How to Account for Compound Financial Instruments (IAS 32)

Compound financial instruments became very common way of raising cash by many companies, but their shareholders don’t like them that much. Why?

Because many compound financial instruments contain the option to convert into shares. Just imagine you purchased convertible bond that gives you the right to take issuer’s share instead of redemption in cash. If the issuer is some solid and quickly growing company, then this option is nice for you because you can gain lots of money in the future from increasing share’s price.

But you can imagine that current issuer’s shareholders don’t like your option—because this option can reduce their share in the company. It’s logical—because if new shares are issued and current shareholders don’t get them, then their proportional share goes down.

In order to clearly show the potential risk of reducing shareholder’s share in the company, standard IAS 32 Financial Instruments: Presentation clearly sets the rules for accounting and presentation of the compound financial instruments.

What is a compound financial instrument?

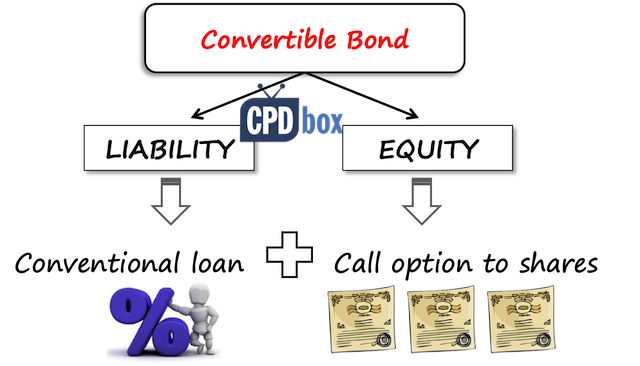

Standard IAS 32 defines compound financial instrument as a non-derivative financial instrument that, from the issuer’s perspective, contains both liability and an equity component.

It means that the issuer of such an instrument cannot simply show it purely as a liability or purely as an equity, because this instrument contains a little bit of both. Wanna examples? Here they are:

Example 1: A bond convertible into a fixed number of issuer’s shares

When the bond is convertible into shares, it means that the bond holder can get paid either by cash at maturity or exchange this bond for some fixed number of issuer’s shares. It is a compound financial instrument because it contains 2 elements:

- a liability = issuer’s obligation to pay interest or coupon and POTENTIALLY, to redeem the bond in cash at maturity (or a conventional loan); and

- an equity = the holder’s call option for issuer’s shares (or in other words, holder can chose to get fixed amount of shares instead of fixed amount of cash).

Example 2: A preference share redeemable at issuer’s discretion with mandatorily paid dividends

If an issuer issuers such a share, he must pay dividends each year (or in line with terms of the share), but the issuer can also chose whether and when he redeems the share. Again, this is a compound financial instrument with 2 elements:

- a liability = issuer’s obligation to pay dividends; and

- an equity = the issuer’s call option for own shares (or in other words, issuer can chose to pay fixed amount of cash for fixed amount of shares).

How to account for compound financial instruments

Before outlining the accounting treatment let me stress that the accounting treatment in issuer’s financial statements significantly differs from accounting treatment in holder’s financial statements.

Issuer is someone who creates the compound financial instrument—we can equally call him “borrower” because he raises money by issuing compound financial instrument.

As opposite, holder is someone who acquires compound financial instrument and we can call him “lender”.

Accounting treatment in issuer’s financial statements

IAS 32 requires so-called “split accounting” for compound financial instruments. It means that the issuer must perform the following steps on initial recognition:

-

Step 1: Identify the various components of the compound financial instrument.

That’s obvious. The issuer must clearly identify what the liability element is and what the equity element is—just refer to examples above.

-

Step 2: Determine the fair value of the compound financial instrument as a whole.

Basically this shouldn’t be any problem, because if the transaction happens under market conditions, then the fair value of the instrument as a whole equals to cash received in return for the instrument.

-

Step 3: Determine the fair value of the liability component.

The fair value of the liability component can be determined at fair value of a similar liability that does NOT have any associated equity conversion feature. So for example, the fair value of the liability component of the convertible bond equals to fair value of the bond with the same parameters (maturity, coupon rate, etc.) but without the option to convert into issuer’s shares.

-

Step 4: Determine the fair value of the equity component.

The equity component is determined simply as the fair value of the compound financial instrument as a whole (step 2) less the fair value of the liability component (step 3).

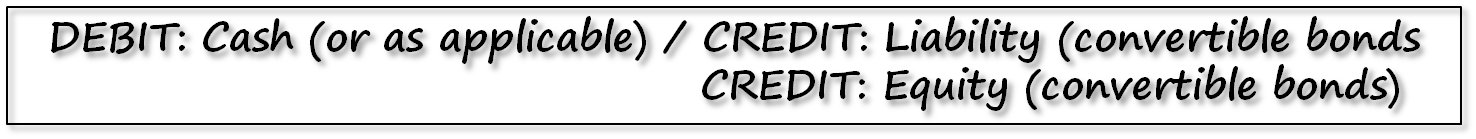

So as a result, the accounting entry on initial recognition is as follows:

Now, if issuer incurs certain costs associated with the issue of compound financial instruments, these should be allocated to the liability and equity components proportionally.

Subsequently, after initial recognition, the equity component remains untouched—so it is NOT remeasured and stays where it is until the final settlement.

On the other hand, liability component is accounted for in line with IFRS 9—either by application of effective interest rate method or at fair value through profit or loss—that depends on the classification of the liability.

Accounting treatment in holder’s financial statements

This is really a different cup of tea. When holder buys a compound financial instrument, for example—convertible bond, it also has 2 components:

- A derivative financial asset—which is the call option for issuer’s share in this example, and

- A receivable towards issuer—which is the loan provided to issuer by acquiring his bond.

So the holder has 2 assets in fact. In this case, a derivative financial asset shall be measured at first (at fair value of the option) and the fair value of the receivable shall be calculated as a residual. However, that’s not the main topic of this article—I just wanted you to know and to realize this 🙂

Compound financial instruments vs. Hybrid financial instruments

To finish this article, let me explain what the difference between “compound” and “hybrid” financial instruments is because I noted that many people interchange these 2 terms—yet they mean totally different things:

- Compound financial instrument: that’s the NON-DERIVATIVE financial instrument containing both equity and liability components.

- Hybrid financial instrument or hybrid contract is the one containing embedded derivative.

While accounting for compound financial instrument is arranged by IAS 32 Financial Instruments: Presentation, rules for identification and accounting for embedded derivatives are arranged by IFRS 9 Financial Instruments.

So just be careful to look for the right thing 🙂

And now, enjoy the video with example on accounting for convertible bond in the issuer’s financial statements. This short video is a clip from my long course on financial instruments, so I hope you’ll like it:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

58 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Can you please help me out in make me understand the accounting treatment of the Compulsory convertible debenture in both the case either with the % of interest or not and with convertible in fixed no of security of variable.

HI Silvia,

How to account convertible preference shares from the borrower’s end?

Hi Samitha, I think the whole article described this. If you mean “lender” or someone who buys these shares, they are accounted for as a financial asset, mostly at FVTPL.

Does compound financial instrument allow for the splitting of liability and equity components when the functional currencies of the issuer and holder are different? Let’s say the issuer’s functional currency is USD and the holder’s functional currency is EUR.

financial instruments that are within the scope of IFRS 4 because they contain a discretionary participation feature are only exempt from applying paragraphs 15-32 and AG25-35 (analysing debt and equity components) but are subject to all other IAS 32 requirements

Hie Silvia,

Very good article.

I have two queries.

First, will an investor also need to separate components of compound financial instruments? In case of change in market rate of interest, will the equity component be remeasured?

My second doubt:

Company A issued 10% compulsorily convertible debentures to Company B in December 2015. For determining the equity and liability they considered 15% market rate of interest. Will subsequent change in interest (Rate of interest as on 31st March 2018 is 18%) be considered?

Further, Company B foregone interest for four months from June 2017 to September 2017.

In October 2017, Company B sold debentures to Company C at face value. Company C further foregone interest for 3 months.

How will the above transactions be recorded in the books of Company A and Company C? Will forego of interest will change my equity component?

Request you to help me at the earliest.

I have made an investment in Convertible Debenture at 0% interest rate which will get converted to Compulsory Convertible preference shares after 10 years and the Compulsory Convertible preference shares will get converted in Compulsory Convertible equity shares after another 10 years @ 10% interest rate.

Please advise:-

1) Whether this will be treated as single instrument and accounting for next 20 years will be done on first date or it will be considered as multiple instrument and for first 10 years it will accounted as it will be converted in Preference shares and for another 10 years it will accounted as it will be converted in equity shares?

2) How to prepare accounting working for it.

Hi Silvia,

Your articles and tutorials are really helpful for gaining in-depth understanding of concepts in IFRS. I really thank you your your effort.

For now, I would be glad to hear from you regarding “Convertible Preference Shares”. Whether these shares are to be classified as financial liability or equity? Or should be segregated like in case of compound financial instruments?

Thank you in advance.

Hi. This is very concise. I would like to know from a perspective of the holder. How does he account the derivative.

Hi Kevin, under IFRS 9, if there’s a derivative embedded in a financial asset, then you don’t have to separate it and you account for it as for a financial asset at fair value.

My client issued a convertible debenture with 2 years maturity. Do I need to separate the equity and the liability under IFRS 9? If I were to separate, I noticed that the FV of the liability is higher than the consideration.

My brother recommended I might like this web site. He was

totally right. This post actually made my day. You cann’t imagine simply how much time I had

spent for this information! Thanks!

Hi silvia

What is the treatment of dividend income of investment which you get after acquiring investment which is decided at the time of acquisition i.e dividend income you pay for acquiring investment

Good Day Sylvia

I have a question about preference share. This is the case.

In the balance sheet, the bank (A) has preference share (with dividends to perpetuity, to one of the investor (AB), not related parties) that is classified as financial liability measure at fair value. The parent (B) buys the preference share to AB (investor) and subsequently sells the share to non controlling interest to B and C. B and C later converts the preference share to ordinary shares. The question is what is the journal entries to record the conversion of preference share, to ordinary share? At fair value or carrying amount of preference share at the date of conversion?

Should I recognized gain or loss? Or il affect the share premium?

Thanks for the help

Hi Zara,

it’s quite hard to respond without specific numbers, but let me try. It seems that the preference shares are perpetual debt and then this debt is converted to ordinary shares. This transaction shall not affect profit or loss. Let’s say that the debt of 120 000 is converted to 100 000 ordinary shares of 1 CU each (the nominal amount). The entry is then Debit Financial liability 120 000, Credit Share capital 100 000, Credit Share premium 20 000. Hope this helps! S.

1.Why equity element is not changed throughout the life of liability while liability element is changed every year? what is logic behind this?

2.How equity element will be accounted for when liability is fully settled at its maturity? what will be journal entries?

Hi Silvia, my company is a convertable bond holder, in you article you briefly mentioned from the holder’s perspective that two assets need to be recorded, first the fair vale of the call option, then residual being the value of the receivables, would you please show how to calculate the fair vale of the call option? And subsequent measurement of the loan?

Thanks,

hai Silvia

i have question, A company issued k1 million k10 par value 10% cumulative preference shares at par value. The preference shares are convertible, at the option of the preference shareholder, into ordinary shares (1 share for every 2 preference shares) on 31 December 2019. If not converted, the preference shares will be redeemed at par.

Required:

Compute the split between equity and liability on 2 January 2015, and finance cost for each year that the preference shares are issued.

Hi Silvia

Quick question why is it that when we buy equity or buy a bond, transaction costs are added whereas when we issue equity or borrow money the transaction costs are deducted?

Thanks

Stefan

Hi Silvia,

What is the entry when the convertible debt is settled. For example, if in your youtube example, all the bonds are paid back in cash of $5,000,000. What is the entry?

DR Liability (fair value of liability component)

CR CASH 5,000,000

DR ???

Where does the difference go? Do you reverse the equity component you recorded upon issuance?

Thanks!

I am interested in Sarah’s question about preference shares as far as gearing is concerned.

If a company issues convertible preference shares and wishes to calculate the gearing is the whole value treated as equity? If so this would reduce gearing. If not, how would they be treated?

Hi Sandy,

as far as gearing is concerned, redeemable preference shares should be treated as debt (not equity). S.

Hi Silvia,

Can you please tell me how we will account for redeemable preferred shares?

So let’s say I issue preferred shares worth 600,000. These shares are redeemable after 6 years. But I am expecting to redeem them after a year for a redemption price of 650,000. And this rate will continue for the next 2 years. How will we account for this?

Hi Sarah,

when the shares are redeemable, then there’s a liability. It’s not a compound financial instrument and you need to treat them as such.

I’m a bit confused with “redemption after 6 years”, then expected redemption. What does the conditions of share issue say? You need to go along with the “contract”. S.

Hello, I have a question and it’s about accounting from the holder’s perspective.

It’s a 3 year $100,000 note and they paid $100,000 for it.

the note is non-interest bearing, but the issuer will sell a fixed amount of goods at a discount for the term of the note.

The market rate is 8%.

what account would the 20,617 go to, and how would the year end work?:

Dr. Note Receivable 79,383

Dr. 20,617

Cr. Cash 100,000

That would go in profit or loss if in the separate transaction. But as I see it, they effectively prepaid for the goods, is that right?

Thanks Silvia For Your Good Work.

May The Universe bless you for your Contribution to the Profession.

Am looking for budget to buy the Whole Kit.

Be blessed

Hi.

From a lenders perspective how does a loan with interest and ability to share profit at the end loan work ? E.g we are giving out a loan which has a equity component (being % profit at the end of the project for which loan was provided ? Is it a compound instrument ?

Thanks

Dear Ikram,

I think you are going the right direction. As this is an issued instrument at lender’s accounts, you need to classify it either as debt/liability or equity or compound instrument and then account for a liability and equity separately. S.

Can you please help me out in make me understand the accounting treatment of the Compulsory convertible debenture in both the case either with the % of interest or not and with convertible in fixed no of security of variable.

if you could please help me in the final allocation of share with accounting entries than that will be more help full

Hi Tinku, well, your question would require much longer answer than I do in the comments. And also, could you please explain what you mean by “and with convertible in fixed no of security of variable”? I’m a little lost here. S.

Good Day, in order to calculate the liability component at initial recognition, how do you enter the small -3 on the calculator, im a bit confused.

Pieter, I guess it depends on your calculator… S.

Hi Silvia,

If the investor hold the compulsory convertible preference shares with a fix conversion ratio after 3 years (with the option to convert any time during year 2 to year 3) which earns fixed dividend, should this investment classified as financial assets at fair value through P/L as entire instruments? In my opinion, from the investor position, the investment will not be returned in cash therefore classification as loan receivables/held to maturity is not appropriate. If the instrument can be designated as FVTPL then do we need to split the conversion option for recognition?

Many thanks!

Hi silvia

I’m trying to define the journal entries from an investor’s perspective on converting a convertible bond into shares. Simple example would do (e.g. 100% conversion on conversion date).

Can’t find this info anywhere. I understand the bond is shown at FV but how to account for the conversion. Straightforward derecognition of the bond and then recognition of the shares? And, if so, what is the base cost to be recorded for the shares?

Many thanks for any help.

Rachel

Hi Rachel,

in fact, you are right – disposal of a bond and recognition of shares at their fair value 🙂 S.

Hi Silvia

I would like to ask from holder’s point of view, if we need to consider fixed conversion ratio or variable cnversion ratio.

If fixed, how to treat

And if variable, how to treat

I just wonder to separate as two financial assets to account for.

Thanks alot

Hi Silvia

I have encountered a situation where the market related interest rate of similar debt instruments with no conversion rights is less than than that of the debt instrument issued. As such the present value (PV) is greater than the proceeds (FV) . The difference which should give us the Equity component is now a negative (DR). Is it possible to have negative equity? how do i account for it ? Loss? Impairment?

Convertible loan apply the same concept as well?

Yes.

Hi Silvia,

I have a question regarding issuance of notes mandatorily convertible to common shares of the issuer. If the issuer’s functional currency is US$ and the notes issued also US$, but the common shares has par value of different currency, is it considered equity instrument in case the note is converted into a fixed number of shares (there is no option to settle in cash)

E.g. US$1 million notes convertible to 100,000 shares

Thank you!

Yes.

Once the split between the fair value of the compounded financial instrument as a whole and the liability portion. How should we fair value the equity portion then.

You do not fair value the equity portion – it’s simply a difference between FV of compound instrument and FV of a liability portion.

Hi Silvia

Hope you are doing great.

I have a question for a foreign currency convertible bond with non-conversion premium.

Does the non-conversion premium, which only comes to existence for the conversion period(a period much shorter than the bond period, would also form part in ascertaining liability related to the bond?

Any advise is helpful. Any reference to IFRS paragraphs will be great.

Thanks

Pranab

very good, precise and upto the point.

thank you…

thank u very much for straighforward presentation of standards, i always watch ur videos for exam preparations, they make my life easier!!! I really appreciate it!! But i dont know how to download it. could u give me instruction??

Hi Dilafruz,

thank you! To download YouTube videos, simply visit Youtube site with the video you want to download. I personally use the “downloader-free” method – to URL, type “ss” before “youtube” and you will be redirected to download page. For example, when the url of some video is http://www.youtube.com/123456, you change it to http://www.ssyoutube.com/123456. Hope it helps! S.

First I would like to extend my thanks for all

Secondly, I have used in your essay submitted to the search professorial

Hi Silivia,

First of all, I would like to thank for such a wonderful article. I have few queries in relation to this article. Like you specified, there is difference between Hybrid and Compound Financial Instruments. The difference lies due to derivative. From the holder’s point of view, holder has option to opt for equity or to receive residual sum at the end. In Compound financial instruments, there is derivative. I am bit confused within hybrid and compound Financial Instruments. To the best of my understanding, that the compound involves the fixed cash and fixed number of shares however, in hybrid, it may be subject to market price (Variable). Please clarify.

Lastly, from the accounting point of view of the issuer, it doesn’t seem to be justifiable to increase the equity element without issuing the equity instruments as this is subject to the holder’s discretion to exercise the right unless and until, it has been confirmed by holder’s intention at the issuance of Compound Financial Instruments.

I would like you to please through lights on above specified queries.

Regards,

Dipti

If the value of liability+ equity exceeds or is less than the proceeds from the compound instrument, how should the difference be accounted for? Should we adjust the same in the liability component or apply the principles of IAS 39 w.r.t. day 1 gain/loss?

Lucid, concise and effective explanation.

I need examples on forecasted transaction in cash flow hedge. If an insurance company hold all investments in HTM, whether they can hedge liability under fair value hedge or cash flow hedge.

Hi Mahesh, well, I gave complex examples of forecast transaction hedge in the IFRS Kit. With regard to hedging investments in HTM – yes, they can be subject to hedging (or hedged item), and they can both be subject to fair value and cash flow hedge, too. It all depends how you construct the hedge and what risks you’re protecting against. Also, here, the accounting treatment of a hedge slightly changes, because when you have HTM, you basically account for the investment using effective interest method and you don’t recognize gain or loss straight to P/L. Therefore, the hedge accounting accommodates to this treatment. S.

Interesting! thank you for your accounting “story”! You make a really interesting “story” for us!

Very straightforward and understandable, excellent.

Thanks,