IAS 38: Intangible Asset or Expense?

Recently I had an argument with auditors of one company related to the customer list they bought.

The company paid significant amount of cash for the list of customers of telecommunications.

The list contained the names, addresses and phone numbers of all the clients.

And, the buyer intended to use the list to contact the potential customers and offer them their own services.

Well, if it’s ethical or not – I leave that up to you, but the auditors of the buyer said that the price paid for the customer list is an expense in profit or loss.

Is it???

I was not so sure.

To me, the customer list perfectly meets the definition of the intangible asset and in this case after asking few more questions I was sure that the buyer acquired an asset instead of expense in profit or loss.

In today’s article we will look at how to distinguish between intangible assets and expenses and you can find practical illustration in the end.

Including the customer list.

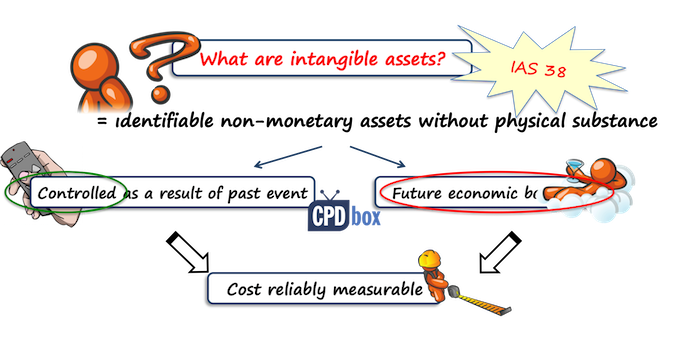

What is an intangible asset?

When I am unsure whether certain item is intangible asset or just an expense, I always look to the basic definition of an asset in IAS 38 and in Conceptual Framework, too:

An asset is a resource controlled by an entity as a result of past events, from which future economic benefits are expected to flow to the entity. (Framework, par. 4.4 (a))

And, IAS 38 expands this definition for intangible assets by specifying that on top of basic definition, an intangible asset is an identifiable non-monetary asset without physical substance.

To sum up, each intangible asset has 3 main characteristics:

- It is controlled by the entity

- No physical substance

- It is identifiable.

Just warning: it can happen that an asset has all 3 characteristics, but you cannot recognize it in your statement of financial position.

The reason is that it still may not meet the recognition criteria.

For example, let’s say you are a telecom company and you have millions of customers.

In this case, you have a customer list that is an intangible asset (please see below for reasoning), but you can’t show it in your balance sheet, because you cannot measure its cost.

Just be aware of these situations.

Now, let me explain shortly what each characteristic means.

1. Controlled by the entity

If you are able to get the future economic benefits from the use of the asset and at the same time, you can prevent others to get these benefits, then you control the asset.

In most cases, you control intangible asset when you have the legal rights to it.

For example, you may have bought the licenses or signed some contract.

Sometimes, control is achieved in a different way.

For example, you may develop some great software internally and you control its sales.

In some cases, you can’t really demonstrate sufficient control of asset and thus you can’t recognize it.

Typical example of such situation is qualified employee – human resources are rarely intangible assets, because you can’t demonstrate control.

2. No physical substance

This one is clear – if some asset has physical substance, then it’s tangible and not intangible.

However, there’s a small exception.

Sometimes, intangible asset is attached to something physical in order to carry it or store it.

In this case, the asset is still intangible because the value of the related physical asset is very small when compared to the value of intangible asset.

3. It is identifiable.

This one is crucial, I think.

The asset is identifiable in one of these 2 cases:

- It is separable – so, you can actually separate the asset and sell it, transfer it, license it or do any other action. Hypothetically.

- Arises from the legal rights – either from contract, legislation etc. In this case, the asset does not need to be separable.

For example, imagine you worked hard and you created a famous brand.

Is it identifiable?

Yes, it is, because you can (hypothetically) license it or sell it.

So, you know what the intangibles are.

From now on, always focus on these 3 characteristics to answer whether you deal with an intangible asset or not.

Can we capitalize the intangible asset?

If it is an intangible asset, then you still have 2 more questions to answer before you capitalize it:

1. Can you measure its cost reliably?

This one is straightforward.

If you can’t measure the cost, then you cannot capitalize even when it is an intangible asset.

I described the example above: you cannot capitalize internally generated customer list because you can’t really determine your cost to develop it.

2. Are the future economic benefits of the asset expected to flow to the entity?

Oh, I love this one.

Future economic benefits can be either increase in revenues or reduction in expenses.

Either way you look at them, the future economic benefits are the potential to increase your profits.

However, many people believe that you must be able to measure them – otherwise they are not the future economic benefits.

No, not at all.

In fact, it is almost impossible.

Imagine you invest in the nicer office, you buy artwork, nice furniture… can you really measure the increase of your revenues as a result of these assets?

No, you cannot, but you are quite sure that nicer office has the potential to pull more money out of the pockets of your clients.

On top of these requirements, there are still some intangible assets that are not intangible assets under IAS 38, but something else.

Important note: The above applies fully to the intangible assets that are NOT under development. If you are developing intangible assets, then you have to meet further 6 conditions to capitalize the expenditures, but let’s touch it in some of my next articles.

Let’s me show you some specific examples.

Examples of intangible assets

Licenses to trade

You operate a taxi service, but you also act as an intermediary for single private taxi drivers to get their own license.

So, as a part of your business you acquire transferrable taxi licenses from the government and you sell some of them to the private drivers who buy from you as it’s easier to get the license this way.

You acquired 1 000 number of taxi licenses.

You employ 400 taxi drivers and you plan to sell another 600 taxi licenses to private drivers.

In this case, all 1 000 taxi licenses are indeed intangible assets, because they satisfy all requirements.

However, you won’t account for all of them as for intangible assets under IAS 38.

Instead:

- 400 licenses used by your own employees are intangible assets; and

- 600 licenses to be sold are your inventories under IAS 2, because you hold them for sale in the ordinary course of business.

Internet websites

The e-shop is famous and attracts a lot of customers. There’s also a section with a company’s blog with articles about the newest fashion trends.

This website is an intangible asset, because yes, the company controls it, it has no physical substance and it is identifiable (i.e. company can sell it).

However, can you recognize it as an asset?

Yes, it brings the future economic benefits, so this one is met.

But, can you measure its cost reliably?

If it was developed externally by the third parties, then yes, you can.

If it was developed internally, then well, you have to apply the rules in IAS 38 and especially in SIC 32 Intangible assets – website costs to determine the capitalization.

Hockey team

The price you paid was derived from the quality and fame of the specific hockey players in that team.

Now, is this hockey team – or better said – contracts with players an intangible asset?

Well, I always say that no, normally you do not capitalize contracts with employees or any other expenses related to employees, because you can’t control them.

In this case, the situation can be different.

For example, hockey players might be prohibited to play in another teams by the legal rules placed by some hockey authority.

Also, the contracts with individual players might legally bind the player to stay with the same team for a number of years.

In this case, you would be able to demonstrate control and yes, recognize hockey team as your intangible asset.

Software licenses

When the computers arrived, you made an online purchase of corresponding number of licenses for Windows XY operating system to run the computers.

Also, you purchased a license to use the specific accounting software.

On top of the purchase cost you are required to pay the annual fee for upgrades of the software. You can continue using the license for accounting software also without annual upgrade fees, but you won’t receive any updates.

Here, we have 3 items:

- Operating system Windows XY

Yes, it is an intangible asset because it meets all the criteria.

However, operating system is an integral part of the computers, because the computers can’t run without the system.

Therefore, you would recognize computers together with operating system as property, plant and equipment, so no separate intangible asset.

For further reference, look to par. 4 of IAS 38.

- Accounting software license

This is an intangible asset, too.

In this case, you need to recognize the license as an intangible asset, because accounting software is NOT essential to run the computer.

- Annual upgrades

Annual upgrades do not meet the definition of an intangible asset, because they are not separable.

They are expensed in profit or loss when incurred.

You can see them as something similar to maintenance and repair costs of property, plant and equipment.

Customer lists

Is this an intangible asset?

In most cases yes, because:

- It has no physical substance,

- It is identifiable (yes, it is because you were able to buy it),

- You control it,

- You can measure its cost reliably (you paid for it) and,

- You expect the future economic benefits (increased sales as a result of new list of potential customers).

I spoke more about it in this IFRS Q&A podcast episode.

Warning: in some countries and at some circumstances such a customer list is not an intangible asset.

The reason is that some countries have legislation in place that prevents you from random contacting the potential customers on the list.

In this case you would not be able to get the future economic benefits from the list because you cannot use it (so why would you buy it anyway?). Thus you do not control the asset fully.

However, telecoms often ask their customers to agree with passing their data to third parties for advertising purposes, so in this case you would be able to use the list (hint – read the small letters in the contracts to know what you agree to!).

You have to assess all of these things to conclude whether the customer list is an asset or not.

Advertising campaign

Some companies invest heavy cash into their advertising campaigns.

Literally millions.

Imagine you plan to invest 1 mil. EUR into the advertising campaign over the next year.

Your advertising agency told you that this campaign would build and strengthen your brand and position in many years to come.

So, some people believe that yes, they should capitalize advertising campaign as it brings the future economic benefits.

No dispute on this.

The only thing is that the advertising campaign is NOT identifiable – you can’t separate it and sell it to someone else.

Therefore, you should recognize the expenditures for advertising campaign in profit or loss.

Of course, when you prepay the campaign for let’s say 2 years, then you should recognize the expenses over 2 years as the services are consumed.

Do you have questions about any other specific items? Please let m know in the comments. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi, Please assist, about UL certificate, should be considered as intangible asset or expense (certificate is life long validity)

Dear Silva,

Our company bought a software ARCGIS and we have also paid for training to use the software sepaaretly. Do I capitalise the training costs?

Dear Philippa,

never capitalise the training cost, because it does not meet the definition of the intangible asset (it is out of entity’s control, as people might leave the company anytime).

Dear silvia

Good day ..

if i have a Microsoft license for One year should I recognize it as an intangible asset or prepaid expenses?

Hi Silvia,

First of all thank you for this very useful and professional website. Really valuable one. Quick question:

How would you treat research costs (you would argue that the answer is in the question) for finding a new production site and related consulting fees + internal salary ? In the end we know that all these costs will end up to build a new factory. So would these research costs be entitled to capitalisation (even it seems not). Thanks a lot in advance.

Hi Sylvia,

A license obtained from the government to operate for 30 years in a country, of which, let’s say, the 10 years are exclusively, can be capitalized as an intangible asset.

Best regards,

Hi,

If an intangible asset (say a license fee) is prepaid for (e.g. for 5 years), is this treated as a normal prepayment or are there special accounting rules for this?

Thanks,

Ali

Hi Ali, similar license meets the definition of an intangible asset and should be treated as such (IAS 38).

Dear Silvia,

Would you classify a Jetty License as an intangible asset?

(A jetty is a structure used to launch or land a vessel on water.)

It seems it is equivalent to a taxi license, so yes.

Hi Silvia,

Thank you very much for your articles.

I have a question regarding internally generated assets (it’s developed by internal resources and hired 3rd party professional services):

1. Creation of a detailed hosting roadmap and detailed asset register for digital workloads (document format)

2. The development of design standards: a shared responsibility model, RACI, cloud design standards and FinOps (Financial Operations) standards

These are intangible assets but can it be capitalised ?

Thank you very much,

Hi Sylvia – great article.

I have a question on whether to capitalize the new ERP system that we intend installing (SAP) and then what about all the consultant fees after we bought the SAP license and the related work they do to tweak the ERP to our companoes needs. Also when do we stop capitalizing if we do. or do we just expense.

hi Silvia. Thank you for the article.

In my case, there is a purchase of sofrware license, and it is to be paid annually, for total 5 years.

We noted that this purchase satisfy the IAS38 (identifiability, control of future economic benefit, no physical substance).

The term of agreement stated that this is a subscription agreement

However we noted an article referring to FASB (https://www.gma-cpa.com/blog/accounting-for-computer-software-costs), subscription is to be accounted for as expense.

We are practicing outside USA, thus the only applicable standard is IFRS, hence we should only follow IFRS.

Kindly need your input upon this matter.

Thank you.

Dear Georgie, I answered this question here: https://www.cpdbox.com/question/ifrs-capitalize-annual-license-fees-on-software/

(1) Advertising is a one-way communication whose purpose is to inform potential customers about products and services and how to obtain them.

(2) In the case described the buyer intended to use the list to contact the potential customers and offer them their own services. -> that is advertising of products (or promotion of the company as a whole).

(3) “If an entity acquires goods solely to be used to undertake advertising or

promotional activities, it applies the requirements in paragraph 69 of IAS 38. Paragraph 69 requires an

entity to recognise expenditure on such goods as an expense when the entity has a right to access those

goods”

(IFRS.org – publication on IAS 38 on September 2017)

This is nice, but it does not relate to customer lists, or in other words – to non-contractual customer relationships. This interpretation relates to goods for promotional activities, like, for example, watches branded with pharma company logo to be given to the doctors.

What is you view on the difference between watches, which were specifically stated as an example in IFRSs, and other purchased goods (be it tangible or intangible – like customer lists), if regardless of their nature these are solely used to conduct promotional activities?

My view is that everything that was bought (good or services) that serve the only purpose to make promotional activity happen – are subject to IAS 38.69. Are there any provisions in the standards that objectively contradict to this? (i.e. not subject to one’s interpretation)

OK, so I say it once again: customer lists are non-contractual customer relationships, not the goods acquired for advertising. One difference is that you can use customer list for multiple contacts with the same potential customer, but you can use a watch with your logo as one-off act (you give it to the customer once and that’s it). You are not giving a customer list to your customers for the purpose of advertising to them. If you do not see the difference, then OK, use your own interpretation.

I need to add here that in most countries, selling customer lists without their consent is illegal.

Can an amount paid to a celebrity’s to endorse a clients product be capitalized as an intangible asset?

Hi Slyvia, if I signed a 10 year contract to have exclusive manufacturing rights and paid the money immediately would I recognize that full amount as a the present value purchase price? Additionally, if I am given the option to extend the contract by 5 years at an additional fee, would I capitalize that amount ?

Dear Slyvia, If you purchase a microsof office for a period of 3 years can you capitalize the annual Subscription fees.

Then each year fully depreciate the asset and then rfcordnise a new asset and continue the parten untill the 3 years is complete.

Hi Vusi, please, are the fees one-off for 3 years, or annual? Because, if you paid for the license of 3 years, then sure you can capitalize and amortize over 3 years; not with annual fees, though, because annual fees usually relate to that single year.

How should i treat membership fee of golf club or condominium that is for a period 10 years. The key employees of the company will be allowed to use the facilities.

Would this be a non current prepayment or this would be a intangibles?

Hi Slyvia, thanks for your clear explanation of intangible asset. Especially it cleared my doubt on classification of Accounting Software License! As my company’s auditor told me to capitalize it under PPE but based on my judgement it should be an intangible asset too.

Dear Sylva,

a company from furniture manufacturing industry made a contract with a third party to develop a collection (design), which was sold to the Company in order to produce the furniture under this furniture line. The design of the furniture line was made only for this Company, and it will not be sold in the future separately, i.e. it is used only for this furniture collection. Company considers this to be intangible assets, and recognized the value of the invoiced furniture line (design) as intangible assets in accordance with IAS 38. My question is, is this really a good accounting treatment? Thanks

Hi Silvia, My employer is paying on a quarterly basis a third party for the use of a software. You could say this is like a rent of the software. At the end of this contract, my employer will not have access anymore to this third party software, but my employer will stay with the code to use in the future. Aside of these quarterly payments for the rent of the software, my employer is also paying the IT consultants for the integration of this software. This software contract is project based. Based on the IAS 38, this software qualifies for an Intangible asset. However, my question is, how can I capitalize and amortize this software if they are not paid in advance, but on a quarterly basis and project basis?

Hi Silvia,

My employer has it own brand and had paid to professional expertise to help with this Trademark Application to prevent the competitor for having the same name of the brand. can i capitalise the payment to professional fee as Intangible Asset?

Hi Budi, no because the fee itself does not meet the criteria for capitalizing an asset and internally generated brands cannot be capitalized.

HI Silvia,

Can we Capitalise Mobile Banking Costs incurred during Development in Financial Position under Intangible Assets?

Hi Silvia,

Can we capitalize consultancy fee for development of a new business line? We expect that this business line will generate revenue for 10 years.

Hi Silvia

Extensions to existing ERP system would qualify for recognition as intangible asset? These are a bunch of enhancements which will increase operational capability of ERP. If yes should i recognize separate asset or include it in NBV of existing ERP?

Hi Sayed, yes, I think so. I would not recognize that as a separate asset because extensions themselves are not capable of operating independently from the original software. However for the purpose of amortization, you need to assess whether the remaining useful life of those extensions is the same as remaining useful life of software and if not, amortize these 2 components separately. S.

Hi Silvia,

My company request a vendor to develop a mobile app to sell in future. So we are paying for the vendor monthly until the app is ready to launch in market. The cost that we are paying to vendor should treat as Intangible asset? The software is not ready yet; in progress.

Hi Silvia,

I’m working in a conglomerate company where IT department is centralized with 30+ subsidiary.

IT bring the retail or ERP system and requested each subsidiary to raise the CAPEX And capitalize . ( cost distributed among 30+ divisions by number of employees or number of retail stores )

How this should be treated? Can individual entity capitalize those portions or allocation OR IT department should capitalize then distribute the cost among 30+ to pay for them. Ultimately individuals entity will treat this as prepaid expense over the period of agreed Number of years. Kindly advise

Hi Silvia

Can we capitalise software cost along with subscription fees paid in advance for 3 years as an intangible asset in the year of purchase?

After 3 years subscription fees will have to be renewed and will be charged to expenses. Is this treatment correct or we should separate the software cost and subscription fee in the year of purchase itself and capitalise the software cost and expense subscription fees ?

Hi, Silvia, I would like to share with you our case. Our company is going to enter into agreement with a vendor. The deliverables are going to be new name, logo, colour specifications, brand Messaging framework and principles, so called new concept of Group identity.

The name, logo – everything that can be registred by our jurisdiction, will be registred.

We have huge discussions whether it is IA, or not.

From one side IAS 38.63/64 prohibits to capitilize brand, but from the other – under this project we create not brand, but a design of Company’s identity, The same as design of office)

And is there any practical desicions about brandbooks of companies? I would appreciate for your opinion on this question.

Hi Silvia, two points to clarify please.

1. Can you please help me understand “software is identifiable and advertising on brands is not”

2. How customer list from telecom company is an IA, if anyone else can collect the same customer list and use it.

Many thanks in advance!

Dear Silvia,

Your articles are really interesting and down to earth making it easier to understand concepts.

I would like to ask your opinion on capitalisation of wages and salaries in the context of intangible assets. In the context of COVID-19 companies have spent money on re-training some of their workforce / employees since they are looking at restructuring their current business model by introducing new ways of conducting business or offering a service. I am well aware that training costs are to be expensed immediately to the profit and loss account. However, can the wages costs settled during such training be capitalised since the company is expecting to either tap new markets and derive new revenues and/or be able to reduce its costs for instance by using less employees. Your contribution would be appreciated.

Hi David, no, sorry.

Dear Silvia, even though I do not know the particulars and might be completely wrong about this but I think the auditor you had the argument with thought to include the customer list as an expense in the PL perhaps not because the customer list did not meet the criteria of an asset, but perhaps because he/she thought that purchasing a customer list can well be considered a reimbursement of the lost value of intangibles and thus reinvestment in intangibles (because we know intangibles use value over time and I suspect that they had similar list earlier which perhaps did not fully serve the intended purpose in new circumstances any more and required improvement through reinvestment) and decided to avoid penalizing the company twice – once through amortization and a second time through reinvestment, therefore recognizing just the reinvested portion (the purchased customer list) as an expense in the PL.

Dear Silvia,

These days most software licenses are given for a year at a time and you need to pay an annual fee for the license.

How does one treat this in accordance with IFRS38?

Kind regards,

Tom.

Dear Silvia

I have a question about software licence for on line selling products wich is not used already in the company . We have a 2 phases of paying before we started using it.

Is it recognize s intangible asset now hen we pay the first part of the amount of the licence or when we will started using it ?

Dear silvia

I have a such question: if entity purchases (externally generated) website but it is used only for advertising, is it recognized as an intangible asset or it is an expense? Thank you in advance.

Dear Silvia,

I hope you are well. Is the use of a franchise brand considered an intangible asset with an indefinite life? considering in this example that the franchise agreement establishes the use of the brand for a period of time.

Dear Vanessa,

yes, franchise agreements meet the definition of an intangible asset in many cases.

Great article, I am contemplating showing it to my (big 4) auditors. Particularly the diagram on ‘What is the purpose or the reason why we hold this asset?’

Sometimes people like to over-complicate things!

Dear Silvia,

May I check if the cost of acquiring the right to use a software license perpetually is through certain percentage of revenue generated by the licensee over the period qualified for capitalization?

Thank you.

Hi Silvia,

I have quite a complicated question and am interested in hearing your feedback. A company has provided a loan to one of their suppliers of (lets say) gas so that the supplier can develop a machine to create the gas for them. This machine will be used exclusively for the company who provided the loan. The supplier will pay back the loan in supply of gas. The loan was given to the supplier at a below market interest rate, so the FV and the transaction amount are different. We are saying that the difference between the fair value and the transaction amount relates to the intangible right of exclusivity over the machine. As such, rather than recognizing the difference between FV and the transaction amount immediately, we will defer it over the term of the loan. I’m just unsure as to which account we would defer it in. Would I defer it in an Intangible asset account or just a deferred expense account? I’m leaning towards deferred expense but I’m just not 100% sure.

I have a question implementation cost of software can be capitalized or not? please give give proper explination

In general yes, because it is a directly attributable cost to the software.

please give the reference of IFRS

Hello Sylivie, if an intangible asset has a finite useful after which an upgrade would be made. If the the intangible asset is reviewed and it is discovered that there is no need of an upgrade. After revaluation, no anticipations are made of when an upgrade would be made. Does that make the asset to have an indefinite or it should be armotised over the remaining useful life????

Hi Kapala, I don’t know, because this is an estimate and it is your task to do so.

Hi

Can the registration and renewal costs of a trademark be capitalised?

Can the cost of acquiring banking or financial services licences be capitalised?

Hi Sylvia, I would like to ask for your advice regarding the subsequent cost that incurred after the capitalization of software (or system). Currently, there are some system’s enhancement just like need to perform additional coding on the system to make a new feature.

Can all of these subsequent cost for system enhancement or upgrade can be capitalized?

Thanks and regards,

It that system enhancement is not just a maintenance, then yes.

Dear Sylvia,

So if it is capitalized, then how we should record the cost incurred for the system enhancement?

Will it be combined with the carrying amount of the existing system or has to be separated assets? thanks alot

Hi Finu,

well, that’s what you have to assess – whether by enhancing the new asset is created or not. If not, then simply add the subsequent cost to the carrying amount of the existing asset. Then assess the new useful life and amortize over the remaining useful life. S.