Troubles with IFRS 16 Leases

The new lease standard IFRS 16 can initially cause some troubles to the affected companies, because it introduces huge changes in the lessee’s accounting for leases.

It was issued in January 2016 and we have to apply it for the periods starting 1 January 2019 or later, with earlier application permitted.

I wrote an article that illustrates the main differences between the older standard IAS 17 and the new standard IFRS 16 here and I have been receiving a lot of questions about its practical application since then.

Therefore today, I’d like to outline the main challenges related to the application of the new IFRS 16 and the main impacts that you should be looking at.

Some companies are greatly affected, some companies are affected just a little bit – this depends on the specific circumstances, such as:

- Are you a lessee or a lessor?

- Are your operations centralized or decentralized?

- Are you currently using finance leases or operating leases?

- Are most of your leases under 1 year?

And many others factors.

What has changed by IFRS 16?

Let me shortly sum up the main changes introduced by IFRS 16:

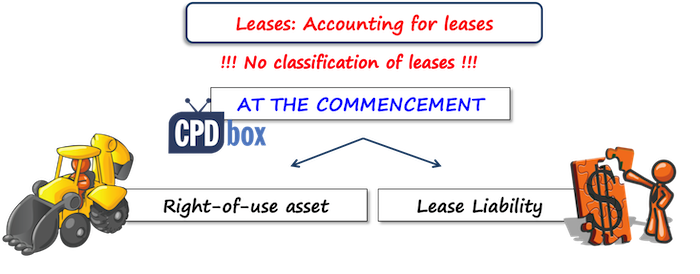

- Single accounting model for all leases (lessees only)

Lessees will NOT classify the leases as finance or operating. Instead, all leases are recognized in the balance sheet, similarly as finance leases before the change.

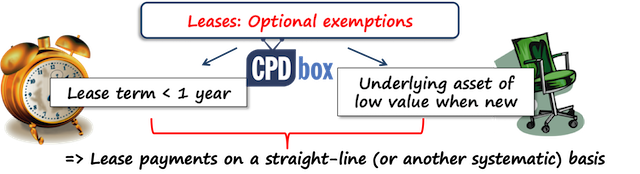

There are 2 exceptions: leases under 1 year and leases of low value assets when new. Lessees can account for the payments under these leases straight in profit or loss.

You can learn more here and here.

I would also like to point you to the IFRS Kit that now contains 13 detailed videos with lots of illustrative examples solved in Excel about IFRS 16 Leases. It runs almost 3 hours and after watching it, you’ll understand what and how to do. (Just a note – there’s more than 110 IFRS videos inside the IFRS Kit, with total running time of almost 40 hours, just to make the things clear).

- No significant change in lessor’s accounting

That’s the good news!

- Sale and leaseback transactions

The accounting for sale and leaseback transactions depends on whether the sale meets the definition of a sale under IFRS 15 Revenue from Contracts with Customers.

This is a good change, because IAS 17 Leases was very messy and you really needed to think twice what type of sale and leaseback you assess.

- More disclosures required

The change n. 1 can have a HUGE impact on the company’s operations, taxes and financial position.

Also, exactly the change n. 1 can cause a headache when trying to implement it.

The reason is that while the accounting for operating leases was very easy and straightforward under IAS 17, IFRS 16 requires you to gather substantially more information to make it happen.

Which industries are the most affected?

It’s difficult to assess the reality, because this is still very fresh and as far as I know, not many companies have completed the adoption of IFRS 16 and its impact (I’m writing this in April 2017).

However, a number of reports and preliminary assessments warn the following industries to watch out and start the implementation early:

- Telecommunications

- Retail and consumer products

- Banking

These industries largely use assets owned by other parties and often, the contracts are not directly titled “lease contract”, but the leases can be hidden in the service contracts.

I’m not referring solely to the rent of premises, but also to the arrangements related to the towers, transmission devices, ATMs, data storage facilities and other.

Financial impacts of IFRS 16

Impact on the financial statements

Lessees will bring the operating leases from off-balance sheet to the balance sheet by showing the assets and liabilities related to these leases.

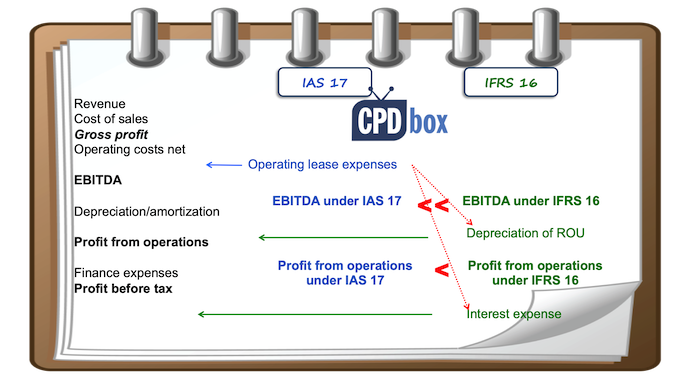

Also, the expense structure will change in profit or loss, because before the change, all operating lease expenses were shown under “operating expenses”, but now, a part of them falls under the “depreciation” (you depreciate the right-of-use asset) and a part of them falls under the “finance cost” or interest expense.

As a result, your EBITDA changes. This is clearly illustrated in this picture:

If you have more assets and liabilities in your financial statements, that can also affect your financial indicators, like ROA (return on assets) – this is likely to go down, due to about the same profit in comparison with higher assets.

Tax implications

Let me make one thing clear: IFRS do NOT tell you how much tax you should pay. It’s your local tax legislation that prescribes how to calculate your tax payable.

Now, when lessees stop recognizing operating lease payments in profit or loss in full amount, but instead, they start accounting for the depreciation of the right-of-use asset and an interest expense, will these expenses be deductible for your income tax purposes?

I don’t know. You should look to your own tax law. But let me describe how it works in our country.

Here, only a lessor can deduct the depreciation charge, not the lessee under the operating lease.

In this case, under IFRS 16, both lessor and lessee will show some asset in their financial statements (not in the same amount), but only the lessor can depreciate the asset for the tax purposes.

The lessee will depreciate only for accounting purposes and in his tax return, the accounting depreciation charge is tax non-deductible and will be added back to the net profit for the purpose of current tax liability calculation.

On the other hand, the lease payments made by the lessee are fully tax-deductible (for operating leases). So these payments will be deducted from the lessee’s accounting profit to arrive at the taxable profit.

I hope that the national legislations of countries that adopted IFRS will acknowledge this change, too and will be amended.

Meanwhile, you have no other choice but to recognize a LOT of deferred taxes. Not a LOT due to their amount, but due to the complexity of tracing and following up its changes.

Main difficulties with IFRS 16 Leases

Is there a lease in the contract?

IFRS 16 defines a lease as a contract (or a part of it) that conveys the right to use an asset for a period of time in exchange for consideration (refer to IFRS 16, Appendix A).

This is a very broad definition and as a result, some leases are “hidden” in the contracts that are not lease contracts.

Imagine you are a retail company and you need to import XY tons of coal to your plants. You agree with the local railways to transport the coal for some period of time from the place of origin to your factories.

Is there a lease?

Maybe yes, maybe not. You need to assess it carefully.

Are the particular rail cars exclusively selected for your use? Can you decide how and when you will use the cars? In this case, there could be a lease.

Does the supplier guarantee you the transport of coal in predetermined times, but without the specification of particular rail cars? In this case, there is no lease, just a service contract.

This was the illustration of a situation when you actually CAN have a lease in a contract that appears NOT to be a lease.

Another illustration of the opposite situation:

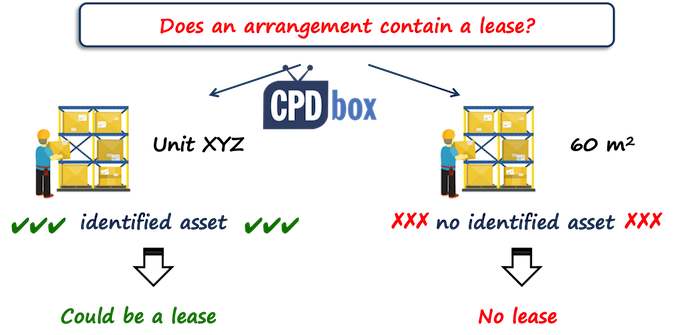

Imagine you are a retail company and want to store some of your inventories in a local warehouse.

Is there a lease? Again, it depends.

Does the contract specify the exact place in a warehouse, for example, unit 1A in the warehouse and can you exclusively use it? If yes, then there is a lease.

Does the contract specify XY cubic meters in a warehouse, without the specification of a particular place? Can the warehouse manager shift places time to time? In this case, no, there is no lease under IFRS 16.

This was the illustration of a situation when there is NO lease even if a contract was titled “Lease contract”.

Under IFRS 16, you always need to look whether there’s an identified asset and whether you have a right to control the use of it.

When you implement IFRS 16, please bear this in mind. Look to all possible contracts (not only the “lease” contracts) and identify whether you have a lease or not.

Use of judgments

Personally, I don’t like using lots of judgments, because there’s a room for manipulation and two different accountants will always arrive at two different numbers.

On the other hand I understand that sometimes, you can’t avoid judgments and they are truly necessary.

With IFRS 16, you will need to use much more judgment than before under IAS 17.

Let me outline where:

- Setting the discount rate

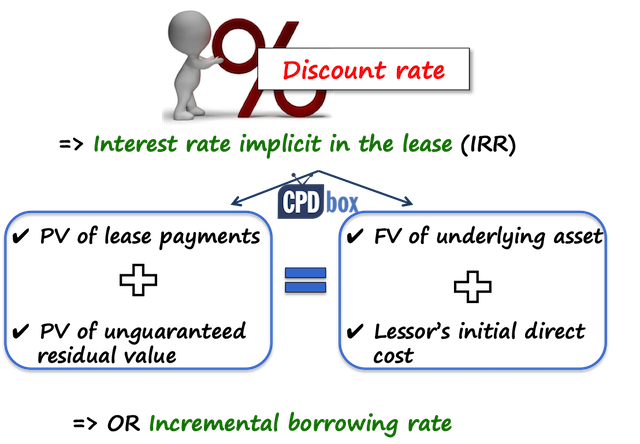

Under IAS 17, you need to use the interest rate implicit in the lease. The same applies in IFRS 16, but there’s a difference in the definition of that rate.

IFRS 16 defines the interest rate implicit in the lease as “The rate of interest that causes the present value of (a) the lease payments and (b) the unguaranteed residual value to equal the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor. “ (IFRS 16, Appendix A)

Please note the word “lessor” in the end of the definition.

Yes, even lessees need to determine the interest rate implicit in the lease with reference to the lessor’s initial direct costs and unguaranteed residual value.

If you are a lessee and you take an asset under the lease, will you know what the initial direct costs of the lessor are? And what the unguaranteed residual value is?

I bet no. I’m sure that most lessors would not tell you their costs.

Therefore, you, as a lessee, in most cases cannot determine the interest rate implicit in the lease and you will need to use your incremental borrowing rate.

In other words – use judgment to set the appropriate discount rate. Here you go.

- Setting the lease term

The lease term is the non-cancellable period for which a lessee has the right to use an underlying asset, together with both:

- Periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option, and

- Periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise the option. (IFRS 16 Appendix A)

Where do you use judgment here?

If you have the option to extend the lease (or to terminate it), you should consider these options at the lease inception.

So, you should be able to say whether you want to continue the lease or not right at the start, because these periods are included in the lease term.

It’s relatively easy for the lease terms with medium horizon, like 2-3 years, but what about the leases for 10 or more years?

You need to use judgment and consider a few factors to assess whether you’re likely to exercise the option or not.

What happens when your judgment proved to be false?

In other words, what if you assessed not to extend the lease, but later, you decided to exercise the option and to continue?

In this case, you need to remeasure the lease when the assumptions change. Let me again point you to the IFRS Kit, where I solve similar situation in a great detail.

Is there some relief?

Before you start worrying about all “that IFRS 16”, familiarize yourself with a few reliefs you can actually apply.

I don’t list all of them here, just the most important ones.

Short-term and low value leases

When the lease term is max. 1 year, or when an underlying asset has low value when new, you can apply the exemption as a lessee and account for the lease payment straight in profit or loss.

There’s no definition of what “low value” means, but the standard refers to furniture or computers.

It’s a great exemption, because it saves you lots of troubles and money.

You just need to know how to apply it.

Therefore, look to a definition of the lease term again. I would like to draw your attention to the word “non-cancellable”.

When you’re assessing the lease term, you always look only to non-cancellable periods, i.e. periods when the lease is enforceable and no party can terminate the lease without permission from the other party with no more than insignificant penalty.

Practical impact?

Imagine you rent an office space and you can terminate the contract anytime with 3-months notice.

What’s the lease term?

Just 3 months, even if you plan to rent an office space for a longer period. Only 3 months are non-cancellable.

It means, that the lease term is shorter than 1 year and you as a lessee can apply the exemption for short-term leases and forget about accounting for a right-of-use asset and a lease liability.

Portfolio lease accounting

When you have a lot of lease contracts with similar characteristics, you can apply a portfolio approach.

It means that you would account for all the leases as for one aggregate lease and not for lots of individual lease contracts.

You can do so only when the results of portfolio accounting would not be materially different from individual approach.

No separating the lease elements

When you have more elements in the same contract, you should separate the lease elements from non-lease elements and account for them accordingly.

For example, imagine you rent an office space and you pay CU 10 000 monthly for the rent. The price includes the cleaning services.

Normally, you would need to split the payment of CU 10 000 into the payment for the lease element (rent) and non-lease element (cleaning).

However, if you are a lessee, you can decide not to do it and account the full amount of CU 10 000 as the lease.

Warning: Lessors need to separate, they can’t apply this expedient!

Transition expedients

Implementing IFRS 16 in your company will be a challenge, that’s sure. But, IFRS 16 offers some reliefs or practical expedients at the transition process, too.

However, this article is much longer than I expected to write, so I will cover the transition to IFRS 16 in the near future.

If you have any questions or comments, please let me know below, thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

72 Comments

Leave a Reply Cancel reply

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

We are setting up a lease liability schedule and the payments in the first 3 years are considerably lower than the rest of the term. This results in interest charged being higher than lease payments and so the total liability increases. Meaning that the non-current liability is higher than the total liability and what would have been the current protion is actually an asset/positive.

Lease liability £985k

Lease payment 1st year £30k

Interest 1st year £54k

Total liability end of year £1,009

Total liability end of the following year £1,034

Do you have a solution to this please?

Hi Silvia,

Hope you can give me some hints. I’m having trouble with IFRS 16 application when it comes to assessing new business acquisitions and impairment testing. I find that under the pre-IFRS 16 there is headroom but when I apply IFRS 16 and include the ROU carrying amount this causes an impairment loss. Now, for more context, the new business is profitable from pre-IFRS 16 point of view and we have an established WACC rate which I believe is causing the issue (i.e. as the DCF is showing a lower NPV for VUI) and this was calculated on the existing capital structure at the time. Also, my assumption is that regardless of pre-IFRS 16 or post-IFRS 16 there should be no change to the impairment but I’m having difficulty trying to calculate this. Would it be correct to re-calculate the WACC by adding on the new lease liability from the possible new business? I would think this is fine and will give me a lower WACC which I can then apply to this scenario? Also, I am keen to hear from you on what other ways I can address this issue.

Thanks and regards,

Dear Silvia,

We putted the journal entries at commencement date,

ROU DR. & Lease Liab. Cr.

please give the journal entries for sale & leaseback after the commencement date, how we decrease the ROU & Lease Liability in case of Sales.

We have an agreement for office rent, whereas rent will increase 10% every 5 years, tenor for the agreement is 25 years.

we valued our ROU with considering these (10%) incremental effect.

Is it okay…

Yes, as soon as the rental payments are fixed now (if they increase by fixed 10% each year, that means you know precisely their amount).

Hi Sylvia,

Greeting from here…

Please let me tell about of Tax base (for calculating deferred tax) for Right of Use Asset

Dear Sylvia, thank you for sharing your knowledge. I would like to ask you a question about the net present value of previous payments. Consider it, we signed a lease contract from 2016 to 2038. In 2019 how can I account for paid rents in 2016, 2017, 2018, and 2019. Does it mean that the financial element of the contract turns positive?

Thank you very much

Great article as usual again Sylvia. I love how you gave everyone the “practical” loophole which is inherent in the Standard itself and that is – “When you’re assessing the lease term, you always look only to non-cancellable periods”. I love it!!! Thank you so much! BTW, another important thing a lot of auditors do not understand is, for SMEs, if it is an operating lease for the office space a typical Small to Medium company – if the CFO insists that they will avail of the exemption even if they do not qualify for the “short-term” or “Low-value underlying assets” criteria – if the non-cancellable period is only 2 to 3 years, the impact of not recognizing both the ROU and Lease liability of an operating lease WOULD USUALLY be IMMATERIAL, unless the operating lease includes machinery, a Big warehouse or other Expensive assets. Remember that the impact to be considered on the Balance Sheet is on equity (Hence- ROU minus Lease liability is usually just the Discounted financing cost) and if there are any differences it is merely cut-off. On the P&L side, it is just also an immaterial classification audit difference (Straight Line rent expense now becomes Depreciation + Interest) and cut-off. So you really need to assess as the IFRS 16 impact for most small companies who only have an operating lease (as a lessee) only for their office space, it is usually immaterial.. It only becomes material for manufacturing companies (i.e. Warehouse, Lease of equipment), F&B (I.e. you are leasing numerous branches), and other industries with a lot of branches under operating lease. You are so right! This is a judgement to be made on a case-to-case basis.

Thank you silivia for great article,

What are the development proposals to remedy these difficulties in IFRS 16?

Hello Silvia

Do you not have a simple calculation that will assist me with completing the calculation for this disclosure that is required?

b. an explanation of any difference between:

i. operating lease commitments disclosed applying IAS 17 at the end of the annual reporting period immediately preceding the date of initial application, discounted using the incremental borrowing rate at the date of initial application; and

ii. lease liabilities recognised in the statement of financial position at the date of initial application.

– I need assistance on the first part of the disclosure (i)

I have 2 leases, with different discount rates and the amounts also differs

Lease 1: Lease commitments are $ 1,110 per month = $ 13,320 per annum, and the rate at date of initial application is 7.79%

Lease 2: Lease commitments are $ 32,601 per month = $ 391,212 per annum, and the rate at the initial application is 7.24%

How do I got about discounting the above figures?

Regards

Hi Sylvia

Not sure if this is the correct place to be posting, but if you receive rent contribution from the landlord, rather then offsetting the contribution against the entire lease under IFRS16 can the contribution be used against the fitout cost associated fitting out the space leased, therefore excluding the contribution against the IFRS16 lease calculation.

Silvia, if due to corona virus the company close the doors for 15 days or 30 month for example. Could I stop to depreciate our assets during this period under IFRS?

What it is your opinion?

You can, if you use number of units method.

Thank you for sharing your article my question is related to setting minimum lease payment. Yes IFRS 16 recommends 5000 USD as a reference is it applicable to all countries?

Hello Silvia,

Hope all is fine from your side.

I have a lease contract to register under IFRS 16 but before using the build I spent considerable amount on improvements.

My doubt/question is: Do I recognize it in two different GLs (ROUA and Leasehold Improvements) or just sum the amounts and account it only as ROUA?

Thanks in advance.

God Bless!

Hi Paulo, these expenses do not represent the initial direct costs attributable to ROU asset, because they were not incurred in obtaining the lease. So in my opinion you can capitalize leasehold improvements as a separate asset, but please do not depreciate them over period longer than is your lease term. S.

Thanks Silvia!

Dear Silvia,

my company leased a land, the lease term is indefinite, and we have built a building on that land that we are using in our production process. I am not sure we have accounted it properly under IFRS 16, since no lease term is defined, and the land itself has indefinite useful life (no depreciation). Could you please give me some insights? Thanks!

Hi Silvia and everyone,

Thanks for the article.

I have a doubt, I’m in a lease contract with lease prepayments (I’ve already paid the lease for the next 5 years starting from Jan’2020). I’m I still under IFRS 16? How to account for it?

Thanks in advance.

Hi Paulo, yes, most likely you need to go under IFRS 16. S.

Many Thanks Silvia!

Being a prepayment I’ll register the ROUA against Cash and will depreciate it over 5 yrs. The question is around the discount rate. In this case there will be NO need to calculate the interest rate implicit in the agreement and NO interest expense will be recognized during the 5 yrs? Please confirm!

Regards

Good day Silva, I have a query regarding consolidation of Financial Statement. What if the Lessee and the lessor entered into a lease contract in which the lessor classified the lease as an operating lease, whereas for the lessee upon issuance of this standard uses only single accounting model for the lease, if the parties are also related parties where parent and subsidiary relationship exist. The cost being recognized for the PPE and Right-of-use asset only pertains to a single underlying asset, also both the parent and subsidiary will recognise depreciation expense for the same underlying asset. How do we for deal with these upon consolidation of financial statement. Thank you so much.

Hi Sylvia, I have not yet seen a detailed guidance on how to account for Forward Options on Inventory Repurchase Agreements. Our company sells cars to dealers covered by repurchase agreements where in we have to buyback the cars after a fixed term (usually within 12 months) at prices lower than the original selling price. This says we have to account for the transaction as lessors of an operating lease. I am keen to know the entries we need to make to record the transactions. Can you also confirm if we need to depreciate the cars during the lease term (fixed term where the cars are still with dealers) considering these are inventories we still intend to sell after the buyback. Thank you!

Hi Silvia,

Thank you for your summarize IFRS 16.

I have a query. May I know if I need to reassess the lease liability if there are changes in borrowing rate.

For your information,now we use annualized effective rate of borrowing (i.e incremental borrowing rate to calculate the lease liability.

Do I need to assess the lease liability if the Company do refinance of its current borrowing which result to change in the annualized effective rate of borrowing. However, the changes in borrowing rate would not result to changes in cash flow as the lease payment is fixed.

Thanks

Hi Silvia,

Thanks for your fantastic examples and easy to grasp concepts about IFRS. Regarding IFRS 16, how do we account for a subsequent sale and leaseback (SLB) transaction. If any heavy maintenance cost (for an aircraft) was being amortised as per normal policy of the company, then should that be also removed from the books at the time of doing SLB or can it continue as is on the basis that the same aircraft is being used subsequently also and substance over form can be applied.

Many thanks.

Hi Silvia,

Please guide on accounting treatment and disclosure for the property taken on lease for 30 years and lease payment made in one go on lease commencement.

Hi, have a question on impairment that I can’t find an answer to. If you have a lease for 5 years non cancellable. If decision taken to vacate property in 2 years time and no option to sublease for reminder of lease term I.e. 3 years. Is asset depreciated over 2 years or 5years? Thanks

Hi Catriona, why are you mentioning impairment? If the lease term shortened, you must account for the lease remeasurement first – it means that your right-of-use asset will change, because your lease liability will decrease. And then the rest depends on the conditions and terms in the contract. S.

thanks for your reply.

And we ignore the payments before 01/2019? no need to adjust anything before 01/2019 in equity with the modified approach please?

Hi Sylvie,

How to treat a lease contract if starts for example in 01/01/2017 and ends in 31/12/2026? do we prepare the PV of lease payments from 01/2017 and then use the PV that is estimated in 01/2019? do we ignore the amounts (PV of Lease payments, Interest and Lease liability) prior to the application? Is that possible to make our lives easier?

You can apply modified approach – i.e. take only the payments after 12/2018 (outstanding at 1 January 2019) and discount those. This amount would be your lease liability and right-of-use asset at the transition date.

Hi Silvia,

Great platform for understanding IFRSs much appreciate the effort. I came across a confusion regarding IFRS 16 wrt lease term.

suppose we obtain a warehouse A located in city X i.e identifiable asset for 5 years at yearly rentals CU10,000 payable in arrears. the agreement has a clause that we can terminate the contract by serving a 5 month notice. it means that lease term is 5 months as per definition and not 5 years.

shall this be classified as short term lease?

if yes what will be the treatment of rentals if the contract is continued for 3 years and then in 3rd year 5 month notice is served to cancel it.

Hi Noorkhan, I think this Q&A session might give an answer. S.

Dear Silvia,

Thank you for your summarize IFRS16. I have a question about the company providing expatriates with apartment to stay for rental period of 2 year with non-cancellable clause. In the past, this have been booked as staff welfare and now i’m confuse whether to capitalise this as right of use asset.

Appreciate your valuable advise.

Best regards

Lieng

Hi Lieng, I am a bit confused about who is a lessee and who is a lessor in this case. So, if the company is an owner of this apartment and is a lessor and an employee is a lessee, then you normally classify the lease as either operating or finance. But I guess employees do not pay anything. Or, is the case that the company is a lessee renting the apartments from someone else? In such a case yes, you need to book the right-of-use asset and all expenses related to it such as an interest charge and depreciation are shown as employee benefits. It is also not clear whether the employees pay something or not – I assume not.

Hi Sylvia,

Thank you very much for your efforts to summarize IFRS 16.. I have one question to ask. We have leased an asset with an option to renew it annually. The asset was leased in 2014 and since then we have renewed the lease. There is no definite end term of it.

What period should i consider when calculation the PV?

Best regards,

You can learn more about setting the lease term here.

Hi Sylvia,

At initial recognition of ROU asset and lease liability should a DTA and DTL be rocognised? My understanding from the IFRS staff papers on the topic is that the recognition exception of IAS12 cannot be applied (they will narrow the exemption scope) and thus a DT asset and a respective liability should be recognised. What is your view on this?

best regards

Hi Silvia

You have any format of calculation of Lease for lessee to recognized in depreciation and Interest expenses.

Hi, how to treat if lease incentive is higher than lease payments and/or we’ll get negative right of use asset? Thank you in advance

Hi

How do you measure the lease liability and right of use asset in the following circumstance:

a) Escalation of 8% each year on the lease instalments

b) 29 months left on 5 year lease

I’ve seen all the examples of lease instalments that stay constant and nothing with an escalation.

Hi Swaleha,

it is the lease modification and in the inception, you do not take this into account (simply take initial payments for full 5 years). When the lease payments change, you recalculate your lease liability with new payments and account for the adjustment. It is very simply said. I have great excel examples exactly on these issues in my IFRS Kit. S.

I have a question on subcontractors e.g XYZ has over 3,000 small captive (regular) subcontractors providing their owned vehicles to the company for freight services under the following terms:

• XYZ controls and direct the use of the vehicle to customer location.

• The small contractor has only one to two trucks and works predominantly for XYZ.

• A yearly renewable contract, but majority serviced XYZ for over 3 years and some does not have a signed contract.

• Compulsory attendance at health and safety training held by XYZ sales and delivery procedures training.

• Wear XYZ uniforms and interact with the customers and customer sign acceptance of delivery on XYZ equipment

• On XYZ payment system ( e.g records number of deliveries to calculate monthly subcontractor payment)

• Subcontractor takes the vehicle home daily after working hours

• Any refund for loss of customer parcels are paid by XYZ and amount deducted from subcontractor payments, if the latter is found at fault.

Appreciate your view on whether we should account for 3,000 under Portfolio lease with following:

• Lease term 3 years

• Discount rate is the XYZ’s incremental borrowing rate

• Lease payment is estimated by reference to market vehicle rental rate ( monthly rate)

Or whether we keep those as sub-contractors expense.

Regards

Rama

Hi Silvia

if I understood well on operating lease we should not have any deferred taxes recorded on the P&L ; shall we then calculate DTA/DTL ….? which are the entries ? can you please provide an example? Many thanks

Hi Silvia,

I appreciate the job you have being doing! It really helped me to understand many topics I was confused before. I am more o less ok now with IFRS 16, besides one point. We have a few lease contracts with unspecified lease term. In fact we already use warehouses from the moment we started business. Highly likely we will continue using them in foreseeable future. Let me know your opinion on this point. Shall we treat it as subject to put it on balance?

Hi Arthur, I think that this short Q&A session will help. S.

Hi Silvia,

Thank you for providing this site to us. It is very helpful and I am really greatful for your efforts!

I would have a question regarding implicitly specified assets. The assets we give our customers for use and we charge them for it are mobile phones. We don’t have an explicitly specified asset, since we don’t mention serial numbers or anything similar in the contract. It is simply said that we provide them with a mobile phone for use. We don’t have only one mobile phone, a specific one which would make a customer being able to provide services with. We purchase several phones with factory settings without modifications and distribute them to customers. Again, the contract doesn’t say anything about serial numbers, not even a manufacturer or a type of a mobile phone.

What are your thoughts on it? Would you say that we have an implicitly identified asset or not?

Best regards and thank you already in advance.

Jonathan

Hi Jonathan, yes, you have an identified asset here, and if you don’t identify the specific serial number, or the type of the mobile phone – it does not matter, it is implicitly identified then. The reason is that as soon as you promise the mobile phone to your customer in the contract, you cannot fulfil the contract without that mobile phone – or specified asset. You must use a mobile phone to fulfil the contract, hence it is identified asset. S.

Hi Silvia

Your site is so helpful! I have tried to find articles on peppercorn rents to confirm a reasonable approach. We pay a variable amount the following year. We know enough about the costs which are a mix of service and space (exclusive space) to budget it fairly reliably every year. But the contract does not state an amount. One member of my team says it falls outside IFRS 16 as there is not a contract value and therefore a liability cannot be calculated. But give it is our biggest contract (its integral to our business) and has some aspects that we know, I am not so certain.

What are your thoughts?

Hi Silvia,

I have a question regarding the standards that are excluded from the IFRS 16 scope particularly IAS 41.

Leases of biological assets within the scope of IAS 41 is excluded but I need more clarity on this. Does this mean any equipment or asset that is rented to ‘maintain’ the biological asset. As an example if I paid a variable rate per ton for a service to be supplied but inherent in this price is an in substance fixed payment for the use of planting and extracting equipment(used for biological assets) because these costs would be capitalized to biological assets does this mean I would exclude this and not consider an IFRS 15 assessment?

Thank you

Hi Devashnee,

I have a different understanding.

The equipment that you lease is NOT a biological asset itself – it is an input to biological assets. Therefore, I would apply IFRS 16 and recognized ROU (right of use) asset. Then, when you actually depreciate ROU asset, you can capitalize the depreciation charge into the cost of a biological asset (if it is not at the “fair value stage” yet).

I hope this helps, S.

Can you give a basic example of how one would account for a repo agreement with a put option which is part of a sale and leaseback? Specifically, I wish to understand what happens when the repurchase amount is less than the original selling price and thus according to IFRS 15 is not accounted for as a lease (customer being lessor) but instead should be accounted for as a financing arrangement under IFRS 9. I can’t find any examples that explain when this might happen and how it is actually accounted for.

Thanks in advance

Nigel, all you need to do is to assess whether the control was transferred or not, regardless the repurchase price (lower or higher). Only when control was not transferred, then you apply IFRS 9. And, I have the full step-by-step numerical examples of this situation inside the IFRS Kit. S.

Hi Silvia,

What about an agreement where the entity enters obtains the right to a piece of property (let’s assume clearly defined in the agreement, and thus identifiable), but in exchange for the property, it provides a service to the lessor (i.e. type of barter agreement). Would this qualify as a lease in terms of IFRS 16 (and thus scoped out of IFRS 15)?

Thanks, as always, for the valuable information!

Thanks alot Silvia

What about advance tent paid for next 70 years? How same will be accounted? In this case we have no lease liability.

good information

What do we do with our deferred liability for straight line rent under IAS 17?

I should clarify. Upon transition to IFRS 16, what happens to the deferred liability for straight line rent?

Hi Traci,

Just to reflect on your issue.The lessor is not required to make any adjustments, except when the lessor is an intermediate lessor.Lessor Accounting can be said unchanged. The impact is mainly on the lessee’s book. IFRS 16 gives TWO transition options for the lessee. One is full retrospective application (like in IAS 8, change in accounting policy).Second is to apply this standard with out restating comparative information where cumulative effect of initially applying it is adjusted to opening retained earnings. The 2nd means, you recognise a lease liability (for previous operating lease balance) @ PV of the remaining lease payments using your current incremental borrowing rate AND an R.O.U asset(s) @ the amount of lease liability adjusted for any accrued or deferred lease payment balances. This std also requires an impairment test to the ROU asset at date of recognition (initial application of IFRS 16). The practical expedient here is also an optional exception in the IFRS 1 for first time adopters of IFRS. The unanswered question for me is when the lessor is accounting for an operating lease type, ROU asset is also accounted by a lessee; ARE WE NOT DOUBLE COUNTING the same asset in two books? Thank you Silvia for answering my question.

Hi Kiros,

this was the main criticism of IFRS 16 – that the asset is presented in both accounts (lessors and lessees) and, the accounting is not symmetrical. There’s a whole paper on this topic on the IFRS Foundation’s website.

However, lessors keep an underlying asset and lessees just right to use it – that’s a bit different. For tax purposes, we need to look at national legislation. Please see my response to Traci and also, part on tax effects in this article. S.

Hi Traci,

what’t the situation precisely? Under IAS 17, you booked rent expense straight-line in profit or loss and what happened under your tax rules? Were you able to deduct the rental expense fully? If yes, then there’s no deferred tax. If not, please explain how the deferred tax liability arose.

Now, under IFRS 16, it may happen that under tax rules, you will continue deducting the full rental expense from taxable profit, but not in your accounting – yes, that’s the deferred tax liability. However, you will recognize depreciation expense and interest expense in accounting, but no deduction for these items in tax return – it’s the deferred tax asset then. You need to look at it as at the complex transaction, because all these items (rental expense, depreciation, interest) relate to the same contract. As such, you can net off the DTA and DTL from these items. And, hopefully, when your contract comes to its end, your deferred tax will be zero. I hope it answers your question. S.

Thank you Silvia for the clarity you added here with the deferred tax issue. I understood Traci’s question as unearned rent income, received inadvance; in the book of a lessor (under operating lease). I hope Traci will clarify her question further. Keep up your excellent job here. This global language does create an international platform for all accountants. Silvia’s platform is the best for me. Thanks again.

Hmhm, I’m not sure, because for the lessors, nothing much changes and they keep accounting for an operating lease as before and the deferred taxes (if any) are recognized in the same way. Thank you for your kind words, I really appreciate and I’m glad that my web helps you 🙂

Thank you for the brief description of IFRS 16.

Some unique lease contracts came to my mind. Here in my country,we are through adoption process and we are facing many difficulties. In many lease contracts it is difficult to determine the lease term, for example. In many contracts, the non-cancellable period is only one year, and renewable annually, mostly with the will of the lessor. Another unique contract is building rent owned by the government. The lease term is renewable and exercisable by the lessee as the rental payment is below market rate. This renewal is almost perpetual, to the extent that the lessee can’t determine the lease term reasonably. I am not sure if there is a specific guidance on such types of lease contracts. Obrigada Silvia.

Hi Kiros,

I think that the determination of the lease term will be one of the biggest issues for the lessees. As I’ve written above, it requires a lot of judgement.

In the first case, when the leases are renewable after 1 year, it’s necessary to evaluate whether it is the option to renew (lessor cannot prevent renewal), or is the agreement of the lessor necessary? Then, what are the incentives to renew? IFRS 16 lists many factors to consider.

As for the second case, if the rental is below market rate, then any extended periods should be included in the lease term, because rental below market rate is definitely an incentive. How many periods to include? I don’t know. Again, it’s judgment and best management’s estimate. If this estimate changes in the future, then you will need to remeasure the lease liability and right-of-use asset.

For me, using lots of judgment in the application of IFRS 16 is one of the most difficult and uncertain parts. Thanks for your comment! S.

Thank you Silvia for the great article. However I remained with a question, regarding separating lease elements: here you say “However, if you are a lessee, you can decide not to do it and account the full amount of CU 10 000 as the lease”, but in the article “IFRS 16 Leases vs. IAS 17 Leases: How the lease accounting changed” you said that “Under new IFRS 16, you need to split the rental or lease payments into lease element and non-lease element”.

Regarding that you asked us to give you feedback about the major impacts on our companies, in the one I work I think it will be relating to telecommunication contracts as all of them include equipments (phones, routers, etc)

Hi Carlos,

in fact, the lease elements need to be separated for the lessors, but the lessees can use the practical expedient (exception) and not to do it. However, I accept your point and will make a comment in the previous article.

And yes, if you are in a telecom industry, then I wish you all the best in IFRS 16 implementation, because it will have big impact. All the best, S.

We are a multinational with quite some lease contracts, but think it would be fairly easy to do it ourselves. Main challenge at this stage is having all contracts available for which we have a setup a contract database where we will reconcile all reported lease costs with the contracts in the database. Then scrutinize all contracts for special clauses.

For calculations we want to use an excel template (which we think would be feasible for around 40 major contracts) to have the opening balances calculated and ongoing for yearly entries. For minor contracts like car lease etc we want to request suppliers to provide calculations.

Does anyone know if such an excel template is somewhere available? Quite similar to the financial lease template which I think a lot of of people use but then adjusted for ifrs 16 specifics. Thanks!

Hi Geoff,

thank you for your valuable insights. I think most companies will undergo the same process and if you have just around 40 major contracts, then it’s quite OK to do them in Excel files. The templates are available within the IFRS Kit. Have a nice day! S.

Thank you Silvia for this great stuff you share it gives a quick outline & explains concepts in an easy & clear way

Its excellent service.