How to Prepare Statement of Cash Flows in 7 Steps

How many times did you sit with the head in your hands worrying about the statement of cash flows? Lots of work, preparation, calculations, adjustments…. and damn it, figures just do not add up! It’s very frustrating and creates headaches. I’ve been there.

You might find making cash flow statements one of the most challenging issues no matter whether you use US GAAP (if you’re in the USA) or IFRS (if you are in one of more than 120 countries in the world applying IFRS). Many people also struggle with preparing IFRS statement cash flows because…

- It’s the only statement prepared on a cash basis, not on an accrual basis;

- Accounting records must be adjusted to exclude non-cash items which might be quite demanding.

Maybe it looks very complicated, but don’t worry, people make much more serious IFRS mistakes than cash flow statements! If you subscribe to my e-mail updates you’ll get my free report “Top 7 IFRS mistakes” and you’ll learn how to avoid these mistakes, too.

But let’s be clear in one point: You still need a good method and resources to prepare statement of cash flows in line with IAS 7. I personally hated to prepare cash flows until I learned this simple method that I am going to show you.

UPDATE 2018:This article has already got a lot of attention and I’m grateful for this. Therefore, I published a video with step-by-step illustration of making cash flow statements. This video comes from my IFRS Kit, but if you’d like to watch it for free, please subscribe to my newsletter (by entering your e-mail address to the form on the right sidebar) and you’ll get it within my free IFRS mini-course. Enjoy!

Before Start

This method works only if you understand the following matters:

-

- You already know what the statement of cash flow is and what parts it has (operating, investing, financing and final reconciliation). You understand the basics of cash flows, relationship between individual components of financial statements (balance sheet, income statement and others), accounting etc. If that’s not the case, I sincerely recommend watching our online videos on these topics—in particular IAS 1: Presentation of Financial Statements and IAS 7: Statement of Cash Flows.

- Availability of various accounting information is generally good and you can easily access them. Sometimes you will need to do some adjustments resulting from supporting data and it would be lovely if you could get all pieces of info in the blink of an eye.

- You will stay cool, no nerves, no stress, just patience and concentration on this lovely work.

Ready? So let’s start. We are going to learn how to prepare statement of cash flows by indirect method.

Step 1: Prepare—Gather Basic Documents and Data

In order to start, you shall obtain at least the following documents:

- balance sheet (statement of financial position) as at the end of the current reporting period (closing B/S) and as at the beginning of the current reporting period (opening B/S)

- statement of comprehensive income (profit or loss statement + statement of other comprehensive income if applicable) for the current reporting period

- statement of changes in equity for the current reporting period

- statement of cash flows for the previous reporting period—well, you can proceed further without this, but it’s good source of potential recurring adjustments in the current period

- information about material transactions in your company during the current reporting period. Of course, you can adjust your statement of cash flows also for immaterial items, but it would not significantly change the information value of cash flow statement (since it’s immaterial, but careful about aggregation), so I would not bother about it

The first four bullets are crystal clear, but what sources of information about material transactions to use? Here is the short list of my ideas what to look for:

- major contracts that your company entered into during and before the end of the reporting period (lease, rental, hedging, construction—all sorts of)

- minutes or memoranda from the meetings of managing bodies in your company, like board of directors’ meetings, supervisory board meetings, shareholders’ meetings, audit committee meetings, etc.

- files from your legal department related to any proceedings against your company (and the opposite cases, too)

- documents from your investment/long-term assets department to look for major purchases, sales, exchanges and other transactions with fixed assets

That’s just a general shortlist and I am sure you know better what kind of transactions might be significant in your company—so go, ask and look for where you think it’s appropriate.

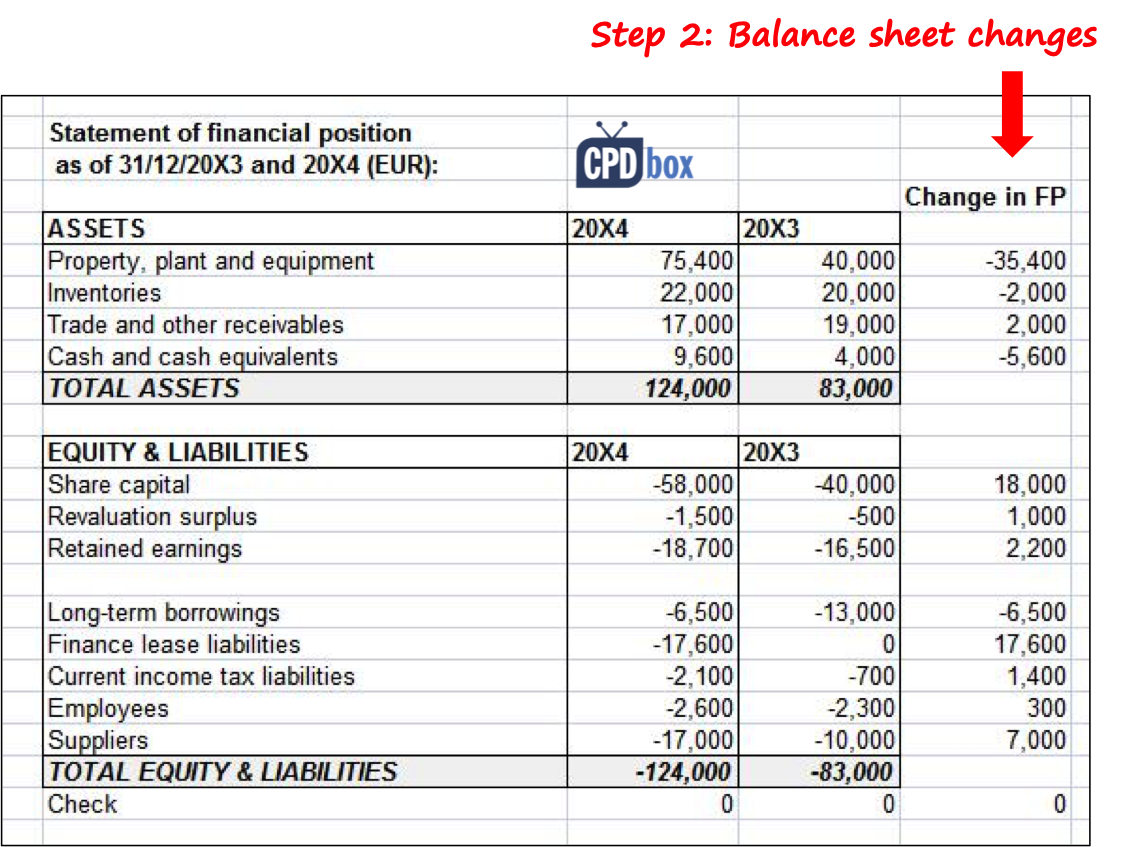

Step 2: Calculate Changes in the Balance Sheet

Now, take the closing and opening B/S and make a simple table with 3 columns: the first column – title of caption in B/S (for example, tangible non-current assets), the second column—balance of this caption from the closing B/S and the third column—balance of this caption from the opening B/S.

As you sure know, each B/S has 2 parts – assets and equity & liabilities. Ideally, totals of both parts should be the same, right? So when you do this simple table, please, enter assets with “+” sign and equity & liabilities with “-“ sign. Now do the check – if you entered the signs and numbers correctly, total of all assets and equity & liabilities should be 0 (don’t include subtotals).

In the 4th column, calculate changes in the balance sheet over the current period. Use simple formula: opening B/S minus closing B/S (careful, not the vice versa!). When you calculate all the changes correctly, total of all changes will be 0 (again, don’t include subtotals). Just let me add that you can use your general ledger accounts instead of balance sheets and you will get greater details as balance sheet represent aggregated figures. It really depends on the level of details you need.

That was an easy bit, agree? But it’s very important to do it properly and not mix the signs and formulas. So you better check it again before moving further.

Step 3: Put Each Change in B/S to the Statement of Cash Flows

By now, you should have a blank statement of cash flows ready for further work. Ideally, you can use the statement of cash flows from previous period and take only titles of individual captions. Likely you will have the same items also in the current period cash flows. Anyway, you can always insert a line for some new items if necessary.

The rationale behind this step is that each change in the balance sheet has also some impact on the cash flow statement—and if not (when movement in balance sheet is fully a non-cash item), it will be adjusted for later.

So now you should look to all changes in your balance sheet and enter each number to the blank form of cash flow statement. For example, you have calculated that change in your property, plant and equipment is -10 000, so you enter this figure in the investing part of your blank cash flows under the title “purchases of PPE” (as a change was minus 10 000, it means that the company spent the cash to purchase PPE).

You shall continue assigning each change in the balance sheet to the statement of cash flows until you finish all. When you are done, you should have a statement of cash flows with 2 columns—1st column = titles of individual cash flow captions and 2nd column = changes in the balance sheet assigned. Now perform a check—total of the 2nd column shall be 0 (without subtotals). If it’s not, you have done something wrong, so go back and review.

Well, if you’d like to know precisely where to put individual changes and how it looks like, please watch our video IAS 7: Statement of Cash Flows—each step is explained very clearly in detail in Excel file with all numbers included.

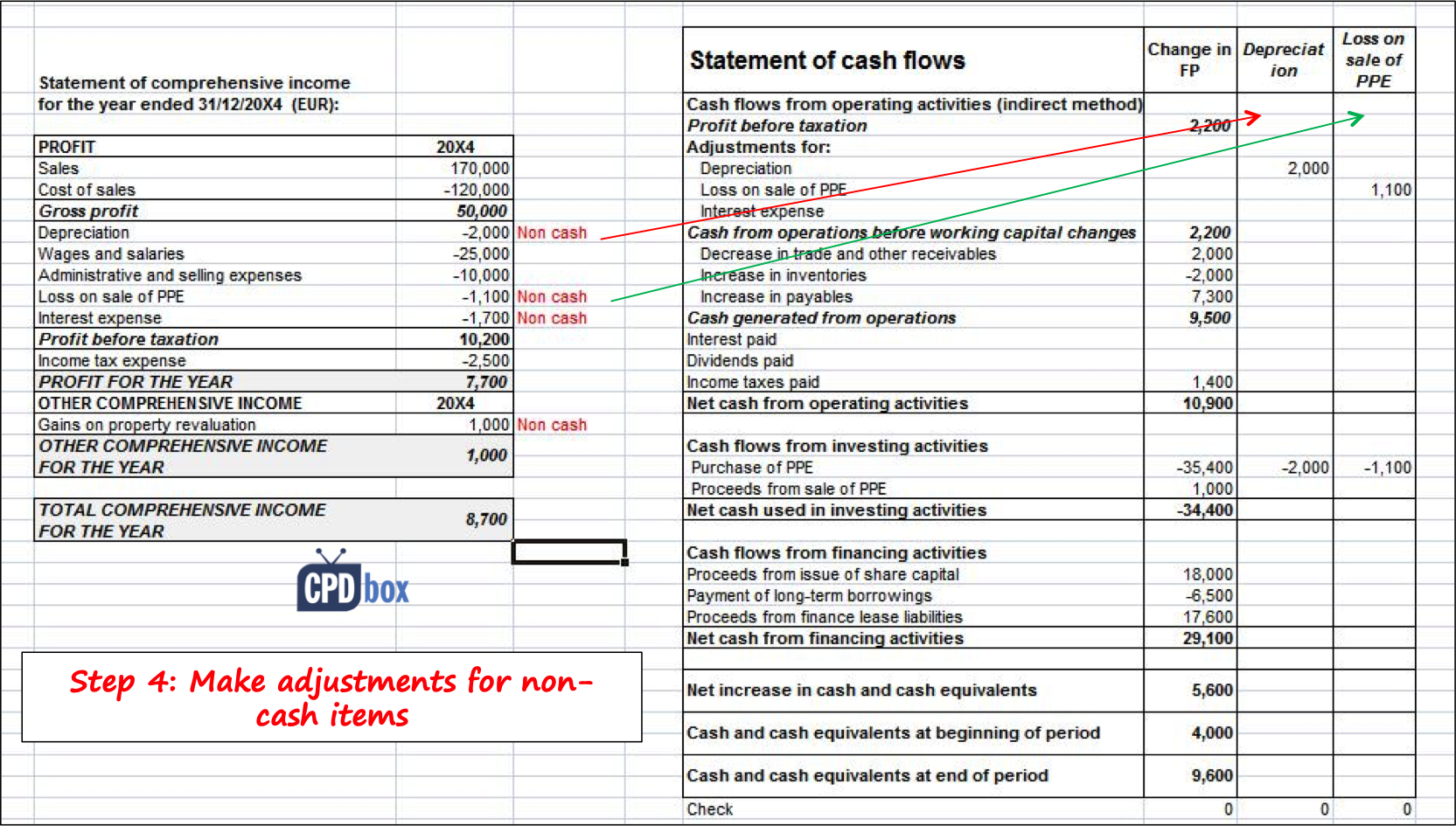

Step 4: Make Adjustments for Non-cash Items from Statement of Total Comprehensive Income

By now, you have a solid base to finish your cash flows successfully. However, these figures do not mean anything. We have more work to do.

Take the profit or loss statement and statement of other comprehensive income. Then identify any numbers where non-cash transaction might have been recorded. Typical non-cash adjustments are usually as follows:

- depreciation expense

- interest income and expense

- income tax expense

- expense for recognition or income from derecognition of various provisions

- change in revaluation reserves

- foreign exchange differences at the end of period

- revaluation of certain assets and liabilities at the end of period

- barter transactions

and many more.

So once you identify non-cash transaction, just make adjustment in the blank statement of cash flows. Do each adjustment in the separate column. Making adjustments means simply adding one number to one caption and deducting it from the other one. It’s like doing double bookkeeping. The trick is to identify: 1) which captions in cash flows are impacted by non-cash item and 2) where is the plus side and where is the minus side.

For example, let’s take depreciation expense. On one side, it causes non-cash decrease in profit figure, so it should be added back. Just enter the figure in the operating part under the heading “adjustments for non-cash items: depreciation” with a plus sign. And where do we put the same figure with a minus sign? Well, depreciation artificially increased total payments for purchases of PPE. So we just deduct it from the investing part under the heading “purchases of PPE”. Perform a check—total of adjustment shall be 0.

Go on until you are done with all identified non-cash adjustments from statement of total comprehensive income. And remember to verify your totals after each adjustment.

Now I know this is probably the most difficult part, because sometimes it’s hard to identify where to put the change and which sign to use. But the principle is always to do both sides of adjustment and keep your totals to be 0.

Again, let me remind you that our comprehensive step-by-step example included in IAS 7: Statement of Cash Flows video shows various types of non-cash adjustments and explains how to deal with them.

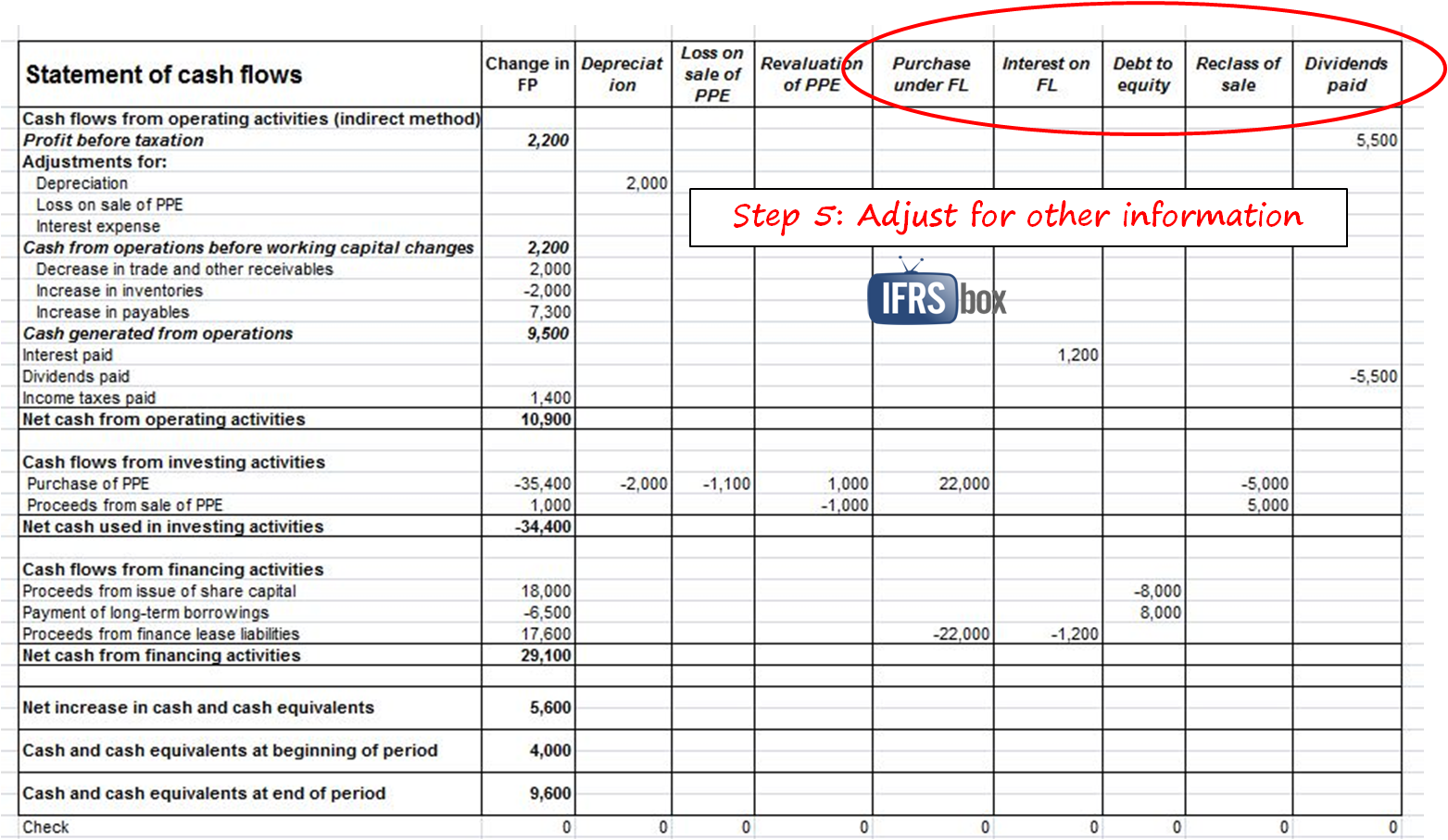

Step 5: Make Adjustments for Non-cash Items from Other Information

Step 5 is pretty much the same as step 4, but now you shall look to other information sources. I listed several of them in step 1.

So for example, you find out that your company entered into new material lease contract. And there is a non-cash adjustment hidden for sure, because on one side, increase in PPE was recorded that was not purchased for cash. On the other hand, increase in loans or lease liabilities was recorded, but the company have not received any cash. So you shall adjust for it, exactly the same way as described in the step 4. Remember about your total—it should be always 0.

You can continue this way until you review all information you consider relevant or necessary. I just remind to make each adjustment in the separate column and check your totals to be 0.

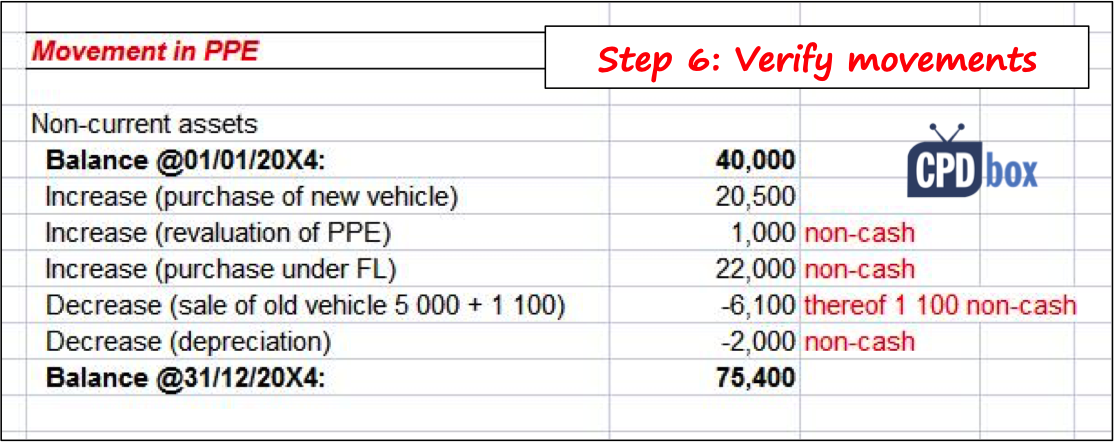

Step 6: Prepare Movements in Material Balance Sheet Items to Verify Completeness

Well, this step is really for diligent, hardworking and dutiful people. You can skip it if you want, but I recommend doing it from very obvious reasons: you will be pretty much sure that you have made all material non-cash adjustments in your cash flows without omitting something important. Well, if you are sure that you have all available information from various departments in your company to include, than fine. But if you are unsure about it, then rather do this step.

It’s very easy. Just take the biggest or material items in your balance sheet and reconcile their movements between opening and closing balance. Check whether each movement is taken into account for in your cash flow statement so far.

For example, PPE. You might find out that movement of PPE was as follows: closing balance (from closing B/S) = opening balance of PPE (from opening B/S) plus cash purchases of PPE plus lease acquisitions of PPE plus PPE received as a gift minus depreciation of PPE minus loss on sale of PPE minus cash sale of PPE. Which items from this movement are non-cash? I suggest the following ones: lease acquisitions of PPE, PPE received as a gift, depreciation and loss on sale of PPE. So for each of those non-cash items, you should have made an adjustment. Have you? Fine. Have you not? Well, that’s why you do the movements—you identified another necessary adjustment, so make it.

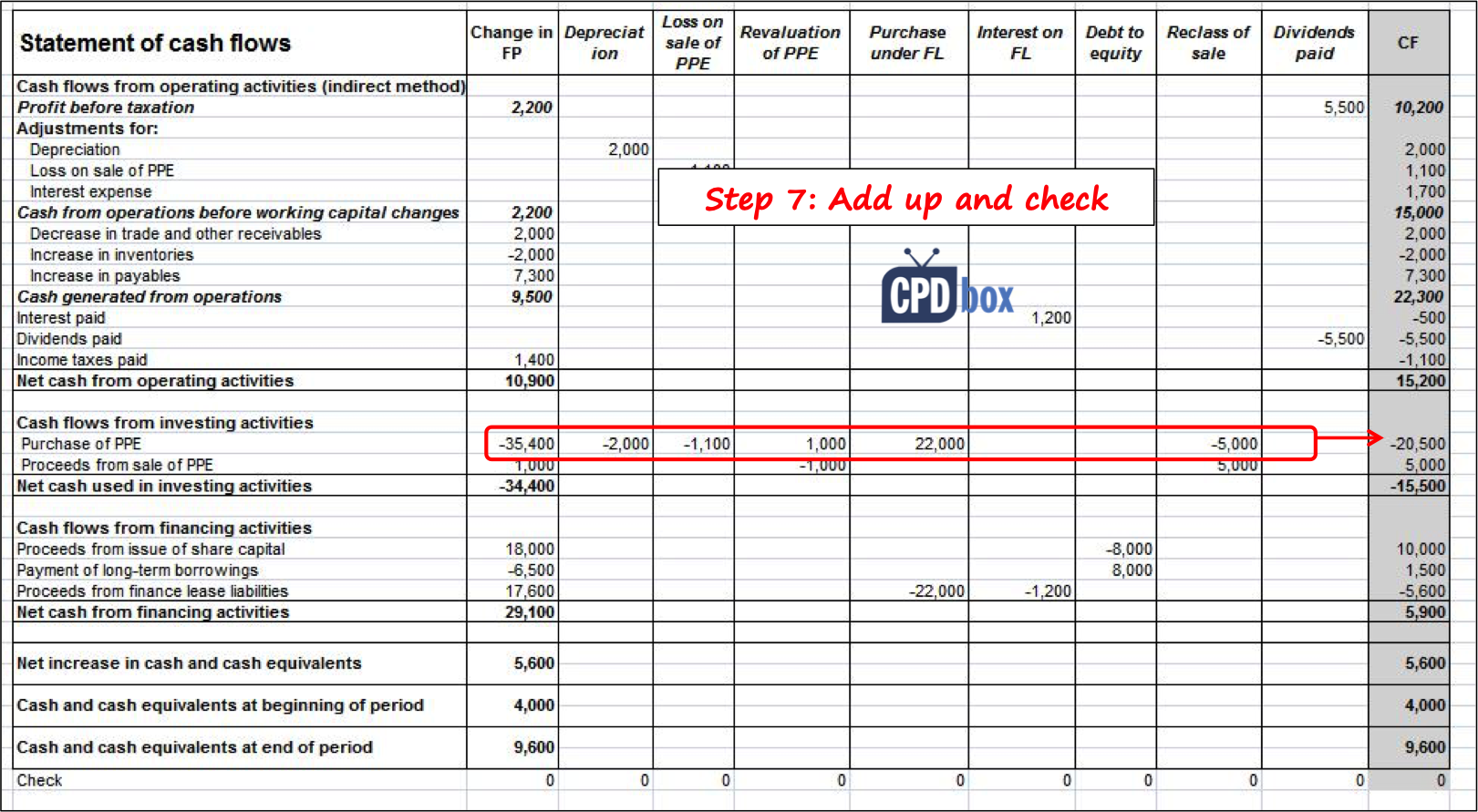

Step 7: Add Up and Perform Final Check

Let’s assume that by now you have done a lot of work, made a lot of adjustments, verified movements in material B/S items, your totals are always 0. Great job!

In this stage, finishing your cash flows is a piece of cake. What do you have in front of you? Huge excel file with 1st column being the headings and titles of your statement of cash flows, 2nd column being the changes in balance sheet and 3rd–xth columns being individual adjustments.

Now it’s time to draw the last column. And you guessed it—your last column will be the statement of cash flows itself. In the individual lines or items from statement of cash flows, you shall make “horizontal” or “line” totals, or in other words, sum up the numbers from columns 2 to x. You effectively calculate the change in the balance sheet for the individual caption adjusted by non-cash items, that gives you the appropriate cash movement for that caption.

Fine. Then verify if it makes sense. For example, you will get certain number in the line “purchases of PPE”—go and verify this number with your accounting records, or ask your investment department whether cash payments for PPE during the period were as you calculated. If not even close to that—you must have omitted something, or messed up signs or you made some other mistake.

Finally, look to “vertical” total of the last column—if it’s 0, you are the winner and deserve to sit back, close your eyes, relax…. but that’s topic for another article :-).

A Few Final Words…

Please bear in mind that my goal of this article was to draft a systematic approach for preparing a statement of cash flows rather than to explain the details of individual adjustments or other technical and factual issues. I just wanted to prove that it’s doable once you do it step by step.

You can see the video with this process here:

If you find it too difficult, or you do not understand all adjustments fully, or you need a clear demonstration, than I frankly encourage you to subscribe for our IAS 7: Statement of Cash Flows video course. You will not only learn about basics related to statement of cash flows, but also all above process is demonstrated very clearly in a comprehensive example and the most common cash flow adjustments are discussed.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

INTERESTED IN THE KIT

Hi ,

I am very thankful to cpdbox for knowledge support.

I am searching how to deal with fixed received as gift in cash flow statement.

You know what i love you for this. Cash flow was my biggest hurdle to make FS and you make it a piece of cake for me now.

I can’t express how happy I am, I had come up with the same idea (double entry to make the non cash adjustments with zero balance) but I couldn’t find anyone to support me or help me to develop it, and I searched for a long time until I found your wonderful article.

I’m grateful to you thank you very much Silvia.

Very pleased to read that! 🙂 Thanks

Dear Silvia,

Kudos for the good work – you make it look so nice and easy 🙂

There are some old comments but unfortunately with no reply 🙁 Could you please elaborate on your method’s approach on Deferred tax assets/liabilities – I cannot figure out where to put the change in “Change in FP”, nor the double bookkeeping adjustment later so it makes sense in the end. It’s definitely a non-cash item and should not exist in CashFlow, but using this method is hard to acknowledge this change. Maybe this happens with other types of non-current assets/liabilities too.

Thank you in advance!

Dear Adnrey, true, I do not reply all the comments since is it beyond my human capacity, although I am trying to give as much help as I can.

To your DT question: Well, ask yourself – which accounts do you use when booking deferred tax? I bet it is the tax expense. So I would say you need to be careful with profit before tax figure. In most cases, the difference in DTA/DTL on balance sheet will be cleared against profit before tax figure. Similarly as with current income tax. In other words – where deferred tax is involved, you need to split taxes into 2 portions: current (cleared against paid current income taxes) and deferred (cleared against changes in balance sheet). Now, of course, there could be complications and you need to adjust accordingly.

Dear Silvia, thanks a lot for your answer! I am going to purchase the Kit with not a single drop of doubt into this decision. It is worth every penny, and I hope that you continue helping all of us, around the world!