How to account for warranties under IFRS 15?

“Our company provides 1-year warranty to all our products in line with our legislation, but the client can extend this warranty at 3 years for a fee.

Is this a separate performance obligation under IFRS 15? How to account for it?”

Answer: It depends.

You have to assess each warranty, because some warranties are separate performance obligations and the other one are not.

And, the accounting is completely different in both cases.

Types of warranties under IFRS 15

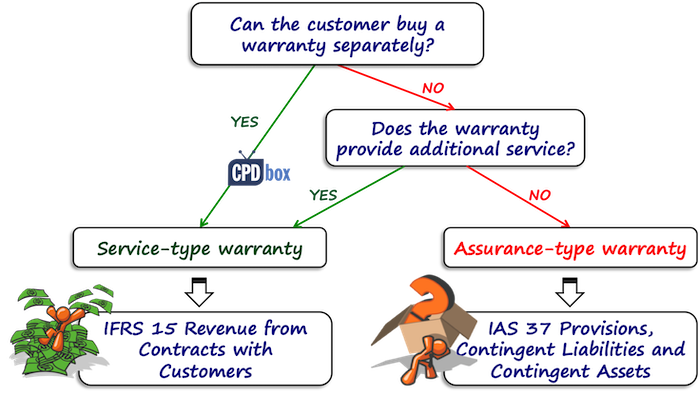

IFRS 15 contains quite a good guidance about warranties. It specifies that there are two basic types of warranties:

- Assurance-type warranties – those are warranties that promise to customer that the delivered product is as specified in the contract and will work as specified in the contract.

These warranties do NOT give rise to a separate performance obligation, and you account just a provision for warranty repairs under IAS 37.

- Service-type warranties – those are warranties that provide something additional to the mere assurance, for example – they provide some extra services.

These warranties give rise to a separate performance obligation, because they provide additional service to the customer and they are accounted for under IFRS 15.

Before you start accounting for warranties, you need to determine what type of warranty you have.

What warranty do you have?

The first thing you need to look at is to see whether your customer has the option to purchase the warranty separately:

- If yes, then it’s for sure service-type warranty and you must account for it as for a separate performance obligation.

- If not, then you need to see whether the warranty provides something more, some additional service beyond fixing the defects existing at the time of sale.

Here, you need to take a few things into account, such as:

- Is the warranty required by the law?

Many countries have laws that require providing a warranty for some period of time. If your warranty is this type, then it is assurance-type warranty and no, you have no separate performance obligation. - Is the warranty for longer period than the period required by the law?

If yes, then well, it’s very likely that you have a service-type warranty.

And there are some other things to consider too based on the nature of the product and service you sell.

All these factors to consider are NOT determinative.

It is just guidance and you need to consider it yourself.

Illustration: Assurance-type vs. service-type warranty

Let’s say that you sell cars.

And, let’s say that you have standard cars and luxury cars.

For standard cars, you provide a warranty period of 2 years as required by the local legislation, but for luxury cars, you provide a warranty period of 3 years.

The reason is that you think it may take longer time for hidden defects to show up.

Normally, this 1 year warranty on top of the regular warranty period required by the law would be assessed as the service-type warranty.

However – not here, because it is not considered as additional service due to the fact, that it’s a luxury car of higher quality and the first hidden defects appear after longer time than in the standard cars.

You can see yourself that this is quite judgmental and you should consider it in context of your own product and situation.

Example: How to account for the individual warranties?

ABC sells refrigerators for CU 100 and the legal warranty period is 2 years. During these 2 years, ABC must remove all the defects that existed at the time of sale.

The customers can extend this warranty for a fee of CU 20 for another 2 years.

ABC estimates the discounted cost of repairs at CU 40 000 in the first 2 years and CU 50 000 in the second 2 years (years 3 and 4 after purchase).

In this case, the first 2 years of warranty period are considered as assurance-type warranty, because the warranty cannot be purchased separately – it is guaranteed by the legislation.

So, you should account for this type of warranty under IAS 37 and not as a separate performance obligation in line with IFRS 15.

It means that you should book a provision for warranty repairs in the amount of estimated cost of repairs over the next 2 years.

The journal entry is:

- Debit Expenses for warranty repairs: CU 40 000,

- Credit Provision for warranty repairs: CU 40 000.

When the warranty repair happens within the first 2 years, ABC books the real expense as a decrease in provision.

Also, you must not forget unwinding the discount because it was measured at the discounted cost, but let’s not get into many details about the provisions right now, it’s not the topic of this Q&A and you can read more about it here.

What about the extended warranty?

Here, it is a separate performance obligation, because the customer actually pays for it separately.

When the client buys the fridge for CU 100 with extended warranty, the total price is CU 120.

ABC accounts it as for separate performance obligation and recognizes the revenue when or as a performance obligation is satisfied.

The revenue from sale of fridge is recognized immediately at sale, because that’s when the fridge is delivered and performance obligation satisfied.

The revenue from sale of extended warranty is recognized over the extended warranty period of 2 years.

The journal entry at the time of sale is:

- Debit Cash: CU 120

- Credit Revenues from sale of fridge: CU 100

- Credit Contract liability: CU 20

Over these last 2 years, the revenue from extended warranty is recognized as:

- Debit Contract liability: CU 20

- Credit Revenue from sale of warranties: CU 20

What about the cost of repairs in the extended period?

Remember, we are under IFRS 15, not under IAS 37, so no provision is recognized.

Instead, you have to book the costs of warranty repairs when they are incurred as contract costs (costs to fulfill the contract) under IFRS 15.

Sure, I omitted the significant financing component here, but it’s just a short illustration, but you should not forget it.

Questions? The comment section is right below this article, so please use it! Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

22 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Salvia, can you please make an example on significant financing component?

Dear Silvia,

In the case of maintenance warranty, if the performance obligation was satisfied over time, do we recognise the provision for warranty over time as well?

Hi Chew, if that maintenance warranty is a separate performance obligation, then you do not recognize a provision at all. However, if that maintenance warranty is in fact assurance-type warranty (e.g. it covers only replacement of defective parts), then yes, you do recognize a provision over time in most cases. You build it up gradually, as you satisfy the performance obligation – because, at the moment of satisfying the PO and recognizing revenue, your partial obligation to remove faults on that partial product (project) is created.

I have a question regarding warranty. There is a scenario : A is a company who sales the product to customer providing warranty of 1 year. And gives contract for warranty repair to Company B. And also Company A sales the Spare Part for warranty to Company B. If Company B purchase the spare parts From Company A and gives foc to Customer . So now Company B ask for the reimbursement to Company A . So how to keep account in Company B. ?

What is the difference between Warranty and free maintenance from business perspective and accounting perspective

If my insurer wants to stand in for me as the party that will satisfy the performance obligation during the extended period, can I then recognize the full revenue from the sale of the extended warrantee on day of sale? I will on the day of sale pay a premium to the insurer to cover this warrantee in X number of years if there is a claim. This expense will be recognised on day of sale. Obviously the premium takes into account the likelihood of a claim, which in theory should be lower than the asking price from the customer. I then don’t need to defer the revenue over the extended warrantee period as I have been relieved from the performance obligation.

Is this a question or a response to a question

How do I treat spares parts received as warranty items from supplier?

If the estimated cost of warranty was provided under IAS 37 over the period of warranty of 1 year and it was not utilised , how do I reverse it after 1 year?

Question Manufacturer A sells laptop computers with a 12-month warranty which assures that the laptops will work as intended for 12 months. The warranty is not sold separately. How should Manufacturer A account for the warranty?

As a assurance warranty. In other words, the warranty in question is not treated as a separate performance obligation and is not accounted for under IFRS 15 but the expected or estimated costs of warranty expenses will be provided for under IAS 37

Hi

Do we account for any deferred tax liability on the deferred income?

Dear Silvia,

Please advise how cost shall be recognized for the extended warranty, What shall be the accounting entries of contract cost. And do we need to make provision at the inception of the contract, as estimation may be recorded on the basis of past practice?

Thanks

Thanks

Dear Silvia,

Thank you so much for your nice explanation. The answer and article above are very useful for me. Thanks.

Hi, how do you account an extended warranty sold by a car dealer in the accounts of the dealer ( the manufacturer is obligated to fulfil the warranty)?

Hi Valentina, that would be a service warranty and yes, it is a separate performance obligation, so you need to allocate some part of the transaction price to it. If the dealer is just the reseller, then from his point of view, only the commission on the sale of a guarantee enters into the total transaction price (since he is acting as an agent). S.

Hi. How do you account for the warranty in the distributors accounts, if the item was sold by a distributor, and it has a manufacturing warranty (ie. the manufacturer is obligated to fulfil the warranty and not the distributor?)

clarification required please for the estimated cost of repair for the second 2 years. How would they qualify as contract costs, and how the accounting entries will be. thanks in advance for your extraordinary efforts.

Hi,

Don’t we need to discount the long term deferred warranty at year end?

Yes, sure – I did not bother with it this time. If you look carefully to the example above, it says that 40 000 is a discounted cost.

Thanks for the Beautiful Clarification!

Please elaborate the “Revenue from sale of extended warranty is recognized over the extended warranty period of 2 years.”

How it has to be accounted year wise and any Provision need to be created?

Regards

Aravind

Allow me to suggest an answer to your inquiry,

the performance obligation related to the service type warranty is a performance obligation that qualifies for over time recognition as it enhances an asset that is controlled by the customer at the time of performance (2 years).

The best measure of progress of this performance obligation is a time based measure in my opinion, so the revenue allocated to this performance obligation shall be recorded evenly over the two years period regardless of how many times the customer brings the item in for repairs during these two years.