IAS 21 The Effects of Changes in Foreign Exchange Rates

These days people use about 180 currencies world wide!

The truth is that we, people, don’t want to stay isolated. We love to sell, buy, import, export, trade together and do many other things, all in foreign currencies!

When you look at the business world, you’ll see that business go global in two ways: they either have individual transactions in foreign currencies, or when they grow bigger, they often set up foreign operations (separate business abroad).

Moreover, the exchange rates change every minute. So how to bring a bit of organization into this currency mix-up? That’s why there is the standard IAS 21 The Effects of Changes in Foreign Exchange Rates.

What is the objective of IAS 21?

The objective of IAS 21 The Effects of Changes in Foreign Exchange Rates is to prescribe:

- How to include foreign currency transactions and foreign operations in the financial statements of an entity; and

- How to translate financial statements into a presentation currency.

In other words, IAS 21 answers 2 basic questions:

- What exchange rates shall we use?

- How to report gains or losses from foreign exchange rates in the financial statements?

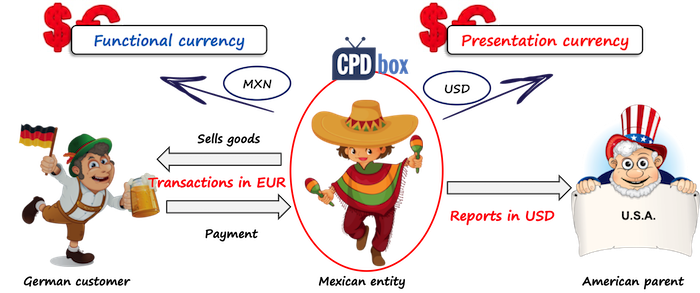

Functional vs. Presentation Currency

IAS 21 defines both functional and presentation currency and it’s crucial to understand the difference:

Functional currency is the currency of the primary economic environment in which the entity operates. It is the own entity’s currency and all other currencies are “foreign currencies”.

Presentation currency is the currency in which the financial statements are presented.

In most cases, functional and presentation currencies are the same.

Also, while an entity has only 1 functional currency, it can have 1 or more presentation currencies, if an entity decides to present its financial statements in more currencies.

You also need to realize that an entity can actually choose its presentation currency, but it CANNOT choose its functional currency. The functional currency needs to be determined by assessing several factors.

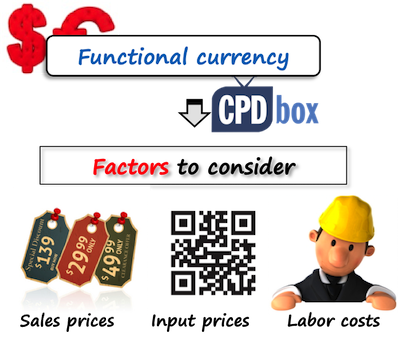

How to determine functional currency

The most important factor in determining the functional currency is the entity’s primary economic environment in which it operates. In most cases, it will be the country where an entity operates, but this is not necessarily true.

The primary economic environment is normally the one in which the entity primarily generates and expends the cash. The following factors can be considered:

- What currency does mainly influence sales prices for goods and services?

- In what currency are the labor, material and other costs denominated and settled?

- In what currency are funds from financing activities generated (loans, issued equity instruments)?

- And other factors, too.

Sometimes, sales prices, labor and material costs and other items might be denominated in various currencies and therefore, the functional currency is not obvious.

In this case, management must use its judgment to determine the functional currency that most faithfully represents the economic effects of the underlying transactions, events and conditions.

How to report transactions in Functional Currency

Initial recognition

Initially, all foreign currency transactions shall be translated to functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

The date of transaction is the date when the conditions for the initial recognition of an asset or liability are met in line with IFRS.

Subsequent reporting

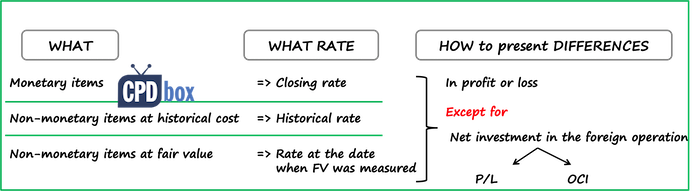

Subsequently, at the end of each reporting period, you should translate:

- All monetary items in foreign currency using the closing rate;

- All non-monetary items measured in terms of historical cost using the exchange rate at the date of transaction (historical rate);

- All non-monetary items measured at fair value using the exchange rate at the date when the fair value was measured.

How to report foreign exchange differences

All exchange rate differences shall be recognized in profit or loss, with the following exceptions:

- Exchange rate gains or losses on non-monetary items are recognized consistently with the recognition of gains or losses on an item itself.For example, when an item is revalued with the changes recognized in other comprehensive income, then also exchange rate component of that gain or loss is recognized in OCI, too.

- Exchange rate gain or loss on a monetary item that forms a part of a reporting entity’s net investment in a foreign operation shall be recognized:

- In the separate entity’s or foreign operation’s financial statements: in profit or loss;

- In the consolidated financial statements: initially in other comprehensive income and subsequently, on disposal of net investment in the foreign operation, they shall be reclassified to profit or loss.

Change in functional currency

When there is a change in a functional currency, then the entity applies the translation procedures related to the new functional currency prospectively from the date of the change.

How to translate financial statements into a Presentation Currency

When an entity presents its financial in the presentation currency different from its functional currency, then the rules depend on whether the entity operates in a non-hyperinflationary economy or not.

Non-hyperinflationary economy

When an entity’s functional currency is NOT the currency of a hyperinflationary economy, then an entity should translate:

- All assets and liabilities for each statement of financial position presented (including comparatives) using the closing rate at the date of that statement of financial position.

Here, this rule applies for goodwill and fair value adjustments, too. - All income and expenses and other comprehensive income items (including comparatives) using the exchange rates at the date of transactions.

Standard IAS 21 permits using some period average rates for the practical reasons, but if the exchange rates fluctuate a lot during the reporting period, then the use of averages is not appropriate.

All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity.

However, when an entity disposes the foreign operation, then the cumulative amount of exchange differences relating to that foreign operation shall be reclassified from equity to profit or loss when the gain or loss on disposal is recognized.

Hyperinflationary economy

When an entity’s functional currency IS the currency of a hyperinflationary economy, then the approach slightly changes:

- The entity’s current year’s financial statements are restated first, as required by IAS 29 Financial Reporting in Hyperinflationary Economies. Comparative figures are used the same as current year’s figures in the financial statements from previous reporting period.

- Only then, the same procedures as described above are applied.

IAS 21 prescribes the number of disclosures, too. Please watch the following video with the summary of IAS 21 here:

Have you ever been unsure what foreign exchange rate to use? Please comment below this video and don’t forget to share it with your friends by clicking HERE. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (74) 74

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (56) 56

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (27) 27

- Uncategorized (1) 1

Is inventory revaluation monthly acceptable in terms of accounting standards, if not how best can one deal with currency fluatuations

Inventory revaluation isn’t required monthly under IFRS, but it’s allowed if it reflects reliable measurement. For currency fluctuations, translate foreign currency inventory at the closing rate at each reporting date (IAS 21). Frequent internal revaluations can be used for management purposes, but not always needed in financial reporting.

Thank you dear Silvia for I’m inspired a lot from your lecture.

Inventory & Foreign Exchange Rate. What happened if inventory which was purchased with foreign currency is required to be recorded based on NRV, do we need to record changes in the exchange rates at closing date?

Hi Silvia, thanks for the always helpful articles and videos. I read/watched both this article and the article about translating entities to a presentation currency. If one applies these rules to companies within the same group (eg holding company makes prepayments to a subsidiary who then sells a service back to the holding company where holding company and subsidiary have different functional currencies) does it make sense that one would then end up with an intercompany imbalances between the prepaid asset and prepaid liability and so to “balance” the intercompany elimination entry one would take the imbalance to the FCTR/CTR?

Hi Silvia

I am currently doing a research study on this Standard may you kindly assist.

Hi explain how realized and unrealized exchange gain or loss come up.if I have a foreign bank account balance and at the reporting date I translate the closing rate to functional currency will the difference be realized or unrealized

Realized. By the way – IFRS do not know the term “unrealized” FX differences. Once you are required to revalue at some reporting date, these differences are realized because you need to recognize them in your financial statements (through profit or loss).

Good job Silvia.

Please how do I reference this your good work

Hi. Thank you for the great article.

Question tho – Are there exceptions to the rule which says that exchange difference arising from the conversion of functional to presentation currency should be recorded in OCI?

Hi, In a hyperinflation environment, what will be the appropriate rate to value inventory that were imported . the rate at the date of the LC or the rate at the day of settlement?

Hello Sylvia.

How to treat currency exchange effect when the upper edge of currency is frozen per contract? For example i have liability in foreign currency, but no more then 3. How to treat effect when exchange rate becomes 3.2? Could you provide some reference from standards? Also i think that it has to be ifrs 9 issue

Thanks in advance

Thank you Silvia for your illustration,

I have a question regarding functional currency , if we have a entity that has a functional currency in US Dollar but chose to present financial statements in EUR for stock market, in this case does it need to translate the financial statements using the rules that are applied when translating from foreign operations to presentation currency ?

Thanks in advance

Hi Silvia. Thank you for your article. I would like to seek guidance on the settlement of foreign currency translation reserve. I encounter a problem where the company functional currency has cleared to zero balance, but there are still some balances in the forex translation reserve. What are the possible reasons causing the remaining balances in the reserve and how to deal with it? I look forward for your reply, thank you.

Hi Silvia, Thank you for your article.

I have one specific question:

I have been told like this “Under IAS -21 each company shall prepare separate financial statement on the basis of functional currency and parent shall follow presentation currency in Consolidated FS”

My Query is :

I have one Company only. I don’t want to touch Consolidation Part. My Company is in Oman and our functional currency is OMR. But management intends to present the FS in USD as well for the shake of potential investors who prefer to read USD. Or, say for any other purpose.

Can we apply IAS 21 Translation of FS from OMR to USD in Case of Standalone FS ?

Hi, How is the industry practice to convert the (1) Stated Capital (2) Retained Earnings Opening Balance ? in the absence of specific guideline in the standard. Would you be able to help me with that ?

I mean when the Financials are converted to another presentation currency ?

Hi Randika, please read this. S.

Dear Silvia,

First of all thank you for all of your articles. I love to read them.

I am writing my thesis and my teacher said that when there was any decrease in equity (like dividend, capital decrease) I should not have translated these transactions with historical rate (the exchange rate at the date of transaction) because the equity should have been decreased like inventory with FIFO or average cost. It is logical, but I have not found any example for that . Do you have maybe an article where it is clearly explained?

Thank you in advance!

Hi Eva, well, there is no guidance on translating the equity items and there are multiple ways of doing it. So perhaps your teacher should explain why she/he thinks that historical cost is the best option. Please try looking here, too. I explained more about translating equity items.

Dear Silvia,

Thank you very much for your explanation in the video, it was very helpful, I have a query that I was hoping you could help me, is there a way to calculate the CTD other than by difference or is there a method where we can test if the CTD is determined correctly?

I look forward reading your opinion and response.

Thanks in advance!

Hi Silvia,

I have a question on this topic.

What happens if an entity located in Kenya, with EUR functional currency and KES presentation currency, has bank balances as of the reporting date in the bank accounts in KES? I mean, does the company have to recognize the fx differences to convert first the KES to EUR and then again to translate the EUR to KES because KES is the presentation currency? it would look weird… is it necessary to do it? is it stated anywhere in the IFRS?

Thanks in advance.

Regards.

Hi, Would a derivative (OTC Forward) be a non-monetary items measured at fair value and therefore use a daily FX rate until it is settled? Would this result in a discrepancy between BS and P&L reporting value?

Thanks.

Dear Silvia,

Please let me clarify the following situation below: (using fictitious company’s name and numbers including exchange rate for a simple explanation purpose)

I prepare an annual budget of ABC company.

It has H/O estimated sales JPY 1000 for Jan, JPY 2000 for Feb, JPY 3000 for March in profit and loss (PL). At the same time, I recognise JPY 1000 for Jan, JPY 3000 (1000+2000) for Feb, and JPY 6000 (1000+2000+3000) as account receivable in Balance Sheet (BS) . As ABC company’s functional & presentational currency is EUR so I translate into EUR.

Using average rate let’s say 1EUR=100 YEN, ABC company’s budget sales in PL shows EUR 10 for Jan, EUR 20 for Feb and EUR 30 March.

At the same time, using same late average rate as accounting team suggested, (not closing period rate), ABC company’s budget account receivable in BS shows EUR 10 for Jan, EUR 30 for Feb and EUR 60 for March.

But I wonder if we use a basic knowledge, when translating items in BS such as account receivable, then we should use closing rate let’s say 1 EUR =110 JPY so it will be EUR 9 for Jan In BS and so on.

If I use closing rate then sale figure and account receivable in the same month shows different figures and this is an inconsistency.(sale EUR 10 in PL and Account receivable EUR 9 in BS for Jan)

Could you please give me your advice which rate to use in PL and BS in this case?

Thank you for your time in advance.

Hi Silvia,

How is profit repatriation from a foreign branch / operation accounted for in the financial statements?

Hi Silvia,

I would like to get some clarification on this : –

“For income and expenses and other comprehensive income items (including comparatives) using the exchange rates at the date of transactions.’

i) Let say Company A have a few sales transaction in foreign currency. So during year end closing, Company A would only have recalculate the receivable part ( monetary asset) using the latest foreign exchange rate. For sales revenue that was recognized early in the year using spot exchange rate, no action needed ?

ii) How should the forex gain / loss on receivables be recognized during year end close ? Seems not proper to recognized it directly to P&L as it is still unrealized forex gain / loss ?

Thanks.