How to Present Financial Instruments under IAS 32

There are three IFRS covering the area of the most complex IFRS topic – financial instruments:

- IAS 32 Presentation of Financial Statements – this standard contains basic definitions and rules for presenting of financial instruments;

- IFRS 7 Financial Instruments: Disclosures – here, you can find a list of all necessary information that you need to include in the notes to the financial statements about your financial instruments, and

- IFRS 9 Financial Instruments – the newest one and the most famous one because it contains all the rules about the recognition, derecognition, measurement of financial instruments and other topics.

You can find the summary of IFRS 9 here and summary of IFRS 7 here.

Also, I dedicated a fair number of articles and podcasts to the financial instruments, so you can browse them here.

In today’s article, I would like to come back to basics, because financial instruments can be quite confusing and we need to explain clearly what they are and how to present them.

What is the objective of IAS 32?

International Accounting Standard 32, or IAS 32, establishes principles for presenting the financial instruments and especially:

- It provides definitions of financial instruments,

- It shows us how to distinguish equity from liabilities,

- It contains the guidance for compound financial instruments,

- It prescribes the rules for presenting the treasury shares

- It states conditions when you can offset a financial asset and a financial liability in your statement of financial position,

just to name a few main topics.

What is a financial instrument?

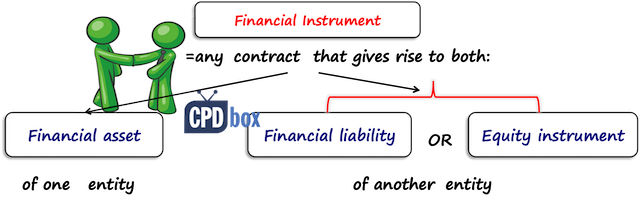

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. (IAS 32.11)

Here, the contract is important.

This is the main difference between the financial instruments and other assets and liabilities: a contract.

While you don’t have to have any contract to recognize a car or a software program as your non-current asset, you DO have to enter into some sort of a contract to recognize a financial instrument.

You can see three main types of financial instruments arising from the definition:

- Financial asset;

- Financial liability; and

- Equity instrument

Let’s break it down.

Definition of a financial asset

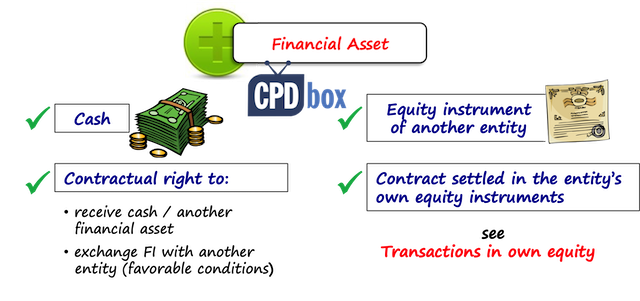

In line with IAS 32.11, a financial asset is any asset that is:

- Cash.

This is crystal clear – all petty cash, bank accounts and other cash equivalents are financial assets. - An equity instrument of another entity.

Example: if you buy shares of Apple on the stock exchange, then Apple shares are your financial asset (and equity instrument of Apple). - A contractual right to:

- Receive cash or another financial asset from another entity.

Example: trade receivables, issued loans, purchased bonds. Or, - To exchange financial assets or financial liabilities with another entity under conditions that are potentially favorable to the entity.

Example: purchased call options, purchased put options.

- Receive cash or another financial asset from another entity.

- A contract that will or may be settled in the entity’s own equity instruments and is:

- a non-derivative for which the entity is or may be obliged to receive a variable a number of the entity’s own equity instruments, or

- a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments.

Examples: please see “Transactions in own equity” below. It is much easier to explain this part on the example.

Definition of a financial liability

Under IAS 32.11, a financial liability is any liability that is:

- A contractual obligation to:

- Deliver cash or another financial asset from another entity.

Example: trade payables, taken loans, issued bonds. Or, - To exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable to the entity.

Example: written call options, written put options.

- Deliver cash or another financial asset from another entity.

- A contract that will or may be settled in the entity’s own equity instruments and is:

- a non-derivative for which the entity is or may be obliged to deliver a variable a number of the entity’s own equity instruments, or

- a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments.

Examples: please see “Transactions in own equity” below. Example will make it clear for you.

There are few exceptions when the instrument meets the definition of a financial liability, but it is still classified as an equity instrument, for example puttable instruments or obligations on liquidation.

Definition of an equity instrument

In line with IAS 32.11, an equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.

So, equity instrument is basically YOUR own equity and it may not include only shares, but also certain warrants, options and other instruments.

You can get more insights into the definitions of financial instruments here.

How to present financial instruments?

The fundamental rule in IAS 32.15 is to classify the financial instruments on initial recognition as a financial liability, a financial asset or an equity instrument in accordance with:

- The substance of the contract, and

- The definitions of a financial asset, financial liability and an equity instrument.

It not such a big deal to classify financial assets, but sometimes there are challenges to distinguish between financial liabilities and equity instruments.

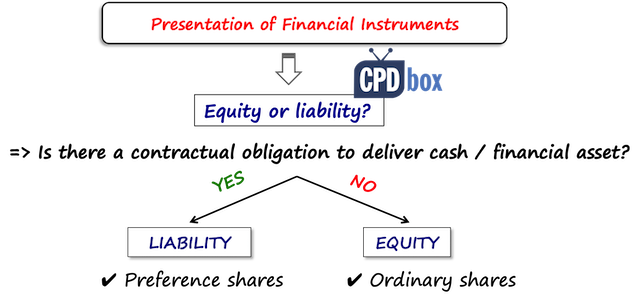

Equity or liability?

The main question to respond when classifying an instrument as either a financial liability or an equity instrument is:

Is there a contractual obligation to deliver cash or another financial asset to another entity?

Or alternatively, to exchange financial assets or financial liabilities under potentially unfavorable conditions?

If yes, then the instrument is a financial liability.

If not, then the instrument is an equity instrument.

However, what if there is an obligation to deliver own equity instruments and not cash or another financial asset?

We are getting to back to the difficult part of the definitions – transactions in own equity.

Transactions in own equity

According to IAS 32.16, an equity instrument is:

- A non-derivative that includes no contractual obligation to deliver a variable number of own equity instruments, or

- A derivative that will be settled only by the issuer exchanging a fixed amount of cash or another financial asset for a fixed amount of its own equity instruments.

To make it simple, two most important things to watch out are:

- Are equity instruments own or issued by somebody else?

- Is the amount to deliver or exchange fixed or variable?

Let me show you a few illustrations:

- You sell an option to deliver 100 shares of Apple to your friend.

This is a financial liability, because the shares are NOT YOUR OWN shares. They are shares of somebody else (Apple in this case). - You sell an option to deliver your own shares in total value of CU 100 to your friend.

This is a financial liability, too, because although the shares are yours, their number is variable. Why?

Because, the exact number of shares will depend on the current price of the share at the delivery.

You will calculate it as 100 divided by the market price of one share. - You sell an option to deliver 100 pieces of your own shares to your friend.

This is an equity instrument, because the shares are yours and their amount is fixed – 100.

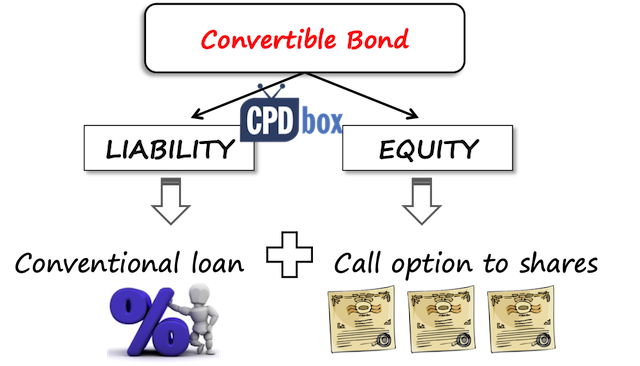

Compound financial instruments

Some financial instruments have both liability and equity component.

For example, a convertible bond where an issuer issues a bond to a holder and the holder has an option to get the bond repaid by some number of the ordinary shares of issuer instead of taking cash.

There are two components:

- A financial liability: a loan, because the issuer has a liability to settle the loan with transfer of cash; and

- An equity instrument: a call option written to the holder to deliver some number of ordinary shares.

In this case, an issuer needs to classify and present these two elements separately:

- The loan element is presented as a financial liability, and

- The call option element is presented as an equity instrument.

There are more methods to do so and you can learn more about accounting for compound financial instruments in this article.

Also, the IFRS Kit contains loads of examples and illustrations about financial instruments including warrants, compound instruments and more, so if interested, check it out here.

Treasury shares

Treasury shares are the term used by IAS 32 for own shares.

If you acquire own shares, you need to deduct them from equity and NOT recognize them as financial assets.

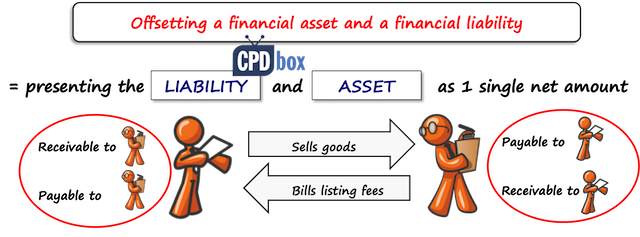

Offsetting a financial asset and a financial liability

Offsetting means presenting a financial asset and a financial liability as one single net amount in the statement of financial position.

IAS 32.42 sets the following rules when you must offset a financial asset with a financial liability:

- When you have a legally enforceable right to set off the recognized amounts, and

- When you intend to settle on a net basis, or realize the asset and the liability simultaneously.

Small illustration:

Imagine you run a supermarket and you buy goods from a local producer.

You purchased some goods and you have a liability of CU 1 000.

But, you charged promotion fees amounting to CU 50 to your supplier, because you issue a leaflet and include his products there.

So, at the same time, you have a receivable of CU 50.

You can present these two items as a net financial liability of CU 950, if there are no legal restrictions to do so and if you agreed with the supplier somewhere in the contract that you would make net payments.

IAS 32 Video

IAS 32 arranges also other issues, such as puttable financial instruments, classification of rights issues, contingent settlement provisions and others.

You can watch the video with the summary of IAS 32 here:

Any comments or questions? Please leave me a message below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

37 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Some financial instruments contain elements of both, liability and equity. IAS 32 Financial Instruments presentation requires segregating these two elements and disclosing them separately

Explain the reason for separately identifying liability and equity elements of compound

financial instruments.

Is that a homework?

Hi Silvia,

I’m interested in the topic of offsetting a financial asset and a financial liability. What does it mean by when you have a legally enforceable right to set off the recognized amounts, and when you intend to settle on a net basis, or realize the asset and the liability simultaneously? I do not understand the sentences behind the rules. Would you be able to provide an examples on this? Really appreciate it. Thank you

Hi Silvia,

Para 37 of IAS 32 states that transaction costs of an equity transaction are accounted

for as a deduction from equity and the costs of an equity transaction that is abandoned are recognized as an expense.

the cost incurred with respect to equity related transactions are gradual. For eg. milestone based cost of financial and legal advisors. How to account for such costs ?

Do i need to create a reserve in equity and build up the cost there and show it as a negative number and net the same with share premium account once the equity is injected. Further, what if subsequently, the transaction is abandoned, how to i charge the cost incurred to profit and loss that was already shown under equity statement.

hi silivia

i just wondering if a company A has a full control on a company B for example and the subsidiary (B) has bought from A shares why this treat as a treasury shares although i can treat this as a non controlling interest on the consolidated financial statement to show the capital of parent deducted the value of treasury shares and show the treasury shares in NCI as a separate account ?? can you justify why this show in consolidated deducted from the capital of parents only ?

Hi Silvia

thanks a lot for making IFRS easy and understandable for normal people.

I have question on the definitions of Financial assets and Financial liabilities.

in the definition of both there is one common point is there that is “a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments” .

Its confusing me why the same sentence is included in both the definitions with out using the words “obliged receive” in Financial Assets’s and “obliged to deliver” for Financial liabilities.

Please help me to understand this.

The company has invested below 10% in CCPS of the company and simultaneous given a loan too that company. The loan entitles the investor company to have seat in board as an observor. The investment will be be treated and recognized under IFRS 9 at fair value and subsequently measurement will be done through FVOCI or FVTP&L.

Please correct my understanding.

Hi Silvia, I find your teaching is so effective and I thank you for the same, I want you to pls clear my doubt here when you mentioned financial asset are also fa that is arising from contracts which will be settled in own equity shares, I am very confused what is this, is it an investment in own convertible debenture, if so how?? Pls reply

hello silvia, can you please explain the puttable instruments under IAS 32 and its exception. Thanks in advance

Hi, A company deposits annual amount in accordance to a tripartite escrow agreement with a bank. The annual deposit amount will earn interest. After six years, the deposit amount can be refunded only after examination of fulfillment of certain conditions by government authority. If the government authority does not approve after sixth year because the company has failed in fulfilling those conditions then the whole amount deposited with bank along with interest thereon will be forfeited. During these six year periods, the company can not deal with the deposits and interest in any manner. Whether the deposit will be a financial assets for the company though it has no control over it during these six years? Whether the company can account for annual interest on deposits as its own interest income during these years?

Hi Siliva! nice to get u. I really love the way u are discussing the issues in IFRS. It is very simple and clear.but i have one concern. i intend to have ur complete packages but no means to effect payment here from Ethiopia.So is there any ways to that?Or can i have it free of payment?

With kind regards!

Hi Sylvia, Can you please help me with an example to understand a financial asset which is a non-derivative for which the entity is or may be obliged to receive a variable a number of the entity’s own equity instruments.

I got lot of example for derivative, but not a single one on non-derivative.

Please help

I’m confused by this category of financial asset too. I have just come up with an example. Com A provides a service to Com B for $50,000. In return, Com A will receive a variable amount of its shares from Com B that is worth $50,000. So if Com A share is at market value $10, Com A will receive 5,000 own shares. IF the Com A share is at market value $20, Com A will receive 2,500 own shares from Com B.

Thank you , Silvia

Hello,,,

I want to contact with you via E-mail . what is your email , please ?

You can contact us here. S.

hi sylvia

IAS 32 and IFRSB 9, IFRS 7 .there is different concept which explain financial instrument.

Hi Bernard,

what is the question, please? S.

Good Day Mrs Sylvia

I Trust that this email serves you well.

Thank you for your kind and easy information as set out in your kit, i hope to pass my exam in weeks time.

I would like to ask what is the easy way of identifying whether one is dealing with a FA/FL especially when it is classified through the Amortization table.

I am looking forward to hear from you soon.

Kind Regards

Hi Silvia,

I have contracted a Forward contract between 2 currencies ( the local currency and the USD), Please advise if I will need to have a revaluation at year end for this Forward contract.

Yes, you will. It is still a derivative.

Hi Silvia,

I have a situation linked to IFRS15, if you could find some time to answer me it will be great. In case the incentive costs offered to customers are linked to trip abroad. According to IFRS15 I need to treat this as loyalty program and deferred my revenue until the moment of performance obligation linked to points gain to get the trip is satisfied. My question is linked to the cost of trip itself, where should this be shown in marketing (OPEX) or discount (affecting gross margin of the product incentive’s with the points)?

Thank you very much for your time and nice presentation of your site!

Dear Irina, this comment is out of topic. Please post it under the relevant topic to keep it tidy.Thank you! S.

my employer company is erecting a building on land lease holding. The lease period is for 50 years the amount is Ethiopian birr four million. Can I capitalized land lease amortization until the building construction is completed? when the building commences a service can be recorded as period expense every year? Please help me for the question. Thanks

Dear sileshi, this comment is out of topic. Please post it under the relevant topic to keep it tidy.Thank you! S.

Hi Silvia,

I wonder whether accrued liabilities, e.g. payroll accrual, invoice accrual are financial instruments as well? thanks!

Hi Maggie, no, because accruals do not meet the definition of a financial instrument.

Thank you Silvia-for invoice accrual,it’s techincally AP,why it does’nt meet the definition?

Hi Silvia,

Can you please advise why shares bought by an investment company (the investor) are treated as Trading stock through profit or loss (as financial assets)? What’s the obligation to delivery ‘cash’ by the investee companies? I do not understand why Cryto currencies are often treated as Intangible assets but some of those currencies that are tradeable could also be treated as Inventories.

Thank you.

Brian

Hi Brian, shares do not necessarily contain obligation to deliver cash by the investees. Instead, it is an equity instrument in another entity (see the definition of a financial asset). As for Crypto currencies, I see I need to make an article about it. Crypto currencies simply do not meet the definition of financial assets, because there is no contract (no counterparty). That’s the main reason why they are treated as intangibles. UPDATE 2020: Here is the article.

Hi Silvia,

Thanks for all this stuff, it really helps us in passing ACCA exams.

Can you please explain, explain the Financial asset & liability with prospective of Investor and Investee separately?

Hi slvia, thank you for your effort and dependable contribution to wards the awareness of this new reporting requirement. Keep it up

Hi Silvia,

Thank you for your informative guidance on the “Financial Instruments”. In this regard, while it is understood that for the trade receivables and issued loans, there is a contractual right to receive cash from another equity, under what circumstances will there be a contractual right to receive another FINANCIAL ASSETS from another entity?

Hi Edmund, thank you! Just to make up some example quickly – when, for example, you agree to accept short-term government treasury notes in return for the delivery of your goods, not cash.

Hi Silvia

Really great article I have a question

what the difference between Compound financial instruments and Embedded derivatives ?

Hi Othman,

compound financial instrument = equity component + liability component, for example convertible bond.

hybrid financial instrument = underlying instrument (non-derivative) + embedded derivative, for example contract between German and Norwegian company to buy some goods and pay in Swiss francs. Here, underlying is a commodity contract, embedded derivative is a foreign currency forward contract.

Convertible bond can be used to explain these 2 concepts of compound financial instrument and embedded derivatives.

Compound instrument = Equity component (Option to convert to equity) + Liability component (Bond)

Hybrid instrument = Embedded derivative (Option to convert to equity) + Non derivative (Bond)