IFRS 13 Fair Value Measurement

Many IFRS standards require you to measure the fair value of some items. Just name the examples: financial instruments, biological assets, assets held for sale and many other.

In the past, there was limited guidance on how to set fair value; the guidance was spread throughout the standards and often very conflicting.

Therefore, IFRS 13 Fair Value Measurement was issued. Also, IFRS 13 is a result of convergence project between IFRS and US GAAP and currently, the rules for measuring fair value are almost the same in IFRS and in US GAAP.

So let’s see what’s in there.

Why IFRS 13?

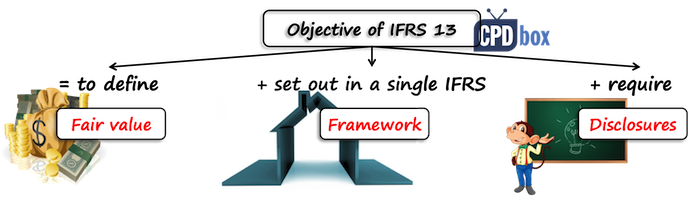

The objectives of IFRS 13 are:

- to define fair value;

- to set out in a single IFRS a framework for measuring fair value; and

- to require disclosures about fair value measurements.

Fair value is a market-based measurement, not an entity-specific measurement. It means that an entity:

- shall look at how the market participants would look at the asset or liability under measurement

- shall not take own approach (e.g. use) into account.

What is fair value?

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

This is the notion of an exit price.

When an entity performs the fair value measurement, it must determine all of the following:

- the particular asset or liability that is the subject of the measurement (consistently with its unit of account)

- for a non-financial asset, the valuation premise that is appropriate for the measurement (consistently with its highest and best use)

- the principal (or most advantageous) market for the asset or liability

- the valuation techniques appropriate for the measurement, considering:

- the availability of data with which to develop inputs that represent the assumptions that market participants would use when pricing the asset or liability; and

- the level of the fair value hierarchy within which the inputs are categorized.

Asset or liability

The asset or liability measured at fair value might be either:

- a stand-alone (individual) asset or liability (for example, a share or a pizza oven)

- a group of assets, a group of liabilities, or a group of assets and liabilities (for example, controlling interest represented by more than 50% of shares in some company, or cash-generating unit being pizzeria).

Whether the asset or liability is stand-alone or a group depends on its unit of account. Unit of account is determined in accordance with the other IFRS standard that requires or permits fair value measurement (for example, IAS 36 Impairment of Assets).

When measuring fair value, an entity takes into account the characteristics of the asset or liability that a market participant would take into account when pricing the asset or liability at measurement date.

These characteristics include for example:

- the condition and location of the asset

- the restrictions on the sale or use of the asset.

Transaction

A fair value measurement assumes that the asset or liability is exchanged in an orderly transaction between market participants at the measurement date under current market conditions.

Orderly transaction

The transaction is orderly when 2 key components are present:

- there is adequate market exposure in order to provide market participants the ability to obtain knowledge and awareness of the asset or liability necessary for a market-based exchange

- market participants are motivated to transact for the asset or liability (not forced).

Market participants

Market participants are buyers and sellers in the principal or the most advantageous market for the asset or liability, with the following characteristics:

- independent

- knowledgeable

- able to enter into transaction

- willing to enter into transaction.

Principal vs. the most advantageous market

A fair value measurement assumes that the transaction to sell the asset or transfer the liability takes place either:

- in the principal market for the asset or liability; or

- in the absence of a principal market, in the most advantageous market for the asset or liability.

Principal market is the market with the greatest volume and level of activity for the asset or liability. Different entities can have different principal markets, as the access of an entity to some market can be restricted (please watch the video below for deeper explanation).

The most advantageous market is the market that maximizes the amount that would be received to sell the asset or minimizes the amount that would be paid to transfer the liability, after taking into account transaction costs and transport costs.

Application to non-financial assets

Fair value of a non-financial asset shall be measured based on its highest and best use from a market participant’s perspective.

The highest and best use takes into account the use of the asset that is:

- physically possible − it takes into account the physical characteristics that market participants would consider (for example, property location or size);

- legally permissible – it takes into account the legal restrictions on use of the asset that market participants would consider (for example, zoning regulations); or

- financially feasible – it takes into account whether a use of the asset generates adequate income or cash flows to produce an investment return that market participants would require. This should incorporate the costs of converting the asset to that use.

The highest and best use of a non-financial asset may be on a stand-alone basis or may be achieved in combination with other assets and/or liabilities (as a group).

When the highest and best use is in an asset/liability group, the synergies associated with the asset/liability group may be reflected in the fair value of the individual asset in a number of ways, for example, by some adjustments via valuation techniques.

Application to financial liabilities and own equity instruments

A fair value measurement of a financial or non-financial liability or an entity’s own equity instruments assumes it is transferred to a market participant at the measurement date, without settlement, extinguishment, or cancellation at the measurement date.

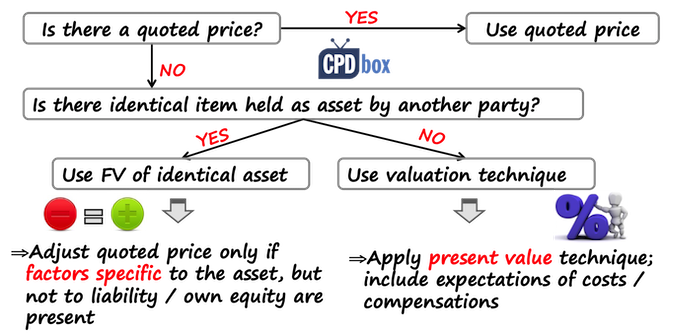

In the first instance, an entity shall set the fair value of the liability or equity instrument by the reference to the quoted market price of the identical instrument, if available.

If the quoted price of identical instrument is not available, then the fair value measurement depends on whether the liability or equity instrument is held by other parties as assets or not:

- If the liability or equity instrument is held by other party as an asset, then

- If there is the quoted price in an active market for the identical instrument held by another party, then use it (adjustments are possible for the factors specific for the asset, but not for the liability/equity instrument)

- If there is no quoted price in an active market for the identical instrument held by another party, then use other observable inputs or another valuation technique

- If the liability or equity instrument is not held by other party as an asset, then use a valuation technique from the perspective of market participant

This is illustrated in the following simplified scheme:

Non-performance risk

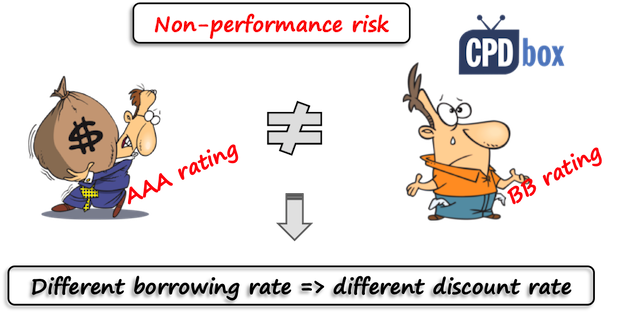

The fair value of a liability reflects the effect of non-performance risk – the risk that an entity will not fulfill its obligation.

Non-performance risk includes, but is not limited to an entity’s own credit risk.

For example the risk of non-performance can be reflected in the different borrowing rates for different borrowers due to their different credit rating. As a result, they would need to discount the same amount with the different discount rate, thus the present value of a liability would differ.

Transfer restrictions

An entity shall not include a separate input or an adjustment to other inputs relating to the potential restriction preventing the transfer of the item to somebody else.

Demand feature

The fair value of a liability with a demand feature is not less than the amount payable on demand discounted from the first date that the amount could be required to be paid.

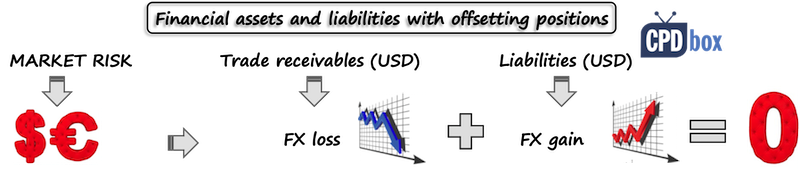

Financial assets and financial liabilities with offsetting positions

IFRS 13 requires a market-based measurement, not for an entity-based measurement. However, there is an exception to this rule:

If an entity manages a group of financial assets and financial liabilities on the basis of its NET exposure to market risks or counterparty risks, an entity can opt to measure the fair value of that group on the net basis, and that is:

- The price that would be received to sell a net long position (asset) for particular risk exposure, or

- The price that would be paid to transfer a net short position (liability) for particular risk exposure.

This is an option and an entity does not necessarily need to follow it. In order to apply this exception, an entity must fulfill the following conditions:

- It must manage the group of financial assets/liabilities based on its net exposure to market/credit risk according to its documented risk management or investment strategy,

- It provides information on that basis about the group of financial assets/liabilities to key management personnel,

- It measures those financial assets and liabilities at fair value in the statement of financial position at the end of each reporting period (so not at amortized cost, or other measurement basis).

Fair value at initial recognition

When an entity acquires an asset or assumes a liability, the price paid/received or the transaction price is an entry price.

However, IFRS 13 defines fair value as the price that would be received to sell the asset or paid to transfer the liability and that’s an exit price.

In most cases, transaction or entry price equals to exit price or fair value. But there are some situations when transaction price is not necessarily the same as exit price or fair value:

- The transaction happens between related parties

- The transaction takes place under duress or the seller is forced to accept the price in the transaction

- The unit of account represented by the transaction price is different from the unit of account for the asset or liability measured at fair value

- The market in which the transaction takes place is different from principal or the most advantageous market.

If the transaction price differs from the fair value, then an entity shall recognize the resulting gain or loss (“Day 1 profit“) to profit or loss unless another IFRS standard specifies other treatment.

Valuation techniques

When determining fair value, an entity shall use valuation techniques:

- Appropriate in the circumstances

- For which sufficient data are available to measure fair value

- Maximizing the use of relevant observable inputs

- Minimizing the use of unobservable inputs.

Valuation techniques used to measure fair value shall be applied consistently.

However, an entity can change the valuation technique or its application, if the change results in equally or more representative of fair value in the circumstances.

An entity accounts for the change in valuation technique in line with IAS 8 as for a change in accounting estimate.

IFRS 13 allows 3 valuation approaches:

- Market approach: uses prices and other relevant information generated by market transactions involving identical or comparable (ie similar) assets, liabilities, or a group of assets and liabilities, such as a business

- Cost approach: reflects the amount that would be required currently to replace the service capacity of an asset (often referred to as current replacement cost).

- Income approach: converts future amounts (e.g. cash flows or income and expenses) to a single current (i.e. discounted) amount. The fair value measurement is determined on the basis of the value indicated by current market expectations about those future amounts.

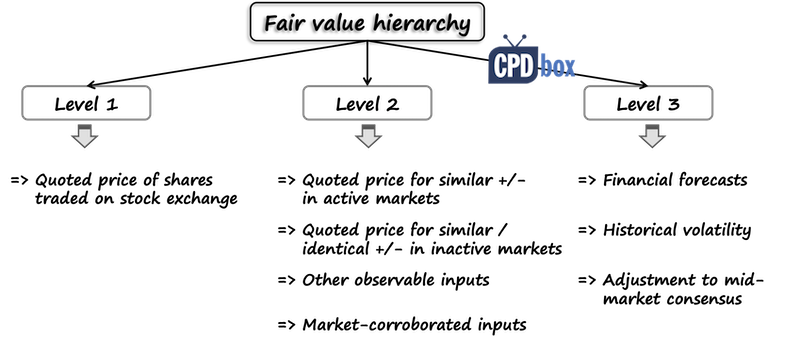

Fair value hierarchy

IFRS 13 introduces a fair value hierarchy that categorizes inputs to valuation techniques into 3 levels. The highest priority is given to Level 1 inputs and the lowest priority to Level 3 inputs.

An entity must maximize the use of Level 1 inputs and minimize the use of Level 3 inputs.

Level 1 inputs

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date.

An entity shall not make adjustments to quoted prices, only under specific circumstances, for example when a quoted price does not represent the fair value (ie when significant event takes place between the measurement date and market closing date).

Level 2 inputs

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs

Level 3 inputs are unobservable inputs for the asset or liability.

An entity shall use Level 3 inputs to measure fair value only when relevant observable inputs are not available.

The following scheme outlines the fair value hierarchy together with examples of inputs to valuation techniques:

Disclosure

IFRS 13 requires extensive disclosure of sufficient information to asses:

- Valuation techniques and inputs used to develop fair value measurement for both recurring and non-recurring measurements;

- The effect of measurements on profit or loss or other comprehensive income for recurring fair value measurements using significant Level 3 inputs.

Recurring fair value measurements are those presented in the statement of financial position at the end of each reporting period (for example, financial instruments).

Non-recurring fair value measurements are those presented in the statement of financial position in particular circumstances (for example, an asset held for sale in line with IFRS 5).

As the disclosures are really extensive, here, the examples of the minimum requirements are listed:

- Fair value measurement at the end of the reporting period;

- The reasons for measurement (for non-recurring)

- The level in which they are categorized in the fair value hierarchy,

- Description of valuation techniques and inputs used;

- And many others.

Please, watch the following video with the summary of IFRS 13 Fair Value Measurement:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

55 Comments

Leave a Reply Cancel reply

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thank you Silvia for your illustration,

I have two questions regarding transaction costs , question No.1 regarding the principal/advantageous market, what is the sense of not including the transaction costs when determining the fair value ?question No.2 is the cost of disposal considered as transaction costs like cost of removal the Machine from the Factory?

Thanks in advance,

Regards,

Mohammad

1. Under IFRS 13, disposal costs are not considered as transaction costs when measuring fair value. Transaction costs are defined as the incremental costs directly attributable to the acquisition, disposal, or other transaction involving the asset or liability.

Disposal costs are costs that an entity incurs to retire or dispose of an asset or liability and are not directly attributable to a transaction involving the asset or liability. Therefore, disposal costs are not included in the transaction costs when measuring fair value.

However, disposal costs may be considered as part of the cost to sell an asset, which is used in certain fair value measurements, such as the fair value less costs to sell. In these cases, the disposal costs are included in the cost to sell and deducted from the fair value to arrive at the fair value less costs to sell.

2. The reason for not including transaction costs when measuring fair value under IFRS 13 is to ensure that fair value reflects only the intrinsic value of the asset or liability and not the cost of the transaction.

Transaction costs are the costs incurred to buy or sell an asset or liability, and they can vary depending on the terms of the transaction, market conditions, and other factors. Including transaction costs in the fair value measurement could distort the fair value and make it difficult for users of financial statements to understand the underlying value of the asset or liability.

By excluding transaction costs, fair value is based on the market price that would be received for the asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This ensures that the fair value is unbiased and reflects the true value of the asset or liability in the current market conditions.

thank you Selvia as usual you make easy and clearly

i am proud for you my teacher

Hi Silvia,

Thank you very much for this great overview. I was looking for a practical understanding of IFRS 13 and looked through various publications of the big 4 before finding your great explanation.

I still have one open question though: Is there a simple overview / list somewhere that tells me which balance sheet items are typically measused at fair value and which typically still at historical cost (like PP&E typically at cost, real estate typically at fair market value etc.)?

Thanks a lot in advance.

Best,

Axel

I am requested to be one of member and study the IFRS Accountant all time. A you you will advise me how pay as I am in South Africa.

Hi Silvia,

Very useful website for any IFRS reference. In this Fair value concept i got a quick question may be you could help me what should be the right guidance for IFRS. One of my entity is doing Trading (example-products is Gas produced in the oil & Gas industry) . My valuation of stock (both unsold and in-trasit -still ownership or title is with my entity) booked Balance Inventory say for example $500,000 at Dec Ending 2019. And During Jan 31st I posted my Inventory as $400,000 (mostly all products are sold immediately so the stock is relatively a new stock left which is in Transit). Will there by any P&L effect for Inventory at my Trading entity?

Note:

• Valuation is on a fair value basis – ie the value is what my entity expects to sell the product at (NOT lower of historic cost & NRV)

• In-Transit Inventory are relatively new purchase in middle of Jan 2020.

• Since the valuation at fair value is already on a replacement cost basis we should not see any P&L impact?

My question is that, do i need to post any P&L effect for Inventory for my trading entity?

That is not a quick question, Carthik and I am not sure what you are asking me. What does that P/L effect relate to? To the revaluation of your inventories? Well if you are trading with commodities as broker and you are taking measurement exception in IAS 2 (valuing inventories always at fair value), then yes, there is P/L effect from valuation.

Hi Silvia.

I have a problem with paragraph 20 of IFRS 13: “Although an entity must be able to access the market at the measurement date, it does not need to be able to sell the particular asset or transfer the particular liability on that date”. The, what does standard mean with the ability to access the market? Can a entity be considered able to access a market for an asset when exists a restriction on selling that asset for all market participant or only for it?

Hi Francisko, “able to access the market” means that the participant is able to trade on that market and there is no restriction of the participant to access it. For example, imagine that some share can be traded on inter-dealer market (only institutional investors like banks can trade here) and on a retail market (anybody can trade here). Let’s say that this share trades and USD 10 at inter-dealer market and at 12 at retail market – now, what is the “correct” price? If you are a retailer with no access to inter-dealer market, you need to take the price of 12 from the retail market where you have access. It does not necessarily mean that you have to be able to sell that share on that market AT THE CERTAIN DATE (e.g. you cannot go there physically on that date – yes, it is silly example in the world of internet, but you get the point). If you are a bank with access to inter-dealer market, you can take the price of 10. I hope this helps.

Thanks Silvia. Your answer is very clarifying to me. Now I understand the meaning of this paragraph.

Congratulations on what you do. I follow your website from Chile.

nice piece of information

thanks

Hi, Silvia. I have a question regarding fair value of shares of a private limited company that is unquoted in stock market and does not have similar markets.

Can such shares be recognized at initial cost (i.e quantity of shares times nominal value of 100 per share)?

And if bonus shares are received later, can it be recognized at (quantity of total shares after bonus times the nominal value of 100 per share) or just at initial actual cost as above?

I have a quick question with regards to the cost approach to fair valuing. The standard refers to obsolescence as a factor to consider as part of this approach. Practically, how would one go about quantifying this as part of the valuation?

Thank you!

Hi,

Appreciate your effort.

I have a question.

A building which is not economically viable(The building is over 60 years old and economically not viable. ) and currently being rented by a subsidiary. Any prudent buyer if purchased or rented this property, will definitely demolish the existing building.

In this scenario what should be the valuation method that need to be used for this INVESTMENT PROPERTY?

Currently the valuer had taken Salvage Value = Market value of used building materials(Taking into consideration the age, present condition of the building).

Made simple. Much appreciate.

Silvia, you have touched my spirit soul and body, having beautiful heart to assist accountants and accounting student to understand what they were avoiding to understand because of its difficult, now you made impossible to be possible,,,continue to do so,..even putting more working and illustrative question and solving freely to access. We encourage those accounting professions whose financial capacity to be like this beatiful professional woman-to have big spirit like this

This is very instructive beautifully packaged and concisely delivered. Thanks

Thank you, Jiel 🙂

According to conceptual framework’s measurement technique fair value belongs to which technique? Is it current cost or realizable value?

Hi,

I have noticed that this IFRS provides guidance for stand-alone non-Financial assets and liabilities, entity’s own equity instruments and financial assets and financial liabilities with offsetting

positions in market risks or counterparty credit risk. My question is that how to use this IFRS for calculating fair values of stand-alone financial assets and financial liabilities. For example a company makes an investment in shares and designates its investment as fair value through OCI. How will it calculate fair value of the investment when there exist no market for the shares ie shares are of a private company and the investing company wants inject funds in investee company and when it stabilizes sell its investment at profit.

Want to download your IFRS BOX and want to talk to you before purchasing it

Dear Syed,

please use our contact form to contact me. Thank you! Silvia

Hello Silvia,

Please how does one go about testing impairment of a fully owned subsidiary using the FV less costs of disposal approach. I would appreciate it if you could provide a template on how to do this.

I have read IFRS 13 many times, did not get the point.

thank god I found your web, just read one time I understand the point now…. thank you silvia, keep your good work…. cheers from Indonesia

Great work…..and very beneficial….

Silvia, I Just want to thank you for yr effort in simplify understanding the IFRSs.

Your work is Wow…

Thank you 😉

Hi Silvia!

Thanks for the good job, please i need more explanation if possible with some relevant examples on highest and best use.

Thanks.

Hi Jamilu, the highest and best use wants to say that you should determine the asset’s fair value with reference to its maximal utilization, not the current use. Sometimes, the asset’s fair value depends on HOW you’ll use it. For example, imagine a land currently developed for industrial use as a site for factory. Alternatively, the same land can be used as a vacant site for residential use – but in that case, its fair value might be lower. Therefore, you need to determine the fair value with reference to its use as an industrial site if you prove that it is the highest use (which maximises your return from land). Hope it helps a bit.

i have some question relating to Highest and best use of the property and will be glad if someone can explain in detail. A company owns a property which is valued on the basis of its discounted cash flows, however the open plot of land after deducting necessary demolition cost is higher the the value determined by DCF method.

In this scenario would the property be valued at the value of the open plot of land or not. the highest and best use of the building would be a mixed used building but it would take considerable time to get all the zoning approvals (lets say around 1 to 2 years) for constructing such building.

Excellent work. The most valuable website for any professional accountant. Very fruitful lessons. Really appreciate your efforts. God bless you..!!!

Thank You Silvia, this is certainly some great effort. This just shows how much of hard work must have gone into this. Your summary of IFRS 13 is just so so helpful, you’ve made it so easy, just what I was looking for…..Thanks once again. God Bless You 🙂

Silvia, You are simply wonderful. I would be pleased to have you present lectures on IFRS to my students at my university in Nigeria someday.

Thank a lot

Hi Francis, thank you! 🙂

In fact, I really enjoy teaching LIVE, because when I see my students, I love to tell them stories that they remember for life 🙂

Of course, we can talk about your idea, I’d love to come one day 🙂

S.

Thank You, Silvia. The way you simplify IFRS is very fruitful for my students. Waiting for your next update. Cheers

hi silvia thank u so much it is very helpful

can you give me some more information

which measurement base, historical cost or fair value would provide the most relevant and reliable accounting information for shareholders of large publicly listed companies

thansk

Hi,

this is really strongly judgmental.

My personal opinion is that the historical cost is more appropriate for those assets and liabilities that are recovered or settled in the normal course of business (production, sale of own goods / products…).

On the other hand, fair value basis is more suitable for those assets and liabilities that are recovered or settled by trading or in a capital appreciation (investment property, shares held for trading, etc.). But of course, somebody else can have totally different opinion.

Kind regards, S.

wow! this is so helpful.. being a student, studying accounting is not really that easy, but with these articles it help us a lot to interpret these standards! thank you so much! i hope you continue to provide us easy-to-understand accounting articles.. 🙂

Hi April, thank you for your feedback – these things confirm that my work helps 🙂 Just a small tip: subscribe to my newsletter and get the newest articles, white papers and videos right to your inbox 🙂

thanks mam

I was on the brink of calling it a day with Accounting all together. I have been practicing my trade in UK for 20 odd years bout all under UK GAAP. I relocated to a sunny island and presso they use IAS/IFRS. I was so worried that I may have become too obsolete and surf and surf to get a website that could help..I mean really help !!!

I could not believe my luck when I came across IFRSbox. Fantastic piece of work! Simple to understand and you also have worked examples and videos. I wish these bodies like ACCA or ACA could learn from you

Kepp up the good work

Hi Les, I am so happy to read this 🙂 Thus I know my work helps real people and that’s great 🙂 So good luck and enjoy the site! S.

great effort

Thanks Silvia. It’s really helpful and easily understandable.

Thanks for support how I can thank you?

By sending me these comments 🙂 Thanks! S.

i want your email

Thks

IT IS INDEED WORTHY AND IAM HAPPY FOR IT, PLS CAN I HAVE, HARD COPIES OF THE TRAINING MATERIALS FOR MY PARENTS CONFIRMATION, THEY ARE MY SPONSORS.

PLS TAKE CARE AND GOD BLESS YOU

Dear Charles, I am very sorry but I can’t provide hard copies of my training. Anyway, there’s a lot of free material on my web and YouTube channel, so enjoy! S.

Hi,

Thank you so much for your hard work to bring this IFRS in a simple manner to understand.

Materials and videos from IFRS box is very useful and easy to understand.

Keep it up…

Regards

Ugamoorthy

Practicing chartered Accountant

Dubai, UAE,

Thanks 🙂

your lectures are amazing, like you ahhaha

excellent work! keep it up

regards

javed jiwani,ACCA

As always, very impactful

Nice one Silvia! Keep up the great work!