IAS 17 Leases

IAS 17 Leases deals with the accounting and financial reporting of the very common business transaction—lease. Leases are the great example of “off-balance sheet” financing if not recorded properly in the financial statements.

In the past, many companies used to hide their finance lease liabilities and they reported all lease payments directly to profit or loss when paid. So no real picture of the transaction was shown.

Therefore, standard IAS 17 was issued in 1982 to tackle this problem. Let’s take a look.

UPDATE 2018: Please note that the standard IFRS 16 Leases will be effective for the periods starting on or after 1 January 2019 and IAS 17 will become superseded. I leave this article here for your information.

Classification of leases

Types of Leases

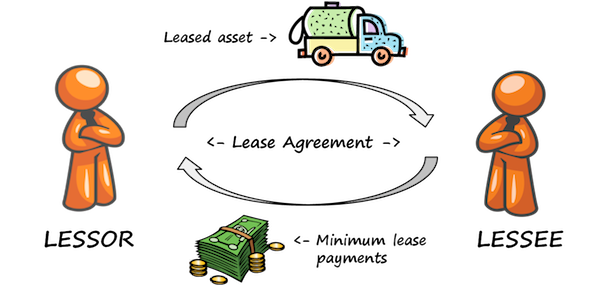

A lease is an agreement whereby lessor conveys to the lessee in return for a payment or series of payments (minimum lease payments) right to use an asset for the agreed period of time (lease term).

The lease relationship is illustrated in the following picture:

There are 2 types of leases defined in IAS 17:

- A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an asset. Legal title may or may not eventually be transferred.

- An operating lease is a lease other than a finance lease.

The classification of leases has to be performed at the inception of the lease, before recognizing any amounts related to the lease in the financial statements.

Situations and Indicators of Finance Lease

IAS 17 outlines examples of situations that would normally lead to a lease being classified as a finance lease:

- The lease transfers ownership of the asset to the lessee by the end of the lease term.

- The lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date of the option exercisability. It is reasonably certain, at the inception of the lease, that the option will be exercised.

- The lease term is for the major part of the economic life of the asset even if the title is not transferred.

- At the inception of the lease the present value of the minimum lease payments amounts to at least substantially all of the fair value of the leased asset.

- The leased assets are of such a specialized nature that only the lessee can use them without major modifications.

IAS 17 also lists 3 indicators that could also lead to lease being classified as a finance, but those are not always conclusive:

- If the lessee is entitled to cancel the lease, the lessor’s losses associated with the cancellation are borne by the lessee.

- Gains or losses from fluctuations in the fair value of the residual fall to the lessee (for example, by means of a rebate of lease payments).

- The lessee has the ability to continue to lease for a secondary period at a rent that is substantially lower than market rent.

Lease of Land and Building

When a lease includes both land and building elements, then the classification of each element as a finance lease or an operating lease shall be assessed separately.

Land has an indefinite economic life and therefore the land element is normally classified as an operating lease (unless legal title is expected to pass to the lessee by the end of the lease term).

The minimum lease payments are allocated between the land and the buildings element in proportion to the relative fair values of the leasehold interests in the land and building elements at the inception of the lease.

Leases in the Financial Statements of Lessees

Finance Lease

Initial Recognition

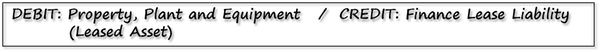

At the commencement of the lease term, lessee should recognize an asset and a lease liability at the lower of the fair value of the asset and the present value of the minimum lease payments.

The discount rate for calculating the present value of the minimum payments is the interest rate implicit in the lease.

The accounting entry is as follows:

Subsequent Measurement

There are 2 things to take care about after initial recognition:

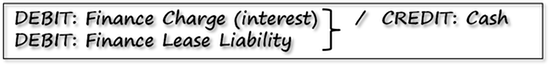

- Minimum lease payments should be apportioned between the finance charge (interest) and the reduction of the outstanding lease liability.The finance charge should be allocated so as to produce a constant periodic rate of interest (interest rate implicit in the lease) on the remaining balance sheet liability. In practice, actuarial method is used a lot to work out the allocation.

The basic accounting entry of minimum lease payment paid to the lessor is as follows:

- Lessee should charge the depreciation expense related to the assets held under finance leases.

Operating Lease

Lessee should recognize the lease payments as an expense in the profit or loss over the lease term on a straight-line basis, unless another systematic basis is more representative of the time pattern of the user’s benefit.

Leases in the Financial Statements of Lessors

Finance Lease

Initial Recognition

At the commencement of the lease term, lessor should recognize lease receivable in his statement of financial position. The amount of the receivable should be equal to net investment in the lease.

Net investment in the lease equals to gross investment in the lease (minimum lease payments receivable by the lessor under the finance lease + any unguaranteed residual value accruing to the lessor) discounted by the interest rate implicit in the lease.

The accounting entry is to debit Lease Receivable and credit Property, plant and equipment (sometimes directly cash).

If lessor incurs any direct and incremental costs in negotiating leases, those must be recognized over the lease term and not to the expenses when incurred.

Subsequent Measurement

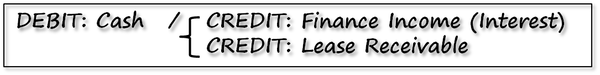

The lessor should split minimum payments received into finance income and reduction of the lease receivable. Finance income shall be recognized based on a pattern reflecting constant periodic rate of return on the lessor’s net investment in the lease.

The accounting entry is as follows:

Manufacturers or dealer lessor

Manufacturers or dealer lessor should recognize profit or loss from sale in the same period as they would for an outright sale. If artificially low rates of interest are charged, selling profit should be restricted to that which would apply if a commercial rate of interest were charged.

Costs incurred by manufacturers or dealer lessor in negotiating and arranging the lease shall be recognized as an expense when selling profit is recognized.

Operating Lease

As under the operating lease the risks and rewards of ownership do NOT transfer from lessor to lessee, lessor keeps recognizing the leased asset in his statement of financial position.

Lease income from operating leases shall be recognized as an income on a straight-line basis over the lease term, unless another systematic basis is more appropriate.

Sale and Leaseback Transactions

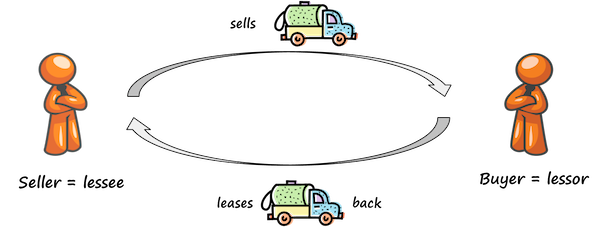

A sale and leaseback transaction involves the sale of an asset and the leasing the same asset back. In this situation, a seller becomes a lessee and a buyer becomes a lessor. This is illustrated in the following scheme:

Accounting treatment of sale and leaseback transactions depends on the character of the resulting lease.

Sale and Leaseback with Finance Lease

If the resulting lease is a finance lease, then in fact, the transaction is a loan securitized by the leased asset and seller / lessee keeps recognizing the asset. Any excess of proceeds over the carrying amount of the leased asset is deferred and amortized over the lease term.

Sale and Leaseback with Operating Lease

If the resulting lease is an operating lease, then a seller/lessee derecognizes the asset and a buyer/lessor recognizes the asset. Further accounting treatment depends on the sale price:

- f the sale price is close to asset’s fair value, then the profit or loss from sale should be recognized immediately.

- If the sale price is below asset’s fair value, then it is necessary to check the rental payments. If the future payments are below market price, then the loss from the sale of asset should be amortized over the period of use. If the future payments are close to market rentals, then the loss from the sale of asset should be recognized immediately.

- If the sale price is above fair value, then the excess over fair value or “profit from sale” should be deferred and amortized over the period of use.

Disclosures

IAS 17 prescribes a full load of disclosures for every type of the lease.

Except for general descriptions of the lease arrangements and other basic information about finance leases, both lessors and lessees are required to present reconciliation of future minimum lease payments (gross investment in the lease for the lessor) and their present value according to the period when they are due: not later than 1 year, later than 1 year and not later than 5 years; later than 5 years.

The same applies to operating leases, however, here both lessors and lessees are required to present the future minimum lease payments under non-cancellable operating leases in the aggregate and for each of the following periods: not later than 1 year, later than 1 year and not later than 5 years; later than 5 years.

Please check out IAS 17 in the following video:

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Hongyun Xiao on IFRS 2 Share-Based Payment

- Hongyun Xiao on Summary of IAS 40 Investment Property

- Silvia on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Krishna on IFRS 17 Example: Initial Measurement of Insurance Contracts

- Jenny on Summary of IAS 40 Investment Property

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (55)

- Financial Statements (49)

- Foreign Currency (9)

- IFRS Videos (67)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

How do you account for a long term leasehold interest in the books of the lessor, lets say 99years?

Hello Silvia,

May I please ask one question?

Under IFRS-16 for lessor, when the lessor buys property and that property is measured as investment property say @ £1m. Later the same property is lease out and qualifies as finance lease. Therefore receivable needs to be debited and crediting this property. The receivable value is £900k. Will the difference of £100k be credit to P/L as gain on sale of investment property or where will this £100k difference be? Also since it is under IAS40 therefore there will be no fair value movement at the end of each year as it is now as receivable?

hi,

i wanna ask you one question.

Assume that Alem Company in Axum town has contracted to lease

buildings and surrounding land together. Based on IAS 17:

a) When is the land element of the lease treated as a finance lease?

b) In which case is the entire lease classified as an operating lease

Hi Silvia – I have the same question as this individual as per the below – what happens if the discounted net present value of the lease receivable is different to the net book value of the assets currently sat on the balance sheet?

Elias Papacharalambous September 13, 2016 at 10:21 pm

Dear Sylvia,

Under lessor accounting, what happens to the difference between the NBV of asset derecognized and the net investment in the lease? Is there a gain/ loss in profit or loss?

Thanks!

Reply

Thank you for better presentation and summarization

Hi Silvia, thanks for the useful info. I have a question. My client has vacated their current office premises to a new office but did not terminate their current office agreement. This has made the current office agreement onerous as they are not deriving any economic benefits. Provision for onerous contract has been made. Do they still need to disclose the operating lease commitments at year end? Appreciate your advice. Thanks.

Hi Silvia, Is there any difference between accounting treatment for finance lease under IAS17 and IFRS16? and what needs to be done to transition IAS17 finance lease to IFRS16 – and will there be any retained earnings when transitioning from IAS17 to IFRS16 (for finance lease)? Thank you in advance.

Well, not so much in relation to methodology of accounting, but yes when it comes to interest rates used. Please revise the articles here. S.

Hi Silvia, we have had bit of a debate in our team about this and would appreciate your thoughts. This is technically FRS102, but there is a divide as to what to disclose in the Commitments note (i.e .disclosure only) e.g. rent is $14,000 per year (or say 70K over a 5 year period) but due to a rent-free period at the start the total amount due is 60K over 5 years. i.e. the expense per year is $12,000, but the actual cash paid after year one is $14,000. $12K is correctly disclosed in the statements (as an expense), but in terms of the Commitments note disclosure, should it be what the rental cash payment is ($14K) or should the 12K be disclosed. FRS102 rules state this should be “the total of future minimum lease payments under non-cancellable operating leases” (split out for within one year, two to five years and more than five years) so I am referring to the ‘within one year’ part, assuming we are halfway through the rental period. Thanks!

Hi Silvia,

According to IAS 17: “a lease is an agreement whereby lessor conveys to the lessee in return for a payment or series of payments (minimum lease payments) right to use an asset for the agreed period of time (lease term).”

From here, we conclude lease term is agreed the period of time in the contract.

But, the definition of lease term according to IAS 17 says: the lease term is the non-cancellable period for which the lessee has contracted to lease the asset.

Now when assessing lease contracts for implementation of IFRS 16, I find these definitions ambiguous.

Is lease term = contract term or to a non-cancellable period of the contract according to IAS 17?

Thank you.

It is the non-cancellable period – but you have to assess it from your point of view. For example, if you are a lessee, the lease term is for 5 years with an option for you to renew for another 5 years and you plan to take that option, then the lease term is 10 years. S.

Hi Silvia, I have a very basic doubt.

If an entity has accounted more rent in the books than what it should be as per IAS 17, what is the accounting entry that should be passed? What is the entry to be passed if the entity has accounted for less rent expense?

Well, then you should perhaps make a correction as under IAS 8. S.

Hello Silvia,

I am confused at one point here regarding Sale and Lease Back transaction under Operating Lease. I will give two different case details here very first one of which I clearly understand based on what IAS 17 says and you explain above. However, second one confused me. I would like to get your insight with regards to the second case;

1st Case:

Carrying Value: 100

Fair Value: 90

Sales Price: 70

Lease payments are being made below the Fair Value amount so that the journal entry should be as follows;

DR Cash 70

DR PL 10 (refer to 63th paragraph. Difference between FV and CV shall be recognized in

PL immediately)

DR Asset 20 (should be amortized over the period of assets’s useful life)

CR PPE 100

2nd Case:

Carrrying Value: 100

Fair Value: 150

Sales Price: 90

What I am confused at the second case is that FV (150) is higher than the CV (100) this time but Sales Price (90) is below both FV and CV. Should I recognize the loss (Sales Price – Carrying Value) immediately at PL at this point or is there anything to do with the FV (150) amount ? I am not sure how to use the FV in this case and not clear on how to book the journal entry.

Thanks,

Çağıl

You are the master

Hi Silvia ,

you said in the video in accordance to the lessor that the MLP + the unguaranteed residual value ( discounted ) must be equal to the fair value of leased asset + initial direct costs , this means that if they not equal to the fair value + initial direct costs i will record the investment receivables with the fair value + the initial direct costs or what ?

Hi Silvia,

I’ve been visiting your site since I was in college and now that I’m working, this site still works like a charm, so thank you 🙂

So quick question, is there a difference in accounting for Floating rate Leases and Fixed rate Leases, like for example, the initial recognition? and how does the change in interest rate for floating rate leases affect the monthly amortization of the leased asset?

I’ve been going from one site to another but I dont see any article specifically addressing this matter.

I would really appreciate your insight. Thanks you so much!!

Hi Dominique,

what do you mean by the floating rate? It means that your payments change every month together with some rate like LIBOR? Or, does it mean that your payments will be updated in the future based on inflation?

IAS 17 did not solve this situation very well, but there’s a clear guidance in IFRS 16 Leases. Let’s say you pay fixed payments for 1 year and then the payments update according to the inflation. At the lease commencement, you simply calculate the lease liability based on the initial payments until the end of the lease term (no inflation is taken into account). Then, when the lease payment update, you recalculate the remaining lease liability and you recognize the difference between the new lease liability and your current lease liability as the decrease or increase of the right-of-use asset. S.

Hello Silvia,

Great job! Thank you so much… I really appreciate your tone and the knowledge about the aspects of IFRS. Gave me a wonderful idea how it works. Thank you Once again

Hi Silvia,

I have noticed that on the last slide of of the video presentation it mentioned that under Sale & Leaseback classified as operating lease – (1) if the sale price of the asset is at fair value, profit/loss is recognized immediately; (2) if sale price of the asset is below fair value – (i) if the future rental payments are at market price, profit/loss is recognized immediately; (ii) if the future rental payments are below the market price, part of loss is deferred over the period in which the asset is expected to be used; and (3) if sale price of the asset is above fair value, the excess over fair value is deferred and amortized over the period for which the asset is expected to be used.

To illustrate, SellCo (seller-lessee) sells aircraft with book value of $80 million to BuyCo (buyer-lessor) and immediately leases the aircraft back from BuyCo. BuyCo pays $100 million for the aircraft at fair value. The lease agreement requires SellCo to pay BuyCo back in equal annual installments over five years, at an interest rate of 10%.

In my example case above, if SellCo (the seller-lessee) sells the aircraft at $100 million, which is the FMV, you said to recognize profit/loss immediately, so does the above means that SellCo will recognize the profit of $20 million immediately?

And if SellCo sells the aircraft at $90 million and assuming that it is leaseback at market rentals, do I understand what you mean that SellCo has to recognize the $10 million gain immediately? And if the leaseback rentals are below market, defer the $10 million gain over the period in which the asset is expected to be used? However, this is still a gain. Am I still on the right track? However if SellCo sells the aircraft at $60 million and assuming that it is leaseback at market rental, does this mean that SellCo has to recognize the $20 million loss immediately? And if the leaseback rental are below market, defer the $20 million loss over the period in which the asset is expected to be used. So what do you mean by “part of loss is deferred over the period in which the asset is expected to be used” above?

And if SellCo sells the aircraft at $120 million, SellCo will have a deferred profit of $40 million and defer and amortize this $40 million over the period in which the asset is expected to be used?

Thank you in advance for your clarification.

Lawrence

Yes, Lawrence, you got it basically right. But I solve a case about it in my IFRS Kit. S.

Dear Sylvia,

Under lessor accounting, what happens to the difference between the NBV of asset derecognized and the net investment in the lease? Is there a gain/ loss in profit or loss?

Thanks!

Dear Silvia,

Thanks for your site!Well done and keep up the good work! A quick question though… so the interest rate implicit in the lease is essentially the effective interest rate of a typical loan transaction? Is there any difference between both terms please?

If your incurred transaction processing fees at the inception of the lease, would that qualify as initial direct costs please?

Thank you so much!

So, at the existence of the unguaranteed residual value (“URV”), the PV of MLPs will ALWAYS be lower than the FV of asset. If no URV exists, then PV of MLPs = FV of asset.

But, FV of asset can never be lower than then PV of MLPs.

Yes?

Dear Sylvia,

This is my first comment in your website and I would like to take this opportunity to congratulate you.

My question is the following:

The interest rate implicit in the lease is calculated in such a way that, at the inception of the lease, the PV of MLPs is equal to the FV of the asset. Therefore, why the rule of initial recognition of the asset / liability in a finance lease is to recognition both at the lower of PV of MLPs and the FV of the asset. The two are by definition always equal, through the way the implicit interest rate is calculated!

Unless it has something to do with the unguaranteed residual value and the direct costs which are also part of the implicit interest rate calculation.

Thanking you in advance for your reply.

Dear Elas,

thanks for commenting 🙂

In fact, PV of MLPs and FV of the asset is not always equal, exactly due to the existence of unguaranteed residual value, just as an example. Also, sometimes, interest rate implicit in the lease is impracticable to determine and therefore, incremental borrowing rate is used – this is also a case when PV of MLPs can differ from the fair value. S.

we want a comperhensive exmaple please

Is Finance Lease liability a financial liability?

Hi Sylvia Have a good day!!

I have a question,we are first time adopter of IFRS, my question is about finance lease, we have land and building under finance lease(we are the lessee), we present that as part of property plant and equipment and we apply IAS 16(treated as tangible) is that right?subsequent measurement is revaluation, my problem is when i looked at the disclosure under IAS 17 there is a disclosures of a reconciliation between the total of future minimum lease payments at the end of the

reporting period, and their present value. In addition, an entity shall disclose the total of

future minimum lease payments at the end of the reporting period, and their present value,

for each of the following periods:

(i) not later than one year;

(ii) later than one year and not later than five years;

(iii) later than five years. Is this aplicable to us?Please help us thank you

Hi, I need support for accounting treatment of lease renewal option, if we have a lease that has 5 years term and an option to renew for another 3 years, do we consider the lease term is 5 or 8? appreciate your guidance here and reference in IAS.

Note, company is most certain it will renew for further 3.

Bilal, lease term in your example should is 5 years. Management’s intent does not matter; what matters is if that intent is based on a “significant economic incentive.” So if management has a significant economic incentive to renew, then the renewal period would be added to the initial lease term. If not, then only the non-cancel-able period of the lease is included, and any renewals are excluded.

Hi George,

Can you indicate where in IAS it states this? Or even better, provide a link?

Thanks

I am referring to when rental payments are below market rentals

Hi Sylvia.

Thanks a lot.

Please, why would the profit or loss from sale of asset in a sale and lease back, operating lease type be deferred? why should I not recognize it in profit or loss since the transaction occurred in the year.

Thanks for your response

normally in sum of digits method total interest for entire lease period keep in a interest in suspense account and debit to the P&L interest for the reporting period so should we keep account like interest in suspense for actuarial method too as sum of digit method.

Example: Sum of Digits Method

Leased Value 100,000×6 =600,000

Fair Value Of the Asset=500,000

Lease Interest =100,000

Debit -Asset A/C 500,000

Debit -Interest in suspense A/C 100,000

Credit -Lease creditor A/C 600,000

And then monthly or yearly interest will charged to P&L like

Debit P&L Lease Interest

Credit Interest in suspense A/C

Should we use same method for actuarial method or can we just record like

Debit asset A/C 500,000

Credit Lease Creditor A/C 500,000

When payment made

Debit Lease Interest A/C-Interest

Debit Lease Creditor A/C-Capital

Credit Cash full installment

Which method is correct

Normally we used sum of digits method to allocate the finance charge.So is it ok.

Nayan, this method is not so precise as an actuarial method, but the standard permits some approximation if it’s not materially different. S.

thank you very much

I want to know one thing. In certain cases the PV of Minimum Lease Payments is lower than the Fair Value of the asset and even in that case the lessee recognizes the asset and obligation at Fair value rather than PV of MLP. Where as the standard states that it should be recorded at lower of PV of MLP or Fair value.

Hi

what the current accounting treatment for lease contracts and the new approach to accounting for leases proposed by a number of standard setting bodies? and what do you think the advantage and disadvantage ?

Regards ,

Qasem

thank you Silvia

Hallo Silvia

I just want to get clarity.

I am studying BCom Acc (at the initial recognition of the lease for the lessor) we don’t Dr the net investment in the lease, but rather we Dr the undiscounted (or gross investment in the lease) and then write a Cr that we call an unearned finance income which basically is the difference between the net investment and the gross investment (or the finance income, if you will) and then at subsequent measurement we would Dr the unearned finance income and Cr gross investment in lease and Cr cash.

Is there any reason why our approache differ? Which one is more correct?

Hi Monique,

well, IAS 17 approach is as I described, for 1 very simple reason: by recognizing unearned finance income as a “liability”, you are effectively “window-dressing”, or increasing both your assets and liabilities with something that will be earned in the future. IAS 17 clearly states that your investment in the lease should be “net”, or effectively what you paid for it – and not overstated by unearned finance income. When you overstate both assets and liabilities, then company’s financial rations artificially change, too and they give the wrong impression about the liquidity/own financing position.

Have a nice day!

Hi, I need clarity on initial costs incurred by the lessee and the lessor. In whos books should we recalculate the new interest rate? What is the distinction between the two there?

Hi Brenda,

lessor and lessee can both have their own costs associated with starting the lease.

In the lessees’ case, these costs are included into cost of an acquired PPE. However, as lessee pays them right in the start of the lease, they do not influence the rate implicit in the lease (or very slightly).

In the lessor’s case, initial costs are added to the initial investment in the lease and they definitely impact the IRR.

Wonderful explanations about all IASs.

As a lecturer, these are immensely help me to teach new IFRS. Thank lot.

Better if u can include more working examples on sale and lease back

Hello Silvia,

I’m not really clear about the initial accounting entry for lessors on a finance lease. The entry says to record the net investment in the lease as a lease receivable at the onset of the lease (Dr Lease receivable Cr Cash) At the onset of the lease, the lessee wouldn’t have paid all the lease payments so where will d cash come from. He may pay an amount but surely not all as he will be reducing his liability periodically. If not cash, it would be a liability

Kindly clarify.

Hi Ronny, the entry for the lessor can be Dr Lease receivable Cr Cash or property, plant and equipment. The reason is that the lessor gives up an asset and gives it away under the lease (that’s why Cr PPE).

Sometimes, lessors don’t even see asset in their accounts, but they pay cash to the suppliers of these assets (that’s why Cr Cash).

Please note that PPE or Cash is on the CREDIT side, not debit side – thus in the beginning lessor gives cash away, not receives it. As the lessee pays periodically, then the entry is Dr Cash (this is receipt), Cr Net investment in the lease (and some interest in P/L).

Lessor does not have any lease liability 😉 Hope it’s a bit clearer. S.

If lessor charge incremental borrowing rate 15% and lessee charge 16%. According to ias which rate would be charge in the books of account.

We will wait for your reply.

First of all, you should apply the interest rate implicit in the lease and if it’s not practicable to determine, only then look at lessee’s incremental borrowing rate. For the lessor, it should not be a problem to use interest rate implicit in the lease.

In the situation, when lessee’s interest rate is different from lessor’s, then lessee will apply his own rate different from lessor’s rate – IAS 17 does not say that these 2 rates must be the same. S.

if you have been given a sales price, carrying value and the fair value of the asset relating to sales and finance leaseback and the fair value is greater than the carrying amount and the sales price is less than the fair value but greater than the carrying value

how do we treat a sale and operating leaseback when the sales price is bigger than the carrying amount

Quick question on operating lease disclosure. Am I right that the lease payments should be disclosed as the annual amount due split between the ageing categories, unlike UK GAAP whereby its the aggregate of payments over the period?

Hi Liz, IAS 17 prescribes disclosures only for non-cancellable operating leases. And you need to disclose the aggregate payments for each aging periods there (sum of payments due less than 1 year – that’s obviously the annual amount; but then the aggregate amount for 1-5 years, etc.).

S.

Hi Mahmoud,

it all depends on the TYPE of the resulting lease in the sale&lease back transaction. You need to meet at least 1 of 5 determinative criteria to classify lease as finance (lease term for majority of asset’s remaining useful life, etc. – please see above).

Just go through the criteria and assess whether resulting lease meets at least 1. If yes, then you need to continue recognizing asset in your financial statements and proceeds from sale are recognized as a loan / liability. S.

Hi guys,

I wonder if you can please direct me how to Calculate the interest rate implicit in the lease fair value = lease payments discounted at the implicit interest rate $35000 = $10000+(10000*a^3i) a^3i = 25000 / 10000 = 2.5 i = 9.7% how did arrive at 9.7% please?

Hi Baker,

interest rate implicit in the lease is the internal return of cash flows from that lease. Just enter your cash flows in the table and use IRR formula. Hope it helps. Kind regards, S.

Hi there,

Great site – thanks for all your effort!

This may be a silly question – but if a lease is truly cancellable without penalties (or even with minor ones only), then would this be an operating lease irrespective of any of the other 5 criteria?

e.g. if the economic life of the asset is 2 years and your lease term is 2 years and the total payments actually equate to recouping your investment over these 2 years then that would satisfy the criteria above – however given the customer can cancel at any time and return the asset without penalties then I don’t see how this transfers the risk to lessee, as it still sits with the lessor… have I read this right?

Cheers 🙂

Hi, Joseph,

in fact, 5 criteria of finance leases are determinative in nature – meeting just 1 of them basically leads to the lease being classified as finance. But here I agree that the situation is a bit unclear. What happens if the asset is damaged and the customer wants to cancel the lease – who bears the losses? There might be no penalty for cancellation of the contract, but it should be clear who bears losses associated with the asset itself. If it’s lessee – then I would basically classify that lease as finance 😉 Silvia

Hi,

In the following section

Leases in the Financial Statements of Lessors –

Finance Lease – Initial Recognition. The accounting treatment shown is

DEBIT Lease receivable

CREDIT cash

Is this correct? I thought it should be credit non current asset.

Hi there,

yes, you are right, it can also be non current asset. But in reality, non-current asset does not pass through lessors account quite often – lessor just passes cash to seller. So in fact, both cash and non-current asset are correct. In the summary, I just used simplification.

Best regards, Silvia

Hi,

I really appreciate the simple and well-organized way you are presenting the IFRS.

In this regard, I think that the credit side may be recognized as deferred income to reflect the credit interest that will be collected. Please advise.

Mohammed, the credit side is a cash, because an interest income will be recognized in the future periods when it is earned. Initially, nothing has been earned yet – lessor only provided a “loan” or a “receivable” to the lessee. Please check the effective interest method. S.

Hi Silvia,

I think that the credit side in the first entry at lessor records should be PPP as he should recognize that an asset is leased on a finance lease and should be derecognized as long as receivables are going to be recognized. Please advise as cash is not reduced at all at this stage by the full amount!

Hesham, it can be cash, yes. And it can also be PPE – I explained that in the above comment. I can really be Debit PPE/Credit cash, then Debit Lease receivable/Credit PPE – therefore, if you do it at the same time and you never see the asset, the entry is as above. But yes, in some countries, you need to account for PPE. I will make that clear in the article. S.

Hi there,

I have what may seem a very blonde question. When classifying an item as a finance lease, does it have to meet ‘all’ the requirements that would lead to this classification or ‘some’ of the requirements.

Hello,

not a blonde question, actually.

There are 5 determinative criteria and if a lease meets just one of them, then it is almost for sure finance – so “some” is enough 🙂

Silvia

Interesting actually.

what if the lease meets all the criteria but the lessor still remains responsible for the asset i.e. insures it against damage etc.

will this still be a finance lease?

Thanks in advance Silvia. I love your articles and the kit was also very good.

Hello there… love your article… easy to understand.. i want to use it as reference.. but there is no date when you post this article..is there anywhere i can find out about this matter?

Hello there, the article is quite fresh, don’t worry 🙂 I don’t give dates here on purpose, because I update all articles for the new changes, so they are always relevant 🙂

This is just great. Very Clear. Very Concise. I like those concept maps. I love you .:D

Well, I’m from the PH taking the Octber 2013 CPA Board Examination. I still cannot afford this Kit but I will surely buy this for the Audit Practice.

Thank you for this! Keep this UP! UP! UP!

Hey Bryan,

thanks for this comment – for this, I love you, too! 🙂

Well, I provide deep discounts for students – all you need is to ask 🙂

Take care!

Silvia

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your blog?

My blog site is in the exact same area of interest as yours and my users would genuinely benefit from some

of the information you present here. Please let me know if this alright with you.

Thank you!

Hello,

well, I don’t mind if you use a few of quotations from my articles as soon as you provide backlink to my site. However, please do not copy the whole full articles as Google and other search engines see it as a duplicate content and then punish you for that in the SEO results.

Thank you and have a nice day!

Silvia

Hi. This is excellent. Would you be able to do a presentation on the new standard for leases where even operating leases will eventually be recorded on the balance sheet? How does this work and how would it differ from the reporting of finance leases?

Thanks

Hi Jonathan,

yes, I will do the presentation about new IAS 17 when it is issued. Well, there will be no distinction between operating and finance leases according to new IAS 17 and therefore, operating leases will be recorded in the same way as finance leases. Of course, there will be some exceptions from those rules. I don’t want to go into much detail now, but the recognition of leases will be pretty similar to current recognition of finance leases.

Silvia, IFRSbox.com

Thank you, Silvia, you are the best.

Excellent post.I want

to thank you for this informative read, I really appreciate sharing this

great post.

Really great work…this is simply amazing. I would encourage to include more practical examples illustrated in excel.

Hi, Salmanpbava, this is just summary of the standard to bring in the theory. But if you subscribe to my free IFRS course, you will get lots of practical examples. Silvia, IFRSbox.com

Good day,

I do appreciate your work on educating accounting and non-accountant on IFRS.

I did subscribe to your site,but i have not recieved any lecture lessons except for the free ifrs guide handbook.

Regards

Hello Obioha, I’ve just checked it. You subscribed yesterday, so you should receive the first lesson today 🙂 Kind regards, S.

Hello Silvia how do you treat a transaction where the lesser transfers some rights of land to a third-party where he receives a given some of money.say you are a lesser and you use part of the land and you let another person use some of the land at a fee