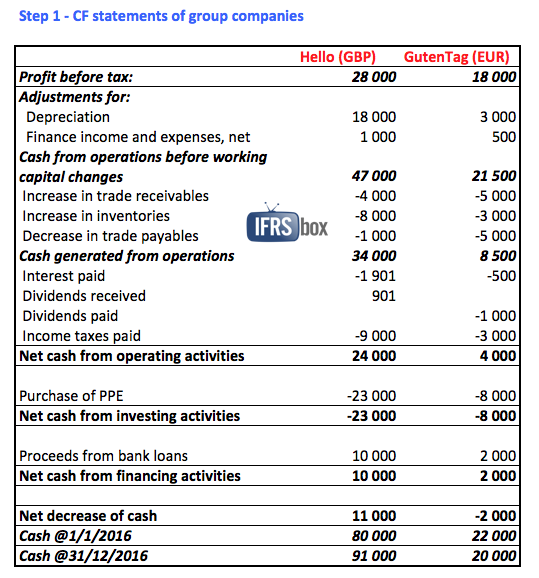

Step 2 – Translate subsidiary’s individual statement of cash flows to the presentation currency

In this step, you need to recalculate all the line items in subsidiary’s cash flows to show them in presentation currency.

What rates should you use?

Standard IAS 7 par. 26 and 27 clearly says that you should translate cash flows using the foreign exchange rate at the date of cash flow (transaction date) and you can use the average rate for the period for approximation.

Therefore, we can use the average rate in 2016 and for the specific cash flow – dividends paid – we use the actual rate valid at the date of cash flow.

Please note that we did not use any specific rate for translating the profit before tax. So where does the amount of GBP 14 907 come from?

This amount comes from the statement of profit or loss of GutenTag translated to presentation currency.

The reason why you should use it is that the individual items in profit or loss can be translated using different rates (average vs. transaction date) and the total profit figure is calculated.

I attached the excel file with all these calculations into the IFRS Kit, so if you are subscribed, you can check it there.

Also, please note that the opening balance of cash was translated using closing rate in 2015, and the closing balance of cash was translated using closing rate in 2016.

This is perfectly right, because these numbers must correspond with the consolidated balance sheet.

However, if you sum up all the movements, then the net decrease of cash plus opening cash balance in GBP do not give you the closing balance of cash in GBP.

Yes, because you applied different translation rates.

Therefore, you simply add the extra line – “effect of exchange rate changes on cash” and this would be your balancing figure.

Actually, it’s possible to verify this number by recalculations.

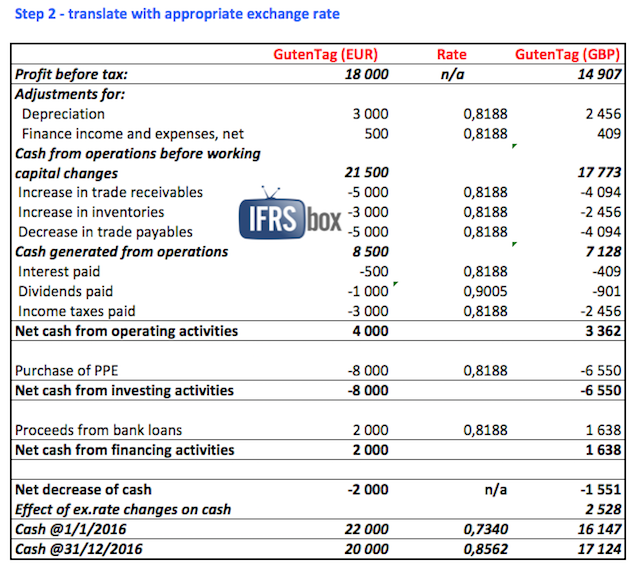

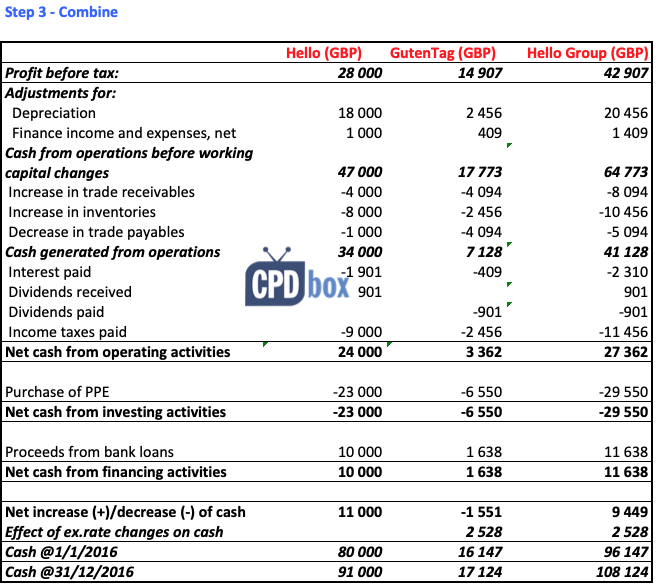

Step 3 – Aggregate parent’s cash flows and subsidiary’s cash flows

Simple as that.

Put both statement of cash flows in the same presentation currency next to each other and sum up. Done.

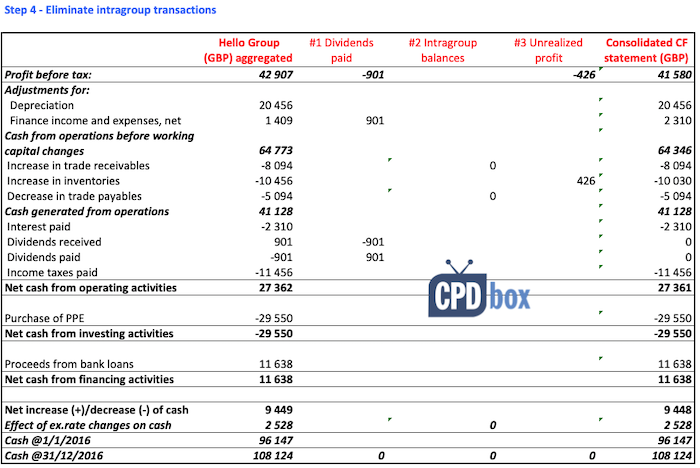

Step 4 – Eliminate intragroup transactions

This step requires some work to do and that’s probably the reason why many groups try to avoid this method and prepare cash flow statements from the consolidated balance sheets.

When you are eliminating, please be extremely careful about the exchange rates you use.

In general, you should use the same exchange rates as were used at preparing the individual line items.

I’ll explain.

In our example, we need to eliminate 3 items:

- Dividends paid by GutenTag and received by Hello Sure, this is an intragroup transaction and if you report 2 companies as 1, nothing happened.

You should eliminate the dividends exactly from the affected captions:

- Profit before tax: Parent’s profit was increased by the dividends, so we must bring it down (deduct dividend)

- Adjustment for finance income and expenses net: The net expenses were added, but they were lowered by the dividends paid, so we must increase them again (add dividend)

- Dividend received: No dividend was received by the group, so deduct.

- Divided paid: No dividend was paid to the group, so add back.

The sum of these adjustments shall be zero. Look to the first adjustment in the picture below and see.

By the way, we used the same rate for all 4 entries, because we assume that the parent recognized the dividend income using the transaction date rate; and the dividend paid in subsidiary’s statement of cash flows was recalculated using the same rate.

- Intragroup receivable and payable of EUR 5 000 Similarly as with balance sheet, we do the same thing here.

We eliminate as follows:

- Subsidiary GutenTag had receivable of EUR 5 000 to the parent. This affected the increase in trade receivables’ line. Without this intragroup receivable, the decrease would have been lower by 5 000 EUR, so we add this amount back.

What rate?Subsidiary’s cash flow statements were translated using average rate, so we translate the elimination in the decrease with average rate, too.

As a result, you add GBP 4 094 back to the line “increase in trade receivables” (5 000*0,8188).

- Parent Hello had an intragroup payable of EUR 5 000. This affected the decrease in trade payables’ line. Without this intragroup payable, the decrease would have been higher by 5 000 EUR, so we deduct this amount.

What rate?Parent’s cash flow statement was prepared from its balance sheet and the intragroup payable was translated by the closing rate there.

As a result, you deduct GBP 4 281 from the line “decrease in trade payables” (5 000*0,8562).

- The difference between GBP 4 094 and GBP 4 281 resulted from the application of different exchange rates and therefore, you need to report GBP 187 in the line “Effect of changes in foreign exchange”.

- Subsidiary GutenTag had receivable of EUR 5 000 to the parent. This affected the increase in trade receivables’ line. Without this intragroup receivable, the decrease would have been lower by 5 000 EUR, so we add this amount back.

- Unrealized profit on inventories The parent bought inventories from the subsidiary and the subsidiary made profit of EUR 500. The inventories remained unsold by the group at the year-end, therefore in fact, no profit was realized from the group’s view and we need to eliminate it in the statement of cash flows.

We eliminate as follows:

- Subsidiary GutenTag made profit of EUR 500 and reported it in the line “Profit before tax”. We need to deduct EUR 500 from that line.

What rate?In subsidiary’s profit, intragroup sale was translated using the actual transaction date rate, so use the same rate when eliminated unrealized profit.

Therefore, we deduct GBP 426 (EUR 500*0,8525) from the line “Profit before taxation”.

- Parent’s inventories are overstated by the unrealized profit of EUR 500 and it affected the line “increase in inventories”. Without this profit, the increase would have been lower and therefore, we need to add it back.

What rate?UK parent recognized the inventories at the transaction date rate (historical rate). The inventories are non-monetary item and therefore, they remained the same, without recalculating by closing rate, at the year-end.

Therefore, we add GBP 426 (EUR 500*0,8525) back to the line “Increase in inventories”.

- Subsidiary GutenTag made profit of EUR 500 and reported it in the line “Profit before tax”. We need to deduct EUR 500 from that line.

That’s it.

The last step is to sum up aggregated numbers with all adjustments and here you go, you get a nice consolidated statement of cash flows in the last column.

Final word and a video

This was the illustration of the consolidated statement of cash flows using indirect method. If you use the direct method, the principles are basically the same.

If you are subscribed to my premium course The IFRS Kit, you can find the excel file with this example attached to the caption “Consolidation/Group accounts”.

Would you like to watch me working this example out? Here’s the video:

Did you find this article and example useful? Please share it with your friends – I really appreciate. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

52 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, I am a paid customer and purchased IFRS KIT, I am trying to find the Excel File you mentioned end of the article. I have checked the IAS 7 Section and I could not find the file you refer to.

I would be greatly apricated if you can provide the exact location of the file.

Hi Riza, thank you for being my member! That would be under Consolidation Section, sorry for the confusion.

Dear Lisa,

Hope you are fine and doing well.

I have a question and I read many article but they were not straight to the point. I know you can help me here

IFRS does NOT distinguish between realized and unrealized difference of exchange (DOE). I understand also that the DOE goes to the Profit or loss statement (I am not talking here about any group accounts or consolidation or transactions related to foreign operations).

My question is: How to report this DOE in the statement of cash flows knowing that the realized DOE is considered a cash transaction while the unrealized DOE is not a cash transaction, so can we include the unrealized DOE under the adjustments (like depreciation for example) in the SCF? If yes, then we need to have separate accounts for realized and un-realized DOE. If not, then how to deal with this non-cash portion of the DOE in the SCF?

Many Thanks,

Hi Silvia,

Thank you very much for the awesome and detailed article about consolidation of cashflow.

However, I have one question which I hope will receive your kind reply.

In Step 4 – Eliminate intragroup transactions, should “unrealized profit” be eliminated from groúp’s profit before tax as following: unrealized profit = revenue – cost = 5000*0.8525 – 4,500*0.8188 = 577.9;

and also, inventory should be eliminated from group’s inventory by an amount of 5000*0.8525- 4,500*0.8188 = 577.9?

I hope you will spare some of your valuable time to help me solve me confusion.

Thank you very much and best regards!

Hi Silvia, thanks for the extremely helpful article. One question pls, do you still use the average rate to convert payments for CAPX? Even in the case of CAPX , are we to use historic rates if available? TIA.

Hi Silvia, if we are straight away preparing the cash flow statement at console level involving 100 of subsidiaries having different currency, can we take this approach since our requirement is to provide consolidated financials.

Hi Silvia, for proceeds from fixed assets disposal. Assuming there were two disposals for the year and the proceeds were 5,000 CU and 6,500 CU, of which only 6,500 CU was paid. So under the investing activity, only 6,500 CU would be included under the proceeds from sales of PPE ? While for the unpaid 5,000 CU would be under the working capital section, increase in trade and other receivable ?

For spoilt / old PPE sold as scrap, the proceeds from selling PPE as scrap to remain under proceeds from sales of PPE ?

As for the unrealized forex on payables, receivables & bank balances, the whole unrealized forex amount in P&L will need to be shown under the adjustment section, Foreign exchange gains / losses ?

Thank you so much !

Hi Mam,

A small doubt in preparing consolidated Cash flow.

Ill explain with an example. A Canada subsidiary has a loan with its German Holding Company. There was payment of loan for the period for suppose 100 CAD. So in Canada Cash Flow there is repayment of 100 CAD which is converted at avg rate to Euro for Germany entity. Now in the eliminations happen in the system at Euro level and for console adjustments. They happen at Euro level. Here the movement of 100 CAD at avg Euro rate is not equal to elimination happening at Euro level. Could you please suggest some way to resolve this difference?

Well, I don’t understand here what you are eliminating – the remaining balance? Because, if you are preparing cash flows by indirect method, this is what matters. Anyway, in general – yes, these differences can arise despite the fact that repayment happened and the balance might be zero after all. The reason is that the group itself is exposed to foreign exchange gains or losses anyway. These differences are mostly shown in group’s profit or loss; or – there is a unified group policy on making eliminations (e.g. big balances are converted with actual transaction- date rate, not average rate), etc.

Hi Silvia,

Thank you so much for the great article! I would appreciate if you could please shed some light on my queries thanks!

I am reviewing a consolidated cash flow which involves an overseas acquisition acquired by one of the existing overseas subsidiaries. The cash flow for investing activities included payment for acquisition, where the cash paid was converted using acquisition date rate. The client had an adjustment in the ”effect of change in fx”, being the difference between year end rate and acquisition date rate for the considerations paid.

That does not seem right to me, and due to this, there is a plugged number in opetating cash flow for a similar amount.

I think these two are related? should they even adjust for the difference between y/e rate and transaction date rate?

Thank you very much!

sorry Silvia, the cash flow statement above refer to the group consolidated CF statement. Group’s currency is AUD and oversess subsidiaries in USD. Thanks!

Hi Silvia,

With regards to the single entity’s statement of cash flows.

Are unrealised gains / losses arising from subsequent measurement of monetary items which are denominated in foreign currencies (e.g. foreign currency banks / debtors / creditors) on the reporting date presented under “effect of exchange rate changes on cash”?

Thanks! 🙂

Only on bank accounts/cash – those losses are reported under “effect of exchange rate changes on cash”. If they relate to assets / liabilities, then they affect the changes in working capital.

Thank you 🙂

Dear Silvia , am already subscribed in ifrs kit , but i am searching for this example , can you provide me with example how to consolidate unconsolidated financial statement. As I am senior auditor and I am working now on this case. The client do not want to provide us with consolidated subsidiary financial statement but unconsolidated subsidiary financial statement.

Hi Mohammad, so are you trying to make a consolidated statement of cash flows, right? Then you do not need consolidated balance sheet of a subsidiary as stated in this article. All you need is the individual financial statements of a subsidiary, so you are OK. Just follow the procedures in this example.

Hi Silvia.

Nice article highlighting a very common issue. I am working in a group with almost 25 subsidiaries out of which approx. 10 are foreign. Up till last year we were preparing the cash flow in same way using CONSO FINANCIALS and this was highlighted by the Auditors. Now the point is:

Group structure is 15 subsi same reporting currency as parent.

10 subsidiaries different functional currency (CAD, GBP, EUR and PKR).

I am sure I can’t use the Conso numbers in any way and prepare separate cash flow for foreign subsidiaries because removing few of them from group will not work (eliminations would get out for the remaining ones as well).

What should be my approach ? Can you please explain the steps you think.

Hi Adnan, well that’s the matter of setting up a system for your consolidation. Sorry, not really possible to answer this complex issue in the comment, but our consultants can help you online. S.

Great stuff.

I think the process is lengthy, that is why isn’t taught in courses/exams

It is not lengthy- once you learn it, then you can make consolidated financial statements really fast.

Hi ,

I am writing to express my concern to the following explanation .

“Therefore, you simply add the extra line – “effect of exchange rate changes on cash” and this would be your balancing figure.

Actually, it’s possible to verify this number by recalculations.”

May I know how to we verify that balancing amount stated correctly for the effect of exchange rates changes on cash ? As my firm is dealing with audit , I guess the auditor would like to find out how did these balancing figure is obtained ?

Thank you .

Hi Aldoe, I did not include the verification on purpose as this article would have been too long. However, it is a part of my IFRS Kit. S.

Yes, the same can be reconciled :

Please do follow these steps :

Step I : Calculate Cash Flows as done by the Tutor .

Step II : From Step I , you will get difference of 2,528

Step III: Calculate Cash Flows using CLOSING RATE ONLY

Step IV: You have 2 cash flows in same currency (as per Step I and Step II)

Step V: Take the difference in cash flows under Step IV

Step VI: You will get the difference of 2,528

Please read step IV: as

Step IV: You have 2 cash flows in same currency (as per Step I and Step III)

Hi, how about eliminating Intercompany revenue and expenses? If subsidiary earned revenue from the service invoice it raised to parent (EUR 1,000). Thanks!

Hi Silvia, great article! Explaining tricky topic in a simple and easy way. One clarification though. When you prepare CF as described, there are differences between the changes in working capital presented in consolidated CF and calculated based on consolidated balance sheet – as I understand, this is in line with our expectations? And question – if these differences should be somewhere explained, in the financial statements? Thanks! Sylwia

Sylwia,

these changes are never going to be the same, not only due to forex. And yes, disclosures in the individual standards require explanation of balance sheet movements in some cases, but I don’t think that explaining of these differences (why working capital changes in CF are different from BS changes) is necessary. S.

Great explanation in this complex topic, I found it very usefoul, thanks a lot. I am working in the conversion of a single CF statement and found the situation that was described by Sylwya. If I look for example the Trade Recivables chage in the converted BS versus the CF is totaly diferent. Where can I found an example of the explanation suggested?

Hi Silvia! You said “but I don’t think that explaining of these differences (why working capital changes in CF are different from BS changes) is necessary.” Do you mean that we don’t need to reconcile the “Effect of exchange rate” of GBP 2,528 in this cash flows statement to the foreign subsidiary translation gain/ loss in the statement of financial position? Let’s say in the statement of financial position we have a exchange rate reserve of GBP5,000. after translating this foreign subsidiary financial statements by closing rate method. We don’t need to reconcile the GBP2,528 figure to GBP5,000 cos they are based on different calculations and it is not a useful reconciliation information.

Respected Ma’am

I’m a student of CA Pakistan. I read all your articles. You are the best presenter on Financial Reporting.

So far as your this article is concerned, i have a query in mind. I think you are using avg rate as per Paragraph 26 & 27 of IAs 7 which refer towards IAS 21.

Whereas the scope paragraph of IAS 21 paragraph 7 as under: –

“This Standard does not apply to the presentation in a statement of cash flows of the cash flows arising from transactions in a foreign currency, or to the translation of cash flows of a foreign operation (see IAS 7 Statement of Cash Flows).”

Can you please explain why we are still using Avg rate for translation of foreign currency cash Flows.

Best Regards,

Hi Silvia,

your presentation is good, If in Hello Group debtor/creditor ledgers also contain multi-currencies – e.g. USD debtor account/ EUR debtor account (which were revalued at closing rates to GBP), do we need to prepare cash flow separately? e.g. strip out fx element in foreign currencies accounts in movement in working capital?

Hi Sveta,

you would need to adjust these “unrealized FX gains/losses” in the changes in working capital, but other than that – no separate cash flow statement is needed. S.

Got it. Thank you kindly

Hi Silvia,

The “parent” company Hello’s separate and unconsolidated financial statements in the example, shouldn’t they show the investment in Guten Tag ?

I also did not find the excel file with the detailed calcuations in the IFRS Kit as mentioned above ?

Thanks

Hi Thomas, yes, technically you are right! I omitted it here as I concentrated on other things. Anyway, it does not change anything. The file should be under the Conso/Group accounts downloads, if not – please write me an e-mail. Thanks, S.

Hi, how about the investment in subsidiary and issuance of shares? For example investment @51%? How to eliminate in the consolidated cash flow. Thanks!

Not many information about the transaction. Can you make it up a numerical example?

Hey Sylvia, your tutorials are so great. I really have to be careful as our business expands internationally and has to deal with accounting with foreign subsidiaries. I will be sure to take some online accounting courses to learn more. You should teach them. You’re knowledge is evident.

Hi Dennis, thank you, but if you want a backlink from my site, then you need to do some work (e.g. write a high-quality article for IFRSbox), not just add hyperlinks to the comment – I remove them all and keep just genuine comments on the web. However, I would gladly give you the backlink within your purely original article that you would submit for publishing on this web. S.

Hi Sylvia.

Please can you do an article on Key Audit Matter in audit report for listed companies/public companies?

Thanks a lot!

Thanks for explaining in a simple and easiest way, and you are right companies are following wrong practice for preparing Consolidated CF through Consolidated Balance Sheet..

HI Silvia;

Thanks so much for the article. Your explanation has been straight-forward and easy to understand. One clarification though, you have adjusted the exchange difference on interco elimination against “effect of ex rate changes on cash”. From what I understand, this “balancing figure” is derived from ex rate movement’s in opening cash balance and current period cash movements. So, I’m not sure on grouping the difference in interco elimination within it.

Would appreciate your clarification. Thanks!

Dear MH, the final effect of FX movement is NOT purely the result of opening and closing cash balance only; a part of it relates to the movements inside the cash flow statement. S.

It was very good explanation and easy to understand

Thanks alot for enhancing our knowledge on consolidated cash flows

1. what happens if parent company Hello has a foreign bank account.you would have revalued the bank account at closing rate. would you not have to add back forex on revaluation of the foreign bank account and the other side – is it effect of exchange rate change on cashflow or against the trade debtors/creditors movement?

2. in your interco elimination column , I thought you need to add back unrealised forex on revaluation of intercompany balances with subsidiary included in the profit of Hello as a non cash adjustment. then any diff left goes to the effect of exchange rate change on cashflow

Hi, HC,

1. No, because the bank account balance does not affect debtors/creditors. The revaluation would be reported in the effect of FX movements.

2. Excellent point. Here, I omitted it, because the revaluation is less than 20 EUR (18.50 or so) and I wanted to focus on the mechanics of preparing group cash flow statement, but yes, in fact you should do it. S.

HI Silvia, I’m trying to follow and tried to recalculate the 18.50, but don’t have luck. Can you let us know what intercompany balances has been used? thanks. jay

Hello purchased goods from GutenTag for EUR 5000 and incurred a trade payables.so Hello needs to remeasure the trade payables of EUR5000 in its individual financial statement at the year end at closing rate from GBP 4,262.50 (EUR 5,000 x 0.8525 on 30/11/2016) to GBP 4,281.00 (EUR5,000 x 0.8562 on 31/12/2016) and the difference is GBP 18.50 exchange loss.

Thanks for laying out is a simple to understand language with illustration. Keep up the good work

Hi Slivia,

Great article!!, Appreciate if you can include a new article or example for Consolidation cash flow (for a initial consolidation / for acquisition).

Thanks.

Simple and precise explanation! I always wondered how they prepared consolidated cashflow. Thanks alot for enhancing our knowledge.