How to Test Goodwill for Impairment

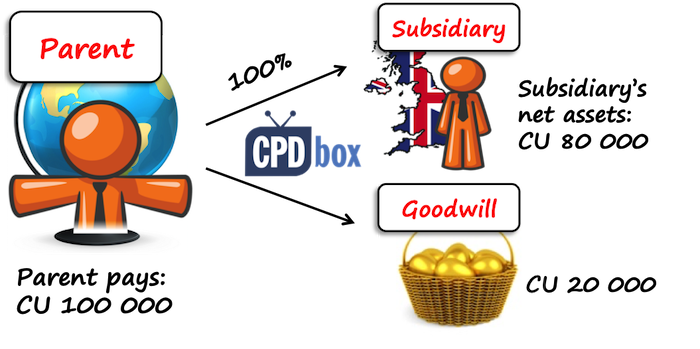

When a company acquires control over another company, then often a goodwill arises, too.

You should present it as an intangible asset, but when you think about it carefully, a goodwill is not a typical asset, because unlike other assets, you cannot sell it to somebody, you cannot use it in your production process or to provide your services.

Therefore, IFRS standards are quite strict about goodwill – for example, you need to test goodwill for impairment every single year (you do not need to test other assets, only when there are some indicators).

Well, OK, but how to test goodwill for impairment every year?

I respond to that question quite frequently, because although IAS 36 prescribes the extensive rules about goodwill impairment, it’s not so easy to understand the logic behind.

What is goodwill?

Before we explain how to test goodwill for impairment, you need to understand what a goodwill is all about.

The definition of goodwill from the standard IFRS 3 Business Combinations tells us that a goodwill is “an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized” (IFRS 3, Appendix A).

Imagine an investor buying 100% shares in some company for CU 120 000. At the date of acquisition, the net assets of this company (or its fair value) amount to CU 100 000.

As you can see, the investor “overpaid” – he paid CU 20 000 more than the fair value of a company is.

Why would he do that?

Maybe the investor believes that there must be some “hidden” value, something extra that he pays willingly for.

Maybe he believes that this “overpayment” for the investment will bring more returns or profits in the future.

Therefore, the investor does not account for the “overpayment” as for the “loss” or some expense in profit or loss.

Instead, the investor accounts for it as for a goodwill – a separate intangible asset.

What to do with goodwill after acquisition?

Some years ago, IFRS asked you to amortize goodwill, but no longer!

You do NOT amortize goodwill.

Instead, you need to test it for impairment annually, as the standard IAS 36 Impairment of Assets requires.

Why is it so?

Well, if an investor is willing to pay more than he gets, then he probably believes that the new business will generate enough profits to provide satisfactory returns even after the investor paid the premium (or goodwill).

But, is this really the case?

Is your new investment really generating sufficient returns? Is it worth it? Isn’t it overstated in your accounts?

Your annual impairment test of goodwill will give you the answers.

A little recap – basic principles of impairment testing

I don’t want to describe what’s the impairment testing about in a detail here – you can read the whole article about it here (with video).

Just to refresh the basics:

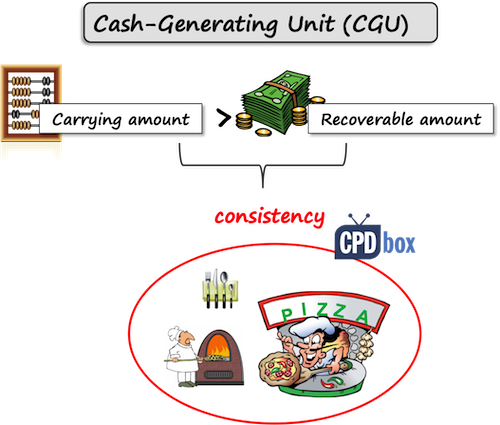

You need to compare an asset’s carrying amount with its recoverable amount (higher of fair value less costs of disposal and value in use).

When the carrying amount is greater that the recoverable amount, then you need to recognize the impairment loss.

Often, it is not possible to test an individual asset for the impairment, e.g. when it does not generate any cash flows on its own and you cannot determine its fair value.

In this case, you need to test cash generating unit (CGU) – the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets (IAS 36.6).

If your CGU is impaired, then you allocate the impairment loss to the individual assets.

That’s the impairment of assets from the airplane.

Now let’s take a closer look to goodwill impairment.

How to test goodwill for impairment

Please, remember this:

You CANNOT test goodwill for impairment as an individual asset, standing on its own, because it is NOT possible.

The reason is that you just cannot calculate the recoverable amount of goodwill.

Why?

Because, goodwill is not an asset that you can sell to someone else separately –there’s no fair value.

Also, you cannot really estimate goodwill’s value in use, because goodwill does not bring anything to the company, it has just been sitting there since acquisition.

In other words, a goodwill is a specific asset that does not generate any cash flows on its own, independently of other assets. Your business would probably generate the same revenues/expenses whether with or without a goodwill, isn’t it?

Instead, you need to look at its impairment testing as at some business valuation test, not as at goodwill impairment test.

Simply said, you are required to compare the book value of your company or division with its revenue-generating ability (whether it is market value or projection of profits).

Translating this to IFRS language: you need to compare the carrying amount of your cash-generating unit including goodwill with its recoverable amount (higher of its fair value less cost of disposal and value in use).

What is a CGU including goodwill?

Typically, a cash-generating unit would be a company as a whole, but if there are some separate divisions generating independent cash flows, then your CGU would be a division.

So if you buy a company with a few divisions and a goodwill arose, then you need to allocate that goodwill to each of the cash-generating units that are expected to benefit from the synergies of the business combination.

However, each CGU to which goodwill is allocated should represent the lowest level at which the goodwill is monitored and it cannot be larger than an operating segment as defined by IFRS 8.

Unfortunately, IAS 36 does not say anything about the allocation method, or how you should allocate the goodwill.

In practice, there are more methods used, for example, you can allocate goodwill based on the fair value of CGU before and after acquisition and the difference represents the allocated goodwill.

Alternatively, you can make a simple difference between the fair value of net assets acquired and the fair value of acquired business (or division).

It’s quite demanding to allocate goodwill, so IAS 36 gives you one year to do so.

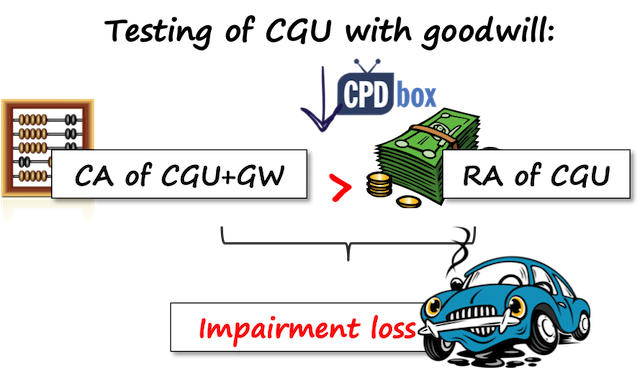

Impairment loss of CGU with goodwill

After you identified you CGUs and allocated goodwill to them, then you can perform the impairment test.

You should compare:

- The carrying amount of your CGU + allocated goodwill, with

- The recoverable amount of your CGU

If the carrying amount is greater than the recoverable amount, then you need to recognize the impairment loss.

However, as the impairment loss relates to many assets within your CGU, you need to allocate it as follows:

- First, you reduce any goodwill to zero;

- If there’s some impairment loss left, you allocate it to the individual assets within CGU on pro-rata basis.

Just be careful not to reduce the carrying amount of any asset below its recoverable amount or zero.

Please remember that you should NEVER reverse any impairment loss related to goodwill.

Example – a company with 3 divisions

Mommy Corp. purchased 100% shares in Baby Ltd. for CU 200 000 when Baby’s net assets were CU 185 000. Baby operates in 3 geographical areas:

- Division Aland; net assets of CU 70 000;

- Division Bland; net assets of CU 50 000;

- Division Cland; net assets of CU 80 000.

Based on synergies expected from the business combination, Mommy allocated the goodwill of CU 15 000 (CU 200 000-CU 185 000) as follows:

- Aland: CU 6 000

- Bland: CU 4 000

- Cland: CU 5 000

At the end of 20X1, an independent valuator estimated Cland’s market value to CU 67 000 and management projected Cland’s value in use to CU 65 000. Cost of disposal related to Cland would be negligible.

At the end of 20X1, Cland’s assets included (in their carrying amounts):

- Buildings: CU 50 000

- Equipment: CU 15 000

- Other assets: CU 6 000

Calculate the impairment loss of Cland and show how to recognize it in the financial statements of Mommy Group.

Solution

Aland, Bland and Cland are all cash generating units to which goodwill was allocated.

Here, we will focus on Cland only, but Mommy needs to test also goodwill allocated to Aland and Bland annually – just not to forget that.

We need to compare:

- Cland’s carrying amount including allocated goodwill at the end of 20X1: CU 50 000 (buildings)+CU 15 000 (equipment)+CU 6 000 (other assets)+CU 5 000 (allocated goodwill) = CU 76 000

- Cland’s recoverable amount at the end of 20X1, that is higher of:

- Cland’s market value (fair value less cost of disposal) of CU 67 000 and

- Cland’s value in use of CU 65 000

WITH

There is an impairment loss of CU 9 000 (CU 67 000 – CU 76 000).

Mommy allocates CU 5 000 to goodwill and thus, the goodwill is reduced to zero. The remaining loss of CU 4 000 is allocated on a pro-rata basis:

| Assets | Carrying amount | Allocated impairment loss |

| Buildings | 50 000 | 2 817 |

| Equipment | 15 000 | 845 |

| Other assets | 6 000 | 338 |

| Total | 71 000 | 4 000 |

Note: Mommy allocated 50 000/71 000*4 000 = 2 817 of impairment loss to buildings. Similar calculation appies to equipment and other assets, too.

The journal entry is:

-

Debit Profit or loss – Impairment of assets: CU 9 000

-

Credit Goodwill: CU 5 000

-

Credit Buildings: CU 2 817

-

Credit Equipment: CU 845

-

Credit Other assets: CU 338

Note – you need to allocate the impairment loss to the individual assets, so in fact, you are crediting some specific building or a piece of machinery.

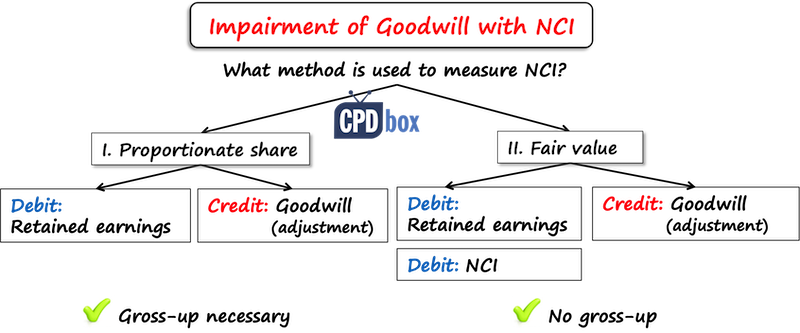

What if there’s a non-controlling interest?

A complication arises when a parent acquired less than 100% shares in a subsidiary and there is some non-controlling interest.

As you might know, you have two options to measure the non-controlling interest:

- Partial method, or at the proportionate share of NCI on subsidiary’s assets, or

- Full method, or at fair value.

Your calculation of goodwill impairment depends on the method you selected for measuring the non-controlling interest.

Goodwill impairment with the partial method for NCI

When you measure your NCI using the partial method, then the goodwill represents only a parent’s share of it.

Therefore, in fact, you need to gross-up the goodwill to 100% before you start testing it for impairment.

Why?

Because you need to compare 100% of CGU’s carrying amount with goodwill with 100% of CGU’s recoverable amount.

If there’s an impairment loss of goodwill, then you need to reduce it to a parent’s share only.

For example, let’s say that a parent has 80% in a subsidiary and you measure NCI by the partial method.

The carrying amount of goodwill is CU 100 and the carrying amount of other CGU’s assets is CU 1 300. The recoverable amount is CU 1 400.

It might seem that there’s no impairment loss, but not so fast – you haven’t grossed up the goodwill yet!

The impairment loss calculation is:

- Carrying amount of goodwill grossed-up to 100%: CU 100/80%*100% = CU 125

- Add carrying amount of other assets: CU 1 300 (no need to gross-up as they are stated at 100%),

- Less recoverable amount of CGU: – 1 400

- Impairment loss: CU 25

As it’s 100% and it fully relates to the goodwill, you need to recognize only 80% of it, that is CU 20.

The journal entry:

-

Debit Profit or loss – Impairment of assets: CU 20

-

Credit Goodwill: CU 20

Goodwill impairment with the full method for NCI

When you measure the NCI using the full method, then the goodwill is stated in full amount as it represents both parent’s and NCI’s share on it.

Therefore, no adjustment of goodwill is needed for the purpose of the impairment testing and the impairment loss is recognized in full.

However, you need to be careful how you recognize the impairment loss. As a part of it is attributable to non-controlling interest, you need to split the entry in your consolidated statement of financial position between the retained earnings and NCI.

In the profit or loss statement, it would be recognized fully as an expense.

Let’s take a look to the same example as above, but this time, goodwill is stated in full, i.e. it is CU 125.

Then the impairment loss calculation is exactly the same as above (without grossing up).

The impairment loss of CU 25 is fully recognized in profit or loss.

In the consolidated statement of financial position, the journal entry is:

-

Debit Retained earnings: CU 20 (80%*CU 25)

-

Debit Non-controlling interest: CU 5 (20%*CU 25)

-

Credit Goodwill: CU 25

Do you have any questions or concerns? Please leave a comment right below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

Hi,

I have encountered an interesting situation. My company is acquiring a standalone entity which states it has £2m of goodwill on its balance sheet arising from a previous business acquisition (these are not consolidated accounts). I have 2 questions. The first is how would goodwill end up in standalone accounts? Also, is impairment testing required on acquisition of the new entity and what are the accounting entries on consolidation for the goodwill for the Group accounts?

Many thanks.

Hi Jon,

1. Well, under IFRS, goodwill can arise only on acquisition and in stand-alone accounts, you are not recognizing assets and liabilities line by line thus no goodwill from previous acquisitions should be shown there. Maybe the subsidiary uses different accounting rules (other than IFRS), maybe you are looking to consolidated accounts and maybe they should better explain this.

2. On acquisition, you should recognize all assets and liabilities at their fair values hence no impairment test is required (since any impairment is reflected in the acquisition-date fair values). As for journal entries, you can see this example. S.

Hi Silvia,

How do you calculate carrying value of CGU in subsequent years. For example if CGU is one of a division in a company having multiple division.

-Will profit/loss of a CGU division in subsequent years lead to increase / decrease in CGU’s carrying value.

– What are the factors that shall lead to an increase/ decrease in CGU’s value in subsequent years.

Hi Ms. Silvia

I would like to understand the impact of goodwill impairment on the stand-alone / separate financial statement of a parent.

As per my understanding goodwill arises at consolidation level and impairment will be charged to p&l and reduce the assets., but what about the carrying value of investments in subsidiary in separate financials, will there be any impact or no?

Your response will be highly appreciated

In the separate FS, the subsid. is measured at 1) cost (IAS 27) and 2) at FV (as per IFRS 9) if I am not mistaken. In 1) Any premium paid for acquisition of the subsid forms part of the cost and is not presented separately as goodwill. You must still apply IAS 36 guidance on impairments and test the subsid annually for impairment. eg. it could be a subsid with a history of being loss-making so one could say the reduction in value is permanent. 2) at FV… similar concept… you adjust the value to “fair” through OCI (or P&L if you could support your case and classify a subsid as FVTPL)

Hi Silvia,

You said “[T]ypically, a cash-generating unit would be a company as a whole”.

and also you said in another article

“[I]n your cash flow estimations, you shall NOT include:

Cash inflows from receivables.

Cash outflows from payables.

Cash outflows expected to arise from future restructurings to which an entity is not yet committed.

Cash outflows expected to arise from improving or enhancing the asset’s performance.

Cash inflows and cash outflows from financing activities.

Income tax receipts and payments.”

My question is how could we ingore the cash flows from receivables and payables if we treat a company as a whole?

thanks!

If you treat Co. as a whole, you do include it as a whole, naturally.

Baby’s net assets were CU 185 000 while the bifurcation of the same amounts to CU 2,00,000. Is there any more to understand behind such value?

Thank you for your great articles….

If no impairment loss is recognized for the CGU (RA>CA), the goodwill is not reduced for that period. Couldnt this lead to goodwill being overstated ? As it wont show the consumption of goodwill throughout that period unless there is impairment loss.

No. No impairment. Goodwill is a premium that the buyer pays on top of fair value of net assets acquired and unless there’s an impairment it is assumed that this premium does not wear off with time.

Hi Silvia

I have a question. Why we should gross up the goodwill, if we use partial goodwill method to measure the NCI. What does “Gross up” means.

Hi Ishara, please read the article carefully – it is very well explained with calculation there.

Hi Silvia,

Why don’t we take into consideration the discounted amount of dismantling cost while calculating goodwill?

Hi Silvia,

if investment in subsidiary is at loss and have to make impairment provision, will the impairment in consolidated accounts offset the loss in the subsidiary? otherwise it may cause double counting, right?

Many thanks

Alice

Hi Alice, you recognize the impairment only in the parent’s separate or individual accounts. You need to eliminate this impairment on consolidation and fully consolidate loss-making subsidiary.

Thank you so much Silvia!!

Hi Silvia

Good day

In step acquisition there is reserve in the second step after acquiring control which is difference between consideration paid and the net assets of the portion acquired , my question. When calculating test for impairment is this amount (reserve for acquisition of additional share in subsidiary) included in the carrying amount of investment or not

Please mention the reference from standard

Thank you

hi Silvia, hi

thank you for your lesson. but i have a question.’

in my case, My company bought own distributer company in 2005, Big goodwil is arised when it becomed. later parent company made restructure in staff transferring from distributor company to parent com. as a result of it, distributor company is just a name company. but they have very small service.

parent company still never impaired goodwill.

how we impair it ? pls suggest me.

in my opinion, we need to make adjustment abot goodwill reducing retained earning.

can this be in accordance with this standard?

If I am preparing 9 months audited accounts, will I be testing good will for impairment ?

Yes.

Hi Silvia,

Under partial method, when testing impairment of goodwill against fair value less cost of disposal, do we need to regross the cost of disposal?

Hi Silvia,

I would like to understand very basic thing that how we can apply full method for NCI and recognize full goodwill in our consolidated books since we need to know the value of investments purchased by other shareholders to determine the total investment value (Investments purchased by us + investments purchased by other shareholders) and then we deduct fair value of assets acquired from this value. Determining value of investments of other shareholders may not be practical.

Hi Ramneek, you actually need to know the fair value of shares, not the value of investments purchased by other shareholders. Practically, this is determined by looking to the stock exchange prices of quoted shares and then you calculate the fair value of NCI as n. of shares attributed to NCI x market value (fair value) per share. However, if the shares are not quoted, you can still determine the fair value of a company (subsidiary) as a whole thing and then calculate the fair value of one share. Anyway, what I saw in practice, in most cases the companies use proportional method for NCI if the shares are not publicly traded. Best, S.

Thanks Sylvia for excellent clarification.

I want to clarify one thing In your conclusion to full method of NCI

We have already taken goodwill impairment loss to P&L, then why are we passing an entry for retained earning and NCI debit with goodwill.

As the P&L share will allocate to both otherwise in proportion of their holding.

Hi Silvia, understand that the total carrying amounts of CGU (say a subsidiary) is Net Tangible Assets + goodwill. What if the subsidiary has negative NTA, can we calculate the total carrying amounts as net, e.g. 1,000 of goodwill less negative NTA of 480= 520? If the recoverable amount is zero, should we impair the full 1,000?

Dear Silvia,

In the testing of goodwill for impairment and the calculation of the value in use, One approach that comes to mind is the use of a free cashflow because it satisfies the requirement of IAS 36. However, my main concern is if we are to use a free cash flow to the equity(FCFE) or the free cash flow to the firm (FCFF). Why I ask this question is because the standard gives an option of using the Weighted Average Cost of Capital. This seems to fit into FCFF. My concern flows to the fact that goodwill acquired would have made significant reference to the equity value. In your view, between the FCFE and the FCFF, which is possible?

OK, I would say FCFF is more appropriate, because the value of the company is relevant not only for equity holders, but also for debt holders. FCFE is lower than FCFF as it excludes the cash for debt payments, and if you use it in the impairment testing, you could have some impairment loss which is probably irrelevant, as debt holders could still get their money back.S.

Hello Silvia, Incredible explanation. Thank very much for sharing this article.

silivia wether we not reverse internally generated good will? or the good will which we accquire in in accordance with ifrs 3-10. or both can not be reversed?

Hello Silvia,

Can you provide me with an idea if the goodwill is arose when the shareholders establish the entity with the initial cash funds (investments) and so far do not have any earnings yet?

Hmmm, I can’t imagine such a situation. S.

Hi Salvia, great article! Thank you for such a detail explanation.

I just curious why the journal entries for proportionate method is debit to Profit or loss but not retained profit as per your slide?

Debit Profit or loss – Impairment of assets: CU 20

Credit Goodwill: CU 20

Thank you!

Incredible explanation. Thank you ! Really helped my understanding

Wow, thanks for making it so interesting and simple!

Dear Silvia,

Thanks a lot. Also please include a section for typical (simple) disclosures.

Thanks

Hi S

My teacher told me that in the proportionate method, the adjusted profit of subsidiary is not affected by goodwill impairmentbut while in the full goodwill method adjusted profit of Subsidiary is affected by goodwill impairment. I want to know the rationale behind these treatments. Could you please elaborate?

Respect

Haider

Hi great article …I have a question ….If you are doing a feasibility study to determine if a project should go forward or terminate and sell off… would the cost if this feasibility study be expensed or capitalized

Thanks

Reshma

Dear Reshma,

I’m afraid no, feasibility study is like a research and is not capitalized. S.

hi assume i hv 80% equity and using partial GW method. Instead of grossing up partial GW, can i take a 80% of assets’s value in use instead to compare against the amt of GW? TIA

Rac, it should work, but then you need to take just 80% of recoverable amount and the result will be the impairment loss (no need to calculate proportion).

Hi Sylvia, very informative and analytical. So if a company purchase 100% of a business that is not combined with its other businesses then that specific operation will have to adjust its specific assets for any impairment. So should we really be recording goodwill ?

Yes, Bernadette. Even if you adjust for impairment, you can still have some goodwill left – it depends on the specific numbers. S.

When should the company access impairment eg first year of acquisition?

At the end of each reporting period. Even in the first year of acquisition.

Hi Sylvia,

I really appreciate the way you explained Goodwill impairment. It is very clear. However, when we are talkin about Goodwill allocation, I don’t know if we should allocate it to the acquirer CGU or the acquiree CGU or both. Thank you in advance. I very much look forward to hearing from you.

Best

karim

Aquiree

Thank you for your reply Levon but this is not what the IAS 36 is saying :

For the purpose of impairment testing, goodwill acquired in a business combination shall, from the

acquisition date, be allocated to each of the acquirer’s cash-generating units, or groups of cashgenerating

units, that is expected to benefit from the synergies of the combination, irrespective of

whether other assets or liabilities of the acquiree are assigned to those units or groups of units. Each

unit or group of units to which the goodwill is so allocated shall:

Dear Silva,

Thanks a lot

You made my day on this

Hi Silva,

Thank you for the article on goodwill.

I like the way you have explained and really appreciate you for your command on IFRSs.

Hi Silvia,

Thank you for enlightening me on the complex IFRSs as you always do. For assessing the value in use regarding the subsidiary on the company level financial statement, could I also adopt either the discounted dividend or discounted cash flow model like the way we deal with associates?

How Can impairment reversal .if have formula please sent me .i know how to recognizes impairment loss formula(Impairment Loss= CA-RA)

Asanka, I wrote in the article that you cannot reverse an impairment loss on goodwill. S.

For the illustration of Goodwill Impairment with the partial method for NCI, carrying amount of goodwill =CU 125 Add carrying amount of other assets=CU 1,400, the total will be=CU 1,525. If CU 1,525 less recoverable amount of CGU: -1,400, the balance of impairment loss should be CU125, right ?

Yhoong, but the example says that the carrying amount of other assets is 1300. But yes, if carrying amount of other assets is 1400, you are right. S.

Hi Silvia,

Your article is excellent and I benefit a lot. In the article, you mentioned that the management made a projection of Value in use in regard to the asset . Assuming that the asset is an investment in Associate. What is the most appropriate way to project its Value in use, considering that the investment is expected to be held for quite some time, which has not yet been determined?

Dear Edmund,

for associates, I recommend looking to standard IAS 28, paragraph 42 – this specifies that you can use one of two alternative methods for determining value in use for an associate – either discounted dividend or discounted cash flow model (meaning that you estimate cash flows generated by the associate). And it is also stressed that both methods should give you the same results. S.

Hi Silvia, just want to say you’re wonderful, making IFRS so easy to understand!

Hi Sylvia Good Day

I have a question , the company has only one CGU,the goodwill has not been allocated to that CGU, During impairment testing of the Goodwill, how to calculate the carrying amount of that CGU? What amounts to be included? Is it asset less liabilities excluding goodwill ?

Please i need your comments

Thanks

Dear Zarah,

can you give me some example of that situation – only one CGU + unallocated goodwill? In this case, why did the goodwill arise? Thanks. S.

Dear Zarah,

In your case, If there is real Goodwill as per IFRS 3 and it is not appropriate for you to alocate to CGUs, I would say, It has to be allocated to the acquired Co. as a whole (i.e, acquired entity as one CGU) and Impairment has to be tested by adding the Goodwill to the company’s carrying amount and comparing it to the recoverable amount of the acquired entity. However, you can’t have internally Goodwill. As clearly explained here, it can ONLY arise from business combination transactions. I am saying this suspecting your question might be referring to an internally generated Goodwill. Thank you Silvia. Great job as usual.

Much appreciated

Hi Silvia, Thank you for your great explanation on impairment. But there are a few issues I don’t understand. In your case, with the goodwill 150 plus carrying amount of other assets of 1,400 less recoverable amount of 1,400, why does the impairment loss come to 25, instead of 125?

And what is meant by “Each CGU to which goodwill is allocated should represent the lowest level at which the goodwill is monitored and it cannot be larger than an operating segment as defined by IFRS 8”

Hi Wilson,

I am sorry, there was a typo as fathima correctly wrote up in the comment, but it should have been corrected by now. Goodwill is 125 (not 150), other assets 1300, less recoverable amount 1400 = 25.

As for the second part: if a company has divisions that meet the definition of operating segment under IFRS 8, then your CGU must represent at max. such a division. For example, you cannot group 2 divisions being operating segments and say that OK, I allocate goodwill to this group of 2 divisions. You can’t do it because they are 2 operating segments.

Thanks for the article, very simple and easy to understand.

Thanks a lot Silvia !!

It was another great article. I love you articles.

I’m curious, could there be instances of an impairment gain? How would it be treated?

Femi,

there’s no such a thing as an “impairment gain”. If the recoverable amount is greater than the carrying amount, you don’t book anything (unless you apply revaluation model, but that’s a different story). And, I stress that you cannot reverse the impairment loss of goodwill. S.

Thank you. Very helpful!

Perfect approach, simple, to the point and effective. Amazing work Silvia.

Well appreciated. Thank you.

thank you

Thank you so much.

well written article.i love the way you make it so simple. i think there is an error under Goodwill impairment with the partial method for NCI, you have mentioned the carrying amount of other CGU’s assets is CU 1 400. i think it should be 1,300.

Hi Fathima,

thank you, glad you liked it! Yes, you are right, there was a typo, corrected, thank you! S.

Dear Silvia,

I don’t understand quite well your note that in the case of NCI measured by using the partial method, goodwill represents only a parent’s share of it. What I understand from the IFRS 3 2008, valule of NCI is added to the value of the consideration transferred to the acquiree when calculating goodwill. So, goodwill recognized by using acquisition method from IFRS 3 2008 will be recognized fully in the financial statement of acquirer, regardless of method used for measuring the NCI?