Top 3 Biggest Dilemmas With Your Auditors

Companies are very watchful when it comes to an audit of their financial statements. How to deal with our auditors? Do they know everything? Should we listen to them? Can they force us to do something we don’t want?

I worked as an audit assistant, audit senior and audit manager for some years and I can relate. The relationship between a client and an auditor is very delicate and sometimes, we (as a client and as an auditor) simply don’t know what we can afford to do or say to each other.

As many audit-related questions pop out in my mailbox these days, I dedicate this article to 3 biggest dilemmas you may experience during audit of your financial statements.

Please, bear in mind that the answer is never clear yes or no, black or white. The life is full of colors.

Warning and disclaimer: Throughout this article, I avoid a professional audit terminology and I don’t recall or cite any professional rules or guidelines, such as International Standards of Auditing (ISAs). I just wanted to give you my opinion based on my own past experiences. Also, I want you to have some fun, too!

So, let’s go through 3 biggest dilemmas. Plus, I could not resist adding a bonus question in the end.

#1: Can we rely on our financial statements prepared by our auditor? Can we trust them?

In short – yes, you can, because:

- Auditors are very smart and they know what they do (in most cases);

- They issue their audit opinion on those financial statements.

BUT!!!

Auditors should NOT prepare your financial statements.

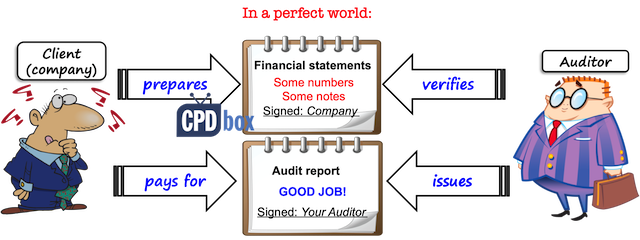

This is YOUR responsibility to prepare your own financial statements. Auditor’s task is to examine them, verify them and issue their opinion in their audit report.

Frankly speaking, officially, no auditor can audit his own work. An auditor must be independent.

What does it mean?

You cannot really hire one company to prepare your financial statements (or even maintain bookkeeping) and the same company to audit those financial statements.

Hmmm, but what about the situation when auditor take your trial balance and prepares the statement of financial position, statement of comprehensive income, cash flows, etc.?

In an ideal world, this should not happen. Indeed, it’s an audited company who should do it, not an auditor.

But in the real world, it happens. It happens A LOT.

When I worked as an audit assistant, I remember preparing lots of cash flow statements (it was the biggest nightmare for any client), notes to the financial statements and other components of the financial statements instead of my clients.

The main reasons were:

- I did not need to wait for the client to prepare it;

- I did not have to search for errors, differences, balancing figures, shady numbers, etc.;

- We saved a lot of time and effort.

Of course, auditor’s name will never appear on the financial statements as an “author’s name” (due to independency, remember), but the truth is as it is.

Just bear in mind that even when auditors make financial statements for you, you are still responsible for them.

#2: Can our auditor force us to book something we don’t want?

In short – NO, he/she CANNOT.

Auditor’s task is not to force you book anything, because auditor is not doing your books.

So no, don’t worry, auditor will not hold a knife to your neck.

BUT!!!

Auditor’s task is to express his opinion on what you have booked.

So what can happen?

Auditor finds out that you booked something and he disagrees with your entries, for whatever reason.

Auditor will propose you some adjustment to your books.

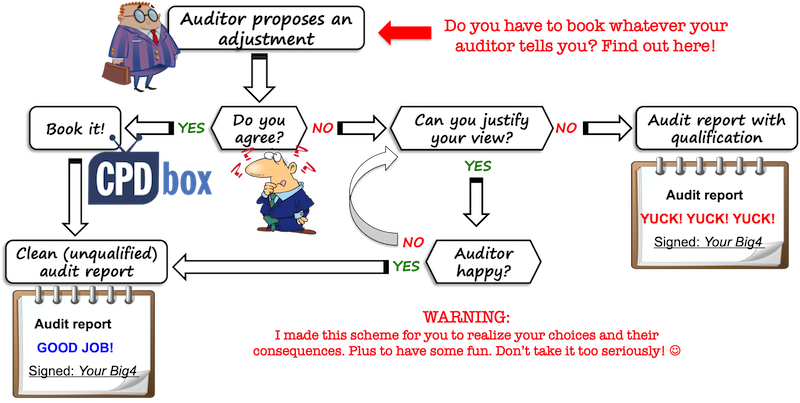

Now, there are 3 basic scenarios:

- You will accept auditor’s proposed adjustments and book them. Auditor will issue clean (unqualified) audit report.

- You will try to support your numbers with some arguments, additional information, estimates, calculations, whatever. If you are lucky and persuasive enough, your auditor may accept it and issue a clean opinion.

- You refuse to book proposed adjustments and leave the books as they are. Auditor will issue an opinion with qualification.

And of course, something in between.

Once I experienced very painful story with that.

I was an audit manager at the time and we performed an audit of a company whose core business was to sell machines for recharging mobile phone credits.

Let’s say you want to recharge your credit, so you pay EUR 50 to the recharging machine. Our client received EUR 50 via the machine, and needed to pay EUR 48 to the mobile operator. Our client’s revenue was EUR 2 being the commission for helping to make a sale via the machine.

The main accounting issue in this company was the incorrect accounting for revenues.

Our client recognized revenue of EUR 50 and the cost of sales of EUR 48.

Wrong, wrong, wrong.

The reason is that when you assess an agent/principal relationship, you find out that in fact, our company was only an agent mediating the sale, as it was a mobile operator who provided a service to the end customer.

Therefore, the correct accounting should have been revenue of EUR 2, and payables of EUR 48.

Why does it matter, when profit or loss effect is still the same EUR 2?

Wow, it makes a HUGE difference.

Our client took some loans and one of the covenants was to maintain certain level of revenues. And, while the revenue of EUR 50 per transaction meets the covenant, the revenue of EUR 2 does not.

Plus, the management bonuses were derived from revenues (not the profit!). You do your math. As you can see, our client had all great reasons to account for these transactions in gross amounts (not in a net amount as a commission revenue only).

So you can imagine the fight!

It was exactly the situation when an auditor strongly disagreed with the numbers. We could not force the client to make it right.

How did it end?

The client refused to book the adjustment and we issued a qualified opinion.

And this can happen to you, too.

#3: Do we need to hire the same auditor as our parent company hires?

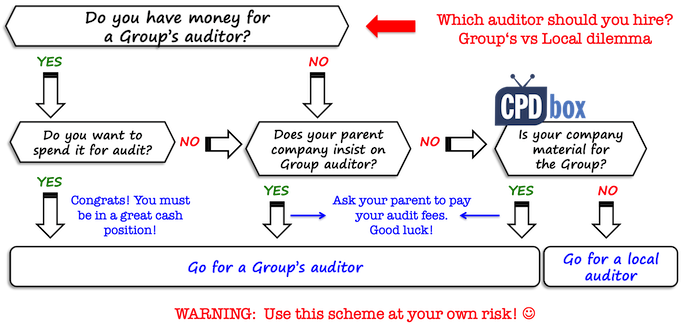

In short – NO, unless your shareholder or group policy requires that.

BUT!!!

It can be more practical and cost effective from the group’s point of view.

Don’t get me wrong here.

I can understand very well why small local branch of a multinational group wants to select local audit firm and not a Big4 branch. Sure, Big4 can cost much more than a local auditor.

However, think about it from the parent’s point of view.

Parent’s auditor needs to audit consolidated financial statements.

Therefore, he will need to audit subsidiaries’ financial statements, too.

In practice, auditors often rely on the work of experts, including other auditors.

If subsidiary’s financial statements are audited by the same auditor (e.g. Big4’s local office), then a parent’s auditor can rely on them, because it’s the same group, using the same audit procedures and policies, known for extensive training of their audit personnel, high audit standards, etc.

However, if subsidiary’s financial statements are audited by the local firm, a parent’s auditor needs to decide whether he can rely on this audit or not.

In some cases, parent’s auditor may decide to perform his own audit of a subsidiary – which can be more expensive in total. Why? Because:

- A subsidiary pays an audit fee to its local auditor;

- A parent can pay an extra audit fee to its group auditor to re-perform an audit of a subsidiary.

So what can you do?

If you work for a company that is a part of a group and you are deciding whether to select an (expensive) group auditor or a (cheaper) local auditor, think about the group’s materiality level.

Is your local company big enough to cause material error in the consolidated financial statements?

If yes, then it’s maybe worth to hire group auditor.

But if your local company is of a size of a “rounding difference” in the group’s financial statements, then leave it to the local auditor.

Bonus Question: We pay audit fees and therefore, our auditor has to issue the opinion in line with our desire, isn’t it?

Actually, I’m not kidding here, it was a real requirement from the real client.

I was just promoted to an audit senior and assigned to my first audit engagement in my new role. It was like a trial by fire and I thought I was doomed.

Mess everywhere I looked. Even trial balance did not balance.

Even coffee was terrible. David Lynch once said “Even bad coffee is better than no coffee at all.” After that audit, I strongly disagree!

When we had a final meeting with the client, we told him that based on what we saw, the report could not be clean.

He looked at me with his blue eyes and said: “ I pay you the audit fees. You HAVE TO issue a clean report, because that’s what I pay for!!!”

Man, he meant it!

Now seriously.

The client pays an audit fee for auditor’s job that is to examine the financial statements and express his independent opinion.

Independent opinion does NOT mean an opinion in line with the client’s desires. That would not be independent.

I know, I know.

It’s a kind of oxymoron – how can auditor be independent from a client if that client pays him an audit fee? How is this different from a tax inspection that is for free?

The answer to the first question: It’s a well-suited and valid argument and therefore, there’s a whole bunch of rules about auditor’s independence in International Standards on Auditing. You know, nothing is perfect.

The answer to the second question: Except for issuing an audit report, auditor is here to help you and giving you good advice about your accounting. Tax inspection is here to impose penalties (edit: although some exceptions do exist, not to offend any helpful tax inspector).

I would absolutely LOVE to read some of your stories, whether you’re an auditor or a client. Please, leave me a comment below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

63 Comments

Leave a Reply Cancel reply

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

I work in Finance for a NFP organisation and for 8 years we have been audited by one of the big 4.

I assume that some the errors that were found during the first audit, gave our Auditors the wrong idea about the Finance Team’s competence. However, we have never failed to take responsibility for those errors.

However, I have always had the feeling that the Auditors “were out to get us” and that changes they required were based on a “we work for..(one of the big 4) and therefore we know better” basis.

So, while I truly agree with what you write in your article, I personally believe that auditors should be independent, as well as leave some preconceived ideas out of the door, otherwise those synergies you mention (taking the audit as an opportunity to improve) are lost.

Thank you

Hi Davide,

I fully agree and I lived this myself, observing my much smarter colleagues to boost their ego on “stupid” clients. This has nothing to do with the audit profession itself, rather this has to do with the specific personality of that particular auditor. However, I experienced the opposite, too – being the freshman, asking too basic questions and getting mockery from the client’s CFO. Ego is a big thing, putting many obstacles to one’s life. All the best!

Hi Silvia

Thank you for your great opinions on the great 3 dilemmas that we are practicing every day with our clients. I am Auditor from Yemen and I have my team for performing the audit assignments; my rule is to control the quality of performing the Audit assignments performed by our team. As you said we prepare the financial statements for our client based on the TB that he provides to us; then we calculate the materiality and do the audit sampling base on the materiality results and risk observed as well as the assessment of internal audit control. With one of our clients, we issued the draft of financial statements with our proposed adjustments required to be passed on our own audit system to issue the clean audit report. The response of our client was very slow because the adjustments in our own audit system will not change anything to his analytical accounts and he does not like to make the adjustments in his accounting system for 2019. So he ignore to response to our proposed adjustments required for 2019; hence my team of auditors started to prepare and audit the FS for 2020. when we saw the situation of mistakes in the monthly closing entries was material in 2020 in aggregation with the mistakes of 2019 in the same transactions ( which lead to calculate earnings from exchange rate of foreign currencies from all the accounts its currency in USD including making exchange foreign currencies earning from sale and expenses in the comprehensive income statements which is not in agreement with the IAS21; we decided to enforce the client to accept to do the adjustments required in his accounting system. Finally he agree to solve the problems in his accounts via reverse the closing monthly entries which was totally wrong and make the correct closing entries which will make the accounts reasonable for 2019 and 2020; this -unfortunately- will cause a lot of work for us as auditor because the opening balances and closing balances for each year will be changed; this new balance will enforce us as auditors to start again for preparing the financial statements for 2019 and 2020 using the new balances in the new TBs for 2019 and 2020. I hope the picture is clear to you Silvia. I have 2 questions dear Silvia:

Q.1 As the closing entries of every month of the year will be revered and new closing entries will be correctly made; the balances of the accounts will be changed and the materiality also will be changed which we previous depend on it for determining the sample test; Do we must make new sample for testing after we complete our testing procedures for 2019 and 202 or we can depend on our pervious audit procedures performed and only prepare the FS based on the new TBS?

Q.2 We requested our clint to pay us extra audit fee for 2019 and 2020 due to the extra work that we will make to prepare the financial statements a gain based on the new TBs resulted from reversing the wrong closing entries and making the new and correct closing entries; Is this requested extra fee for 2019 and 2020 is due for us as auditors or not?

Q.3 Bonus for our friends of CPDBOX : Kindly comment on the issue.

Kindly response to our new dilemma.

My love to you MAM..

Hi Tawfik,

thank you! OMG, I got sincerely lost mid-way reading the story, so I believe it must be a mess. However, I try to tackle this very simply:

1) If the materiality went down, then the previous sampling and testing might not be sufficient, so I recommend performing additional tests.

2) That fully depends on the contractual provisions of your agreement between you (auditors) and your client. If the fee was fixed in the agreement with no room for any potential adjustments, then you will have a hard time to get it from your client (unless the client agrees voluntarily).

3) I did not understand the Q3.

My love to you ALL. 🙂

Hi Silvia, Thanks for sharing a practical example of the relationship between clients and the Auditor. This is quite educating and enlighten. The Client really need to know their roles and plays it accordingly while the Auditor needs to be focused.

Once again, I say thank you so much.

Hi Sylvia. Thank you so much for such a practically truthful article about our life as an auditor. haha! BTW, please update this portion:

Auditor finds out that you booked something (and it is material) and he disagrees with your entries, for whatever reason. Auditor will propose you some adjustment to your books. (Remember that the auditor only proposes an adjustment if the audit difference is material). Thank you so much!!!

Hi Silvia,

Very interesting and helpful article.

I have questions on the second dilemma, that what will be the entry if the company works as a distributor ( that is, the company purchases from the producers and sales to the final consumers with a restricted profit margin) ? We can use the same sales, purchase and profit figures as you mentioned on your example. The point here is the purchase invoice ( or the supplier’s sales invoice) is prepared in the amount of CU48. I think our recording should be based on our source documents.

Hi Silvia,

Your articles is always on point. Keep it up.

Dear Silva

Thank you for your informative and helpful articles.

As a client ( employee of my company ) I have sweet moments with local as well as big 4 auditors . Infact one of our audit company inspired me to join and complete ACCA . I used to tell my colleagues that do not fear about Audit. Take this as your annual test and opportunity to improve your accounting profession and work to grow than grow to work.

Of course there are many occasions I get irritated from a common query which may not be related to out industry or take objection based on prescriptive rules by junior auditors (students). In such circumstances I take charge by explaining the Accounting and auditing standards to these juniors ( during my study for CA) and keep them convinced.( of course these students will write the comments and discuss with their audit incharge) . But on the whole I enjoyed those days.

Hi Thomas, yes, I know where you are! 🙂 I remember myself as a newbie auditor – the clients were literally giving training to us 🙂

Hello silvia,

Thanks for the great write up though they make me laugh and at the same time sad because I am an auditor. These scenarios are what I experience daily almost on all my engagements.

Thanks once more for sharing this…..

I am a graduate in Accounting,I love your write up and wish to enroll on your IFRS Kit and wish to ask the payment,can it be installmental especially does of us that are just going into the labor market.

Dear Silvia, Many thanks for sharing good article which explains the reality when you face with an audit of a group. Hugely helpful…

Thank you. Have a wonderful day!

Dear Silvia,

Thank you for the good article. I am an Accountant. When I provide some reports, say for example Gratuity report to Auditor extracted from the system, the Auditor usually asks us to do manual calculation. Do we really mean to calculate & give?

Further, I would request you to make a complete “Audit course” like IFRS Kit course which explains complete Audit tasks from planning phase to issue Audit report with ISAs explanation. I am very happy to subscribe as it would be very much helpful for us to understand detailed Audit techniques.

Thank you.

Have a great time.

Hi Mohammad, thank you! 🙂 Well, as for manual calculations – no, you do not have to do any of it. All you have to do is to prove that your numbers extracted from the system are correct. Auditor can test them by doing manual calculations himself or test the system whether it is failsafe – however, this is just said in general. S.

Dear Silvia, I love the way you present the topic and draft articles. Thanks for sharing such basic insights and found it very useful 🙂

Hi silvia,

I must confess that your articles are second to none. I wish to appreciate your good works and to encourage you to continue doing what you know how to do best.

hi Silva,

Thank you for this article, it’s really worth reading.

Can you continue as an auditor for next year if you have qualified the audit report this year?

Yes of course. You only need to withdraw if it is a disclaimer (material and pervasive) due to management’s scope limitation. You may wish to note that paragraphs 13, A13 and A14 of ISA 705, Modifications to the Opinion in the Independent Auditor’s Report refer to the situation when the inability to obtain sufficient appropriate audit evidence is due to a management-imposed limitation. If management refuses to remove the limitation, the auditor is unable to obtain sufficient appropriate audit evidence from performing alternative procedures, and the auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be both material and pervasive, the auditor would then be required to withdraw from the audit, where practicable and possible under applicable law or regulation. Hence, in a situation when the disclaimer of opinion is not due to a management-imposed limitation, it is possible to seek re-appointment as auditor.

Hi Silvia,

Thanks for this piece, it really worth reading.

When a Company and its auditor have difference either in applying an accounting standard or accounting treatment of a transaction/ disclosure. The Financial reporting standard in use remains the last resort i.e anyone whose treatment complies more with the standard should have his way. But in practice, Organisation wants to have their way at all time(especially when they have ulterior motives that are not known to the auditors) and despite this, they do not appreciate a qualified report.And where the fees of the Organisation in question is material to the audit firm, such firm will have no choice than to comprise.

Relationship between auditors and clients is really sensitive and must be treated as such

Hi Silvia, thank you for sharing article in your experience as an Auditor. I worked with a local subsidiary of foreign Bank as a Compliance Officer in Papua New Guinea. We engaged KPMG for nine solid years and they have been doing our F/S audit, financial report and also tax return to the Government. In most cases, KPMG has been sending graduate trainees to audit our books and quality of workout was substandard. Please share your opinion on his aspect.

Hi, thanks a lot Silvia for this interesting artices. In my opinion the main point in settling many disagreements that might arise during the audit course is the approach of the external auditor. A joke or positive attitude from the auditor side can easily melt the ice in the beginning & help in conducting the audit & finishing it in a positive approach.

If the client realize that the auditor is really here not to catch his mistakes yet to provide him with better understanding of the reporting standards then both they can have a win-win situation however this is also subject to that client is having a clean books.

Hi Silvia, thank you so much for your articles! This one just made my day:) I`ve been on both side as client as Big4 auditor and agree with every word in you posting!!

Great article Silvia! I had fun reading it. I also always read your other articles. They are very helpful and easy to understand. Keep it up and hoping for more of this. Actually, I have share your site to my colleagues in audit and they’re thanking me for that.

interesting!!!!

Thanks Silvia for this piece. You’re good at what you do.

Hi Silvia,

Thank you for clarification, i am from Somalia and working with bank as Finance Manager i really liked “Every trial balance was not balance”

My question, Is audit firm ptofit or non for profit?

Thank you again

Hi Ahmed, thank you!

Well, audit firms are “profit” companies 🙂 S.

A great article..

Thanks for sharing Silvia

Hi Silvia,

I appreciate how you presnted this frustrating aspect of auditor-client relationship with much fun and simple manner. I will share this with my CFO. Thanks.

OMG . You are genius and you are great

Far from that, but thanks for the flattering comment! 🙂

Thank you very much for this awesome article,

Unfortunately here in Iraq the we (the external auditors) MOST prepare the FSs for the client especially IFRS FSs (most of times we enforced to issue clean reports but we defend ourselves with MLPs) cause nobody here knows the real role of external auditor and because client’s lake of knowledge in IFRS.

I hope this situation will end soon.

And again thank you for your efforts 🙂

Omar K.

Wow, that’s a kind of sad. You know, I went through situations when we made a compromise, but then the things were not material. Hm, seems you’ve (Iraq) a long way to go… good luck!

Very Interesting article, i can relate from an operational accountant angle. I’m always waiting for auditors to come and tell me what i have done isn’t right then we argue back & forth.

I ensure i post all my transaction with adequate basis so an auditor cant come & tell me to change it.

It’s always fun fun, i have made good friends with my auditors 🙂

Hi Aisha,

I had exactly the same relationship with my clients as an auditor, and vice versa – as a client with my auditors. With many of them, we are friends to these days.

And also, I owe audit profession and my past clients very much, because it was them who were my best teachers! 🙂

hi madam, well appreciated your audit and client facts in fs auditing. However, your statement somewhere “tax inspection is here to impose penalties”, I find unconfirmed.

I work as a tax inspector and finalise taxes based on audited financial statements. We go there to finalise the tax based on certain scrutiny and not to “impose penalties”. We found many areas where an auditors can make the financial statements tax law compliant thereby all tax dues of the government are paid instantly thereby tax inspectors not needing go in detail.

Any way thanks for warning the auditees as you go on.

Cheers!

Dear Yeshi,

yes, you are right and let me apologize – I did not mean to offend any tax inspector, believe me! I wrote it more to have fun rather than take it seriously. However, the truth is that I rarely find tax inspectors trying to help, but yes, there can be a lot of exceptions.

I also truly think that most companies feel uncomfortable when being subject to any inspection – whether audit or tax. Peace! S.

Simply the audit firm even the big 4 is not a none profit organisation and he want to maintain the big customer which represent a big share of his income.more over ,the audit report always contain a sentences that protect the auditor and that his responsability is limited to expression of an opinion . Therefore , the auditor if enforced by board or CEO are concerned only with clear , bold , obvious breaches of main accounting principles only and passes all other details .

Yes, I understand. Again, this has to do with materiality – both individual and aggregate. And also, this “business” view is a problem to auditor’s independence – how can you be independent when your income depends on these clients? As I wrote above, even ISAs recognize it as an “issue”. S.

To some limits this client is true as long as he pay the fees . I personaly experienced this issue with KPMG egypt and i am senior AP accountant . The auditor may agree on wrong issues if enforced by CEO in terms of short audit times , violations in book keeping , very limited documents examination, ,enforced few adjustments . All these breaches are agreed by auditor if they are not violating only the main ,big,bases of financial standards

Sure, Ashraf, I can understand. If these issues do not materially distort user’s view on the financial statements, then there’s a room for discussion. But I was writing about the client with total and complete mess where we as auditors could not just close one eye… Thank you and all the best, S.

I can definitely relate to the pressure the client puts on you to issue an unqualified opinion. Nobody likes us auditors and they like us even less when we issue the “wrong” report 🙂 Otherwise I’m so glad I came across your website and articles as they make such a big difference to my studying!

Thank you, Denise! You are right, no one wants any stain in their financial statements!

Hi Silvia,

I am also an auditor from Pakistan (not in Big 4) and currently I am on audit of a listed company, the management of my client says, do what ever you want to do man! We just need report whether clean, qualified, adverse or disclaimer (they know they are already in big trouble, they can not save themselves from adverse opinion). I am glad with your work and unfortunately can not collect sufficient time to go through your all mails!

Wow, what a client! But, I believe that most people are honest and they really strive to get everything in a good shape, so they see auditors as a help rather than some annoying insects 🙂 All the best! S.

Yeah, You are right! Thanks!

interesting to read the known facts …….presented in a different manner

Sure, Jinendra, nothing new – for some of us. 🙂

Great article Silvia! Thanks for the insight! I am just finishing my credits to get into the Canadian Chartered Accountant designation program (CPA) this fall. I did a co-op with a big 4 company last year and I will be returning after grad, and I find your posts about the industry so valuable and interesting!!

Thank you, Caroline, and I wish you good luck with your CPA! S.

Thank you for the detailed clarification however I have a question. What is the treatment of WIP in the book of a construction company and how is it different from Due to/from customer.

Tunde,

I’m not sure you posted your question below the right article… This is not about WIP/IAS 11, but about audit. And to reply it, it would take more than 1 comment. But I promise to write up something about it in the future. S,

Thanks for the interesting piece. Reminds me of my experience when I dealt with two of the big four as a client. I tagged them ‘necessary evil’. Their opinion does not come without some troubles, yet they add great value to integrity of FS.

Hi Pius,

you are very right. I also think that the difficult clients teach us very much. Although you might feel very depressed when performing audit, you will certainly learn a lot. S.

Hi Silvia,

Am amazed and described the realty so perfectly.

Thanks for sharing.

😀

It’s easy to describe well, when you really lived it, and – what’s better – survived! :)Thank you!

Hi Silvia,

Really enjoyed your factual and humorous piece. I am an auditor and resonates with these dilemmas our clients face working with us. I’ll be sending this to some of my clients to enlighten and also make them laugh too. Lol…

Wole, thank you and I’ll be glad if you share! 🙂

Hey Silvia,

you made me laugh with “YUCK” report, LOL 🙂 I am auditor, too and frankly speaking, I look almost the same as one in your pictures!

Thumbs up!

🙂 🙂 🙂 🙂 🙂

Actually, our audit partner was a really beautiful woman! 🙂