IFRS 10 Consolidated Financial Statements

In my previous article I introduced the world of group accounts and consolidation to you.

You learned that there about 6 IFRS dealing with this topic.

Here, I’d like to summarize the first “consolidation” standard dealing with the consolidated financial statements: IFRS 10.

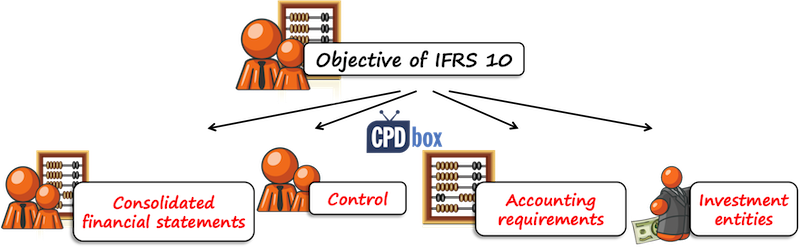

What is the objective of IFRS 10?

The objective of IFRS 10 Consolidated Financial Statements is to establish principles for the presentation and preparation of consolidated financial statements when an entity controls another entity.

More specifically, IFRS 10:

- Requires an entity (a parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements;

- Defines the principle of control as the basis for consolidation and sets out how to identify whether the investor controls the investee;

- Sets out the accounting requirements for the preparation of consolidated financial statements, and

- Defines an investment entity and sets out an exception to consolidating particular subsidiaries of an investment entity.

Control as the basis for consolidation

Simply speaking, the basic rule is:

- If an investor controls its investee => investor must consolidate;

- If an investor does NOT control its investee =>; investor does NOT consolidate.

So what is control?

An investor controls an investee when the investor:

- Is exposed to, or has right to variable returns from its involvement with the investee;

- Has the ability to affect those returns

- Through its power over the investee.

How to assess control

Remember 3 basic elements inherent in control: power, ability to use this power and variable returns.

Power is the existing rights that give the current ability to direct the relevant activities. Let’s break it down a bit:

- The rights must be substantive, not only some minor rights;

- The ability must be current, exercisable in the present time;

- The relevant activities must be significant and related to major activities of investee.

When assessing whether an investor controls an investee, more than one factor need to be considered. IFRS 10 contains guidance in this area.

Accounting requirements of IFRS 10

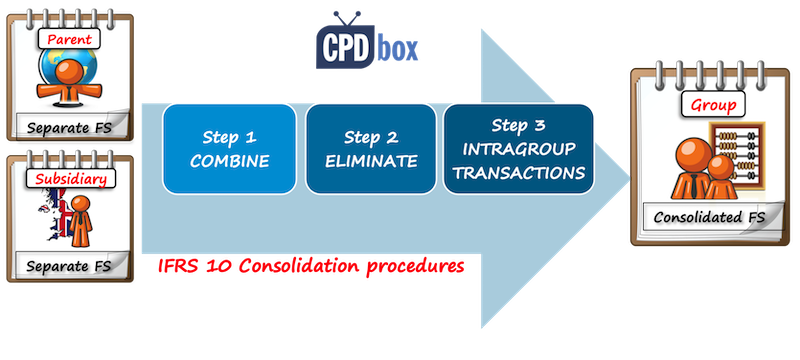

Consolidation procedures

In order to prepare consolidated financial statements, IFRS 10 prescribes the following consolidation procedures:

- Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries;

- Offset (eliminate):

- The carrying amount of the parent’s investment in each subsidiary; and

- The parent’s portion of equity of each subsidiary;

- Eliminate in full intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between entities of the group.

If you’d like to learn HOW to actually apply these consolidation procedures and how to prepare the consolidated financial statements on numerical examples, please check out the IFRS Kit.

Other accounting requirements

Except for basic consolidation procedures, IFRS 10 prescribes number of other rules for preparing consolidated financial statements, such as:

- Presentation of non-controlling interests: in equity, but separately from the equity of owners of the parent;

- Uniform accounting policies shall be used by both parent and subsidiary;

- The financial statements of the parent and the subsidiary shall have the same reporting date;

- How to deal when the parent loses its control over subsidiary,

and number of other rules dealing with the specific circumstances.

Exceptions in IFRS 10

As I wrote above, when a parent controls a subsidiary, then it should consolidate.

But not always. IFRS 10 sets the following exceptions from consolidation:

- A parent does not need to present consolidated financial statements if it meets all of the following conditions:

- It is a wholly-owned subsidiary or is a partially-owned subsidiary of another entity and its other owners agree;

- Its debt or equity instruments are not traded in a public market;

- It did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market, and

- Its ultimate or any intermediate parent of the parent produces consolidated financial statements available for public use that comply with IFRSs.

- Post-employment benefit plans or other long-term employee benefit plans to which IAS 19 Employee Benefits applies – they don’t need to present consolidated financial statements;

- Investment entities. This exception applies for the periods starting on or after 1 January 2014 and I have written about this exception in the article “Top 5 2013 and 2014 IFRS Changes“.

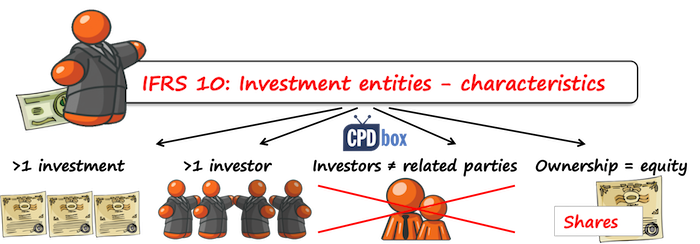

Investment entities

Investment entity is an entity that:

- Obtains funds from one or more investors for the purpose of providing those investor(s) with investment management services;

- Commits to its investor(s) that its business purpose is to invest funds solely for returns from capital appreciation, investment income, or both, and

- Measures and evaluates the performance of substantially all of its investments on a fair value basis.

IFRS 10 sets the guidance and rules about determining whether the entity is an investment entity or not. Typical characteristics of investment entities are:

- It has more than one investment;

- It has more than one investor;

- It has investors that are not related parties of the entity;

- It has ownership interests in the form of equity or similar interests.

Most investment entities CANNOT present consolidated financial statements and instead, they need to measure an investment in a subsidiary at fair value through profit or loss in line with IFRS 9 Financial Instruments.

Please watch the following video with the summary of IFRS 10:

If you like this summary, please let me know by leaving a comment right below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

how to consolidate the other components of income from subsidiaries if these items exists after the acquisition ?

Hi Silvia, IFRS 10.4, exceptions to consolidation does not include subsidiaries with dissimilar business activities from that of parent. Should such businesses be consolidated and what adjustments or disclosures must be made? Can a subsidiary be left out of consolidation on the grounds of immateriality in relation to size of parent and what disclosures to make please?

Very good question. Yes, even dissimilar businesses need to be consolidated and you need to test whether they would meet the criteria for segment reporting under IFRS 8. It happens quite often that IFRS 8 does not apply at individual level (where the business might be homogenous), but it does apply at consolidated level when different subsidiaries perform different operations/activities and belong to different segments. As for not including subsidiary in the consolidation based on immateriality – yes, that happens and is not strictly against the standards, but you should indeed be sure that subsidiary’s results are immaterial (ask you auditor what he/she thinks).

Hi there,

Is “Available for public use” (IFRS 10 par 4) defined in IFRS?

Thank you Silvia for your explanation,

I have question regarding Identifiable Assets, you said the Asset can be Identified if it meet one of the 2 criteria : 1. separable and 2. arising from contractual rights, could you please provide example of criteria No.2?

Hi Silvia,

Thank for explaining complex topic in the way for me to understand. It is very useful and I am grad that I have found this site. I have a question for you. We have a company in Switzerland and the company is currently under administration since May 2020. The company is 100% owned subsidiary of a Head Co which is based in Australia. Since we have lost control to the administrator, I was wondering if we still need to consolidate the subsidiary. It would be appreciated if you could give me a guidance. Thanks!

Thank you Silvia very useful u rock but I have still a long way to understand it and again THANK YOU SO MUCH

Hi Silvia,

I have one point not clear, i a parent company has minority interests in a subsidiary (30%) but responsible for managing this subsidiary (due to know how), can this Parent company consolidate this subsidiary results in its financials?

Hi Ehab, as soon as the know how gives control to the parent (that’s up to you to assess), then yes, consolidation is necessary despite 30% share. In this case, your non-controlling interest will be 70%.

Hello,

If a seaports expands it operations by investing and operating a dryport. Is segment reporting required for the seaport and dryport.

The key management and staff are the same. Staff are rotated and equipment deployed from seaport to dryport depending on the volume demand. core services and billing are performed at the seaport and while some core services such as additional storage and additional handling is performed at the dryport.

The additional revenue at the dryport is 10% of the total revenue

Hi, evening. A holding company (USD currency) with a foreign subsidiary (SGD currency), so first step is to convert foreign subsidiary financial statement to local currency, then consol the figures with local holding company, then follow by eliminate of interco transactions, i.e. investing in subsidary , holding currency was USD100k , but in subsidiary books , share capital held by holding was SGD135k , but when it converted to USD currency based on the year end rate it become USD98,765 , so when do the elimination, there will have a different of USD1235, please teach me how to adjust this ? thanks in advance , Silvia

Thanks Silvia, your videos are very interesting and brief

I hope to benefit from you more.

Hai Silvia,

Thanks for the detail information on consolidation. Its very useful tools for auditor like me.

We need your advice on the following situation:

The Holding co has acquired shares in Subsidiary co on 17 April 2014. Few % of shares was purchased earlier on and total share completely transfered as at 17 April 2014 is 52%. The holding co year end is 31.12.2014. Thus in order to calculate pre-acquisition reserves at the date of acquisition, do we need to prorate the subsidiary’s account to daily or monthly basis? i.e. total net asset x 4/12 (if based on monthly)?

Please advice me on this. I’m so confused ;(

Hi Silvia,

Thanks for sharing these articles.

Suppose an investor could demonstrate control over an entity (meet all criteria contractually) but did not prepare consolidated Financial Statements over the years and was not involved with the investee companies and let local management operate and take decisions. Now, after all these years, the same investor wishes to know whether there has been a departure against IFRS 10 and whether he should have consolidated the FS (none of the FS were unaudited).

Key thing is that it seems he qualified for being considered as parent but since it was not involved at all with the companies, then can it now claim that it controlled/controls the subsidiaries.

Looking forward to hear from you.

Thanks