IFRS 11 Joint Arrangements

Joint venture or joint operation? What is joint control? How to account for joint arrangements?

In our consolidation series, we have already covered investments in subsidiaries (IFRS 3 and IFRS 10), associates (IAS 28) and other financial instruments.

Today, we’ll take a look at the investments in joint arrangements which can be either joint venture or joint operation.

These investments are covered by the standard IFRS 11 Joint Arrangements.

IFRS 11 is relatively new standard. It was issued in 2011 and it is effective for all reporting periods starting 1 January 2013 or later.

IFRS 11 replaced the older rules in IAS 31 Interests in Joint Ventures and interpretation SIC-13 Non-monetary contributions by venturers. As a result, IAS 31 and SIC-13 are no longer valid.

What is the objective of IFRS 11?

The objective of IFRS 11 Joint Arrangements is to establish principles for financial reporting by entities that have an interest in arrangements that are controlled jointly (i.e. joint arrangements).

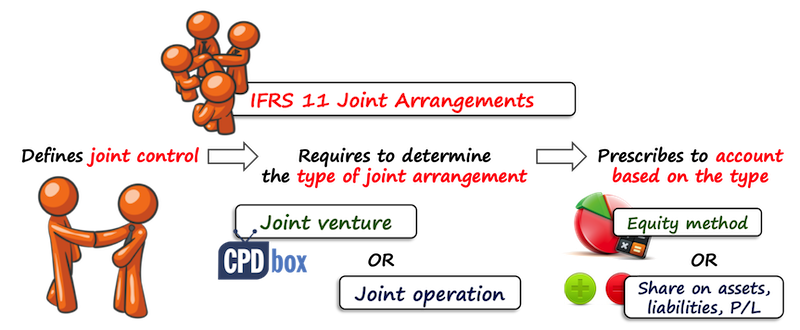

To meet this objective, IFRS 11:

- Defines joint control;

- Requires determining the type of joint arrangement; and

- Account for the interest in a joint arrangement based on the type.

What is joint control and how to detect it?

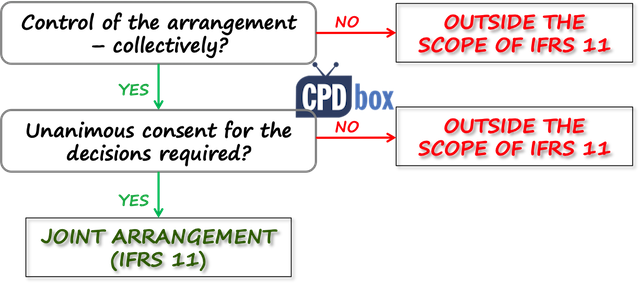

Standard IFRS 11 defines joint control as the contractually agreed sharing of control of an arrangement, which exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control.

Let’s break it down. There are 3 basic elements of joint control:

- Contractual arrangement: Please note that here, contractual arrangement must be present – often in writing in the form of contract or some documented decisions of the parties involved. Sometimes law or other statutory mechanisms are sufficient to create contractual arrangement.

- Sharing of control: This condition or element is met when all parties, or group of parties, considered collectively, are able to direct the relevant decisions of the arrangement.

In other words – no single party can decide on its own.

Let me give you an example:

Imagine 3 joint venturers: Company Large has a share of 50% in a joint venture, companies Medium and Regular have shares of 25% each. Let’s say that the contract specifies that to make important decisions, at least 75% must agree.

What does that mean?

Well, although Large can veto or block any decisions by Medium and Regular (in other words, Medium and Regular do not have enough voting power to decide against Large’s decision), Large does not have a control, because to make a decision, Large still needs the support of either Medium or Regular.

In this example, collective control is present, but you still need to assess whether Large, Medium and Regular need to decide unanimously (all of them must agree) or not. That would be written in the contract, for example.

- Unanimous consent: Unanimous consent means that every party of the joint arrangement must agree with (or at least does not object to) the decision and no one can block it.

In our above example, if the contract says it simply: 75% of voting power is enough to make all decisions, then there is NO unanimous consent, because just 2 parties are sufficient to present (Large and either Medium or Regular).

When you are assessing the presence of joint control, this chart might help:

Classify your joint arrangement

Once the investor acquires an interest in joint arrangement, then she must classify this arrangement correctly and apply the appropriate accounting method.

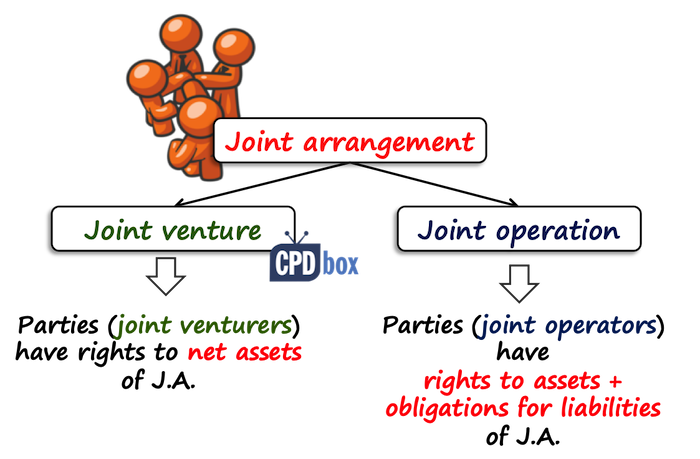

There are 2 types of joint arrangements:

- Joint venture: In a joint venture, the parties having joint control have rights to the net assets of the arrangement. These parties are called “joint venturers”.

- Joint operation: In a joint operation, the parties having joint control have rights to the assets and obligations for the liabilities relating to the arrangement. These parties are called “joint operators”.

How to distinguish between joint venture and joint operation

It’s very important to classify the joint arrangement correctly as the accounting method for both types is different.

The classification depends upon the rights and obligations arising from the joint arrangement.

When assessing the rights and obligations from the joint arrangements, it’s very important to look at how the joint arrangement is structured, mainly whether the arrangement is structured through separate vehicle or not.

Separate vehicle is a separately identifiable financial structure, including separate legal entities (e.g. company) or some entities recognized by a statute (not necessarily having legal personality).

NOT structured through a separate vehicle

When a joint arrangement is NOT structured through a separate vehicle, then the classification is easy: it is a clear joint operation.

Structured through a separate vehicle

When the joint arrangement is structured through separate vehicle, then it can be either joint venture or joint operation.

For making your conclusion, you should examine further:

- The legal form of joint arrangement;

- The terms of the contractual arrangement; and

- Other facts and circumstances when relevant.

Let me give you another example:

Imagine companies Medium and Regular invest their money in the separate legal entity, MRJoint. Medium and Regular have 50% share each.

Is it joint venture or joint operation?

As Medium and Regular established separate vehicle (MRJoint), it can be either joint venture or joint operation.

Now, what rights and obligations do Medium and Regular have with regard to MRJoint?

If there’s no other contractual arrangement and MRJoint is separated from its owners (meaning that assets and liabilities in MRJoint belong to MRJoint), then Medium and Regular have interests in joint venture.

However, if there is some contractual arrangement stating that both Medium and Regular have interests in the assets of MRJoint and they are liable for the liabilities of MRJoint in a specified proportion, then it would be joint operation.

My own experience is that once parties establish a separate legal entity (company) with sharing joint control, then it is a joint venture in most cases.

Accounting for joint arrangements

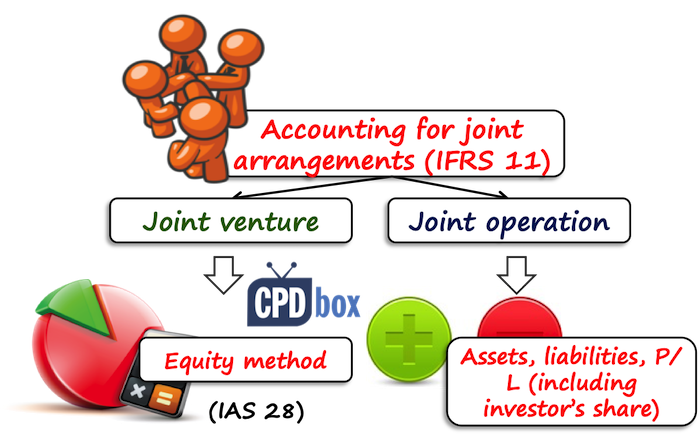

IFRS 11 sets two different methods of accounting for interests in joint arrangements, depending on the type of the arrangement:

Accounting for interest in joint venture

IFRS 11 requires accounting for the investment in a joint venture using the equity method according to IAS 28 Investments in Associates and Joint Ventures.

I have covered the basic principles of the equity method in the article about IAS 28. If you need more than basics and you wish to actually learn how to apply the equity method, then please consider subscribing to my premium package the IFRS Kit.

Accounting for interest in joint operation

When an investor classifies its investment as a joint operation, then you should recognize in the financial statements:

- Its assets, including its share of any assets held jointly;

- Its liabilities, including its share of any liabilities incurred jointly;

- Its revenue from the sale of its share of the output arising from the joint operation;

- Its share of the revenue from the sale of the output by the joint operation; and

- Its expenses, including its share of any expenses incurred jointly.

You need to account for these items in line with the appropriate standard, for example – you would account for a machine provided to joint operation in line with IAS 16 Property, Plant and Equipment.

Here’s the video with the short summary of IFRS 11 Joint Arrangements:

If you like this article and the video, please help me spread a word about it and share it with your friends. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

33 Comments

Leave a Reply Cancel reply

Recent Comments

- Jelilat on How to Measure Fair Value in Agriculture – IAS 41 and IFRS 13

- ROHAIL on Expected Credit Loss on Intercompany Loans

- Muhammad Anwar on Top 4 Changes in Profit or Loss Statement under IFRS 18 (with video)

- DEBET on How to Account for Compound Financial Instruments (IAS 32)

- Peter on How to account for intercompany loans under IFRS

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (51)

- Foreign Currency (9)

- IFRS Videos (69)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

- Uncategorized (1)

Hi Silvia,

I have a question on the above example – Large, Medium and Regular and hope you can help me out on this. Large is neither having control and joint control over the arrangement, how should Large account for the arrangement? Which IFRS would apply?

Thank you.

Hi Raven, well, the percentage of ownership is only an indicator of certain relationship like control or joint control, but not a decisive factor. Let’s say that the third party would have contractually guaranteed control of the arrangement despite having zero percentage – in this case, examine whether Large has at least significant influence – if yes, then apply equity method for associate. If not, then Large needs to account for this investment in line with IFRS 9 as for a financial instrument.

Thank you Silvia! I understand now.

(p.s. Thank you for the articles and videos, they’ve made complex things easy to understand)

Hi Sylvia,

My question is whether you can have a joint operation without joint control in terms of IFRS 11.23?

Thanks

Hi

If you have invested capital in the joint operations, do you eliminate that and hiw?

Thanks

Hi,

Suppose there are two entites (say A & B) and both contributes in third entity (say C) to meet its operational cost. The entity B is holding of C. The third entity (C) is providing services to only (A) but receives fund from A & B for meeting its operational cost so that it enables C to provide services to A.

Whether C record’s revenue funds received from A Or it would do some other treatment?

I am a master’s student in the accounting department in Turkey. I want to thank you because through my studies, I use this site very much. God bless you.

What are the types of joint venture

Hi Sylvia,

Thank you very much for the above detailed explanation. I have got a question dear. There is a joint operation in which there are 3 partners whereby A holds 50%, B 25% and C holds 25%. There was a transaction entered by B and C, whereby B sold goods with a cost of $36m for 50m with C. How the partners will account this in their financial Statements?? Should it be

A P&l

Revenue: 50% of 50m

COS: 50% of 36m

& Same for the other 2 partners according to their proportion in the joint operation???

Hi Silvia, what is your take regarding a Joint Control where the vehicle in a Joint Arrangement is an unincorporated vehicle but parties intend to have right to net assets of the arrangement with the expectation that one of the parties shall be responsible for the operation. Does this arrangement still qualify as a Joint Venture( and not Joint Operation) not withstanding the unincorporated status of the vehicle.

Dear Silvia

When accounting for Joint operation , the standard requires entities to account for their share of assets , liabilities , revenues and expenses. Does it mean that the entity will account for it using proportional consolidation ? we know that the IASB banned the use of proportional consolidation , if that is the case how entities will account for their share in Joint operation

Hi Omer,

no, not a proportionate consolidation. OK, let’s say you form a joint operation with company B and you have a share of 50%. You+B decide to buy a big boat for joint operation and you’ll pay 50% of price each. The boat cost is 10 000. IFRS 11 requires you to recognize your share on the asset of joint operation – i.e. in your PPE, you’ll recognize 50% of this boat in the cost of 5 000. That’s not fully “proportionate consolidation” – just recognizing your share of assets. S.

So helpful to understand the joint venture and joint operations. If few math added then would be fantastic

Привет! прикольный у вас сайт!

Нашел хорошую базу кино: исторические фильмы 2017 в хорошем качестве

Тут: лучшие фильмы фантастика онлайн 720 http://kinofly.net/fantastika/ список 2018

Здесь: посмотреть комедии онлайн хорошем качестве http://kinofly.net/komediya/ список 2018

Здесь: мелодрамы россия онлайн бесплатно в хорошем качестве http://kinofly.net/melodrama/ список 2018

Здесь: http://kinofly.net/multfilmy/910-korova-za-rulem-2007.html Смотреть Корова за рулем (2007) онлайн бесплатно

Тут: http://kinofly.net/multfilmy/12809-malenkiy-princ-le-petit-prince-sezon-1-3-2010-2017.html

Hi Silvia,

Am currently engaged to audit a joint arrangement. The following applies to the arrangement.

Independent company A and B agreed to enter into a joint arrangement with A contributing 60% and B 40% of the joint venture annual budgeted expenses. The arrangement is to be operated by A, however, A delegated the operation to company C which is a wholly owned subsidiary of A. C manages the arrangement on behalf of A, and prepares annual financial returns to the partners(A & B) at the end of each period. At the start of each period, C prepares an expense budget, and cash call each of the partners in accordance with their stake in the arrangement. Cash calls are received and expended in line with the approved budget. The following are my challenges

1. Cash calls are not received in the proportion in which they are called, there are backlogs of outstanding from partners, this is because, C uses its money to finance some of the expenses on behalf of the partners. How do i separate C involvement in the venture, and how to account for cash calls owing by partners(A&B)

2. In preparing the 60% financial statement, all assets, liabilities, expenses and income are taken from the 100% Financial statement, except A partner’s current account which is taken at actual, this resulted in the balance sheet not balancing off. how do i resolve this?

3. How do incorporate cash call owing by each partners into the financial statements?

4. Is this a joint venture or joint operation?

Thanks for your prompt response.

Hi Silvia,

May I check with you if let said the condition stated in the contractual arrangement with Company A, B, C, D, E (assumed individual has only 1 vote regardless of % it held on ABCDE)and ABCDE are:-

(i) The contractual arrangement specifies that the simple majority vote are required to direct the relevant activities of ABCDE and no specify which combination of the parties is required to agree unanimously to decisions about the relevant activities of ABCDE.

(ii) No action or decision relating to any of the matters set out in “Reserve Matter” stated in the contract shall be taken or made without the unanimous approval and vote of all shareholders.

As a result of (i) and (ii) above, shall A, B, C, D, E treat the ABCDE as an associate or joint control? I had a bit confuse due to condition (ii) above stated in the contract. If without (ii) above stated in the contract, I will treat the ABCDE as an associate rather than joint arrangement due to the contractual arrangement has no specify which combination of the parties (A, B and C or A, C and D etc) is required to agree unanimously to decisions about the relevant activities of ABCDE.

However, due to the “reserve matter” above required unanimously approval by all the parties, It made me a bit confuse as it seem both treatment (either associate / joint arrangement) is correct.

Please advise and thanks!

Hi Silvia,

I am just confuse. Could you please reply to my question? In accounting for interest in joint operation section above, what is the difference between the 3rd bullet and 4th bullet below “When an investor classifies its investment as a joint operation, then you should recognize in the financial statements:” 3rd bullet •Its revenue from the sale of its share of the output arising from the joint operation; and the 4th bullet •Its share of the revenue from the sale of the output by the joint operation? Could you please provide examples?

Thank you in advance!

Dear Lawrence,

I understand that it may seem these 2 items are one and the same thing, but in fact, there is a slight difference.

– “Its revenue from the sale of its share of the output arising from the joint operation”: let’s say joint operation produces 100 machines and your share is 50%, so you take 50 machines and sell them – this is your revenue from the sale of your share of the output arising from the joint operation.

– “Its share of the revenue from the sale of the output by the joint operation” – let’s say joint operation produces 1 machine (boat) and sells it, then your share of the revenue is 50% of the revenue from the sale of the boat. S.

Dear Silvia, it would be great if you could help with the following:

Two entities bought an equipment together, that will be leased at no cost to third entity in order to produce a product. First two entities only financed the acquisition of the equipment and will finance the raw materials needed for the production. Third entity will be the manufacturer, and will have labor and other costs.

Since there is no setting up of separate vehicle, I assume this is joint operation. The output will be soled to third parties. My question is, should the joint operation agreement include the third party (the manufacturer) since, the third party does not have legal rights to the equipment, and the production will be at break even point (it is only an operating lease)? Thank you very much in advance!

Hi Silvia,

I have a few questions relating to accounting for Joint Operation (JO). The case is as follows:

Two entities (Entity A and B) entered into an arrangement (C) that is not structured through a separate vehicle and thus classified as a JO in line with requirements of IFRS 11 Joint Arrangements in a portion of 50:50 ratio. According to IFRS 11, as joint operators, Entity A and B recognises in relation to their interests in a joint operation:

(a)assets, including share of any assets held jointly;

(b)liabilities, including share of any liabilities incurred jointly;

(c)revenue from the sale of share of the output arising from the joint operation;

(d)share of the revenue from the sale of the output by the joint operation; and

(e)expenses, including share of any expenses incurred jointly.

Although not incorporated, C has its own bank account and planning to pay a sum of cash to the joint operators from its retained earnings. Currently, C is thinking of classifying it as a dividend payment to A and B (i.e. for A and B, it is a dividend income). However, there is no guidance in the Standards in relation to dividend received from JO other than dividend received from Subsidiaries, Joint Ventures and Associates.

Due to the facts that there is no guidance available and whether you have any experience on this matter in particular:

1.Is it appropriate to recognise this sum of cash as dividend?

2.What is the accounting treatment/double entry for this dividend received from JO?

Your kind feedback is highly appreciated and thank you for taking your time to assist me in this particular case.

Dear Silvia,

Please, what’s the treatment of the acquisition-related cost (advisors fees, financial & legal due diligence fees) in connection with the Joint venture or associate investment acquired?

Shall we capitalize or expense them ?

Hi, Yacine,

it depends on what method of accounting for these investments you chose in your separate financial statements. E.g. if you account for these investments at cost, then yes, you can capitalize these fees. If you account for these investments under IFRS 9, then it depends on how you classify these investments. S.

Hi Sylvia

Regarding for accounting interest in joint operation, may I know how to “PRESENT”in the financial statement? I cannot find any working example in the IFRS11 (all are theories) and appreciated if you can share some of the example here.

Hi Garry, yes, basically it’s OK. S.

Thanks you Silva!

Hi Gary, OK, maybe I’ll add some example, but it’s not really difficult. IFRS 11 says that you should present the individual items in line with the other applicable standards (e.g. PPE under IAS 16 etc.), maybe that’s why there’s no example. S.

Thank you very much. This was so helpful to me

I want to learn IFRS faster

how to link the conceptual framework with ifrs11??????

Well explained

Very well articulated

thank you, madam, this is very helpful, because my exams are next week!