IFRS 16 Leases vs. IAS 17 Leases: How the lease accounting changed

In January 2016, IASB issued another important and long-discussed standard: IFRS 16 Leases that will replace IAS 17.

Ever since then I receive lots of e-mails asking me to sum up what’s new.

OK, so here you go.

In this article, you’ll learn about the main changes that IFRS 16 introduces to the accounting for leases, illustrated on a very simple example.

Warning: this is NOT exhaustive description of the standard, and I simplify the things a lot for illustration purposes.

I will come back to it at the later stage, because I truly think that there will be lots of questions, discussions and additional guidance on how to tackle several areas of the lease accounting.

The effective date of the new IFRS 16 is 1 January 2019.

Why the new lease standard?

Short answer: To eliminate off-balance sheet financing.

Under IAS 17, lessees needed to classify the lease as either finance or operating.

If the lease was classified as operating, then the lessees did not show neither asset nor liability in their balance sheets – just the lease payments as an expense in profit or loss.

But, some operating leases were non-cancellable, and therefore, they represented a liability (and an asset) for the lessees.

This liability was hidden from the readers of the financial statements, as it was not presented anywhere.

Oh yes, some disclosures in the notes to the financial statements were mandatory, but frankly – who, except for auditors, ever reads the notes to the financial statements?

New IFRS 16 removes this discrepancy and puts most leases on balance sheet.

I’ll show you how in the next paragraphs.

Let’s see what has changed

Is it a lease?

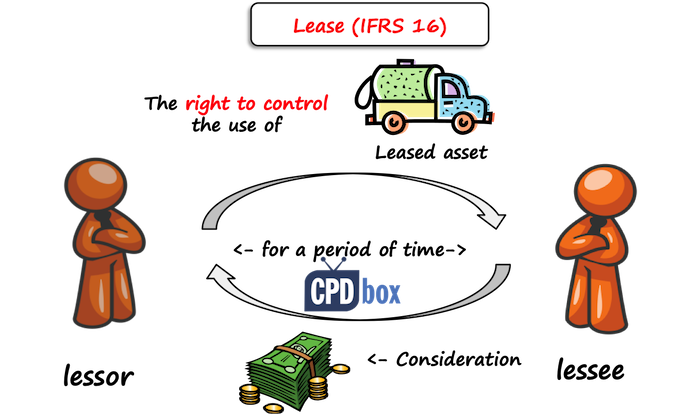

The new IFRS 16 introduces a new definition of a lease. However, it is very similar to the old definition in older IAS 17 (differences do exist).

It means that when you actually accounted for some contracts as for lease contracts under IAS 17 Leases, you will continue to do so also under the new standard (careful, methodology may change).

BUT!!!

You have to be extremely careful when it comes to some service contracts.

Why?

Because, the new standard IFRS 16 provides a detailed guidance to determine whether your contract is a lease contract or a service contract (non-lease contract).

Under old IAS 17, it did not matter so much whether you have an operating lease contract or a service contract, for a very simple reason: you probably accounted for both types of contracts in the same way (that is, as a simple expense in profit or loss).

However, as the accounting for some types of previously-called operating lease contracts dramatically changes, we need to distinguish whether we have a lease under IFRS 16 or some other service contract under different standard.

As a simple illustration, let me come up with a small example:

- You will occupy a certain area of XY cubic meters, but the specific place will be determined by the owner of the warehouse, based on actual usage of the warehouse and free storage.

- You will occupy the unit n. 13 of XY cubic meters in the sector A of that warehouse. This place is assigned to you and no one can change it during the duration of the contract.

Both contracts look like lease contracts, and indeed, in both cases, you would book the rental payments an expense in profit or loss under older IAS 17.

Under new IFRS 16, you need to assess whether these contracts contain lease as defined in IFRS 16.

The first thing you would look at is whether an underlying asset can be identified.

Long story short:

- The first contract does not contain any lease, because no asset can be identified.

The reason is that the supplier (warehouse owner) can exchange one place for another and you lease only certain capacity. Therefore, you would account for rental payments as for expenses in profit or loss. - The second contract does contain a lease, because an underlying asset can be identified– you are leasing the unit n. 13 of XY cubic meters in the sector A.

Therefore, you need to account for this contract as for the lease and it means recognizing some asset and a liability in your balance sheet.

This was a very simplified illustration to make you aware of this and it’s by no means exhaustive – but you get a point.

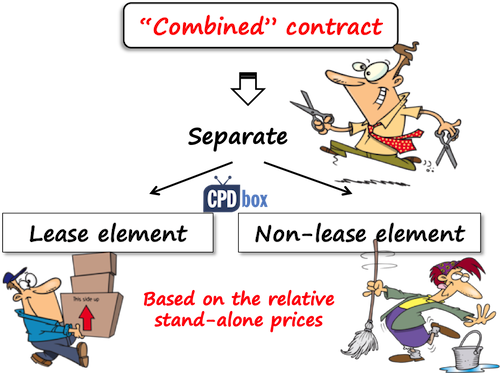

Do we pay only for a lease, or also for some services?

This is another change we need to watch out under IFRS 16.

When you lease some assets under operating lease (as called by older IAS 17), in most cases, a lessor provides certain services to you, such as maintenance, repairs, cleaning, etc.

Under older IAS 17, you did not need to think about it too much, because you put all lease payments as some rental expense to your profit or loss.

BUT!!!

Under new IFRS 16, you need to split the rental or lease payments into lease element and non-lease element, because you need to:

- Account for a lease element as for a lease under IFRS 16 (if it meets the criteria in IFRS 16); and

- Account for a service element as before, in most cases as an expense in profit or loss.

From our example above: let’s say you took the option 2 and you pay CU 10 000 per year. This payment includes the payment for rental of the unit n. 13 and its cleaning once per week.

Therefore, you need to split the payment of CU 10 000 into lease element and cleaning element based on their relative stand-alone selling prices (i.e. for similar contracts when got separately).

You find out that you would be able to rent out similar unit in the warehouse next door for CU 9 000 per year without cleaning service, and you would need to pay CU 1 500 per year for its cleaning.

Based on this, you need to:

- Allocate CU 8 571 (CU 9 000/(CU 9 000+CU 1 500)) to the lease element and account for that as for the lease; and

- Allocate CU 1 429 (CU 1 500/(CU 9 000+CU 1 500)) to the service element and in this case, probably recognize it in profit or loss as an expense for cleaning.

Not an easy thing, especially when the stand-alone selling prices are not readily available.

The biggest change: lessee’s accounting for leases

Here’s the biggest change: lessees (those who take an asset under lease) do not need to classify the lease at its inception and determine whether it’s finance or operating.

You might say: OH YES!!!

But not so fast.

The reason is that IFRS 16 prescribes a single model of accounting for every lease for the lessees. Very shortly:

- Lessee needs to recognize a right-of-use asset and corresponding liability in its statement of financial position.

- An asset shall be depreciated and a liability amortized over the lease term.

This model is very similar to the accounting for finance leases under IAS 17.

And yes, you need to account for operating leases in the same way.

There are 2 exceptions from this rule:

- Lease of assets for less than 12 months (short-term leases), and

- Lease of assets of a low value (such as computers, furniture etc.).

Example IAS 17 vs. IFRS 16

Let me illustrate the new accounting model and put it in the contract with the treatment under IAS 17.

I will continue in the above example of a warehouse. To make it quick, I will just make up some data:

- Annual rental payments are CU 10 000, including the cleaning services, all payable in arrears (at the end of year)

- Appropriate discount rate is 5%

- The lease term is 3 years.

How would you account for this contract under IAS 17 and IFRS 16?

Accounting under IAS 17 Leases

Under IAS 17, you need to classify the lease first.

Let’s say that based on warehouse’s economic life, lease payments, etc. you assess that this lease is operating.

Therefore, accounting is very simple:

- At the commencement, you do nothing;

- At the end of each year, you simply book the rental expense of CU 10 000 in profit or loss.

Accounting under IFRS 16

Here, no classification is necessary as one accounting model applies to all leases.

You need to follow 3 steps:

- Is it a lease under IFRS 16?

Yes, here it probably is. Please see the explanation above.

- Is there some element other than lease element? Do we need to separate?

Yes, we need to separate the cleaning element from the lease element. We did it above:

- CU 8 571 relates to the lease element;

- CU 1 429 relates to the cleaning element.

- How to we recognize these elements?

- At the commencement:

- You need to recognize right to use a warehouse in the amount equal to the lease liability plus some other items like initial direct costs.

- The lease liability is calculated at present value of lease payments over the lease term. In this case you need to calculate the present value of 3 payments of CU 8 571 (only lease element) at 5%, which is CU 23 341.

- Accounting entry is then

-

Debit Right-of-use asset: EUR 23 341

-

Credit Lease Liability: EUR 23 341

-

- Subsequently, when you make a payment and/or at the end of reporting period, you need to:

- Recognize depreciation of the right-of-use asset over the lease term, in this case CU 7 780 (CU 23 341/3) per year (I took straight-line depreciation);

- Recognize remeasurement of the lease liability to include interest, exclude amounts paid and take any lease modifications into account.

- At the commencement:

This simple table illustrates our example:

| Year | Lease liability b/f | Add interest at 5% | Less amounts paid | Lease liability c/f |

| 1 | 23 341 | 1 167 | – 8 571 | 15 937 |

| 2 | 15 937 | 797 | – 8 571 | 8 163 |

| 3 | 8 163 | 408 | – 8 571 | 0 |

| Total | n/a | 2 372 | – 25 713 | n/a |

Note: “b/f” means “brought forward (at the beginning of the year)”, “c/f” means “carried forward (at the end of the year)”.

Summary of accounting entries under IFRS 16:

| When | What | How much | Debit | Credit |

| At the commencement | Right-of-use asset + lease liability | 23 341 | Right-of-use asset | Lease liability |

| At the end of the year 1 | Interest | 1 167 | P/L: Interest expense | Lease liability |

| Rental payment | 10 000 | Cash (bank account) | ||

| 8 571 | Lease liability | |||

| 1 429 | P/L: Expenses for cleaning services | |||

| Depreciation | 7 780 | P/L: Depreciation | Right-of-use asset | |

Now, let’s compare.

Under IAS 17, the impact on profit or loss in the year 1 was CU 10 000, as we recognized the full rental payment in profit or loss.

Under IFRS 16, the impact on profit or loss in the year 1 was:

- Interest of CU 1 167, plus

- Depreciation of CU 7 780, plus

- Expense for cleaning services of CU 1 429.

- TOTAL of CU 10 376.

Hmmm, that’s actually more expenses in the first year under IFRS 16 than under IAS 17, isn’t it?

The reason is that thanks to the new model, the pattern of expenses has changed: we have loads of interest in the beginning of the lease, but smaller expenses at the end of the lease when the lease liability is amortized.

In total, both models have the same profit or loss impact over total lease term:

| Type of expense | IAS 17 | IFRS 16 | Note |

| Rental expense | 30 000 | – | 3*10 000 |

| Interest expense | – | 2 372 | Table above |

| Depreciation | – | 23 341 | 3*7 780 |

| Cleaning expenses | – | 4 287 | 3*1 429 |

| Total | 30 000 | 30 000 | |

Note: I am showing the cleaning expenses, too in order to show total impact of the whole contract, although technically they are not part of the lease accounting.

Also, under IFRS 16, we show more assets on the balance sheet, but also more debt or liabilities.

Please note that the cash flow does not change. You pay still the same amounts whether you apply IAS 17 or IFRS 16.

What about Lessors and accounting for leases under IFRS 16?

Good news, folks!

Accounting for leases by lessors almost does not change, so they can continue in the same way.

That’s all I need to say about it.

Final warning

The new lease standard will have significant impact on the companies heavily working with operating leases, no questions about it.

The financial indicators of these companies can substantially change, because new assets and liabilities are coming to the balance sheet.

Also, many lessees will have a hard time to set up a system of gathering and analyzing enough information to satisfy new requirements.

I will stop here, as this post is longer than I expected, but if you have some ideas or remarks on whether and how the new standard can affect your company, please let us know below in the comments. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Mpho on How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

- Silvia on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

- Bilawal on IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

- Augustine Fabuinkwi on IFRS 18 Explained: Full Guide + Free Video Lectures + Checklist

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Silvia,

I’m confused as to how the lessor and lessee shall recognise an asset and a RUA respectively at the same time when a lessor enters into an operating lease and the lease qualifies as per ifrs 16 as a lease contract.

Does this happen. Can the same asset be on the Balance sheets of 2 entities.

Please elaborate.

Thanks.

Correction….lessor enters into a finance lease and the lessee recognise a RUA.

Can this happen

Yes, it can happen and happens a lot; however when lessor enters into a finance lease, he/she does not have an asset in the balance sheet, but instead he has a net investment in the lease. You perhaps meant the first question – when a lessor enters into an operating lease, he/she does not give up the asset, but recognizes received lease payments straight in profit or loss; and on the other hand, lessee recognizes right of use asset. Yes, this is asymetric accounting, meaning that both of them have an asset in their account. I must say that ROU asset (at lessee’s accounts) is not the same as an underlying asset itself though. But this normally happens and IASB is fully aware of it.

Hi Silvia,

We are engaged in a business renting residential properties on an annual basis. We require our customers to pay ther rent 100% in advance, but they wont pay unless we issue an invoice. I know it is a bit off-topic but my question would be: are we allowed as lessors to invoice the client in advance before the lease starts and recognize accounts receivable and “advance contract billing” which is like a deferred income but uncollected? Thank you in advance!

Hi, Thank you so much for that educational comparison of the two.

I am struggling to identify some of the key challenges and potential benefits key stakeholders will be presented with following the implementation of IFRS 16.

While your discussion has brought clarity for me on differences IFRS 16 brings compared to IAS 17 which many other articles have not, this is an area which has been difficult to acquire useful information on.

Many thanks

Yvonne

Dear Silvia,

When a company adopts IFRS 16 for the first time, can it decide to reverse or stop apppying it?

I do not think so.

Dear Silva,

Please help me understand the IFRS -16 accounting in Lessee’s book for the following transaction;

1. Lease contract – Right to use the land for indefinite period with minimal fee (i.e. rental) with lease increment of 0.2 % every two years.

2. The lessee has used the leased land to construct the production facilities and office building. The lessee do not intend to terminate the contract and use for indefinitely.

Thank you

Dear Silva,

Please enlighten us in case of IFRS-16 accounting for lease contract for assets with infinite useful life.

Thanks

Hello Silva,

Thanks for all your IFRS guidance. Is employee accommodation rent paid/funded by Company within the scope of IFRS 16 being employee benefit and also within 12month term with or without renewal option?

Hi Silvia,

Thanks for the clarity on IFRS16. I have one question though, How do we treat the security deposits when implementing this standards?

Hello Sylvia,

Your example above made the subject very understandable, However i have a query where with mutual understanding both lessor and lessee agree to vacate the place without any more liabilities at both end. How this will be treated, i will take the same example used by you above. We are vacating the place at the end of Year 2 . Normal Account P&L total charge would have been CU 20,000 however as per IFRS 16 accounting we would have got a charge of CU 20,382 which would have been covered if we had stayed in the location for last year as well. Please advise.

Hello Sylvia,

Kindly advise how concession agreement should be accounted for by the landlord. That is the agreement has a fixed fee (guarantees) and variable fee (based on volumes). IFRIC 12 is excluded from IFRS 16 and I cannot find any other standard addressing this issue

hi, could you please clarify, if we recognise FRS 16 impact in FY2019 (both ROU and lease liability), However, in subsequent year, (FY2020), we have early terminate the tenancy. therefore, we need to reverse the ROU and lease liability, the difference will charge to profit or loss as what item ?

Dear Silvia,

Thank you so much for providing such information, I have 2 question, could you please answer them?

First, what is the need for an updated standard on leases ?

Second, what is the impact that the standard will have on the financial statements of companies that adopt IFRS?

Hi rsh, thank you! Well, these are so broad questions that I will not reply them here in the comment and you need to do a little research on this website, as I answer these in numerous articles and comments. You can start here. S.

Thanks! A really clear explanation. It’s just what I was looking for, Congratulations and thanks again!

Hi Silvia

I would be glad if could assist with this situation:

We entered into a five year lease on Jan. 1, 2020 with annual rentals payable on Jan. 1 of each year. The rental amount is GHc100,000 per year in advance. We made an advance payment of GHc300,000 on Jan. 1, 2020. Our incremental rate of borrowing is 15% so we set the initial entries as follows:

Dr: ROU asset-385,500

CR: Liase Liability-85,500

CR:Bank-300,000

The challenge now is how to set up the amortization table. Kindly assist

Hi Silvia,

I have encountered a case for IFRS 16.

A parent company has a contract for lease of building office with the lessor. Parent company pays this rent to the vendor. Thereafter, it cross charges its subsidiary who is using that building.

Here, there is no agreement between the subsidiary and the lessor and no agreement for cross charge between parent and subsidiary.

Shall we consider this as a sub lease ?

Hi Silvia

I wanted to know if we ever reclassify Lease receivable that was previously recognised on IAS 17

Hi Silvia,

Lets say, the arrangement is for the asset to transfer ownership at the end of the lease period. the depreciation would have done on the useful life of the asset, hence leaving a balance on the Right to use at the end of the lease term.

What is then the double entry to convert this remaining Right to use to actual asset i.e. PPE.

Hi Silvia,

It is difficult to identify from your notes in ifrsbox but what would you do if the company is paying the lease of the car (invoice issued to company) of some employees and then the lease amounts are deducted from the salary of the employees? should you use IFRS to capitalise car leasing if other IFRS 16 conditions met?

Hi billl,

there are 2 separate contracts I assume: 1) one with the lease company; 2) one with the employee regarding deductions; thus treat it as 2 separate things and yes, apply IFRS 16 to the lease.

Thanks for your quick reply .there is only one contract with the employee, the invoice is issued to the company and paid by the company but then this amount is deducted from the salary of the employee, so PnL effect should be nill. Is IFRS16 applicable to that case?

Hi Silvia,

What we do we onerous lease provision recognised at the date of transition under modified retro. approach?

The standard says that it has to be set off against the ROUA at the transition date, what does this mean?

Do we credit ROUA and Debit Provision for onerous leases? or we amortise onerous provision over the lease term?

Dear Silvia

Under IAS 17 straight-lining, a asset or liability will sitting in the balance sheet. Adopting IFRS16 we now recognise a right of use asset, corresponding liability. And depreciation and interest in the balance sheet. What happens to the IAS16 smoothing balance sheet item, do we release it to the income statement.

Hi Sylvia

What happens if the lease is of low-value and are renewed on an annual basis. Do we leave it as an expense in the income statement or do we still have to do all the journals as per IFRS16 to get it onto the balance sheet.

If underlying assets low-value when new, then don’t worry about the lease term and put all expenses in profit or loss.

Hi Sylvia

It’s rikas. Just on my question. Currently the lease is for $200 per month paid monthly on the 1st of each month, now we need to apply IFRS 16

I cannot say based on the monthly expense – you need to look at the value of an underlying asset and assess.

Dear Silvia

Thanks for your useful video. could you please guide me how can I find the question and answer for each Standards separately.

Best Regards

Hi Silvia,

First of all thank you so much for your help .

I miss something here , How you allocate the lease amount 8571 and the service exp. amount 1429 ? i miss the calculation

HI Silvia,

We have instances in our company where a lease is entered into then prepaid in full for all outstanding payments at inception, how does this affect the right of use calculation/lease liability calculation?

can you please send me all advantages and disadvantages with IFRS 16 compared to IAS 17. God bless

Good day Sivia,

Thank you for breaking this down. I need a clarification on lease payments where total lease rentals have been paid upfront. I presume that means there is no recognition for lease liability. I checked the standard and it does not state that clearly. Is there any other way this should be treated?

Hi Silvia-Thanks for sharing a good article. The inter-company elimination on consolidation level is getting more challenging in the case where the Parent itself leasing the assets from an outside group of an entity and sub-leasing it to its subsidiary i.e. Parent is lessee in head lease and lessor in sub-lease. The difficulty arise where sub-lease results in operating lease since ROU has not been sublet for the majority of the part. How the elimination work in such cases?

Hi Silvia

If the operating lease ( rent expense) was previously straight -lined in accordance with IAS 17 and resulted in a deferred rent liability as at 31 December 2018. What will happen during the initial recognition of the right of use of asset at the comencement on 1 January 2019 if the lease’s termination date is after 2021?

Do we reduce the ROU by the deferred rent liability amount? What happens to the lease liability?

Hi Anna,

you do not reduce anything. You will simply recalculate new deferred tax liability/asset based on ROU and lease liability and book any change or difference from previous amount. This is very simply said – you need to be careful with how to recognize the difference (equity vs. profit or loss). S.

Hi Silvia,

Thank for interesting article here.I have encountered a concern where a company identified a lease liability in there book of account and once i persuade agreement, the agreement parties are the parent company vs lease company.Do the subsidiary company can recognize the lease liability as per IFRS 16?

Hi Devo,

yes, if a subsidiary is a lessee and a parent is a lessor, then yes. However – upon consolidation, there is no lease as it is fully intragroup and in the consolidated financial statements it will be eliminated.

Hi Silvia,

I realized that there were lesser attention given to the distinction between acquisition and leasing of assets. If an Entity is acquiring the assets by way of finance lease, rightfully it should be accounted under IAS16 instead of IFRS 16. right?

Question 1: if I debit my Plant and Equipment (“PPE”) and credit my hire-purchase/finance lease payable, would this seem strange? since IFRS 16 has clearly remove the distinction between operating lease and finance lease. Showing a finance lease payable in the financial statements seem to indicate a departure of IFRS 16.

Question 2: For example, an entity purchase an equipment that typically last for 20 years. The acquisition is by way of financing for a period of 5 years. Under IFRS 16, i may account the Right-of-Use of assets (“ROU”) and depreciate over 20 years with i account the lease liabilities over 5 years. So what happened at the end of the 5th years? Do i do a reclassification from ROU to PPE? Or should I account them under PPE at inception?

Hi Kelvin,

the answer to the first question is no. If an entity acquires an asset under the lease, then it is accounted for under IFRS 16 as for the right-of-use asset and not a piece of PPE itself.

Hi Silva,

Thanks for the answer,

Would the following situation make a different?

the entity purchase an assets, the ownership (both legal and accounting, ie. substance over form) has been effectively transfer to the entity, the entity finance the assets by way of installment plans.

In this situation, will you account them as ROU or PPE?

Then it’s probably PPE and loan, because legal ownership passes straight away to the lessee.

Hi – thanks for this article – very useful. When reporting can the liability be off-set from the right of use asset?

Nope.

Hi Silvia

In terms of IAS 17 operating lease, can the lessee capitalise the lease improvements made?

In short – yes.

Hi Silvia, if a tenant has financial year end other than December 2018, when should the IFRS 16 be applied? Will it be from January 2019 or depending on the tenant’s year end?

Hi Shana, from the first day of his accounting period if it starts after 1 January 2019. I.e. if his year-end is 31 March 2019, then he starts applying IFRS 16 in the period starting 1 April 2019.