Example: How to Consolidate

Last update: 01/2025

The video lecture (the written explanations are below the video)

After summaries of standards related to consolidation and group accounts, I’d like to show you how to prepare consolidated financial statements step by step.

I’ll do it on a case study, with explaining what I do and why. If you don’t like reading, you can skip to the end of this article and watch my video.

If you’d like to revise a theory first, then please read my summary of IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements, both of them contain video in the end.

What’s the situation?

Here’s the question:

Mommy Corp purchased 80% shares of Baby Ltd. a few years ago.

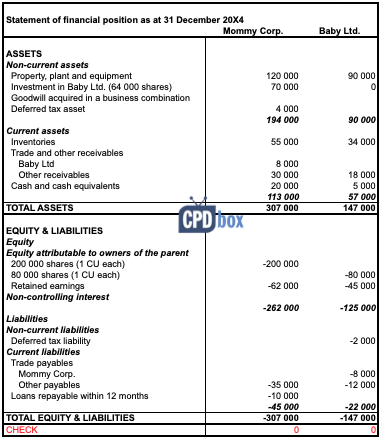

Below there are statements of financial positions of both Mommy and Baby at 31 December 20X4.

Prepare consolidated statement of financial position of Mommy Group as at 31 December 20X4. Measure NCI at its proportionate share of Baby’s net assets. All retained earnings of Baby are post-acquisition.

Please note here that in the above statements of financial position, all assets are with “+” and all liabilities are with “-“. I use it this way because for me it’s easier to verify and identify mistakes, but it’s up to you.

3 Steps in Consolidation Procedures

I have described the consolidation procedures and their 3-step process in my previous article with the summary of IFRS 10 Consolidated financial statements, but let me repeat it here and follow these steps:

- Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries;

- Offset (eliminate):

- the carrying amount of the parent’s investment in each subsidiary; and

- the parent’s portion of equity of each subsidiary;

- Eliminate in full intragroup assets and liabilities, equity, income, expenses and cash flows relating to transactions between entities of the group.

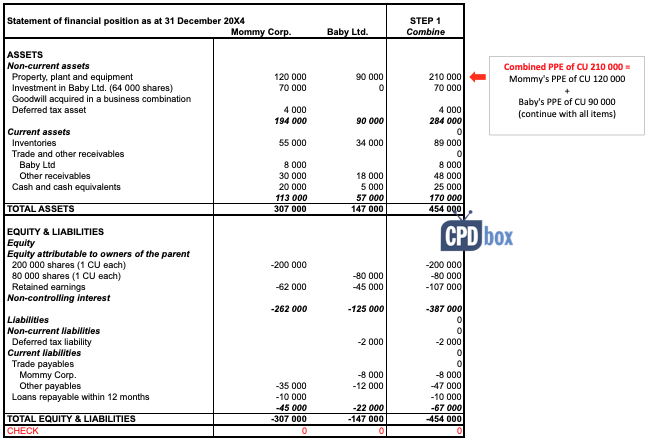

Step 1: Combine

After you make sure that all subsidiary’s assets and liabilities are stated at fair values and all the other conditions are met, you can combine, or add up like items.

It’s very easy when a parent (Mommy) and a subsidiary (Baby) use the same format of the statement of financial position – you just add Mommy’s PPE and Baby’s PPE, Mommy’s cash and Baby’s cash balance, etc.

In reality, companies use their own format for presenting their financial position and therefore it can be difficult to combine. That’s exactly WHY so many groups use their “consolidation packages” and subsidiaries’ accountants must fill them up along with preparing own financial statements.

Therefore, when a group controller calls you every five minutes to remind you the consolidation package, you’ll know why!

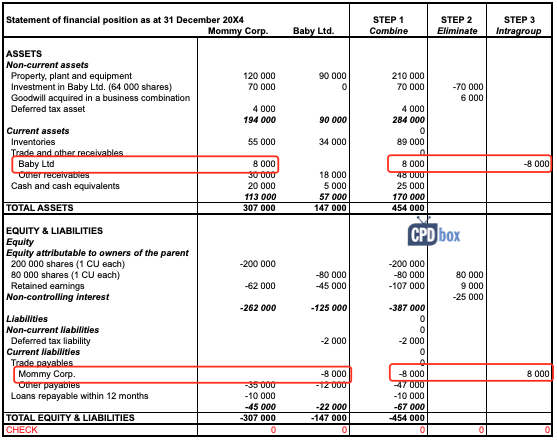

In our case study, combined numbers looks as follows:

Of course, there are some strange and redundant numbers, for example both Mommy’s and Baby’s share capital, but we haven’t finished yet!

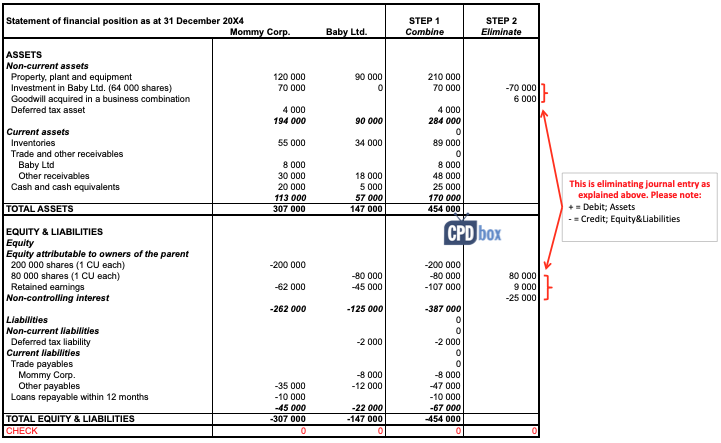

Step 2: Eliminate

After combining like items, we need to offset (eliminate):

- the carrying amount of the parent’s investment in each subsidiary; and

- the parent’s portion of equity of each subsidiary;

and of course, recognize any non-controlling interest and goodwill.

So let’s proceed. The first two items are easy – just remove Mommy’s investment into Baby (CU – 70 000), and remove Baby’s share capital in full (CU + 80 000).

As there is some non-controlling interest of 20% (please see below), you need to remove its share in Baby’s post-acquisition retained earnings of CU 9 000 (20%*CU 45 000).

Wait a second – how do we know that all Baby’s reserves (retained earnings) of CU 45 000 are post-acquisition?

Well, the question says that the full Baby’s retained earnings are post-acquisition, otherwise you need to trace it.

Be careful here, because you absolutely need to differentiate pre-acquisition retained earnings from post-acquisition retained earnings, but here, we’re not going to complicate the things.

Then we need to recognize any non-controlling interest and goodwill.

Non-controlling interest at 31 December 20X4

Mommy has owned 80% of Baby’s share and therefore, non-controlling interest owns remaining 20% of Baby’s net assets.

The question asks to measure non-controlling interest at proportionate share on Baby’s net assets, so here’s how it looks like at the end of the reporting period:

Baby’s net assets are CU 125 000 as at 31 December 20X4, including Baby’s share capital of CU 80 000 and Baby’s post-acquisition reserves of CU 45 000.

Non-controlling interest at 31 December 20X4 is 20% of Baby’s net assets of CU 125 000, which is CU 25 000. Recognize it with minus, as we are crediting equity with non-controlling interest.

Initial recognition of goodwill

There might be some goodwill arisen on initial recognition. If you’d like to learn more about goodwill, please refer to the article about IFRS 3 Business Combinations.

Let’s calculate it. Please don’t forget that we calculate goodwill based on numbers on acquisition, not on 31 December 20X4.

The goodwill is calculated as:

- Fair value of consideration transferred: in this case, we simply take Mommy’s investment in Baby of CU 70 000;

- Add any non-controlling interest at acquisition: here, we’re not adding the non-controlling interest calculated above, as it’s the measurement on 31 December 20X4. At acquisition, the value of non-controlling interest is 20% of Baby’s net assets on its incorporation of CU 80 000 (share capital only). It equals CU 16 000.

- When a business combination was achieved in stages, you would need to add the acquisition-date fair value of the acquirer’s previously-held equity interest in the acquiree, but in this example, it’s not applicable,

- Deduct Baby’s net assets at acquisition: CU – 80 000.

Goodwill acquired in a business combination comes to CU 6 000 (70 000 + 16 000 – 80 000).

The elimination entry looks as follows (sign “+” indicates a debit entry; sign “-“ indicates a credit entry):

| Description | Amount | Debit | Credit |

| Remove Mommy’s investment in Baby | -70 000 | FP – Investment in Baby | |

| Remove Baby’s share capital in full | +80 000 | FP – Baby’s share capital | |

| Remove 20% (NCI) of Baby’s post-acquisition retained earnings | +9 000 | FP – Retained earnings | |

| Recognize non-controlling interest on 31 December 20X4 | -25 000 | FP – Non-controlling interest | |

| Recognize goodwill acquired in a business combination | +6 000 | FP – Intangible assets (goodwill) | |

| Check | 0 |

I have transferred this journal entry into our consolidation worksheet and it looks as follows:

Eliminate Intragroup Transactions

Parents and subsidiaries trade with each other very often.

However, when you look at both parent and subsidiary as at 1 company, which is the purpose of consolidation, then you find out that there’s no transaction at all.

In other words, group has not performed any transaction from the view of some external user.

Therefore you need to eliminate all transactions happening within the group, between a parent and its subsidiaries.

Looking to above individual statements of financial position of Mommy and Baby you see that Mommy has a receivable to Baby of CU 8 000 and Baby has a payable to Mommy of CU 8 000. Perhaps these 2 items relate to the same transaction between them and we need to eliminate them, by debiting payables and crediting receivables:

Final steps

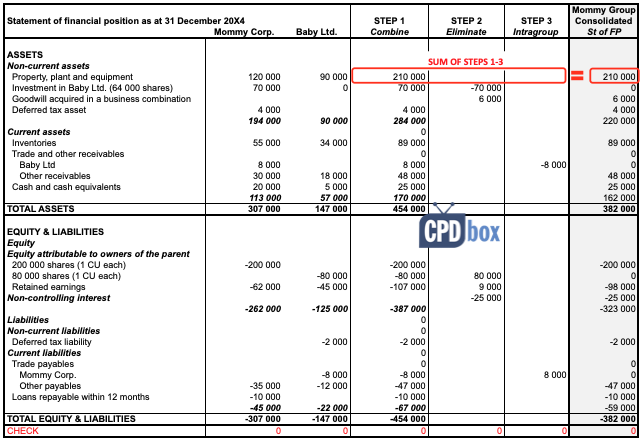

After we have completed all steps or consolidation procedures, we can add up all the combined numbers with our adjustments and thus we arrive at consolidated statement of financial position.

You can revise all the steps and formulas in Excel file that you can download at the end of this article.

Here’s how it looks like:

Please note the following facts:

- Consolidated numbers are simply sum of Mommy’s balance, Baby’s balance and all adjustments or entries (Steps 1-3).

- Mommy’s investment in Baby’s shares is 0 as we eliminated it in the step 2. The same applies for Baby’s share capital and consolidated statement of financial position shows only a share capital of Mommy (parent).

- There’s a goodwill of CU 6 000 and non-controlling interest of CU 25 000, as we have calculated above.

- Consolidated retained earnings are CU 98 000 and they consist of:

- Mommy’s retained earnings of CU 62 000 in full, and

- Mommy’s share (80%) on Baby’s post-acquisition retained earnings of CU 45 000, that is CU 36 000

Exam-style consolidation

I know that many of you prepare for your exams and this is NOT the way how you learned consolidation during exam preparation courses.

OK, I understand.

I prefer this way of making consolidation by far, because here, you go systematically, step by step. You can deal with each adjustment in a separate column and as a result, your numbers will always balance. You will never forget anything.

The “exam-style” of making consolidated financial statements is good and easy when there are just a few issues or complications.

But when you need to deal with more complex situations, then you can forget or omit the things very easily. Trust me, I did it too.

However, to make you happy, you can find the same case study solved “by the exam-style” in the attached excel file that you can download in the end of this article.

Is consolidation really easy?

Sometimes.

But in most cases, there is lots of issues or circumstances that you need to take into account and exactly their significance and amount makes it all difficult.

What issues? For example:

- Consideration transferred for acquiring the shares may involve not only cash, but also some other forms, such as share issue, contingent consideration, transfers of assets, etc.

- Non-controlling interest can be measured at fair value instead of at proportionate share.

- There might be some unrealized profit on transactions within the group and it needs to be eliminated.

- There might be some transfer of property, plant and equipment at profit within the group and as a result, you need to adjust both unrealized profit and depreciation charge, too.

- Goodwill might be either positive or negative (=gain on a bargain purchase). Moreover, it can be impaired.

- Subsidiary’s net assets might be stated in the amounts different from their fair value, or even not recognized at all.

- Subsidiary may show both pre-acquisition retained earnings and post-acquisition retained earnings. You need to be extremely careful in differentiating them and dealing with them separately.

I can go on and on, but I don’t want to discourage you. However, if you need to know more about all these issues, I have covered them fully in my premium learning package the IFRS Kit, so please check out if interested.

Further reading: Here’s the list of all articles and videos published on CPDbox on consolidation – totally free.

If you like this example and explanations, please help me spread a word about it and share it with your friends. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Tan Chee Hong on Retention in construction contracts

- Ahumuza on Accounting for discounts under IFRS

- Saheed Kehinde on How to account for intercompany loans under IFRS

- hassan ali on IFRS 15 Explained: Full Guide on 5-step Model for Revenue Recognition + Free Journal Entries Template

- BiG4 on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (6)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanks for great articles. One question i need to ask. The situation is Company A does not own any share capital of Company B. However, the director of Company A owns 100% of the share capital of both Company A and Company B. The director of Company A can also influence the direction, decisions, and power of Company B. Can Company A consolidate the financial statements with Company B based on IFRS10? Thanks

Thank you for your question. No, under IFRS 10, Company A cannot consolidate Company B — because Company A does not control B directly or indirectly through ownership or contractual rights.

Do you have such a kind of step by step example for IFRS 17. Thank you.

Try checking here.

Thank you, most helpful! One question regarding the eliminations – what if we are capitalizing expenses that are intercompany, how is that reflected in the consolidation – are they eliminated and how? These capitalized items can be either administrative expenses for services provided from one subsidiary to another or interest expense on a loan provided by one subsidiary to another where the subsidiaries are both within the Consolidation group and roughly the entries are 1) in the receiving sub Dr P/L Cr Cash and then Dr CAPEX Cr P/L whilst 2) in the providing sub it is only Dr Cash Cr Income. My logic is Dt P/L Cr CAPEX but I am not sure if I should remove them at all.

Hi Mira, yes, you should eliminate those from whichever items they relate to; including the depreciation. So if for example, you capitalized intragroup interest to the cost of PPE, then you eliminate it (and consolidated PPE will be net of interest), but also, do not forget to eliminate related depreciation charge in the next years.

Thank you, much appreciated!

Dear Silvia

Thanks for simplifying consolidation.

Thanks a lot

It is good article