How to Make Hedging Documentation

If your company enters into some derivatives or other contracts to protect against any (potentially adverse) changes in cash flows or fair values, then it’s probably beneficial to apply hedge accounting.

I wrote a few articles about hedge accounting, therefore if you need to refresh your memory, here they are:

- Hedge accounting: IAS 39 vs. IFRS 9

- Difference Between Fair Value Hedge and Cash Flow Hedge

- Hedge Accounting Under IFRS 9: Rebalancing – What Is This New Concept?

I need to stress that hedge accounting is OPTIONAL.

No, you do NOT have to apply it.

Instead, you can book all profits or losses resulting from your derivatives straight in profit or loss statement.

However, this approach is not very beneficial for two reasons:

- You are NOT showing the true character and substance of your derivatives (or other instruments) and it can look you are speculating on the market;

- Profits and losses that you report in your financial statements can look like an electrocardiogram of a heart attack – lots of bumps, ups and downs, with great volatility.

I’m convinced that YES, once you take some derivatives or something else to protect your assets/liabilities/cash flows, you DO WANT to apply hedge accounting.

BUT!

It’s not a free ride.

You need to meet three conditions before you can apply the hedge accounting.

If you don’t meet them, then sorry, no hedge accounting.

These conditions are described in IFRS 9 Financial Instruments par. 6.4.1 and one of them is to have a hedging documentation ready.

In today’s article, I tried to explain how you should prepare your hedging documentation in order to be acceptable.

I never planned to write it, because frankly speaking – hedge accounting is not my favorite topic, but I got so many requests from you, guys, that persuaded me to go into these deep waters again. I really hope you enjoy!

What is hedging documentation?

It’s a document that describes your hedging.

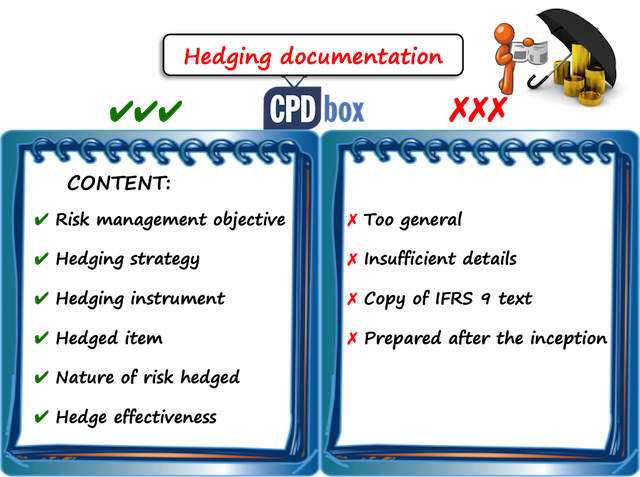

While the term “hedging documentation” is not defined in IFRS, IFRS 9 specifies (par. 6.4.1) what you need to write in your documentation:

- What your risk management objective is and why you undertake the hedge

- What your hedging instrument is(e.g. derivative)

- What your hedged item is (Receivables? Forecast sales?)

- What risk you’re protecting against (Foreign exchange risk? Interest rate risk? Commodity price risk? Etc.).

- You should state the type of the hedge here (Fair value? Cash flow?)

- How you assess the hedge effectiveness

One of the biggest mistakes that accountants do is that they try to apply hedge accounting, yet they don’t have the sufficient hedging documentation and as a result, they do not meet the hedge accounting criteria.

I’ve seen so many sad examples while working with my clients that I included this mistake in my report “Top 7 IFRS Mistakes That You Should Avoid” (by the way, you’ll receive it on your e-mail if you subscribe to my free newsletter here).

What your auditor would NOT accept as a hedging documentation

Here are few examples of totally unacceptable hedging documentation:

- Few sentences in the accounting manual

The common practice is that bigger groups or holdings elaborate their own group accounting manual with all accounting policies so that all subsidiaries can apply the same accounting rules.

Within this accounting manual, there’s a few sentences stating something like:

“ABC Group enters into interest rate swaps in order to hedge the interest rate risk. By swapping the floating rate for fixed rate, the interest payments are fixed and cash flow risk is eliminated.”

Pardon me, but this is NOT the hedging documentation.

It’s merely a description of the hedging strategy, and I doubt it’s sufficient even for this purpose.

Your auditor should definitely NOT accept it. - A hedging documentation with insufficient details

One of my clients elaborated a 5-page document titled “Hedging documentation”.

I was so happy to hold it in my hands… well, until I started reading it.

The company’s accountants loosely described their transactions. They wrote something like:

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

“ABC Ltd. partially finances its research activities with the bank loans and pays floating interest rate. In order to minimize the volatility of cash flows risk, ABC enters into interest rate swaps and uses them as the hedging instruments.”Then, on the remaining 4.5 pages, individual paragraphs from IFRS 9 were copied.

This is also unacceptable, because it does NOT describe ABC’s hedging relationship at all.

- Hedging documentation worked out subsequently

Some companies were even not aware of the fact that they needed a hedging documentation, so they had none.

But, they still wanted to apply hedge accounting and therefore, they quickly prepared some document with description of what’s happening.

OK, I will be silent about the question whether the auditor can or cannot accept the hedging documentation prepared well after the hedged item and hedging instruments have already been in place for some while.

Just let me remind you that you need to think UPFRONT.

You should work out your hedging documentation AT THE INCEPTION of the hedging relationship and not when it has already started.

- Too general hedging documentation

I have also experienced the companies who prepared their hedging documentation for all hedges they have, without precise identification of individual hedged items and hedging instruments.

Hedging documentation contained other necessities, such as the type of the hedge, the nature of the risk hedged, methods for effectiveness testing, etc.

However, their hedging documentation was still NOT sufficient, because it is necessary to identify precisely WHAT specifically the hedged item is and WHAT specifically the hedging instrument is.

Writing: “The hedged item are all loans with floating interest rate and the hedged instruments are interest rate swaps pay fixed receive floating” is not enough.

You should precisely give details of each loan and each swap that you use.

How to make your hedging documentation

If you read this far, please don’t be scared.

The hedging documentation does NOT need to be very complex or lengthy document.

If it contains all necessary information as I listed above, just 1 or 2 pages will be sufficient.

IFRS 9 does NOT prescribe the format, so it’s up to you to decide.

Just don’t forget to include everything it needs and don’t forget to make it AT THE INCEPTION of your hedging relationship.

Example – hedging documentation

EUtec, a producer of technical equipment operating in Germany with the functional currency of EUR, enters into a contract to produce and sell technical equipment for USlab, an American R&D company.

The contract was signed on 1 February 20X1 with the total contract price of USD 25 million. The equipment will be delivered on 31 July 20X1 and the payment terms are as follows:

- USD 5 million: upon contract signature

- USD 20 million: within 30 days after delivery

EUtec is worried about the adverse movement in foreign exchange rates and their negative effect on EUtec’s cash flows (that is, EUtec is afraid that the USD will weaken against EUR and EUtec will receive less EUR for 20 mil. USD than it would have received at the inception).

Therefore, in order to hedge foreign exchange exposure, EUtec enters into a foreign currency forward contract with BigBank under the following terms:

- Start date: 1 February 20X1

- End date: 30 August 20X1 (30 days after delivery)

- EUtec pays 20 million USD and receives 18 million EUR

Note: here, I am not going to show you how to calculate the fair value changes of the forward contract, or journal entries, or measuring the hedge effectiveness. I solve these questions in the IFRS Kit. Here, we are solving only the hedge documentation.

Before EUtec can apply the hedge accounting, it must prepare the hedge documentation on 1 February 20X1, that is on the inception of the hedging relationship.

It can look as follows:

EUtec: Hedging documentation #01/20X1

Risk management objective:

To protect the cash flows resulting from the future sale of equipment produced for USlab denominated in USD and the subsequent conversion of USD to the functional currency of EUR.

Strategy for undertaking the hedge:

EUtec is exposed to foreign exchange risk when selling to clients overseas in currencies different from EUR. Therefore, its strategy is to minimize the risk of adverse impact of foreign exchange rate movements on EUtec’s cash flows by entering into offsetting foreign currency forward contracts.

Type of the hedge:

Cash flow hedge

Nature of the risk being hedged:

Foreign currency risk

Hedged item:

Cash flows in USD resulting from the future sale of technical equipment to USlab, American R&D company, based on the contract signed on 1 February 20X1.

Exposed cash flows amount to USD 20 million and EUtec expects to receive them on 30 August 20X1.

Hedging instrument:

Foreign currency forward contract #346/20X1. The counterparty is BigBank.

The forward contract starts on 1 February 20X1, matures on 30 August 20X1, EUtec pays 20 million USD and BigBank pays 18 million EUR.

Method of assessing the hedge effectiveness:

EUtec uses both qualitative and quantitative methods for assessing the hedge effectiveness. Hedge is assessed at the inception:

- An economic relationship between the hedged item (cash flows of 20 million EUR) and hedging instrument (foreign currency forward contract) was tested by:

- The qualitative analysis: comparing the critical terms of both items and concluding that they are offsetting.

- The quantitative analysis: simple scenario analysis method was used.

EUtec simulated a few scenarios. EUtec examined how the fair value of the hedging instrument moved when the fair value of the hedged item was shifted in various directions.

The conclusion is that the changes in fair values of the hedged item and the hedging instrument are moving in the opposing directions and the change in fair value of hedging instrument highly offsets the change in fair value of the hedged item (note – it would be perfect if you could prepare this analysis and document it).

- Credit ratings of both EUtec and BigBank are solid, therefore credit risk does not affect any value changes in the hedging relationship.

- The hedge ratio is 1:1, which is exactly 20 million USD (quantity of hedged item) to 20 million USD (quantity of notional amount in foreign currency forward).

EUtec assessed that based on these 3 criteria, the hedge is highly effective and hedge accounting can be applied.

DONE!

Did this article help you?

In this case, please spread the word about it and share it with your friends. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

19 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello Sylvia,

Great site and knowledge centre. Keep it going. I am a subscriber doing your courses and have actually got some friends to onboard too.

I have a question about FX forward contracts to hedge for currency risks of future cash inflows in foreign currency. The company expects to sell biological assets in the future months after the rearing season but at this point in time there are uncertainties about the sales value and cash inflows (due to weight and price unknowns). What is certain is that the invoicing and receipts will be in FX and from experience, there is an indicative range of what the sales in FX will amount to.

The company enters into forward contracts shorting 65% of the (expected) FX at a forward spot rate offered by the banker over the counter. Will this qualify for hedge accounting? If not, how would the financial instrument (obligation to sell the FX) be accounted for?

Many thanks.

Hi Frankie,

thank you, I really appreciate!

With regard to hedging of the forecast transaction, you cannot just designate vague “future sales of cows in foreign currency” (whatever the biological asset in question is).

You should really state the amount of the transactions and expected timing (that does not necessarily need to be precise). It is possible to do so since you have a past evidence from your experience.

Now, to 65% portion – yes, you can designate only a proportion of the entire item, if this is consistent with the risk management objective (so you should give reason in the documentation).

If you do not wish to apply the hedge accounting (it is voluntary), then usually you account nothing at the time of entering into forward contract (since it’s fair value should be close to zero), but at each reporting date, you should calculate the fair value of that contract and book any profit/loss in profit or loss statement. Your banker should be able to give you the forward contract valuation on mark-to-market basis, which is usually acceptable. If your sales happen within the same reporting period, I would not bother.

I hope this helps.

Thank you Silvia. So we should be able to switch to hedge accounting.

On the other hand, if we do not apply hedge accounting, I am still struggling with accounting for the ‘firm and irrevocable commitment’ to sell the foreign currency at the agreed future date. Can this be compared to a purchase commitment and hence kept off balance sheet?

When the foreign cash hits our account there will be a settlement of the sales invoice with a DOE (difference between invoice spot rate and receipt spot rate), I suppose this is a realised DOE – difference between spot at invoice date and that at settlement date, even if settled in foreign currency?

Then, would the foreign cash be adjusted to FV at each reporting date till expiry of the contract, with the difference between the spot rate on date it was received and spot on BS date being an unrealised FV adjustment? Will the difference between the spot on date of receipt and the contract exercise spot rate eventually turn into a realised gain or loss (on exercising the obligation of the contract)?

And at the same time, will the difference between the FV of the contract at BS date and the future spot rate agreed in the contract (which you mentioned in your reply), be also expensed to PL as an unrealised gain or loss?

Apologies this might sound confused. As I said I am still struggling with this part. 🙂

1) If you do not apply hedge accounting, then you still have a derivative there and you need to account for all the changes in its fair value in profit or loss.

2) No, this is not how this works. And, unfortunately, as I am not able to see the specific contract conditions of that derivative (method of settlement, amount, etc.), I can’t really say how it turns out. Sorry, but I have very little information about the transaction and also, hedge accounting of highly probable forecast transactions involves far more details than I can provide here in the comments. Thank you for understanding that.

3) I do recommend watching the mechanics of hedge accounting in the IFRS Kit first. You will see that in cash flow hedge, a part of derivative’s (hedging instrument’s) fair value is accounted in equity, rather than in profit or loss (the effective part), which you are not mentioning in your questions above. So not all the changes of its fair value go in profit or loss.

Hi Silvia, is a company required to preparehedge documentation for every instrument or by hedging activity or hedging objective? Eg: A company entered 10 FX contracts to hedge FX exposure for a project, would the company require to document 1 hedge documentation or 10 separate hedge documentations?

Hi Silvia. Th above was very helpful. I had a query, My client has multiple forward contracts, so should he have formal document for each of the contract or can have a common for all the contracts. The hedge instrument is same for all the hedged item.

Hi. This was very helpful – thank you. Since the guidance doesn’t say the specific document that is needed and the direct meaning for “inception” – would it be ok to have a pdf memo with the inception date (not distributed or signed?) The auditors are asking for evidence that the memo was created at inception…but it’s not clear that this documentation needs to be distributed or having some kind of evidence.

Hi Silvia,

Many thanks for your simple but detail article that helped me a lot.

Dear Silvia,

First of all, I am very impressed what you wrote down regarding the hedging documentation. I helped a lot to my company. In fact, I am a beginner of accounting and recently I faced some problems about the hedging documentation because our external auditor mentioned the hedging documentation in their management letter. So I need to figure it out how we need. According to your mentioning above, this is not mandatory but is recommended. Can you share a kind of sample for the hedging documentation?

Hi Lucas,

I need to correct you – hedge accounting is NOT mandatory, it is voluntary. BUT, if you choose to apply hedge accounting, then hedging documentation IS mandatory. It is one of the pre-conditions for hedge accounting.

Sample of hedging documentation is right in this article – see section “Example: Hedging documentation”. Best, S.

Unrecognised firm Committment is considered as fair value hedge. By having unrecognised firm committment and designating FX contract as hedged instrument against hedged item, there will be mismatch in recognition i.e. FX contract gain or loss recognised in PL while unrecognised firm committment does not have PL impact until it is recognised.

Issue/Query Can you help me to understand how this works.

Hi Silvia,

Very insightful & helpful.

Hello

I have a client with foreign payable to settle in the future. The client entered into forward exchange contract with a bank to ensure availability of the forex and also protect itself again exchange rate fluctuation at settlement date. The forward contract is 100% cash backed at the inception of the contract.

How should this transaction be accounted for?

Can hedge accounting be applied to account for the foreign payable (hedged item) and foreign exchange forward contract (hedging instrument)? if yes, kindly assist with the accounting entries.

Hello Silvia,

I have a question outside the scope of this point but also relates to IFRS 9, if company A has 20% investments in company B which is not traded in the market or even doesn’t have a stock price. How this company account for this investment? Should it account for this investment under IFRS9 and how? or it should account for under different IFRS? Thanks so much

Dear HM,

first, you need to classify the investment – what is it? Does the company exercise significant influence? Then it’s an associate under IAS 28. No significant influence? Then it’s a financial instrument under IFRS 9. Control? Then it’s a subsidiary under IFRS 3/IFRS 10 (yes, it’s possible even with 20%). Please read more here. S.

Thanks Silvia for your prompt reply. They don’t have control. But I would like to inquire about their situation in two scenarios: first, if they have significant influence and can not measure the the FV of their investments. second, if they don’t have significant influence and also can not measure the FV.

Last question, will the cost method for accounting of investment still existing or not and when can a company apply it?

Many thanks and apologize for the too many inquiries.

If they have significant influence, then they need to apply IAS 28. If they don’t have significant influence, then they need to apply IFRS 9. Under IFRS 9, there’s no “cost method” for accounting of investment. There’s a good guidance on how to set the fair value in IFRS 13 – and no, it does not need to be the market value in all circumstances. S.

Thank you for sharing your technical articles and definitely very informative! May I ask if a company enters into a floating rate loan of $500,000 for the period from 1 January 2017 to 31 December 2020, but subsequently entered into two interest rate swap contracts with different trade dates and loan amounts (e.g. trade date: 1 March 2017 to 31 December 2020 for $250,000 and 1 April 2017 to 31 December 2020 for $250,000). I am not sure whether the company can qualify for hedge accounting (cash flow hedge) under the qualitative method you mentioned above. Appreciate your thoughts on this.

Dear Cecilia,

yes, the company can apply the hedge accounting if the conditions are met – but you need to evaluate. In the article, I gave an example of a perfect match, but it does not need to be 100% perfect. In your situation, if you designate 1st swap to hedge 1/2 loan and 2nd swap to hedge the other half, plus you conclude that swap floating for fixed offsets the variability of cash flows from the loan… this should be fine. S.