IFRS 3 Business Combinations

When should you apply IFRS 3 and when IFRS 10?

What is the difference between IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements?

Today, I’d like to continue our “consolidation” series and after the introductory lesson and the summary of IFRS 10, let’s dive in the IFRS 3 Business Combinations.

What is the objective of IFRS 3?

The objective of IFRS 3 Business Combinations is to improve the relevance, reliability and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects.

More specifically, IFRS 3 establishes principles and requirements for how the acquirer:

- Recognizes and measures the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree;

- Recognizes and measures the goodwill acquired in the business combination, or a gain from a bargain purchase;

- Determines what information to disclose about the business combination.

What is the difference between IFRS 3 and IFRS 10?

Although it may seem that the IFRS 10 Consolidated Financial Statements and IFRS 3 Business Combinations deal with the same thing, that’s not the whole truth.

Both standards deal with business combinations and their financial statements.

But while IFRS 10 defines a control and prescribes specific consolidation procedures, IFRS 3 is more about the measurement of the items in the consolidated financial statements, such as goodwill, non-controlling interest, etc.

If you need to deal with the consolidation, then you need to apply both standards, not just one or the other.

Is it a business combination or not?

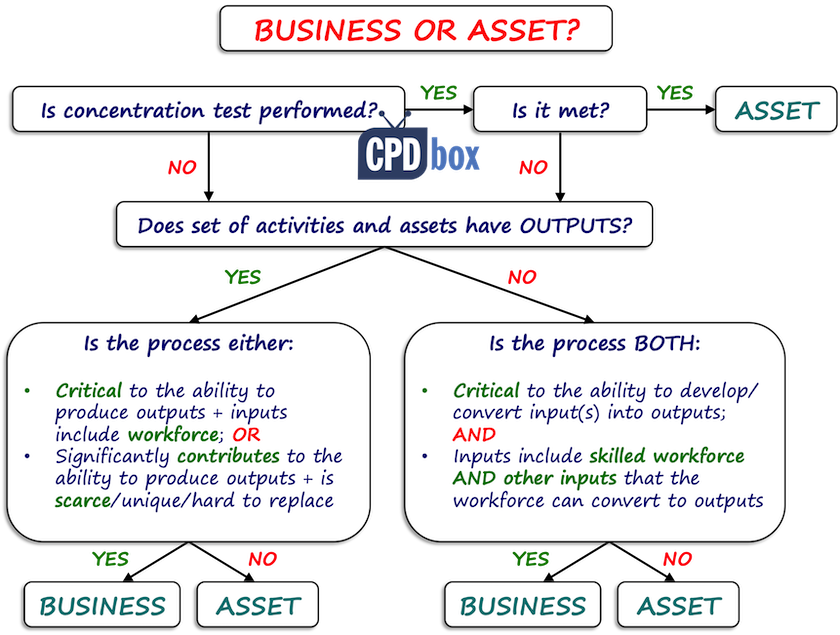

Any investor who acquires some investment needs to determine whether this transaction or event is a business combination or not.

IFRS 3 requires that assets and liabilities acquired need to constitute a business, otherwise it’s not a business combination and an investor needs to account for the transaction in line with other IFRS.

A business consists of 3 elements:

- Input = any economic resource that creates or can create outputs when one or more processes are applied to it, e.g. non-current assets, etc.;

- Process = any system, standard, protocol, convention or rule that when applied to an input(s), creates outputs, e.g. management processes, workforce, etc.

- Output = the result of inputs and processes applied to those inputs that provide or can provide a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners.

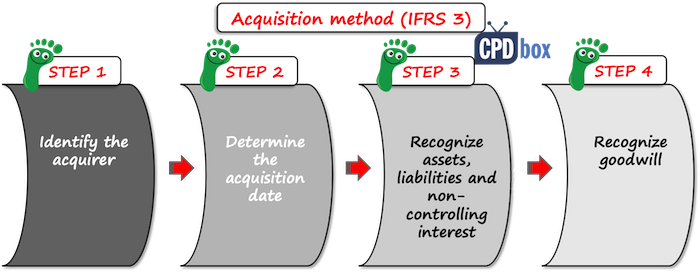

Apply the acquisition method

Once the investor acquires a subsidiary, it has to account for each business combination by applying the acquisition method.

Now you may ask: what is the difference between the acquisition method and consolidation procedures?

I would say that the acquisition method is simply a part of all consolidation procedures you need to perform.

So when you prepare your consolidated financial statements, you must start with the correct application of the acquisition method, and then continue with the eliminating the mutual intra-group transactions, etc.

The acquisition method involves 4 steps:

- Identifying the acquirer,

- Determining the acquisition date,

- Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree;

- Recognizing and measuring goodwill or a gain from a bargain purchase.

Let’s break it down.

Step 1: Identify the acquirer

Most of the time, it’s straightforward – the acquirer is usually the investor who acquires an investment or a subsidiary.

Sometimes, it is not so clear. The most common example is a merger. When two companies merge together and create just 1 company, the acquirer is usually the bigger one – with larger fair value.

However, IFRS 3 provides the application guidance in its appendix, so you might need to check out.

Step 2: Determine the acquisition date

The acquisition date is the date on which the acquirer obtains control of the acquiree.

It is generally the date on which the acquirer legally transfers the consideration (=the payment for the investment), acquires the assets and assumes the liabilities of the acquiree – the closing date.

However, it can be earlier or later than the closing date, too. It depends on the contractual arrangements in the written agreement, if something like that exists.

Step 3: Recognize and measure the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree

3.1 Acquired assets and liabilities

An acquirer or investor shall recognize all identifiable assets acquired, liabilities assumed and non-controlling interests in the acquiree separately from goodwill.

So please be careful, because sometimes, there’s some unrecognized asset in an acquiree, and an investor needs to recognize this asset if it meets the criteria for the recognition.

For example, a subsidiary can have some unrecognized internally generated intangible assets meeting separability criterion. In such a case, an acquirer needs to recognize these assets, too.

All assets and liabilities are measured at acquisition-date fair value.

Often, investors need to perform “fair value adjustments” at acquisition date, because assets and liabilities are often valued in a different way – either at cost less accumulated depreciation, at amortized cost, etc.

However, there are some exceptions from fair value measurement rule:

- Contingent liabilities (IAS 37);

- Income taxes (IAS 12);

- Employee benefits (IAS 19);

- Indemnification assets;

- Reacquired rights;

- Share-based payment transactions (IFRS 2);

- Assets held for sale (IFRS 5).

3.2 Non-controlling interest

Non-controlling interest is the equity in a subsidiary not attributable, directly or indirectly, to a parent.

For example, when an investor acquires 100% share in a company, then there’s no non-controlling interest, because the investor owns subsidiary’s equity in full.

However, when an investor acquires less than 100%, let’s say 80%, then there’s non-controlling interest of 20%, as the 20% of subsidiary’s net assets belong to someone else.

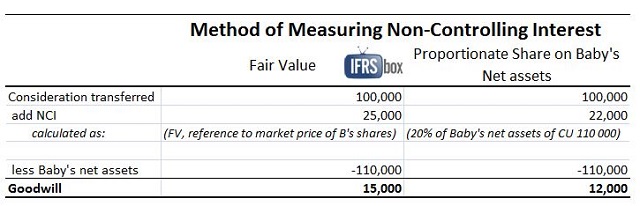

IFRS 3 permits 2 methods of measuring non-controlling interest:

- Fair value, or

- The proportionate share in the recognized acquiree’s net assets.

Selection of method for measuring non-controlling interest directly impacts the amount of goodwill recognized, as you can see in the illustrative example below Step 4.

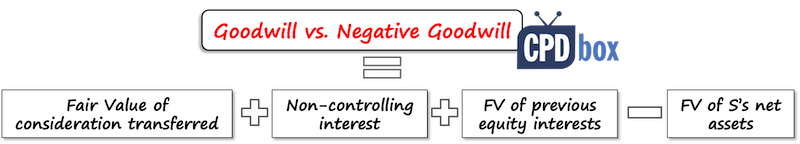

Step 4: Recognize and measure goodwill or a gain from a bargain purchase.

Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized.

It is calculated as a difference between:

- The aggregate of:

- The fair value of the consideration transferred;

- The amount of any non-controlling interest;

- In a business combination achieved in stages: the acquisition-date fair value of the acquirer’s previously-held equity interest in the acquiree;

and

- The acquisition-date amounts of net assets in an acquiree.

The goodwill can be both positive and negative:

- If the goodwill is positive, then you shall recognize it as an intangible asset and perform annual impairment test;

- If the goodwill is negative, then it is a gain on a bargain purchase. You should:

- Review the procedures for recognizing assets and liabilities, non-controlling interest, previously held interest and consideration transferred (i.e. check whether they are error-free);

- Recognize a gain on bargain purchase in profit or loss.

Consideration transferred is measured at fair value, including any contingent consideration. Subsequent change in a consideration transferred is accounted for depending on the initial recognition of the contingent consideration.

Example: Goodwill and non-controlling interest under IFRS 3

Mommy Corp. acquires 80% share in Baby Ltd. for the cash payment of CU 100 000.

On the acquisition date, the aggregate value of Baby’s identifiable assets and liabilities in line with IFRS 3 is CU 110 000.

The fair value of non-controlling interest (the remaining 20% share) is CU 25 000. This amount was determined with the reference of market price of Baby’s ordinary shares before the acquisition date.

I have calculated goodwill and non-controlling interest using both methods mentioned in Step 3 and the results are in the following table. Please note the differences:

Additional guidance to specific transactions

Besides the above rules on application of the acquisition method, IFRS 3 provides guidance about the following transactions:

- A business combination achieved in stages:

The acquirer shall re-measure its previously held equity interest in the acquiree at its acquisition-date fair value and recognize the resulting gain or loss, if any, in profit or loss or other comprehensive income, as appropriate. - Acquisition costs:

Costs of issuing debt or equity instruments are accounted for under IAS 32 Financial Instruments: Presentation and IAS 39 Financial Instruments: Recognition and Measurement/IFRS 9 Financial Instruments. All other costs associated with an acquisition must be expensed. - Pre-existing relationships

If the acquirer and acquiree were parties to a pre-existing relationship, this must must be accounted for separately from the business combination. - Reacquired rights

A reacquired right recognized as an intangible asset shall be amortized over the remaining contractual period of the contract in which the right was granted. An acquirer that subsequently sells a reacquired right to a third party shall include the carrying amount of the intangible asset in determining the gain or loss on the sale. - Contingent liabilities:

Yes, acquirer recognizes a contingent liability in a business combination, contrary to IAS 37, even when the outflow of economic benefits to settle it is remote.After initial recognition and until the liability is settled, cancelled or expires, the acquirer shall measure a contingent liability recognized in a business combination at the higher of the amount determined in accordance with IAS 37, and the amount initially recognized less cumulative amortization in line with IAS 18 Revenue. - Indemnification assets

Indemnification assets recognized at the acquisition are subsequently measured on the same basis of the indemnified liability or asset, subject to contractual impacts and collectibility. Indemnification assets are only derecognized when collected, sold or when rights to it are lost.

Standard IFRS 3 prescribes a number of disclosures, too.

Here’s the list of articles published on IFRSbox related to the consolidation and group accounts:

- Intro to consolidation and group accounts – which method for your investment?

- Example: How to consolidate

- Example: Consolidation with foreign currencies

- How to make consolidated statement of cash flows with foreign currencies

- How to test goodwill for impairment

- How the groups change

- Accounting for deemed disposal of an associate

- Podcast 002: How to treat different useful lives of PPE used by the parent and subsidiary?

Please watch the video with IFRS 3 summary here:

If you like this summary, please let me know by leaving a comment right below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

I’ve seen a situation recently where the acquiring company purchased 999 shares of a company and the the director of the aqcuiring company purchased 1 share. Does the 1 share represent the non-controlling interest?

Yes, as soon as the share is ordinary and carries voting rights (however small).

Dear Silvia how to account for a transaction where a company A

buys company B, B ceases to exist as a separate legal entity and is absorbed in company A

can you record good will in separate financial statements in this case!

How about how to record acquisition of subsidiary in parent’s separate FS. For instance, we have paid consideration of 100 for shares worth 50 only. How this will be recoded in separate book of parent. Thanks.

Dear Sylvia

for the merger of entities under common control will the acquirer recognize the pre-acquisition retained profit of the acquiree in its book on acquisition date?

Hi, I have a scenario where we are buying a 25% stake in a listed company. The book value Per share is $150 where the fair valuation done by us for the transaction shows a value of $120 per share. We agreed to buy the shares at $100 per share. The investment will be classified as associate in the book. In this scenario, could you please show the accounting entries to be passed both at the acquisition date and doe we need to re assess the fair value of the investment every year till we match the books as per their book value?

Hi Silvia,

I have a situation where I am calculating goodwill as part of a purchase price allocation engagement and noted that the Target has contingent receivables. Would this be included as part of identified net assets in calculating the goodwill?

Thank you.

Thank your Silvia,

I have question regarding the consolidation, if at the end the non-controlling interest will get its share in the entity why we do not calculate the parent share in its subsidiary like the equity method from the beginning?

Thanks in advance

First of all, non-controlling interest actually has its share in the entity – that’s why it is called “interest”. Secondly, yes, NCI applies which ever method is applicable to its own consolidated statements.

How to account for business combinations where shares are acquired in credit

Hi Silva, great explanation. I have one confusion.

In case that NCI is measured at fair value then will any part of goodwill be allocated to NCI as well? As the goodwill amount is different in both cases (difference of CU 3000).

Yes, of course.

Hi Silvia it helps a lot, thanks

Hi Silvia, If we had a business combination on 2020. How do we have to present comparative financial statements?

Combinated 2020 compare to what?

To the parent’s individual financial statements of 2019 – in fact, these would be the same as consolidated statements for 2019 (as there was nothing to consolidate).

Hi Silvia, your guidance in such topics is really precious… only one question: usually I find cases where the calculation of net assets acquired is simplified by taking the whole amount of the equity section from the balance sheet statement of the acquiree. However, I have doubts about how should I treat the pre-acquisition other comprehensive income which is included in this equity section. Should I also take the pre-acquisition OCI in the such calculation? or not? Thanks a lot in advance….

Hi Silvia,

Can you please help me to understand the accounting of merger. And, what standard is applied to account for merger acquisition?

Thanks in advance.

Hi Silvia, How the company should recognize the put options on NCI in consolidation and Seperate financial statements.

Supposedly, the acquirer has acquired 70% of equity and 100% control and 100% voting rights. Does the acquirer do the full consolidation or NCI will be calculated. Any specific clause in IFRS on Business Combination?

Percentage of voting rights just points to the method of accounting you should apply. Percentage of shares points to the specific numbers. So, 100% of voting rights point to the control and thus full consolidation. However, as the ownership is 70%, you will have some NCI (30%). You can revise the example on consolidating special purpose entity here – ownership of shares was 0%, but 100% control – as a result, there was a huge NCI (100%).

Thanks Silvia for the quick response. Full consolidation is fine but you advise that we should create NCI to the tune of 30% or there should be no NCI in this case. If no NCI, is thee any specific reference under IFRS?

As per Appendix A to IFRS on Business combination, NON-CONTROLLING INTEREST is “The equity in a subsidiary not attributable, directly or indirectly, to a parent”.

Am I right?

NCI = 30%. In your case, voting rights are 100%, but equity (attributable to a parent) is just 70% (share = 70%).

Really thanks for clearing my doubts.

Hi

How does the company account for fees charged by a finder agent engaged by a shareholder looking to sell the business. Do these qualify as expenses in the ordinary course of the business? Thanks

Hi Silvia, do you have any example for re measurement period under IFRS 3?

Hi Silvia, if parent acquired a subsidiary at $1, and the subsidiary is in a net liability position of $1,000. How do I account this? Thanks

very nice described and good example. Easy to understand.

Thanks for author.

If you want to combine the financial statements prepared in different currencies, you will still follow the same consolidation procedures.

Basically yes, but you need to do some preparation. Take a look here.

Hi, I was wondering what you would do if Baby corp.’s balance sheet already had goodwill on it (presumably from a previous acquisition where Baby corp was the acquirer, not internally generated goodwill)? Would Mommy corp. include that goodwill as one of the identified assets that they’ve acquired, and recognize it in their statements upon consolidation? Would this pre-existing goodwill also be included in the “net assets” for use in the new goodwill calculation? Or would you essentially write-off the pre-existing goodwill?

Hi Mel, in most cases such goodwill stays there, because if Baby controls another entity, then Mommy controls it, too (indirectly via control of Mommy). S.

Hi,

You have shared a great knowledge, however it would be great if you can share the treatment and guidelines for merging 100% owned subsidiary into parent company. Thanks.

i look forward to hearing from you.

Hi Sylivie. Well done. Some thing disturbing me here.

If a parent acquires a subsidiary but the consideration consists of Cash plus an issue of shares at later date. We have the market fair value at acquisition date and the market fair value at date of issuance of the shares.

Which value should we use to value the share issue consideration? Fair value at acquisition or at date of issue. Thanks

Dear Silvia,

Thank you for your content.

My company recently bought the only the asset and customer base of another company. Consequently, this is some sort of acquisition,, although NO liability was transferred. I was looking at treating it as a business combination. My worry lies in the accounting treatment of my payment for this acquisition.

As we agreed to pay instrumentally for 8 installments in 1 year 9 months. The first installment was paid at acquisition, How do i treat the future payments?

Hi Silvia,

If an acquired subsidiary is at capital deficit, e.g. consideration paid 3m for net equity of -0,5m, how the goodwill should be calculated? 3,5m or 3m?

Many thanks

Alice

Hi , thank you for this awesome video. i was wondering if you have this video in ifrs kit because i have the ifrskit and i dont find this video. thanks

Hello Kevine, yes, of course – this video is in “Further reading” section (link to this article and video). Anyway it is a summary and the IFRS Kit contains much detailed videos covering the same topic.

Hello, one question on acquisition of a subsidiary and we fair value the assets and liabilities, if you obtain a net gain on business combination. In year 2, when we reassess and there is an impairment, on the face of the statements of profit and loss, what is the exact term to be used?.

Hi Silva

Thanks for above explanation but can you help me understand the accounting adjustment for Reciprocal Interest held by Subsidiary into Holding Co. If the subsidiary has acquired the same through open market.

What will be the entry in consolidated financials while eliminating this investment suppose Investment is at $10mio and Face value is $1mio.

Thanks

Hi Silva,

Thanks for your teachings, its has really helped my understanding of IFRS. I need some clarification on adjustments after the measurement period

After the expiration measurement period, it was noted that there was an error in the PPA amount for customer distribution network, how can this be corrected, will it impact goodwill previously recorded. what are the accounting entries to correct this error? Any reference material?

If the error is as a result of information that existed as at the acquidition date and during the measurement period but was not considered.

If the change is as a result of new information after the measurement period.

Please suggest possible accounting treatment for the two scenarios.

Hi Silvia,

I have a question regarding the child company. For example, Child company C was owned by parent Company A before A sold it to parent Company B. On the book of C, to record the sale transaction, we should debit cash, credit shareholders equity, is that right? Is there any other entry needed on Child company’s book?

Hi Grace, if A sells shares in C to B, then why would C make any entries? It is the transaction between A and B. S.

Thanks so much for your reply,and I realize that was a dumb question. I just started to get involved in the consolidation and I feel confused all the time. For example, based on the ownership, the parent company should use the consolidated accounting,I understand that dividend payment are internal transfer of cash and are not reported on the FS. But I don’t know if we still book the transaction on parent and child company?then do the elimination?please advise? Also, can you please suggest any article to learn the consolidation? Thanks so much for your help

Hi Grace, “dumb questions” are actually great, because they help you understand and think. Either you learn this word by word and don’t understand, or you ask “dumb questions” and get the point. No worries. When it comes to dividend – yes, you still book this in individual parent’s and subsidiary’s accounts (I like when you call it a “child company” – in my own language this is a “daughter company”, but it is a “subsidiary” in English). And yes, when you prepare consolidated accounts, you eliminate. You can learn basics of consolidation here and maybe then here and here for cash flows. S.

Hi Silvia,

A quick question – is goodwill a concept only for consolidated FS? i.e. it won’t show up in parent’s individual financial statement?

Many thanks

Alice

Yes, consolidated only. No, not in individual parent’s FS. The thing is that acquired goodwill appears on consolidation. If you have internally created goodwill (ie acquired other than on acquisition of subsidiary), you are not permitted to show it.

Many thanks Silvia!

Hi Silvia

Was just wondering why is goodwill only appearing on consolidated financial statements?

Hi Silvia,

If parent’s shareholder transfers his personal holding in an entity to the parent’s subsidiary in exchange of shares in the parent, how this should be recorded in the subsidiary’s books? Dr investment in subsidiary (the unrelated entity now becomes subsidiary’s subsidiary), and Cr what? owing to the ultimate parent’s co?

Many thanks

Alice

Dear Silvia

With reference to International Financial Reporting Standards (IFRS) how do I discuss the treatment of noncontrolling interests if the parent company pays a premium on acquisition of 90% of the subsidiary due to plant being undervalued in the subsidiary’s books, and the subsidiary sells goods at a profit to the parent company which owns 75% of the subsidiary’s shares.

Well, you should discuss something about fair value adjustments upon acquisition (as subsidiary’s assets need to be stated at fair value); and about elimination of unrealized profit on intragroup transactions.

Dear Silvia,

thank you very much for your prompt response. Yes, this is in deed a strange situation, but in real life, I know a few companies which were acquired by the investors only for their land (everything else was destroyed during the war, and companies in deed had huge debt), and forward 10 years from then, the new owners built shopping malls on that land 🙂 The only actual value of those companies was the location of their land… Anyway, I also realised that business combinations of entities under common controls fall out of scope of IFRS 3, therefore, there will be no goodwill in my example because these are related parties… Thank you once again for your response. Regards from Sarajevo

Ah OK. Entities under common control are indeed outside of IFRS 3 scope. However, let me comment under the situation when it is a typical parent-subsidiary acquisition. If the subsidiary’s land is the reason for such a high price and they believe that the market value of the land is greater than the carrying amount of the land in subsidiary’s account, then it is necessary to make fair value adjustments in subsidiary’s accounts – hence bring the land’s value up to its fair value. In this case, goodwill will not be so huge. As I wrote earlier – you always need to examine the core reason for paying so much for the acquisition. By the way – I love Sarajevo!!!

Dear Silvia, thank you again for your response. And if you ever visit Sarajevo in the near future, I would be happy to show you around. Best regards

Dear Silvia,

excellent article, I always check your website first when I encounter an accounting problem 🙂

However, not even one article online (including yours) covers the situation when you acquire company with negative net equity (liabilities>assets). For example, you pay 10.000$ for a company that has assets 100.000 $ and liabilities 300.000$. In this case, mathematics say that you should recognize goodwill in amount of 190.000$, but this just does not make any sense to me… Can you record these 190K$ in P&L as expenses?

Cheers

Belma, this situation is very unlikely as it does not make an economic sense – apart from the fact that there is some unrecognized asset in that subsidiary, such as some intangible internally generated brand valuable for acquirer, etc. Thus first of all – you need to examine the reason WHY it was purchased for such a high price and recognize all unrecognized assets upon consolidation. If it is a transaction at fair value (market transaction), then yes, you would recognize this big goodwill and not an expense. However, you must test the goodwill for the impairment each year.

Thank you Silvia for the response. This came in very handy

Thank you Belma for this question, even in 2024 5 years after it came in handy

Well explained. Thank you

In case of reacquired right in Business Combination, it is seen that carrying value in the books of acquiree is recorded in acquirer books and the excess of market fair value of the asset reacquired over the carrying value in the books of acquiree is treated as unfavorable to acquirer and recognized as loss in the books of acquirer.

My doubt is that how it can be unfavorable since the acquirer got the asset at lower price compared to market value. So, on what logical basis, the loss booked and it is not recorded at market fair value on acquirer books?